Quick Start

This guide covers every FreshBooks feature:

- 入门 — Create account and basic setup

- How to Use Custom Invoicing — Send branded invoices and get paid faster

- How to Use Payment Management — Track every payment in one place

- How to Use Expense Categorizing — Sort expenses for clean tax reports

- How to Use Time Tracking — Log billable hours and add them to invoices

- How to Use Project Management — Keep teams and budgets on track

- How to Use Apps Integration — Connect FreshBooks to your favorite tools

- How to Use Advanced Payments — Store cards and automate charges

- How to Use Mileage Tracking — Log business miles for tax deductions

Time needed: 5 minutes per feature

Also in this guide: Pro Tips | Common Mistakes | 故障排除 | 定价 | 替代方案

Why Trust This Guide

I’ve used FreshBooks for over two years and tested every feature covered here. This tutorial comes from real hands-on experience — not marketing fluff or vendor screenshots.

FreshBooks is one of the most popular 会计 tools for small businesses today.

But most users only scratch the surface of what it can do.

This guide shows you how to use every major feature.

Step by step, with screenshots and pro tips.

FreshBooks Tutorial

This complete FreshBooks tutorial walks you through every feature step by step, from initial setup to advanced tips that will make you a power user.

FreshBooks入门指南

Before using any feature, complete this one-time setup.

It takes about 3 minutes.

Watch this quick overview first:

Now let’s walk through each step.

Step 1: Create Your Account

Go to freshbooks.com and click “Try It Free.”

Enter your email address and create a password.

FreshBooks gives you a 30-day free trial with full access.

✓ Checkpoint: 检查你的 收件箱 for a confirmation email.

Step 2: Set Up Your Business Profile

Click the gear icon and select “Business Profile.”

Enter your company name, address, and industry.

Upload your company logo to brand your invoices.

Here’s what the dashboard looks like:

✓ Checkpoint: You should see your business name in the top-left corner.

Step 3: Connect Your Bank Account

Go to Expenses and click “Connect Your Bank.”

Search for your bank and enter your login details.

FreshBooks will import transactions automatically from now on.

✅ Done: You’re ready to use any feature below.

How to Use FreshBooks Custom Invoicing

Custom Invoicing lets you create branded invoices and send them in seconds.

Here’s how to use it step by step.

Watch Custom Invoicing in action:

Now let’s break down each step.

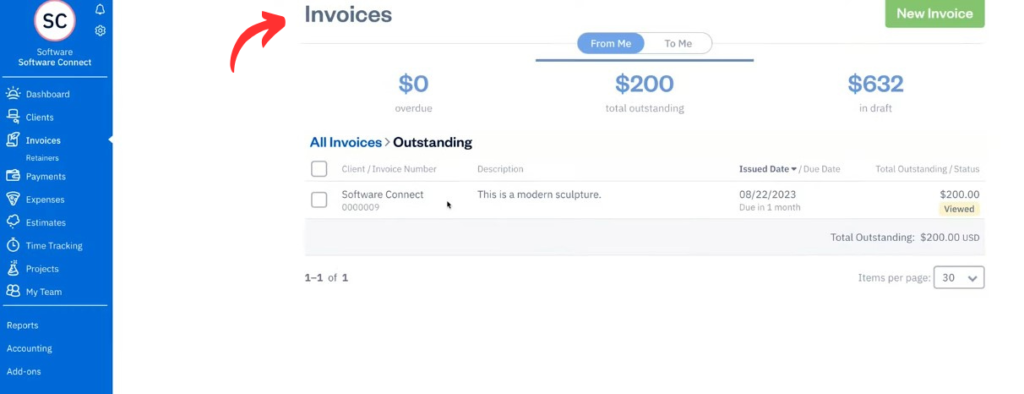

Step 1: Open the Invoice Builder

Click “Invoices” in the left sidebar, then “New Invoice.”

You can also press Shift + Space + I as a keyboard shortcut.

Step 2: Customize Your Invoice

Select a client from the dropdown or add a new one.

Add line items with descriptions, quantities, and rates.

Choose your brand colors and add your logo in Settings.

✓ Checkpoint: You should see a live preview of your invoice on the right.

Step 3: Send the Invoice

Click “Send” to email the invoice directly to your client.

FreshBooks tracks when your client opens and pays it.

✅ Result: Your branded invoice is sent and payment tracking starts automatically.

💡 专业提示: Set up recurring invoices for repeat clients. FreshBooks will send them automatically on your schedule so you never forget to bill.

How to Use FreshBooks Payment Management

Payment Management lets you accept online payments and track every dollar.

Here’s how to use it step by step.

Watch Payment Management in action:

Now let’s break down each step.

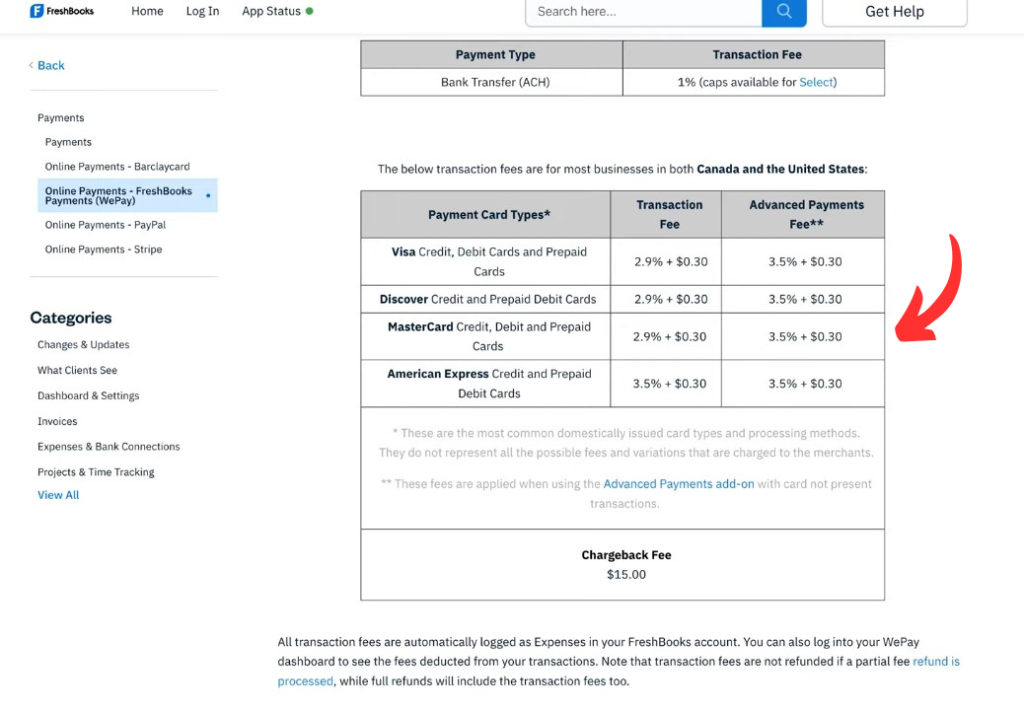

Step 1: Enable Online Payments

Go to Settings and click “Online Payments.”

Connect a payment processor like Stripe, PayPal, or FreshBooks Payments.

Step 2: Configure Payment Options

Choose which payment methods to accept: credit cards, ACH, or Apple Pay.

Set up automatic payment reminders for overdue invoices.

You can also add late fees to encourage on-time payments.

✓ Checkpoint: You should see a green “Online Payments Active” badge.

Step 3: Track Incoming Payments

Visit the Payments tab to see all received and pending amounts.

FreshBooks matches payments to invoices automatically.

✅ Result: Clients can pay you online and every payment is tracked in one place.

💡 专业提示: Use Checkout Links to collect payments without sending an invoice. Share the link on your website or 社交媒体 for quick payments.

How to Use FreshBooks Expense Categorizing

Expense Categorizing lets you sort every business expense for clean tax reports.

Here’s how to use it step by step.

Watch Expense Categorizing in action:

Now let’s break down each step.

Step 1: Add a New Expense

Click “Expenses” in the sidebar, then “New Expense.”

You can also press Shift + Space + X to create one 即刻.

Step 2: Categorize and Attach Receipts

Enter the date, amount, and select a category like “Office Supplies.”

Snap a photo of your receipt or upload it from your computer.

FreshBooks uses OCR to read receipt details automatically.

✓ Checkpoint: You should see the expense listed with its category and receipt attached.

Step 3: Review Bank-Imported Expenses

If your bank is connected, FreshBooks imports transactions daily.

Review each one and assign a category, then click “Save.”

✅ Result: All expenses are sorted and ready for tax season reporting.

💡 专业提示: Use the FreshBooks mobile app to snap receipt photos on the go. The OCR scanner captures merchant names, totals, and taxes instantly.

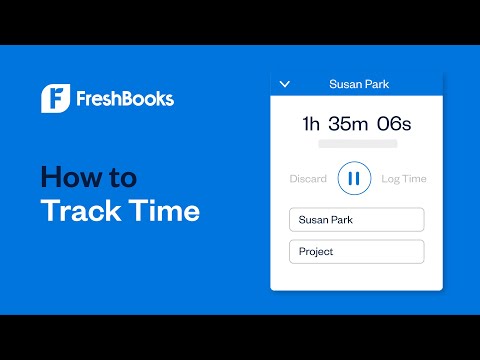

How to Use FreshBooks Time Tracking

时间跟踪 lets you log billable hours and add them directly to invoices.

Here’s how to use it step by step.

Watch Time Tracking in action:

Now let’s break down each step.

Step 1: Start the Timer

Click “Time Tracking” in the sidebar or press Shift + T.

Hit the play button to start logging time for a task.

Step 2: Assign Time to a Client or Project

Select a client and project from the dropdown menus.

Add a description of the work you completed.

Mark the entry as “Billable” so it appears on invoices.

✓ Checkpoint: You should see the time entry with a green “Billable” tag.

Step 3: Add Tracked Time to an Invoice

Create a new invoice and click “Add Unbilled Time.”

Select the hours you want to bill and they appear as line items.

✅ Result: Your billable hours flow directly into invoices with zero manual entry.

💡 专业提示: You can pause and resume time entries throughout the day. FreshBooks keeps a running total so nothing gets lost between tasks.

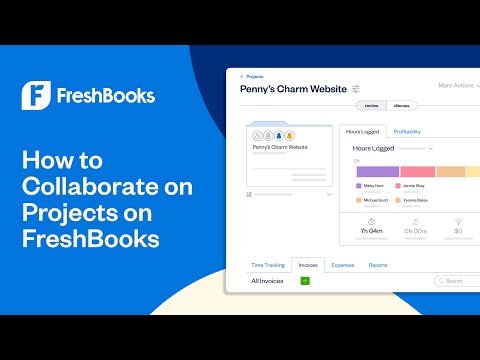

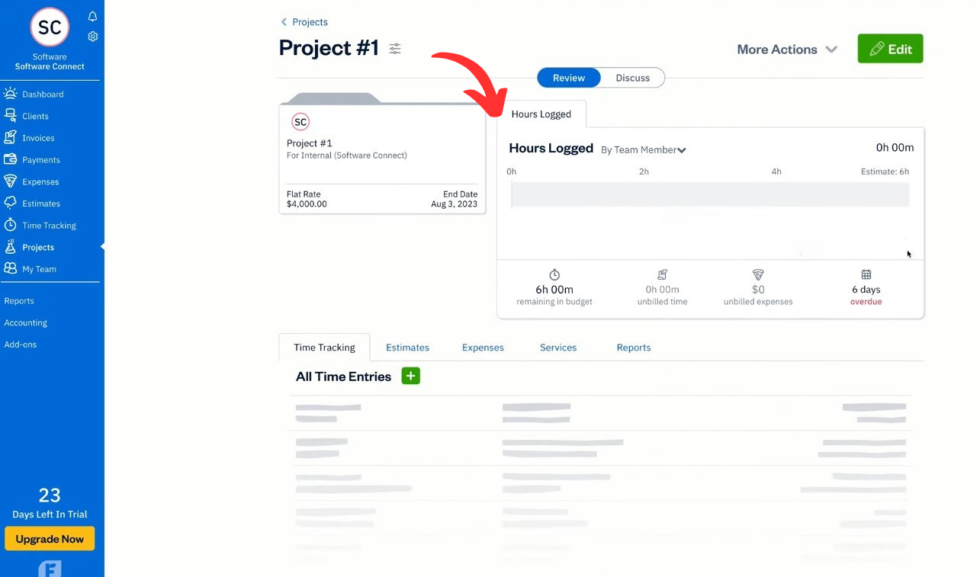

How to Use FreshBooks Project Management

项目管理 lets you track budgets, deadlines, and team progress in one place.

Here’s how to use it step by step.

Watch Project Management in action:

Now let’s break down each step.

Step 1: Create a New Project

Click “Projects” in the sidebar, then “New Project.”

You can also press Shift + Space + P as a shortcut.

Step 2: Set Up Project Details

Name the project and assign it to a client.

Choose a billing method: flat rate, hourly, or non-billable.

Set a budget and invite team members if needed.

✓ Checkpoint: You should see the project appear in your projects list.

Step 3: Track Project Costs

Log time and expenses directly to the project.

FreshBooks shows you real-time profitability against your budget.

✅ Result: You can see exactly how profitable each project is at a glance.

💡 专业提示: Use project profitability reports (Premium plan) to identify which clients and projects make you the most money over time.

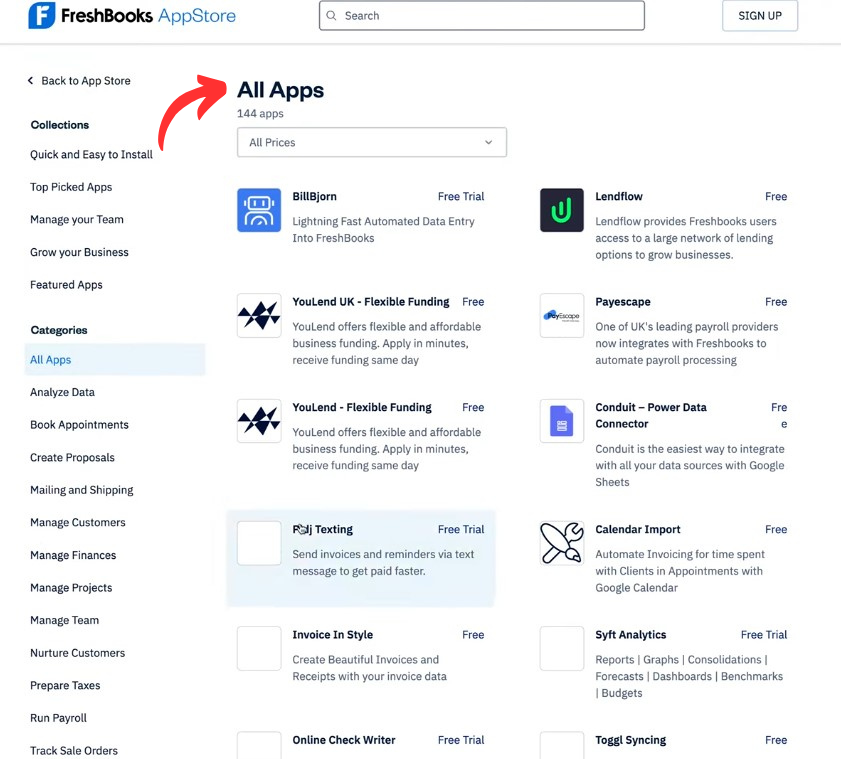

How to Use FreshBooks Apps Integration

Apps Integration lets you connect FreshBooks with hundreds of business tools.

Here’s how to use it step by step.

Watch Apps Integration in action:

Now let’s break down each step.

Step 1: Browse the App Store

Click “Apps” in your FreshBooks sidebar.

Browse categories like Payments, 客户关系管理, eCommerce, and Project Management.

Step 2: Connect an App

Click the app you want and follow the on-screen setup steps.

Most apps connect in under two minutes with your login credentials.

✓ Checkpoint: You should see a “Connected” status on the app tile.

Step 3: Configure Sync Settings

Choose which data to sync: contacts, invoices, payments, or expenses.

Set the sync frequency and save your settings.

✅ Result: Data flows between FreshBooks and your other tools automatically.

💡 专业提示: Connect Gusto for payroll if you have employees. It syncs wages and tax data directly into FreshBooks without manual entry.

How to Use FreshBooks Advanced Payments

Advanced Payments lets you store client credit cards and charge them automatically.

Here’s how to use it step by step.

Watch Advanced Payments in action:

Now let’s break down each step.

Step 1: Enable Advanced Payments

Go to Settings and click “Advanced Payments.”

This is a $20/month add-on to any FreshBooks plan.

Step 2: Store Client Card Details

Open a client profile and add their credit card on file.

FreshBooks stores card data securely with bank-level encryption.

✓ Checkpoint: You should see a card icon next to the client name.

Step 3: Set Up Auto-Billing

Create a recurring invoice and enable “Auto-Pay.”

FreshBooks charges the stored card on the billing date.

✅ Result: Recurring clients are billed and paid without any manual work.

💡 专业提示: Pair Advanced Payments with recurring invoices for retainer clients. You get paid on time every month without chasing anyone.

How to Use FreshBooks Mileage Tracking

里程跟踪 lets you log business miles for accurate tax deductions.

Here’s how to use it step by step.

Watch Mileage Tracking in action:

Now let’s break down each step.

Step 1: Open Mileage Tracking

Tap “Mileage” in the FreshBooks mobile app.

This feature works best on iOS and Android devices with GPS.

Step 2: Log Your Trip

Tap “Start Trip” to begin automatic GPS tracking.

Or enter your start and end addresses manually for exact distance.

✓ Checkpoint: You should see the distance logged with a map of your route.

Step 3: Categorize the Trip

Mark the trip as “Business” or “Personal.”

FreshBooks calculates the deduction using the current IRS mileage rate.

✅ Result: Business miles are logged and tax deductions are calculated automatically.

💡 专业提示: Enable automatic trip detection in the app settings. FreshBooks detects when you start driving and prompts you to categorize later.

FreshBooks Pro Tips and Shortcuts

After testing FreshBooks for over two years, here are my best tips.

键盘快捷键

| Action | Shortcut |

|---|---|

| Open Shortcuts Menu | Shift + ? |

| Go to Invoices | Shift + I |

| Create New Invoice | Shift + Space + I |

| Go to Clients | Shift + C |

| Create New Client | Shift + Space + C |

| Go to Expenses | Shift + X |

| Create New Expense | Shift + Space + X |

| Go to Time Tracking | Shift + T |

| Go to Reports | Shift + R |

| Go to Projects | Shift + P |

Hidden Features Most People Miss

- Client Portal: Your clients get a self-service portal to view invoices, make payments, and download receipts without emailing you.

- Checkout Links: Create a payment link and share it anywhere — no invoice needed. Great for collecting deposits or one-time payments.

- Dashboard Customization: Drag and reorder dashboard widgets to show the metrics that matter most to your business at the top.

- Bank Reconciliation: Match imported transactions to your books. Available on Plus plans and higher to catch errors fast.

FreshBooks Common Mistakes to Avoid

Mistake #1: Not Categorizing Expenses Regularly

❌ Wrong: Letting bank transactions pile up for months and sorting them all at tax time.

✅ Right: Review and categorize imported transactions weekly. It takes five minutes and keeps your books clean.

Mistake #2: Forgetting to Set Up Payment Reminders

❌ Wrong: Manually chasing clients for overdue payments via email or phone.

✅ Right: Enable automatic payment reminders in Settings. FreshBooks sends polite nudges so you don’t have to.

Mistake #3: Using the Lite Plan When You Need More Clients

❌ Wrong: Creating workarounds to bill more than 5 clients on the Lite plan.

✅ Right: Upgrade to Plus when you pass 5 clients. You get 50 client slots plus proposals and bank reconciliation.

FreshBooks Troubleshooting

Problem: Bank Connection Keeps Disconnecting

Cause: Your bank may have changed its 安全 settings or login credentials.

使固定: Go to Expenses, click your bank, and re-enter your login details. If it still fails, try removing and re-adding the connection.

Problem: Invoice Not Delivered to Client

Cause: The client’s email provider may be blocking FreshBooks emails as spam.

使固定: Ask your client to check their spam folder and whitelist notifications@freshbooks.com. You can also resend from the invoice page.

Problem: Time Entries Not Showing on Invoice

Cause: The time entries may not be marked as “Billable” or assigned to the right client.

使固定: Go to Time Tracking, edit the entry, check the “Billable” box, and assign the correct client. Then try adding unbilled time to the invoice again.

📌 笔记: If none of these fix your issue, contact FreshBooks support at 1-888-674-3175 or through the in-app chat.

FreshBooks是什么?

FreshBooks is a cloud-based accounting tool that makes invoicing, expense tracking, and financial reporting simple for small businesses and 自由职业者.

Think of it like a personal bookkeeper that lives in your browser and handles the boring parts of running a business.

Watch this quick overview:

It includes these key features:

- Custom Invoicing: Create branded invoices with your logo, colors, and payment terms in minutes.

- Payment Management: Accept credit cards, ACH, Apple Pay, and track every payment automatically.

- Expense Categorizing: Sort expenses by category and attach receipts with OCR scanning.

- 时间跟踪: Log billable hours with a built-in timer and add them to invoices.

- 项目管理: Track budgets, deadlines, and profitability for every project.

- Apps Integration: Connect with Stripe, PayPal, Gusto, Shopify, and hundreds more tools.

- Advanced Payments: Store client cards on file and set up automatic billing.

- Mileage Tracking: Log business trips with GPS and calculate tax deductions.

For a full review, see our FreshBooks review.

FreshBooks Pricing

Here’s what FreshBooks costs in 2026:

| 计划 | 价格 | 最适合 |

|---|---|---|

| 精简版 | 每月 21 美元 | Freelancers with up to 5 clients |

| 加 | 每月 38 美元 | Growing businesses with up to 50 clients |

| 优质的 | 每月65美元 | Businesses with unlimited clients |

| 选择 | 风俗 | High-volume businesses needing dedicated support |

免费试用: Yes — 30 days with full access, no credit card required.

退款保证: Yes — 30-day money-back guarantee on all plans.

💰 Best Value: Plus plan at $38/month — it covers 50 clients and adds recurring invoices, proposals, bank reconciliation, and automated reminders.

FreshBooks vs Alternatives

How does FreshBooks compare? Here’s the competitive landscape:

| 工具 | 最适合 | 价格 | Rating |

|---|---|---|---|

| FreshBooks | Invoicing and ease of use | $21/mo | ⭐ 4.3 |

| QuickBooks | Advanced accounting features | $1.90/mo | ⭐ 4.4 |

| Xero | Multi-currency and global teams | 每月 29 美元 | ⭐ 4.5 |

| Zoho Books | All-in-one Zoho ecosystem | 每月 0 美元 | ⭐ 4.3 |

| 海浪 | Free accounting for startups | 每月 0 美元 | ⭐ 4.0 |

| 圣人 | 小型企业 遵守 | 每月7美元 | ⭐ 4.2 |

| Expensify | Expense reporting for teams | $5/mo | ⭐ 4.1 |

| NetSuite | Enterprise-level ERP | 风俗 | ⭐ 4.5 |

Quick picks:

- Best overall: FreshBooks — easiest invoicing and time tracking for service businesses.

- Best budget: Wave — completely free accounting for micro-businesses.

- Best for beginners: Zoho Books — free plan with a clean interface and helpful guides.

- Best for advanced accounting: QuickBooks — deeper reporting and accountant access.

🎯 FreshBooks Alternatives

Looking for FreshBooks alternatives? Here are the top options:

- 🚀 Puzzle IO: AI-powered accounting with automated categorization and real-time financial insights for tech startups.

- 📊 右手: Automates receipt capture and data extraction so you spend less time on manual 簿记.

- 🌟 Xero: Best for global businesses with multi-currency support and a massive app marketplace.

- ⚡ 辛德: Syncs payment data from Stripe, PayPal, and Shopify into your books automatically.

- 🔧 轻松结束月末: Simplifies monthly close processes with automated reconciliation checklists for 会计师.

- 🧠 Docyt: AI-driven accounting 自动化 for multi-location businesses and franchises.

- 🏢 圣人: Trusted by millions with strong compliance features and payroll integration for small teams.

- 💰 Zoho Books: Free plan available with invoicing, expense tracking, and tight Zoho 客户关系管理 一体化。

- 👶 海浪: Completely free accounting and invoicing — perfect for solo freelancers and side hustles.

- 💼 加速: Personal and small business finance tracking starting at just $2.99/month.

- 🔒 Hubdoc: Automatically fetches bills and receipts from vendors and stores them in the cloud.

- 🎯 Expensify: Industry-leading expense reporting with SmartScan receipt capture for teams of any size.

- ⭐ QuickBooks: The most popular 会计软件 with deep reporting and a huge accountant network.

- 🎨 自动输入: Extracts data from receipts and invoices and pushes it to your accounting software.

- 🔥 NetSuite: Enterprise-grade ERP with full accounting, inventory, and CRM for scaling companies.

For the full list, see our FreshBooks的替代方案 guide.

⚔️ FreshBooks Compared

Here’s how FreshBooks stacks up against each competitor:

- FreshBooks vs Puzzle IO: FreshBooks wins for invoicing ease, but Puzzle IO offers better AI-powered 自动化 for tech companies.

- FreshBooks 与 Dext: Dext focuses on receipt capture only. FreshBooks is a full accounting platform with built-in OCR scanning.

- FreshBooks 与 Xero 的比较: Xero has stronger multi-currency support. FreshBooks has a simpler interface for service businesses.

- FreshBooks vs Synder: Synder excels at payment reconciliation for eCommerce. FreshBooks is better for service-based invoicing.

- FreshBooks 与 Easy Month End 的对比: Easy Month End targets accountants doing month-end close. FreshBooks is built for business owners.

- FreshBooks vs 多西特: Docyt handles multi-location accounting with AI. FreshBooks is simpler and cheaper for single-location businesses.

- FreshBooks 与 Sage 的比较: Sage offers deeper compliance tools. FreshBooks wins on user-friendliness and invoicing speed.

- FreshBooks 与 Zoho Books 的比较: Zoho Books has a free plan and Zoho ecosystem. FreshBooks has better invoicing and time tracking.

- FreshBooks 与 Wave 的比较: Wave is free but limited. FreshBooks adds time tracking, projects, and better payment options.

- FreshBooks 与 Quicken: Quicken is personal finance first. FreshBooks is purpose-built for business invoicing and accounting.

- FreshBooks 与 Hubdoc: Hubdoc is a document collection tool, not full accounting. FreshBooks covers the entire accounting workflow.

- FreshBooks 与 Expensify 的比较: Expensify leads in expense reporting for teams. FreshBooks offers a broader set of accounting features.

- FreshBooks 与 QuickBooks: QuickBooks has more advanced reporting and inventory. FreshBooks is easier to learn and better for invoicing.

- FreshBooks 与 AutoEntry 的比较: AutoEntry automates data entry into other apps. FreshBooks is a standalone accounting platform with built-in entry.

- FreshBooks 与 NetSuite: NetSuite is enterprise ERP for large companies. FreshBooks is designed for small businesses and freelancers.

Start Using FreshBooks Now

You learned how to use every major FreshBooks feature:

- ✅ Custom Invoicing

- ✅ Payment Management

- ✅ Expense Categorizing

- ✅ Time Tracking

- ✅ Project Management

- ✅ Apps Integration

- ✅ Advanced Payments

- ✅ Mileage Tracking

Next step: Pick one feature and try it now.

Most people start with Custom Invoicing.

It takes less than 5 minutes.

常见问题解答

Is FreshBooks easy to learn?

Yes. FreshBooks is built for non-accountants and has one of the simplest interfaces among accounting tools. Most users can create their first invoice within 10 minutes of signing up. The dashboard walks you through setup with clear prompts.

What are the downsides of FreshBooks?

The Lite plan caps you at 5 billable clients, which is limiting for growing businesses. The mobile app lacks detailed reporting features. Inventory management is also limited compared to QuickBooks. Advanced accounting features like double-entry are only available on Plus plans and higher.

How do FreshBooks work?

FreshBooks is a cloud-based platform you access through your web browser or mobile app. You create invoices, track expenses, log time, and run financial reports from one dashboard. It connects to your bank account to import transactions and syncs with payment processors to accept online payments.

Is FreshBooks easier to use than QuickBooks?

Yes, for most users. FreshBooks has a cleaner interface and fewer menus to navigate. QuickBooks offers more advanced accounting features but has a steeper learning curve. If you’re a freelancer or service business, FreshBooks is faster to set up and use daily.

How much do FreshBooks cost monthly?

FreshBooks plans start at $21/month for Lite, $38/month for Plus, and $65/month for Premium. The Select plan has custom pricing. You can save 10% by paying annually. FreshBooks offers a 30-day free trial and a 30-day money-back guarantee on all plans.

How to start with FreshBooks?

Go to freshbooks.com and click “Try It Free.” Enter your email to create an account. Set up your business profile, upload your logo, and connect your bank. You can start sending invoices within minutes. No credit card is required for the trial.

Does FreshBooks have a chart of accounts?

Yes. FreshBooks includes a default chart of accounts that covers common income and expense categories. You can also create custom accounts to match your business needs. The chart of accounts is available on Plus plans and higher with double-entry accounting.

Which is better, QuickBooks or FreshBooks?

It depends on your needs. FreshBooks is better for freelancers and service businesses that want easy invoicing and time tracking. QuickBooks is better for businesses that need advanced reporting, inventory tracking, and multi-user accounting. Both offer free trials so you can test before you buy.

How much does FreshBooks charge per transaction?

FreshBooks Payments charges 2.9% + 30 cents for credit card transactions and 1% for ACH bank transfers. Rates vary by payment processor if you connect Stripe or PayPal instead. Select plan customers may access lower transaction fees.

How to do 簿记 manually step by step?

Start by recording every transaction in a ledger with the date, amount, and category. Track income and expenses separately. Reconcile your records with bank statements monthly. FreshBooks automates most of this process — just connect your bank and it categorizes transactions for you.

Can you use FreshBooks for free?

FreshBooks does not have a permanent free plan. However, it offers a 30-day free trial with full feature access and no credit card required. After the trial, you need to choose a paid plan starting at $21/month. FreshBooks often runs promotions with discounted rates for the first few months.