¿Sentirse abrumado por su factura mensual? contabilidad ¿tareas?

Imaginar the stress of scrambling to find receipts, reconcile accounts, and meet deadlines.

Todo mientras intentas ejecutar tu negocio.

Este artículo se adentra en dos temas populares: contabilidad soluciones.

Analizaremos las características de Easy Month End vs FreshBooks para ayudarlo a decidir cuál simplificará realmente su contabilidad.

Descripción general

Para darle la imagen más clara.

Hemos hecho pruebas exhaustivas Fin de mes fácil y FreshBooks, examinando sus características, facilidad de uso y valor general.

Este fin de mes fácil, únete a 1257 usuarios que ahorraron un promedio de 3,5 horas y redujeron los errores en un 15 %. ¡Comienza tu prueba gratuita!

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $45 al mes.

Características principales:

- Conciliación automatizada

- Flujos de trabajo optimizados

- Interfaz fácil de usar

¿Listo para simplificar tu facturación y cobrar más rápido? Más de 30 millones de personas han usado FreshBooks. ¡Explora la plataforma para saber más!

Precios: Tiene una prueba gratuita. El plan de pago cuesta desde $2.10 al mes.

Características principales:

- Seguimiento del tiempo

- Facturación

- Teneduría de libros

¿Qué es Easy Month End?

Hablemos de Fin de Mes Fácil. ¿Qué es?

Es una herramienta diseñada para hacer tu facturación mensual contabilidad cerrar simple.

Piense en ello como su guía a través de ese proceso a menudo temido.

Además, explora nuestros favoritos Alternativas fáciles para el fin de mes…

Nuestra opinión

Aumente la precisión financiera con Easy Month End. Aproveche la conciliación automatizada y los informes listos para auditoría. Programe una demostración personalizada para optimizar su proceso de cierre de mes.

Beneficios clave

- Flujos de trabajo de conciliación automatizados

- Gestión y seguimiento de tareas

- Análisis de varianza

- Gestión de documentos

- Herramientas de colaboración

Precios

- Motor de arranque:$24/mes.

- Pequeño: $45/mes.

- Compañía: $89/mes.

- Empresa: Precios personalizados.

Ventajas

Contras

¿Qué es FreshBooks?

Ahora, hablemos de FreshBooks. ¿De qué se trata?

Es un popular software de contabilidadMuchos autónomos y pequeñas empresas úsalo.

Ayuda con la facturación, el seguimiento de gastos y la gestión de proyectos.

Además, explora nuestros favoritos Alternativas a FreshBooks…

Nuestra opinión

¿Cansado de la contabilidad compleja? Más de 30 millones de empresas confían en FreshBooks para crear facturas profesionales. Simplifica tu... software de contabilidad ¡hoy!

Beneficios clave

- Creación de facturas profesionales

- Recordatorios de pago automáticos

- Seguimiento del tiempo

- Herramientas de gestión de proyectos

- Seguimiento de gastos

Precios

- Ligero: $2.10/mes.

- Más: $3.80/mes.

- De primera calidad: $6.50/mes.

- Seleccionar: Precios personalizados.

Ventajas

Contras

Comparación de características

A continuación se muestra una descripción detallada de cómo Easy Month End y FreshBooks se comparan entre sí.

Exploraremos características clave para ayudarle a comprender qué plataforma es más adecuada para usted.

Sus necesidades comerciales únicas a medida que navega por la elección contabilidad software.

1. Propósito principal

- Fin de mes fácilEl único propósito de esta herramienta es ayudar a un equipo financiero a gestionar el cierre de mes de forma más eficiente. Es una solución especializada para tareas específicas del equipo financiero.

- FreshBooks:Esta es una plataforma de soluciones de software de contabilidad más amplia para pequeña empresa Propietarios. Gestiona todo, desde la facturación hasta el seguimiento de gastos y los informes básicos.

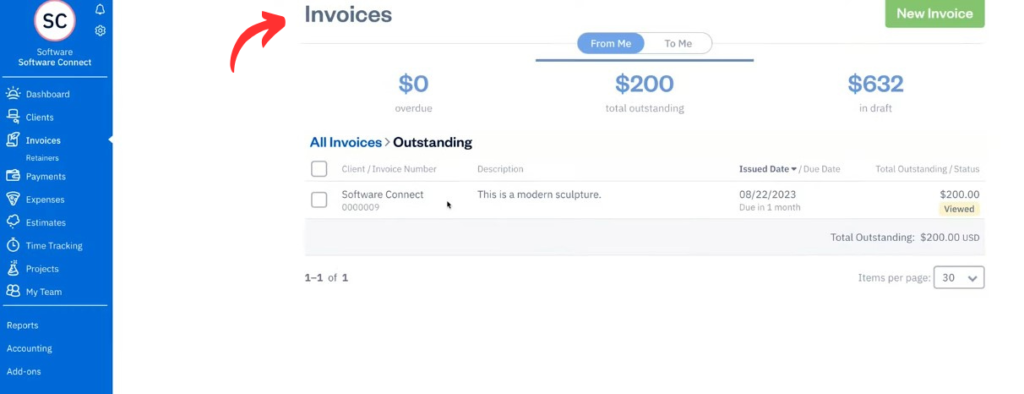

2. Facturación y pagos

- Fin de mes fácil:Esta herramienta no tiene ninguna función de facturación.

- FreshBooksFreshBooks destaca en este aspecto. Puede crear facturas profesionales, configurar la facturación recurrente e incluso aceptar pagos por adelantado, como tarjetas de crédito y pagos ACH, directamente. Esto facilita la aceptación de pagos y acelera su cobro.

3. Cierre de mes y conciliación

- Fin de mes fácilEsta es su principal fortaleza. Proporciona un flujo de trabajo estructurado para gestionar todas sus conciliaciones. Le ayuda a recopilar... auditoría evidencia y agiliza el proceso, lo que conduce a un cierre de mes más fluido y a menos errores y demoras.

- FreshBooks:Maneja la conciliación bancaria básica, pero no está diseñado como una herramienta dedicada a la conciliación formal de balances ni a proporcionar documentación para auditores.

4. Colaboración y flujo de trabajo en equipo

- Fin de mes fácilEstá diseñado para la gestión de equipos. Puede asignar tareas al equipo de finanzas, realizar un seguimiento de las autorizaciones y dejar comentarios en un ticket para garantizar que una tarea se complete correctamente.

- FreshBooksLa plataforma permite que varios usuarios colaboren en proyectos. Sin embargo, sus funciones de flujo de trabajo no son tan completas ni específicas para el cierre de procesos como Easy Month End.

5. Informes y contabilidad

- Fin de mes fácil: Reporting is limited to the closing process itself. It’s not a full software de contabilidad.

- FreshBooksProporciona informes contables estándar, como el de pérdidas y ganancias. En planes superiores, ofrece contabilidad por partida doble y facilita el seguimiento de la rentabilidad del proyecto.

6. Precios y planes

- Fin de mes fácil:Tiene tres planes de precios principales que se adaptan al tamaño de su equipo.

- FreshBooks:Ofrece cuatro planes, incluido un plan Lite y un plan Plus, que se adaptan a la cantidad de clientes facturables y las funciones que necesita. El precio normalmente es por mes.

7. Facilidad de uso y plataforma

- Fin de mes fácilLa plataforma es sencilla, pero está diseñada para profesionales contables que comprenden el flujo de trabajo de cierre. Es una plataforma única para su propósito específico.

- FreshBooksConocido por su panel de control FreshBooks, fácil de usar, se considera uno de los mejores programas de contabilidad para autónomos. pequeña empresa propietarios debido a su diseño intuitivo.

8. Datos e integraciones

- Fin de mes fácil:Se integra con otro software de contabilidad como QuickBooks y Xero para importar datos para conciliaciones.

- FreshBooksSe integra con más de 100 aplicaciones. Esto lo convierte en una excelente plataforma para la gestión financiera, especialmente para empresas de servicios que utilizan otro software para gestionar proyectos y clientes.

9. Capacidades móviles

- Fin de mes fácilEsta es una aplicación web. No tiene una aplicación móvil dedicada.

- FreshBooks:Tiene una aplicación móvil FreshBooks muy bien valorada tanto para iOS como para Android dispositivosPuede administrar su negocio mientras viaja con una simple conexión a Internet.

¿Qué tener en cuenta al elegir un software de contabilidad?

- Su tipo de negocio: ¿Eres un? persona de libre dedicación¿Basado en servicios o en productos? Tus necesidades específicas determinarán la mejor opción.

- Escalabilidad: ¿Puede el software crecer con su negocio? Considere el futuro. necesidades comerciales.

- Necesidades de integración: ¿Se conecta con sus otras herramientas (por ejemplo, pasarelas de pago, CRM)?

- Acceso móvil: ¿Necesita administrar sus finanzas mientras viaja?

- Atención al cliente: ¿Qué tipo de ayuda está disponible si surge algún problema?

- Informes Profundidad: ¿Necesita resúmenes simples o análisis financieros detallados?

- Seguridad: ¿Cómo protege la plataforma tu información confidencial? datos financieros?

- Interfaz de usuario: ¿Es fácil de aprender y usar para ti y tus compañeros? Esto es clave para los nuevos usuarios.

Veredicto final

Después de probar ambos, recomendamos FreshBooks.

Si bien Easy Month End es excelente por su proceso de fin de mes dedicado.

FreshBooks es una solución más completa para una pequeña empresa.

Su plataforma gestiona todo, desde el envío de facturas hasta la gestión de proyectos y seguimiento del tiempo.

Por su dinero, FreshBooks le ofrece más valor diario.

Su plan premium y otros planes de precios ofrecen una variedad de características como facturas recurrentes y pagos FreshBooks, simplificando sus finanzas y brindando a su equipo de finanzas las herramientas que se merece.

Para la mayoría de los propietarios de pequeñas empresas, la opción más inteligente es simplificar sus vidas y administrar el dinero sin problemas.

Más de Fin de Mes Fácil

A continuación se muestra una breve comparación de Easy Month End con algunas de las principales alternativas.

- Fin de mes fácil vs Puzzle io: Mientras que Puzzle.io está destinado a la contabilidad de empresas emergentes, Easy Month End se centra específicamente en agilizar el proceso de cierre.

- Fin de mes fácil vs. Dext: Dext está destinado principalmente a la captura de documentos y recibos, mientras que Easy Month End es una herramienta integral de gestión de cierre de mes.

- Fin de mes fácil vs. Xero: Xero es una plataforma de contabilidad completa para pequeñas empresas, mientras que Easy Month End proporciona una solución dedicada al proceso de cierre.

- Fin de mes fácil vs. Synder: Synder se especializa en la integración de datos de comercio electrónico, a diferencia de Easy Month End, que es una herramienta de flujo de trabajo para todo el cierre financiero.

- Fin de mes fácil vs. Docyt: Docyt utiliza IA para la contabilidad y la entrada de datos, mientras que Easy Month End automatiza los pasos y tareas del cierre financiero.

- Fin de mes fácil vs. RefreshMe: RefreshMe es una plataforma de asesoramiento financiero, que se diferencia del enfoque de Easy Month End en la gestión cercana.

- Fin de mes fácil vs. Sage: Sage es una suite de gestión empresarial a gran escala, mientras que Easy Month End ofrece una solución más especializada para una función contable crítica.

- Fin de mes fácil vs. Zoho Books: Zoho Books es un software de contabilidad todo en uno, mientras que Easy Month End es una herramienta diseñada específicamente para el proceso de fin de mes.

- Fin de mes fácil vs. ola: Wave ofrece servicios de contabilidad gratuitos para pequeñas empresas, mientras que Easy Month End ofrece una solución más avanzada para la gestión cercana.

- Fin de mes fácil vs. Quicken: Quicken es una herramienta de finanzas personales, lo que hace que Easy Month End sea una mejor opción para las empresas que necesitan administrar el cierre de mes.

- Fin de mes fácil vs. Hubdoc: Hubdoc automatiza la recopilación de documentos, pero Easy Month End está diseñado para administrar todo el flujo de trabajo de cierre y las tareas del equipo.

- Fin de mes fácil vs. Expensify: Expensify es un software de gestión de gastos, que es una función diferente del enfoque principal de Easy Month End en el cierre financiero.

- Fin de mes fácil vs. QuickBooks: QuickBooks es una solución de contabilidad integral, mientras que Easy Month End es una herramienta más específica para gestionar el cierre de mes en sí.

- Fin de mes fácil vs. entrada automática: AutoEntry es una herramienta de captura de datos, mientras que Easy Month End es una plataforma completa para la gestión de tareas y flujo de trabajo durante el cierre.

- Fin de mes fácil vs. FreshBooks: FreshBooks está dirigido a autónomos y pequeñas empresas, mientras que Easy Month End ofrece una solución específica para el cierre de mes.

- Fin de mes fácil vs NetSuite: NetSuite es un sistema ERP completo, con un alcance más amplio que el enfoque especializado de Easy Month End en el cierre financiero.

Más de FreshBooks

- FreshBooks frente a Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- FreshBooks frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- FreshBooks frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- FreshBooks frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- FreshBooks vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- FreshBooks frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- FreshBooks frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- FreshBooks frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- FreshBooks frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- FreshBooks frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- FreshBooks frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- FreshBooks frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- FreshBooks frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- FreshBooks vs. AutoEntryEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- FreshBooks frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Cuál es la principal diferencia entre Easy Month End y FreshBooks?

Easy Month End se centra principalmente en optimizar el proceso de cierre contable de fin de mes y los flujos de trabajo de conciliación. Por el contrario, FreshBooks ofrece una solución de contabilidad más amplia basada en la nube, que destaca en la facturación, el seguimiento de gastos y las funciones básicas. teneduría de libros Para autónomos y pequeñas empresas.

¿Puede FreshBooks reemplazar a Xero o QuickBooks?

FreshBooks puede ser una alternativa sólida para empresas que priorizan la facturación y el seguimiento de proyectos. Sin embargo, para necesidades más complejas de inventario, nómina o contabilidad avanzada, algunas empresas podrían preferir soluciones especializadas como Xero o QuickBooks.

¿Es Easy Month End adecuado para empresas muy pequeñas o trabajadores autónomos?

Easy Month End es más beneficioso para pequeñas empresas o equipos que cuentan con un proceso de cierre mensual estructurado. Los autónomos o las pequeñas empresas con necesidades más sencillas podrían encontrar FreshBooks más completo para su gestión financiera general.

¿Estas plataformas ayudan con la preparación de impuestos?

Ambas plataformas ofrecen informes que pueden facilitar la preparación de impuestos, como estados de resultados. Sin embargo, ninguna ofrece servicios directos de declaración de impuestos. Normalmente, utilizará sus datos financieros para su asesor fiscal o software.

¿Existen tarifas ocultas entre los precios de FreshBooks y Easy Month End?

Ambos detallan claramente sus niveles de precios. FreshBooks cobra por usuario por cada miembro adicional del equipo y aplica comisiones por transacción para pagos en línea. El precio de Easy Month End se ajusta según el tamaño y las entidades del equipo, así que siempre consulte los detalles del plan específico para consultar todas las preguntas frecuentes.