Quick Start

This guide covers every RefreshMe feature:

- Erste Schritte — Create account and basic setup

- How to Use AI Assistant — Get smart money insights instantly

- How to Use Budget Manager — Set spending limits and track goals

- How to Use Dark Web Monitoring — Protect your personal data online

- How to Use Privacy Management — Remove your info from data brokers

- How to Use Identity Theft Protection — Guard your identity with $1M coverage

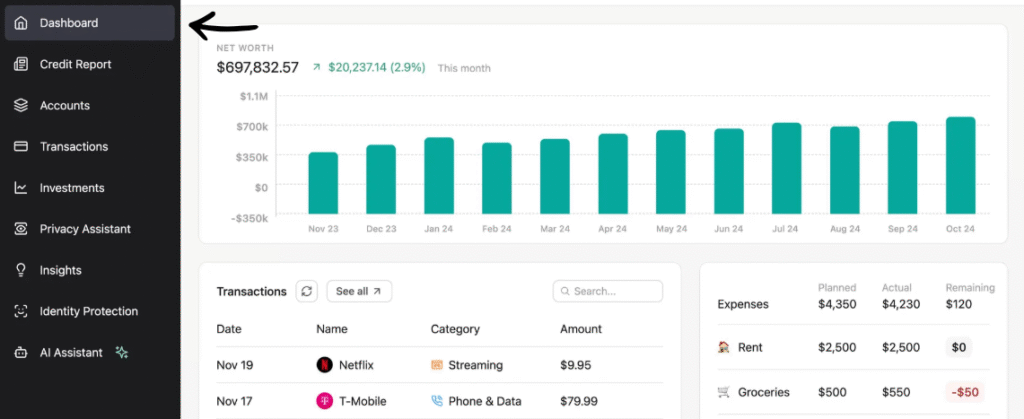

- How to Use Financial Dashboard — See all accounts in one place

- How to Use Spending Tracker — Monitor where your money goes

- How to Use Bill Data Management — Never miss a payment again

- How to Use Superpowered Insights — Unlock deep financial analysis

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | Fehlerbehebung | Preisgestaltung | Alternativen

Why Trust This Guide

I’ve used RefreshMe for over 6 months and tested every feature covered here. This tutorial comes from real hands-on experience — not marketing fluff or vendor screenshots.

RefreshMe is one of the most powerful personal finance tools available today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

RefreshMe Tutorial

This complete RefreshMe tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

RefreshMe

Take control of your finances in one place. RefreshMe connects to 12,000+ banks and gives you AI-powered spending insights, identity theft protection, and credit monitoring. Try it with a free trial today.

Erste Schritte mit RefreshMe

Before using any feature, complete this one-time setup.

It takes about 3 minutes.

Watch this quick overview first:

Now let’s walk through each step.

Step 1: Create Your Account

Go to refresh.me and click “Get Started.”

Enter your email and create a strong password.

Choose Individual or Couple plan based on your needs.

✓ Checkpoint: Überprüfen Sie Ihre Posteingang for a confirmation email.

Step 2: Connect Your Bank Accounts

RefreshMe connects to over 12,000 financial institutions.

Search for your bank and enter your login details.

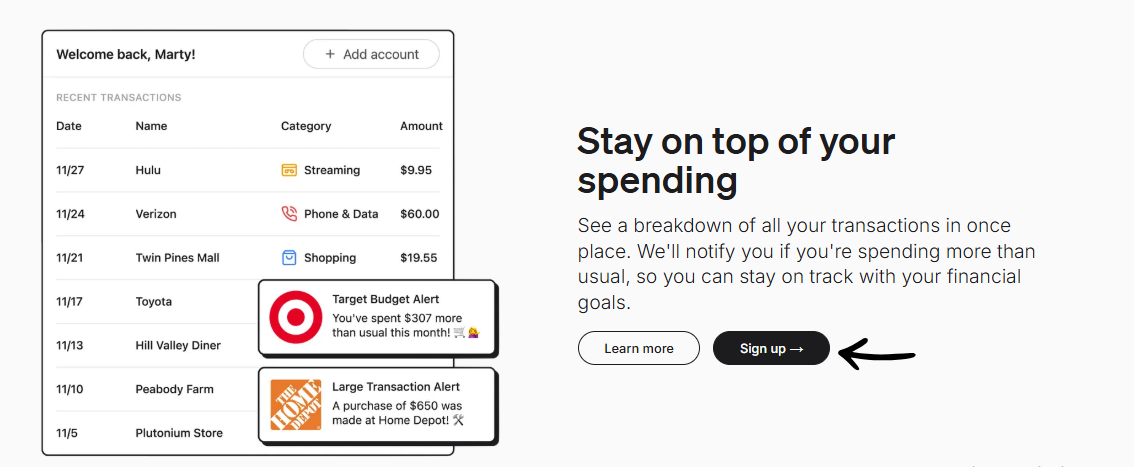

Here’s what the dashboard looks like:

✓ Checkpoint: You should see your account balances on the dashboard.

Step 3: Complete Your Profile

Add your personal details for identity protection features.

Set your financial goals and monthly budget targets.

Enable notifications for spending alerts and bill reminders.

✅ Done: You’re ready to use any feature below.

How to Use RefreshMe AI Assistant

KI Assistent lets you get personalized financial insights based on your spending habits.

Here’s how to use it step by step.

See AI Assistant in action:

Now let’s break down each step.

Step 1: Open the AI Assistant

Click the AI Assistant icon on your dashboard sidebar.

The assistant loads your recent financial Daten automatisch.

Step 2: Ask a Financial Question

Type a Frage like “Where am I spending the most?

The AI analyzes your transactions and gives a clear answer.

✓ Checkpoint: You should see a detailed breakdown of your spending categories.

Step 3: Apply the Recommendations

Review the AI’s suggestions for saving more money.

Click “Apply” to set up automatic budget adjustments.

✅ Result: You now have AI-powered insights guiding your daily spending decisions.

💡 Profi-Tipp: Ask the AI to compare this month’s spending to last month. It reveals spending patterns you’d never notice on your own.

How to Use RefreshMe Budget Manager

Budgetmanager lets you set custom spending limits and track progress in real time.

Here’s how to use it step by step.

Watch Budget Manager in action:

Now let’s break down each step.

Step 1: Create a New Budget

Go to the Budget Manager tab and click “Create Budget.”

Name your budget and set a monthly spending limit.

Step 2: Set Category Limits

Assign spending limits to categories like food, transport, and entertainment.

RefreshMe auto-categorizes your transactions to match.

✓ Checkpoint: You should see progress bars for each spending category.

Step 3: Enable Spending Alerts

Turn on alerts for when you hit 80% of any category limit.

Choose push notifications, email, or both.

✅ Result: You have a working budget with real-time tracking and alerts.

💡 Profi-Tipp: Start with just 3 to 4 spending categories. Adding too many makes the budget hard to follow and easy to abandon.

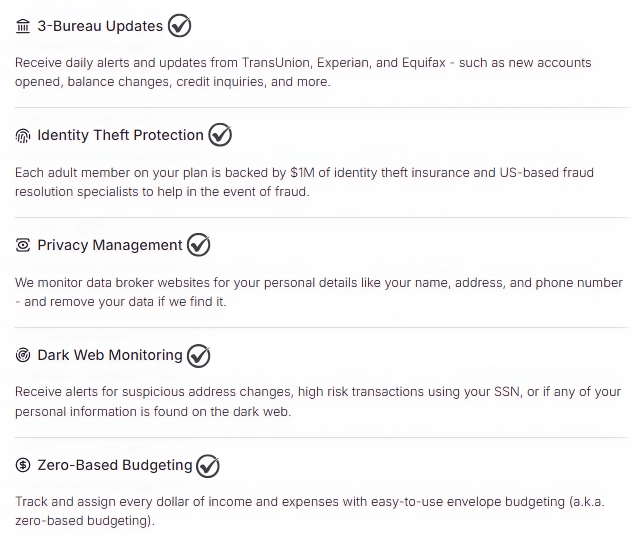

How to Use RefreshMe Dark Web Monitoring

Dark-Web-Überwachung lets you scan for your personal data on hidden websites and marketplaces.

Here’s how to use it step by step.

See Dark Web Monitoring in action:

Now let’s break down each step.

Step 1: Navigate to Dark Web Monitoring

Click “Sicherheit” in the main menu, then select “Dark Web Monitoring.

Step 2: Add Your Personal Information

Enter your email addresses, phone numbers, and Social Security number.

RefreshMe encrypts this data with bank-level security before scanning.

✓ Checkpoint: You should see a scan status showing “Monitoring Active.”

Step 3: Review Scan Results

Check your alerts for any data found on the dark web.

Follow the recommended steps to secure any compromised accounts.

✅ Result: Your personal information is now being monitored around the clock.

💡 Profi-Tipp: Add all your email addresses, including old ones you rarely check. Hackers often target forgotten accounts first.

How to Use RefreshMe Privacy Management

Datenschutzverwaltung lets you remove your personal information from data brokers online.

Here’s how to use it step by step.

Watch Privacy Management in action:

Now let’s break down each step.

Step 1: Open Privacy Management

Go to the Security section and click “Privacy Management.”

Step 2: Run a Privacy Scan

Click “Scan Now” to find where your data appears online.

RefreshMe checks dozens of data broker sites for your information.

✓ Checkpoint: You should see a list of sites that have your personal data.

Step 3: Request Data Removal

Click “Remove” next to each data broker listing.

RefreshMe sends removal requests on your behalf automatically.

✅ Result: Your personal data removal requests are being processed across all listed brokers.

💡 Profi-Tipp: Run privacy scans monthly. Data brokers re-add your information over time, so regular checks keep you protected.

How to Use RefreshMe Identity Theft Protection

Schutz vor Identitätsdiebstahl lets you guard your identity with up to $1M Versicherung coverage.

Here’s how to use it step by step.

See Identity Theft Protection in action:

Now let’s break down each step.

Step 1: Activate Identity Protection

Go to Security and toggle on “Identity Theft Protection.”

Confirm your personal details to activate the $1M insurance coverage.

Step 2: Set Up Monitoring Alerts

Choose what to monitor: credit applications, address changes, and public records.

Enable real-time alerts for any suspicious activity.

✓ Checkpoint: You should see “Identity Protection Active” on your security dashboard.

Step 3: Review Your Protection Status

Check the Identity Protection dashboard for your current risk score.

Review any flagged activities and take action when needed.

✅ Result: Your identity is now protected with active monitoring and $1M insurance coverage.

💡 Profi-Tipp: Freeze your credit at all three bureaus through RefreshMe. This stops anyone from opening new accounts in your name.

How to Use RefreshMe Financial Dashboard

Financial Dashboard lets you see all your accounts, balances, and net worth in one place.

Here’s how to use it step by step.

Watch Financial Dashboard in action:

Now let’s break down each step.

Step 1: Access Your Dashboard

Click “Dashboard” from the main navigation menu.

All connected accounts load with current balances.

Step 2: Customize Your View

Drag and drop widgets to arrange your dashboard layout.

Choose which accounts and metrics appear on your main screen.

✓ Checkpoint: You should see your total net worth and account breakdown.

Step 3: Review Your Financial Snapshot

Check your cash flow, investments, and credit score at a glance.

Click any account for detailed transaction history.

✅ Result: You have a complete financial overview updated in real time.

💡 Profi-Tipp: Add your investment and retirement accounts too. Seeing everything together helps you make better financial decisions.

How to Use RefreshMe Spending Tracker

Spending Tracker lets you monitor every transaction and spot unusual spending patterns.

Here’s how to use it step by step.

See Spending Tracker in action:

Now let’s break down each step.

Step 1: Open the Spending Tracker

Click “Spending” in the main menu to view your transactions.

All transactions from connected accounts appear here automatically.

Step 2: Review Your Spending Categories

See a visual breakdown of where your money goes each month.

Click any category to drill down into individual transactions.

✓ Checkpoint: You should see a pie chart with your top spending categories.

Step 3: Set Spending Alerts

Enable alerts for unusual spending or large transactions.

RefreshMe notifies you when spending exceeds your normal patterns.

✅ Result: You can now track every dollar and catch overspending früh.

💡 Profi-Tipp: Re-categorize mis-labeled transactions weekly. This keeps your spending reports accurate and your budget on track.

How to Use RefreshMe Bill Data Management

Bill Data Management lets you track all bills and never miss a payment deadline.

Here’s how to use it step by step.

Step 1: Add Your Bills

Go to the Bills section and click “Add Bill.”

Enter the bill name, amount, and due date.

Step 2: Set Up Reminders

Choose how many days before due dates you want reminders.

RefreshMe also auto-detects recurring bills from your transactions.

✓ Checkpoint: You should see a calendar view of all upcoming bills.

Step 3: Track Payment History

Mark bills as paid and view your payment history over time.

Check for any missed payments that may affect your credit.

✅ Result: All your bills are organized with automatic reminders set.

💡 Profi-Tipp: Set reminders for 3 days before due dates, not the day of. This gives you time to transfer funds if needed.

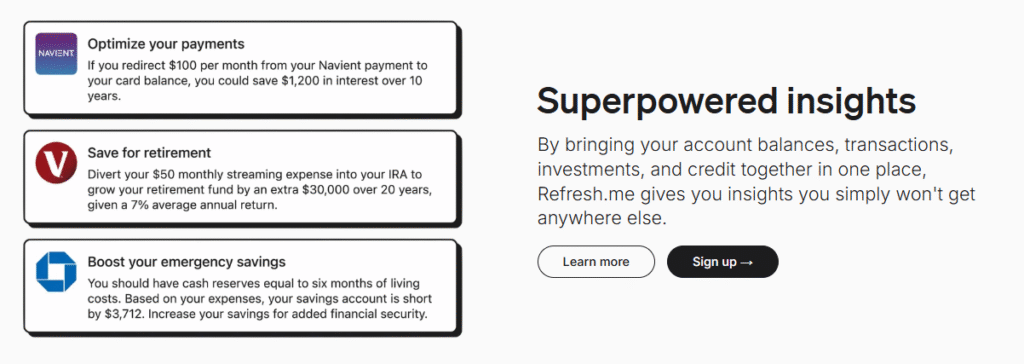

How to Use RefreshMe Superpowered Insights

Superpowered Insights lets you unlock deep financial analysis across all your accounts.

Here’s how to use it step by step.

Watch Superpowered Insights in action:

Now let’s break down each step.

Step 1: Open Superpowered Insights

Click “Insights” from your dashboard to access the analysis tools.

Step 2: Explore Your Financial Trends

Review spending trends, income patterns, and net worth changes over time.

Use the date range filter to compare different time periods.

✓ Checkpoint: You should see charts showing your financial trends over time.

Step 3: Act on Recommendations

Review the AI-generated suggestions for saving and investing.

Click “Apply” on any recommendation to adjust your budget settings.

✅ Result: You now have deep financial analysis guiding your money decisions.

💡 Profi-Tipp: Check Superpowered Insights at the start of each month. The month-over-month comparison reveals where your money habits are changing.

RefreshMe Pro Tips and Shortcuts

After testing RefreshMe for over 6 months, here are my best tips.

Tastenkombinationen

| Action | Shortcut |

|---|---|

| Open Dashboard | D |

| Go to Spending | S |

| Open Budget Manager | B |

| View Insights | I |

Hidden Features Most People Miss

- Credit Score Timeline: Go to Security → Credit and toggle “Historical View” to see your credit score changes over months and years.

- Recurring Transaction Detection: Check Spending → Recurring to find subscriptions you forgot about. Many users discover charges they no longer need.

- Investment Allocation View: Go to Dashboard → Investments → Allocation to see your portfolio spread across asset classes in one visual chart.

RefreshMe Common Mistakes to Avoid

Mistake #1: Not Connecting All Your Accounts

❌ Wrong: Only connecting your main checking account and ignoring credit cards, savings, and investments.

✅ Right: Connect every financial account so RefreshMe gives you a complete picture of your finances.

Mistake #2: Ignoring Spending Alerts

❌ Wrong: Dismissing spending alerts without checking what triggered them.

✅ Right: Review every alert and adjust your budget or investigate unusual charges right away.

Mistake #3: Skipping Identity Protection Setup

❌ Wrong: Only using RefreshMe for budgeting and ignoring the security features entirely.

✅ Right: Activate dark web monitoring and identity theft protection during setup. These features are included in your plan.

RefreshMe Troubleshooting

Problem: Bank Account Won’t Sync

Cause: Your bank may have changed login requirements or added two-factor authentication.

Fix: Remove the account and re-add it. Make sure you complete any new security verification your bank requires.

Problem: Transactions Showing Wrong Categories

Cause: Auto-categorization sometimes misreads merchant names or transaction descriptions.

Fix: Manually re-categorize the transaction. RefreshMe learns from your corrections and improves over time.

Problem: Credit Score Not Updating

Cause: Credit bureaus report data monthly. New information takes time to appear.

Fix: Wait until the next monthly credit report cycle. Check back in 2 to 4 weeks for updated scores.

📌 Notiz: If none of these fix your issue, contact RefreshMe support.

Was ist RefreshMe?

RefreshMe is a personal financial management tool that puts your money, credit, and identity protection in one dashboard.

Think of it like a control room for your entire financial life.

Watch this quick overview:

It includes these key features:

- KI-Assistent: Get personalized insights based on your spending habits and financial goals.

- Budget Manager: Set custom spending limits and track progress with real-time alerts.

- Dark-Web-Überwachung: Scan hidden websites for your leaked personal information.

- Privacy Management: Remove your data from online data brokers automatically.

- Identity Theft Protection: Guard your identity with monitoring and $1M insurance coverage.

- Financial Dashboard: See all accounts, balances, and net worth in one place.

- Spending Tracker: Monitor transactions and catch unusual spending patterns.

- Bill Data Management: Track bills and get reminders before due dates.

- Superpowered Insights: Access deep financial analysis and AI-driven recommendations.

For a full review, see our RefreshMe review.

RefreshMe Pricing

Here’s what RefreshMe costs in 2026:

| Planen | Preis | Am besten geeignet für |

|---|---|---|

| Einzelperson (3B) | 24,99 $/Monat | Single users managing personal finances |

| Paar (3B) | 44,99 $/Monat | Partners who want shared financial tracking |

Kostenlose Testversion: Yes, RefreshMe offers a free trial for new users.

Geld-zurück-Garantie: Contact support for refund options during your trial period.

💰 Best Value: Individual (3B) — gives you full access to AI insights, identity protection, and credit monitoring at under $25/month.

RefreshMe vs Alternatives

How does RefreshMe compare? Here’s the competitive landscape:

| Werkzeug | Am besten geeignet für | Preis | Rating |

|---|---|---|---|

| RefreshMe | All-in-one personal finance + identity protection | 24,99 €/Monat | ⭐ 3.2 |

| Puzzle IO | AI-powered financial planning | $0-$255/mo | ⭐ 3.5 |

| Dext | Document capture and data extraction | 24 $/Monat | ⭐ 4.3 |

| Xero | Wolke Buchhaltung for small businesses | 29 $/Monat | ⭐ 4.5 |

| Snyder | E-commerce financial data syncing | $52/mo | ⭐ 4.1 |

| Beschleunigen | Detailed investment tracking | $2.99/mo | ⭐ 3.8 |

| Welle | Frei Kleinunternehmen Buchhaltung | $0-$19/mo | ⭐ 4.0 |

| QuickBooks | Full business Buchhaltung | $1.90/mo | ⭐ 4.4 |

Quick picks:

- Best overall: RefreshMe — combines budgeting, credit monitoring, and identity protection in one app.

- Best budget: Wave — free accounting tools for small businesses and Freiberufler.

- Best for beginners: Quicken — simple interface with affordable pricing starting at $2.99/month.

- Best for businesses: QuickBooks — the industry standard for Kleinunternehmen Buchhaltung.

🎯 RefreshMe Alternatives

Looking for RefreshMe alternatives? Here are the top options:

- 🧠 Puzzle IO: AI-powered financial planning with project accounting tools, starting free for basic features.

- 📊 Dext: Automates receipt capture and data extraction for bookkeepers, saving hours of manual entry work.

- 🌟 Xero: Top-rated cloud accounting with a strong app marketplace and simple bank reconciliation for businesses.

- ⚡ Snyder: Syncs financial data from e-commerce platforms automatically, perfect for online sellers.

- 🔧 Unkomplizierter Monatsabschluss: Speeds up month-end close with automated reconciliation for accounting teams.

- 🏢 Docyt: KI-gesteuert Buchhaltung automation for businesses handling high transaction volumes.

- 💼 Salbei: Trusted Buchhaltungssoftware with a free plan and options for growing businesses.

- 💰 Zoho Books: Affordable cloud accounting with inventory management and a free plan for small businesses.

- 🚀 Welle: Completely free core accounting tools for freelancers and small business owners.

- ⭐ Beschleunigen: Affordable personal finance manager with strong investment tracking starting at $2.99/month.

- 🔒 Hubdoc: Fetches financial documents from banks and vendors automatically for accountants.

- 🎯 Kosten erhöhen: Automates expense reports and receipt scanning for teams of all sizes.

- 🔥 QuickBooks: Industry-leading small business accounting with payroll, invoicing, and tax support.

- 🎨 Automatischer Einstieg: Automates data entry from invoices and receipts into your accounting software.

- 👶 FreshBooks: Easy invoicing and time tracking built for freelancers and service-based businesses.

- 🏢 NetSuite: Enterprise-grade ERP system with full financial management for large organizations.

For the full list, see our RefreshMe-Alternativen guide.

⚔️ RefreshMe Compared

Here’s how RefreshMe stacks up against each competitor:

- RefreshMe vs Puzzle IO: Puzzle IO focuses on AI financial planning while RefreshMe adds identity protection and credit monitoring to personal finance.

- RefreshMe vs Dext: Dext wins for receipt capture and bookkeeping Automatisierung. RefreshMe is better for personal financial tracking.

- RefreshMe vs. Xero: Xero is built for business accounting. RefreshMe targets individuals who want budgeting plus identity protection.

- RefreshMe vs Synder: Synder is best for e-commerce sellers. RefreshMe works better for personal spending and credit monitoring.

- RefreshMe vs. Easy Month End: Easy Month End speeds up accounting close. RefreshMe focuses on personal financial health and security.

- RefreshMe vs Docyt: Docyt automates business bookkeeping. RefreshMe gives individuals AI insights and privacy management.

- RefreshMe vs Sage: Sage offers a free plan for basic accounting. RefreshMe adds dark web monitoring and identity protection.

- RefreshMe vs Zoho Books: Zoho Books handles business invoicing and inventory. RefreshMe is designed for personal finance management.

- RefreshMe vs Wave: Wave offers free business accounting. RefreshMe wins for personal budgeting and identity security features.

- RefreshMe vs Quicken: Both handle personal finance, but RefreshMe includes AI assistance and identity protection that Quicken lacks.

- RefreshMe vs Hubdoc: Hubdoc specializes in document capture for bookkeepers. RefreshMe consolidates personal financial data instead.

- RefreshMe vs Expensify: Expensify manages business expense reports. RefreshMe helps individuals track personal spending and budgets.

- RefreshMe vs QuickBooks: QuickBooks dominates business accounting. RefreshMe is the pick for personal finance with security features.

- RefreshMe vs AutoEntry: AutoEntry automates invoice data entry. RefreshMe provides personal financial tracking and credit analysis.

- RefreshMe vs FreshBooks: FreshBooks is designed for service-based business invoicing. RefreshMe handles personal financial organization.

- RefreshMe vs NetSuite: NetSuite is an enterprise ERP system. RefreshMe is tailored for individual financial management.

Start Using RefreshMe Now

You learned how to use every major RefreshMe feature:

- ✅ AI Assistant

- ✅ Budget Manager

- ✅ Dark Web Monitoring

- ✅ Privacy Management

- ✅ Identity Theft Protection

- ✅ Financial Dashboard

- ✅ Spending Tracker

- ✅ Bill Data Management

- ✅ Superpowered Insights

Next step: Pick one feature and try it now.

Most people start with the Financial Dashboard.

It takes less than 5 minutes.

Häufig gestellte Fragen

Is RefreshMe safe?

Yes, RefreshMe uses bank-level encryption to protect your data. The SSL certificate is valid and updated. Your login details are encrypted and never stored in plain Text. RefreshMe also includes $1M identity theft insurance for added protection.

How does refresh work?

RefreshMe connects to your bank accounts through secure API connections. It pulls in your transactions, balances, and account details automatically. The AI then analyzes this data to give you spending insights, budget tracking, and credit monitoring all in one place.

Was ist RefreshMe?

RefreshMe is a personal financial management platform that combines budgeting, spending tracking, credit monitoring, and identity theft protection. It connects to over 12,000 financial institutions. Think of it as your complete money command center with built-in security.

How do you refresh your page?

If you’re using RefreshMe in a web browser, press F5 or Ctrl+R (Cmd+R on Mac) to refresh the page. Inside the RefreshMe app, pull down on the dashboard to sync your latest account data. Accounts typically sync every few hours automatically.

What does “refresh me” mean?

The name “Refresh Me” represents a fresh start for your finances. The platform helps you take control of your money by bringing everything into one clean view. It’s about refreshing your approach to money management with AI-powered tools and identity protection.

![Refresh.me Review: Best Credit Score & Finance Tracking App [2025]](https://www.fahimai.com/wp-content/cache/flying-press/Y1M5YJO63yQ-hqdefault.jpg)