Are you struggling to keep track of your money?

Do you want to take control of your finances but feel overwhelmed by all the options out there?

Many people face this problem, and picking the right tool can make a huge difference.

In 2025, two popular finance software options are Refreshme vs Quicken.

Both promise to help you manage your money better, but they do it in different ways.

Overview

We looked at both Refreshme and Quicken very closely.

We tried out their features.

This helped us see how they compare for managing your money.

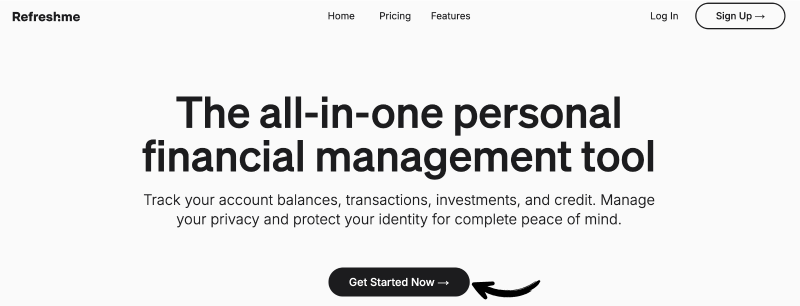

Unlock deeper financial insights! Refresh Me analyzes your spending and helps you save smarter.

Try it now!

Pricing: It has a free trial. The premium plan at $24.99/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

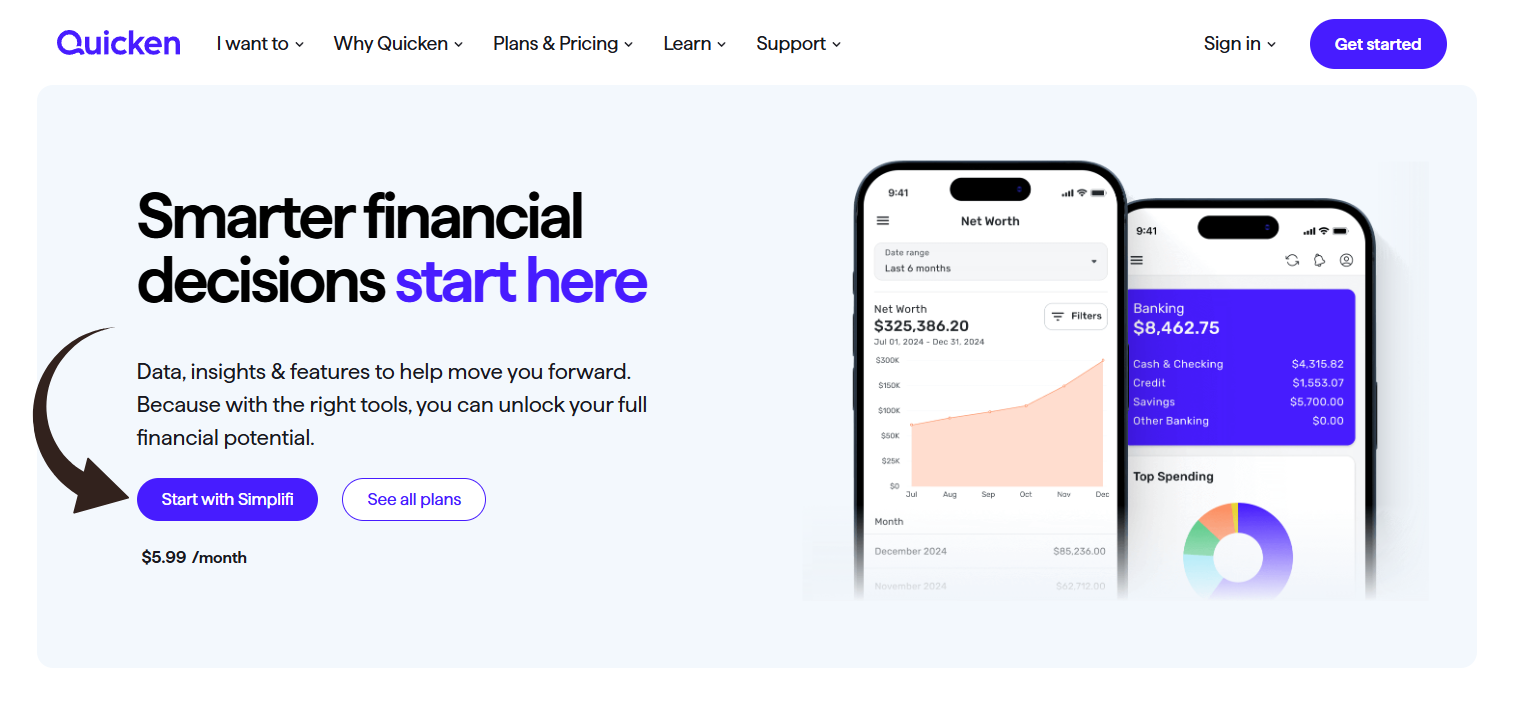

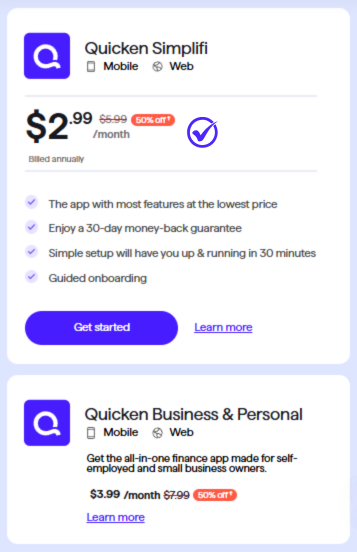

Want to take control of your finances? With Quicken, you can connect to thousands of financial institutions. Explore it for more!

Pricing: It has a free trial. The premium plan at $5.59/month.

Key Features:

- Budgeting Tools

- Bill Management

- Investment Tracking

What is RefreshMe?

RefreshMe is a tool to help you track your spending.

It can help you keep your receipts in one place. It also helps you see where your money is going.

It tries to make expense tracking simple for everyone.

Also, explore our favorite Refreshme alternatives…

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

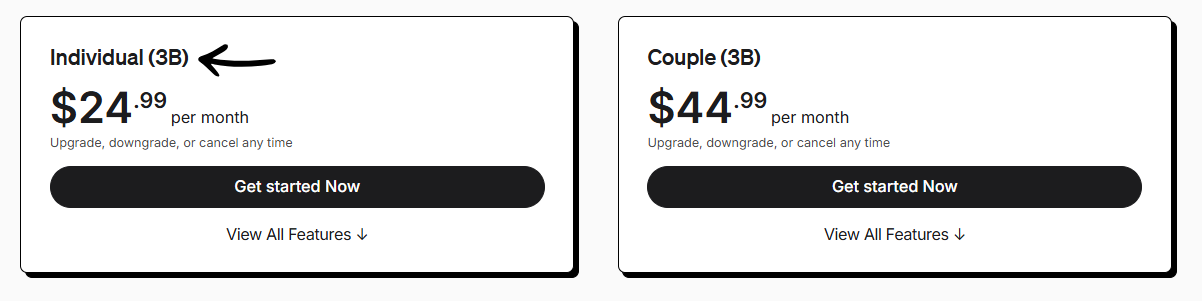

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

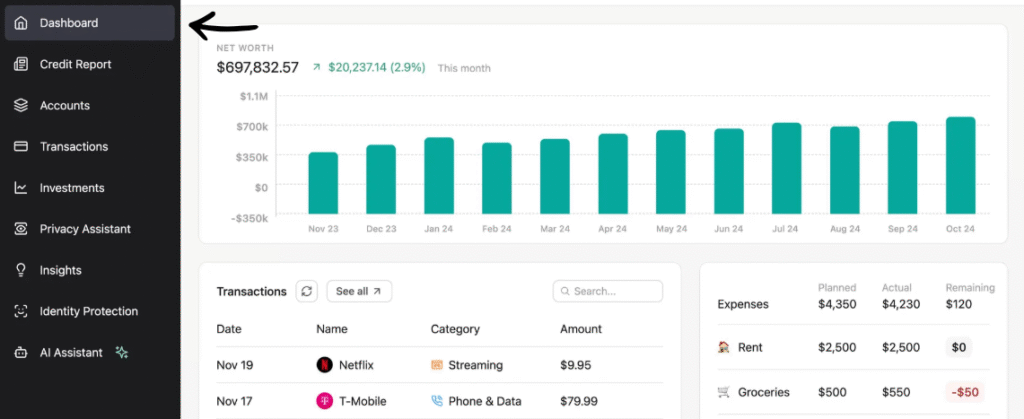

What is Quicken?

So, you’re wondering about Quicken?

It’s like a tool that helps you see all your money stuff in one place. Think of it as your digital money organizer.

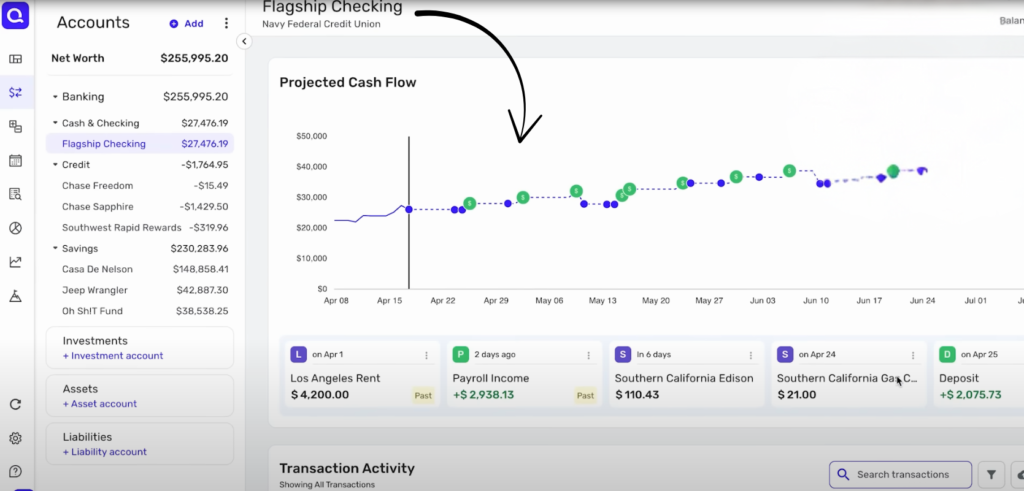

It can help you track your bank accounts, bills, and even investments.

Pretty handy, right?

Also, explore our favorite Quicken alternatives…

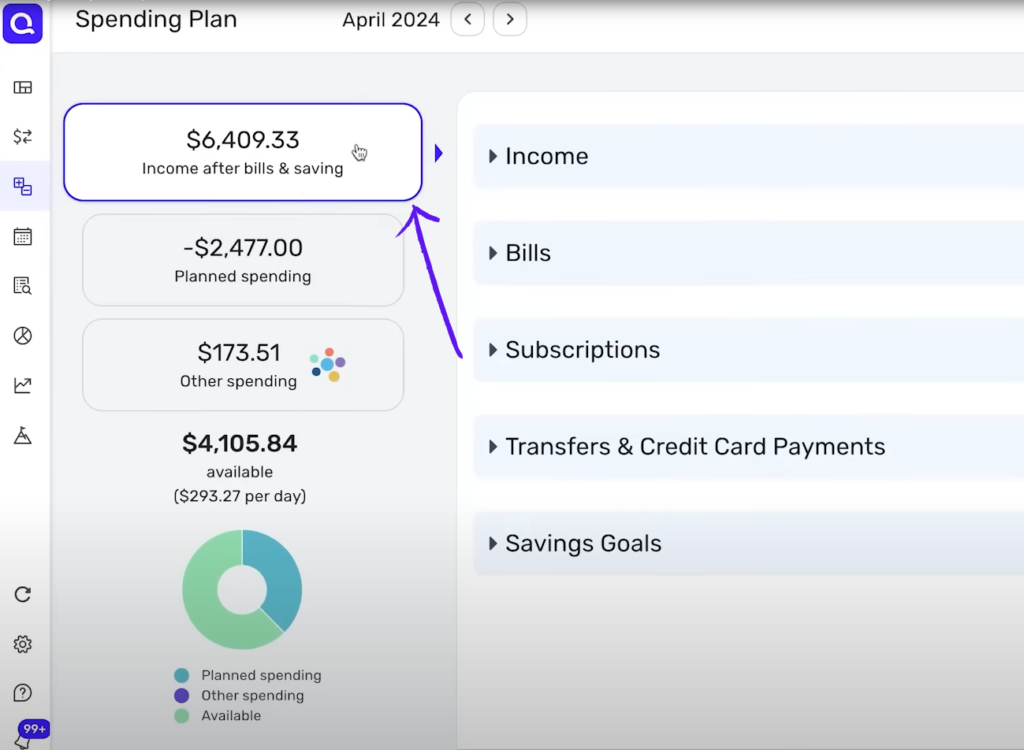

Key Benefits

Quicken is a powerful tool for getting your financial life in order.

They boast over 40 years of experience and have been a #1 best-selling product.

Their various plans can connect to over 14,500 financial institutions.

You can also get a 30-day money-back guarantee to try it out risk-free.

- Connects with thousands of banks and credit cards.

- Creates detailed budgets.

- Tracks investments and net worth.

- Offers retirement planning tools.

Pricing

- Quicken Simplifi: $2.99/month.

Pros

Cons

Feature Comparison

Selecting personal finance software requires evaluating a platform’s depth and services.

This Feature Comparison of Refreshme and Quicken breaks down the difference between modern AI-driven simplicity and decades of comprehensive financial planning functionality.

1. Platform Focus and Business Use

- Refreshme: This is a pure personal finance software that helps clients collect data to track expenses and improve their financial treatment. It is not designed for small business accounting, but for personal use.

- Quicken: The quicken brand offers plans like quicken business and personal (and the quicken business & personal plan) which allow users to manage rental properties and business finances alongside personal accounts. It’s the best accounting software for a full picture.

2. Software Architecture and Access

- Refreshme: It is cloud-based, accessible via mobile app, and requires an internet connection. The user interface is continually updated to improve the clients’ experience, and you can access the services easily.

- Quicken: It is historically self hosted/on premise software, running primarily on windows and mac desktop systems, though it offers limited mobile and download access now. This age of design is a key difference.

3. Investment and Retirement Planning

- Refreshme: It offers basic investment monitoring to refresh your knowledge of your balances and profit.

- Quicken: The quicken premier and quicken deluxe tiers offer advanced retirement planning and sophisticated analysis of investment portfolios. It is built to manage complex financial assets and project future balances.

4. Cost and Licensing Model

- Refreshme: The price is typically a budget-friendly, low-cost subscription with clear billing period terms.

- Quicken: The price has shifted entirely to a subscription model and often includes add-on fees. The core quicken software is a high cost upfront and comes in different versions (deluxe, premier) with varying functionality.

5. Content, Reviews, and Support

- Refreshme: Reviews note its modern content and AI-driven treatment plans. The content is easily digestible and geared to improve basic financial literacy for clients.

- Quicken: The quicken review highlights decades of comprehensive content and a large community. This history provides vast information, even though some reviews note that support team quality has failed to match the software’s depth.

6. Transaction Tracking and Entry

- Refreshme: It helps clients collect bank transactions and uses cookies for easy login. The automation saves time by automatically entering transactions to refresh the dashboard.

- Quicken: It has robust features to collect bank transactions and enter manual transactions. Quicken software allows for longer transaction history and greater detail in financial records.

7. Budgeting and Cash Flow

- Refreshme: It is a simple tool for budgeting tools and gives a quick review of cash flow. The primary goal is to improve spending habits.

- Quicken: It offers more traditional, detailed budgeting tools that allow every users to analyze historical data & forecast future cash flow. The quicken deluxe version provides enhanced reporting for deeper analysis.

8. Business and Tax Functionality

- Refreshme: It is strictly personal finance software and has no ability to send invoices or handle sales tax.

- Quicken: The Quicken Premier and Quicken Business & Personal plans offer sales tax tracking, run payroll, send invoices, and accounts receivable features, providing a full picture for the self employed.

9. User Experience and Design

- Refresh me: Its user interface is often described as modern and clean, with a clear focus on the personal financial picture change from the beginning.

- Quicken: Its user interface can be complex, but the quicken software is designed to provide key features for every personal planning need, offering services for every age and financial art stage.

10. Bill Management and Market Alternatives

- Refreshme: This platform’s services include robust bill tracking and management, helping clients monitor upcoming payments to maintain cash flow. It aims to be a modern personal finance software alternative in the current market.

- Quicken: The quicken home and quicken deluxe versions have dedicated features to connect with vendors and pay bills directly. Users can easily create and forecast future income and explore various alternatives in the market for advanced financial planning.

What to look for in an Accounting Software?

Here are some extra things to think about:

- Scalability: Can the services change with your clients? If you need to track mileage and manage purchase orders, the process must be perfect and remain secure for a longer date. Aquiline capital partners often analyze software based on its value for long-term growth and payments handling.

- Support: What kind of help is available if you have questions? You should review vendors and their support dates to see how quickly they refresh their system when a financial transaction has failed. The difference in treatment is clear: good support must offer information immediately to clients.

- Ease of Use: Is it something you and your team can learn quickly? Expensify makes it easy to enter a photo and log mileage from your pocket, but the desktop version of QuickBooks can be harder to master for a new manager.

- Specific Needs: Does it handle the unique things your business does? Does the treatment of clients change based on their age? Does the software manage expenses for a small number of users and allow you to track mileage and purchase orders with tags?

- Security: How safe is your financial data with this software? The face of security is constantly updated. The expensify card provides real time security, but you should always review stored data. The difference in art is clear: simple interfaces are less likely to fail than every complex ones, and they help employers approve requests to manage expenses.

Final Verdict

So, which one wins: Refreshme or Quicken?

For most people wanting a simple way to manage everyday money, Refreshme is a great pick.

It’s easier to use and helps you see your money clearly without lots of complicated features.

However, if you have many investments or need very deep reports, Quicken might be better.

We looked at everything from budgeting to tracking bills and investments.

Our goal is to give you the best advice for your money.

Choose the one that fits how you handle your finances best.

More of Refreshme

- Refresh me vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Refresh me vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Refresh me vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Refresh me vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Refresh me vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Refresh me vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Refresh me vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Refresh me vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Refresh me vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Refresh me vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- Refresh me vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Refresh me vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Refresh me vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Refresh me vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Refresh me vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Refresh me vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of Quicken

- Quicken vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Quicken vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Quicken vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Quicken vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Quicken vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Quicken vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Quicken vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Quicken vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Quicken vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Quicken vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Quicken vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Quicken vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Quicken vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Quicken vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Quicken vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is Refreshme better for beginners?

Yes, Refreshme is often better for beginners. Its simple design makes it easy to set up and start tracking your spending. It focuses on essential money management without overwhelming features.

Does Quicken offer investment tracking?

Yes, Quicken offers strong investment tracking. It allows you to monitor various investment accounts, analyze performance, and get detailed reports. This makes it suitable for active investors.

Can I link all my bank accounts to both platforms?

Generally, yes, you can link most bank accounts to both Refreshme and Quicken. They aim to consolidate your financial data in one place for a complete overview of your money.

Do Refreshme vs Quicken have mobile apps?

Yes, both Refreshme and Quicken offer mobile apps. This lets you manage your finances on the go from your smartphone or tablet. Their features on mobile might differ slightly from desktop versions.

Which one is more secure for my financial data?

Both Refreshme and Quicken use security measures to protect your financial data. They employ encryption and other safeguards. Always ensure you use strong passwords and practice good online privacy habits.