Quick Start

This guide covers every Synder feature:

- Empezando — Create account and connect your platforms

- How to Use AI-Powered Accounting — Automate bookkeeping with smart categorization

- How to Use Automated Revenue Recognition — Stay GAAP-compliant on subscriptions

- How to Use Automated Categorization — Sort transactions with Smart Rules

- How to Use Data Analysis — Get real-time financial insights

- How to Use Accounting Integrations — Connect 30+ sales platforms to your books

- How to Use Sales Transactions Bookkeeping — Sync every sale automatically

- How to Use Streamlined Reconciliation — Match bank deposits in one click

- How to Use Synder Insights — Track KPIs on a single dashboard

- How to Use Accounting Firms Support — Manage multiple clients efficiently

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | Solución de problemas | Precios | Alternativas

Why Trust This Guide

I’ve used Synder for over 12 months and tested every feature covered here. This tutorial comes from real hands-on experience — not marketing fluff or vendor screenshots.

Synder is one of the most powerful contabilidad automation tools available today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

Synder Tutorial

This complete Synder tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

Synder

Automate your e-commerce teneduría de libros across 30+ platforms. Synder syncs sales, fees, taxes, and refunds directly into QuickBooks, Xero, or Sabio Intacct with 95% accuracy. Try free for 15 days — no credit card required.

Getting Started with Synder

Before using any feature, complete this one-time setup.

It takes about 3 minutes.

Watch this quick overview first:

Now let’s walk through each step.

Step 1: Create Your Account

Go to Synder’s website at synder.com.

Click “Start Free Trial” in the top right corner.

Enter your email and create a password.

You can also sign up with your Google account.

✓ Checkpoint: Comprueba tu bandeja de entrada for a confirmation email.

Step 2: Connect Your Accounting Software

Synder works with QuickBooks Online, QuickBooks Desktop, Xero, Sage Intacct, and NetSuite.

Select your contabilidad platform from the setup wizard.

Authorize the connection by logging into your accounting account.

Here’s what the dashboard looks like:

✓ Checkpoint: You should see your software de contabilidad listed as “Connected.

Step 3: Connect Your Sales Platforms

Click “Add Integration” from the left sidebar.

Choose your sales channels like Stripe, PayPal, Shopify, or Amazon.

Follow the on-screen prompts to authorize each platform.

Synder supports over 30 platforms in total.

✅ Done: You’re ready to use any feature below.

How to Use Synder AI-Powered Accounting

AI-Powered Accounting lets you automate teneduría de libros tasks with smart transaction processing.

Here’s how to use it step by step.

See AI-Powered Accounting in action:

Now let’s break down each step.

Step 1: Enable Auto-Sync

Go to Settings in your Synder dashboard.

Toggle “Auto-synchronization” to ON for each connected platform.

Choose your sync frequency — hourly works for most businesses.

Step 2: Choose Your Sync Mode

Select “Per Transaction” for line-level detail on every sale.

Or select “Summary Sync” for daily journal entries.

Summary mode works best for high-volume sellers with 500+ daily orders.

✓ Checkpoint: You should see your sync mode displayed under each integration.

Step 3: Review AI-Processed Transactions

Go to “Platform Transactions” to see synced data.

Synder automatically captures sales, fees, taxes, and refunds.

Each transaction shows status: Synced, Ready to Sync, or Failed.

✅ Result: Your transactions flow from sales platforms to your books without manual data entry.

💡 Consejo profesional: Always do a test sync on 2-3 transactions before syncing your full history. This catches mapping errors early.

How to Use Synder Automated Revenue Recognition

Automated Revenue Recognition lets you stay GAAP and ASC 606 compliant on subscription revenue.

Here’s how to use it step by step.

See Automated Revenue Recognition in action:

Now let’s break down each step.

Step 1: Enable Revenue Recognition

Go to Settings and find the Revenue Recognition section.

Toggle the feature ON for your subscription-based integrations.

Step 2: Configure Recognition Schedules

Set your recognition period — monthly, quarterly, or annual.

Synder creates deferred revenue entries and recognizes income over time.

✓ Checkpoint: You should see deferred revenue schedules listed in your dashboard.

Step 3: Review Recognition Reports

Check the Revenue Recognition tab for scheduled and recognized amounts.

Synder posts journal entries automatically on the correct dates.

✅ Result: Your subscription revenue is recognized correctly over time, keeping you audit-ready.

💡 Consejo profesional: If you sell annual subscriptions, set recognition to monthly. This spreads revenue across 12 months for accurate financial statements.

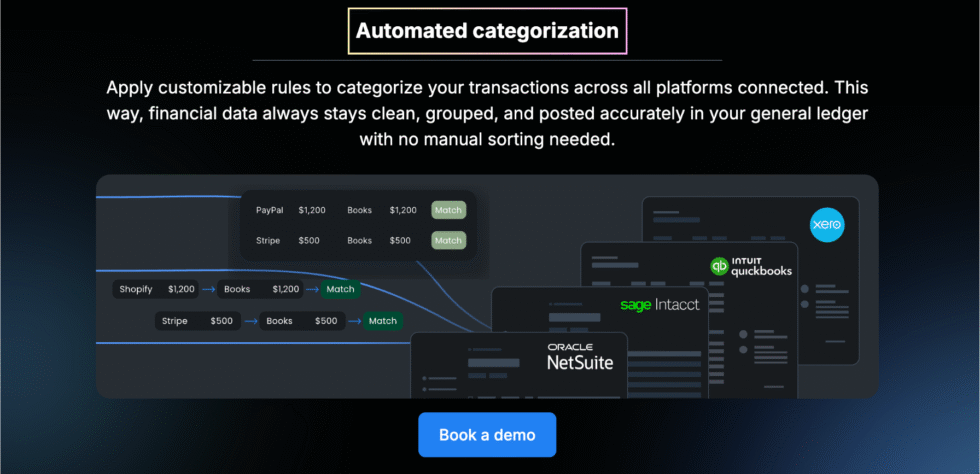

How to Use Synder Automated Categorization

Automated Categorization lets you sort every transaction into the right account using Smart Rules.

Here’s how to use it step by step.

See Automated Categorization in action:

Now let’s break down each step.

Step 1: Open Smart Rules

Click “Smart Rules” in the left sidebar menu.

Then click “Rules” and select “Create Rule.”

Step 2: Build Your If-Then Conditions

Choose a trigger like “Sales Receipt → Created.”

Set a condition — for example, “Line: Description contains ‘shipping’.”

Then set the action to assign the correct category or class.

✓ Checkpoint: Your rule should show as Active in the Rules list.

Step 3: Test and Activate

Sync one transaction to verify the rule works correctly.

Check the result in your software de contabilidad.

Once confirmed, the rule applies to all future transactions automatically.

✅ Result: Every transaction gets categorized correctly without manual sorting.

💡 Consejo profesional: Create separate rules for fees, refunds, and chargebacks. This keeps your expense tracking clean from day one.

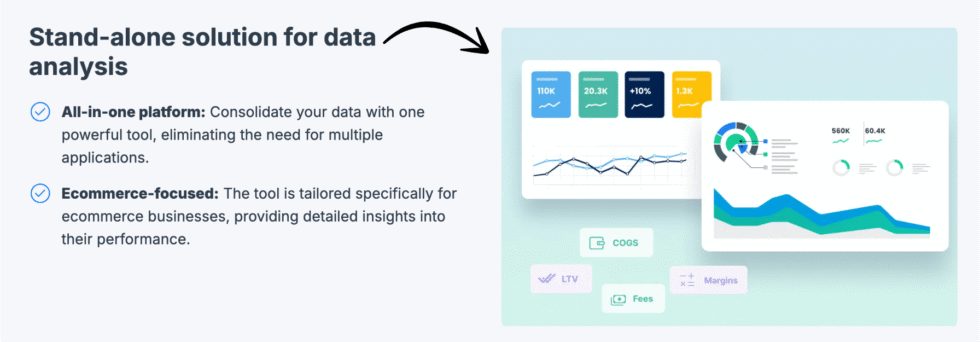

How to Use Synder Data Analysis

Análisis de datos lets you get real-time financial insights across all your sales channels.

Here’s how to use it step by step.

See Data Analysis in action:

Now let’s break down each step.

Step 1: Open the Analytics Dashboard

Click “Insights” or “Analytics” from the main navigation.

The dashboard shows revenue, costs, and key metrics at a glance.

Step 2: Filter by Channel or Date Range

Use the dropdown filters to view data by sales platform.

Set custom date ranges to compare performance over time.

You can also ask plain-English questions with the AI dashboard feature.

✓ Checkpoint: You should see charts and numbers for your selected filters.

Step 3: Export or Share Reports

Click “Export” to download your report as CSV or PDF.

Share the link with your accountant or team members.

✅ Result: You have a clear view of your financial performance across every channel.

💡 Consejo profesional: Use the AI dashboard to ask questions like “Show me total sales by channel last quarter.” It returns instant charts without building custom reports.

How to Use Synder Accounting Integrations

Accounting Integrations lets you connect 30+ sales platforms to your accounting software in clicks.

Here’s how to use it step by step.

See Accounting Integrations in action:

Now let’s break down each step.

Step 1: Browse Available Integrations

Go to the Integrations page from the left menu.

You’ll see all supported platforms: Shopify, Amazon, eBay, Etsy, Stripe, PayPal, Square, and more.

Step 2: Authorize Each Platform

Click “Connect” next to the platform you want to add.

Log into that platform and grant Synder access.

The connection is established in under a minute.

✓ Checkpoint: The platform should show a green “Connected” badge.

Step 3: Configure Sync Settings

Set your preferred sync mode for each integration.

Map your accounts, tax codes, and product categories.

Enable auto-sync to keep data flowing without manual triggers.

✅ Result: All your sales channels funnel data into one accounting system automatically.

💡 Consejo profesional: Your accounting platform doesn’t count toward your integration limit. Only sales channels and payment processors count.

How to Use Synder Sales Transactions Bookkeeping

Sales Transactions Bookkeeping lets you record every sale, fee, tax, and refund in your books automatically.

Here’s how to use it step by step.

See Sales Transactions Bookkeeping in action:

Now let’s break down each step.

Step 1: Import Historical Data

Go to “Platform Transactions” and click “Import.”

Select a start date — begin from when you last entered data manually.

Synder can import years of historical transactions at once.

Step 2: Review and Sync Transactions

Filter transactions by “Ready to Sync” status.

Review a few entries to make sure mapping is correct.

Click “Sync” to push them to your accounting software.

✓ Checkpoint: Transactions should show “Synced” status with green checkmarks.

Step 3: Verify in Your Accounting Software

Open QuickBooks, Xero, or your connected platform.

Check that sales receipts, expenses, and fees appear correctly.

Synder’s “Skip Duplicates” feature prevents double entries.

✅ Result: Every sale from every platform is recorded accurately in your books.

💡 Consejo profesional: Use the Rollback feature if a sync goes wrong. It undoes the last batch so you can fix settings and re-sync cleanly.

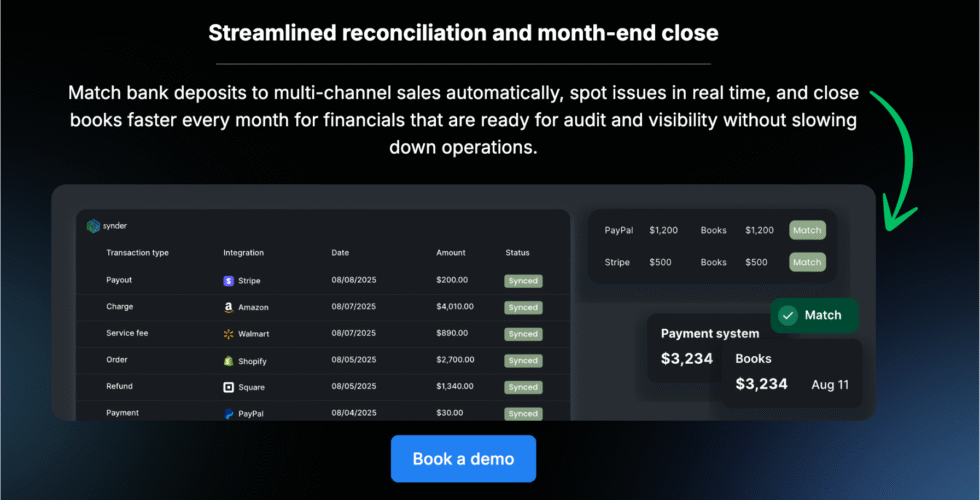

How to Use Synder Streamlined Reconciliation

Streamlined Reconciliation lets you match bank deposits to multi-channel sales in one click.

Here’s how to use it step by step.

See Streamlined Reconciliation in action:

Now let’s break down each step.

Step 1: Enable the Payout Feature

Go to Settings and enable the Payout/Transfer tracking feature.

This tells Synder to match deposits with processor payouts.

Step 2: Let Synder Match Deposits

Synder posts deposits and processor fees to the correct clearing accounts.

Your Banking tab in QuickBooks or Xero will show matched entries.

✓ Checkpoint: Bank deposits should match synced transaction totals exactly.

Step 3: Reconcile with One Click

Open the Banking tab in your accounting software.

Matched transactions appear as suggested matches.

Click to confirm — and your month-end is done in minutes.

✅ Result: Bank reconciliation that used to take hours now takes minutes.

💡 Consejo profesional: Use Summary Sync mode if you have hundreds of daily transactions. It creates one journal entry per day per channel, making reconciliation much cleaner.

How to Use Synder Insights

Perspectivas de Synder lets you track all major KPIs on a single live dashboard.

Here’s how to use it step by step.

See Synder Insights in action:

Now let’s break down each step.

Step 1: Access the Insights Dashboard

Click “Insights” from the left sidebar navigation.

The dashboard loads with revenue, costs, and profit metrics.

Step 2: Customize Your View

Select specific sales channels to compare performance side by side.

Adjust the date range to spot trends over weeks or months.

The AI-powered dashboard lets you ask questions in plain English.

✓ Checkpoint: You should see interactive charts with your real sales data.

Step 3: Set Up Alerts

Configure notifications for unusual transaction patterns.

Get alerted when refund rates spike or revenue dips unexpectedly.

✅ Result: You always know how your negocio is performing across every channel.

💡 Consejo profesional: The AI dashboard is free for all Summary Sync users. Ask it “What was my best-selling channel last month?” for instant answers.

How to Use Synder Accounting Firms Support

Accounting Firms Support lets you manage multiple clients from a single Synder account.

Here’s how to use it step by step.

See Accounting Firms Support in action:

Now let’s break down each step.

Step 1: Set Up Your Partner Account

Sign up for Synder’s Partner Program through your dashboard.

This gives you multi-organization access and partner pricing.

Step 2: Add Client Organizations

Click “Add Organization” and enter your client’s business details.

Connect their sales platforms and accounting software separately.

Each client’s data stays isolated in their own workspace.

✓ Checkpoint: You should see all client organizations listed in your dashboard switcher.

Step 3: Manage and Monitor

Switch between clients with one click from the top navigation.

Monitor sync status, transaction counts, and reconciliation progress for each client.

✅ Result: You manage all e-commerce clients from one login, saving hours on month-end close.

💡 Consejo profesional: The more clients you connect, the higher your partner tier climbs. Higher tiers unlock better pricing and priority onboarding support.

Synder Pro Tips and Shortcuts

After testing Synder for over 12 months, here are my best tips.

Atajos de teclado

| Action | Shortcut |

|---|---|

| Sync selected transactions | Select → Click “Sync” |

| Rollback last sync batch | Transactions → Rollback |

| Switch between organizations | Top nav → Organization dropdown |

| Quick-filter by status | Status dropdown → Ready/Synced/Failed |

Hidden Features Most People Miss

- Rollback and Re-sync: Made a mapping mistake? Rollback undoes the last sync batch so you can fix settings and sync again cleanly.

- Smart Rules Email Triggers: Beyond categorization, Smart Rules can send automated thank-you emails or invoice reminders when transactions sync.

- Multi-Currency Auto-Conversion: Synder automatically converts foreign currency transactions to your base currency using real-time exchange rates.

Synder Common Mistakes to Avoid

Mistake #1: Syncing All History Without Testing First

❌ Wrong: Importing 12 months of transactions and syncing everything at once without reviewing.

✅ Right: Sync 2-3 test transactions first. Verify they appear correctly in your accounting software before bulk syncing.

Mistake #2: Using Per Transaction Mode for High-Volume Stores

❌ Wrong: Syncing 500+ daily orders as individual sales receipts, cluttering your books.

✅ Right: Switch to Summary Sync mode. It creates one clean journal entry per day per channel.

Mistake #3: Not Setting Up Smart Rules for Fees

❌ Wrong: Leaving all processor fees in the default expense account with no categorization.

✅ Right: Create Smart Rules to route Stripe fees, PayPal fees, and marketplace fees to separate expense accounts.

Synder Troubleshooting

Problem: Transactions Stuck on “Ready to Sync”

Cause: Your accounting software connection may have expired or lost authorization.

Arreglar: Go to Settings → Integrations. Disconnect and reconnect your accounting platform. Then retry the sync.

Problem: Duplicate Transactions in Accounting Software

Cause: You may have entered transactions manually before connecting Synder.

Arreglar: Remove the manually entered duplicates from your books. Synder’s “Skip Duplicates” feature prevents its own double entries, but can’t detect manual ones.

Problem: Smart Rules Not Applying to Transactions

Cause: Rules only apply to newly synced transactions, not previously synced ones.

Arreglar: Use the Rollback feature to undo the affected batch. Then re-sync after activating your rule. The rule will apply on the fresh sync.

📌 Nota: If none of these fix your issue, contact Synder support via live chat, phone, or email.

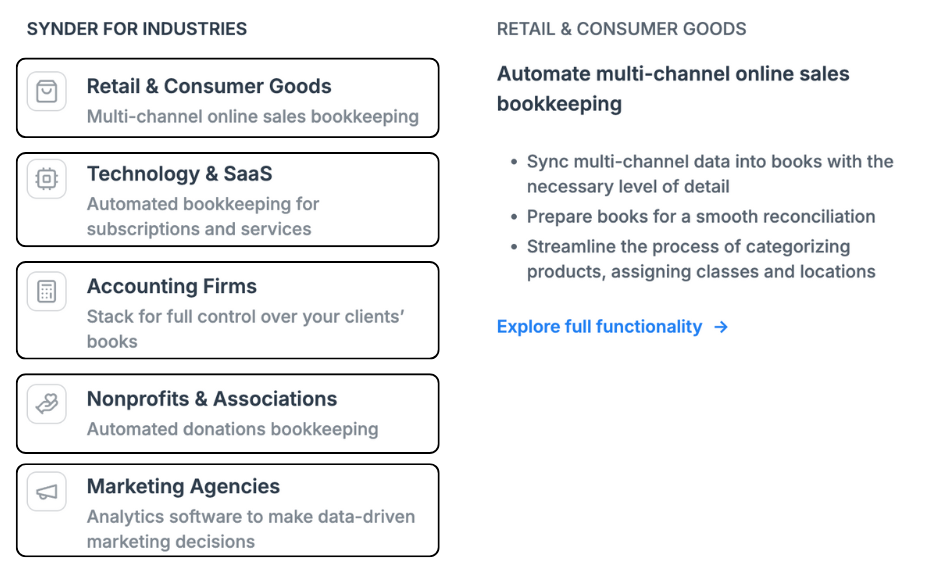

¿Qué es Synder?

Synder is an accounting automatización tool that syncs sales data from 30+ e-commerce platforms into your accounting software.

Think of it like a bridge between where you sell and where you do your books.

It includes these key features:

- AI-Powered Accounting: Automates bookkeeping with smart transaction processing and categorization.

- Automated Revenue Recognition: Handles GAAP-compliant deferred revenue for subscriptions.

- Automated Categorization: Uses Smart Rules to sort transactions into the right accounts.

- Data Analysis: Provides real-time dashboards with AI-powered insights.

- Accounting Integrations: Connects Shopify, Amazon, Stripe, PayPal, and 30+ more platforms.

- Sales Transactions Bookkeeping: Records every sale, fee, tax, and refund automatically.

- Conciliación simplificada: Matches bank deposits to sales data in one click.

- Synder Insights: Tracks KPIs across all channels on a live dashboard.

- Accounting Firms Support: Manages multiple clients from a single account.

For a full review, see our Synder review.

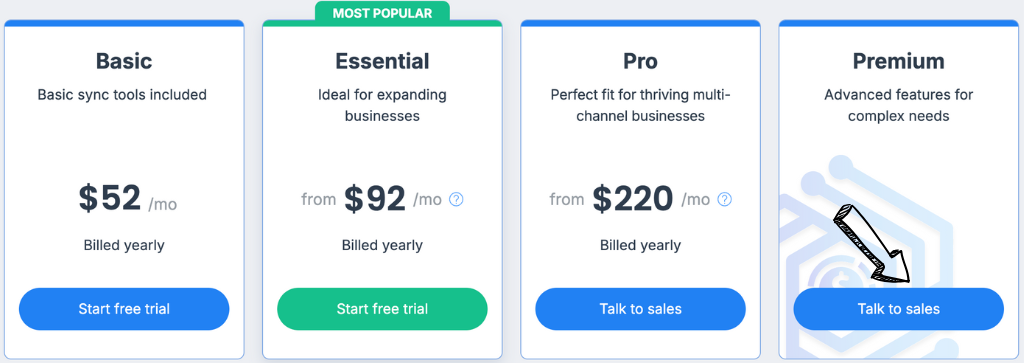

Synder Pricing

Here’s what Synder costs in 2026:

| Plan | Precio | Mejor para |

|---|---|---|

| Básico | $52 | Pequeñas empresas with low transaction volume |

| Básico | $92 | Growing stores that need more integrations |

| Pro | $220 | High-volume sellers needing advanced features |

| De primera calidad | Costumbre | Enterprise businesses with dedicated support needs |

Prueba gratuita: Yes — 15 days, no credit card required.

Garantía de devolución de dinero: Contact support within 30 days for billing questions.

💰 Best Value: Essential plan — it covers most growing businesses with enough integrations and transaction limits for multi-channel selling.

Synder vs Alternatives

How does Synder compare? Here’s the competitive landscape:

| Herramienta | Mejor para | Precio | Rating |

|---|---|---|---|

| Synder | Multi-channel e-commerce automation | $52/mo | ⭐ 4.1 |

| Dext | Receipt capture and expense tracking | $24/mes | ⭐ 4.3 |

| Xero | Full cloud accounting for pequeña empresa | $29/mes | ⭐ 4.5 |

| QuickBooks | All-in-one accounting with payroll | $1.90/mo | ⭐ 4.4 |

| FreshBooks | Invoicing and seguimiento del tiempo | $21/mo | ⭐ 4.3 |

| Libros de Zoho | Affordable full-suite accounting | Gratis | ⭐ 4.3 |

| Sabio | Scalable accounting for growing teams | Gratis | ⭐ 4.2 |

| NetSuite | Enterprise financial management | Costumbre | ⭐ 4.5 |

Quick picks:

- Best overall: Synder — unmatched for multi-channel e-commerce bookkeeping automation

- Best budget: Zoho Books — free plan covers basic accounting needs

- Best for beginners: FreshBooks — simplest interface for non-accountants

- Best for enterprise: NetSuite — full ERP with advanced reportando and compliance

🎯 Synder Alternatives

Looking for Synder alternatives? Here are the top options:

- 🚀 Destreza: Best for automated receipt capture and expense management. Scans documents and pushes data to your accounting platform.

- 💰 Rompecabezas IO: AI-powered accounting built for startups. Offers a free plan with automated transaction categorization.

- 🌟 Xero: Full cloud accounting with strong bank feeds and multi-currency support. Great for small to mid-size businesses.

- 🏢 Sabio: Scalable accounting for growing businesses. Offers both desktop and cloud versions with payroll features.

- 💼 Libros de Zoho: Affordable full-suite accounting with a free plan. Integrates with the entire Zoho ecosystem.

- ⚡ Fin de mes fácil: Focused on automating month-end close processes. Best for contadores who want faster reconciliation.

- 🧠 Docyt: AI-powered back-office automation for real-time accounting. Handles AP, AR, and expense management.

- 🔧 Refrescarme: Personal finance management with automated tracking. Best for trabajadores autónomos and solopreneurs.

- 👶 Ola: Free accounting software for small businesses. Includes invoicing and receipt scanning at no cost.

- 📊 Acelerar: Personal and small business finance management. Strong budgeting tools starting at $2.99 per month.

- 🔒 Hubdoc: Document collection and data extraction tool. Pairs well with Xero for automated bookkeeping.

- ⭐ Expensificar: Expense reporting and receipt tracking for teams. Popular with companies that need employee expense management.

- 🎯 QuickBooks: The most popular small business accounting software. Offers payroll, invoicing, and tax tools in one platform.

- 🔥 Entrada automática: Automated data entry for accountants and bookkeepers. Extracts data from invoices and receipts accurately.

- 🎨 FreshBooks: Best for freelancers and service businesses. Easy invoicing, time tracking, and client management.

- 🏢 NetSuite: Enterprise-grade ERP with advanced financial management. Best for large businesses with complex needs.

For the full list, see our Alternativas a Synder guide.

⚔️ Synder Compared

Here’s how Synder stacks up against each competitor:

- Synder contra Dext: Synder automates full transaction syncing to your books. Dext focuses on receipt capture and document management.

- Synder vs Puzzle IO: Synder handles 30+ platform integrations. Puzzle IO targets startups with AI-powered accounting basics.

- Synder frente a Xero: Xero is full accounting software. Synder is an automation layer that feeds data into Xero or QuickBooks.

- Synder contra Sage: Sage offers broader ERP features. Synder wins on e-commerce transaction automation and multi-channel syncing.

- Synder frente a Zoho Books: Zoho Books is a full accounting suite with a free tier. Synder adds multi-platform sync that Zoho lacks natively.

- Synder vs Easy Month End: Easy Month End focuses on closing processes. Synder covers the full bookkeeping workflow from sync to reconciliation.

- Synder frente a Docyt: Docyt handles AI back-office automation broadly. Synder specializes in e-commerce and payment processor syncing.

- Synder frente a RefreshMe: RefreshMe targets personal finance. Synder is built for businesses selling on multiple platforms.

- Synder contra Wave: Wave is free but lacks multi-channel automation. Synder automates data flow from 30+ platforms.

- Synder frente a Quicken: Quicken focuses on personal finance and budgeting. Synder handles business-level e-commerce accounting.

- Synder contra Hubdoc: Hubdoc collects and extracts document data. Synder syncs live transaction data directly from sales platforms.

- Synder frente a Expensify: Expensify handles employee expense reports. Synder automates sales and revenue bookkeeping.

- Synder frente a QuickBooks: QuickBooks is accounting software. Synder enhances QuickBooks by automating data entry from 30+ sales channels.

- Synder frente a AutoEntry: AutoEntry extracts data from paper documents. Synder pulls live digital transaction data from payment platforms.

- Synder frente a FreshBooks: FreshBooks excels at invoicing for freelancers. Synder wins for e-commerce sellers with multi-channel operations.

- Synder frente a NetSuite: NetSuite is a full ERP for enterprises. Synder is more affordable and focused on e-commerce automation.

Start Using Synder Now

You learned how to use every major Synder feature:

- ✅ AI-Powered Accounting

- ✅ Automated Revenue Recognition

- ✅ Automated Categorization

- ✅ Data Analysis

- ✅ Accounting Integrations

- ✅ Sales Transactions Bookkeeping

- ✅ Streamlined Reconciliation

- ✅ Synder Insights

- ✅ Accounting Firms Support

Next step: Pick one feature and try it now.

Most people start with AI-Powered Accounting.

It takes less than 5 minutes.

Preguntas frecuentes

How does Synder work?

Synder connects your sales platforms like Shopify, Stripe, and Amazon to your accounting software. It automatically imports and syncs transactions including sales, fees, taxes, and refunds. You choose between Per Transaction mode for detailed records or Summary mode for daily journal entries.

What does Synder mean?

The name “Synder” comes from “sync” — reflecting the tool’s core function of syncing financial data between sales platforms and accounting software. It was created by CloudBusiness Inc. to automate e-commerce bookkeeping.

What is Synder used for?

Synder is used for automating e-commerce accounting. It handles transaction syncing, revenue recognition, bank reconciliation, tax tracking, and financial reporting. It’s popular with online sellers, SaaS companies, and accounting firms managing e-commerce clients.

¿Qué hace Synder?

Synder automates the flow of financial data from 30+ sales platforms into accounting software like QuickBooks, Xero, and Sage Intacct. It records sales, fees, refunds, and taxes automatically. It also provides Smart Rules for categorization and real-time financial dashboards.

Which is the best software for accounting?

The best accounting software depends on your needs. QuickBooks is the most popular for small businesses. Xero is great for cloud-first teams. For e-commerce sellers who need automated bookkeeping across multiple platforms, Synder paired with QuickBooks or Xero is the top choice.