Struggling to keep your negocio finances neat and tidy?

Muchos pequeña empresa owners face the headache of managing receipts, invoices, and bank statements.

Imaginar a world where your financial documents organize themselves.

This is where tools like Wave vs Hubdoc step in.

Let’s dive in and find out, so you can hacer una elección inteligente y volver a lo que mejor sabes hacer.

Descripción general

We put Wave and Hubdoc through real-world tests.

We tried them with different businesses. This helped us see how each one works.

Now, we can share what we found to help you compare them easily.

Más de 4 millones pequeñas empresas Confíe en Wave para administrar sus finanzas. Explore los planes de Wave y encuentre el ideal.

Precios: Plan gratuito disponible. Plan de pago desde $19 al mes.

Características principales:

- Facturación

- Bancario

- Complemento de nómina.

¡Ahorra tiempo con Hubdoc! Los usuarios suelen ahorrar 4 horas semanales en la entrada de datos. Además, Hubdoc autoorganiza el 99 % de los documentos.

Precios: Tiene una prueba gratuita. El plan premium cuesta desde $12 al mes.

Características principales:

- Obtención automatizada de documentos

- Extracción de datos

- Directo Contabilidad Integración

¿Qué es Wave?

Bien, hablemos de Wave.

Piense en ello como un amigo útil para el dinero de su negocio.

Le permite hacer cosas como enviar facturas y realizar un seguimiento del dinero que entra y sale.

Puede ayudarle a ver el panorama general de las finanzas de su negocio.

Además, explora nuestros favoritos Alternativas de olas…

Nuestra opinión

¡No te conformes con menos! Únete a los más de 2 millones de pequeñas empresas que confían hoy mismo en las potentes funciones de contabilidad gratuitas de Wave para optimizar sus finanzas.

Beneficios clave

Los puntos fuertes de Wave incluyen:

- Un plan de contabilidad básico 100% gratuito.

- Sirviendo a más de 2 millones de pequeñas empresas.

- Fácil creación de facturas y procesamiento de pagos.

- Sin contratos a largo plazo ni garantías.

Precios

- Plan de inicio: $0 al mes.

- Plan Pro: $19 al mes.

Ventajas

Contras

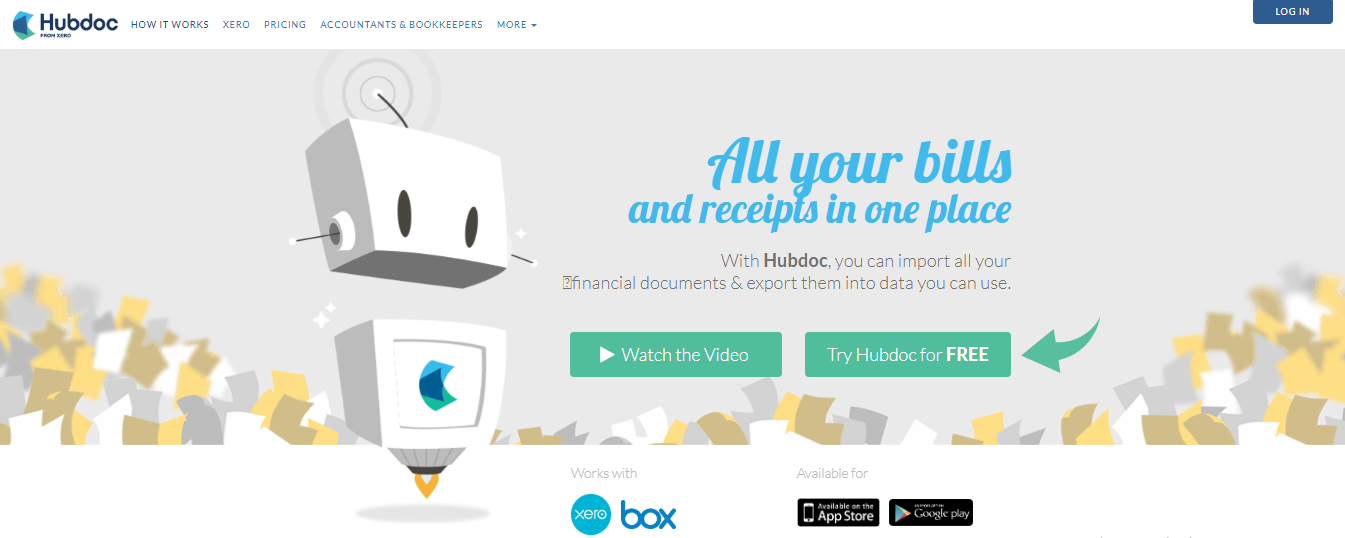

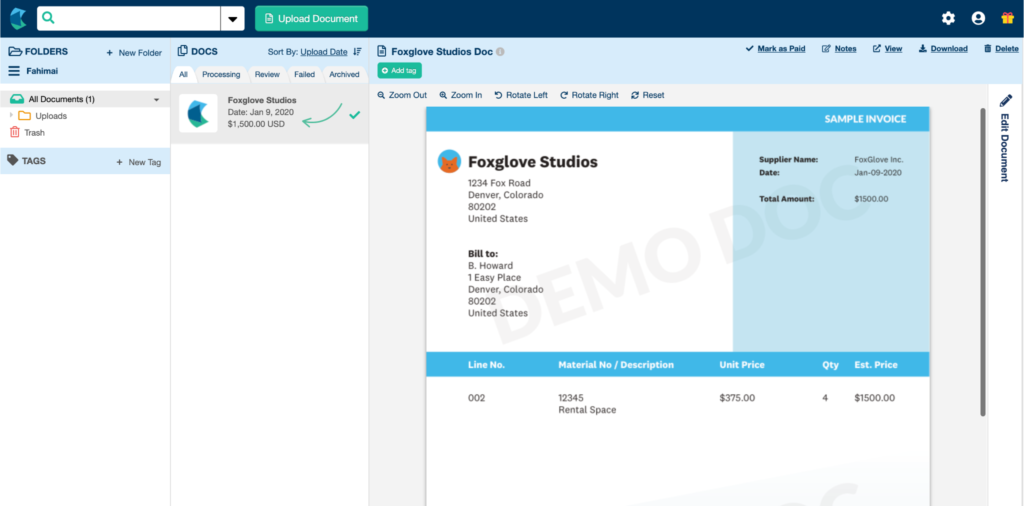

¿Qué es Hubdoc?

Bien, hablemos de Hubdoc.

Piense en ello como un asistente útil para sus documentos.

Obtiene sus facturas y estados de cuenta de diferentes lugares en línea.

Luego los mantiene a todos organizados en un solo lugar.

Bastante ordenado, ¿verdad?

Además, explora nuestros favoritos Alternativas a Hubdoc…

Beneficios clave

La principal fortaleza de Hubdoc es su enfoque en la automatización de documentos.

- 99% de precisión:Hubdoc utiliza OCR para garantizar que los datos se capturen correctamente.

- Almacenamiento a prueba de auditorías:Almacena documentos de forma segura, por lo que nunca volverás a perder un archivo.

- Ahorra 10 horas mensualesLos usuarios informan de un importante ahorro de tiempo al eliminar la entrada manual.

- Búsqueda automatizada de proveedores.

- Captura de fotografías con el móvil.

- Integración perfecta con Xero.

Precios

- Precio de Hubdoc: $12/mes.

Ventajas

Contras

Comparación de características

Selecting the best contabilidad software is a matter of understanding each platform’s core specialty.

This Wave review and Hubdoc review will evaluate a free accounting software against a powerful document automation tool, guiding pequeña empresa owners to the right solution for their business operations.

1. Propósito principal y plataforma

- Ola Financial is a full small business software de contabilidad solution. Its free platform includes the general ledger, teneduría de libros records, and core accounting features. Wave makes managing personal finance simple and is built for the small business owner.

- Hubdoc is a document and datos capture service, not an accounting platform. Its key features automate tasks by collecting financial documents and converting them into usable bank transactions. It works as a third party app to help accountant access data for other online accounting systems.

2. Precios y suscripción

- Ola offers a complete free version (free starter plan), including unlimited invoices and multiple companies management. Wave’s two plans structure offers a paid pro plan for advanced features with optional additional costs for add-ons, making it a very cost-effective choice.

- Hubdoc is often available as free teneduría de libros software when bundled with other popular business apps (like Xero), but it is a paid product on its own. The billing period is typically monthly, and its value is measured by the seguimiento del tiempo and save time it provides the bookkeeper.

3. Expense and Data Automation

- Ola helps track expenses by allowing you to connect to bank accounts to auto import bank transactions. Digital receipt capture is available, and the auto merge feature helps reconcile bank transactions with less manual effort.

- Hubdoc is a specialist in document automation. It can automatically file records and bank statements and extract data from them, significantly reducing the time tracking spent on manual data entry for expenses. The mobile app is excellent for receipt scanning receipts on the go.

4. Facturación y pagos

- Ola Financial’s invoicing software allows you to create and send recurring invoices. You can accept multiple online payments via credit card payments (credit card transaction) and bank payments, with integrated payment processing that includes Apple Pay.

- Hubdoc has no native invoicing features. Its payments functionality is limited to capturing vendor bills and invoices sent to you (accounts payable), which it then pushes to other systems like QuickBooks Online for the accountant to pay bills.

5. Nómina y seguimiento del tiempo

- Ola Payroll is an integrated accounting and payroll add-on that enables payroll processing and direct deposit for both active employee and independent contractor paid. Wave does not, however, offer dedicated billable hours or track mileage functionality.

- Hubdoc does not have run payroll or payroll processing capabilities. It is focused on financial documents and does not track employee time or manage sales tax calculations.

6. User Access and Collaboration

- Ola supports unlimited users for free, making it an ideal free platform for collaboration with your accountant or bookkeeper. It also allows you to track expenses for multiple companies from a single account.

- Hubdoc allows you to grant accountant access to clients’ records. This collaborative feature ensures that the accountant or bookkeeper always has the latest files via the internet connection, allowing them to spend less time requesting documents.

7. Financial Analysis and Reporting

- Ola offers essential financial reports and tools to view cash flow and profit from your income and expenses. This allows the small business owner to keep a full picture of their personal finance and business finances.

- Hubdoc does not generate financial reports or offer budgeting tools. It merely collects the raw source records and data so that the connected online accounting system can generate reports and provide real time data.

8. Funcionalidad y acceso móvil

- Both platforms offer a strong mobile app. Olas mobile app allows you to create invoices and manage payments on the go. Hubdoc’s app is purely focused on receipt scanning and document upload to the cloud.

- Hubdoc cloud-native nature ensures you have access to your documents from anywhere in the world with an internet connection. Wave is also cloud-based, so you can run your business from any mobile device.

9. Automation of Cash Flow and Payments

- Ola products help with cash flow by providing automated payment reminders and recurring billing. Wave integrates its own services seamlessly to simplify the entire process of getting paid and pay bills.

- Hubdoc helps automate the front end of cash flow management by collecting and organizing bank statements and vendor bills. This saves time for the bookkeeping tasks and the back-end process of tax time. The wave accounting review is why many recommend wave as a strong online accounting platform.

¿Qué buscar en un software de contabilidad?

To find the right financial solution, you must evaluate an accounting platform on five key dimensions that determine its value and fit.

- Escalabilidad: Can the software grow with any of your business?Scalability is crucial, especially when deciding between self hosted and cloud-based solutions. A strong subscription level should support unlimited bookkeeping records and allow you to easily add multiple users. Unlike on premise systems that require purchasing new hardware, cloud platforms allow you to pay for your needs through a tiered structure (such as a free plan to a paid plan), often with a discounted rate for commitment, ensuring your financial system adapts over time.

- Apoyo: What kind of help is available if you have questions?Support quality is paramount for giving peace of mind and simplifying tax filing. Ensure the vendor has a reliable help center and can address issues related to bank transfers and accounts receivable quickly. Look for clear support channels that promise resolution within a few business days.

- Facilidad de uso: Is it something you and your team can learn quickly? The simplicity of the user interface affects how quickly multiple users can become proficient. The software should make it easy to track expenses and manage money management features. It should also efficiently handle core operations, like automatically importing transactions automatically from your bank, to reduce manual effort.

- Necesidades específicas: Does it handle the unique things your business does? The system must directly support your core workflows. If you manage sales, it should integrate purchase orders and facilitate accounts receivable. If you have global customers, it should support multiple tax jurisdictions. Features like accept online payments are crucial for modern customers. For advanced users, particularly those integrating with add-ons (like Xero users frequently do), checking API compatibility is essential.

- Seguridad: How safe is your financial data with this software?Security is non-negotiable for bank transfers and managing customers’ payment data. The vendor must protect your information with advanced security measures, such as multi factor authentication. You should be able to segment reportando for a specific date range for security audits and be confident that your tax filing data is secure.

Veredicto final

Which one wins: Wave or Hubdoc?

If you need a full, free contabilidad system, choose Wave.

It offers invoicing and basic expense tracking. It’s great for small businesses.

But if you struggle with receipts and bank statements, pick Hubdoc.

It’s very smart. It grabs details automatically. We tested both tools. We saw them work in real businesses.

Choose Wave for all your contabilidad.

Pick Hubdoc for document help. Your business will be happier.

Más de Wave

- Ola vs. Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Wave contra DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Wave frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave contra SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Ola vs. Fin de mes fácilEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Wave vs. DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- Wave vs SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Wave frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Wave frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- Wave frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- Wave frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Wave frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Onda vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Wave frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Wave frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Más de Hubdoc

- Hubdoc contra PuzzleEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- Hubdoc frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- Hubdoc frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Hubdoc contra SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- Hubdoc vs. Easy Month EndEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- Hubdoc frente a Docyt:Esto utiliza IA para la contabilidad empresarial y automatizaciónEl otro utiliza la IA como asistente de finanzas personales.

- Hubdoc frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- Hubdoc frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- Hubdoc frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- Hubdoc frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- Hubdoc frente a QuickBooksEste es un conocido software de contabilidad para empresas. Su alternativa está diseñada para finanzas personales.

- Hubdoc vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- Hubdoc frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- Hubdoc frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

Is Wave really free for users?

Yes, Wave offers its core accounting, invoicing, and receipt tracking features for free. They make money from paid services like payroll and credit card processing. This makes Wave a great option for trabajadores autónomos and small businesses on a budget.

How does Wave vs Hubdoc compare for document collection?

Hubdoc specializes in automated document collection and data extraction. It’s superior for gathering receipts, bills, and bank statements automatically. Wave also allows receipt uploads, but Hubdoc’s smart capture is more robust for high-volume document management.

Can Hubdoc integrate with accounting software other than Xero?

While Hubdoc is owned by Xero and integrates seamlessly, it also offers connections to other platforms. You can export data to other accounting software, but its deepest functionality and automation are typically realized when paired with Xero.

Is Hubdoc better for bank reconciliation?

Hubdoc helps a lot with bank reconciliation by automatically fetching bank statements and extracting transaction data. This pre-populates information, making the reconciliation process smoother and faster in your accounting software like Xero or FreshBooks, or even Libros de Zoho.

How do you make money from these comparisons?

Our aim is to offer objective reviews. We may earn a referral fee when you visit a vendor or provider through our links. This does not impact our research or methodology, ensuring our reviews are authentic and unbiased to help you choose the best tool.