Como un bienes raíces Agente, su tiempo es su activo más valioso.

Estás ocupado mostrando propiedades, reuniéndote con clientes y negociando acuerdos.

Lo último que quieres hacer es pasar horas enterrado en hojas de cálculo.

No está solo; muchos agentes tienen dificultades con las partes tediosas y que consumen mucho tiempo de contabilidad.

¿Qué pasaría si usted pudiera dedicar menos tiempo al papeleo y más tiempo a cerrar tratos?

La respuesta está en las herramientas adecuadas.

Este artículo lo guiará a través de los 9 mejores software de contabilidad de IA para agentes inmobiliarios en 2025, mostrándole cómo pueden transformar su negocio y devolverte tu tiempo.

¿Cuál es el mejor software de contabilidad para agentes inmobiliarios?

Eligiendo el El mejor software de contabilidad con inteligencia artificial Depende de tus necesidades.

Las herramientas adecuadas impulsadas por IA pueden optimizar los procesos comerciales e impulsar el crecimiento del negocio al brindarle una visión clara del desempeño financiero de su empresa.

Descubrirás que estas herramientas, especialmente el mejor software de gestión de gastos, manejan información relevante. datos con facilidad.

Esto le ayuda a centrarse en lo que es importante y no preocuparse: la IA no reemplazará contadores;Simplemente les hace más fácil el trabajo.

1. Dext(⭐4.8)

Dext es una herramienta poderosa para contabilidad empresas y profesionales.

Utiliza inteligencia artificial para automatizar teneduría de libros.

Puede simplemente cargar recibos y facturas, y Dext utilizará tecnología de inteligencia artificial para extraer los datos financieros.

Ahorra mucho tiempo y ayuda a reducir errores.

El análisis de datos que proporciona le ayudará a controlar mejor sus finanzas.

Desbloquea su potencial con nuestro Tutorial de Dext.

Nuestra opinión

¿Listo para recuperar más de 10 horas al mes? Descubre cómo la entrada de datos automatizada, el seguimiento de gastos y la generación de informes de Dext pueden optimizar tus finanzas.

Beneficios clave

Dext realmente brilla cuando se trata de hacer que la gestión de gastos sea muy sencilla.

- El 90% de los usuarios informan una disminución significativa en el desorden de papeles.

- Cuenta con una tasa de precisión de más del 98%. en la extracción de datos de documentos.

- Crear informes de gastos se vuelve increíblemente rápido y fácil.

- Se integra sin problemas con plataformas de contabilidad populares, como QuickBooks y Xero.

- Ayuda a garantizar que nunca pierda el rastro de documentos financieros importantes.

Precios

- Suscripción anual: $24

Ventajas

Contras

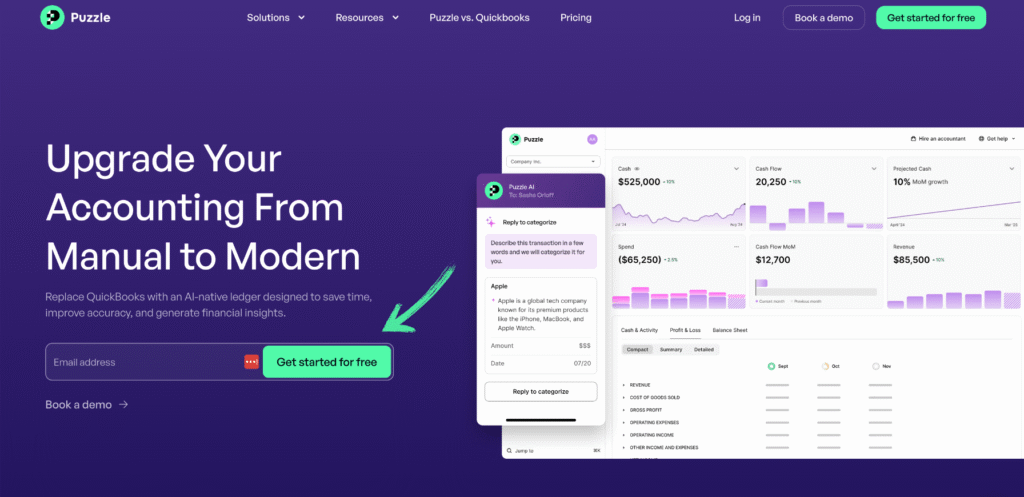

2. Rompecabezas IO (⭐4.5)

Puzzle IO está diseñado para datos financieros en tiempo real.

Este software utiliza IA para automatizar muchos procesos financieros, desde teneduría de libros para informar.

Analiza continuamente los datos financieros para detectar errores antes de que se conviertan en un problema.

Es perfecto para aquellos que quieren que sus libros sean precisos y actualizados todos los días, no sólo a fin de mes.

Desbloquea su potencial con nuestro Tutorial de Puzzle IO.

Nuestra opinión

¿Listo para simplificar tus finanzas? Descubre cómo Puzzle io puede ahorrarte hasta 20 horas al mes. ¡Descubre la diferencia hoy mismo!

Beneficios clave

Puzzle IO realmente brilla cuando se trata de ayudarle a comprender hacia dónde se dirige su negocio.

- 92% de Los usuarios informan de una mayor precisión en las previsiones financieras.

- Obtenga información en tiempo real sobre su flujo de caja.

- Cree fácilmente diferentes escenarios financieros para planificar.

- Colabore sin problemas con su equipo en los objetivos financieros.

- Realice un seguimiento de los indicadores clave de rendimiento (KPI) en un solo lugar.

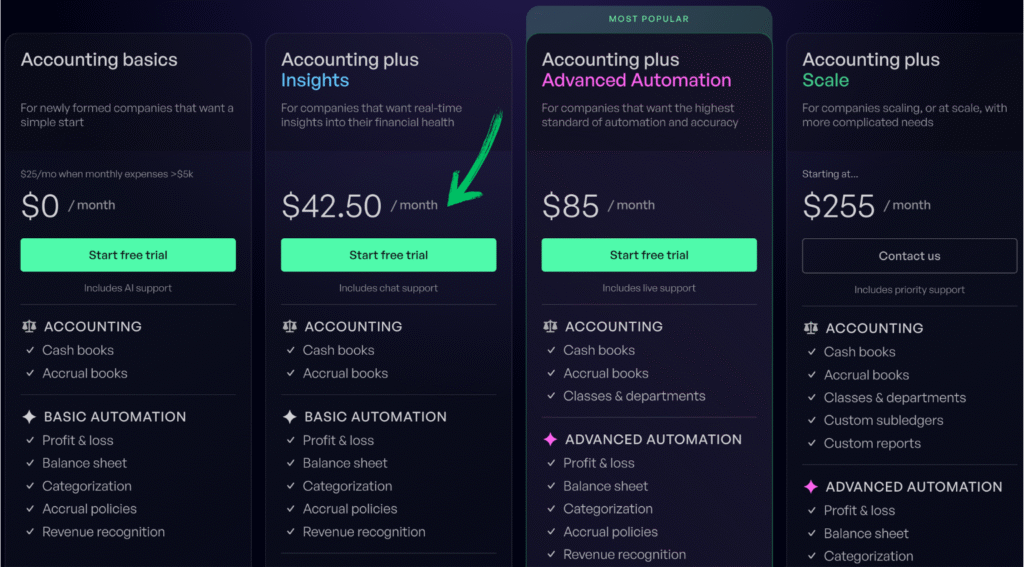

Precios

- Conceptos básicos de contabilidad: $0/mes.

- Perspectivas de contabilidad Plus: $42.50/mes.

- Contabilidad más automatización avanzada: $85/mes.

- Escala de Contabilidad Plus: $255/mes.

Ventajas

Contras

3. Xero (⭐4.0)

Xero es un nombre muy conocido en el contabilidad industria.

Sus funciones impulsadas por IA, como el Superagente Financiero JAX, ayudan a automatizar las conciliaciones bancarias y la entrada de datos.

JAX aprende los ritmos de su negocio para hacer Sugerencias inteligentes.

El sistema utiliza PNL para comprender sus consultas y brindar información útil.

Desbloquea su potencial con nuestro Tutorial de Xero.

Nuestra opinión

Únase a más de 2 millones de empresas usando Xero Software de contabilidad. ¡Explora sus potentes funciones de facturación ahora!

Beneficios clave

- Conciliación bancaria automatizada

- Facturación y pagos en línea

- Gestión de facturas

- Integración de nóminas

- Informes y análisis

Precios

- Motor de arranque: $29/mes.

- Estándar: $46/mes.

- De primera calidad: $69/mes.

Ventajas

Contras

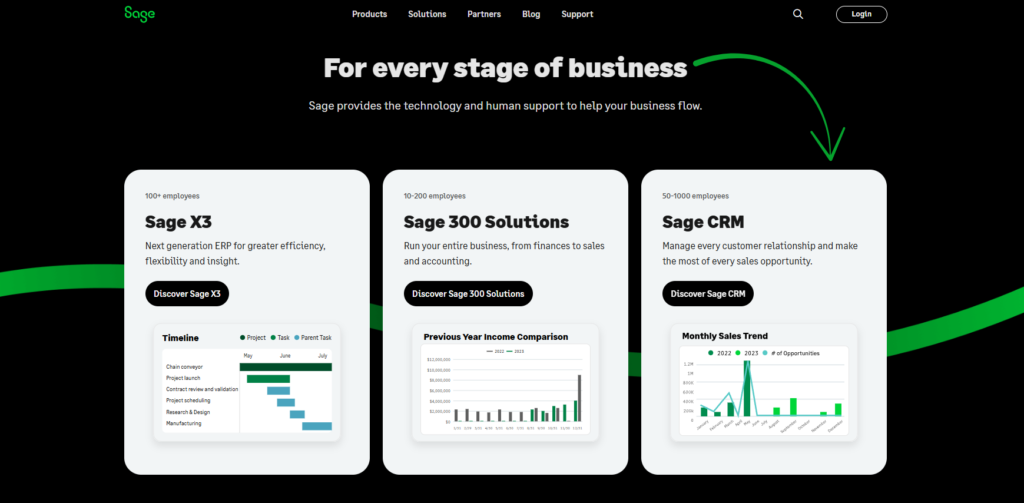

4. Salvia (⭐️3.8)

Sage es una plataforma integral para gestionar las finanzas empresariales.

Sage AI, especialmente a través de Sage Copilot, agiliza los procesos financieros.

Utiliza IA para automatizar tareas como la ingesta de facturas y la detección de duplicados.

Esta tecnología proporciona análisis predictivos para ayudarlo con el flujo de efectivo y reportando.

Es una excelente opción para empresas que buscan análisis de datos sólidos y automatización.

Desbloquea su potencial con nuestro Tutorial de Sage.

Nuestra opinión

¿Listo para optimizar tus finanzas? Los usuarios de Sage han reportado un aumento promedio del 73 % en la productividad y una reducción del 75 % en el tiempo de procesamiento.

Beneficios clave

- Facturación y pagos automatizados

- Informes financieros en tiempo real

- Fuerte seguridad para proteger los datos

- Integración con otras herramientas empresariales

- Soluciones de nómina y RRHH

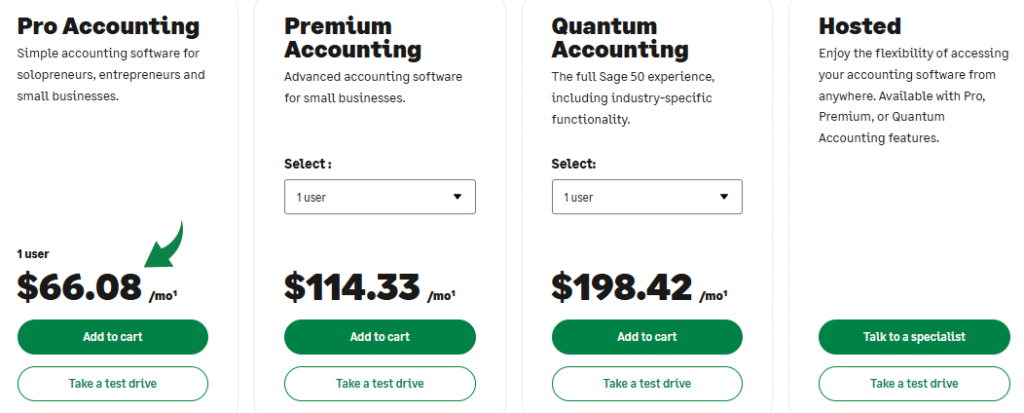

Precios

- Contabilidad profesional: $66.08/mes.

- Contabilidad Premium: $114.33/mes.

- Contabilidad cuántica: $198.42/mes.

- Paquetes de RRHH y nómina: Precios personalizados según sus necesidades.

Ventajas

Contras

5. Synder (⭐3.6)

Synder le ayuda a sincronizar transacciones de varias plataformas de pago y comercio electrónico.

Utiliza tecnología de inteligencia artificial para automatizar la entrada y conciliación de datos, lo que la convierte en una herramienta poderosa para las empresas que venden en línea.

Esto le permite analizar fácilmente datos financieros de múltiples fuentes.

Se trata de reunir sus datos y darles sentido.

Desbloquea su potencial con nuestro Synder tutorial.

Nuestra opinión

Synder automatiza su contabilidad, sincronizando los datos de ventas sin problemas con QuickBooks, XeroY más. Las empresas que utilizan Synder informan que ahorran un promedio de más de 10 horas por semana.

Beneficios clave

- Sincronización automática de datos de ventas

- Seguimiento de ventas multicanal

- Conciliación de pagos

- Integración de la gestión de inventario

- Informes de ventas detallados

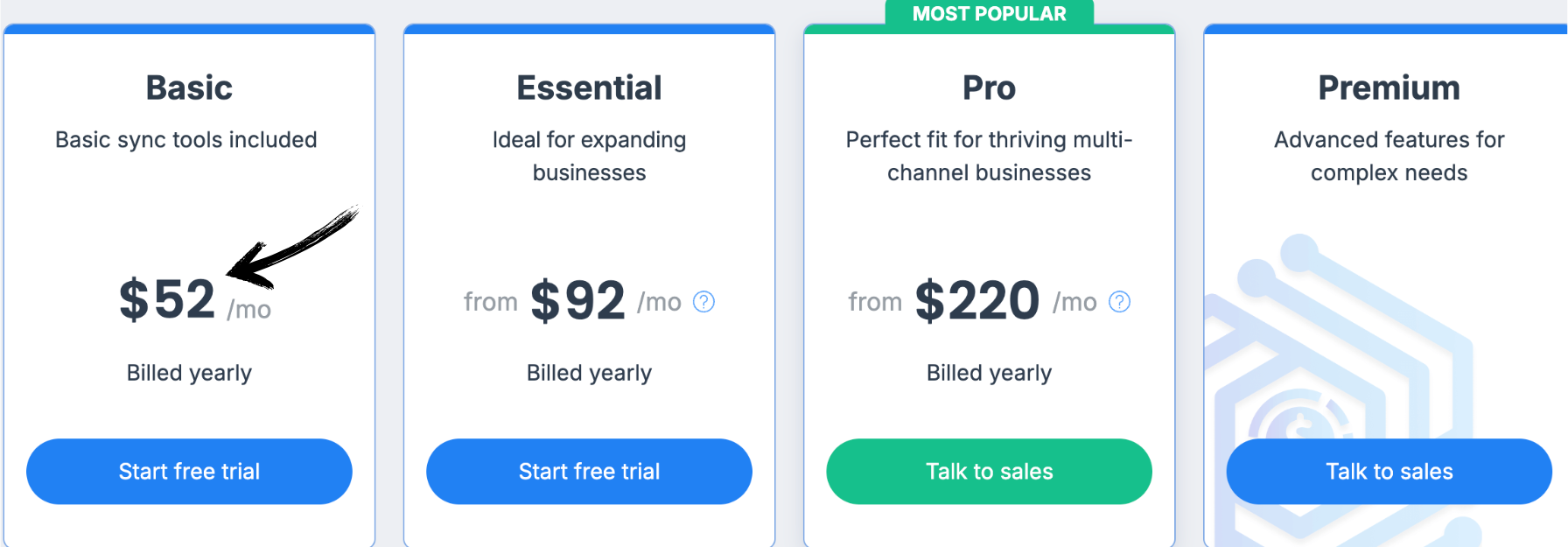

Precios

Todos los planes se cumplirán Facturado anualmente.

- Básico: $52/mes.

- Básico: $92/mes.

- Pro: $220/mes.

- De primera calidad: Precios personalizados.

Ventajas

Contras

6. Fin de mes fácil (⭐3.4)

Easy Month End está diseñado para simplificar la parte más dolorosa de la contabilidad: el cierre de mes.

Utiliza el procesamiento del lenguaje natural para ayudar contabilidad Los profesionales automatizan tareas repetitivas.

Esta tecnología de IA ayuda a organizar y procesar datos financieros.

Es un salvavidas para cualquiera que tema el ajetreo de fin de mes.

Desbloquea su potencial con nuestro Tutorial fácil de fin de mes.

Nuestra opinión

Aumente la precisión financiera con Easy Month End. Aproveche la conciliación automatizada y los informes listos para auditoría. Programe una demostración personalizada para optimizar su proceso de cierre de mes.

Beneficios clave

- Flujos de trabajo de conciliación automatizados

- Gestión y seguimiento de tareas

- Análisis de varianza

- Gestión de documentos

- Herramientas de colaboración

Precios

- Motor de arranque:$24/mes.

- Pequeño: $45/mes.

- Compañía: $89/mes.

- Empresa: Precios personalizados.

Ventajas

Contras

7. RefrescaMe (⭐️3.2)

RefreshMe es una herramienta de finanzas personales con un potente asistente de inteligencia artificial.

Si bien está orientado al uso personal, sus funciones pueden ser aplicadas fácilmente por agentes inmobiliarios.

La IA analiza datos financieros, rastrea los gastos y ofrece información personalizada.

Le ayuda a controlar sus gastos y administrar su presupuesto sin esfuerzo.

Desbloquea su potencial con nuestro Tutorial de Refreshme.

Nuestra opinión

La fortaleza de RefreshMe reside en proporcionar información práctica y en tiempo real. Sin embargo, la falta de precios públicos y la posible falta de funcionalidades contables básicas completas podrían ser un factor a considerar para algunos usuarios.

Beneficios clave

- Paneles financieros en tiempo real

- Detección de anomalías impulsada por IA

- Informes personalizables

- Previsión del flujo de caja

- Evaluación comparativa del rendimiento

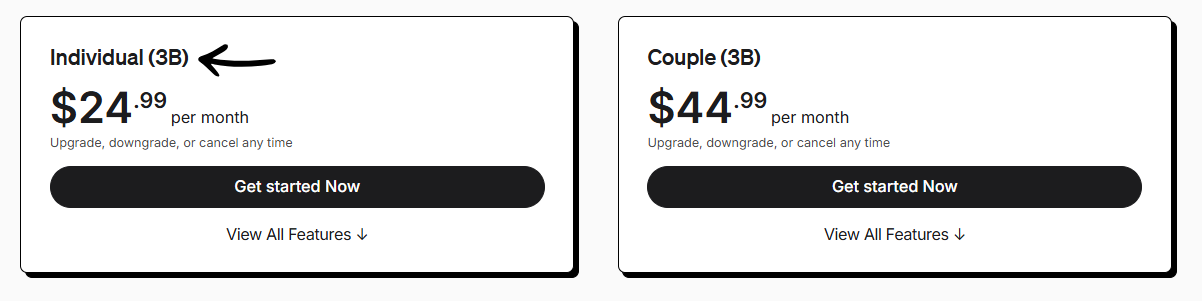

Precios

- Individual (3B): $24,99/mes.

- Pareja (3B): $44,99/mes.

Ventajas

Contras

8. QuickBooks (⭐3.0)

QuickBooks ha sido un elemento básico durante años y ahora se está volviendo aún más inteligente con IA.

Sus agentes de IA trabajan detrás de escena para ayudar con todo, desde categorizar transacciones hasta conciliar cuentas.

Esta inteligencia artificial hace que los procesos financieros sean más fluidos.

Está diseñado para brindarle datos más precisos y agilizar su día a día. contabilidad.

Desbloquea su potencial con nuestro Tutorial de QuickBooks.

Beneficios clave

- Categorización automatizada de transacciones

- Creación y seguimiento de facturas

- Gestión de gastos

- Servicios de nómina

- Informes y paneles de control

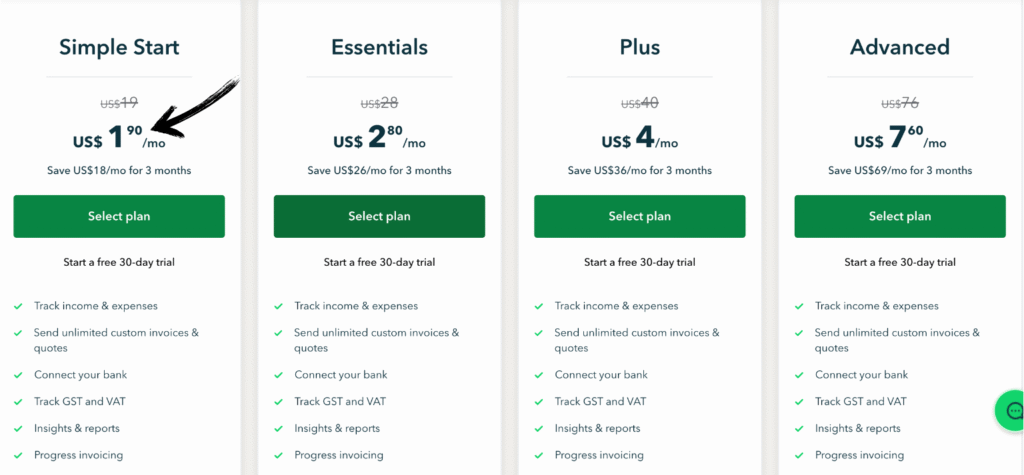

Precios

- Comienzo sencillo: $1,90/mes.

- Básico: $2.80/mes.

- Más: $4/mes.

- Avanzado: $7.60/mes.

Ventajas

Contras

9. Docyt(⭐2.8)

El motor de IA de Docyt está diseñado para la precisión. Es una herramienta excelente para empresas de contabilidad y profesionales individuales.

Esta plataforma utiliza tecnología de IA para automatizar tareas complejas. teneduría de libros flujos de trabajo.

Puede procesar datos financieros, generar análisis e incluso detectar anomalías.

Se trata de ofrecerle finanzas más limpias con menos trabajo manual.

Desbloquea su potencial con nuestro Tutorial de Docyt.

Beneficios clave

- Automatización impulsada por IA: Docyt utiliza inteligencia artificial. Extrae automáticamente datos de documentos financieros. Esto incluye información de más de 100.000 proveedores.

- Contabilidad en tiempo real: Mantiene sus libros contables actualizados en tiempo real. Esto le proporciona una visión financiera precisa en todo momento.

- Gestión de documentos: Centraliza todos tus documentos financieros. Puedes buscarlos y acceder a ellos fácilmente.

- Automatización del pago de facturas: Automatiza el proceso de pago de facturas. Programa y paga facturas fácilmente.

- Reembolso de gastos: Agiliza las reclamaciones de gastos de los empleados. Presenta y aprueba gastos rápidamente.

- Integraciones perfectas: Se integra con los programas de contabilidad más populares. Esto incluye QuickBooks y Xero.

- Detección de fraude: Su IA puede ayudar a detectar transacciones inusuales. Esto añade una capa de seguridad. seguridadNo existe garantía específica para el software, pero se proporcionan actualizaciones continuas.

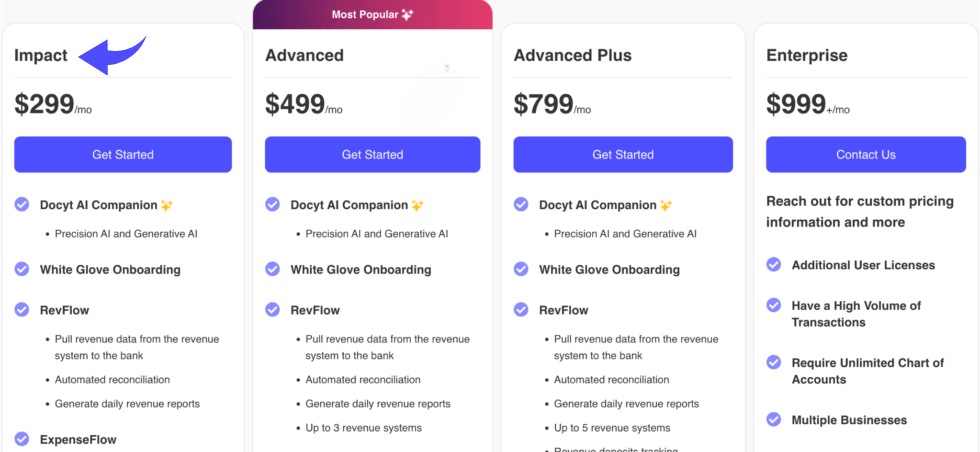

Precios

- Impacto: $299/mes.

- Avanzado: $499/mes.

- Avanzado Más: $799/mes.

- Empresa: $999/mes.

Ventajas

Contras

What Real Estate Agents need in an Accounting Software?

Cuando eres un agente, quieres una herramienta que trabaje para ti, no al revés.

Elegir el software de contabilidad de IA adecuado es un paso crucial para su negocio.

Entonces, ¿qué características deberías tener en cuenta?

- La automatización es clave. El objetivo principal de usar IA en contabilidad es ahorrar tiempo. Busca software que utilice algoritmos de aprendizaje automático y automatización robótica de procesos para gestionar tareas repetitivas como la entrada de datos y los informes de gastos. Estas funciones deberían reducir el riesgo de error humano y liberarte para tareas más importantes.

- Los conocimientos predictivos son importantes. La mejor IA contable va más allá de simplemente registrar lo sucedido. Debe ser capaz de analizar datos financieros para facilitar la planificación y la previsión financiera. Un buen sistema le proporcionará la información necesaria para tomar decisiones empresariales inteligentes y estratégicas.

- Necesita manejar detalles específicos del sector inmobiliario. Sus procesos contables son diferentes a los de una empresa típica. Busque un software que comprenda los aspectos únicos de sus procesos contables internos, como el seguimiento de comisiones, los gastos de propiedad y los estados financieros complejos.

- No te olvides del cumplimiento tributario. A nadie le gusta la temporada de impuestos. El software adecuado puede simplificarlo al usar IA para registrar las deducciones y preparar informes financieros. Esto le ayuda a mantenerse al día con el cumplimiento tributario sin complicaciones.

- La integración no es negociable. El software debería funcionar bien con otras herramientas que ya utiliza, como su CRM o cuentas bancarias. La integración perfecta implica menos trabajo manual y un flujo de trabajo más eficiente para los profesionales de finanzas y contabilidad.

- La seguridad es una prioridad. Al manejar datos financieros confidenciales, la seguridad es primordial. Asegúrese de que la herramienta cuente con amplias medidas de seguridad para prevenir ataques de hackers y proteger su información.

- No se preocupen, la IA no reemplazará por completo a los contadores. Es una herramienta, no un sustituto. La IA puede encargarse de las partes tediosas y numéricas de su trabajo, permitiéndole centrarse en el aspecto humano de su negocio.

¿Cómo pueden beneficiarse los agentes inmobiliarios del uso de software de contabilidad?

El uso de herramientas de contabilidad de inteligencia artificial puede cambiar realmente la forma en que gestiona su negocio.

Estas herramientas están diseñadas para automatizar tareas contables repetitivas que ocupan gran parte de su día.

Esto incluye todo, desde la gestión de datos hasta la gestión de cuentas a pagar.

Al dejar que el software de IA se encargue de estas tareas, ahorrarás muchísimo tiempo.

Esto significa que usted puede concentrarse en lo que mejor sabe hacer: ayudar a los clientes y hacer crecer su negocio.

Estas herramientas no solo automatizan; también le brindan una visión clara de la salud financiera de su negocio.

Utilizan análisis predictivos analizando datos históricos para ayudarle con la planificación financiera.

Esto ayuda a las empresas a gestionar mejor sus finanzas y a tomar decisiones más inteligentes.

Si bien algunos podrían preocuparse de que la IA reemplace a los contadores, la verdad es que las herramientas de contabilidad con IA están aquí para ayudar, no para reemplazar.

Hacen que sus operaciones financieras sean más fluidas y ayudan a reducir los errores humanos.

Podrás dedicar menos tiempo al papeleo y más tiempo a las partes de tu trabajo que más te gustan.

Guía del comprador

Sabemos lo importante que es elegir el sistema de contabilidad adecuado.

Para ayudarle a tomar la mejor decisión, realizamos nuestra investigación basándonos en varios factores clave.

Queríamos asegurarnos de que nuestra lista fuera completa y útil para los profesionales inmobiliarios.

He aquí un vistazo a nuestro proceso:

- Precios: Comenzamos mirando el costo de cada uno herramienta de IAAnalizamos los modelos de precios para ver qué valor ofrecían para diferentes presupuestos. Es importante encontrar una herramienta que se ajuste a su plan financiero y le ayude a ahorrar tiempo a largo plazo.

- Características: A continuación, profundizamos en las funciones. Buscamos sistemas de IA que fueran más allá de la simple introducción de datos. Prestamos especial atención a funciones avanzadas como la previsión del flujo de caja, la detección de fraudes y la automatización contable. Queríamos ver cómo estas herramientas contables contribuyen al rendimiento financiero y la gestión de riesgos.

- Negativos: Ninguna herramienta es perfecta. Identificamos las desventajas de cada producto, desde la falta de funciones hasta una curva de aprendizaje pronunciada. Creemos que es importante ser transparentes sobre lo que podría faltar.

- Soporte y comunidad: Verificamos el tipo de soporte que ofrece cada producto. ¿Cuentan con un foro comunitario, chat en vivo o una política de reembolsos sólida? Un buen soporte es crucial, especialmente cuando se trata de datos financieros importantes.

- Capacidades de IA: Analizamos específicamente cómo se integró la inteligencia artificial (IA). Evaluamos cómo la herramienta de IA ayuda a automatizar tareas rutinarias y a analizar datos para obtener información valiosa. Nos centramos en las herramientas que están marcando las tendencias futuras en el mundo contable y ayudando a los departamentos financieros y a los líderes empresariales a alcanzar el éxito. También consideramos cómo estas herramientas podrían reducir la necesidad de introducir manualmente los datos.

Terminando

El mundo inmobiliario está cambiando y las herramientas de inteligencia artificial están marcando el camino.

Estas herramientas impulsadas por IA no están aquí para dejar obsoletos a los profesionales financieros.

En cambio, están aquí para automatizar tareas repetitivas. teneduría de libros tareas y ayudar a su equipo de contabilidad a trabajar de forma más inteligente.

Al proporcionar información en tiempo real y ayudarlo a identificar patrones en sus informes financieros, la IA ayuda a mejorar el flujo de caja y la comunicación con los clientes.

Adoptar estos nuevos modelos de negocio es clave para el crecimiento del negocio.

Confíe en nuestra investigación y en la información que le proporcionamos para ayudarle a encontrar la mejor herramienta para sus necesidades.

Preguntas frecuentes

¿Reemplazará la IA a los contadores en el sector inmobiliario?

No, la IA no reemplazará a los contables. Gestiona tareas repetitivas, permitiendo a los profesionales financieros y a las firmas de contabilidad centrarse en el asesoramiento estratégico y la comunicación con los clientes.

¿Cómo analiza la IA los datos financieros?

Los sistemas de IA utilizan aprendizaje automático y algoritmos para analizar datos financieros. Identifican patrones, automatizan la entrada de datos y proporcionan información en tiempo real para mejorar el rendimiento financiero.

¿Qué tipo de tareas de la industria contable pueden automatizar las herramientas de IA?

Las herramientas de IA automatizan una variedad de tareas, incluido el procesamiento de facturas, la conciliación bancaria, la categorización de gastos y la generación de informes financieros, lo que ahorra mucho tiempo.

¿Es seguro el software de contabilidad con inteligencia artificial?

Sí. La mayoría de las herramientas de contabilidad de IA utilizan medidas de seguridad avanzadas, como cifrado de datos e inicios de sesión seguros, para proteger datos financieros confidenciales, garantizando la privacidad y el cumplimiento.

¿Cómo puede la IA beneficiar a una pequeña empresa inmobiliaria?

La IA ayuda a las pequeñas empresas a administrar sus finanzas de manera eficiente al automatizar tareas, reducir el error humano y ofrecer información valiosa para tomar decisiones inteligentes y hacer crecer el negocio.