¿Estás tratando de averiguar cuál? software de contabilidad ¿Es lo mejor para tu negocio?

¡Con tantas opciones, puede resultar difícil!

Dos opciones populares que podría considerar son Puzzle IO y QuickBooks.

Realizar un seguimiento del dinero no debería ser una lucha, como tampoco lo deberían ser las tareas que se puedan automatizar.

En este artículo, compararemos Puzzle IO y QuickBooks para ayudarlo a decidir cuál es el más adecuado para usted.

Descripción general

Hemos pasado tiempo explorando Puzzle IO y QuickBooks.

Profundizando en sus características y cómo funcionan para diferentes negocio necesidades.

Esta comparación es el resultado de una experiencia práctica y una evaluación cuidadosa para brindarle una imagen clara de lo que ofrece cada uno.

¿Listo para simplificar tus finanzas? Descubre cómo Puzzle IO puede ahorrarte hasta 20 horas al mes. Experimenta la diferencia.

Precios: Plan gratuito disponible. El plan de pago cuesta desde $42.50 al mes.

Características principales:

- Planificación financiera

- Pronóstico

- Análisis en tiempo real

Utilizado por más de 7 millones de empresas, QuickBooks puede ahorrarle un promedio de 42 horas por mes en teneduría de libros.

Precios: Tiene una prueba gratuita. El plan cuesta desde $1.90 al mes.

Características principales:

- Gestión de facturas

- Seguimiento de gastos

- Informes

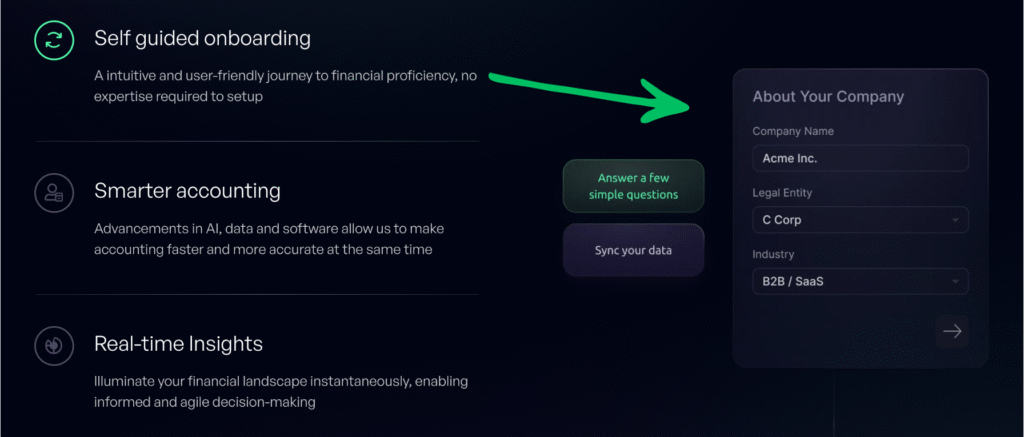

¿Qué es Puzzle IO?

Entonces, Puzzle IO, ¿de qué se trata?

Piense en ello como una herramienta que realmente le ayuda a ver el futuro de las finanzas de su negocio.

No se trata sólo de lo que está sucediendo ahora, sino de lo que podría suceder.

Además, explora nuestros favoritos Alternativas a Puzzle IO…

Nuestra opinión

¿Listo para simplificar tus finanzas? Descubre cómo Puzzle io puede ahorrarte hasta 20 horas al mes. ¡Descubre la diferencia hoy mismo!

Beneficios clave

Puzzle IO realmente brilla cuando se trata de ayudarle a comprender hacia dónde se dirige su negocio.

- 92% de Los usuarios informan de una mayor precisión en las previsiones financieras.

- Obtenga información en tiempo real sobre su flujo de caja.

- Cree fácilmente diferentes escenarios financieros para planificar.

- Colabore sin problemas con su equipo en los objetivos financieros.

- Realice un seguimiento de los indicadores clave de rendimiento (KPI) en un solo lugar.

Precios

- Conceptos básicos de contabilidad: $0/mes.

- Perspectivas de contabilidad Plus: $42.50/mes.

- Contabilidad más automatización avanzada: $85/mes.

- Escala de Contabilidad Plus: $255/mes.

Ventajas

Contras

¿Qué es QuickBooks?

Bien, hablemos de QuickBooks. Probablemente ya lo conoces.

Montón de pequeñas empresas Lo utilizan para administrar sus asuntos financieros del día a día.

Piense en ello como un centro neurálgico para facturas, gastos y seguimiento del rendimiento actual de su negocio.

Además, explora nuestros favoritos Alternativas a QuickBooks…

Beneficios clave

- Categorización automatizada de transacciones

- Creación y seguimiento de facturas

- Gestión de gastos

- Servicios de nómina

- Informes y paneles de control

Precios

- Comienzo sencillo: $1,90/mes.

- Básico: $2.80/mes.

- Más: $4/mes.

- Avanzado: $7.60/mes.

Ventajas

Contras

Comparación de características

A continuación se presenta una comparación del desempeño de estas dos empresas en aspectos financieros clave.

Esto le brindará la información clara que necesita para elegir la mejor solución para su pequeña empresa.

1. Métricas en tiempo real y pista de efectivo

This is often a game-changer for early-stage founders and co-founders.

- Rompecabezas IO: Proporciona información en tiempo real sobre métricas clave como el efectivo. pista and burn rate on a clean dashboard. This gives an up-to-date, accurate picture of the current state of the company quickly.

- QuickBooks: Requiere más esfuerzo manual para obtener una imagen precisa de estas métricas clave. Los usuarios a menudo necesitan exportar datos empresariales. datos a hojas de cálculo y calcular ellos mismos el efectivo disponible, lo que les obliga a esperar más tiempo para obtener información crucial.

2. Automatización impulsada por IA y categorización de transacciones

Flujo de trabajo automatización es clave para ahorrar menos tiempo en tareas tediosas.

- Rompecabezas IO: Features AI-powered workflow automation for transaction categorization directly into the general ledger. This is designed to reduce errors and make bookkeeping easier for non-accountants.

- QuickBooks: Tiene una buena automatización para vincular cuentas bancarias y tarjetas de crédito, pero la categorización de las transacciones a menudo requiere una revisión manual, lo que significa que quienes no son contadores pueden dedicar más tiempo a corregir errores.

3. Reconocimiento de ingresos y contabilidad de acumulación

Manejo complejo contabilidad Aplicar las reglas correctamente es esencial para un seguimiento adecuado de los ingresos.

- Rompecabezas IO: Ofrece reconocimiento y acumulación de ingresos automatizados e integrados contabilidadEsto es vital para obtener una visión precisa de los ingresos de los inversores. Garantiza el cumplimiento tributario sin necesidad de un experto financiero a tiempo completo desde el principio.

- QuickBooks:Si bien admite la acumulación contabilidadLas complejas reglas para el reconocimiento de ingresos a menudo requieren un esfuerzo manual significativo o un contador experimentado para configurarlas y mantenerlas correctamente.

4. Activos fijos y gastos pagados por anticipado

El seguimiento y la depreciación adecuados de los activos y gastos son imprescindibles en la época de impuestos.

- Rompecabezas IO: Automatiza el seguimiento y la depreciación de activos fijos, así como la acumulación de gastos pagados por anticipado. Esto facilita enormemente a los fundadores de startups mantener sus libros contables al día y listos para su contador a la hora de presentar sus impuestos.

- QuickBooks: Admite tanto activos fijos como gastos prepagos, pero requiere más configuración manual y asientos contables, lo que puede aumentar las posibilidades de errores para quienes no son contadores.

5. Panel financiero y perspectivas financieras

Obtener visibilidad instantánea de su efectivo e ingresos es un cambio radical.

- Rompecabezas IO: El panel está diseñado para brindar a los fundadores de startups información financiera práctica y en tiempo real. Está estructurado para ofrecer una visión clara y rápida del estado actual de la empresa.

- QuickBooks: Los paneles se centran principalmente en el libro mayor y los estados financieros tradicionales. Si bien son eficaces, la información financiera a menudo requiere un análisis más profundo, y obtener una visión precisa puede esperar hasta que su contador cierre la contabilidad.

6. Funciones de nómina

La gestión de pagos de empleados y contratistas es un requisito habitual.

- Rompecabezas IO: Generalmente se integra con servicios de terceros como Gusto o Rippling para gestionar la nómina. Se centra en registrar fluidamente las transacciones de nómina en el libro mayor.

- QuickBooks: Ofrece opciones integradas como la nómina de QuickBooks (incluido el servicio completo de QuickBooks) teneduría de libros con nómina) para depósito directo y pagos a contratistas. Esto mantiene la nómina y la contabilidad bajo un mismo techo.

7. Versión de escritorio vs. versión en línea

La accesibilidad y las funciones cambian según los productos QuickBooks utilizados.

- Rompecabezas IO: Es solo una versión en línea, que ofrece acceso en línea desde cualquier lugar.

- QuickBooks: QuickBooks tiene dos productos principales: QuickBooks Online (en la nube) y QuickBooks Desktop (instalación local con una licencia para un solo equipo). QuickBooks Desktop cuenta con funciones específicas que las versiones en línea no tienen.

8. Manejo de facturas y órdenes de compra

Administrar el dinero adeudado a los proveedores es vital para el flujo de caja.

- Rompecabezas IO: Enables bill payment automation by Seguimiento de salidas de efectivo e integración con plataformas de gestión de gastos.

- QuickBooks: Proporciona funciones sólidas para pagar facturas, crear facturas para clientes y utilizar órdenes de compra para mantener registros de inventario precisos, especialmente en la versión de escritorio de QuickBooks.

9. ¿Por qué los fundadores eligieron Puzzle?

Una mirada rápida a la mentalidad detrás de la elección.

- Rompecabezas IO: Muchos fundadores eligieron Puzzle porque actúa como QuickBooks pero con un enfoque moderno impulsado por inteligencia artificial, ahorrando menos tiempo en tareas tediosas y brindando información financiera más profunda.

- QuickBooks: Los usuarios se quedan con QuickBooks Porque es el industria contable estándar. La amplia aceptación y el carácter integral de Intuit QuickBooks a pesar de pequeñas empresas es un factor importante

¿Qué tener en cuenta al elegir un software de contabilidad?

A continuación se muestra una lista de verificación rápida para tener en cuenta:

- Facilidad de uso: ¿La interfaz es intuitiva? Busca una configuración sencilla que te ayude a mantenerte organizado.

- Funciones principales: ¿Realiza un seguimiento eficaz del dinero, administra su plan de cuentas y maneja la conciliación?

- Informes Fuerza: ¿Puede generar fácilmente informes esenciales como balances generales e informes financieros detallados para mostrar su salud financiera?

- Automatización: ¿Minimiza la entrada manual de datos y ofrece una buena automatización del flujo de trabajo?

- Integración: ¿Se conecta bien con otras herramientas que utiliza, como QuickBooks Time para el tiempo de los empleados o sistemas para gestionar las ventas?

- Listo para los impuestos: ¿Simplifica los cálculos del impuesto sobre las ventas y la preparación de impuestos al final del año?

- Gestión de clientes: ¿Puede gestionar la facturación a los clientes y enviar recordatorios de pago?

- Detalles específicos de QuickBooks: ¿Está pasando de los datos de escritorio y necesita las funciones que QuickBooks le ofrece, o es autónomo y solo necesita un seguimiento básico?

- Costos y soporte: Tenga en cuenta todos los cargos potenciales antes de registrarse y consulte las reseñas de QuickBooks para obtener información sobre la atención al cliente y lo fácil que es cancelar.

- Reflexiones finales: El mejor software es el que le brinda a su negocio los mayores beneficios con la menor cantidad de molestias.

Veredicto final

La elección entre un rompecabezas y QuickBooks depende de sus necesidades.

Si la planificación futura y unos estados financieros sólidos son clave para tu startup, puedes probar su versión de prueba gratuita.

Puzzle IO podría ser genial.

Para funciones de contabilidad cotidianas y gran cantidad de conexiones, QuickBooks gana.

While no fully free software de contabilidad does it all.

Sus planes les convienen a muchos. Los hemos comprobado.

Y conocer tus objetivos principales guiará tu elección.

Más de Puzzle IO

Hemos comparado Puzzle IO con otras herramientas de contabilidad. Aquí tienes un vistazo rápido a sus características más destacadas:

- Puzzle IO frente a Xero: Xero ofrece amplias funciones de contabilidad con sólidas integraciones

- Rompecabezas IO contra Dext: Puzzle IO destaca por sus perspectivas y previsiones financieras basadas en IA.

- Puzzle IO contra Synder: Synder se destaca en la sincronización de datos de ventas y pagos.

- Puzzle IO vs. Easy Month End: Easy Month End simplifica el proceso de cierre financiero.

- Puzzle IO frente a Docyt: Docyt utiliza IA para automatizar tareas de contabilidad.

- Puzzle IO frente a RefreshMe: RefreshMe se centra en el seguimiento en tiempo real del rendimiento financiero.

- Puzzle IO contra Sage: Sage ofrece soluciones contables sólidas para empresas de distintos tamaños.

- Puzzle IO frente a Zoho Books: Zoho Books ofrece contabilidad asequible con CRM integración.

- Puzzle IO contra Wave: Wave ofrece software de contabilidad gratuito para pequeñas empresas.

- Puzzle IO frente a Quicken: Quicken es conocido por la gestión de finanzas personales y de pequeñas empresas.

- Rompecabezas IO contra Hubdoc: Hubdoc se especializa en recopilar documentos y extraer datos..

- Puzzle IO frente a Expensify: Expensify ofrece informes y gestión de gastos integrales.

- Puzzle IO frente a QuickBooks: QuickBooks es una opción popular para la contabilidad de pequeñas empresas.

- Puzzle IO vs. Entrada automática: AutoEntry automatiza la entrada de datos de facturas y recibos.

- Puzzle IO frente a FreshBooks: FreshBooks está diseñado para la facturación empresarial basada en servicios.

- Puzzle IO frente a NetSuite: NetSuite ofrece una suite integral para la planificación de recursos empresariales.

Más de QuickBooks

- QuickBooks frente a Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- QuickBooks frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- QuickBooks frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- QuickBooks frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- QuickBooks vs. Easy Month EndEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- QuickBooks frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- QuickBooks frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- QuickBooks frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- QuickBooks frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- QuickBooks frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- QuickBooks frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- QuickBooks frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- QuickBooks vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- QuickBooks frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- QuickBooks frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Qué software es mejor para empresas pequeñas y medianas como QuickBooks?

Depende de las necesidades contables específicas. QuickBooks es eficaz para la contabilidad general, mientras que otros ofrecen funciones especializadas.

¿Puede la automatización del flujo de trabajo mejorar las finanzas de mi negocio con cualquiera de los dos software?

Sí, tanto Puzzle IO como QuickBooks ofrecen funciones para automatizar tareas como la facturación y el ingreso de datos, ahorrando tiempo.

¿Cómo se compara Puzzle IO con el estándar en la industria contable?

Puzzle IO se centra en la previsión y la información basada en inteligencia artificial, un enfoque más moderno en comparación con el software tradicional.

¿Cuáles son los factores clave a considerar al evaluar las necesidades contables de mi negocio?

Piense en su presupuesto, las funciones requeridas (como facturación o nómina), las integraciones y los planes de crecimiento futuro.

¿Es difícil cambiar de una plataforma de contabilidad (como QuickBooks) a otra?

El cambio puede llevar tiempo y una planificación cuidadosa para garantizar que la migración de datos sea precisa y que su equipo se adapte al nuevo sistema.