Struggling with messy stacks of paper?

Managing your business money feels like a giant, scary puzzle.

It is easy to lose track of bills and get stressed at tax time.

One small mistake can cost you a lot of money.

You deserve a break from the chaos. Stop worrying and start growing.

Our guide shows you how to usar Zoho Books step by step.

We make contabilidad feel like a breeze. You will master invoices and track every penny.

Click here to take control of your negocio today, finally!

Agilice su contabilidad with Zoho Books. Join over 500,000 businesses saving 20 hours on paperwork monthly. Start your 14-day trial today.

Zoho Books Tutorial

Setting up your account is the first step toward easier teneduría de libros.

First, enter your business details and tax info.

Next, connect your bank account to track your money automatically.

It sounds hard, but the software does the heavy lifting.

You will be sending professional invoices and managing bills in no time.

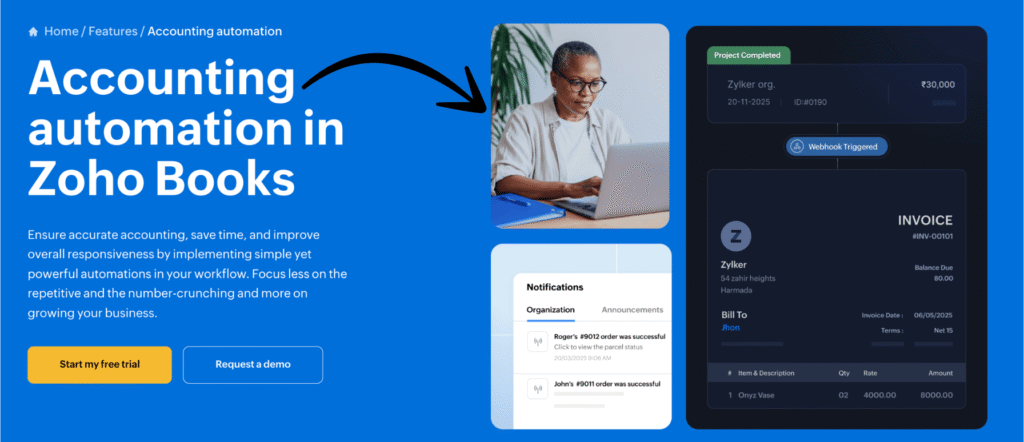

How to Use Accounting Automation

Time is money. You should not waste hours typing numbers into your accounting systems.

Accounting software like Zoho Books is built to save you time.

Se utiliza automatización to handle the boring tasks.

This lets you focus on growing your business rather than on datos entry. Here is how to set it up.

Step 1: Connect Your Bank Account

This is the most important step.

It lets your Zoho Books account see your spending and earnings in real time.

- Go to the Banking Module: Look at the sidebar on the left. Click on “Banking” to open the dashboard.

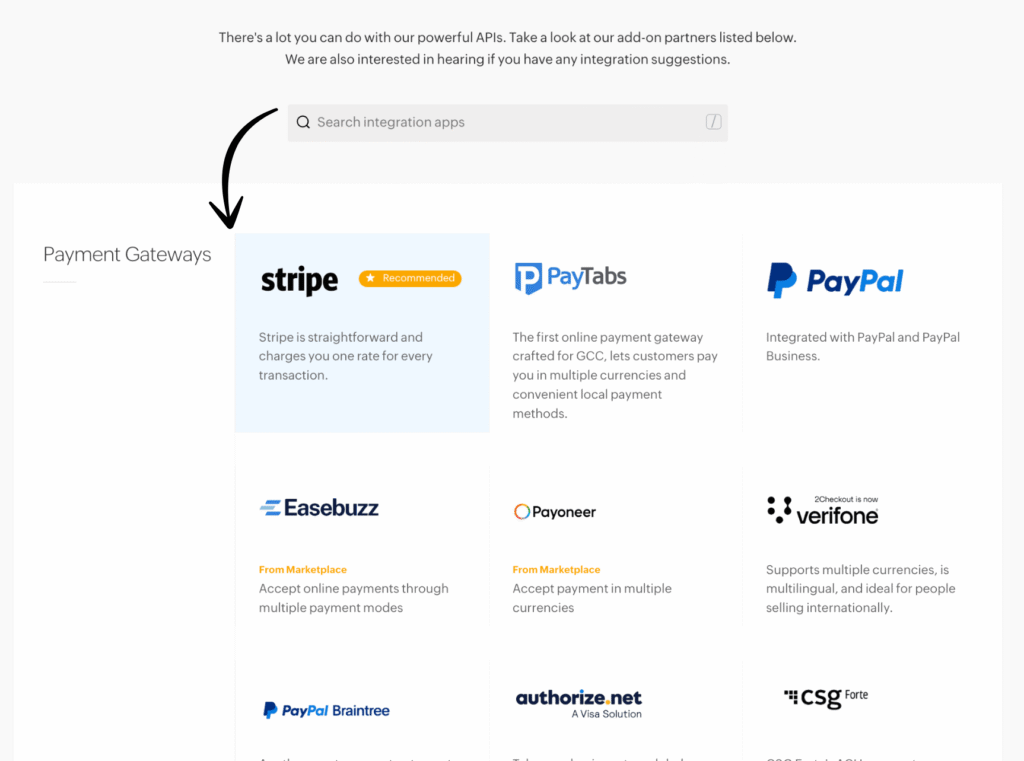

- Add Bank or Credit Card: Click the button to add a new account. You can connect standard banks and online payment gateways like PayPal or Stripe.

- Enable Bank Feeds: Enter your banking credentials safely. This turns on bank feeds, which automatically pull in your financial data.

- Verify the Connection: Check that your balance updates. Now, you do not have to enter every single deposit or withdrawal manually.

Step 2: Set Up Transaction Rules

Categorizing every coffee or office supply purchase gets old fast.

You can use rules to instantáneamente sort your sales and purchase transactions.

- Access Settings: Clicked on the gear icon in the top right corner. Select “Transaction Rules” from the menu.

- Create a New Rule: Give your rule a name. For example, you can track specific purchase transactions from vendors such as “Amazon” or “Staples.”

- Set Criteria: Tell the system what to look for. This works like workflow rules, where the software automatically reacts to data.

- Save and Apply: Once saved, the system sorts new transactions for you. It organizes your money without you having to lift a finger.

Step 3: Automate Recurring Journals

Some costs recur monthly, like rent or seguro. You can set these on autopilot.

- Go to the Accountant Tab: Find the “Accountant” section in the sidebar. Select “Recurring Manual Journals.”

- Set the Schedule: Choose how often the entry should happen. This is great for standard monthly expenses that include sales tax.

- Enter Details: Fill in the debit and credit accounts. You can even attach files, such as rental agreements or contracts, for reference.

- Activate: Save the journal. The system will now record this entry for you every single month.

How to Use the Zoho Ecosystem

Zoho Books is powerful on its own, but it works even better when it talks to other apps.

For growing businesses, connecting different tools is the key to success.

You can manage everything from the web or use the desktop app for easy access.

Here is how to link everything together.

Step 1: Access the Integrations Menu

El initial setup of your integrations is simple. You do not need to be a tech expert.

- Find the Menu: Go to Setting, then click “Integrations.” This is where you connect other Zoho apps or third-party tools.

- Explore Options: You will see options for many tools. You can even set up custom functions here to make the software do exactly what you want.

- Get Expert Help: If this part feels tricky, experts like Zenatta Consulting often help businesses configure these complex settings perfectly.

- Conectar: Choose the apps you use most and get ready to sync.

Step 2: Sync with Zoho CRM

Sales and accounting should always work together.

Connecting Zoho CRM keeps your customers ‘ and vendors’ lists matching in both places.

- Link the Apps: Select Zoho CRM from the list and click “Connect.

- Sync Data: This ensures that when a salesperson closes a deal, you see the transactions immediately.

- Manage Orders: You can turn a quote into a sales order instantly.

- Update Info: It keeps your price lists accurate across departments. This stops errors where sales teams sell items for the wrong price.

Step 3: Connect Zoho Expense

Tracking employee spending is vital for healthy cash flow.

Connecting Zoho Expense automates this process.

- Map Categories: meaningful Link your expense categories to your chart of accounts. This ensures every penny goes to the right place.

- Set Rules: Configure your tax preferences so the system calculates taxes correctly on every claim.

- Automate Reports: This integration automatically updates your financial reports. Your balance sheet and trial balance will always be up to date without manual work.

- Streamline Payments: It works alongside your payment gateways and recurring invoices to keep your money organized.

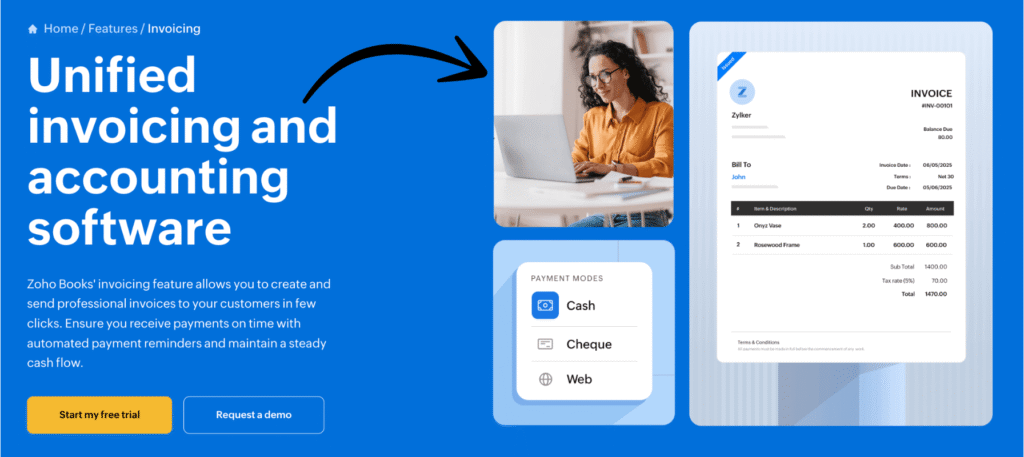

How to Use Unified Invoicing and Accounting

Managing money should not be hard.

The app brings sales and expenses together.

It has powerful features that seamlessly link different modules.

You can set up your workflows to automate boring tasks.

Here is how to create professional documents and get paid faster.

Step 1: Create a Custom Invoice Template

Your invoice represents your company. You need it to look good so customers trust you.

- Configure Your Look: Go to Settings and select templates. Choose a design that fits your style.

- Add Branding: Upload your logo. You can even add a digital sign to make it official.

- Set Preferences: Decide how you want to save and send files. You can email them or generate a PDF.

- Acceso móvil: You can access and edit these templates from the web or the Androide mobile app.

Step 2: Generate Your First Invoice

It is now time to bill your clients. This process updates both your inventory and sales records simultaneously.

- Start a New Invoice: Go to the Sales module and click Create. Select a contact from your user list.

- Add Details: Enter the services or products they bought. You can also convert existing estimates into invoices with one click.

- Check the Facts: Verify the due date and assign it to specific projects if needed.

- Send it Out: Once you save it, you can email it or export the data. This helps you track who has paid and who still owes money.

Step 3: Record and Reconcile Payments

Getting the money is the best part. You need to record the payment to keep your reports accurate.

- Log the Money: When a client pays, mark the invoice as paid. You can attach receipts or other supporting documents as proof.

- Match with Bank Data: You can import your bank data to ensure every penny is accounted for. This is safer than using manual spreadsheets.

- Manage Expenses: Do not forget your vendors. You can track purchases and bills in the same system.

- Share with Experts: Give your accountant access to view these records. If you used QuickBooks before, you can easily move your history here.

Alternativas a Zoho Books

- Dext: Este software se centra en automatizar la extracción de datos de recibos y facturas. Ahorra tiempo en la entrada manual de datos al digitalizar su documentación.

- Docyt: Esta plataforma se basa en IA para automatizar la contabilidad y las tareas administrativas. Docyt busca eliminar la introducción manual de datos y proporcionar información financiera en tiempo real, lo que la convierte en una potente alternativa para las empresas que buscan una solución altamente automatizada.

- SabioUna plataforma potente que ofrece soluciones para empresas de todos los tamaños. Es una alternativa sólida, especialmente para empresas con necesidades financieras más complejas.

- Xero: Esta es una popular plataforma de contabilidad en la nube. Es una alternativa a las funciones de contabilidad de Atera, ofreciendo herramientas para facturación, conciliación bancaria y seguimiento de gastos.

- Fin de mes fácil: Este software especializado está diseñado específicamente para simplificar el proceso de cierre financiero. Se integra con otras plataformas de contabilidad como QuickBooks y Xero para garantizar un cierre de mes fluido y sencillo.

- Rompecabezas io: Este es un software de contabilidad moderno, diseñado específicamente para startups. Facilita la generación de informes financieros y la automatización, ofreciendo información en tiempo real y un enfoque en la optimización de la contabilidad para un cierre más rápido.

- Sabio: Sage, un conocido proveedor de software de gestión empresarial, ofrece una gama de soluciones contables y financieras que pueden servir como alternativa al módulo de gestión financiera de Atera.

- Synder: Este software se centra en sincronizar sus plataformas de comercio electrónico y pago con su software de contabilidad. Es una alternativa útil para empresas que necesitan automatizar el flujo de datos desde los canales de venta hasta sus libros contables.

- Fin de mes fácil: Esta herramienta está diseñada específicamente para agilizar el proceso de cierre de mes. Es una alternativa especializada para empresas que desean mejorar y automatizar sus informes financieros y tareas de conciliación.

- Docyt: Docyt, una plataforma de contabilidad basada en IA, automatiza los flujos de trabajo financieros. Competirá directamente con las funciones de contabilidad basadas en IA de Atera, ofreciendo datos en tiempo real y gestión automatizada de documentos.

- Refrescarme: Esta es una plataforma de gestión financiera personal. Si bien no es una alternativa empresarial directa, ofrece funciones similares, como el seguimiento de gastos y facturas.

- Ola: Este es un popular software financiero gratuito. Es una excelente opción para autónomos y pequeñas empresas para la facturación, la contabilidad y el escaneo de recibos.

- Acelerar: Una herramienta reconocida para finanzas personales y de pequeñas empresas. Facilita la elaboración de presupuestos, el control de gastos y la planificación financiera.

- Hubdoc: Este software es una herramienta de gestión documental. Obtiene automáticamente sus documentos financieros y los sincroniza con su software de contabilidad.

- Expensificar: Esta plataforma se centra en la gestión de gastos. Es ideal para escanear recibos, gestionar viajes de negocios y crear informes de gastos.

- QuickBooks: Uno de los programas de contabilidad más utilizados. QuickBooks es una alternativa potente que ofrece un conjunto completo de herramientas para la gestión financiera.

- Entrada automática: Esta herramienta automatiza la entrada de datos. Es una buena alternativa a las funciones de captura de recibos y facturas de Atera.

- FreshBooks: Este programa es ideal para facturación y contabilidad. Es popular entre autónomos y pequeñas empresas que necesitan una forma sencilla de controlar el tiempo y los gastos.

- NetSuite: Una potente y completa suite de gestión empresarial basada en la nube. NetSuite es una alternativa para grandes empresas que necesitan más que solo gestión financiera.

Comparación de Zoho Books

Al elegir una solución de contabilidad, es aconsejable comparar las mejores opciones.

Hemos realizado la investigación para ayudarle a ver cómo se compara Zoho Books con sus principales competidores.

- Zoho Books frente a QuickBooksQuickBooks es líder del mercado, conocido por sus amplias funciones e integraciones. Sin embargo, Zoho Books suele ser elogiado por su interfaz clara y sus precios más asequibles y escalables, especialmente para pequeñas y medianas empresas.

- Zoho Books frente a XeroXero es una popular plataforma de contabilidad en la nube que prioriza la facilidad de uso. Si bien ambas ofrecen funciones básicas sólidas, Zoho Books ofrece una gestión de inventario más robusta en sus planes de mayor nivel.

- Zoho Books frente a FreshBooksFreshBooks es una excelente opción para autónomos y empresas de servicios, con un enfoque en la facturación. Zoho Books ofrece un programa de contabilidad más completo con una gama más amplia de funciones, además de la facturación.

- Zoho Books frente a SageSage generalmente se dirige a empresas más grandes y complejas. Zoho Books es más adecuado para pequeñas y medianas empresas y es conocido por su interfaz intuitiva y precios competitivos.

- Zoho Books frente a NetSuite:NetSuite es una potente solución ERP para grandes empresas. Zoho Books es una excelente alternativa para las pequeñas empresas que necesitan una plataforma sólida, asequible y flexible que pueda crecer con ellas.

- Zoho Books frente a WaveWave es una opción popular en su versión gratuita. Si bien Wave es ideal para pequeñas empresas y autónomos, Zoho Books ofrece un conjunto de funciones más completo y es una opción más escalable para empresas en crecimiento.

- Zoho Books frente a DextDext es principalmente una herramienta de extracción de datos, enfocada en automatizar el procesamiento de recibos y facturas. Zoho Books, por otro lado, es un completo software de contabilidad que incluye la gestión de gastos entre sus muchas funciones.

- Zoho Books frente a SynderSynder se especializa en sincronizar transacciones financieras de diversas fuentes con software de contabilidad. Zoho Books incluye esta funcionalidad como parte de su plataforma completa, junto con la facturación, los informes y otras funciones contables esenciales.

- Zoho Books frente a ExpensifyExpensify es una potente herramienta de informes y gestión de gastos. Zoho Books cuenta con gestión de gastos integrada, pero Expensify es una opción más especializada para empresas con políticas de gastos complejas.

- Zoho Books frente a DocytDocyt utiliza IA para automatizar la entrada de datos de recibos y extractos bancarios. Zoho Books también cuenta con funciones de automatización, pero Docyt se centra principalmente en esta automatización específica.

- Zoho Books frente a HubdocHubdoc es una herramienta de gestión documental que automatiza la extracción de datos de facturas y recibos. Zoho Books ofrece una función similar, pero el objetivo principal de Hubdoc es alimentar datos a otros sistemas como QuickBooks o Xero.

- Zoho Books vs. Entrada automáticaAutoEntry es otra herramienta para la entrada automatizada de datos desde documentos. Zoho Books es un programa de contabilidad completo, mientras que AutoEntry es una herramienta especializada que puede utilizarse como complemento.

- Zoho Books frente a Puzzle ioPuzzle.io es una solución de contabilidad impulsada por IA para empresas emergentes que ofrece información financiera en tiempo real.

- Zoho Books vs. Easy Month End:Easy Month End no es una alternativa directa, ya que es una función dentro de Zoho Books que simplifica el proceso de cierre.

- Zoho Books frente a QuickenQuicken está destinado principalmente a finanzas personales y empresas muy pequeñas, mientras que Zoho Books es una solución completa diseñada para tareas de contabilidad empresarial.

- Zoho Books frente a RefreshMe:Esta no es una comparación directa; RefreshMe es un recurso o una función que puede estar asociada con Zoho Books.

Conclusión

Managing your business money does not have to be scary.

We showed you how to use automation and create clear invoices.

You now have the right tools to succeed.

Zoho Books makes the hard work easy for you.

You can focus on growing your company instead of stressing over math.

Do not wait to get started.

If you get stuck, there are many helpful resources online to guide you.

You can also read the cookie policy zoho page to learn how your data stays safe.

Take control of your finances today. You are ready to win.

Preguntas frecuentes

Is Zoho Books easy to use?

Yes, it is very user-friendly. The layout is clean and simple. You do not need to be an accounting expert to manage your business finances.

How to use Zoho for beginners?

Start by syncing your bank account. Then, customize your invoice template. The system guides you through every step so you never get lost or confused.

What is the main purpose of Zoho Books?

It helps businesses track money. You use it to send invoices, pay bills, and see your profits. It keeps all your financial records organized in one place.

How does Zoho Books work?

It connects to your bank to fetch data. You categorize transactions, and the software builds reports. It automates tedious tasks such as recurring billing and payment reminders.

Is Zoho Book better than QuickBooks?

It is often better for pequeñas empresas. Zoho is more affordable and easier to learn. However, QuickBooks offers more complex features for very large companies.

Is Zoho free for 5 users?

No, the free plan is limited. It allows only one user and one accountant. To add more people to your team, you must upgrade to a paid plan.

More Facts about Zoho Books

- Moving Your Data: Zoho helps you switch from your old accounting system. You can upload spreadsheet files (CSVs) to bring in your customers, items, and past financial records.

- Starting Fresh: Before you begin, upload your “opening balances.” This means telling the software how much money you had at the end of last year so your new records are correct.

- Banking Connection: You can link your bank accounts and credit cards directly to the software. This lets you see money coming in and going out automatically without typing it in by hand.

- Easy Invoicing: You can create bills (invoices) and send them to your customers. You can also set the software to automatically send these bills to regular customers to save time.

- Tracking Expenses: You can use a mobile app to take pictures of your paper receipts. The software reads the receipt and saves the expense for you.

- Ahorrando tiempo con la automatización: You can create rules so the software does boring work for you. For example, it can automatically sort your expenses or send polite email reminders to people who owe you money.

- Acceso del equipo: You can invite your employees to use the system. You get to decide exactly what each person is allowed to see or change.

- Gestión de proyectos: If you charge clients for your time, you can use the Timesheets feature to track hours and add them directly to a bill.

- Global Features: The software works with money from different countries (multi-currency) and can handle various types of sales taxes.

- Business Health: There are over 40 different reports you can run. These show you how much profit you made, where your money is, and if you are ready for tax season.

- Buena relación calidad-precio: Many users like Zoho Books because it offers many of the same features as bigger, more expensive brands, but at a lower cost and often easier to use.

- Trying it Out: There is a free trial version that lets you test the premium features before you decide to buy a subscription plan.