Angesichts Buchhaltungssoftware für Ihr Unternehmen?

Sie suchen wahrscheinlich nach einer Lösung, die Ihnen das Verwalten Ihrer Finanzen erleichtert, nicht erschwert.

Die Wahl zwischen beliebten Anbietern wie Sage und QuickBooks kann sich wie eine schwierige Entscheidung anfühlen.

Beide versprechen Hilfe, aber welcher hält sein Versprechen wirklich? dein Konkrete Situation?

In diesem Leitfaden werden wir Sage und QuickBooks vergleichen.

Überblick

Wir haben sowohl Sage als auch QuickBooks getestet.

Wir haben sie wie echte Unternehmen genutzt. Dadurch konnten wir sehen, wie sie täglich funktionieren.

Nun können wir Ihnen zeigen, wie sie im Vergleich zueinander abschneiden.

Über 6 Millionen Kunden vertrauen Sage. Mit einer Kundenzufriedenheitsbewertung von 56 von 100 Punkten sind die robusten Funktionen eine bewährte Lösung.

Preisgestaltung: Kostenlose Testversion verfügbar. Das Premium-Abo kostet 66,08 $/Monat.

Hauptmerkmale:

- Fakturierung

- Integration der Gehaltsabrechnung

- Bestandsverwaltung

QuickBooks wird von über 7 Millionen Unternehmen genutzt und kann Ihnen durchschnittlich 42 Stunden pro Monat einsparen. Buchhaltung.

Preisgestaltung: Es gibt eine kostenlose Testphase. Das Abo kostet ab 1,90 $/Monat.

Hauptmerkmale:

- Rechnungsverwaltung

- Ausgabenverfolgung

- Berichterstattung

Was ist Salbei?

Reden wir über Sage.

Es gibt das schon eine Weile.

Viele Unternehmen nutzen es. Es hilft, den Überblick über die Finanzen zu behalten.

Betrachten Sie es als ein digitales Notizbuch für Ihre Geschäft Sachen.

Entdecken Sie auch unsere Favoriten Sage-Alternativen…

Unsere Einschätzung

Bereit, Ihre Finanzen auf ein neues Level zu heben? Sage-Anwender berichten von einer durchschnittlich 73 % höheren Produktivität und einer 75 % schnelleren Prozesszykluszeit.

Wichtigste Vorteile

- Automatisierte Rechnungsstellung und Zahlungen

- Finanzberichte in Echtzeit

- Hohe Sicherheitsstandards zum Schutz der Daten

- Integration mit anderen Geschäftstools

- Lohn- und Gehaltsabrechnungs- und HR-Lösungen

Preisgestaltung

- Professionelle Buchhaltung: 66,08 $/Monat.

- Premium-Buchhaltung: 114,33 $/Monat.

- Quantenbuchhaltung: 198,42 $/Monat.

- HR- und Gehaltsabrechnungspakete: Individuelle Preisgestaltung nach Ihren Bedürfnissen.

Vorteile

Nachteile

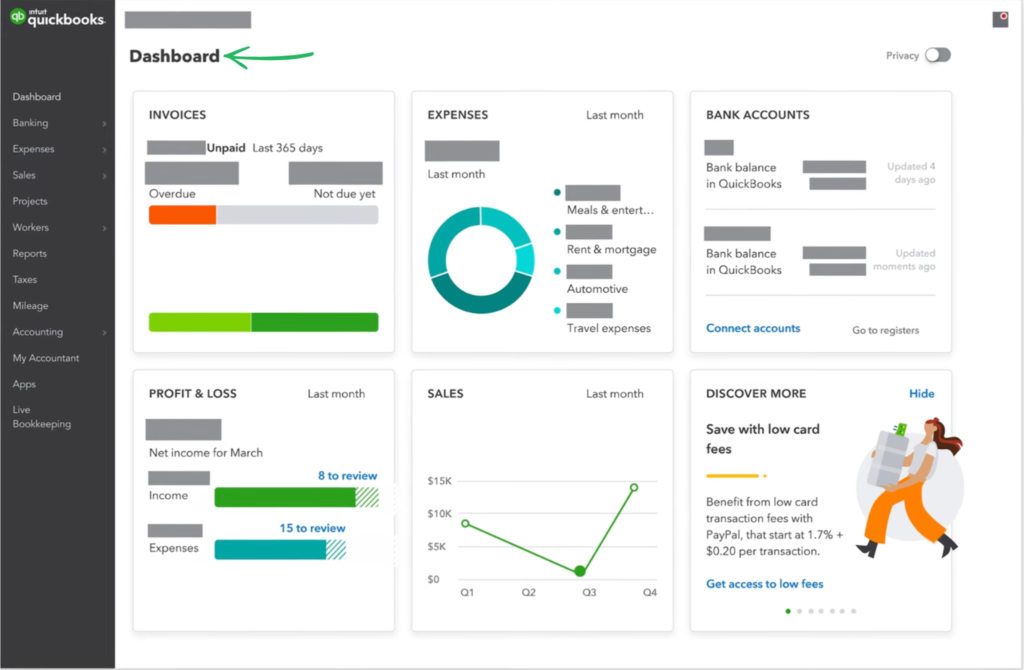

Was ist QuickBooks?

QuickBooks ist wie ein hilfreicher Freund für Ihre geschäftlichen Finanzangelegenheiten.

Es hilft Ihnen dabei, den Überblick über Ihre Einnahmen und Ausgaben zu behalten.

Viele kleine Unternehmen Ich mag es, es zu benutzen.

Entdecken Sie auch unsere Favoriten QuickBooks-Alternativen…

Wichtigste Vorteile

- Automatisierte Transaktionskategorisierung

- Rechnungserstellung und -verfolgung

- Kostenmanagement

- Lohnabrechnungsdienste

- Berichterstellung und Dashboards

Preisgestaltung

- Einfacher Start: 1,90 $/Monat.

- Essentiell: 2,80 $/Monat.

- Plus: 4 US-Dollar pro Monat.

- Fortschrittlich: 7,60 $/Monat.

Vorteile

Nachteile

Funktionsvergleich

Sage und QuickBooks sind führend Buchhaltung Plattformoptionen für Kleinunternehmer und mittelständische Unternehmen.

Dieser Funktionsvergleich analysiert die wichtigsten Unterschiede in Bezug auf Preise, Dienstleistungen und Sicherheit um Ihnen dabei zu helfen, die beste Buchhaltungssoftware für die Verwaltung Ihrer Unternehmensfinanzen zu finden.

1. Rechnungsstellung und Zahlungen

- Salbei Business Cloud Buchhaltung Es ermöglicht Ihnen die Analyse und Erstellung von Verkaufsrechnungen und Bestellungen und unterstützt Sie so bei der Verwaltung Ihrer Umsätze und Ihres Cashflows. Zudem bietet es eine Zahlungsverfolgung.

- QuickBooks bietet umfassende Rechnungsstellungsfunktionen. Sie können damit Rechnungen bezahlen und Online-Zahlungen von Kunden akzeptieren. Das System versendet außerdem automatische Zahlungserinnerungen, was Ihnen Zeit spart und sicherstellt, dass Sie bezahlt werden. QuickBooks verwenden Zahlungsprüfung.

2. Gehaltsabrechnung und Mitarbeiter

- Die Lohnabrechnungssoftware von Salbei ist als Zusatzoption verfügbar und bietet umfassende Lohnabrechnungsdienste. Sie können Sage verwenden Die Lohnabrechnung dient der Durchführung der Lohn- und Gehaltsabrechnung und der Auszahlung der Gehälter an die Mitarbeiter. Dieser Service wurde entwickelt, um Buchhaltungsteams mit komplexen Lohn- und Gehaltsabrechnungsanforderungen zu unterstützen.

- Die Lohnabrechnungssoftware von Intuit, QuickBooks Die Lohnbuchhaltung ist nahtlos in die Produkte integriert. QuickBooks unterstützt Sie bei Direktüberweisungen und Zahlungen an Auftragnehmer und ermöglicht die Zeiterfassung Ihrer Mitarbeiter – ein großer Vorteil. Auch die Steuerzahlung kann über dieses System abgewickelt werden.

3. Preise und Tarife

- Die Preisgestaltung für Salbei Die Preise können höher sein, da einige Versionen der Desktop-Software höhere Anschaffungskosten verursachen. Es werden ein professioneller Buchhaltungsplan und verschiedene Zusatzleistungen angeboten, die jedoch mit höheren Kosten verbunden sein können.

- Die Preisgestaltung für Intuit QuickBooks Die Online-Version ist abonnementbasiert und kann daher für Kleinunternehmer günstiger sein. Für die Desktop-Version von QuickBooks hingegen ist unter Umständen eine einmalige Lizenzgebühr erforderlich. Es gibt außerdem einen speziellen Tarif für Selbstständige.

4. Berichterstattung und Analyse

- Die Software Salbei beinhaltet Echtzeit Berichterstattung and financial reporting tools to generate reports on cash flow, sales, and most revenue. This gives accounting teams the insights they need to make decisions and evaluate the business.

- QuickBooks Das System bietet eine breite Palette an Finanzberichten, darunter auch Bilanzen. Es unterstützt Sie bei der genauen Buchführung und der Nachverfolgung Ihrer Finanzen, um ein umfassendes Bild zu erhalten. Zudem können Sie Berichte zur Einhaltung steuerlicher Vorschriften erstellen.

5. Bestandsmanagement

- Salbei verfügt über ein umfassendes Bestandsverwaltungssystem. Es ermöglicht Ihnen die automatische Synchronisierung des Lagerbestands, die Erstellung von Produktvarianten und die Ausgabe von Warnmeldungen bei niedrigem Lagerbestand, damit Sie keine Verkaufschance verpassen.

- Die Bestandsverwaltung in QuickBooks Hilft Ihnen dabei, organisiert zu bleiben. Die Bestandsverfolgung ist Teil des umfassenden Serviceangebots. Buchhaltung und aktualisiert die Lagerbestände bei jedem Verkauf. Für Unternehmen, die physische Produkte verkaufen, ist dies eine unverzichtbare Funktion.

6. Automatisierung und Effizienz

- Der Salbei Die Plattform nutzt Workflow-Management und Online-Backups, um Zeit bei manuellen Aufgaben zu sparen. Das System automatisiert viele alltägliche Buchhaltungsaufgaben, wie z. B. die Rechnungsverfolgung und den Bankabgleich.

- QuickBooks Es hilft Ihnen, Aufgaben zu automatisieren und so Zeit zu sparen. Sowohl die Online- als auch die Desktop-Version bieten Funktionen zur Automatisierung des Bankkontoabgleichs, was für die Finanzen von Unternehmen einen großen Vorteil darstellt.

7. Zugänglichkeit und Benutzeroberfläche

- Der Salbei Die Plattform verfügt über eine eigene mobile App und Cloud-Anbindung, allerdings ist der Fernzugriff bei einigen Desktop-Softwareversionen eingeschränkt, was ein potenzieller Nachteil ist. Die Benutzeroberfläche wirkt mitunter traditioneller und die Einrichtung ist komplexer als bei Konkurrenzprodukten.

- QuickBooks verfügt über eine intuitive Benutzeroberfläche, die einfach einzurichten ist. Dank des Online-Zugriffs können Sie Ihr Unternehmen verwalten. Daten Sie können von jedem Computer aus auf Ihr Konto zugreifen. Auch die Daten und Dateien auf Ihrem Desktop sind leicht zugänglich, was das System flexibel macht.

8. Unterstützung und Ressourcen

- Salbei Mit der Sage University, einem Community-Portal und Artikeln zur Beantwortung von Fragen und Lösung von Problemen, bietet Sage ein starkes Supportsystem. Dies ist besonders hilfreich für Buchhaltungsteams, die zusätzliche Unterstützung benötigen.

- QuickBooks bietet eine Vielzahl von Dienstleistungen zur Unterstützung der Nutzer. Dazu gehören ein umfassender Buchhaltungsservice sowie zahlreiche Artikel und Foren zur Problemlösung. Auch bei der Steuererklärung erhalten Sie Unterstützung.

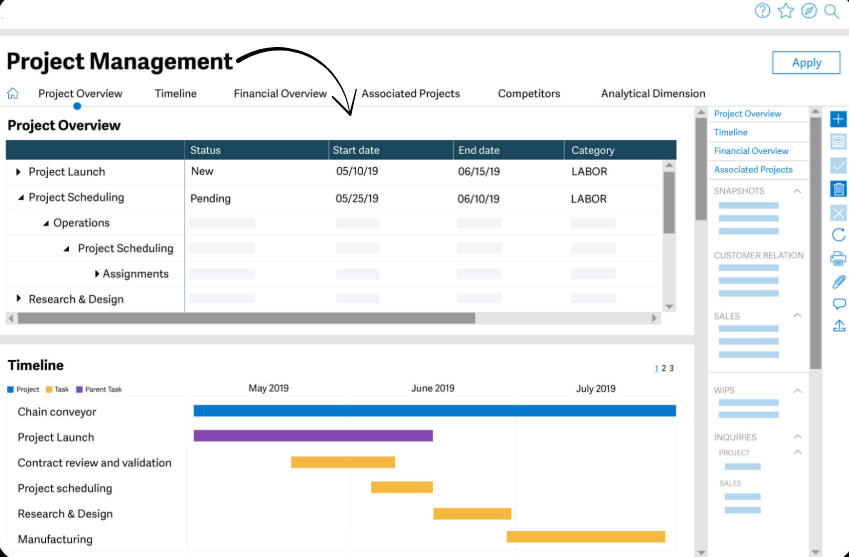

9. Wichtigster Vergleich und Anwendungsfall

- Salbei Die Plattform bietet leistungsstarke Services und Funktionen für mittelständische Unternehmen, die ein robustes und skalierbares System benötigen. Dank der Kostenrechnung mit Kostenstellen und individuellen Datensätzen eignet sie sich ideal für Unternehmen mit komplexen Projektmanagement-Anforderungen. Die Plattform unterstützt die Umsatzsteuer und verfügt über ein umfassendes Lohnabrechnungssystem.

- QuickBooks Online ist aus gutem Grund Marktführer. Es bietet eine hervorragende Lösung für Kleinunternehmer und Selbstständige. Es hilft Ihnen, den Überblick zu behalten und bietet Ihnen alle Tools, um Ihre Finanzen, einschließlich Steuern und Umsätze, über ein einziges Benutzerkonto zu verwalten. Sie können Ihre Lizenz jederzeit kündigen. Es ist ein sehr flexibles System.

Worauf sollte man bei einer Buchhaltungssoftware achten?

- Ihre GeschäftsgrößeSind Sie ein kleines Team oder ein großes Unternehmen? Manche Tools eignen sich besser für unterschiedliche Unternehmensgrößen. Für ein kleines Team oder einen Einzelnutzer, Freshbooks Eine Buchhaltungssoftware oder eine ähnliche Plattform mit grundlegenden Funktionen zur Spesenverwaltung kann ausreichend sein. Für größere Organisationen mit mehreren Buchhaltungsteams ist jedoch ein System erforderlich, das eine unbegrenzte Anzahl von Teammitgliedern unterstützt und professionelle Buchhaltungsfunktionen bietet.

- Mobile App QualitätWie gut ist die Handy-App? Sie werden häufig eine spezielle App zum Fotografieren von Belegen verwenden. Die beste Software ist sowohl für iOS als auch für Android verfügbar. GeräteDadurch können Sie flexibel von jedem beliebigen Smartphone aus arbeiten. Beachten Sie jedoch, dass der eingeschränkte Fernzugriff bei Desktop-Lösungen Ihre mobile Arbeit beeinträchtigen könnte.

- Genehmigung des WorkflowsKann man festlegen, wer was genehmigen muss? Das System sollte nicht abgeglichene Banktransaktionen verarbeiten und etwaige Differenzen in der Kreditorenbuchhaltung identifizieren können. Eine leistungsstarke Plattform bewältigt komplexe Arbeitsabläufe für die Genehmigung und Bezahlung von Rechnungen, auch bei Mahngebühren.

- KundensupportIst es einfach, Hilfe zu bekommen, wenn Probleme auftreten? Prüfen Sie die Supportoptionen. Einige Plattformen bieten exklusiven Zugang zu Supportteams. FreshBooks-Bewertungen loben häufig den Kundenservice, während andere, wie beispielsweise QuickBooks-Bewertungen, auf mögliche Schwächen in diesem Bereich hinweisen.

- BerichterstattungsbedarfWelche Berichte benötigen Sie? Stellen Sie sicher, dass die Software diese erstellen kann. Ein gutes System sollte Ihnen helfen, Berichte zu allen Aspekten Ihres Unternehmens zu generieren – von der Kostenverwaltung bis hin zu Ihrer gesamten Finanzlage. Ein solider Kontenplan und ein guter Abstimmungsprozess sind entscheidend für die Erstellung präziser Berichte.

- ZukunftswachstumKann die Software mit Ihrem Unternehmen mitwachsen? Sie möchten ja nicht schon bald wieder wechseln müssen. Suchen Sie nach einer Plattform, die Projekte verwalten und alles nachverfolgen kann. Zeiterfassungund individuelle Rechnungsstellung. Diese erweiterten Zahlungs- und wiederkehrenden Rechnungsfunktionen sind für ein wachsendes Unternehmen von entscheidender Bedeutung, insbesondere beim Wechsel zu einem Premium-Tarif oder anderen Versionen mit erweiterten Funktionen.

- Mobile Funktionalität und DatenzugriffFür Unternehmen, die viel unterwegs sind, ist eine zuverlässige Internetverbindung unerlässlich. Ein potenzieller Nachteil eines nicht vollständig cloudbasierten Systems besteht darin, dass der mobile Zugriff eingeschränkt sein kann. Beispielsweise unterstützt Ihre mobile App möglicherweise nicht alle Funktionen, sodass Sie auf Ihre Desktop-Software zurückgreifen müssen.

- Leistungsstarke Cloud-basierte Software bietet jedoch Funktionen, die dies erleichtern. QuickBooks-Produkte wie QuickBooks Time ermöglichen die Erfassung von Auftragsstatus und Arbeitszeiten der Mitarbeiter. Diese Dienste lassen sich bequem über mobile Geräte verwalten. Sie können Ihre Lieferanten und deren Informationen einfach verwalten, Kreditkartenzahlungen akzeptieren und Ihre Finanzen stets im Blick behalten. Die Möglichkeit, mit der App Ihrer Plattform Arbeitsstunden zu erfassen, Auftragsstatus zu aktualisieren und sogar Kredite zu verwalten, ist ein großer Vorteil.

- Ein weiterer wichtiger Faktor ist der Umgang mit Ihren Geschäftsdaten beim Wechsel zu einer neuen Software. Eine leistungsstarke Plattform sollte einen reibungslosen Prozess zur Migration Ihrer bestehenden Buchhaltungsdaten aus anderen Systemen ermöglichen. Sie sollte außerdem Funktionen bieten, die Ihnen ein effektives Finanzmanagement und einen gesunden Cashflow durch Echtzeitberichte zu all Ihren Umsätzen gewährleisten. Der Sage Marketplace bietet zahlreiche Services, die Sie dabei unterstützen – von fortschrittlichen Lohnbuchhaltungsintegrationen bis hin zu spezialisierten Add-ons für die Kostenrechnung. Suchen Sie nach einer Lösung, die diese Prozesse vereinfacht und Ihnen ein hohes Maß an Sicherheit und Kontrolle bei der Unternehmensführung ermöglicht.

Endgültiges Urteil

Also, welches System gewinnt: Sage oder QuickBooks?

Für die meisten kleinen und wachsenden Unternehmen wählen wir Sage. Es ist in der Regel einfacher zu erlernen und anzuwenden.

Es verfügt über leistungsstarke Funktionen wie Rechnungsstellung und Lohnabrechnung, die viele Unternehmen benötigen.

Außerdem lässt es sich mit vielen anderen Apps verbinden.

Wir haben uns viel Zeit genommen, beide Produkte ausgiebig zu testen.

Unser Ziel war es herauszufinden, was für alltägliche Geschäftsaufgaben am besten funktioniert.

Sage vereinfacht generell die Verwaltung Ihrer Finanzen und ermöglicht es Ihnen, sich auf Ihre Kernkompetenzen zu konzentrieren.

Es ist eine solide Wahl, die mit Ihnen mitwachsen kann.

Mehr von Sage

Es ist hilfreich zu sehen, wie Sage im Vergleich zu anderer gängiger Software abschneidet.

Hier ein kurzer Vergleich mit einigen Konkurrenten.

- Sage vs Puzzle IO: Beide Programme bieten Buchhaltungsfunktionen, Puzzle IO ist jedoch speziell für Startups konzipiert und konzentriert sich auf Echtzeit-Cashflow und Kennzahlen wie die Burn Rate.

- Salbei vs. Dextro: Dext ist in erster Linie ein Tool zur automatisierten Datenerfassung von Belegen und Rechnungen. Es wird häufig zusammen mit Sage eingesetzt, um die Buchhaltung zu beschleunigen.

- Sage vs. Xero: Xero ist eine cloudbasierte Lösung, die für ihre Benutzerfreundlichkeit bekannt ist, insbesondere für kleine Unternehmen. Sage bietet mit zunehmender Unternehmensgröße auch umfangreichere Funktionen.

- Sage vs Synder: Synder konzentriert sich auf die Synchronisierung von E-Commerce-Plattformen und Zahlungssystemen mit Buchhaltungssoftware wie Sage.

- Sage vs. Easy Monatsende: Diese Software ist ein Aufgabenmanager, der Ihnen hilft, den Überblick über alle Schritte zu behalten, die für den Monatsabschluss erforderlich sind.

- Sage vs Docyt: Docyt nutzt KI, um die Buchhaltung zu automatisieren und die manuelle Dateneingabe zu eliminieren, und bietet damit eine hochautomatisierte Alternative zu herkömmlichen Systemen.

- Sage vs RefreshMe: RefreshMe ist kein direkter Konkurrent im Bereich Rechnungswesen. Der Fokus liegt vielmehr auf der Anerkennung und dem Engagement der Mitarbeiter.

- Sage vs Zoho Books: Zoho Books ist Teil einer umfangreichen Suite von Business-Anwendungen. Es wird häufig für sein übersichtliches Design und die enge Integration in andere Zoho-Produkte gelobt.

- Sage vs Wave: Wave ist bekannt für seinen kostenlosen Tarif, der grundlegende Buchhaltungs- und Rechnungsstellungsfunktionen bietet und daher bei Freiberuflern und Kleinstunternehmen beliebt ist.

- Sage vs Quicken: Quicken eignet sich eher für private Finanzen oder Finanzen sehr kleiner Unternehmen. Salbei bietet robustere Funktionen für wachsende Unternehmen, wie Lohnabrechnung und erweiterte Bestandsverwaltung.

- Sage vs Hubdoc: Hubdoc ist ein Dokumentenmanagement-Tool, das Finanzdokumente automatisch erfasst und organisiert, ähnlich wie Dext, und sich in Buchhaltungsplattformen integrieren lässt.

- Sage vs Expensify: Expensify ist Experte für Spesenmanagement. Es eignet sich hervorragend zum Scannen von Belegen und zur Automatisierung von Spesenabrechnungen für Mitarbeiter.

- Sage vs. QuickBooks: QuickBooks ist ein wichtiger Akteur im Bereich der Buchhaltung für kleine Unternehmen. Es ist bekannt für seine benutzerfreundliche Oberfläche und seinen breiten Funktionsumfang.

- Sage vs AutoEntry: Dies ist ein weiteres Tool, das die Dateneingabe von Belegen und Rechnungen automatisiert. Es eignet sich gut als Erweiterung für Buchhaltungssoftware wie z. B. Salbei.

- Sage vs FreshBooks: FreshBooks eignet sich besonders gut für Freiberufler und dienstleistungsorientierte Unternehmen, da es sich auf einfache Rechnungsstellung und Zeiterfassung konzentriert.

- Sage vs. NetSuite: NetSuite ist ein umfassendes ERP-System für größere Unternehmen. Salbei verfügt über eine Reihe von Produkten, von denen einige auf diesem Niveau miteinander konkurrieren, aber NetSuite ist eine größere und komplexere Lösung.

Mehr zu QuickBooks

- QuickBooks vs Puzzle IODiese Software konzentriert sich auf KI-gestützte Finanzplanung für Startups. Ihr Gegenstück ist für private Finanzen gedacht.

- QuickBooks vs. DextDies ist ein Geschäftstool zum Erfassen von Belegen und Rechnungen. Das andere Tool dient der Erfassung privater Ausgaben.

- QuickBooks vs. XeroDies ist eine beliebte Online-Buchhaltungssoftware für Kleinunternehmen. Das Konkurrenzprodukt ist für den privaten Gebrauch bestimmt.

- QuickBooks vs SynderDieses Tool synchronisiert E-Commerce-Daten mit Buchhaltungssoftware. Die Alternative konzentriert sich auf private Finanzen.

- QuickBooks vs. Easy MonatsabschlussDies ist ein Geschäftstool zur Optimierung von Monatsabschlussarbeiten. Das Konkurrenzprodukt dient der Verwaltung privater Finanzen.

- QuickBooks vs DocytDas eine System nutzt KI für die Buchhaltung und Automatisierung von Geschäftsprozessen. Das andere System nutzt KI als persönlichen Finanzassistenten.

- QuickBooks vs. SageDies ist eine umfassende Buchhaltungssoftware für Unternehmen. Das Konkurrenzprodukt ist ein benutzerfreundlicheres Tool für private Finanzen.

- QuickBooks vs Zoho BooksDies ist ein Online-Buchhaltungstool für Kleinunternehmen. Das Konkurrenzprodukt ist für den persönlichen Gebrauch bestimmt.

- QuickBooks vs WaveDies bietet kostenlose Buchhaltungssoftware für Kleinunternehmen. Das entsprechende Gegenstück ist für Einzelpersonen konzipiert.

- QuickBooks vs. QuickenBeides sind Tools für die persönliche Finanzplanung, aber dieses hier bietet eine detailliertere Investitionsverfolgung. Das andere ist einfacher.

- QuickBooks vs HubdocDieses Produkt ist auf die Dokumentenerfassung für die Buchhaltung spezialisiert. Sein Konkurrent ist ein Tool für die persönliche Finanzplanung.

- QuickBooks vs. ExpensifyDies ist ein Tool zur Verwaltung von Geschäftsausgaben. Das andere dient der Erfassung und Budgetierung privater Ausgaben.

- QuickBooks vs. AutoEntryDies dient der Automatisierung der Dateneingabe für die betriebliche Buchhaltung. Die Alternative dazu ist ein Tool für die private Finanzplanung.

- QuickBooks vs FreshBooksDies ist eine Buchhaltungssoftware für Freiberufler und Kleinunternehmen. Die Alternative dazu ist für die private Finanzplanung gedacht.

- QuickBooks vs. NetSuiteDies ist eine leistungsstarke Business-Management-Suite für große Unternehmen. Ihr Konkurrent ist eine einfache App für persönliche Finanzen.

Häufig gestellte Fragen

Ist QuickBooks besser für kleine Unternehmen geeignet?

Ja, QuickBooks ist oft besser für kleine Unternehmen geeignet. Es ist leichter zu erlernen und anzuwenden. Es bietet viele Funktionen, die kleine Unternehmen benötigen. Dadurch wird die Finanzverwaltung für sie einfacher.

Kann Sage auch große Unternehmen betreuen?

Ja, Sage eignet sich hervorragend für große Unternehmen. Es bietet fortschrittliche Funktionen und bewältigt komplexe Aufgaben. Es ist darauf ausgelegt, mit wachsenden Unternehmen und deren individuellen Anforderungen mitzuwachsen.

Welches ist günstiger, Sage oder QuickBooks?

Die Kosten können variieren. QuickBooks bietet oft verschiedene Tarife für unterschiedliche Bedürfnisse an. Auch Sage hat verschiedene Versionen im Angebot. Sie sollten die jeweiligen Tarife vergleichen, um den günstigsten für Sie zu finden.

Benötige ich Buchhaltungskenntnisse, um sie zu verwenden?

Sie benötigen keine umfangreichen Vorkenntnisse. QuickBooks ist so konzipiert, dass es auch für Anfänger einfach zu bedienen ist. Sage erfordert möglicherweise etwas mehr Einarbeitungszeit, aber beide Programme können auch ohne Buchhaltungskenntnisse genutzt werden.

Kann ich von Sage zu QuickBooks wechseln (oder umgekehrt)?

Ja, ein Wechsel ist in der Regel möglich. Die Datenübertragung kann jedoch etwas Aufwand erfordern. Beide Unternehmen bieten Tools und Unterstützung an, um den Wechsel für Ihr Unternehmen zu vereinfachen.