Tired of spending too much time on bookkeeping?

It can feel like a never-ending chore, right?

Imagine if there were a way to make it faster and easier.

Two popular options are Dext and Synder.

But which one is the better fit for you in 2025?

This article will break down Dext vs Synder.

Overview

We looked closely at both Dext and Synder.

We tried them out to see how they work.

This helped us compare them fairly.

Now we can show you what each one can do.

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and streamlining your finances.

Pricing: It has a free trial. The premium plan starts at $24/month.

Key Features:

- Receipt Scanning

- Expense Reports

- Bank Reconciliation

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Check it out today!

Pricing: It has a free trial. The premium plan starts at $52/month.

Key Features:

- Multi-Channel Sales Sync

- Automated Reconciliation

- Detailed Reporting

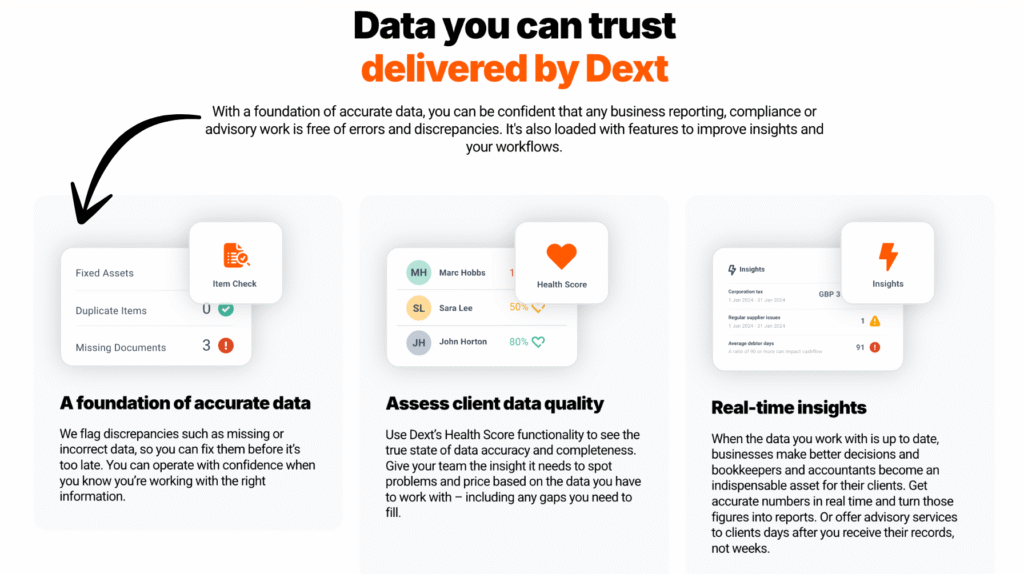

What is Dext?

Okay, so what is Dext?

Think of it like a super smart helper for your papers.

It mostly takes care of things like bills and receipts.

You just snap a picture, and Dext gets all the important info.

Unlock its potential with our Dext alternatives…

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

What is Synder?

Let’s talk about Synder.

It’s a tool that helps your different business apps talk to each other.

Think of it like a helper that moves your money info where it needs to go.

This can save you a lot of time.

Unlock its potential with our Synder alternatives…

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

Feature Comparison

We compare Dext and Synder, two powerful automation tools.

Focusing on how each streamlines accounting and bookkeeping workflows to save small business owners time and ensure secure data flow into their accounting systems.

Both platforms aim to reduce the manual entry of financial documents, but they have different areas of expertise and feature sets.

1. Primary Workflow Focus

- Dext (formerly Receipt Bank) concentrates on the effortless data extraction and management of expenditure documents.

- Its core function is to allow users to quickly capture receipts, bills, and invoices using the dext mobile app or email, automating data entry for expenses.

- Synder specializes in automated accounting for multi-channel sales, focusing on syncing all your cost and sales data from all your sales channels like Shopify and Stripe.

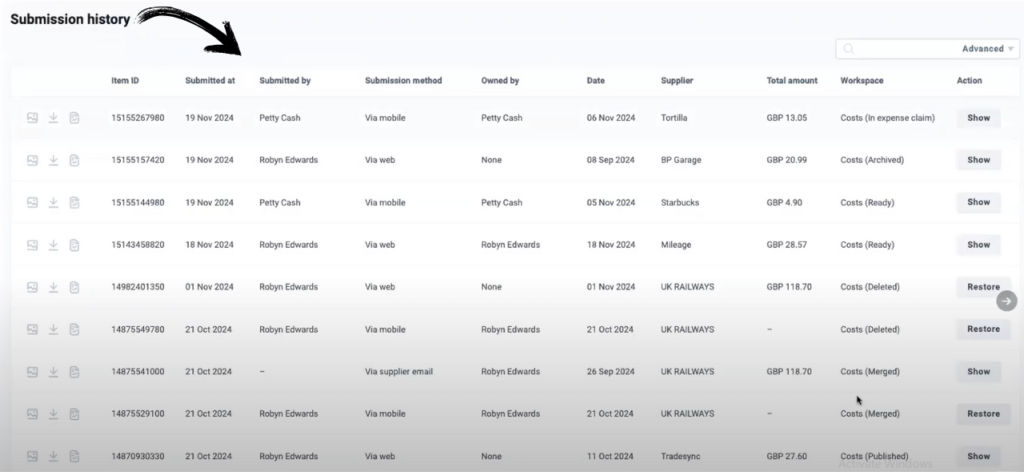

2. Document/Transaction Submission Methods

- Dext offers multiple ways for users to submit receipts and financial documents, including the dext mobile app for mobile scanning, email submission, and bank feeds. This simplifies data collection.

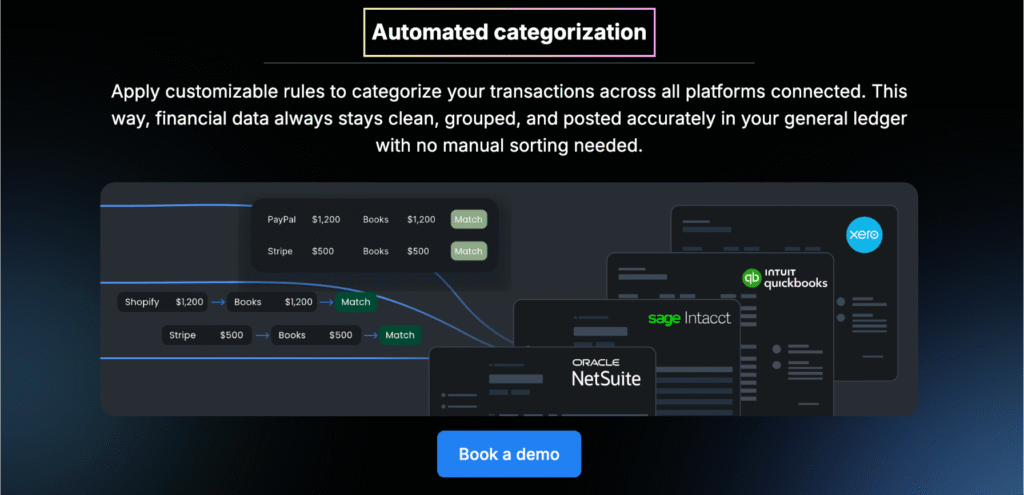

- Synder’s primary method is deep integration with e-commerce platforms and payment processors like PayPal and Square to import and categorize historical transactions and current sales data automatically.

3. Data Extraction Technology

- Dext utilizes advanced optical character recognition (OCR technology) to accurately extract data from photos of receipts, invoices, and other documents, eliminating the need for manual entry.

- Synder focuses on accurately importing and structuring complex multi-channel sales data, including fees, refunds, and discounts, which is a structured API-driven process.

4. E-commerce and Sales Data Handling

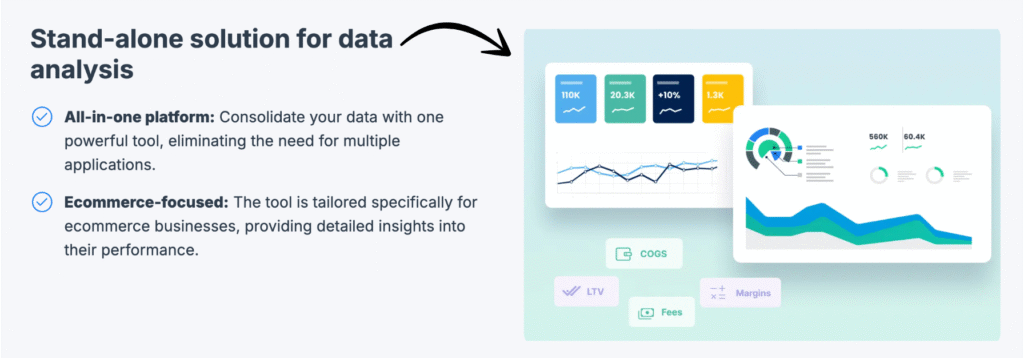

- Synder’s key strength lies in its ability to manage high-volume multi-channel sales transactions and ensure GAAP compliance for areas like revenue recognition. It helps get your books balanced by recording granular detail from platforms like Etsy and eBay.

- Dext Commerce also addresses e-commerce, but Synder is more holistically built around the intricate cost and sales data workflow of online retailers.

5. Automated Categorization and Rules

- Both offer automation to streamline bookkeeping workflows. Dext allows the user to set up supplier rules to automatically assign tracking categories and tax details.

- Synder uses a smart sync mode and intelligent categorization for sales and expenses to map all transaction components (e.g., taxes, fees, shipping) correctly into the general ledger.

6. Expense Management and Tracking

- Dext is an award-winning expense management solution, making it easy for small business owners and their employees to manage expenses and submit receipts for expense claims in just a few minutes, removing hassle. It is ideal for quickly processing and storing evidence for tax details.

- Synder’s expense management is centered on the fees and expenses associated with e-commerce transactions and payment gateways, rather than general employee expense claims.

7. Core Accounting System Integration

- Both tools offer deep integration with major accounting packages like QuickBooks, Xero, and Sage Intacct, ensuring a secure data flow of financial information.

- Dext’s strength is seamlessly sending extracted purchase/expense data, while Synder’s strength is its ability to send structured, complex multi-currency sales data, including handling of refunds and payouts, ready for reconciliation.

8. System Dependability and Security

- Both providers emphasize use and system dependability with high-level encryption.

- Dext ensures document security and cloud storage. While technical codes like a Cloudflare Ray ID or Cloudflare Ray ID found are part of a website’s security service against online attacks, both tools employ strong internal security, as a simple SQL command is not a security solution.

9. Price and Scalability

- Both offer tiered pricing plans, often with a free trial today.

- Dext saves bookkeepers’ time by streamlining receipt capture and fetching invoices. Synder’s pricing, typically based on transaction volume, scales effectively for high volume e-commerce sellers needing precise revenue recognition.

10. Missing Document and Data Integrity

- Dext Prepare includes features to help a Dext account user identify missing receipts and chase for required documents. The platform is designed to catch malformed data during the data extraction phase.

- Synder’s focus on historical transactions and automatic multi-platform synchronization helps prevent missing sales data, making it easier for finance teams to resolve discrepancies and ensure accurate reports and balance sheets for bookkeeping and taxes.

What to Look for When Choosing an Automated Accounting Tool?

Choosing the right automated accounting tool, such as Dext or Synder, requires evaluating its core capabilities, ease of use, and compatibility with your existing systems.

- Core Functionality: Determine if the tool’s core strength aligns with your primary need. Dext’s strength is helping your accountant collect receipts and other documents, while Synder is best for syncing multi-channel ecommerce data from platforms like Clover to get a clean background of transactions.

- Ease of Use and Onboarding: Look for a solution where the setup is simple and not riddled with mistakes. The platform should be intuitive to use daily to minimize stress. You should feel glad that you chose to try Dext or its alternative.

- Integration and Compatibility: Ensure the software is compatible with your main accounting system (like QuickBooks, Xero, or NetSuite) and payment processors. Check if the product can bring historical data correctly without causing issues.

- Data Capture Flexibility: The tool should offer several actions for data input, such as one-click submission, to easily store receipts and other purchase orders. Verify if it can process certain word patterns or rules.

- Automation and Workflow: The system should be able to process transactions and track expenses automatically. Look for evidence that critical actions are performed, triggered by new data rather than manual intervention.

- E-commerce Specifics: For online sellers, the tool must handle subscriptions, refunds, and platform fees accurately to reduce the need to manually resolve complex payout data.

- Support and Resources: Customer support should be helpful. If you’re a site owner or an accountant managing multiple customers, reliable support is non-negotiable, even if the company’s roots are in a tech hub like San Francisco.

- Scalability and Commitment: Choose a tool that can grow with you. The process to switch from an old method or drop a confusing system should be straightforward. Get to the truth of its capabilities during the trial.

Key Insights (No Fluff):

- Dext works best as a pre-accounting tool to digitize expenses for your accountants.

- Synder excels at consolidating multi-channel ecommerce sales data before sending a summarized journal entry to your books.

- Do not be solely swayed by highlighted features; test for accurate, real-world reconciliation across all your sales channels.

- Verify the tool’s ability to correctly map taxes and fees from platforms like Clover.

Final Verdict

So, we looked at both Dext and Synder.

They both do some cool things to help with business stuff.

If you deal with lots of papers like receipts, Dext is really good at that.

If you sell things online a lot, Synder has some neat tools just for that.

For many businesses, especially those selling online, Synder seems to have more to offer right now, with its strong e-commerce integration and sales workflow automation.

So we think our pick can help you make the right choice to save time and get your business numbers in order.

More of Dext

We’ve also taken a look at how Dext compares with other expense management and accounting tools:

- Dext vs Xero: Xero offers comprehensive accounting with integrated expense management features.

- Dext vs Puzzle IO: Puzzle IO excels in AI-powered financial insights and forecasting.

- Dext vs Synder: Synder focuses on syncing e-commerce sales data and payment processing.

- Dext vs Easy Month End: Easy Month End streamlines the month-end financial closing procedures.

- Dext vs Docyt: Docyt uses AI to automate bookkeeping and document management tasks.

- Dext vs RefreshMe: RefreshMe provides real-time insights into business financial performance.

- Dext vs Sage: Sage offers a range of accounting solutions with expense tracking capabilities.

- Dext vs Zoho Books: Zoho Books provides integrated accounting with expense management features.

- Dext vs Wave: Wave offers free accounting software with basic expense tracking features.

- Dext vs Quicken: Quicken is popular for personal finance and basic business expense tracking.

- Dext vs Hubdoc: Hubdoc specializes in automated document collection and data extraction.

- Dext vs Expensify: Expensify offers robust expense reporting and management solutions.

- Dext vs QuickBooks: QuickBooks is a widely used accounting software with expense management tools.

- Dext vs AutoEntry: AutoEntry automates data entry from invoices, receipts, and bank statements.

- Dext vs FreshBooks: FreshBooks is designed for service-based businesses with invoicing and expense tracking.

- Dext vs NetSuite: NetSuite offers a comprehensive ERP system with expense management functionalities.

More of Synder

- Synder vs Puzzle io: Puzzle.io is an AI-powered accounting tool built for startups, with a focus on metrics like burn rate and runway. Synder is more focused on syncing multi-channel sales data for a broader range of businesses.

- Synder vs Dext: Dext is an automation tool that excels at capturing and managing data from bills and receipts. Synder, on the other hand, specializes in automating the flow of sales transactions.

- Synder vs Xero: Xero is a full-featured cloud accounting platform. Synder works with Xero to automate data entry from sales channels, whereas Xero handles all-in-one accounting tasks like invoicing and reporting.

- Synder vs Easy Month End: Easy Month End is a tool designed to help businesses organize and streamline their month-end closing process. Synder is more about automating daily transaction data flow.

- Synder vs Docyt: Docyt uses AI for a wide range of bookkeeping, including bill pay and expense management. Synder is more focused on automatically syncing sales and payment data from multiple channels.

- Synder vs RefreshMe: RefreshMe is a personal finance and task management application. This is not a direct competitor, as Synder is a business accounting automation tool.

- Synder vs Sage: Sage is a long-standing, comprehensive accounting system with advanced features like inventory management. Synder is a specialized tool that automates data entry into accounting systems like Sage.

- Synder vs Zoho Books: Zoho Books is a complete accounting solution. Synder complements Zoho Books by automating the process of importing sales data from various ecommerce platforms.

- Synder vs Wave: Wave is a free, user-friendly accounting software, often used by freelancers and very small businesses. Synder is a paid automation tool designed for businesses with high-volume, multi-channel sales.

- Synder vs Quicken: Quicken is primarily personal finance management software, though it has some small business features. Synder is built specifically for business accounting automation.

- Synder vs Hubdoc: Hubdoc is a document management and data capture tool, similar to Dext. It focuses on digitizing bills and receipts. Synder focuses on syncing online sales and payment data.

- Synder vs Expensify: Expensify is a tool for managing expense reports and receipts. Synder is for automating sales transaction data.

- Synder vs QuickBooks: QuickBooks is a comprehensive accounting software. Synder integrates with QuickBooks to automate the process of bringing in detailed sales data, making it a valuable add-on rather than a direct alternative.

- Synder vs AutoEntry: AutoEntry is a data entry automation tool that captures information from invoices, bills, and receipts. Synder focuses on automating sales and payment data from ecommerce platforms.

- Synder vs FreshBooks: FreshBooks is an accounting software designed for freelancers and small service-based businesses, with a focus on invoicing. Synder is for businesses with a high volume of sales from multiple online channels.

- Synder vs NetSuite: NetSuite is a comprehensive Enterprise Resource Planning (ERP) system. Synder is a specialized tool that syncs ecommerce data into broader platforms like NetSuite.

Frequently Asked Questions

What is the main difference between Dext and Synder?

Dext is best for managing receipts and bills, as well as pulling key data for accounting. Synder focuses on automating sales data entry and syncing from e-commerce platforms and payment systems directly into your accounting software.

Which is better for e-commerce businesses, Dext or Synder?

Synder is generally better for e-commerce businesses. It offers direct integrations with platforms like Shopify and automates the syncing of sales, payments, and even inventory data, streamlining your workflow.

Can Dext or Synder integrate with QuickBooks Online (QBO)?

Yes, both Dext and Synder can integrate with QuickBooks Online (QBO). This allows for a smoother flow of financial data into your accounting system, reducing the need for manual data entry.

Is there a free trial available for Dext and Synder?

Yes, typically both Dext and Synder offer a free trial period. This lets you test their features and see which one best fits your business needs before committing to a paid plan.

Which tool is more suitable for an accounting firm?

Accounting firms often favor Dext due to its efficient handling of client paperwork like receipts and invoices. Synder can also be valuable for firms with e-commerce clients, simplifying their sales data management.