~로서 부동산 agent, your time is your most valuable asset.

You’re busy showing properties, meeting clients, and negotiating deals.

The last thing you want to do is spend hours buried in spreadsheets.

You’re not alone; many agents struggle with the tedious, time-consuming parts of 회계.

What if you could spend less time on paperwork and more time on closing deals?

The answer lies in the right tools.

This article will lead you through the 9 Best AI Accounting Software for Real Estate Agents in 2025, showing you how they can transform your 사업 and give you back your time.

What is the Best Accounting Software for Real Estate Agents?

선택하는 것 최고의 AI 회계 소프트웨어 필요에 따라 다릅니다.

The right AI powered tools can streamline business processes and drive business growth by giving you a clear view of your company’s financial performance.

You’ll find that these tools, especially the top expense management software, handle relevant 데이터 쉽게.

This helps you focus on what’s important, and don’t worry—AI won’t replace 회계사; it just makes their job easier.

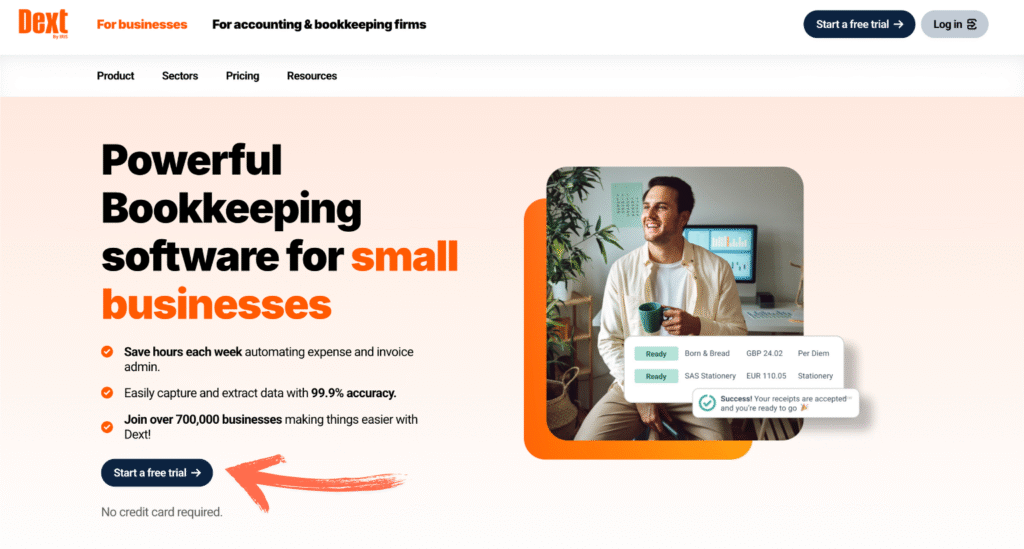

1. 덱스트린(⭐4.8)

Dext is a powerful tool for 회계 firms and professionals.

인공지능을 사용하여 자동화합니다. 부기.

You can simply upload receipts and invoices, and Dext will use AI technology to extract the financial data.

It saves so much time and helps reduce errors.

The data analysis it provides helps you get a better handle on your finances.

저희와 함께 그 잠재력을 발휘해 보세요 덱스트 튜토리얼.

우리의 의견

매달 10시간 이상을 되찾고 싶으신가요? Dext의 자동 데이터 입력, 비용 추적 및 보고 기능이 어떻게 재정 관리를 간소화하는지 확인해 보세요.

주요 이점

Dext는 경비 관리를 간편하게 해주는 데 있어서 정말 탁월합니다.

- 사용자의 90%가 서류 더미가 상당히 줄었다고 응답했습니다.

- 이 제품은 98% 이상의 정확도를 자랑합니다. 문서에서 데이터를 추출하는 데 사용됩니다.

- 경비 보고서 작성이 놀라울 정도로 빠르고 간편해집니다.

- QuickBooks 및 Xero와 같은 인기 있는 회계 플랫폼과 원활하게 통합됩니다.

- 중요한 금융 서류를 분실하는 일이 없도록 도와줍니다.

가격

- 연간 구독료: $24

장점

단점

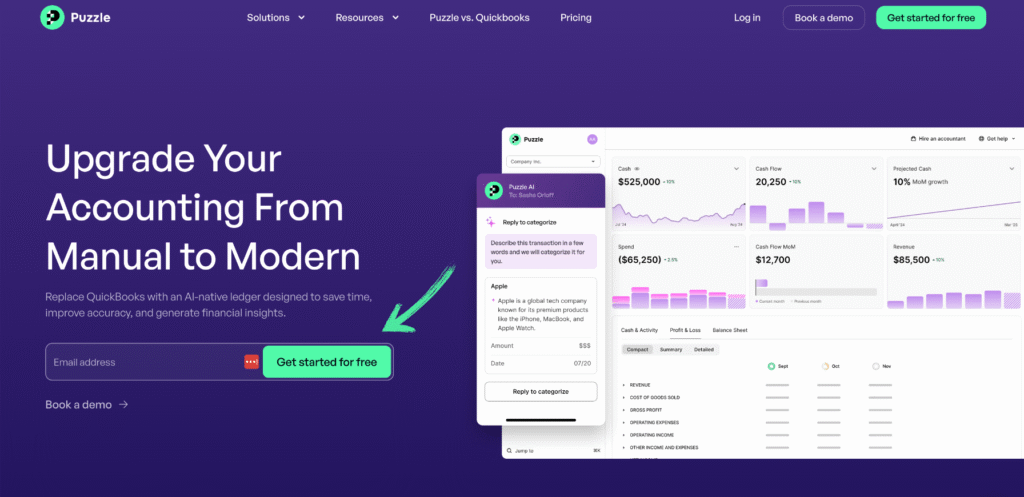

2. 퍼즐 IO (⭐4.5)

Puzzle IO is built for real-time financial data.

This software uses AI to automate many financial processes, from 부기 to reporting.

It continuously analyzes financial data to catch errors before they become a problem.

It’s perfect for those who want their books to be accurate and up-to-date every single day, not just at month’s end.

저희와 함께 그 잠재력을 발휘해 보세요 Puzzle IO 튜토리얼.

우리의 의견

재정 관리를 간소화할 준비가 되셨나요? Puzzle io가 어떻게 한 달에 최대 20시간을 절약해 줄 수 있는지 확인해 보세요. 지금 바로 차이를 경험해 보세요!

주요 이점

Puzzle IO는 비즈니스의 미래 방향을 파악하는 데 있어 정말 탁월한 도구입니다.

- 92% 사용자들은 재무 예측 정확도가 향상되었다고 보고합니다.

- 현금 흐름에 대한 실시간 정보를 얻으세요.

- 다양한 재무 시나리오를 손쉽게 생성하여 계획을 세울 수 있습니다.

- 팀원들과 원활하게 협업하여 재무 목표를 달성하세요.

- 핵심성과지표(KPI)를 한 곳에서 추적하세요.

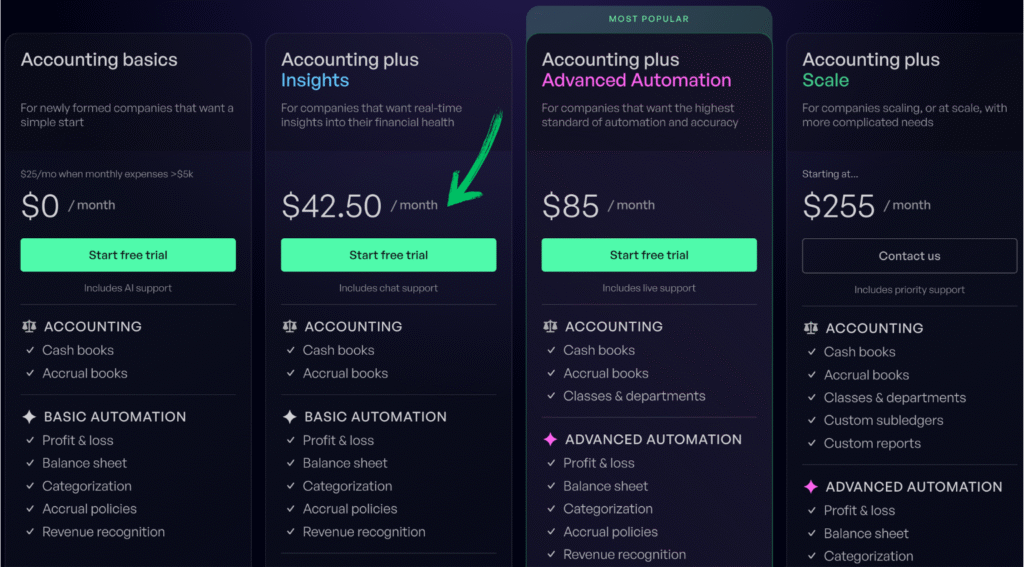

가격

- 회계 기초: 월 0달러.

- 회계 플러스 인사이트: 월 42.50달러.

- 회계 및 고급 자동화 기능: 월 85달러.

- Accounting Plus 규모: 월 255달러.

장점

단점

3. 제로(⭐4.0)

Xero is a well-known name in the 회계 산업.

Their AI-powered features, like the Financial Superagent JAX, help automate bank reconciliations and data entry.

JAX learns your business rhythms to 만들다 smart suggestions.

The system uses NLP to understand your queries and provide actionable insights.

저희와 함께 그 잠재력을 발휘해 보세요 Xero 튜토리얼.

우리의 의견

200만 개 이상의 기업에 합류하세요 Xero를 사용하여 회계 소프트웨어. 강력한 청구서 발행 기능을 지금 바로 확인해 보세요!

주요 이점

- 자동 은행 계정 조정

- 온라인 청구 및 결제

- 청구서 관리

- 급여 연동

- 보고 및 분석

가격

- 기동기: 월 29달러.

- 기준: 월 46달러.

- 프리미엄: 월 69달러.

장점

단점

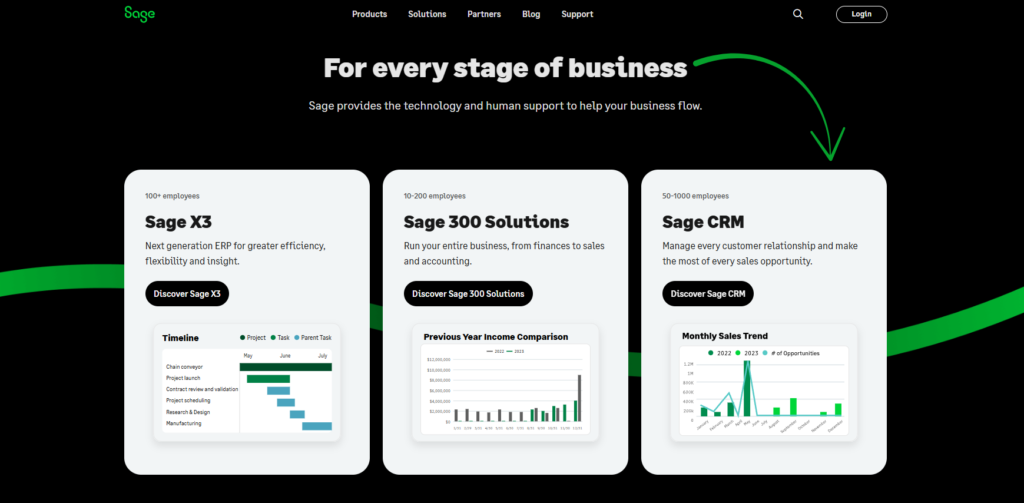

4. 세이지(⭐️3.8)

Sage is a comprehensive platform for managing business finances.

Sage AI, especially through Sage Copilot, streamlines financial processes.

It uses AI to automate tasks like invoice ingestion and duplicate detection.

This technology provides predictive analytics to help you with cash flow and 보고.

It’s a great choice for firms looking for robust data analysis and 오토메이션.

저희와 함께 그 잠재력을 발휘해 보세요 세이지 튜토리얼.

우리의 의견

재무 관리를 한 단계 업그레이드할 준비가 되셨나요? Sage 사용자들은 평균 73%의 생산성 향상과 75%의 프로세스 처리 시간 단축을 경험했다고 보고했습니다.

주요 이점

- 자동 청구 및 결제

- 실시간 재무 보고서

- 데이터를 보호하기 위한 강력한 보안

- 다른 비즈니스 도구와의 통합

- 급여 및 인사 관리 솔루션

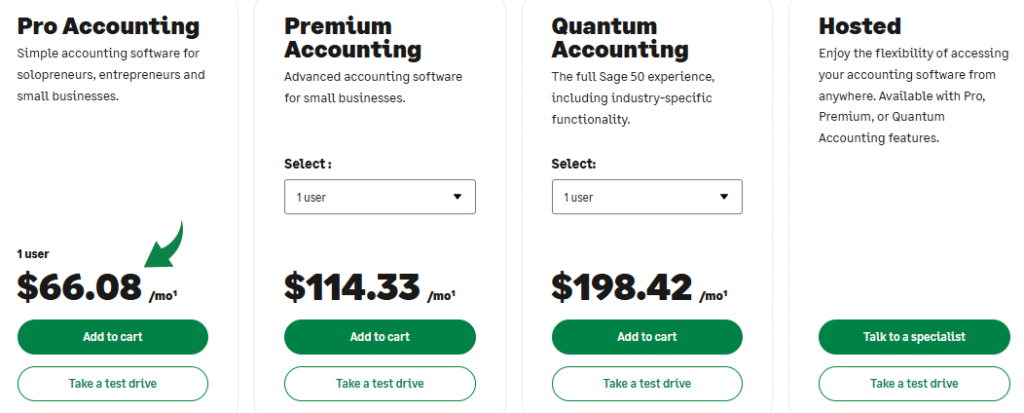

가격

- 전문 회계: 월 66.08달러.

- 프리미엄 회계: 월 114.33달러.

- 양자 회계: 월 198.42달러.

- 인사 및 급여 패키지: 고객의 요구사항에 따른 맞춤 가격 책정.

장점

단점

5. 스나이더(⭐3.6)

Synder helps you sync transactions from various e-commerce and payment platforms.

It uses AI technology to automate data entry and reconciliation, making it a powerful tool for businesses that sell online.

This allows you to easily analyze financial data from multiple sources.

It’s all about bringing your data together and making sense of it.

저희와 함께 그 잠재력을 발휘해 보세요 Synder tutorial.

우리의 의견

Synder는 회계 업무를 자동화하여 매출 데이터를 QuickBooks와 원활하게 동기화합니다. 제로그 외에도 다양한 이점이 있습니다. Synder를 사용하는 기업들은 평균적으로 주당 10시간 이상을 절약한다고 보고합니다.

주요 이점

- 자동 판매 데이터 동기화

- 다채널 판매 추적

- 지불 대조

- 재고 관리 통합

- 상세 판매 보고서

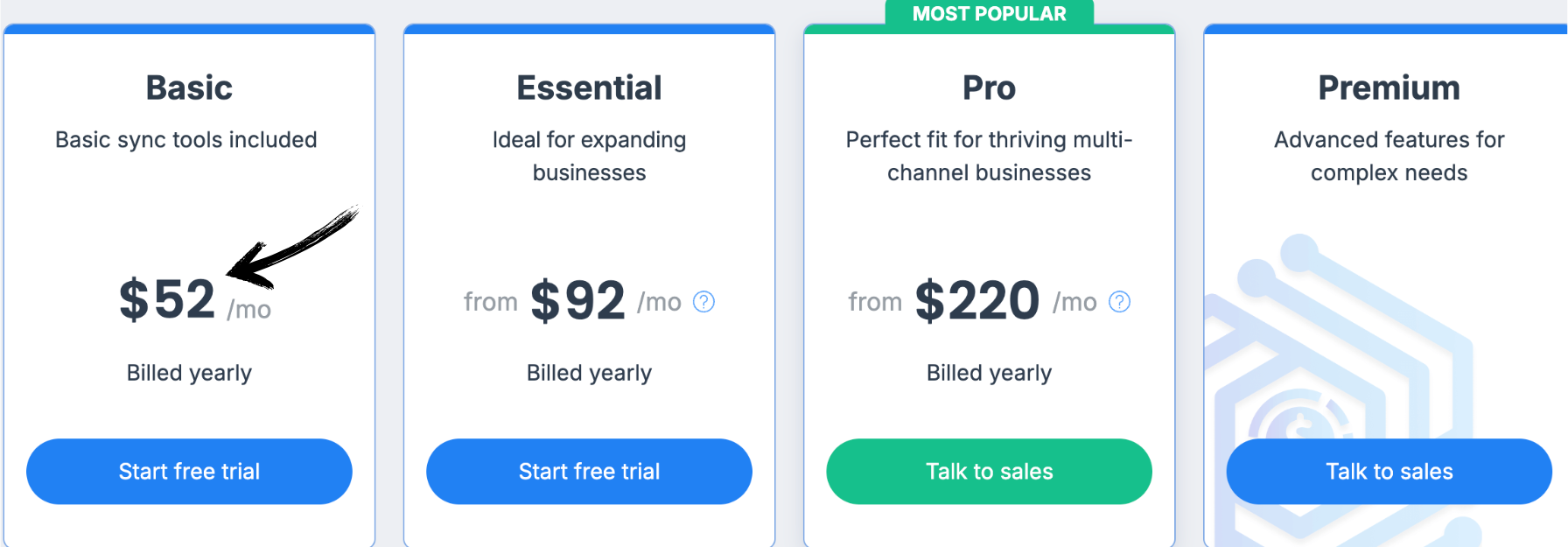

가격

모든 계획은 다음과 같습니다. 연간 청구.

- 기초적인: 월 52달러.

- 필수적인: 월 92달러.

- 찬성: 월 220달러.

- 프리미엄: 맞춤형 가격 책정.

장점

단점

6. 쉬운 월말 정산 (⭐3.4)

Easy Month End is designed to simplify the most painful part of accounting—the month-end close.

It uses natural language processing to help 회계 professionals automate repetitive tasks.

This AI technology helps organize and process financial data.

It’s a lifesaver for anyone who dreads the end-of-the-month scramble.

저희와 함께 그 잠재력을 발휘해 보세요 간편한 월말 결산 튜토리얼.

우리의 의견

Easy Month End로 재무 정확도를 높이세요. 자동화된 대조 및 감사 준비 보고서를 활용하십시오. 맞춤형 데모를 예약하여 월말 결산 프로세스를 간소화하세요.

주요 이점

- 자동화된 조정 워크플로

- 작업 관리 및 추적

- 분산 분석

- 문서 관리

- 협업 도구

가격

- 기동기: 월 24달러.

- 작은: 월 45달러.

- 회사: 월 89달러.

- 기업: 맞춤형 가격 책정.

장점

단점

7. 리프레시미(⭐️3.2)

RefreshMe is a personal finance tool with a strong AI assistant.

While it’s geared towards personal use, its features can easily be applied by real estate agents.

The AI analyzes financial data, tracks spending, and offers personalized insights.

It helps you keep an eye on your expenses and manage your budget effortlessly.

저희와 함께 그 잠재력을 발휘해 보세요 Refreshme 튜토리얼.

우리의 의견

RefreshMe의 강점은 실시간으로 실행 가능한 인사이트를 제공하는 데 있습니다. 하지만 가격 정보가 공개되지 않았고 핵심 회계 기능이 다소 부족할 수 있다는 점은 일부 사용자에게 고려 사항이 될 수 있습니다.

주요 이점

- 실시간 재무 대시보드

- AI 기반 이상 탐지

- 맞춤형 보고서

- 현금 흐름 예측

- 성능 벤치마킹

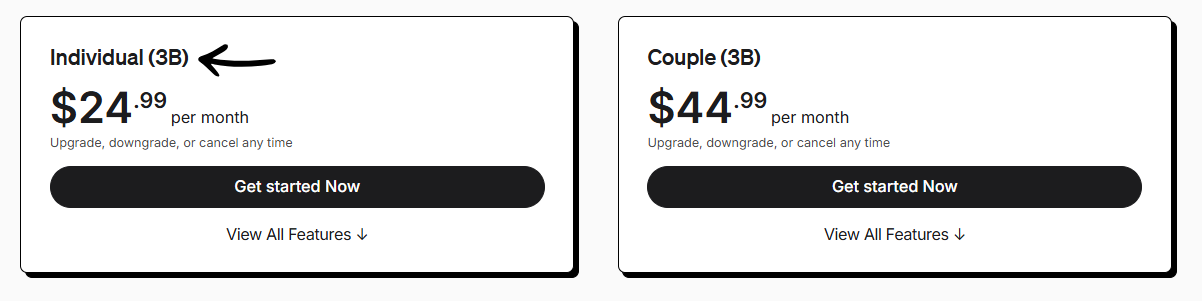

가격

- 개인(3B): 월 24.99달러.

- 커플 (3B): 월 44.99달러.

장점

단점

8. 퀵북스(⭐3.0)

QuickBooks has been a staple for years, and now it’s getting even smarter with AI.

Their AI agents work behind the scenes to help with everything from categorizing transactions to reconciling accounts.

This artificial intelligence makes financial processes smoother.

It’s designed to give you more accurate data and streamline your day-to-day 회계.

저희와 함께 그 잠재력을 발휘해 보세요 QuickBooks 튜토리얼.

주요 이점

- 자동 거래 분류

- 송장 생성 및 추적

- 비용 관리

- 급여 서비스

- 보고 및 대시보드

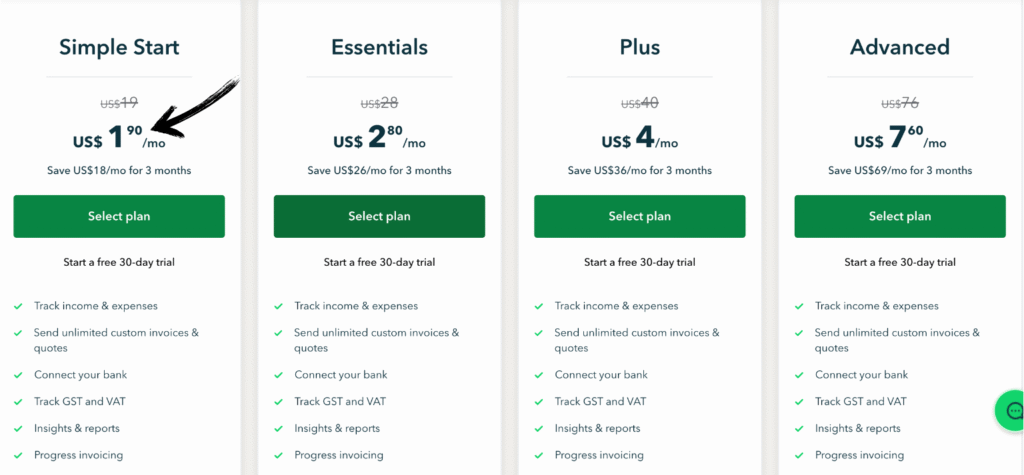

가격

- 간단한 시작: 월 1.90달러.

- 필수적인: 월 2.80달러.

- 을 더한: 월 4달러.

- 고급의: 월 7.60달러.

장점

단점

9. 도시트(⭐2.8)

Docyt’s AI engine is built for precision. It’s a great tool for accounting firms and individual professionals.

This platform uses AI technology to automate complex 부기 워크플로우.

It can process financial data, generate analytics, and even detect anomalies.

It’s all about giving you cleaner financials with less manual work.

저희와 함께 그 잠재력을 발휘해 보세요 Docyt 튜토리얼.

주요 이점

- AI 기반 자동화: Docyt는 인공지능을 활용하여 금융 문서에서 데이터를 자동으로 추출합니다. 여기에는 10만 개 이상의 공급업체 정보가 포함됩니다.

- 실시간 회계: 실시간으로 장부를 업데이트하여 언제든지 정확한 재무 상태를 파악할 수 있도록 합니다.

- 문서 관리: 모든 재무 문서를 한곳에 모아 관리할 수 있습니다. 간편하게 검색하고 접근할 수 있습니다.

- 청구서 결제 자동화: 청구서 납부 과정을 자동화합니다. 간편하게 청구서를 예약하고 납부하세요.

- 경비 상환: 직원 경비 청구 절차를 간소화합니다. 경비를 신속하게 제출하고 승인하세요.

- 원활한 통합: 널리 사용되는 회계 소프트웨어와 연동됩니다. 여기에는 다음이 포함됩니다. 퀵북스 그리고 제로.

- 사기 탐지: 이 회사의 AI는 비정상적인 거래를 식별하는 데 도움을 줄 수 있습니다. 이는 보안을 한층 강화하는 요소입니다. 보안소프트웨어에 대한 특정 보증은 없지만 지속적인 업데이트가 제공됩니다.

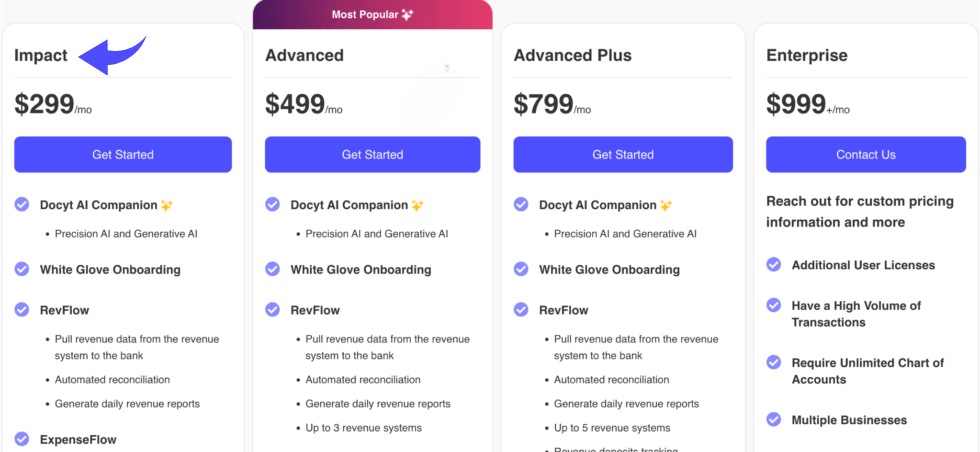

가격

- 영향: 월 299달러.

- 고급의: 월 499달러.

- 고급의 을 더한: 월 799달러.

- 기업: 월 999달러.

장점

단점

What Real Estate Agents need in an Accounting Software?

When you’re an agent, you want a tool that works for you, not the other way around.

Choosing the right AI accounting software is a crucial step for your business.

So, what features should you be on the lookout for?

- Automation is key. The whole point of using AI in accounting is to save time. Look for softwares that use machine learning algorithms & robotic process automation to handle repetitive tasks like data entry and expense reports. These features should reduce the risk of human error and free you up for more important work.

- Predictive insights matter. The best accounting AI goes beyond just recording what happened. It should be able to analyze financial data to help with financial planning and forecasting. A good system will give you the insights you must need to make smart & strategic business decisions.

- It needs to handle real estate specifics. Your accounting processes are different from a typical business. Look for software that understands the unique aspects of your internal accounting processes, like commission tracking, property expenses, and complex financial statements.

- Don’t forget about tax compliance. Nobody loves tax season. The right software can make it a breeze by using AI to track deductions and prepare financial reporting. This helps you stay on top of tax compliance without a headache.

- Integration is non-negotiable. The software should play nicely with other tools you already use, like your CRM or bank accounts. Seamless integration means less manual work and a more efficient workflow for finance and accounting professionals.

- Security is a priority. When you’re dealing with sensitive financial data, then the security is paramount. Make sure the tool has wide security measures in place to prevent hackers & protect your information.

- Don’t worry, AI won’t replace accountants entirely. It’s a tool, not a replacement. AI can handle the tedious, number-crunching parts of your work, leaving you to focus on the human side of your business.

How Can Real Estate Agents Benefit from Using Accounting Software?

Using AI accounting tools can truly change how you run your business.

These tools are designed to automate repetitive accounting tasks that take up so much of your day.

This includes everything from data management to managing accounts payable.

By letting the AI software handle these tasks, you free up a ton of time.

This means you can focus on what you do best: helping clients and growing your business.

These tools don’t just automate; they also give you a clear view of your business’s financial health.

They use predictive analytics by analyzing historical data to help you with financial planning.

This helps businesses manage their finances better & makes smarter decisions.

While some might worry about AI replacing accountants, the truth is that AI accounting tools are here to help, not replace.

They make your financial operations smoother and help reduce human error.

You get to spend less time on paperwork and more time on the parts of your job that you love.

구매자 가이드

We know how important it is to choose the right accounting system.

To help you make the best decision, we conducted our research based on several key factors.

We wanted to make sure our list was comprehensive and useful for real estate professionals.

저희의 업무 과정을 살펴보겠습니다.

- 가격: We started by looking at the cost of each AI 도구. We examined pricing models to see what kind of value they offered for different budgets. It’s important to find a tool that fits your financial plan and helps you save time in the long run.

- 특징: Next, we dove into the features. We looked for AI systems that went beyond basic data entry. We paid close attention to advanced capabilities like cash flow forecasting, fraud detection, and accounting automation. We wanted to see how these accounting tools help with financial performance and risk management.

- 단점: No tool is perfect. We identified the downsides of each product. This included anything from missing features to a steep learning curve. We believe it’s important to be transparent about what you might be missing.

- 지원 및 커뮤니티: We checked to see what kind of support each product offered. Do they have a community forum, live chat, or a solid refund policy? Good support is crucial, especially when you’re dealing with important financial data.

- AI 기능: We specifically looked at how artificial intelligence (AI) was integrated. We assessed how the AI tool helps automate routine tasks & analyze data to provide valuable insights. We focused on tools that are shaping future trends in the accounting world and helping finance departments and business leaders succeed. We also considered how these tools could reduce the need for manual data entry.

마무리

The world of real estate is changing, and AI tools are leading the way.

These AI powered tools are not here to make financial professionals obsolete.

Instead, they are here to automate repetitive 부기 tasks and help your accounting team work smarter.

By providing real time insights and helping you identify patterns in your financial reports, AI helps improve cash flow and client communication.

Embracing these new business models is key to business growth.

Trust in our research and the information we’ve provided to help you find the best tool for your needs.

자주 묻는 질문

Will AI replace accountants in the real estate industry?

No, AI won’t replace accountants. It handles repetitive tasks, allowing financial professionals and accounting firms to focus on strategic advice and client communication.

How does AI analyze financial data?

AI systems use machine learning and algorithms to analyze financial data. They identify patterns, automate data entry, and provide real-time insights to improve financial performance.

What kind of accounting industry tasks can AI tools automate?

AI tools automate a range of tasks, including invoice processing, bank reconciliation, expense categorization, and generating financial reports, which saves significant time.

Is AI accounting software secure?

Yes. Most AI accounting tools use advanced security measures like data encryption and secure logins to protect sensitive financial data, ensuring privacy and compliance.

How can AI benefit a small real estate business?

AI helps small businesses manage their finances efficiently by automating tasks, reducing human error, and offering valuable insights for smart decisions and business growth.