Feeling frustrated with accounting software that doesn’t quite fit?

Is RefreshMe falling short, making financial management a headache?

You’re not alone. Clunky interfaces or missing features can really slow you down.

Imagine accounting software that truly helps, making tracking intuitive and reports clear.

This article will show you the 9 best RefreshMe alternatives. Discover how these platforms can simplify your accounting, save time, and help your business thrive in 2025.

Find your perfect financial partner!

What Are the Best RefreshMe Alternatives?

Choosing the best accounting software is a big decision.

With so many options out there, how do you pick the best one for your business?

We’ve done the hard work for you.

Here’s our ranked list of the 9 best RefreshMe alternatives, designed to help you find the perfect fit to manage your finances.

1. Xero (⭐4.8)

Xero is an online accounting software popular with small and growing businesses.

It helps you manage money from anywhere and is known for being easy to use. If you’ve found other software clunky, Xero might be a breath of fresh air.

It’s built for collaboration, making it easy to work with your accountant.

Unlock its potential with our Xero tutorial.

Also, explore our RefreshMe vs Xero comparison!

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

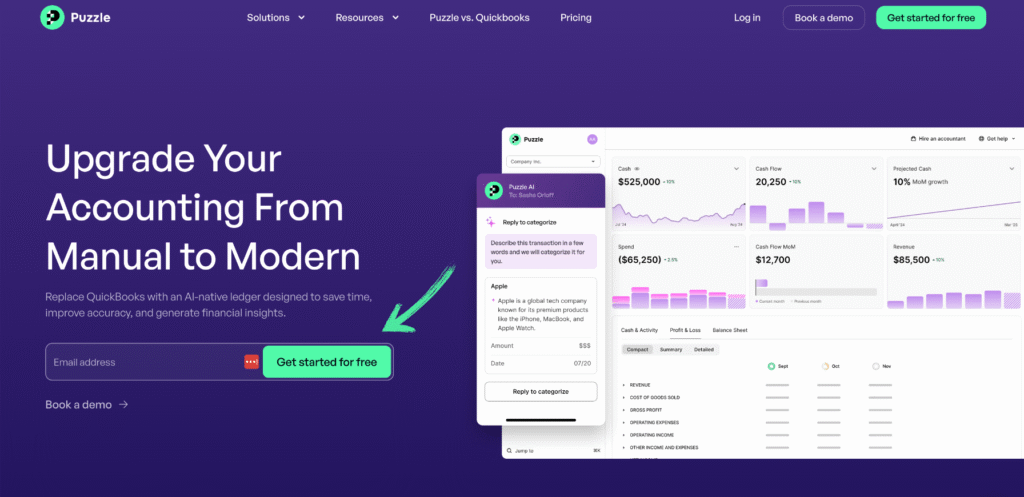

2. Puzzle IO (⭐4.5)

Puzzle IO is an accounting tool that uses smart AI.

It helps businesses with financial planning.

It’s especially good for project-based work. You can bill clients based on time or materials.

It makes sending invoices simpler.

Unlock its potential with our Puzzle IO tutorial.

Also, explore our RefreshMe vs Puzzle IO comparison!

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

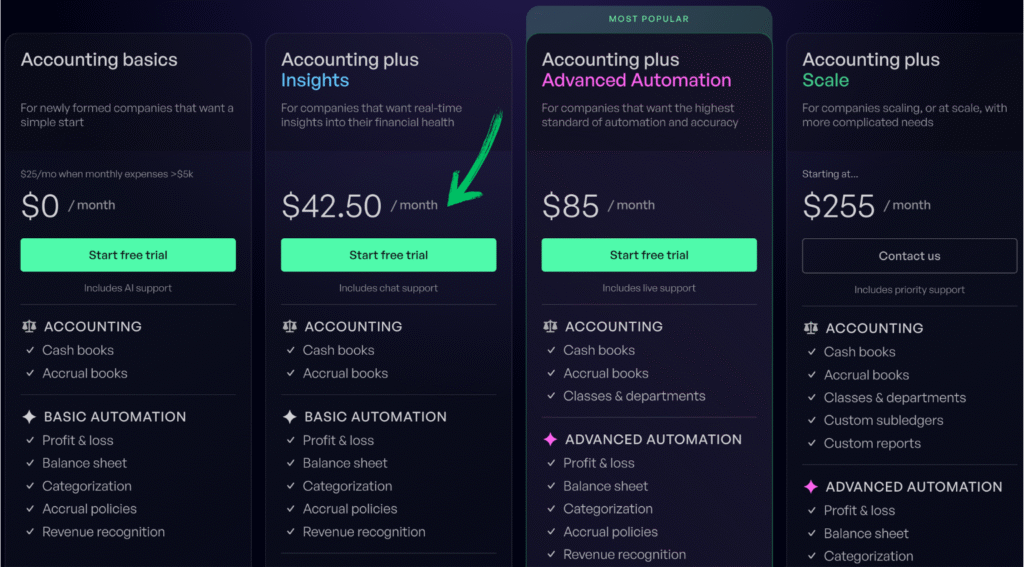

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

3. Dext (⭐4.0)

Dext (formerly Receipt Bank) is focused on simplifying data entry.

It’s not a full accounting system itself. Instead, it works with other software, such as QuickBooks or Xero.

It helps you get receipts and invoices into your accounting faster.

Unlock its potential with our Dext tutorial.

Also, explore our RefreshMe vs Dext comparison!

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

4. Synder (⭐3.8)

Synder (formerly CloudBusiness) focuses on syncing e-commerce and payment data.

It connects your online sales channels to your accounting software.

Think Shopify, Amazon, Stripe, etc. This makes reconciliation much easier.

Unlock its potential with our Synder tutorial.

Also, explore our RefreshMe vs Synder comparison!

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

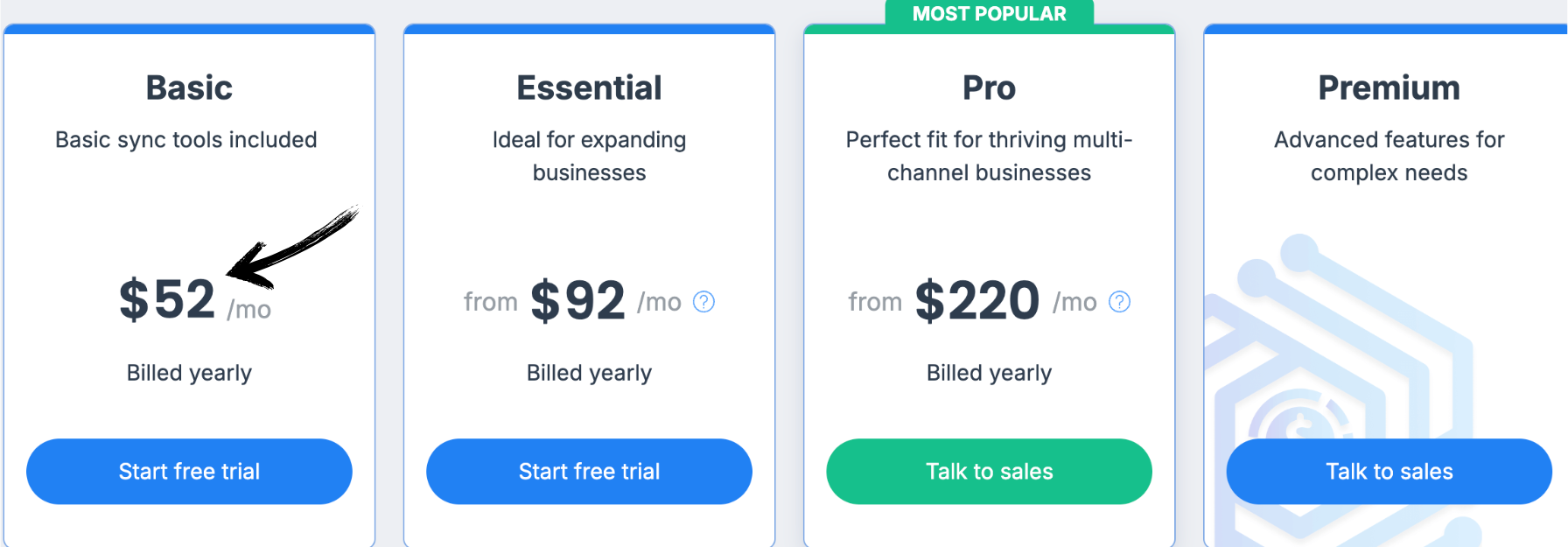

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

5. Easy Month End (⭐3.6)

Easy Month End is a tool made to help accountants.

It makes the end-of-month process much smoother and helps you close your books faster.

This software focuses on making sure your numbers are right, saving a lot of time.

Unlock its potential with our Easy Month End tutorial.

Also, explore our RefreshMe vs Easy Month End comparison!

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

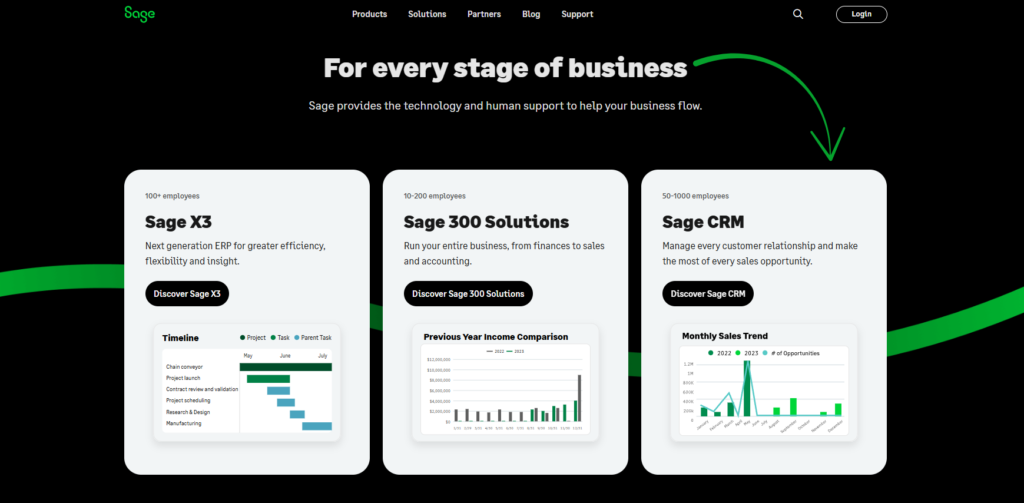

6. Sage (⭐️3.4)

So, Sage is a big name in the accounting world. They have been around for a while.

Their software uses AI to help with things like invoicing and bank reconciliation.

From small startups to large enterprises. It helps manage finances, payroll, and operations.

It’s a well-established name in accounting.

Unlock its potential with our Sage tutorial.

Also, explore our Refreshme vs Sage comparison!

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

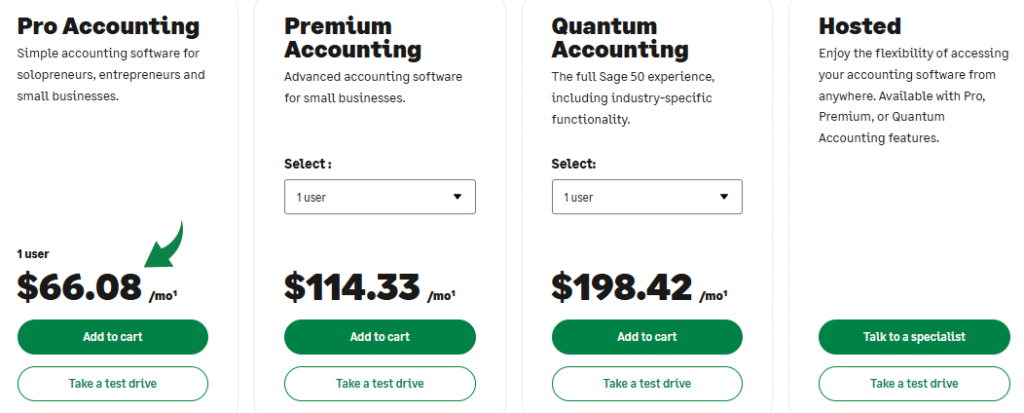

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

7. Docyt (⭐3.2)

Docyt is an accounting tool that uses AI. It helps automate many money tasks.

It’s great for getting financial data. Docyt can sort and check your books.

It makes accounting much simpler and faster.

Unlock its potential with our Docyt tutorial.

Also, explore our RefreshMe vs Docyt comparison!

Key Benefits

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

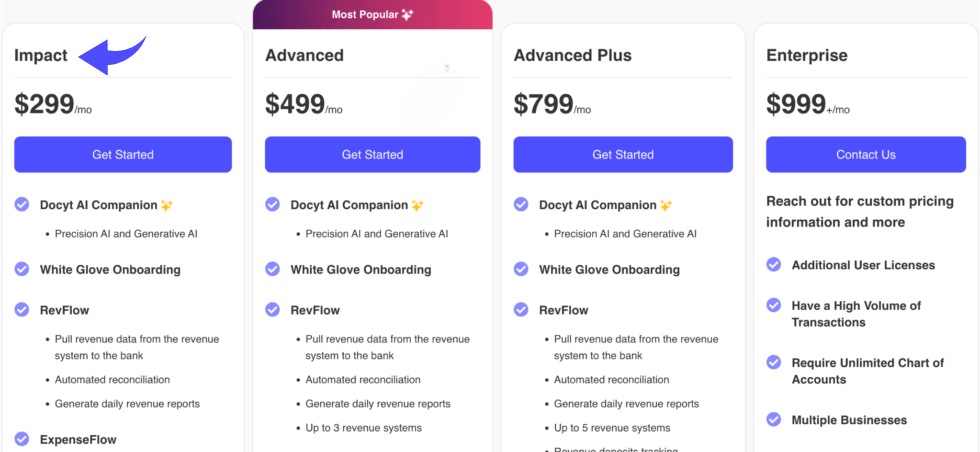

Pricing

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Pros

Cons

8. FreshBooks (⭐3.0)

FreshBooks is an online accounting tool.

It’s built mainly for freelancers and small service businesses.

It helps you send invoices fast.

You can also track time spent on projects. It makes getting paid easier.

Unlock its potential with our FreshBooks tutorial.

Also, explore our RefreshMe vs FreshBooks comparison!

Our Take

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

Key Benefits

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

Pricing

- Lite: $2.10/month.

- Plus: $3.80/month.

- Premium: $6.50/month.

- Select: Custom Pricing.

Pros

Cons

9. QuickBooks (⭐2.8)

QuickBooks is super popular. Lots of small businesses use it.

It helps you keep track of money, send invoices easily, and manage payroll.

It’s great for managing all your money tasks, like invoicing or tracking costs.

It’s a strong tool that can grow with your business.

Unlock its potential with our QuickBooks tutorial.

Also, explore our RefreshMe vs QuickBooks comparison!

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

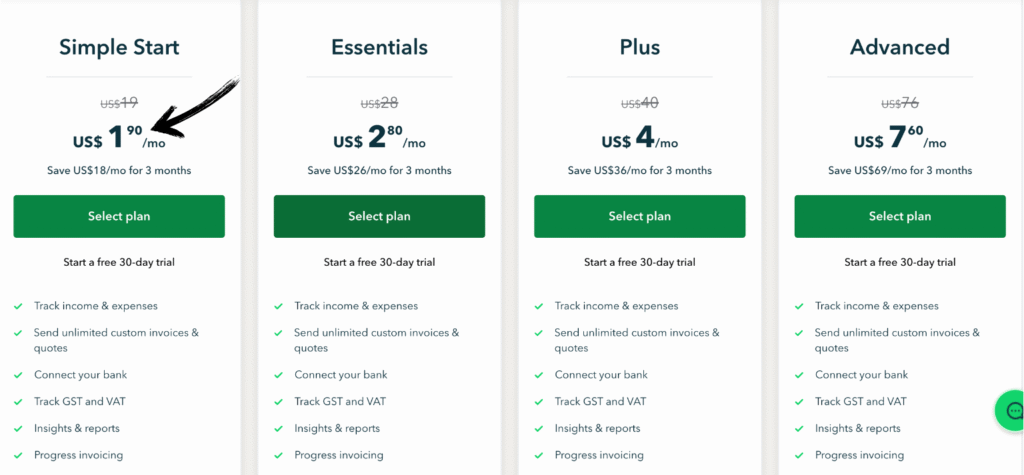

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

Buyers Guide

When conducting our research to find the best product, we used the following steps and factors to make our determination:

- Defining the Market: We started by identifying the primary function of Refresh.me, which is personal finance software for managing personal finances. We then searched for refresh me alternatives and competitors, focusing on those that offered similar features and cater to the same audience. We also acknowledged that some users may be looking for accounting software alternatives, which have a different but related function, especially for managing business expenses.

- Establishing Evaluation Factors: We developed a set of key factors to evaluate each product consistently. These factors were:

- Pricing: We analyzed the starting price and various pricing plans, including any free trials or freemium options. We looked at the cost per month and what features were included at each tier, helping users identify unnecessary costs.

- Features: We meticulously reviewed the features of each product. This included core functionalities like connecting with financial institutions, tracking all your transactions, bill reminders, and creating custom categories. We also looked for advanced features such as cash flow analysis, investment performance tracking, identity theft protection, and expense reporting for business expenses. We also considered AI features to help users gain insights and receive detailed insights.

- Negatives: We sought out what was missing from each product, such as limitations on the number of linked bank accounts, a lack of certain reports, or a more manual effort required for certain tasks. We also looked for common user complaints to understand potential drawbacks.

- Support or Refund: We investigated the level of support provided by each company, including community forums, customer service availability, and refund policies. We also checked for security and privacy management, as well as the ability of the company to protect user data and keep finances organized.

- Data Collection: We gathered data from a variety of sources, including official company websites for their pricing and features, user reviews and testimonials, and third-party comparison sites. We also looked for articles and guides that discussed refresh.me alternatives to get a broad understanding of the market.

- Analysis and Comparison: We used the data we collected to create a side-by-side comparison of the products. We analyzed how each product performed based on our evaluation factors, identifying which ones excelled at helping users save money, spot unusual spending, or reach their financial targeted goals with just a few clicks. We focused on clear reports and how a company could provide extra money for the user in the form of savings.

- Final Recommendation: Based on our comprehensive analysis, we formulated our final recommendations, highlighting the strengths and weaknesses of each product and providing a clear path for buyers to choose the best solution for their needs, whether for personal finances or business expenses, and especially during tax season.

Wrapping Up

We’ve covered a lot of ground in our guide to Refreshme alternatives.

The right software offers powerful tools to improve your financial health.

By using these platforms, you can simply track account balances and manage recurring transactions.

This helps you meet your financial goals.

The best tools go even further. They let you monitor investments and improve your credit score.

Some even support multiple currencies, which is great for anyone with global finances.

These features are all about giving users a full picture of their financial well being.

Our goal is to help you find the best software for your needs and allowing users to make a fast movement.

We believe our research will help you make a smart choice and get your finances on the right track.

Frequently Asked Questions

What is the best free replacement for Mint?

NerdWallet is widely considered the best free successor. It offers robust credit score monitoring and cash flow tracking without a subscription fee. While Simplifi and Monarch are popular, they require paid plans to unlock full functionality.

Which are the best alternatives to ChatGPT?

Google Gemini and Claude 4.5 Sonnet lead the pack in 2026. Gemini excels at deep Google ecosystem integration, while Claude offers superior reasoning and nuance. For real-time web data, Perplexity remains the go-to “answer engine” for most users.

What is the best free alternative to Midjourney?

Stable Diffusion and Leonardo.ai are the top contenders. Leonardo provides a generous daily credit allowance for high-quality generations. For a completely local, uncensored experience, running Stable Diffusion on your own hardware is the definitive professional choice.

Is there a free alternative to Fliki?

Zebracat offers a free tier that allows you to test AI video generation features. However, most free versions include watermarks and limited credits. For open-source enthusiasts, combining local text-to-speech with tools like OBS Studio can bypass subscription costs.

What is the best alternative to ElevenLabs?

Murf.ai and Play.ht are the strongest rivals for high-fidelity voice cloning. Murf is particularly praised for its studio-quality output and collaborative features. If you need vast language support, Play.ht offers over 140 languages with ultra-realistic intonation.

Who are clear secure competitors?

In the identity verification space, Vanta and Sift are major corporate rivals. For travelers, TSA PreCheck is the primary “government-run” alternative. While CLEAR speeds up the physical kiosk process, these competitors focus on broader security compliance and automated fraud prevention.

Who are some of Olipop’s biggest competitors?

Poppi is the most direct rival in the functional soda market. Both brands dominate retail shelves with prebiotic-infused sparkling tonics. Other rising challengers include Culture Pop and Longevity Soda, which target the same health-conscious “better-for-you” beverage demographic.

More Facts about RefreshMe Alternatives

- Xero is a website that helps small businesses manage their finances.

- Puzzle uses smart computers, or AI, to help companies plan their spending.

- Dext makes it easy to scan receipts so you don’t have to type in every bill.

- Synder connects online stores to accounting software, so sales are automatically recorded.

- QuickBooks is a very famous tool that helps people pay employees and send bills.

- Docyt uses smart tech to automate boring money chores.

- FreshBooks is built for people who work for themselves, like freelancers.

- Zoho Books is a great choice for small businesses because it costs little.

- People look for RefreshMe alternatives to find better prices or different features.

- Top money apps use encryption, like a secret code, to keep your private info safe.

- Moving your data from RefreshMe to a new app is usually easy using “import” tools.

- MoneyPatrol is a free app that helps you watch your spending and cash flow.

- PocketGuard tells you exactly how much “spending money” you have left after bills are paid.

- Monarch Money consolidates all your bank accounts into a single, simple view.

- Albert is an all-in-one app for saving, spending, and even investing.

- Emma looks at your bank account to find all the monthly bills you pay.

- Money Pro helps you manage your budget and pay your bills on time.

- Moneydance is a simple program that can handle money from different countries.

- CountAbout lets you make as many categories and accounts as you want.

- Firefly III is a detailed tool that lets you set spending limits in different currencies.

- Toshl connects to your bank to show you where your money goes.

- Spendee automatically lists your purchases to give you a full picture of your money.

- Monee (often spelled Money) lets you organize your accounts with your own labels.

- Brigit has tools to help you track your spending and watch your bills.

- Freo gives you features to help you spend and invest your money wisely.

- NAD+ boosters are tiny helpers that give your body’s cells more energy.

- Coconut water is a natural drink full of electrolytes that help your body stay hydrated.

- Fruit water tastes good and helps you drink more water without eating extra sugar.

- RefreshMe connects with over 12,000 banks and helps protect you from identity theft.

- RefreshMe pricing has three levels: Individual ($12), Couple ($22), and Family ($32) per month.

- All RefreshMe plans give you credit reports and help from a smart AI assistant.

- Watermelon contains a special nutrient called L-citrulline, which helps your muscles feel better after exercise.

- Sugar-free electrolyte water has vitamins and minerals like magnesium and potassium, but no sugar.

- You can make a homemade hydration drink using just water, salt, sugar, and lemon.

- Liquid I.V. is a popular powder that helps your body soak up water faster.

- If someone is very dehydrated from thirst, doctors may recommend oral rehydration solutions.

- Adaptogenic drinks use special plants like Ashwagandha to help you feel calm and less stressed.