Quick Start

This guide covers every Quicken feature:

- Empezando — Create account and basic setup

- How to Use Recurring Transactions — Track bills and income automatically

- How to Use Checking Overview — See your bank accounts at a glance

- How to Use Spending Plan — Budget your money without rigid categories

- How to Use Link Transactions — Connect payments to bill reminders

- How to Use Spending Watchlist — Monitor specific spending areas

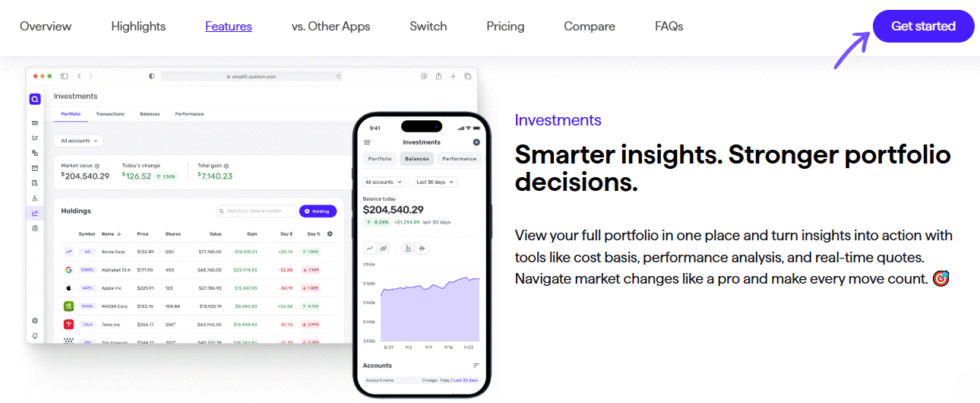

- How to Use Investment Tracking — Monitor your portfolio in one place

- How to Use Debt Management — Create a payoff strategy that works

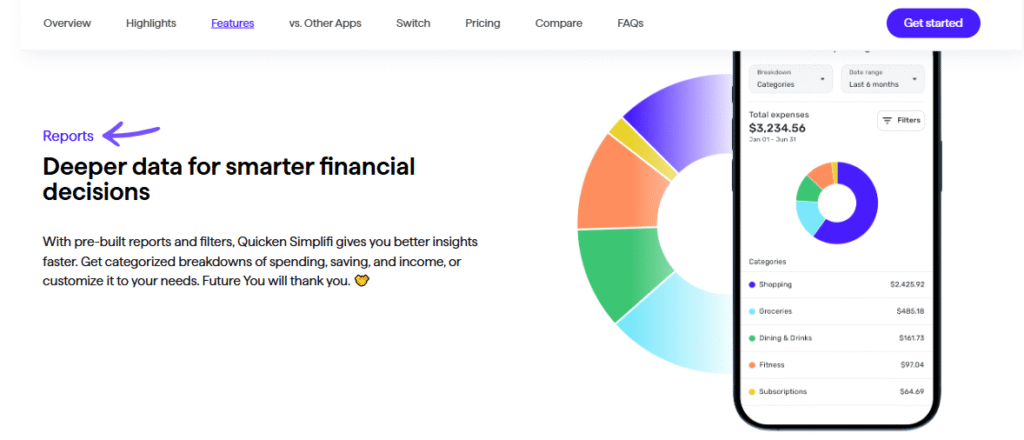

- How to Use Financial Reporting — Get clear insights into your money

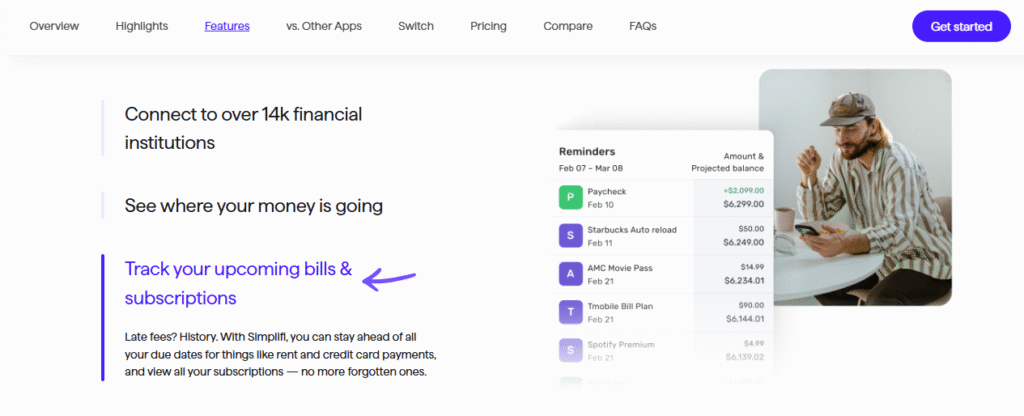

- How to Use Bill Pay and Key Features — Pay bills and manage subscriptions

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | Solución de problemas | Precios | Alternativas

Why Trust This Guide

I’ve used Quicken for over two years and tested every feature covered here. This tutorial comes from real hands-on experience — not marketing fluff or vendor screenshots.

Quicken is one of the most powerful personal finance tools available today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

Quicken Tutorial

This complete Quicken tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

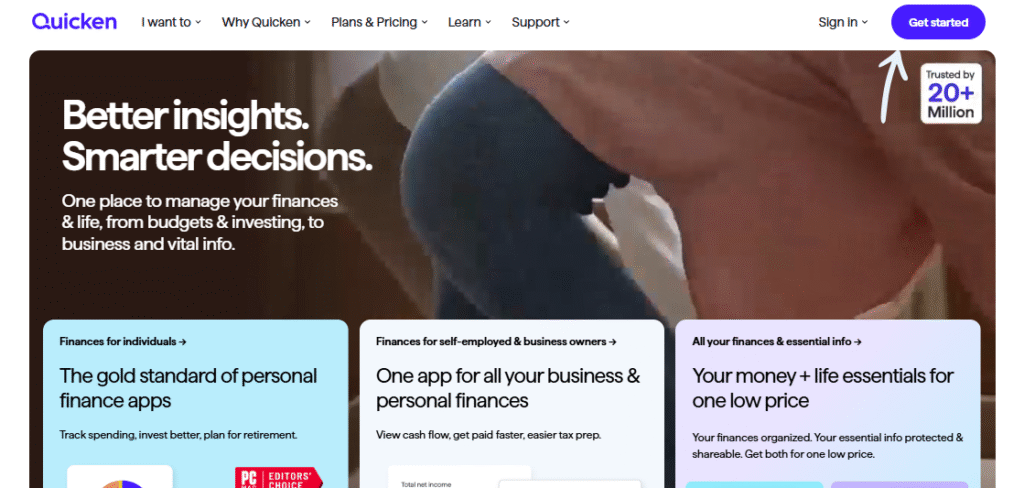

Acelerar

Take control of your personal and negocio finances in one app. Quicken connects to 14,000+ financial institutions and tracks spending, investments, and bills automatically. Try it with a 30-day money-back guarantee.

Introducción a Quicken

Before using any feature, complete this one-time setup.

It takes about 3 minutes.

Watch this quick overview first:

Now let’s walk through each step.

Step 1: Create Your Account

Go to Quicken’s website and click “Get Started.”

Choose between Quicken Simplifi or Quicken Classic.

Enter your email and create a Quicken ID password.

✓ Checkpoint: Comprueba tu bandeja de entrada for a confirmation email.

Step 2: Download or Access the App

Quicken Simplifi works on web, iOSy Android.

Quicken Classic requires Windows 10/11 or macOS Monterey or más tarde.

Log in with your new Quicken ID.

Here’s what the dashboard looks like:

✓ Checkpoint: You should see the main dashboard with your account overview.

Step 3: Connect Your Financial Accounts

Click “Add Account” from the dashboard.

Search for your bank, credit card, or investment company.

Quicken connects to over 14,000 financial institutions.

Enter your bank login credentials to link your accounts.

Quicken downloads your recent transactions automatically.

✅ Done: You’re ready to use any feature below.

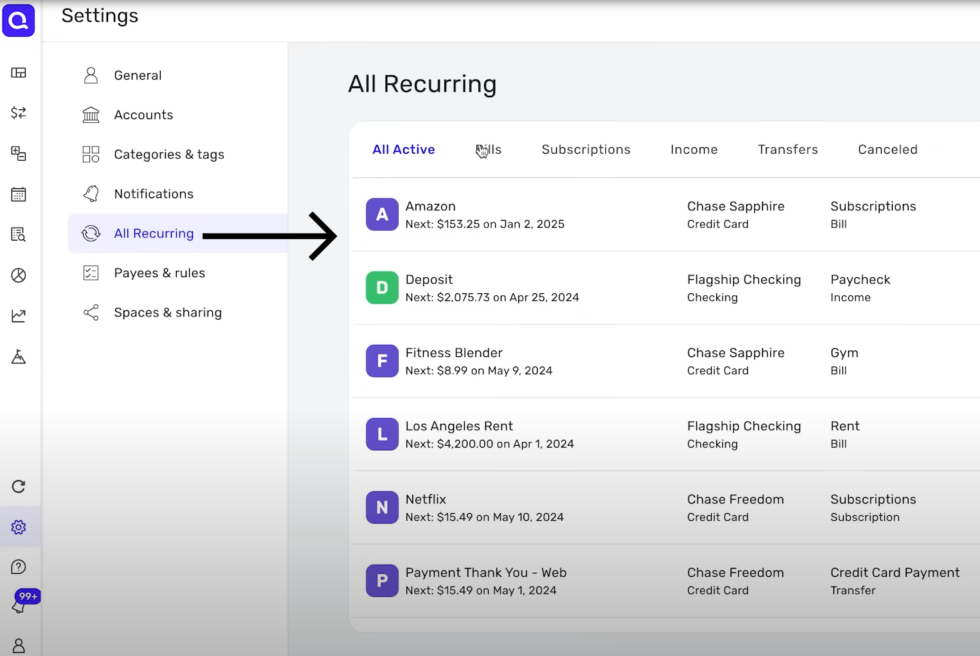

How to Use Quicken Recurring Transactions

Recurring Transactions lets you track all your repeating bills and income in one place.

Here’s how to use it step by step.

Watch Recurring Transactions in action:

Now let’s break down each step.

Step 1: Open the Recurring Section

Go to Settings and select “All Recurring” from the menu.

Quicken automatically detects recurring payments from your transactions.

Step 2: Review and Confirm Your Bills

Quicken shows a list of detected recurring bills and subscriptions.

Confirm each one or remove items that no longer apply.

Set the expected amount and due date for each bill.

✓ Checkpoint: You should see all your bills listed with due dates and amounts.

Step 3: Add Income Reminders

Click “Add Recurring” and choose “Income.”

Enter your paycheck amount, frequency, and expected date.

Quicken uses this to predict your future account balances.

✅ Result: You now have a complete picture of all money coming in and going out each month.

💡 Consejo profesional: Set bills to “Match any amount” so Quicken auto-adjusts when amounts change slightly each month.

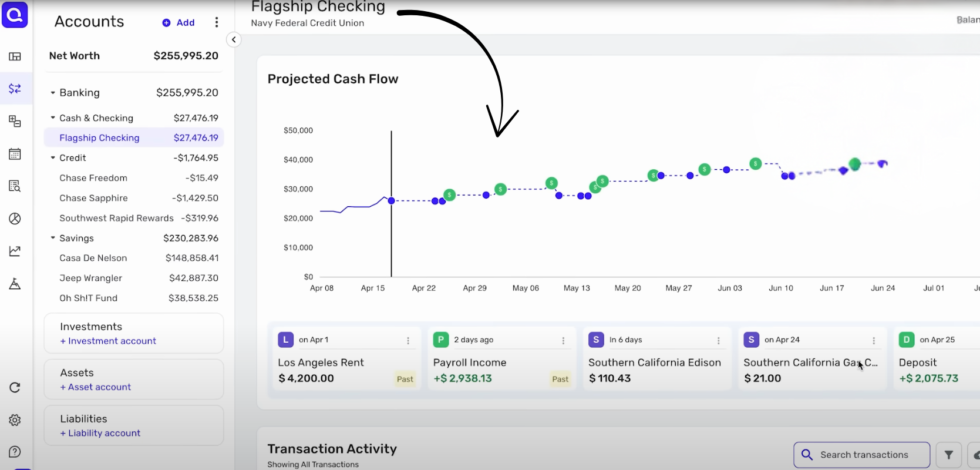

How to Use Quicken Checking Overview

Checking Overview lets you see all your bank account activity in one dashboard.

Here’s how to use it step by step.

Watch Checking Overview in action:

Now let’s break down each step.

Step 1: Navigate to Your Checking Account

Click on your linked checking account from the left sidebar.

Quicken displays your current balance and recent transactions.

Step 2: Review Your Transactions

Scroll through your transaction list to see deposits and withdrawals.

Quicken auto-categorizes each transaction for you.

Click any transaction to edit the category or add notes.

✓ Checkpoint: You should see categorized transactions with running balances.

Step 3: Check Your Balance Trends

Look at the balance graph above your transactions.

This shows how your balance has changed over time.

Spot dips before they become problems.

✅ Result: You have a complete view of your checking account with categorized transactions and balance trends.

💡 Consejo profesional: Review your transactions weekly to catch miscategorized items early and keep your data accurate.

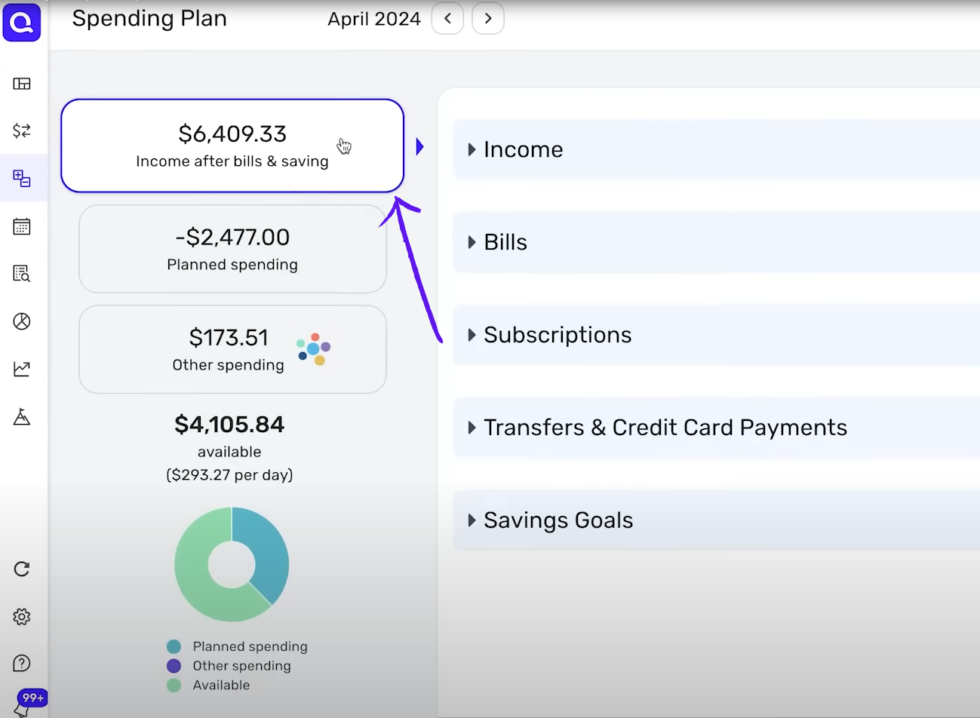

How to Use Quicken Spending Plan

Plan de gastos lets you budget your money without tracking every single category.

Here’s how to use it step by step.

Watch Spending Plan in action:

Now let’s break down each step.

Step 1: Open the Spending Plan

Click “Spending Plan” from the left navigation menu.

Quicken starts with your monthly income at the top.

Step 2: Review Your Monthly Breakdown

See your income minus bills, subscriptions, and planned spending.

The “Left This Month” number shows your remaining spendable cash.

Add planned expenses like groceries or gas to get a more accurate picture.

✓ Checkpoint: You should see income, bills, planned spending, and available balance.

Step 3: Add Savings Goals

Click “Add Savings Goal” to set money aside for big purchases.

Enter your target amount and deadline.

Quicken calculates how much to save each month.

✅ Result: You have a real-time spending plan that updates as transactions come in throughout the month.

💡 Consejo profesional: Move extra cash into a Savings Goal at month-end to trick yourself into spending less than you earn.

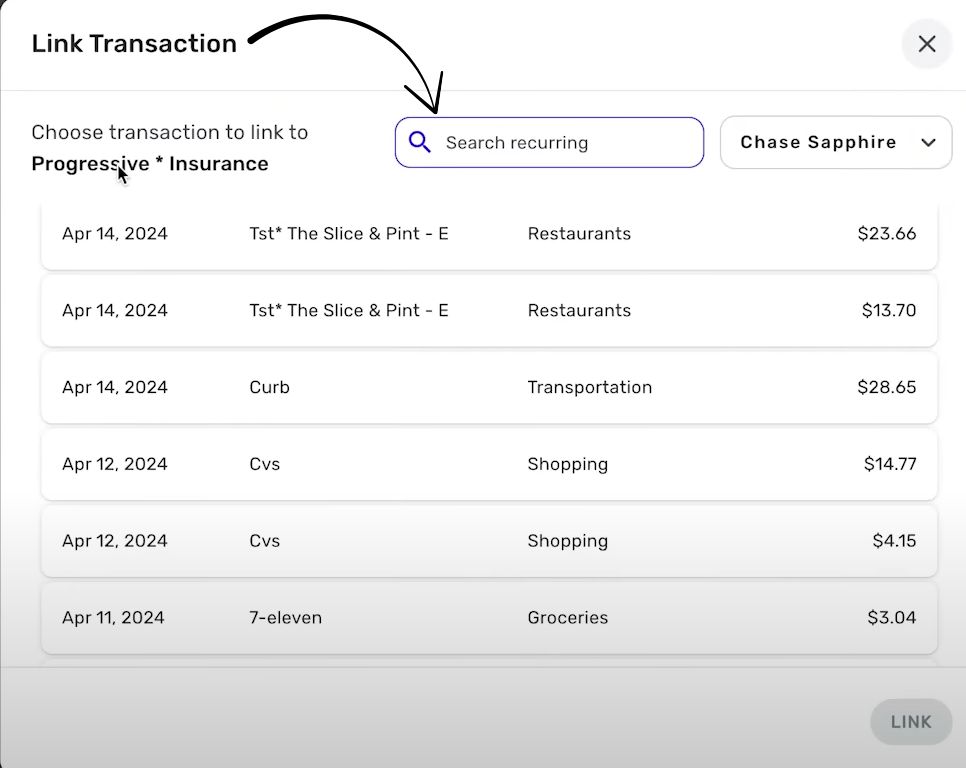

How to Use Quicken Link Transactions

Link Transactions lets you connect actual payments to your bill reminders for accurate tracking.

Here’s how to use it step by step.

Watch Link Transactions in action:

Now let’s break down each step.

Step 1: Find an Unlinked Transaction

Open your transaction list and look for payments that match a bill.

Quicken suggests matches when it finds likely connections.

Step 2: Link the Payment to a Reminder

Click the transaction and select “Link to Reminder.”

Choose the matching recurring bill from the dropdown.

Quicken marks that bill as paid for the month.

✓ Checkpoint: The bill reminder should now show as “Paid” with the linked amount.

Step 3: Enable Auto-Linking

Go to Settings and turn on automatic transaction linking.

Quicken matches future payments to reminders without your help.

✅ Result: Your Spending Plan now avoids double-counting by linking real payments to bill reminders.

💡 Consejo profesional: Linked transactions appear in the Bills section of your Spending Plan, not Planned Spend, preventing duplicates.

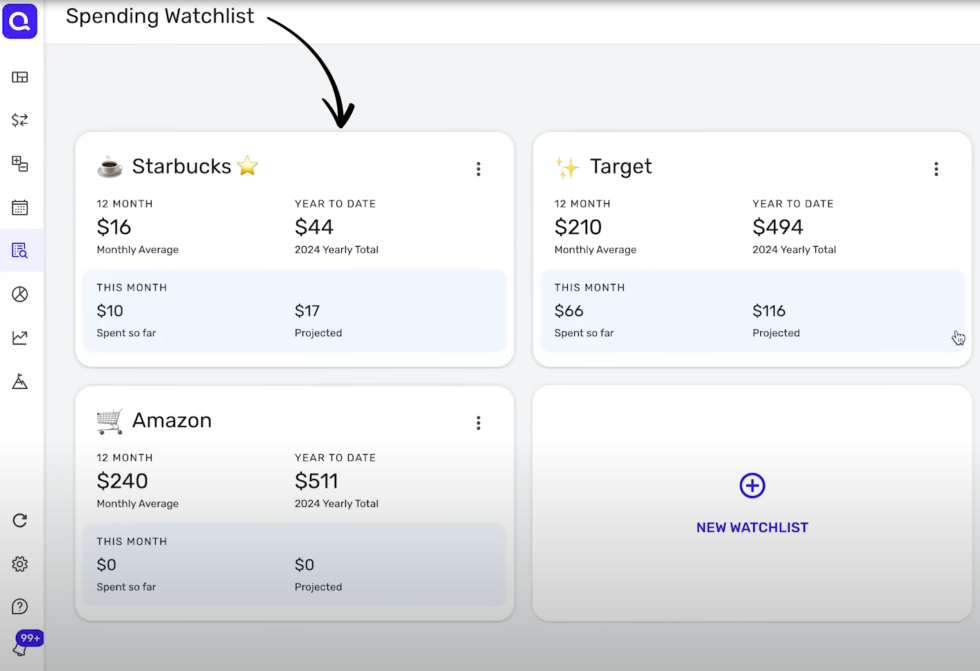

How to Use Quicken Spending Watchlist

Lista de vigilancia de gastos lets you monitor specific spending areas without budgeting everything.

Here’s how to use it step by step.

Watch Spending Watchlist in action:

Now let’s break down each step.

Step 1: Create a New Watchlist

Click “Add Watchlist” from the Watchlists section on your dashboard.

Choose to track by category, payee, or custom tag.

Step 2: Set Your Target Amount

Enter a monthly spending limit for this watchlist.

Quicken shows your current spend and projects your month-end total.

Turn on notifications to get alerted when you’re nearing your limit.

✓ Checkpoint: You should see a watchlist card with current spend, projected total, and monthly average.

Step 3: Review Your Spending Trends

Click the watchlist card to see a month-by-month graph.

Click any bar in the graph to drill down into specific transactions.

✅ Result: You’re now tracking specific spending areas with projections and alerts.

💡 Consejo profesional: Create watchlists for problem areas like dining out or subscriptions to catch overspending before the month ends.

How to Use Quicken Investment Tracking

Seguimiento de inversiones lets you monitor your entire portfolio across all accounts in one place.

Here’s how to use it step by step.

Watch Investment Tracking in action:

Now let’s break down each step.

Step 1: Connect Your Investment Accounts

Click “Add Account” and search for your brokerage or retirement provider.

Quicken connects to major brokerages and pulls in your holdings.

Step 2: View Your Portfolio Dashboard

Navigate to the Investments section from the left menu.

See your total portfolio value, performance, and asset allocation.

Quicken shows gains, losses, and cost basis for each holding.

✓ Checkpoint: You should see all investment accounts with current values and performance datos.

Step 3: Check Your Asset Allocation

Click on the allocation view to see your mix of stocks, bonds, and cash.

Compare your actual allocation against your target percentages.

✅ Result: You can now monitor all investments in one dashboard and spot rebalancing needs.

💡 Consejo profesional: Check the Retirement Planner to project whether your current savings rate will meet your retirement goals.

How to Use Quicken Debt Management

Debt Management lets you create a payoff strategy for credit cards, loans, and other debts.

Here’s how to use it step by step.

Watch Debt Management in action:

Now let’s break down each step.

Step 1: Add Your Debts

Go to the Debt section and add each credit card, loan, or balance.

Enter the current balance, interest rate, and minimum payment.

Step 2: Choose a Payoff Strategy

Pick between the Avalanche method (highest interest first) or Snowball method (smallest balance first).

Quicken shows your estimated payoff date and total interest saved.

Adjust your monthly payment amount to see how it changes the timeline.

✓ Checkpoint: You should see a payoff timeline with estimated dates for each debt.

Step 3: Track Your Progress

Check your debt dashboard monthly to see balances dropping.

Quicken updates your payoff projection as you make payments.

✅ Result: You have a clear debt payoff plan with projected dates and interest savings.

💡 Consejo profesional: The Avalanche method saves the most money on interest, but the Snowball method gives faster wins to keep you motivated.

How to Use Quicken Financial Reporting

Financial Informes lets you see spending breakdowns, income trends, and net worth changes.

Here’s how to use it step by step.

Watch Financial Reporting in action:

Now let’s break down each step.

Step 1: Open the Reports Section

Click “Reports” from the left navigation menu.

Choose from pre-built reports like Spending, Income, or Net Worth.

Step 2: Customize Your Report

Set the date range to focus on a specific month, quarter, or year.

Filter by account, category, or tag to zoom in on specific areas.

Quicken displays your data in charts and detailed number breakdowns.

✓ Checkpoint: You should see a visual report with charts and category breakdowns for your selected period.

Step 3: Export or Save Your Report

Click the export button to download your report as a CSV or PDF.

Share it with your accountant or financial advisor at tax time.

✅ Result: You have detailed financial reports you can analyze, export, and share.

💡 Consejo profesional: Run the Net Worth report quarterly to track your overall financial progress over time.

How to Use Quicken Bill Pay and Key Features

Bill Pay and Key Features lets you pay bills directly from Quicken and manage subscriptions.

Here’s how to use it step by step.

Watch Bill Pay in action:

Now let’s break down each step.

Step 1: View Your Bills Calendar

Open the Bills & Payments section from the dashboard.

See all upcoming bills on a visual calendar view.

Step 2: Identify and Cancel Unused Subscriptions

Review your recurring subscriptions list for services you no longer use.

Quicken flags subscriptions automatically so you can spot waste fast.

Cancel any subscription you don’t need directly from the provider.

✓ Checkpoint: You should see a clean list of active bills and subscriptions with upcoming due dates.

Step 3: Set Up Bill Alerts

Turn on notifications to get alerted before each bill is due.

Quicken can also warn you if a bill might cause your balance to dip too low.

✅ Result: You never miss a bill payment and cut out wasted subscription spending.

💡 Consejo profesional: Check your subscriptions list every three months to catch services you signed up for but forgot about.

Quicken Pro Tips and Shortcuts

After testing Quicken for over two years, here are my best tips.

Atajos de teclado

| Action | Shortcut |

|---|---|

| Add new transaction | Ctrl + N (Cmd + N on Impermeable) |

| Search transactions | Ctrl + F (Cmd + F on Mac) |

| Sync accounts | Ctrl + R (Cmd + R on Mac) |

| Open Spending Plan | Click sidebar icon |

Hidden Features Most People Miss

- Projected Cash Flow: Go to Bills section and enable cash flow projections to see future balances based on your bills and income.

- Custom Tags: Add tags to transactions for tracking things that don’t fit standard categories, like “vacation” or “side project.”

- Zillow Integration: Connect to Zillow to track your home value and see it reflected in your net worth automatically.

Quicken Common Mistakes to Avoid

Mistake #1: Ignoring Uncategorized Transactions

❌ Wrong: Letting transactions pile up without reviewing or categorizing them.

✅ Right: Review and categorize new transactions once a week to keep reports accurate.

Mistake #2: Setting Unrealistic Budget Amounts

❌ Wrong: Creating a spending plan based on what you wish you spent, not what you actually spend.

✅ Right: Use your 3-month spending average as a starting point, then gradually reduce from there.

Mistake #3: Not Linking All Accounts

❌ Wrong: Only connecting your checking account and missing credit cards, loans, or investments.

✅ Right: Connect every financial account for a complete picture of your net worth and spending.

Quicken Troubleshooting

Problem: Bank Account Won’t Sync

Cause: Your bank may have changed its login page or security settings.

Arreglar: Disconnect the account, wait 30 seconds, and reconnect with your updated credentials.

Problem: Duplicate Transactions Appearing

Cause: Quicken may download a transaction that you already entered manually.

Arreglar: Delete the duplicate entry and let Quicken match future downloads to existing transactions.

Problem: Spending Plan Shows Wrong Balance

Cause: Unlinked recurring bills or missing income entries throw off the calculation.

Arreglar: Check that all recurring bills and income are confirmed in your Spending Plan settings.

📌 Nota: If none of these fix your issue, contact Quicken support.

¿Qué es Quicken?

Acelerar is a personal finance tool that helps you track spending, manage bills, and monitor investments in one app.

Think of it like a digital command center for all your money.

Watch this quick overview:

It includes these key features:

- Recurring Transactions: Auto-track all repeating bills and income

- Checking Overview: See all bank account activity in one view

- Spending Plan: Budget your money with a flexible top-down approach

- Link Transactions: Connect real payments to bill reminders

- Spending Watchlist: Monitor specific spending areas with alerts

- Seguimiento de inversiones: View your full portfolio across all accounts

- Debt Management: Build a payoff plan for all your debts

- Financial Reporting: Get spending, income, and net worth reports

- Bill Pay: Track due dates and manage subscriptions

For a full review, see our Quicken review.

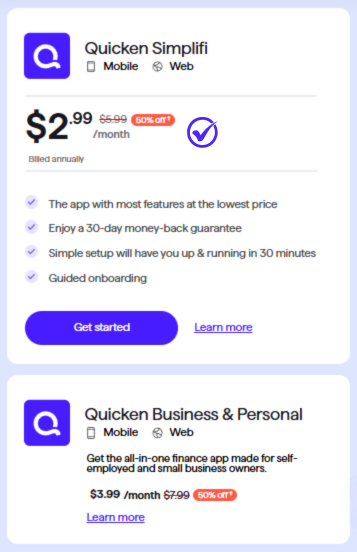

Precios de Quicken

Here’s what Quicken costs in 2026:

| Plan | Precio | Mejor para |

|---|---|---|

| Quicken Simplifi | $2.99/mes | Individuals who want easy budgeting and spending tracking |

| Quicken Business & Personal | $3,99/mes | Self-employed and pequeña empresa owners managing both finances |

Prueba gratuita: No free trial, but all plans come with a 30-day money-back guarantee.

Garantía de devolución de dinero: Yes, 30 days — no questions asked.

💰 Best Value: Quicken Simplifi — It covers budgeting, investments, and bill tracking for less than $3 per month.

Quicken vs Alternatives

How does Quicken compare? Here’s the competitive landscape:

| Herramienta | Mejor para | Precio | Rating |

|---|---|---|---|

| Acelerar | Personal finance and budgeting | $2.99/mo | ⭐ 3.8 |

| QuickBooks | Pequeña empresa contabilidad | $1.90/mo | ⭐ 4.4 |

| Xero | Cloud-based business accounting | $29/mes | ⭐ 4.5 |

| FreshBooks | Persona de libre dedicación invoicing and expenses | $21/mo | ⭐ 4.3 |

| Libros de Zoho | Económico teneduría de libros | $0/mes | ⭐ 4.3 |

| Ola | Free accounting for startups | $0/mes | ⭐ 4.0 |

| Sabio | Growing businesses | $7/mes | ⭐ 4.2 |

| Expensificar | Expense tracking and receipts | $5/member/mo | ⭐ 4.1 |

Quick picks:

- Best overall: Quicken — Best for personal finance, budgeting, and investment tracking in one app

- Best budget: Wave — Free accounting with invoicing and receipt scanning

- Best for beginners: Zoho Books — Simple interface with a free plan for small users

- Best for small business: QuickBooks — Industry standard for business teneduría de libros and payroll

🎯 Quicken Alternatives

Looking for Quicken alternatives? Here are the top options:

- 🚀 Rompecabezas IO: AI-powered accounting with real-time financial insights for startups and growing businesses.

- 💰 Destreza: Automates receipt capture and bookkeeping data entry to save hours of manual work.

- 🎨 Xero: Beautiful cloud accounting with strong invoicing and bank reconciliation for small businesses.

- ⚡ Synder: Syncs e-commerce and payment platform data into your software de contabilidad automáticamente.

- 🔒 Fin de mes fácil: Simplifies the monthly close process with automated checklists and reconciliation tools.

- 🧠 Docyt: AI bookkeeping that automates transaction coding and financial reporting for businesses.

- 👶 Sabio: Beginner-friendly accounting with plans starting free for solo users and freelancers.

- 🏢 Libros de Zoho: Full-featured bookkeeping with a generous free tier for businesses under 1,000 invoices.

- 🔧 Ola: Completely free accounting and invoicing built for freelancers and micro-businesses.

- 🌟 Hubdoc: Fetches and organizes financial documents from vendors automatically for easy bookkeeping.

- ⭐ Expensificar: Leading expense management tool with receipt scanning and corporate card tracking.

- 🎯 QuickBooks: The industry standard for small business accounting with payroll and tax filing built in.

- 💼 Entrada automática: Extracts data from invoices and receipts and posts it to your accounting software.

- 📊 FreshBooks: Easy invoicing and seguimiento del tiempo built for freelancers and service-based businesses.

- 🔥 NetSuite: Enterprise-grade ERP and accounting for fast-growing mid-size companies with complex needs.

For the full list, see our Alternativas de Quicken guide.

⚔️ Quicken Compared

Here’s how Quicken stacks up against each competitor:

- Quicken vs Puzzle IO: Quicken wins for personal finance; Puzzle IO is better for startup accounting with AI automatización.

- Quicken frente a Dext: Quicken handles full budgeting and investments; Dext focuses only on receipt capture and data entry.

- Quicken frente a Xero: Quicken is best for personal finance; Xero excels at business accounting and invoicing.

- Quicken frente a Synder: Quicken covers personal budgeting; Synder specializes in e-commerce payment syncing.

- Quicken vs. Easy Month End: Quicken tracks daily finances; Easy Month End focuses on month-end close processes.

- Quicken frente a Docyt: Quicken is simpler for individuals; Docyt offers AI bookkeeping for businesses with high volumes.

- Quicken frente a Sage: Quicken leads in personal finance features; Sage is better for growing business accounting needs.

- Quicken frente a Zoho Books: Quicken wins for investment tracking; Zoho Books wins on free business bookkeeping features.

- Quicken frente a Wave: Quicken offers deeper budgeting and investments; Wave is completely free for basic accounting.

- Quicken frente a Hubdoc: Quicken manages all finances; Hubdoc only handles document fetching and organization.

- Quicken frente a Expensify: Quicken covers full personal finance; Expensify specializes in corporate expense reports.

- Quicken frente a QuickBooks: Quicken is better for personal finance; QuickBooks is the standard for business accounting.

- Quicken frente a AutoEntry: Quicken tracks budgets and investments; AutoEntry automates invoice and receipt data entry.

- Quicken frente a FreshBooks: Quicken handles personal budgeting; FreshBooks is built for freelancer invoicing and time tracking.

- Quicken frente a NetSuite: Quicken suits individuals and small users; NetSuite serves mid-size enterprises with complex ERP needs.

Start Using Quicken Now

You learned how to use every major Quicken feature:

- ✅ Recurring Transactions

- ✅ Checking Overview

- ✅ Spending Plan

- ✅ Link Transactions

- ✅ Spending Watchlist

- ✅ Investment Tracking

- ✅ Debt Management

- ✅ Financial Reporting

- ✅ Bill Pay and Key Features

Next step: Pick one feature and try it now.

Most people start with the Spending Plan.

It takes less than 5 minutes.

Preguntas frecuentes

Is Quicken easy to learn?

Yes, Quicken is fairly easy to learn, especially Quicken Simplifi. The app walks you through account setup and auto-categorizes your transactions. Most new users can set up their accounts and start tracking spending within 15 minutes. The Classic desktop version has more features and a slightly steeper learning curve.

What is Quicken and how does it work?

Quicken is a personal finance app that connects to your bank accounts, credit cards, and investments. It downloads your transactions automatically and organizes them into categories. You can create budgets, track bills, monitor investments, and see your full financial picture in one dashboard. Over 20 million people have used Quicken since 1983.

Which one is better, QuickBooks or Quicken?

They serve different needs. Quicken is better for managing personal finances, budgeting, and investment tracking. QuickBooks is designed for business accounting with invoicing, payroll, and tax filing. If you need to manage both personal and business finances, Quicken Business & Personal handles both in one app at a lower price.

Do I need to pay for Quicken every year?

Yes, Quicken uses an annual subscription model. All plans are billed yearly. Without an active subscription, you lose access to bank syncing, online features, and software updates. The desktop app still runs, but you can’t download transactions. Plans start at $2.99 per month billed annually.

Has Quicken been discontinued?

No, Quicken has not been discontinued. It was sold by Intuit in 2016 and is now owned by Aquiline Capital Partners. Quicken continues to release updates and new features regularly. The company rebranded its mobile-first product as Quicken Simplifi and added a Business & Personal plan for self-employed users.