Haben Sie Schwierigkeiten, Ihre Finanzen zu verwalten?

Fragen Sie sich jemals, ob Sie die besten Tools für Ihre persönlichen Finanzen verwenden? Kleinunternehmen Buchhaltung?

Die gute Nachricht ist: Software kann helfen!

Zwei beliebte Alternativen, von denen Sie vielleicht schon gehört haben, sind Wave und Quicken.

Aber welches ist das Richtige für Sie?

Lassen Sie uns diese Optionen im Detail erläutern, damit Sie diejenige auswählen können, die am besten zu Ihren Bedürfnissen passt.

Überblick

Wir haben sowohl Wave als auch Quicken ausgiebig genutzt.

Wir haben Konten eingerichtet, die Ausgaben verfolgt und deren Funktionen erkundet.

Diese praktische Erfahrung führte uns zu diesem direkten Vergleich.

Über 4 Millionen kleine Unternehmen Vertrauen Sie Wave die Verwaltung Ihrer Finanzen an. Entdecken Sie die Angebote von Wave und finden Sie das passende für sich.

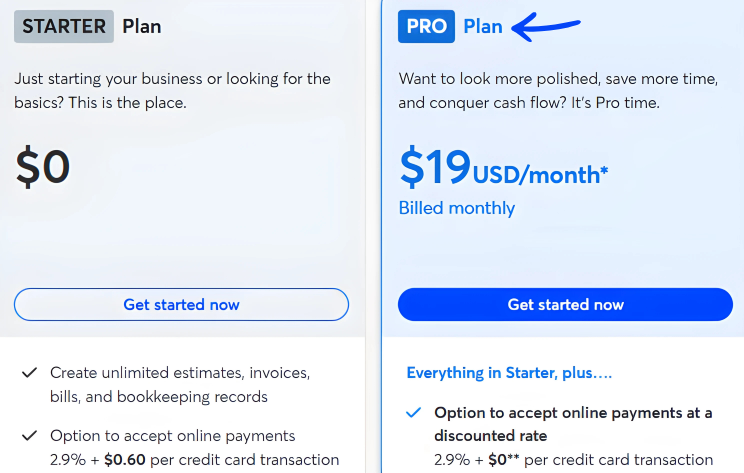

Preisgestaltung: Kostenloser Tarif verfügbar. Der kostenpflichtige Tarif beginnt bei 19 $/Monat.

Hauptmerkmale:

- Fakturierung

- Bankwesen

- Lohnabrechnungs-Add-on.

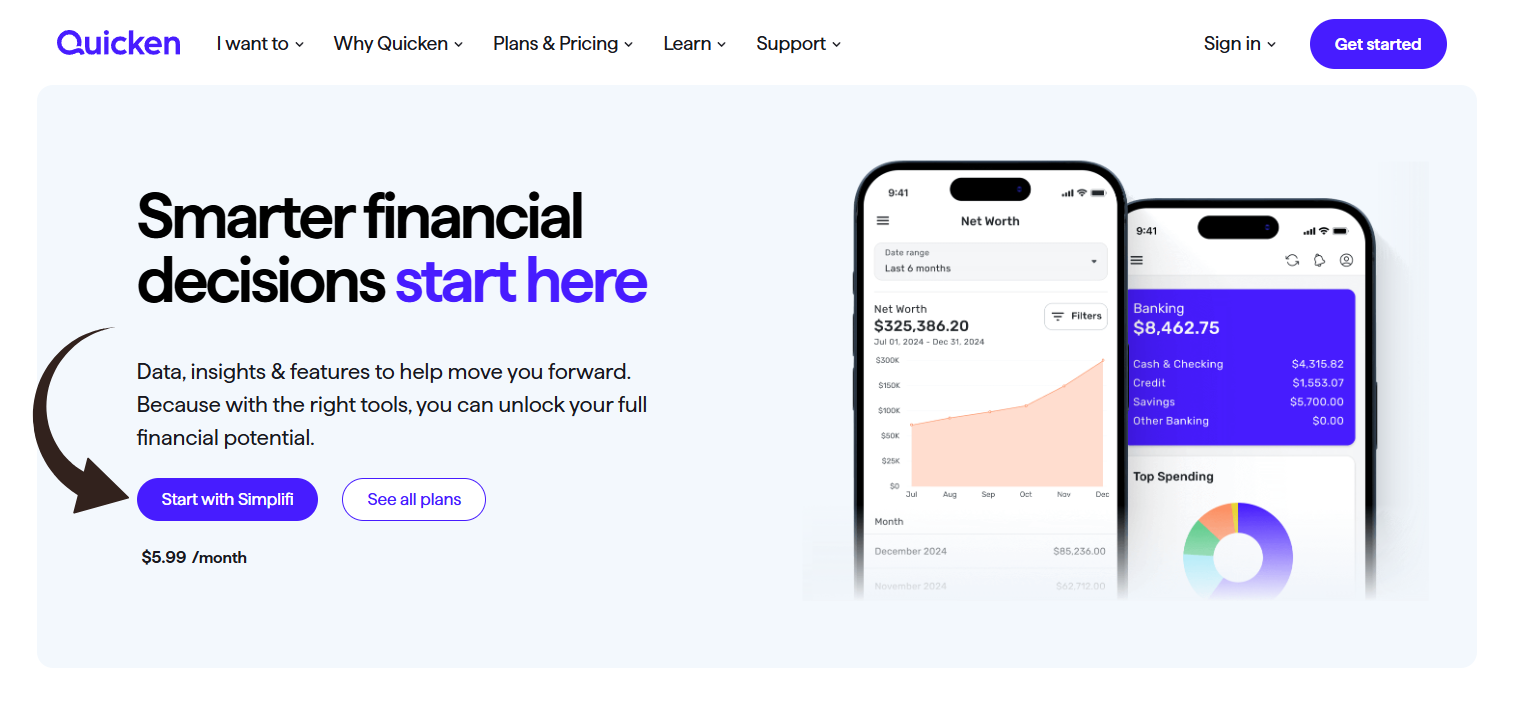

Sie möchten Ihre Finanzen selbst in die Hand nehmen? Mit Quicken haben Sie Zugriff auf Tausende von Finanzinstituten. Entdecken Sie mehr!

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Premium-Abo kostet 5,59 $/Monat.

Hauptmerkmale:

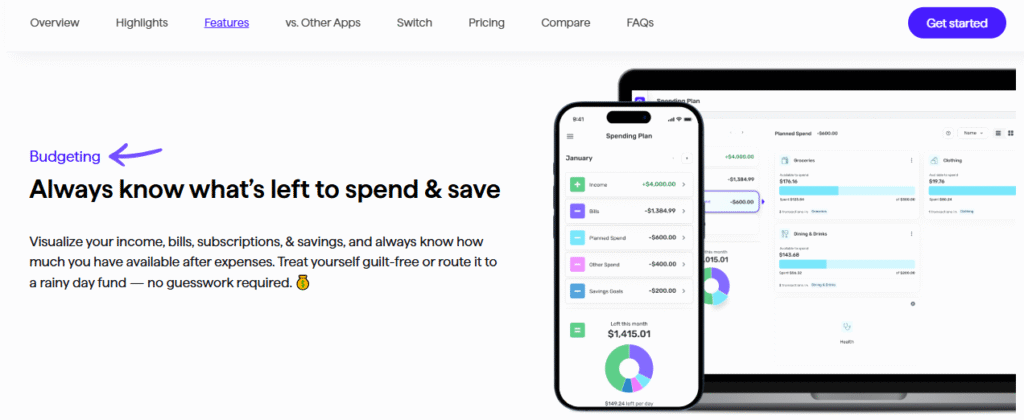

- Budgetierungstools

- Rechnungsverwaltung

- Investitionsverfolgung

Was ist eine Welle?

Okay, reden wir über Wave.

Betrachten Sie es als einen hilfreichen Freund für Ihre Geschäft Geld.

Es ermöglicht Ihnen beispielsweise das Versenden von Rechnungen und die Nachverfolgung von Einnahmen und Ausgaben.

Es kann Ihnen helfen, sich einen umfassenden Überblick über Ihre Unternehmensfinanzen zu verschaffen.

Entdecken Sie auch unsere Favoriten Wellenalternativen…

Unsere Einschätzung

Geben Sie sich nicht mit weniger zufrieden! Schließen Sie sich den über 2 Millionen Kleinunternehmen an, die auf die leistungsstarken, kostenlosen Buchhaltungsfunktionen von Wave setzen, um ihre Finanzen noch heute zu optimieren.

Wichtigste Vorteile

Zu den Stärken von Wave gehören:

- Ein 100% kostenloser Basis-Buchhaltungsplan.

- Wir betreuen über 2 Millionen Kleinunternehmen.

- Einfache Rechnungserstellung und Zahlungsabwicklung.

- Keine langfristigen Verträge oder Garantien.

Preisgestaltung

- Starterplan: 0 € pro Monat.

- Pro-Plan: 19 Dollar pro Monat.

Vorteile

Nachteile

Was ist Quicken?

Sie interessieren sich also für Quicken?

Es ist wie ein Tool, mit dem Sie all Ihre Finanzangelegenheiten an einem Ort im Blick haben. Betrachten Sie es als Ihren digitalen Finanzorganisator.

Es kann Ihnen helfen, Ihre Bankkonten, Rechnungen und sogar Investitionen zu verfolgen.

Ziemlich praktisch, oder?

Entdecken Sie auch unsere Favoriten Quicken-Alternativen…

Wichtigste Vorteile

Quicken ist ein leistungsstarkes Werkzeug, um Ihre Finanzen in Ordnung zu bringen.

Sie verfügen über mehr als 40 Jahre Erfahrung und sind ein absolutes Bestsellerprodukt.

Ihre verschiedenen Tarife ermöglichen die Anbindung an über 14.500 Finanzinstitute.

Sie erhalten außerdem eine 30-Tage-Geld-zurück-Garantie, um es risikofrei auszuprobieren.

- Verbindet sich mit Tausenden von Banken und Kreditkarten.

- Erstellt detaillierte Budgets.

- Erfasst Investitionen und Nettovermögen.

- Bietet Instrumente zur Ruhestandsplanung.

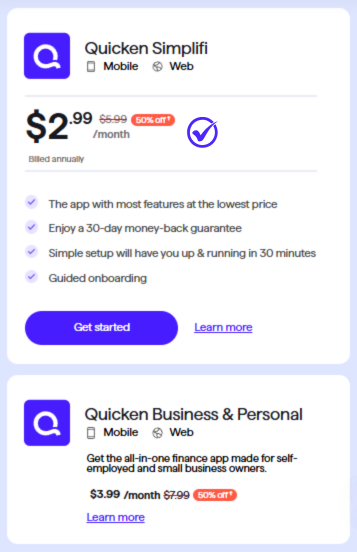

Preisgestaltung

- Quicken Simplifi: 2,99 $/Monat.

Vorteile

Nachteile

Funktionsvergleich

Die Auswahl des richtigen Buchhaltungsprogramms ist ein entscheidender Schritt für Kleinunternehmen Eigentümer.

Dieser Wave-Testbericht und der Quicken-Testbericht helfen Ihnen, die wichtigsten Funktionen jeder Plattform zu bewerten und Ihnen ein umfassendes Bild zu vermitteln, das Ihnen als Entscheidungshilfe dient und Ihnen Sicherheit gibt.

1. Geschäftliche und private Finanzen

- Welle Financial ist ein engagiertes Kleinunternehmen Buchhaltung Diese Software wurde für die Hauptbuchhaltung von Unternehmen entwickelt und dient der Verwaltung von Transaktionen für ein oder mehrere Unternehmen sowie der Erstellung von Finanzberichten. Sie ist die perfekte kostenlose Buchhaltungssoftware für ein Unternehmen. Freiberufler & unabhängiger Auftragnehmer, der seine geschäftlichen und privaten Finanzen trennen möchte.

- Beschleunigen Quicken ist seit Jahrzehnten ein dominierender Akteur auf dem Markt für Software zur privaten Finanzverwaltung. Der Schwerpunkt liegt auf Software mit umfassenden Funktionen zur Geldverwaltung. Die Quicken Business-Version ist für Anwender konzipiert, die ihre geschäftlichen und privaten Finanzen zentral verwalten möchten, beispielsweise ein Vermieter. Vermietung Immobilien oder ein Einzelunternehmer.

2. Preise und Tarife

- Welle Financial bietet eine komplett kostenlose Plattform für seine wichtigsten Buchhaltungs- und Rechnungsstellungsfunktionen. Sie können unbegrenzt Rechnungen versenden und Ihre Rechnungen verwalten. Buchhaltung Aufzeichnungen sind kostenlos. Für einen größeren Funktionsumfang bietet Wave einen Pro-Tarif und einen kostenpflichtigen Tarif für seine Lohnabrechnungsdienste an.

- Beschleunigen Quicken basiert auf einem Abonnementmodell mit verschiedenen Versionen für unterschiedliche Bedürfnisse. Quicken Deluxe und Quicken Premier eignen sich für die private Finanzverwaltung, während Quicken Home & Business die beste Option für geschäftliche Zwecke darstellt. Die Kosten richten sich nach dem gewählten Abonnement, wobei längere Abonnements einen Rabatt bieten.

3. Automatisierung

- Wave's Die Automatisierungsfunktionen konzentrieren sich auf den Bankbereich. Die Plattform kann Banktransaktionen automatisch importieren und zusammenführen, um die Bankabstimmung zu vereinfachen. Dies spart viel Zeit und reduziert den manuellen Aufwand. Daten Eintrag.

- Der Beschleunigen Die Marke ist seit Langem für ihre Automatisierungsfunktionen bekannt. Sie lädt Transaktionen von verbundenen Bank- und Anlagekonten automatisch herunter und kategorisiert sie. Diese Funktion ist ein Schlüsselmerkmal und bietet eine hervorragende Grundlage für Finanzanalysen.

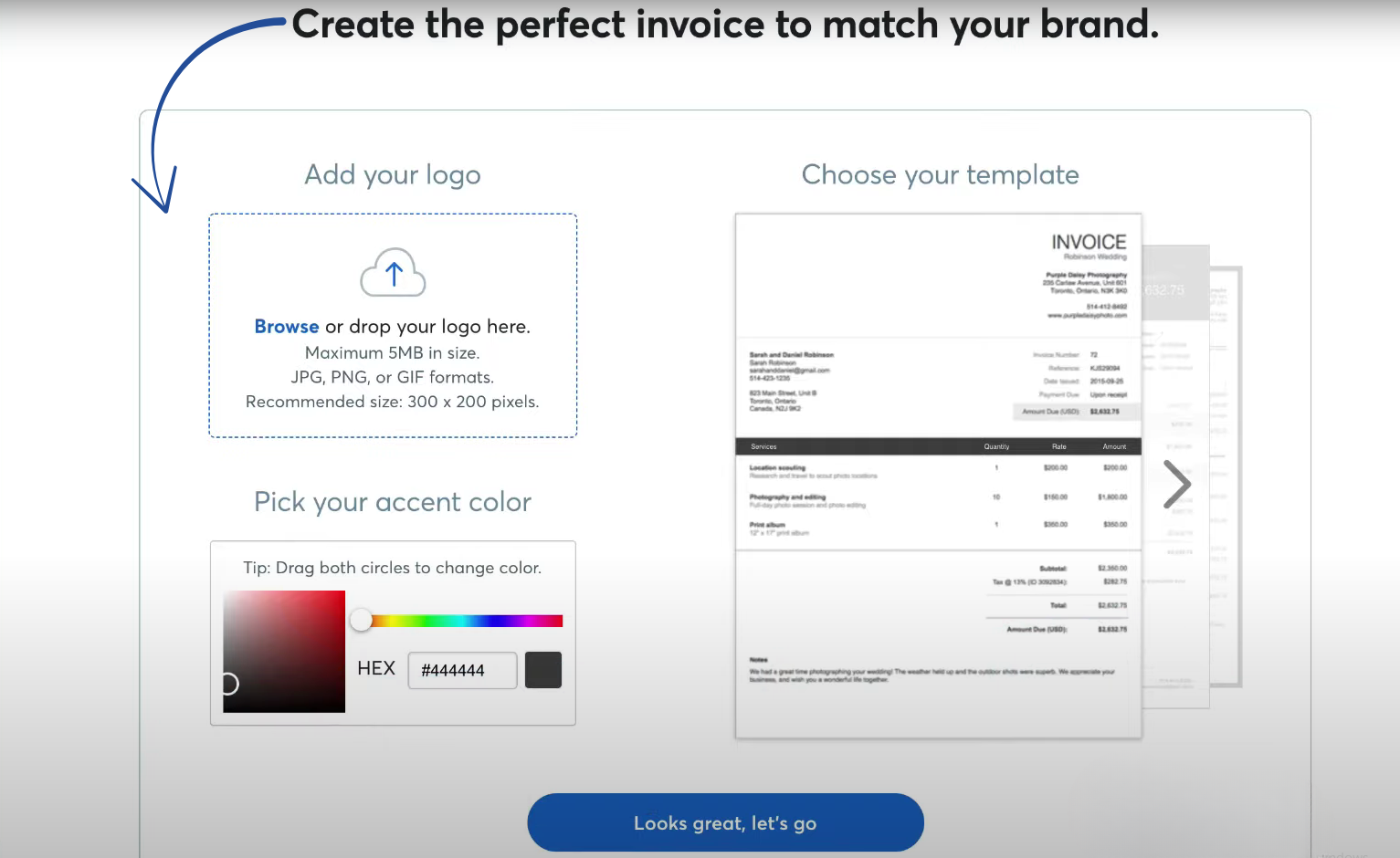

4. Rechnungsstellung und Zahlungen

- Welle Financial bietet eine hervorragende Rechnungssoftware mit umfangreichen Funktionen. Sie können professionelle und wiederkehrende Rechnungen erstellen und Online-Zahlungen per Kreditkarte oder Banküberweisung akzeptieren. Außerdem lassen sich automatische Zahlungserinnerungen einrichten.

- Quicken's Die Funktionen zur Rechnungserstellung sind eher einfach gehalten. Die Funktionen zur Rechnungsverfolgung und Online-Zahlung sind hingegen stärker ausgeprägt. Zwar können Sie Online-Zahlungen akzeptieren, die Optionen sind jedoch nicht so umfangreich wie bei Wave.

5. Lohn- und Gehaltsabrechnung

- Welle Die Lohnabrechnung ist ein Zusatzservice. Sie übernimmt die Lohn- und Gehaltsabrechnung für Angestellte und Stundenlohnempfänger. Mit ihr können aktive Mitarbeiter oder freiberufliche Auftragnehmer per Direktüberweisung bezahlt werden. Die Steuererklärung wird automatisch erstellt.

- Beschleunigen Es verfügt über keine eigene integrierte Lohnabrechnungsfunktion. Es handelt sich primär um ein Finanzmanagement-Tool und unterstützt nicht den gleichen Umfang an Lohnabrechnung und Steuererklärung für mehrere Mitarbeiter wie ein spezialisierter Lohnabrechnungsdienst.

6. Ausgabenverfolgung und Belegerfassung

- Welle Die Buchhaltungssoftware bietet eine zuverlässige Ausgabenverfolgung. Dank der Funktion zur digitalen Belegerfassung können Sie Belege fotografieren und Ausgaben automatisch erfassen. Ein ideales Tool für Selbstständige und Kleinunternehmer.

- Quicken's Die Ausgabenverfolgung eignet sich hervorragend für private und geschäftliche Ausgaben und konzentriert sich auf Budgetplanung und die Nachverfolgung Ihrer Geldflüsse. Das Scannen von Belegen ist ebenfalls über die mobile App möglich.

7. Zugänglichkeit und Plattform

- Welle Es handelt sich um eine cloudbasierte Plattform, die über einen Webbrowser und eine mobile App zugänglich ist. Das bedeutet, dass Sie von überall mit Internetverbindung auf Ihre Finanzdaten zugreifen und somit ein hohes Maß an Kontrolle behalten können.

- Beschleunigen ist in erster Linie eine Desktop-Software, die Sie herunterladen und auf einem Windows- oder PC installieren. Mac Computer. Zwar gibt es eine zugehörige mobile App, aber die Kernfunktionalität und die Daten befinden sich auf dem Desktop-Computer.

8. Integrationen und Wertschöpfung

- Welle Es lässt sich nur mit einer begrenzten Anzahl von Geschäftsanwendungen integrieren. Sein Nutzenversprechen liegt in der kostenlosen All-in-One-Plattform, die für viele Freiberufler ausreichend sein kann.

- Der Wert von Beschleunigen Quicken genießt seit Langem einen hervorragenden Ruf als Tool für die persönliche Finanzplanung. Seine Stärken liegen in den Funktionen für Budgetierung, Altersvorsorgeplanung und die Verwaltung von Anlagekonten. Die Übernahme der Marke Quicken durch Aquiline Capital Partners könnte zukünftig neue Entwicklungen auf den Markt bringen.

9. Benutzeroberfläche und Funktionalität

- A Welle Buchhaltungsprüfungen heben oft die übersichtliche und einfache Benutzeroberfläche hervor. Wave bietet einen unkomplizierten Prozess für die Abrechnung von Arbeitsstunden, was besonders für dienstleistungsorientierte Unternehmen von Vorteil ist. Die Software ist benutzerfreundlich und konzentriert sich auf die wichtigsten Buchhaltungsaufgaben.

- Quicken's Die Benutzeroberfläche ist detaillierter und bietet ein umfassendes Dashboard für alle Finanzinformationen. Sie vermittelt Nutzern einen vollständigen Überblick über ihre Finanzen, von Bankguthaben bis hin zu Anlageerträgen, und hilft ihnen, den Überblick über ihre privaten und geschäftlichen Finanzen zu behalten.

Worauf sollte man bei einer Buchhaltungssoftware achten?

Hier sind einige weitere Punkte, die Sie beachten sollten:

- SkalierbarkeitMan kann nicht einfach ein Programm für heute auswählen; man muss für die Zukunft planen. Viele Buchhaltungssoftware offers different tiers, from a free starter plan to a paid pro plan with additional costs for more functionality. Wave makes it simple to upgrade from its free version to a more robust subscription. Quicken software and its alternatives also have different versions, so make sure you evaluate them based on your anticipated sales and growth.

- UnterstützungWelche Hilfe gibt es bei Fragen? Gerade am Anfang werden Sie wahrscheinlich Fragen haben. Deshalb ist es wichtig, einen Softwareanbieter mit zuverlässigem Kundensupport zu finden. Viele bieten ein Hilfecenter und Online-Tutorials an. Wave bietet Support über verschiedene Kanäle, und in guten Wave-Bewertungen wird oft die einfache Verfügbarkeit von Hilfe hervorgehoben. Ein gutes Programm erleichtert Ihnen die Arbeit und gibt Ihnen Sicherheit.

- BenutzerfreundlichkeitIst es etwas, das Sie und Ihr Team schnell erlernen können? Eine intuitive Benutzeroberfläche ist für jedes Buchhaltungsprogramm unerlässlich. Sie benötigen ein Programm, das für alle Benutzer einfach zu bedienen ist, damit Ihr Team sofort loslegen kann. Ziel ist es, weniger Zeit mit komplexen Prozessen und mehr Zeit mit dem Kerngeschäft zu verbringen. Quicken bietet eine andere Benutzererfahrung, daher ist es wichtig, die Benutzeroberfläche zu testen, um herauszufinden, welche Ihnen am besten zusagt.

- Spezielle BedürfnisseErfüllt die Software die individuellen Anforderungen Ihres Unternehmens? Jedes Unternehmen hat individuelle Bedürfnisse. Wenn Sie Mitarbeiter beschäftigen, benötigen Sie Funktionen für Buchhaltung und Lohnabrechnung. Wenn Sie Ihren Kunden Zeit in Rechnung stellen, achten Sie auf eine Funktion zur Erfassung der abrechnungsfähigen Stunden. Manche Software unterstützt bestimmte Zahlungsmethoden wie Kreditkartenzahlungen oder Apple Pay. Die Möglichkeit, wiederkehrende Zahlungen oder Kreditkartentransaktionen zu verfolgen, ist ebenfalls unerlässlich.

- SicherheitWie sicher sind Ihre Finanzdaten mit dieser Software? Ihre Finanzdaten müssen geschützt sein. Achten Sie auf Software, die ein hohes Maß an Datensicherheit bietet, um Ihre Informationen zu schützen. Multifaktor-Authentifizierung und starke Verschlüsselung sind Standard. Es ist ratsam, die Sicherheitsmaßnahmen und Bewertungen jedes Dienstes zu prüfen. Quicken bietet seit Jahrzehnten bewährte Sicherheit und hat sich in der Praxis bewährt.

Endgültiges Urteil

Welche ist besser: Wave oder Quicken? Das hängt von Ihnen ab.

Wenn Sie ein Kleinunternehmen, wähle Wave.

Es kümmert sich um Rechnungsstellung und Geschäftsabwicklung. Buchhaltung Also.

Für geschäftliche Zwecke ist es leistungsstark. Wenn Sie jedoch Ihre privaten Finanzen verwalten, verwenden Sie Quicken.

Es erfasst Budgets und Investitionen. Wir haben beides verwendet.

Unsere Empfehlungen basieren auf dieser direkten Erfahrung.

Mehr von Wave

- Wave vs Puzzle IODiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Wave vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Wave vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- Wave vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Wellen vs. Einfaches MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Wave vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- Wave vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Wave vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Wave vs. QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- Wave vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- Welle vs. AusgabenDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- Wave vs. QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Wave vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Wave vs. FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Wave vs. NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Mehr von Quicken

- Quicken vs PuzzleDiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- Quicken vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- Quicken vs. XeroDas ist online beliebt. Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Quicken vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- Quicken vs. Easy MonatsendeDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- Quicken vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- Quicken vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- Quicken vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- Quicken vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- Quicken vs. HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- Quicken vs ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- Quicken vs QuickBooksDies ist eine bekannte Buchhaltungssoftware für Unternehmen. Die Alternative dazu ist für private Finanzen konzipiert.

- Quicken vs AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- Quicken vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- Quicken vs. NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Ist Wave Accounting für Kleinunternehmen wirklich kostenlos?

Ja, Wave Accounting bietet einen kostenlosen Tarif für grundlegende Buchhaltung, Rechnungsstellung und Fakturierung an. Für Lohn- und Gehaltsabrechnung sowie Zahlungsabwicklung fallen Gebühren an. Das macht Wave Accounting zu einer hervorragenden Option für Startups.

Was ist der Hauptunterschied zwischen Quicken und QuickBooks?

Quicken vs QuickBooks Quicken dient unterschiedlichen Zwecken. Es ist für die private Finanzverwaltung gedacht. QuickBooks von Intuit hingegen ist für die betriebliche Buchhaltung konzipiert und bietet Unternehmen erweiterte Funktionen, darunter auch die Debitorenbuchhaltung.

Kann ich mein Bankkonto sowohl mit Wave als auch mit Quicken verbinden?

Ja, Sie können Ihre Bankkonten mit beiden Plattformen verknüpfen. Dadurch werden Transaktionen automatisch importiert. Das erleichtert die Nachverfolgung Ihrer Einnahmen und Ausgaben und ermöglicht Ihnen ein besseres Finanzmanagement.

Welche Software eignet sich besser für das Cashflow-Management?

Für die Verwaltung des Geschäfts-Cashflows ist Wave aufgrund seiner umfassenden Funktionen für die Unternehmensbuchhaltung in der Regel besser geeignet. Für die private Finanzplanung und Budgetierung ist Quicken hingegen hervorragend. Es kommt darauf an, ob Sie private oder geschäftliche Finanzverwaltung benötigen.

Kann Quicken die Abrechnung und Rechnungsstellung für Kleinunternehmen übernehmen?

Quicken ist nicht primär für die Rechnungsstellung und Abrechnung kleiner Unternehmen konzipiert. Zwar eignet es sich gut für die Verwaltung privater Finanzen, doch für Unternehmen, die regelmäßig Rechnungen erstellen müssen, sind Wave oder spezialisierte Unternehmenssoftware wie QuickBooks besser geeignet.