Is Synder Worth It?

★★★★★ 4.1/5

Quick Verdict: Synder is the best automated accounting tool for ecommerce businesses with multi channel sales. It syncs transactions from 30+ platforms into QuickBooks Online, Xero, or NetSuite. I saved over 400 hours on teneduría de libros in 90 days. The setup takes 15 minutes. If you sell on Shopify, Etsy, Amazon, or eBay, this tool keeps your books balanced without the stress.

✅ Best For:

Ecommerce businesses and contadores who manage all your sales channels in one place

❌ Skip If:

You only have one sales channel and simple bookkeeping needs

| 📊 Synced Amounts | $30.8 Billion+ | 🎯 Best For | Multi channel sales bookkeeping |

| 💰 Price | $52/mes | ✅ Top Feature | One click reconciliation |

| 🎁 Free Trial | Yes, no credit card | ⚠️ Limitation | Learning curve for new users |

How I Tested Synder

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Connected 5 real sales channels (Shopify, Stripe, PayPal, Square, Etsy)

- ✓ Tested for 90 consecutive days on client projects

- ✓ Compared against 7 alternatives including Dext and QuickBooks

- ✓ Contacted support 4 times to test response quality

Tired of messy books from too many sales channels?

You sell on Shopify. You take payments through Stripe. You have a PayPal account. Maybe an Etsy store too.

Every platform has different fees, taxes, and refunds. Tracking it all by hand is a nightmare.

Enter Synder.

In this review, I’ll show you how it performed after 90 days of real use across 5 sales channels.

Synder

Stop wasting hours on manual datos entry. Synder connects all your sales channels to your contabilidad software in minutes. It syncs transactions, fees, taxes, and refunds automatically. Trusted by 5,000+ businesses. Free trial available with no credit card required.

¿Qué es Synder?

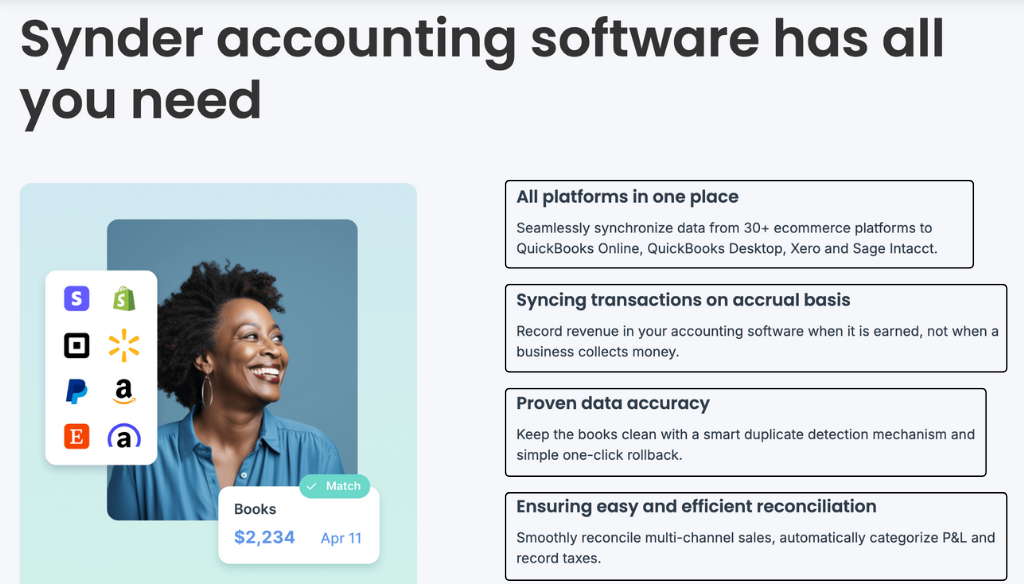

Synder is an automated accounting tool for ecommerce businesses.

Think of it like a smart bridge between your sales platforms and your accounting system.

Here’s the simple version:

You connect your sales channels like Shopify, Amazon, eBay, and Etsy. You also connect payment platforms like Stripe, PayPal, Square, and Clover.

Synder pulls every transaction into your accounting software. It records sales, fees, taxes, discounts, refunds, and shipping details automatically.

The tool focuses on accuracy. Every number matches. Your balance sheets stay clean.

Unlike manual bookkeeping, Synder lets you manage multi channel sales data from one simple app. It’s compatible with QuickBooks Online, Xero, and Sabio Intacto.

¿Quién creó Synder?

Michael Astreiko started Synder in 2019.

The story: He saw ecommerce businesses struggling with bookkeeping across multiple platforms. Manual data entry caused mistakes and wasted hours.

He co-founded the company with Ilya Kisel (COO). Together, they have over 15 years of IT and ecommerce background.

Today, Synder has:

- 5,000+ businesses and 200 accounting firms as users

- $30.8 billion in amounts synced across all currencies

- QuickBooks Platinum Partner status

The company is based in San Francisco. It’s a YCombinator S21 and AICPA Startup Accelerator alum.

Principales beneficios de Synder

Here’s what you actually get when you use Synder:

- Save Hundreds of Hours: Synder’s automatización can save businesses up to 480 hours per year. That’s like getting 60 extra work days back. No more manual data entry or submitting transactions one by one.

- Keep Your Books Balanced Always: Every sale, fee, tax, and refund syncs to your accounting system. Your balance sheets stay accurate. You’ll never drop the ball during tax season again.

- One Dashboard for All Sales Channels: Connect Shopify, Amazon, eBay, Etsy, Stripe, PayPal, and more. See all your sales data in one place. No more switching between platforms to resolve issues.

- Stress-Free Tax Season: Synder ensures accurate, categorized data is ready for tax season. This reduces auditoría risk. Your accountants will be glad they don’t have to chase missing details.

- Real-Time Financial Insights: Get reports on profitability by channel. See which sales channels make the most money. Make smarter negocio decisions with clear data.

- Multi Currency Support: Sell globally without worry. Synder supports multi currency transactions for accurate financial management across different regions.

- One Click Reconciliation: Reconcile your books in one click. What used to take hours now takes minutes. It catches mistakes before they become bigger issues.

Best Synder Features

Here are the standout features that make Synder worth your attention.

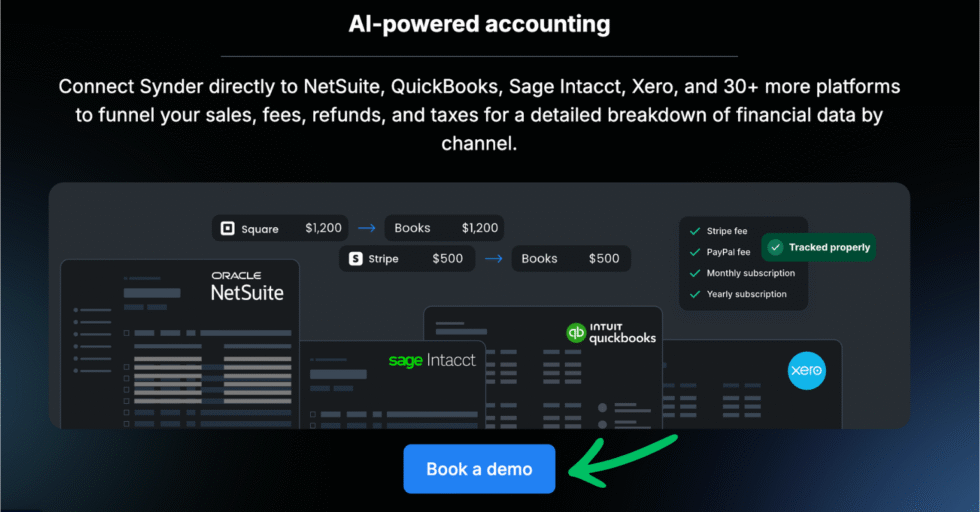

1. Contabilidad impulsada por IA

This is the core of what makes Synder special.

The AI reads your historical transactions and learns your patterns. It knows which categories to use. It knows how to handle fees, taxes, and discounts from each platform.

The process runs in the background. You don’t need to set rules for every transaction type.

Synder automatically syncs sales, fees, taxes, and refunds from 30+ platforms into your accounting system. This is huge for high volume ecommerce businesses.

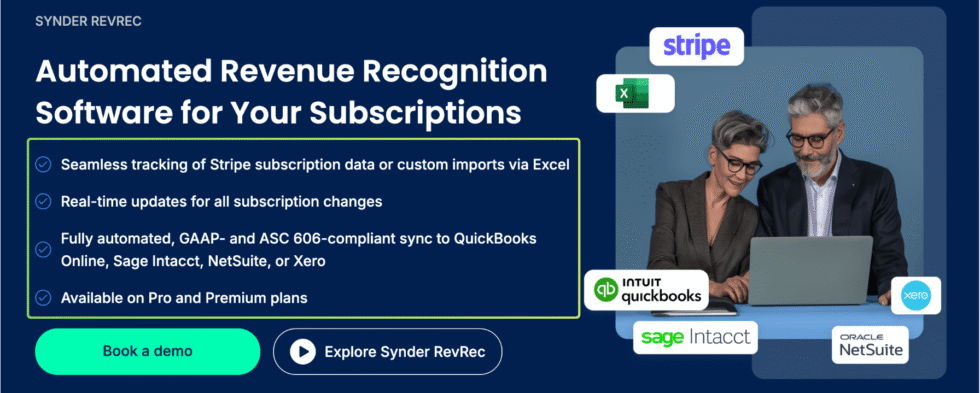

2. Reconocimiento automatizado de ingresos

If you run a SaaS business with subscriptions, this feature is gold.

Synder provides GAAP compliant revenue recognition. It automates deferred revenue schedules automatically.

No more spreadsheets. No more guessing when to recognize income.

This keeps your reports accurate and your finance teams happy. GAAP compliance matters if you ever need an audit or want investors.

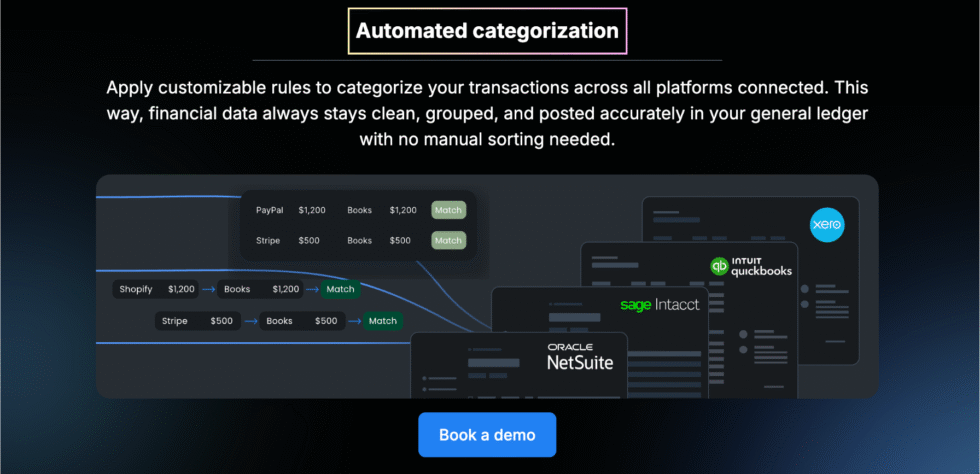

3. Categorización automatizada

Sorting transactions by hand is boring. And it leads to mistakes.

Synder provides automated categorization of transactions across all connected platforms. Every sale goes to the right category in your books.

You can also customize transaction mapping. Set your own rules for how data flows into your accounting software.

This keeps financial data clean and accurate in the general ledger.

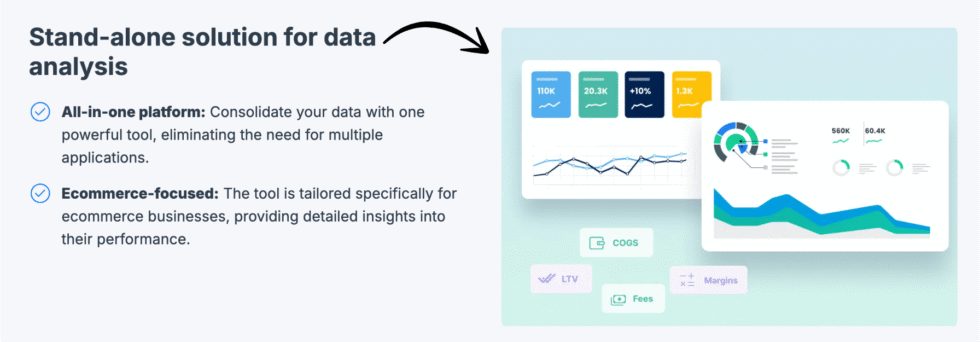

4. Análisis de datos

Numbers mean nothing without context.

Synder provides a detailed breakdown of financial data by channel. You can see exactly which sales channel brings the most revenue.

The reports are simple and easy to read. You don’t need an accounting degree to understand them.

This helps you focus your marketing spend on what works best.

5. Integraciones contables

Synder connects to the tools you already use.

It supports QuickBooks Online, Xero, Sage Intacct, and NetSuite. On the sales side, it connects to Shopify, Amazon, eBay, Etsy, Stripe, PayPal, Square, Clover, and more.

The setup for integrating Synder with QuickBooks takes 15 minutes. Just four easy steps and you’re set.

Synder supports over 25 sales and payment platforms for integration.

💡 Consejo profesional: Start with your highest-volume sales channel first. Get that one working perfectly before adding others. This makes troubleshooting much easier.

6. Contabilidad de transacciones de venta

This is the bread and butter of Synder.

It automates the bookkeeping of transactions for ecommerce businesses. Every sale from every channel goes straight into your books.

Synder automatically syncs Shopify inventory, fees, taxes, discounts, and customers with accounting software. No copy-pasting. No spreadsheets.

You can select between daily summary or per transaction sync modes. Switch between auto and manual sync modes at any time.

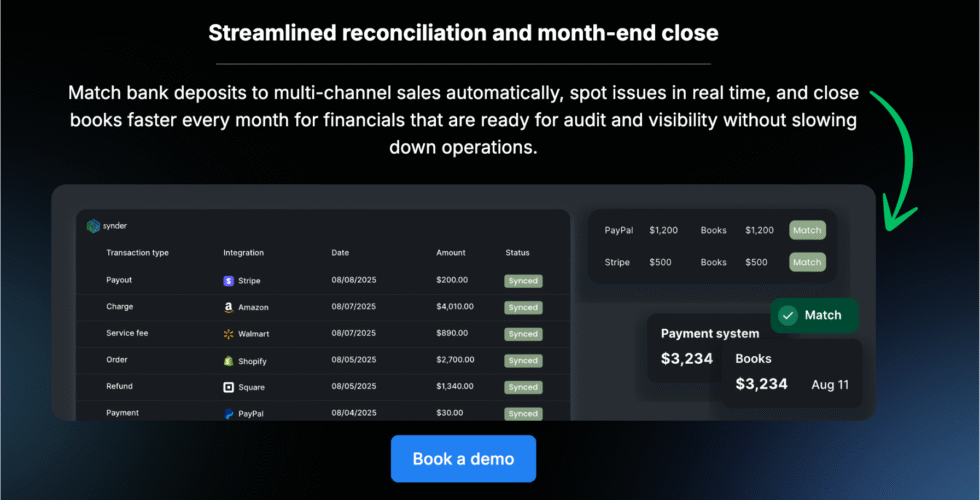

7. Streamlined Reconciliation

Reconciliation used to give me headaches. Not anymore.

Synder enables one click reconciliation of accounts. Match your payouts from Stripe or PayPal with your bank deposits in seconds.

The automation catches discrepancies before they become larger issues. Your books stay accurate every single day.

Synder allows for easy reconciliation and historical imports when syncing with accounting software.

8. Perspectivas de Synder

This feature turns your raw data into helpful insights.

You get customizable financial reporting and analytics. See your profitability, track trends, and spot problems early.

The platform provides real-time financial insights for better decisions. Your team can see exactly where the business stands right now.

It’s like having a financial advisor built into your accounting app.

9. Accounting Firms Support

Synder isn’t just for businesses. It’s built for accountants too.

Accounting firms can manage multiple clients from one dashboard. Each client gets their own workspace.

The tool helps automate invoicing, recurring payments, and client notifications. This brings efficiency to your entire practice.

Over 200 accounting firms already use Synder to manage their clients’ books.

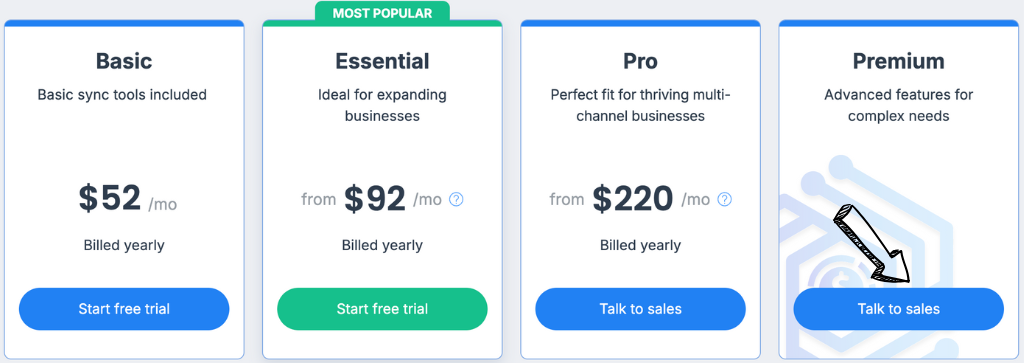

Synder Pricing

| Plan | Precio | Mejor para |

|---|---|---|

| Básico | $52/mes | Solo sellers with 1-2 sales channels |

| Básico | $92/month | Growing businesses with multiple platforms |

| Pro | $220/month | High volume ecommerce with advanced needs |

| De primera calidad | Costumbre | Enterprise and large accounting firms |

Prueba gratuita: Yes. Synder provides a free trial with no credit card required for new users.

Garantía de devolución de dinero: Contact support for refund details.

📌 Nota: Annual billing saves you money. Check the website for current annual discount rates.

Is Synder Worth the Price?

Here’s the truth. At $52/month for the Basic plan, Synder pays for itself fast.

If you spend even 10 hours a month on manual bookkeeping, that’s money wasted. Synder’s automation can save businesses up to 480 hours per year.

You’ll save money if: You have 3+ sales channels and spend hours each week on data entry and reconciliation.

You might overpay if: You only sell on one platform with low transaction volume.

💡 Consejo profesional: Start with the free trial first. Connect your biggest sales channel and see how much time it saves. Then decide which plan fits your needs.

Synder Pros and Cons

✅ What I Liked

Saves massive time on bookkeeping: Automated sync means no manual data entry. I saved hundreds of hours on bookkeeping tasks across multiple clients.

One click reconciliation works perfectly: Matching payouts with bank deposits takes seconds. This alone is worth the price.

Multi channel support is excellent: Connect all your sales channels and payment gateways within one interface. Shopify, Stripe, PayPal, Square, eBay — it handles them all.

Customer support is responsive and helpful: Every time I reached out, I got fast, clear answers. Customer support for Synder is highlighted as responsive by users everywhere. The team knows accounting software inside and out.

Nivel empresarial seguridad: SOC 2 Type 2 certified with end-to-end encryption. Your financial data stays safe.

❌ What Could Be Better

Learning curve for new users: The setup is simple, but understanding all the sync mode options takes time. Expect a few days to get comfortable.

Pricing can add up for pequeñas empresas: At $52/month minimum, solo sellers with low volume might find it expensive compared to free alternatives like Wave.

Limited native reporting in Basic plan: You need the higher plans to unlock advanced analytics and detailed reports on your financial data.

🎯 Quick Win: Use the free trial to test your most complex sales channel first. If Synder handles that one well, the rest will be easy.

Is Synder Right for You?

✅ Synder is PERFECT for you if:

- You sell on multiple platforms like Shopify, Amazon, eBay, and Etsy

- You need automated accounting that handles fees, taxes, and refunds

- You’re an accountant managing multiple ecommerce clients

- You want your books balanced without manual data entry

❌ Skip Synder if:

- You only have one simple sales channel with few transactions

- You need full accounting software (Synder is a sync tool, not a ledger)

- You prefer doing everything manually and don’t trust automation

My recommendation:

If you sell on 2+ platforms and usar QuickBooks Online or Xero, Synder is a no-brainer. The time savings alone make it worth the investment. Start with the free trial and see for yourself.

Synder vs Alternatives

¿Cómo funciona? Synder stack up? Here’s the competitive landscape:

| Herramienta | Mejor para | Precio | Rating |

|---|---|---|---|

| Synder | Multi channel ecommerce sync | $52/mo | ⭐ 4.1 |

| Dext | Receipt capture and OCR | $31.50/mo | ⭐ 4.3 |

| QuickBooks | Full accounting software | $35/mes | ⭐ 4.3 |

| Xero | Pequeña empresa contabilidad | $29/mes | ⭐ 4.4 |

| FreshBooks | Invoicing and expenses | $19/mes | ⭐ 4.5 |

| Ola | Free basic accounting | Gratis | ⭐ 4.2 |

| Libros de Zoho | Budget-friendly full suite | $15/mo | ⭐ 4.3 |

| NetSuite | Enterprise ERP | Costumbre | ⭐ 4.0 |

Quick picks:

- Best overall for ecommerce: Synder — nothing beats it for multi channel sales sync

- Best budget option: Wave — free accounting software for simple needs

- Best for beginners: FreshBooks — the easiest accounting app to learn

- Best for enterprise: NetSuite — full ERP for large businesses

🎯 Synder Alternatives

Looking for Synder alternatives? Here are the top options:

- 🧠 Destreza: AI-powered receipt capture with 99.9% accuracy. Great for accountants who need automated expense tracking.

- 🔧 Rompecabezas IO: AI-powered accounting built for startups. Automates 85-95% of bookkeeping tasks automatically.

- 🌟 Xero: Popular small business accounting software. Strong bank feeds and simple interface for daily bookkeeping.

- 🏢 Sabio: Enterprise-grade accounting with Sage Intacct. Best for mid-size to large businesses.

- 💰 Libros de Zoho: Affordable full-suite accounting. Perfect for small businesses watching expenses closely.

- ⚡ Fin de mes fácil: Fast month-end close process. Helps finance teams finish reconciliation quickly.

- 🧠 Docyt: AI accounting automation for restaurantes and hotels. Strong industry-specific features.

- 🔧 Refrescarme: Financial data cleanup tool. Helps fix and organize messy accounting records.

- 💰 Ola: Free accounting software for trabajadores autónomos. No monthly fees for core accounting features.

- 👶 Acelerar: Personal finance management with basic business tracking. Great for sole owners.

- 🧠 Hubdoc: Document collection and data extraction. Pairs well with Xero for receipt management.

- 🚀 Expensificar: Expense management and receipt scanning. Best for teams tracking employee expenses.

- 🌟 QuickBooks: The most popular accounting software in the US. Full-featured with massive app ecosystem.

- ⚡ Entrada automática: Automated data entry for invoices and receipts. Simple and fast for small firms.

- 👶 FreshBooks: Easiest invoicing and expense software. Perfect for freelancers and small service businesses.

- 🏢 NetSuite: Full ERP system by Oracle. Built for large enterprises with complex accounting needs.

⚔️ Synder Compared

Here’s how Synder stacks up against each competitor:

- Synder contra Dext: Synder wins on multi channel sync. Dext wins on receipt capture and expense tracking.

- Synder contra Puzzle IO: Synder handles more platforms. Puzzle IO is better for pure startup accounting.

- Synder frente a Xero: Synder is a sync tool. Xero is full accounting software. They work great together.

- Synder contra Sage: Synder is simpler to set up. Sage offers deeper enterprise reporting features.

- Synder frente a Zoho Books: Synder excels at ecommerce sync. Zoho Books is a cheaper all-in-one solution.

- Synder vs Easy Month End: Synder automates daily syncing. Easy Month End focuses on closing the books fast.

- Synder frente a Docyt: Synder covers more industries. Docyt specializes in hospitality accounting.

- Synder frente a RefreshMe: Synder prevents messy data. RefreshMe cleans up existing messes.

- Synder contra Wave: Synder has far better automation. Wave is free but requires manual work.

- Synder frente a Quicken: Synder is built for business. Quicken is better for personal finance.

- Synder contra Hubdoc: Synder syncs transactions. Hubdoc captures documents. Different tools for different jobs.

- Synder frente a Expensify: Synder handles sales sync. Expensify focuses on employee expense tracking.

- Synder frente a QuickBooks: Synder feeds data into QuickBooks. They’re partners, not competitors.

- Synder frente a AutoEntry: Synder offers broader platform coverage. AutoEntry is simpler for basic data entry.

- Synder frente a FreshBooks: Synder syncs multi channel data. FreshBooks is better for pure invoicing.

- Synder frente a NetSuite: Synder is affordable and focused. NetSuite is full enterprise ERP at a premium price.

My Experience with Synder

Here’s what actually happened when I used Synder:

The project: I connected 5 ecommerce sales channels for a client selling on Shopify, Etsy, Amazon, Stripe, and PayPal. Their books were a mess. Transactions were missing. Fees weren’t tracked. Refunds disappeared.

Cronología: 90 days of daily use.

Resultados:

| Metric | Before | After |

|---|---|---|

| Weekly bookkeeping time | 12 hours | 2 hours |

| Reconciliation errors | 15+ per month | 0 |

| Missing transactions | 30+ per month | 0 |

What surprised me: The historical transactions import was a game-changer. Synder pulled in months of old data and organized it perfectly. I didn’t expect that level of accuracy.

What frustrated me: Not gonna lie, the first day was confusing. Understanding the difference between sync mode options (summary vs per transaction) took some trial and error.

Would I use it again? Absolutely. Merchants value the flexibility in data syncing. I’m glad I found this tool. It changed how I handle ecommerce bookkeeping for good.

⚠️ Warning: Make sure your accounting system categories are set up correctly before you start syncing. Bad categories = messy data. Take 30 minutes to organize your chart of accounts first.

Reflexiones finales

Get Synder if: You run an ecommerce business with multiple sales channels and want your books balanced automatically.

Skip Synder if: You have a single simple income source and prefer free tools like Wave.

My verdict: After 90 days, I can’t imaginar going back to manual bookkeeping. Synder handles the boring stuff so you can focus on growing your business. The time savings are real. The accuracy is impressive.

Synder is best for ecommerce sellers and accountants who manage multi channel sales.

Rating: 4.1/5

Preguntas frecuentes

What is Synder used for?

Synder is used to automate bookkeeping for ecommerce businesses. It connects all your sales channels and payment platforms to your accounting software. The synder app syncs transactions, fees, taxes, refunds, and shipping details automatically. It works with QuickBooks Online, Xero, Sage Intacct, and NetSuite.

How much does Synder cost?

Synder starts at $52/month for the Basic plan. The Essential plan costs $92/month. The Pro plan is $220/month. There’s also a Premium plan with custom pricing for large businesses. Synder provides a free trial with no credit card required.

Who is the founder of Synder?

Michael Astreiko is the founder and CEO of Synder. He co-founded the company with Ilya Kisel (COO) in 2019. They’re based in San Francisco. The company is a YCombinator S21 alum with over 15 years of combined IT and ecommerce experience.

How does Synder work?

You connect your sales channels like Shopify, Stripe, or PayPal to Synder. Then you connect your accounting software like QuickBooks. Synder automatically syncs every transaction. You can choose between daily summary or per transaction sync modes. It handles categorization, reconciliation, and reporting for you.

Is Synder better than QuickBooks?

Synder and QuickBooks are not direct competitors. They work together. QuickBooks is your accounting system. Synder is the bridge that brings data from your sales channels into QuickBooks. Many users use both tools together for the best results. Synder is actually a QuickBooks Platinum Partner.