Doing your own taxes is a total nightmare.

Most software costs too much and feels way too hard to learn.

You just want to track your money without a headache.

Wave is a free tool that can solve these problems fast.

It makes sending invoices and tracking expenses very simple.

You do not need to be a math genius to use it.

Our guide shows you exactly how to use Wave to get started today.

You will feel like a pro in just a few minutes.

Let’s get your 사업 organized right now.

Wave Tutorial

Getting started with Wave is easier than you think.

First, set up your free account and link your bank.

This lets the software automatically track your spending.

Next, we will show you how to create professional invoices and quickly organize your business receipts.

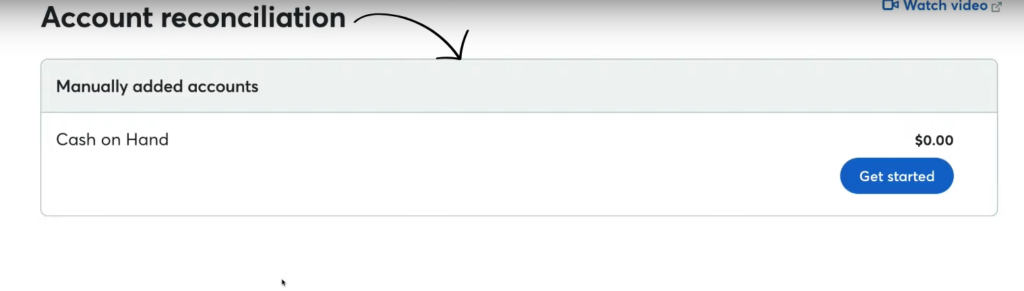

How to Use Account Reconciliation

소규모 사업체 owners need smart solutions to focus on growth.

You must access your bank transactions to get rid of every error. This point is vital.

You will match online payments, bills, and other transactions to catch mistakes.

Follow these tips to ensure every payment is correct.

Step 1: Start a New Reconciliation

- Navigate to the sidebar and click on 회계.

- Select Reconciliation from the dropdown menu to view your accounts.

- Choose the specific bank account or credit card you want to check.

- Click on Get Started or New Reconciliation to begin the process.

Step 2: Enter Statement Details

- Grab your physical or digital bank statement for the month.

- Find the Ending Balance and the Ending Date on your statement.

- Enter these exact numbers into the Wave reconciliation screen.

- Click Next to verify your 데이터 and view the transaction list.

Step 3: Match Transactions

- Look at the list of charges on your screen.

- Check the box next to every item that matches your bank statement.

- Watch the “Difference” number at the top of the page.

- Keep checking boxes until the difference reaches $0.00.

- Click Save to finish reconciling your month.

How to Use Expense Tracking

Running a business is hard work.

Many people face tax issues for years because they lose receipts.

You must avoid this mess. It takes a bit of time to set up, but Wave runs the checks for you.

You can view where money goes and share data easily.

Read these steps to make your life easier.

This simple process works great.

Step 1: Connect Your Bank Account

- Navigate to the left-hand menu on your dashboard.

- Click on Banking and then select Connected Accounts.

- Choose your specific bank from the secure list.

- Enter your online banking login details to link the data.

- Select the checking or savings accounts you want to import.

Step 2: Classify Your Transactions

- Go to the 회계 tab and click on Transactions.

- Look at the list of imported spending from your bank.

- Click on a specific transaction to open the details.

- Select a Category (like “Office Supplies” or “Rent”).

- Wave learns your habits and will categorize similar items automatically next time.

Step 3: Upload Receipts

- Download the Wave mobile app or use the desktop version.

- Take a clear photo of your paper receipt.

- Upload the image to the Receipts section in the menu.

- Wait for Wave to scan the numbers and date for you.

- Click Verify to save the expense to your books officially.

How to Use Multi-Currency Support

Selling to people in other countries is a great way to grow your business.

But dealing with different money types can be confusing and hard.

You do not need to do the math yourself every time.

Wave handles the exchange rates automatically for you.

This tool lets you send bills in Euros, Pounds, or Pesos easily.

It keeps your records accurate without extra work.

You can now do business globally without stress.

Step 1: Add a New Currency

- Scroll to the bottom of the menu & click Settings.

- Look for the Currencies section in the list.

- Click the button that says Add Currency.

- Select the specific money type you need from the dropdown list.

- Click Save to add it to your system.

Step 2: Assign Currency to a Customer

- Go to the Sales tab, then click Customers.

- Click Add a customer to make a new profile or edit an old one.

- Find the Currency field in their profile settings.

- Change it from your home currency to their local currency (like Euros).

- Click Save to update the customer profile.

Step 3: Create a Foreign Invoice

- Go to Invoices and click Create New.

- Select the global customer you just set up in Step 2.

- Notice that the invoice automatically switches to their currency symbols.

- Enter your prices (Wave estimates the exchange rate for your reports).

Click Send to email the invoices to your client.

Alternatives to Wave

Wave가 여러분의 요구 사항을 완벽하게 충족하지 못한다면, 다음과 같은 Wave 대안들을 고려해 보세요:

- 퍼즐 IO: 이 소프트웨어는 인공지능 기반 재무 계획에 중점을 두고 있습니다.

- 덱스트: 이 도구는 문서를 캡처하고 데이터를 추출하는 데 매우 유용합니다.

- 제로: 이는 중소기업에서 널리 사용되는 인기 있는 온라인 회계 소프트웨어입니다.

- 시나이더: 이 회사는 전자상거래 및 결제 데이터를 회계 소프트웨어와 동기화하는 데 특화되어 있습니다.

- 쉬운 월말: 이 소프트웨어는 월말 재무 업무를 간소화하도록 설계되었습니다.

- 도시트: 이 시스템은 회계 처리를 위해 인공지능을 사용하고 재무 워크플로우를 자동화합니다.

- 세이지: 이 제품은 종합적인 비즈니스 및 회계 소프트웨어 제품군입니다.

- 조호 북스: 이 온라인 회계 도구는 저렴하고 소규모 사업체에 적합한 것으로 알려져 있습니다.

- 빠르게 하다: 개인 예산을 관리하는 데 도움이 되는 인기 있는 재정 관리 도구입니다.

- 허브독: 이 회사는 회계 처리를 위한 재무 문서를 수집하고 정리하는 데 특화되어 있습니다.

- Expensify: 이 앱은 비용 관리에 중점을 두고 있으며, 영수증을 쉽게 추적하고 제출할 수 있도록 해줍니다.

- 퀵북스: 기업의 송장 발행부터 급여 지급까지 모든 업무를 지원하는 매우 유명한 회계 소프트웨어입니다.

- 자동 입력: 이 도구는 송장 및 영수증과 같은 문서를 스캔하고 분석하여 데이터 입력을 자동화합니다.

- 프레시북스: 이 소프트웨어는 프리랜서와 소규모 사업체를 위해 특별히 개발되었으며, 청구서 발행 및 시간 추적에 중점을 두고 있습니다.

- 넷스위트: 대기업을 위한 강력하고 완벽한 클라우드 기반 비즈니스 관리 솔루션입니다.

파동 비교

- 웨이브 vs 퍼즐 IO이 소프트웨어는 스타트업을 위한 AI 기반 재무 계획에 중점을 두고 있습니다. 개인 재무 관리에 대한 버전도 있습니다.

- 웨이브 vs 덱스트이것은 영수증과 송장을 기록하는 업무용 도구입니다. 다른 도구는 개인 경비를 추적하는 데 사용됩니다.

- 웨이브 vs 제로이 소프트웨어는 중소기업에서 널리 사용되는 온라인 회계 소프트웨어입니다. 경쟁 제품은 개인용으로 개발되었습니다.

- 웨이브 vs 시너더이 도구는 전자상거래 데이터를 회계 소프트웨어와 동기화합니다. 대안으로는 개인 재무 관리에 초점을 맞춘 도구가 있습니다.

- 웨이브 vs 이지 월말이 앱은 월말 업무를 간소화하는 비즈니스 도구입니다. 경쟁 앱으로는 개인 재정 관리 앱이 있습니다.

- 웨이브 vs 도시트하나는 AI를 활용하여 기업 회계 및 자동화를 지원하고, 다른 하나는 AI를 개인 재정 관리 도우미로 활용합니다.

- 웨이브 vs 세이지이 제품은 종합적인 기업 회계 소프트웨어 제품군입니다. 경쟁 제품은 개인 재무 관리에 더 사용하기 쉬운 도구입니다.

- Wave와 Zoho Books 비교: 이는 소규모 사업체를 위한 온라인 회계 도구입니다. 경쟁 제품은 개인용입니다.

- 웨이브 vs 퀵큰둘 다 개인 재무 관리 도구이지만, 이 도구는 보다 심층적인 투자 추적 기능을 제공합니다. 다른 하나는 사용이 더 간편합니다.

- Wave vs Hubdoc이 회사는 회계 장부 작성을 위한 문서 캡처를 전문으로 합니다. 경쟁 업체는 개인 재무 관리 도구입니다.

- Wave vs Expensify이것은 업무 경비 관리 도구입니다. 다른 하나는 개인 경비 추적 및 예산 관리 도구입니다.

- Wave와 QuickBooks 비교: 이는 기업용으로 잘 알려진 회계 소프트웨어입니다. 그 대안은 개인 재무 관리에 맞춰 개발되었습니다.

- 웨이브 방식 vs 자동 입력 방식이 프로그램은 기업 회계 데이터 입력을 자동화하도록 설계되었습니다. 이와 유사한 프로그램으로는 개인 재무 관리 도구가 있습니다.

- 웨이브 vs 프레시북스이 소프트웨어는 프리랜서와 소규모 사업자를 위한 회계 소프트웨어입니다. 개인 재무 관리용으로도 사용할 수 있습니다.

- 웨이브 vs 넷스위트이 제품은 대기업을 위한 강력한 비즈니스 관리 소프트웨어 제품군입니다. 경쟁 제품은 간단한 개인 재무 관리 앱입니다.

결론

Wave helps you take control of your business money.

You do not need to be an expert to use it well.

We showed you how to track your spending and easily fix mistakes.

We also looked at how to get paid in other currencies.

This tool takes the heavy stress out of tax season.

Your financial records will be clean and safe from now on.

You can finally stop worrying about messy spreadsheets.

The best part is that it costs nothing to start. Go set up your account today.

Your future self will thank you for being organized.

자주 묻는 질문

Is WaveApps completely free?

Wave offers a robust 스타터 플랜 that is completely free. It includes unlimited invoicing, expense tracking, and basic 보고. However, they recently introduced a 프로 플랜 (approx. $16/month) which is required for automated bank import features and live support. Payroll and payment processing fees are extra.

Is WaveApps better than QuickBooks?

For freelancers and micro-businesses, Wave is often better because it is simpler and free. QuickBooks is superior for larger businesses requiring inventory management, complex payroll, or 심사 trails. Wave is the “lite,” user-friendly alternative; QuickBooks is the heavy-duty industry standard.

Does Wave App report to the IRS?

Yes, regarding payment processing. If you accept payments through Wave (Wave Payments) and meet the IRS thresholds, Wave automatically files Form 1099-K with the IRS and sends you a copy. However, it does not file your annual income tax return (like Schedule C) for you.

What are the drawbacks of Wave Accounting?

Wave has limitations: it lacks inventory management, project management features, and audit trails. Additionally, the free plan does not include live customer support (only 챗봇), and recent updates moved automatic bank syncing to the paid Pro plan.

How does the Wave app work?

Wave is a cloud-based financial platform. You create an account, connect your bank (on Pro) or upload statements, and categorize transactions as “Income” or “Expense.” It compiles this data into reports like Profit & Loss statements, making tax time significantly easier for non-accountants.

Is Wave easy to use for beginners?

Extremely. Wave is built specifically for non-accountants. Its dashboard is clean, jargon-free, and intuitive. Unlike traditional software that requires 회계 knowledge, Wave focuses on simple workflows: “Send Invoice,” “Add Expense,” and “View Report.

How much does it cost to use Wave?

그만큼 스타터 플랜 is $0/month. The 프로 플랜 is roughly $16/month (billed monthly) or $170/year. Payroll services start at a base fee of $40/month plus $6 per employee. Credit card processing fees are standard industry rates (approx. 2.9% + $0.60 per transaction).

More Facts about Wave Software

- WAVE is a set of tools designed to help you make websites easier for everyone to use.

- The tool cannot decide on its own if a website is perfect; a human still needs to make the final decision.

- It is easy to use. You can check a webpage just by typing in its address.

- You can add WAVE to Chrome, Firefox, or Edge browsers to check pages directly on your computer.

- WAVE adds small icons to the webpage to provide information about accessibility.

- If you see red icons, it means there are errors you need to fix.

- It helps you follow important accessibility guidelines, such as WCAG 2.2, to ensure your site works for everyone.

- It helps you check things that computers can’t understand, like whether a picture has a good description.

- You can turn off the website’s design (CSS) to see the page structure clearly.

- WAVE checks the page after it has fully loaded to give you an accurate report.

- The tool is designed for use by people with disabilities.

Wave (The 회계 & Finance App)

- You can create reports to see how much profit your projects are making.

- Wave Payments lets your clients pay bills with credit cards, bank transfers, or Apple Pay to help you get money faster.

- The Pro Plan lets you link your business bank account so transactions appear automatically.

- Scanning receipts helps you prepare for taxes by saving the proof right next to your purchase records.

- The mobile app can read 텍스트 from your receipts and sort them into the right projects for you.

- You can create your own income & expense groups to organize your spending.

- It is a good idea to keep your business money and personal money separate when using this tool.

- Wave is built for freelancers and 소규모 사업체, offering free tools for accounting and sending invoices.

- You can let partners view or edit your data without giving them your password.

- To start, you sign up with a business email and set up your company’s look, like your logo and colors.

- 그것은 허용합니다 소규모 사업 owners create professional-looking invoices and accept online payments.

- The software is simple and made for people running their own businesses at any stage.

- You can easily track your cash flow & read important business reports.

- There is a Google Sheets tool that lets you move your customer and product data in and out of Wave.

- You can add buttons to your invoices so customers can pay by card or bank transfer.

- If a customer needs a refund, you can issue a full or partial refund.

- If you type in a transaction that the bank also sends automatically, you might see the same entry twice.