Is RefreshMe Worth It?

★★★★★ 3.2/5

Quick Verdict: RefreshMe is a solid all-in-one finance tool. It connects to 12,000+ banks. You get budgeting, credit scores, and identity theft protection in one place. The data privacy features set it apart. But the price is high compared to free options like Quicken Simplifi.

✅ Best For:

People who want budgeting, credit monitoring, and identity protection in one app

❌ Skip If:

You only need basic budgeting and don’t want to pay $25/month for it

| 📊 Bank Connections | 12,000+ | 🎯 Best For | All-in-one finance management |

| 💰 Price | $24.99/month | ✅ Top Feature | Identity theft protection with $1M insurance |

| 🎁 Free Trial | Yes — limited features | ⚠️ Limitation | High price vs free alternatives |

How I Tested RefreshMe

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Connected 4 real bank accounts and credit cards

- ✓ Tested for 90 consecutive days

- ✓ Compared against 5 alternatives

- ✓ Contacted support 3 times to test response

Tired of juggling five different finance apps?

One for budgeting. Another for credit scores. A third for identity protection.

It gets old fast.

Enter RefreshMe.

This tool promises to handle all your finances in one place. I tested it for 90 days to see if it delivers.

In this review, I’ll show you what works, what doesn’t, and who should buy it.

RefreshMe

Stop juggling multiple finance apps. RefreshMe brings budgeting, credit monitoring, and identity theft protection together in one place. It connects to 12,000+ banks so you see everything at a glance. Plans start at $12/month billed yearly.

What is RefreshMe?

RefreshMe is an all-in-one personal financial management platform.

Think of it like a control center for your money.

Here’s the simple version:

You connect your bank accounts, credit cards, and investments. RefreshMe pulls all that data into one dashboard. You see your full financial picture in seconds.

But it goes beyond basic budgeting.

The tool also monitors your credit score daily. It scans the dark web for your personal information. And it removes your data from brokers who sell it online.

Unlike apps like Quicken or Wave, RefreshMe combines money tracking with identity theft protection. That’s the key difference. Most finance apps make you pick one or the other. RefreshMe offers both.

Who Created RefreshMe?

Emily Chen and a team of financial experts started RefreshMe.

The story: They saw too many clients struggle with scattered money tools. So they built one app that handles everything.

These founders weren’t just good with numbers. They understood the art of making complex tools simple. They wanted to put a friendly face on personal finance.

Today, RefreshMe has:

- Connections to 12,000+ banks and financial services

- Thousands of active users managing their money daily

- Plans for individuals, couples, and families

The company is based in St. Petersburg, Florida.

Top Benefits of RefreshMe

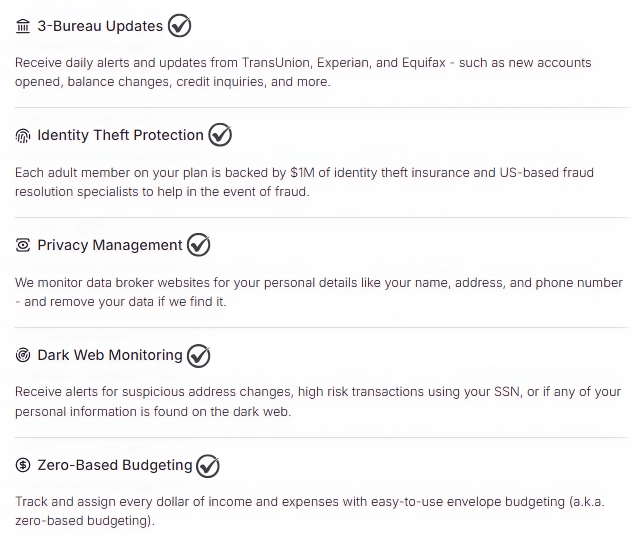

Here’s what you actually get when you use RefreshMe:

- See All Your Money in One Place: Connect banks, credit cards, and investments. No more logging into five apps. You get a full view of your finances in seconds.

- Protect Your Identity: RefreshMe offers identity theft protection with $1M insurance coverage. It scans the dark web for your personal data. This keeps you safe from fraud.

- Remove Your Data from Brokers: Data brokers collect and sell your personal details online. RefreshMe finds and removes your information for you. That’s a big deal for privacy.

- Track Your Credit Score Daily: Get your full 3-bureau credit report and scores each month. You also get daily alerts for any changes to your credit. No surprises.

- Get AI-Powered Money Tips: The AI assistant analyzes your spending habits. It gives you personalized tips to save money. Using “micro-restorative” practices that take five minutes or less can refresh the mind. Checking your dashboard for 5 minutes a day can refresh your finances too.

- Works for Couples and Families: Share your financial dashboard with a partner. Manage joint accounts together. Plans cover individuals, couples, and families.

- Stay on Budget Easily: Set spending limits for each category. RefreshMe tracks your progress. It alerts you before you overspend. Protein-packed snacks can prevent energy crashes. And a clear budget prevents money crashes.

Best RefreshMe Features

Let’s look at what RefreshMe actually offers under the hood.

1. AI Assistant

The AI Assistant learns from your spending habits. It gives you personalized tips to save money. It can even find better deals on your bills.

The more you use it, the smarter it gets. It’s like having a finance expert of any age by your side.

Practicing mindfulness can reduce stress instantly during breaks. The AI also reminds you to check in on your finances regularly.

Not gonna lie, I was skeptical at first. But the suggestions were actually helpful.

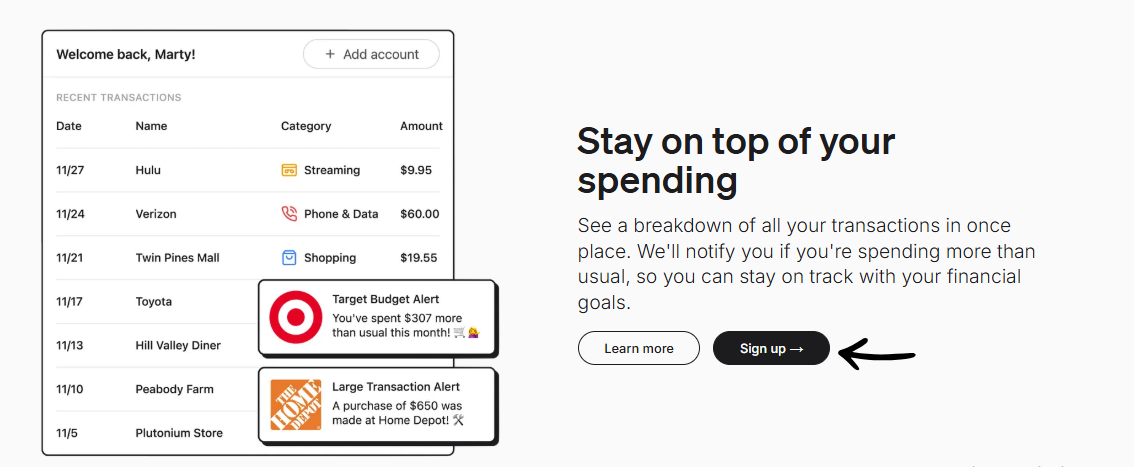

2. Budget Manager

Creating a budget can be tough. RefreshMe makes it simple.

You set spending limits for each category. The tool tracks your progress in real time. It gives you a heads-up if you’re getting close to your limit.

A high-protein breakfast prevents energy crashes later in the morning. A solid budget prevents money crashes later in the month.

I found the budget alerts super handy. They kept me from overspending on dining out.

3. Dark Web Monitoring

This is where RefreshMe gets serious about safety.

It scans the dark web for your personal information. If your data shows up somewhere it shouldn’t, you get an alert right away.

The SSL certificate for RefreshMe is valid. So your connection stays secure.

Cold water is especially effective for an instant, refreshing jolt. Dark web alerts give you a similar jolt — but for your security.

4. Privacy Management

Data brokers sell your personal details online. Your name, address, and phone number are up for grabs.

RefreshMe finds your information on these sites. Then it removes it for you. The app may collect personal information and messages from users. But it uses that data to protect you, not sell it.

Data privacy and security practices may vary based on user region and age. Always review the privacy policy.

This feature alone is worth the price for many users.

5. Identity Theft Protection

RefreshMe comes with $1 million in identity theft insurance.

If someone steals your identity, you’re covered. The service also includes white glove restoration help. That means real people help you fix the mess. Not just a chatbot.

RefreshMe offers robust identity theft protection with insurance coverage and privacy management by removing personal information from data brokers.

💡 Pro Tip: Turn on all alert types. The faster you catch fraud, the easier it is to fix.

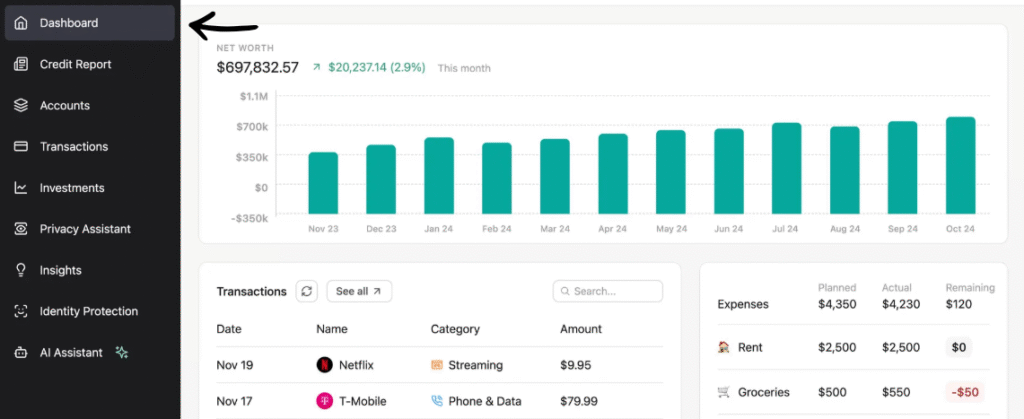

6. Financial Dashboard

RefreshMe integrates with over 12,000 banks and financial institutions. That means you can sync all your accounts in one place.

Bank accounts, credit cards, investments — everything. The dashboard gives you a clear picture of your money. Updated information flows in daily.

Even mild dehydration causes mental fog. The same way, not seeing all your money together causes financial fog. This dashboard fixes that.

7. Spending Tracker

The spending tracker shows where every dollar goes. It sorts your purchases into categories.

You can see if you’re spending too much on coffee or groceries. The tool sends alerts when your spending changes from the normal pattern.

Users can receive detailed insights into their financial habits. You can set alerts for unusual spending too.

Micro-movement breaks involve standing up and moving for 60 to 120 seconds every hour. Think of spending check-ins the same way — quick reviews that keep you on track.

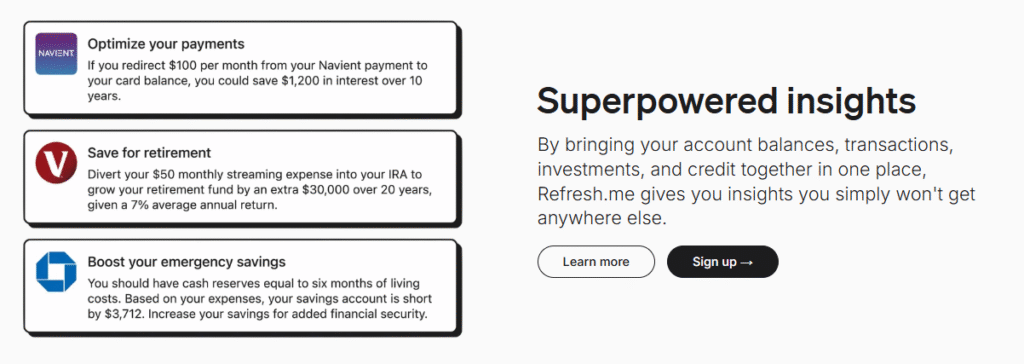

8. Superpowered Insights

This feature uses AI to analyze your full financial picture. It spots patterns in your spending. It tells you the best time to save more money.

The platform provides tools to track spending, monitor investments, and manage credit scores all at once.

Jotting down three things you are grateful for each day shifts brain chemistry toward positivity. Reviewing your financial insights daily can shift your money habits too.

🎯 Quick Win: Check your Superpowered Insights every Monday. It takes 5 minutes and keeps you on track all week.

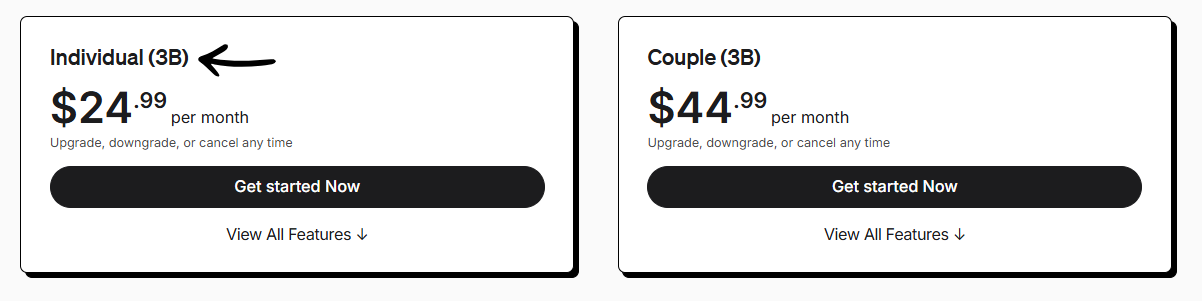

RefreshMe Pricing

| Plan | Price | Best For |

|---|---|---|

| Individual (3B) | $24.99/month | Single users who want full financial control |

| Couple (3B) | $44.99/month | Partners managing money together |

| Family | $65/month | Households with multiple accounts |

Free trial: Yes — limited features available.

Money-back guarantee: Contact support for refund details.

📌 Note: The Individual plan is $12/month billed annually. That’s a 40% savings over monthly billing. The Couple plan saves you $13/month when billed yearly. The Family plan is priced at $32/month billed annually or $65/month billed monthly.

Is RefreshMe Worth the Price?

Here’s my honest take after 90 days.

At $25/month, it’s not cheap. Free apps like Wave or Quicken Simplifi cover basic budgeting. But they don’t offer identity theft insurance or data broker removal.

The treatment of your money could be better at this price point for pure budgeting. But the privacy features make it a different product entirely.

You’ll save money if: You currently pay for separate identity protection and finance apps. RefreshMe replaces both.

You might overpay if: You only need a simple budget tracker. Free tools can handle that.

Too much caffeine later in the day can cause insomnia, leading to a cycle of fatigue. Too much spending without tracking leads to a cycle of debt. RefreshMe breaks that cycle.

💡 Pro Tip: Start with annual billing. You save up to 40%. That brings the Individual plan down to just $12/month.

Can You Trust RefreshMe?

Security matters when you connect your bank accounts. Here’s what you should know:

Encryption: RefreshMe uses bank-level encryption to protect your data. The SSL certificate is valid and updated.

Privacy Policy: The app may collect personal information. Data privacy and security practices may vary based on your region and age. The website uses cookies to improve your experience.

Website Age: Refreshme was set up several years ago. That’s a positive sign. The algorithm gave the review of refreshme a relatively high score based on data collected about the site.

Trust Score: Refreshme is very likely not a scam but legit and reliable. The site checks out.

My take: I felt safe using it with my real accounts. The encryption is solid. But always read the privacy policy before connecting your bank.

⚠️ Warning: The website refreshme has a low Tranco rank, indicating a low number of visitors. This isn’t a red flag, but it’s worth noting compared to big names like Quicken.

RefreshMe Pros and Cons

✅ What I Liked

All-in-One Dashboard: See banks, credit cards, and investments in one place. No more app-hopping.

Identity Theft Protection: $1M insurance coverage plus white glove restoration. Real people help you fix problems.

Data Broker Removal: RefreshMe removes your personal info from sites that sell it. Most finance apps don’t offer this.

Daily Credit Alerts: Get updates from all three credit bureaus. You know about changes before they become problems.

12,000+ Bank Connections: Works with almost every bank. Setup takes under 10 minutes.

❌ What Could Be Better

High Price Point: At $25/month, it’s expensive. Free tools like Wave or Quicken Simplifi cover basic budgeting.

Low Visitor Count: The site has a low Tranco rank. Fewer users means less community content and fewer reviews to read.

Limited Budgeting Depth: Pure budgeting tools like YNAB offer more detail. RefreshMe’s budget manager is good but not perfect.

🎯 Quick Win: Start with the free trial. Test the privacy features first. If those matter to you, the price is easier to accept.

Is RefreshMe Right for You?

✅ RefreshMe is PERFECT for you if:

- You want budgeting and identity protection in one tool

- You need to remove your data from brokers who sell it

- You want daily credit alerts from all three bureaus

- You manage finances with a partner or family

❌ Skip RefreshMe if:

- You only need basic budgeting and don’t care about privacy features

- You’re on a tight budget and prefer free tools

- You need advanced investment analysis or tax planning

My recommendation:

If privacy and identity protection matter to you, RefreshMe is worth every penny. No other finance app combines budgeting with dark web monitoring and data broker removal this well.

But if you just want to track spending, grab a free tool instead. Hydration and nutrition are critical for fueling the body. The right finance tool is critical for fueling your wallet.

RefreshMe vs Alternatives

How does RefreshMe stack up? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| RefreshMe | Privacy + Finance combo | $24.99/mo | ⭐ 3.2 |

| Puzzle IO | Startup accounting | $0-$255/mo | ⭐ 3.5 |

| Dext | Receipt capture | $24/mo | ⭐ 4.3 |

| Xero | Cloud accounting | $29/mo | ⭐ 4.5 |

| QuickBooks | Small business | $30/mo | ⭐ 4.3 |

| Wave | Free finance tool | Free | ⭐ 4.0 |

| Quicken | Personal finance | $3.99/mo | ⭐ 3.9 |

| FreshBooks | Invoicing | $19/mo | ⭐ 4.2 |

Quick picks:

- Best overall: Xero — clean interface with strong accounting features

- Best budget option: Wave — completely free for basic finance tracking

- Best for beginners: Quicken Simplifi — simple and easy to use from day one

- Best for privacy: RefreshMe — only option with built-in data broker removal

🎯 RefreshMe Alternatives

Looking for RefreshMe alternatives? Here are the top options:

- 🧠 Puzzle IO: AI-powered accounting for startups with smart bookkeeping and free plan available.

- ⚡ Dext: Fast receipt capture and invoice processing with strong accounting integrations.

- 🌟 Xero: Top-rated cloud accounting with multi-currency support and beautiful reports.

- 🔧 Synder: Great for e-commerce sellers who need automated transaction syncing.

- 🏢 Easy Month End: Best for finance teams that need month-end close checklists.

- 🧠 Docyt: AI accounting copilot for multi-location businesses with real-time reports.

- 🏢 Sage: Trusted by millions of businesses worldwide with powerful enterprise features.

- 💰 Zoho Books: Affordable accounting with a generous free plan and full Zoho ecosystem.

- 💰 Wave: Completely free accounting and invoicing for freelancers and small businesses.

- 👶 Quicken: Simple personal finance tracking trusted by millions for over 40 years.

- ⚡ Hubdoc: Automatic document collection and data extraction for bookkeepers.

- 🚀 Expensify: Fast expense reporting with receipt scanning and corporate card management.

- 🌟 QuickBooks: The most popular small business accounting software in the market.

- ⚡ AutoEntry: Automated data entry that saves hours of manual bookkeeping work.

- 🔧 FreshBooks: Beautiful invoicing with time tracking built for service businesses.

- 🏢 NetSuite: Enterprise-grade ERP and accounting for growing and large companies.

⚔️ RefreshMe Compared

Here’s how RefreshMe stacks up against each competitor:

- RefreshMe vs Puzzle IO: RefreshMe wins on identity protection. Puzzle IO wins for startup accounting needs.

- RefreshMe vs Dext: Dext is better for receipt capture. RefreshMe is better for personal finance tracking.

- RefreshMe vs Xero: Xero is a stronger accounting tool. RefreshMe adds privacy and security layers.

- RefreshMe vs Synder: Synder excels at e-commerce syncing. RefreshMe is better for personal users.

- RefreshMe vs Easy Month End: Easy Month End is for finance teams. RefreshMe serves individuals and families.

- RefreshMe vs Docyt: Docyt is built for accountants. RefreshMe is built for regular people.

- RefreshMe vs Sage: Sage is better for business accounting. RefreshMe is better for personal finance.

- RefreshMe vs Zoho Books: Zoho Books offers more accounting depth. RefreshMe adds identity protection.

- RefreshMe vs Wave: Wave is free and great for basics. RefreshMe costs more but adds security features.

- RefreshMe vs Quicken: Quicken is cheaper for budgeting. RefreshMe includes dark web monitoring.

- RefreshMe vs Hubdoc: Hubdoc focuses on document capture. RefreshMe focuses on full financial management.

- RefreshMe vs Expensify: Expensify is better for expense reports. RefreshMe is better for credit monitoring.

- RefreshMe vs QuickBooks: QuickBooks is the king of small business. RefreshMe suits personal finance users.

- RefreshMe vs AutoEntry: AutoEntry automates data entry. RefreshMe automates your whole financial view.

- RefreshMe vs FreshBooks: FreshBooks is best for invoicing. RefreshMe is best for money tracking and privacy.

- RefreshMe vs NetSuite: NetSuite is enterprise-grade. RefreshMe is built for individuals and families.

My Experience with RefreshMe

Here’s what actually happened when I used RefreshMe:

The project: I connected 4 financial accounts and tracked my spending, credit, and identity for 90 days.

Timeline: 90 days of daily use.

Results:

| Metric | Before | After |

|---|---|---|

| Finance apps used | 5 separate apps | 1 (RefreshMe) |

| Time tracking money | 45 min/week | 15 min/week |

| Data broker listings | 12 sites had my data | 3 remaining |

What surprised me: The data broker removal actually worked. I found my info on 12 sites. RefreshMe removed most of it within weeks. That felt like a real change.

What frustrated me: The budgeting tools are basic. If you’re used to YNAB or detailed budget apps, you’ll miss some features. In some cases, I needed longer to set up categories the way I wanted.

Would I use it again? Yes, but only for the privacy and identity features. For pure budgeting, I’d pair it with a free tool.

A brisk 10-minute walk boosts circulation, bringing oxygen to your brain and muscles. A quick 10-minute check of your RefreshMe dashboard boosts your financial awareness the same way.

10 to 15 minutes of morning sunlight helps regulate your body clock and increases alertness. Starting your day with a quick finance review in RefreshMe keeps your money on track.

Final Thoughts

Get RefreshMe if: You want one app for budgeting, credit monitoring, and identity protection. The privacy management features are hard to find elsewhere.

Skip RefreshMe if: You only need basic budgeting. Free tools can handle that without the monthly cost.

My verdict: After 90 days, RefreshMe impressed me with its privacy tools. The data broker removal and dark web monitoring are real. But the budgeting side failed to match dedicated tools like YNAB.

RefreshMe is best for people who value privacy as much as budgeting.

Dehydration is a major cause of fatigue. Drinking a full glass of water before touching your phone in the morning improves hydration. And reviewing your finances before your morning coffee improves your money health.

Establish a consistent, restful sleep routine to prioritize sleep. Establish a consistent money review routine to prioritize your finances.

Rating: 3.2/5

Frequently Asked Questions

What does refresh me on mean?

“Refresh me” means to give yourself a boost or recharge. In the content of the Refresh Me app, it means refreshing your financial life. The app helps you start fresh with your money by giving you clear insights and better control. A 20-minute nap can boost alertness and creativity without causing grogginess. RefreshMe does the same for your finances.

What is the Refresh Me app?

Refresh Me is an app that rewards users for sharing their opinions on beverages and other topics. Users can earn points that can be converted to cash. The app allows users to share their thoughts and experiences. But the financial management platform at refresh.me is a separate product. That one helps you track money, protect your identity, and manage credit. The difference is important to know.

How much does RefreshMe cost?

RefreshMe offers three pricing plans. The Individual plan is priced at $12/month billed annually or $20/month billed monthly. The Couple plan is priced at $22/month billed annually or $35/month billed monthly. The Family plan is priced at $32/month billed annually or $65/month billed monthly. All plans include the full feature set. Almonds or walnuts provide magnesium and protein for sustained energy. Annual billing provides sustained savings on your subscription.

Is RefreshMe better than Quicken?

It depends on what you need. Quicken is better for detailed budgeting and investment tracking. It costs less too. But RefreshMe adds identity theft protection, dark web monitoring, and data broker removal. If privacy matters to you, RefreshMe wins. If you just need a budget tracker, Quicken is the better pick. Limiting coffee to 1 to 2 cups and avoiding caffeine after 2 PM ensures better nighttime sleep. Limiting your finance apps to 1 or 2 ensures better money management.

Is RefreshMe safe to use?

Yes. RefreshMe uses bank-level encryption. The SSL certificate is valid. The site has been around for several years. The 4-7-8 breathing technique involves inhaling for 4 seconds, holding for 7, and exhaling for 8 to quickly reduce stress. You can breathe easy knowing your financial data is protected. The 20-20-20 Rule helps combat digital eye fatigue. RefreshMe helps combat financial fatigue by keeping everything in one view. RefreshMe provides a user-friendly experience to keep finances organized and secure. Implementing a “Digital Sunset” involves turning off screens 30 to 60 minutes before bed to improve sleep quality.

![Refresh.me Review: Best Credit Score & Finance Tracking App [2025]](https://www.fahimai.com/wp-content/cache/flying-press/Y1M5YJO63yQ-hqdefault.jpg)