En vista de software de contabilidad ¿para su negocio?

Probablemente esté buscando una solución que le facilite la gestión de su dinero, no que la haga más difícil.

Elegir entre opciones populares como Sage y QuickBooks puede parecer una decisión importante.

Ambos prometen ayudar, pero ¿cuál cumple realmente? su ¿Situación específica?

En esta guía, analizaremos Sage frente a QuickBooks.

Descripción general

Probamos tanto Sage como QuickBooks.

Los usamos como lo harían las empresas reales. Esto nos ayudó a ver cómo funcionan a diario.

Ahora podemos mostrarle cómo se comparan entre sí.

Más de 6 millones de clientes confían en Sage. Con una calificación de satisfacción del cliente de 56 sobre 100, sus robustas funciones son una solución de eficacia comprobada.

Precios: Prueba gratuita disponible. El plan premium cuesta $66.08 al mes.

Características principales:

- Facturación

- Integración de nóminas

- Gestión de inventario

Utilizado por más de 7 millones de empresas, QuickBooks puede ahorrarle un promedio de 42 horas por mes en teneduría de libros.

Precios: Tiene una prueba gratuita. El plan cuesta desde $1.90 al mes.

Características principales:

- Gestión de facturas

- Seguimiento de gastos

- Informes

¿Qué es Sage?

Hablemos de Sage.

Ya existe desde hace tiempo.

Muchas empresas lo utilizan. Ayuda a controlar el dinero.

Piense en ello como un cuaderno digital para su negocio cosa.

Además, explora nuestros favoritos Alternativas a la salvia…

Nuestra opinión

¿Listo para optimizar tus finanzas? Los usuarios de Sage han reportado un aumento promedio del 73 % en la productividad y una reducción del 75 % en el tiempo de procesamiento.

Beneficios clave

- Facturación y pagos automatizados

- Informes financieros en tiempo real

- Fuerte seguridad para proteger los datos

- Integración con otras herramientas empresariales

- Soluciones de nómina y RRHH

Precios

- Contabilidad profesional: $66.08/mes.

- Contabilidad Premium: $114.33/mes.

- Contabilidad cuántica: $198.42/mes.

- Paquetes de RRHH y nómina: Precios personalizados según sus necesidades.

Ventajas

Contras

¿Qué es QuickBooks?

QuickBooks es como un amigo útil para las cuestiones financieras de su negocio.

Le ayuda a realizar un seguimiento del dinero que entra y del dinero que sale.

Montón de pequeñas empresas Me gusta usarlo.

Además, explora nuestros favoritos Alternativas a QuickBooks…

Beneficios clave

- Categorización automatizada de transacciones

- Creación y seguimiento de facturas

- Gestión de gastos

- Servicios de nómina

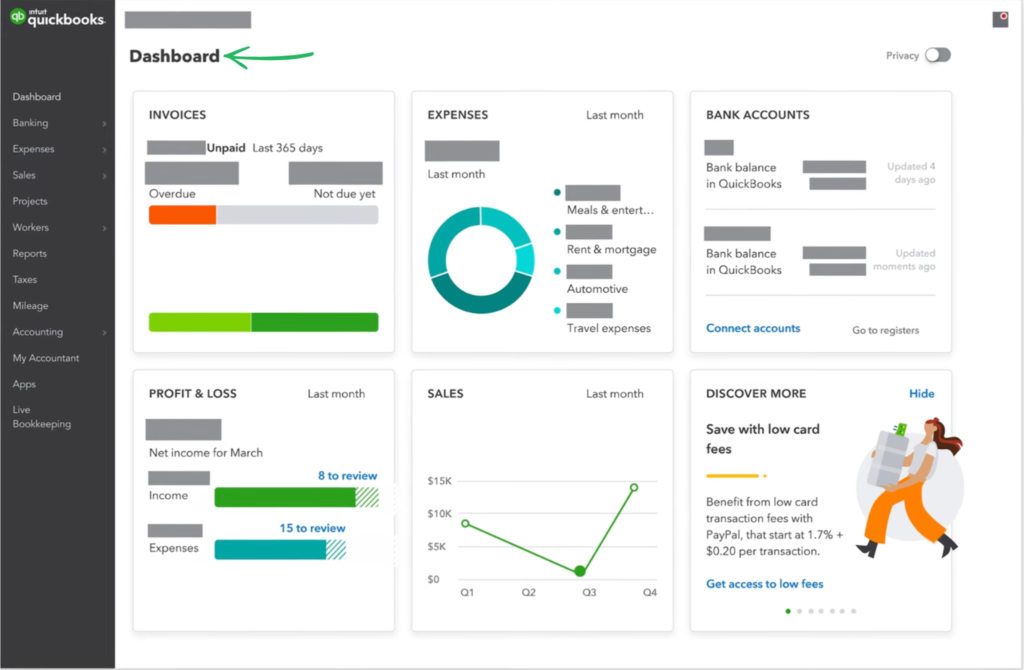

- Informes y paneles de control

Precios

- Comienzo sencillo: $1,90/mes.

- Básico: $2.80/mes.

- Más: $4/mes.

- Avanzado: $7.60/mes.

Ventajas

Contras

Comparación de características

Sage y QuickBooks son líderes contabilidad Opciones de plataforma para propietarios de pequeñas empresas y empresas medianas.

Esta comparación de características analizará las diferencias clave en sus precios, servicios y seguridad para ayudarle a encontrar el mejor software de contabilidad para administrar las finanzas de su negocio.

1. Facturación y pagos

- Sabio nube empresarial contabilidad Permite analizar y crear facturas de venta y órdenes de compra, lo que facilita la gestión de ventas y flujo de caja. También permite el seguimiento de facturas para los pagos.

- QuickBooks Ofrece funciones de facturación robustas. Le ayuda a pagar facturas y aceptar pagos en línea de sus clientes. El sistema también envía recordatorios de pago automáticos, lo que le ahorra tiempo y le garantiza el cobro. También puede usar QuickBooks Comprobando pagos.

2. Nómina y empleados

- El software de nómina de Sabio está disponible como complemento y ofrece servicios integrales de nómina. Puedes usa Sage Nómina para gestionar la nómina y pagar a los empleados. Este servicio está diseñado para ayudar a los equipos de contabilidad con necesidades complejas de nómina.

- El software de nóminas de Intuit, QuickBooks La nómina está perfectamente integrada en sus productos. QuickBooks le ayuda con el depósito directo y los pagos a contratistas, y puede controlar el tiempo de los empleados, lo cual es una gran ventaja. También puede pagar impuestos a través de este sistema.

3. Precios y planes

- El precio de Sabio Puede tener precios más altos, ya que algunas versiones de su software de escritorio tienen un costo inicial más elevado. Ofrece un plan de contabilidad profesional y varios servicios mediante complementos, pero estos pueden tener un costo mayor.

- Los precios de Intuit QuickBooks La versión en línea se basa en suscripción, lo que puede resultar más asequible para los propietarios de pequeñas empresas. Sin embargo, la versión de escritorio de QuickBooks puede requerir una licencia única. También ofrece un plan específico para autónomos.

4. Informes y análisis

- El software Sabio incluye tiempo real reportando and financial reporting tools to generate reports on cash flow, sales, and most revenue. This gives accounting teams the insights they need to make decisions and evaluate the business.

- QuickBooks Ofrece una amplia variedad de informes financieros, incluyendo balances generales. El sistema le ayuda a mantener registros precisos y a controlar su dinero para obtener un panorama financiero completo. También puede generar informes para cumplir con las obligaciones tributarias.

5. Gestión de inventario

- Sabio Cuenta con un sistema integral de gestión de inventario. Le permite sincronizar el inventario automáticamente, crear variaciones de productos y emitir alertas de stock bajo para asegurarse de no perder ninguna oportunidad de venta.

- La gestión de inventarios en QuickBooks Te ayuda a mantenerte organizado. Realiza un seguimiento del inventario como parte de su servicio completo. teneduría de libros y actualiza los niveles de stock a medida que realizas ventas. Es una función esencial para negocios que venden productos físicos.

6. Automatización y eficiencia

- El Sabio La plataforma utiliza la gestión del flujo de trabajo y las copias de seguridad en línea para ahorrar tiempo en tareas manuales. El sistema automatiza muchas tareas contables diarias, como el seguimiento de facturas y la conciliación bancaria.

- QuickBooks Te ayuda a automatizar tareas para ahorrar tiempo. Tanto su versión en línea como la de escritorio incluyen funciones para automatizar la conciliación de tu cuenta bancaria, lo cual supone una gran ventaja para las finanzas de tu empresa.

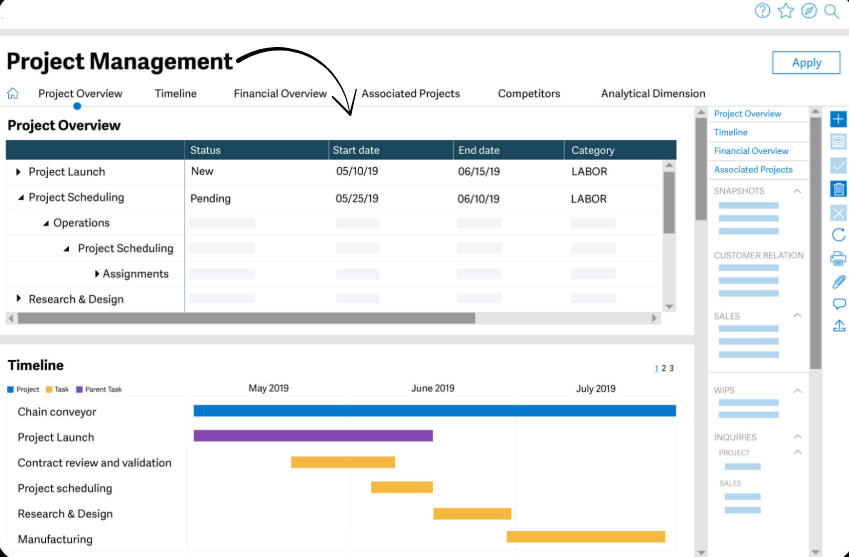

7. Accesibilidad e interfaz

- El Sabio La plataforma cuenta con una aplicación móvil dedicada y conectividad en la nube, pero algunas versiones de software de escritorio tienen acceso remoto limitado, lo cual puede ser una desventaja. La interfaz de usuario puede parecer más tradicional y su configuración es más compleja que la de la competencia.

- QuickBooks Tiene una interfaz de usuario intuitiva y fácil de configurar. Con su acceso en línea, puede gestionar su negocio. datos y su cuenta desde cualquier computadora. También se puede acceder fácilmente a los datos y archivos del escritorio, lo que lo convierte en un sistema flexible.

8. Apoyo y recursos

- Sabio Cuenta con un sólido sistema de soporte con Sage University, un centro comunitario y artículos para responder preguntas y resolver problemas. Esto es especialmente útil para los equipos de contabilidad que necesitan más ayuda.

- QuickBooks Ofrece diversos servicios para ayudar a los usuarios. Ofrece una opción completa de contabilidad y una gran cantidad de artículos y foros para resolver problemas. También puede obtener asistencia para la preparación de impuestos.

9. Comparación de claves y caso de uso

- Sabio Ofrece servicios y funciones potentes para empresas medianas que necesitan un sistema robusto y escalable. Su sistema de cálculo de costos por trabajo, con códigos de costo y registros únicos, lo hace ideal para empresas con necesidades complejas de gestión de proyectos. La plataforma gestiona el impuesto sobre las ventas y cuenta con un sistema integral de nóminas.

- QuickBooks Online es líder del mercado por algo. Ofrece una excelente solución para pequeños empresarios y autónomos. Te ayuda a mantenerte organizado y te proporciona las herramientas para gestionar todas tus finanzas, incluyendo impuestos y ventas, desde una sola cuenta. Además, puedes cancelar tu licencia en cualquier momento. Es un sistema muy flexible.

¿Qué buscar en un software de contabilidad?

- El tamaño de su negocio¿Tiene un equipo pequeño o una empresa grande? Algunas herramientas se adaptan mejor a diferentes tamaños. Para un equipo pequeño o una operación de un solo usuario, libros frescos Un software de contabilidad o una plataforma similar con funciones básicas de gestión de gastos puede ser suficiente. Sin embargo, para una organización más grande con varios equipos de contabilidad, necesitará un sistema que admita un número ilimitado de miembros y permita funciones de contabilidad profesional.

- Calidad de la aplicación móvil¿Qué tal es la app del teléfono? Usarás mucho una app móvil específica para tomar fotos de recibos. El mejor software está disponible tanto para iOS como para Android. dispositivos, lo que le brinda la flexibilidad de trabajar desde cualquier teléfono. Tenga en cuenta que cualquier acceso remoto limitado en una solución de escritorio podría dificultar su trabajo desde cualquier lugar.

- Flujo de trabajo de aprobación¿Puedes configurar quién debe aprobar qué? El sistema debe ser capaz de gestionar transacciones no conciliadas de transacciones bancarias e identificar cualquier diferencia no conciliada en tus cuentas por pagar. Una plataforma sólida puede gestionar flujos de trabajo complejos para la aprobación y el pago de facturas, incluso con cargos por mora.

- Atención al cliente¿Es fácil obtener ayuda si tienes problemas? Consulta sus opciones de soporte. Algunas plataformas ofrecen acceso exclusivo a los equipos de soporte. Las reseñas de FreshBooks suelen elogiar su servicio al cliente, mientras que otras, como las de QuickBooks, han señalado posibles inconvenientes en ese aspecto.

- Necesidades de informes¿Qué tipo de informes necesita? Asegúrese de que el software pueda generarlos. Un buen sistema debería ayudarle a generar informes sobre todos los aspectos de su negocio, desde la gestión de gastos hasta su panorama financiero general. Un plan de cuentas sólido y un buen proceso de conciliación son clave para generar informes precisos.

- Crecimiento futuro¿Puede el software crecer con su negocio? No quiere cambiar de nuevo pronto. Busque una plataforma que pueda gestionar proyectos y hacer seguimiento. seguimiento del tiempoy facturación personalizada. Estas funciones de pagos avanzados y facturas recurrentes son cruciales para un negocio en crecimiento, especialmente al optar por un plan premium u otras versiones con funciones avanzadas.

- Funcionalidad móvil y acceso a datosPara las empresas móviles, una conexión a internet fiable es fundamental. Una de las posibles desventajas de un sistema que no esté completamente basado en la nube es que podría tener limitaciones de acceso móvil. Por ejemplo, es posible que su aplicación móvil dedicada no sea compatible con todas las funciones, lo que le obligaría a volver a usar su software de escritorio.

- Sin embargo, un software robusto basado en la nube incluye funciones que facilitan este proceso. Productos de QuickBooks, como QuickBooks Time, ofrecen información sobre el estado de los trabajos y el seguimiento del tiempo de los empleados, y estos servicios se pueden gestionar desde un dispositivo móvil. Puede gestionar fácilmente a sus proveedores y su información, aceptar pagos con tarjeta de crédito y tener una visión completa de las finanzas de su empresa. La posibilidad de usar la aplicación de su plataforma para registrar horas, actualizar el estado de los trabajos e incluso gestionar el crédito es una gran ventaja.

- Otro factor importante a considerar es qué sucede con los datos de su empresa al cambiar a un nuevo software. Una plataforma robusta debe ofrecer un proceso fluido para migrar los datos contables existentes desde otros sistemas. También debe contar con funciones que le ayuden a gestionar eficazmente sus finanzas y a mantener un flujo de caja saludable, proporcionando informes en tiempo real sobre todas sus ventas. Sage Marketplace ofrece numerosos servicios para facilitar esto, desde integraciones avanzadas de nómina hasta complementos especializados para el cálculo de costes de trabajo. Busque una solución que simplifique estos procesos y le ayude a gestionar su negocio con un alto grado de confianza y control.

Veredicto final

Entonces, ¿cuál gana: Sage o QuickBooks?

For most small and growing businesses, we pick Sage. It’s usually easier to learn and use.

Tiene características potentes como facturación y nómina que muchas empresas necesitan.

Además, se conecta con muchas otras aplicaciones.

Hemos dedicado mucho tiempo a probar ambos.

Nuestro objetivo era ver qué funciona mejor para las tareas comerciales cotidianas.

Sage, en general, hace que administrar tu dinero sea más sencillo, permitiéndote concentrarte en lo que haces mejor.

Es una opción sólida que puede crecer contigo.

Más de Sage

Es útil ver cómo se compara Sage con otro software popular.

A continuación se muestra una breve comparación con algunos de sus competidores.

- Sage vs Puzzle IO: Si bien ambos se encargan de la contabilidad, Puzzle IO está diseñado específicamente para empresas emergentes y se centra en el flujo de caja en tiempo real y en métricas como la tasa de consumo.

- Sage contra Dext: Dext es principalmente una herramienta para automatizar la captura de datos de recibos y facturas. Suele funcionar junto con Sage para agilizar la contabilidad.

- Sage frente a Xero: Xero es una opción basada en la nube conocida por su facilidad de uso, especialmente para pequeñas empresas. Sage puede ofrecer funciones más robustas a medida que la empresa crece.

- Sage contra Synder: Synder se centra en sincronizar plataformas de comercio electrónico y sistemas de pago con software de contabilidad como Sage.

- Fin de mes sabio vs. fácil: Este software es un administrador de tareas que le ayuda a realizar un seguimiento de todos los pasos necesarios para cerrar sus libros al final del mes.

- Sage contra Docyt: Docyt utiliza IA para automatizar la contabilidad y eliminar la entrada manual de datos, proporcionando una alternativa altamente automatizada a los sistemas tradicionales.

- Sage vs. RefreshMe: RefreshMe no es un competidor directo de contabilidad. Se centra más en el reconocimiento y el compromiso de los empleados.

- Sage vs. Zoho Books: Zoho Books forma parte de una amplia gama de aplicaciones empresariales. Recibe elogios por su diseño limpio y sus sólidas conexiones con otros productos de Zoho.

- Sage vs Wave: Wave es conocido por su plan gratuito, que ofrece contabilidad y facturación básicas, lo que lo convierte en una opción popular para trabajadores independientes y empresas muy pequeñas.

- Sage frente a Quicken: Quicken está más orientado a las finanzas personales o de empresas muy pequeñas. Sabio ofrece funciones más sólidas para un negocio en crecimiento, como nómina e inventario avanzado.

- Sage contra Hubdoc: Hubdoc es una herramienta de gestión documental que recopila y organiza automáticamente documentos financieros, similar a Dext, y puede integrarse con plataformas de contabilidad.

- Sage frente a Expensify: Expensify es experto en la gestión de gastos. Es ideal para escanear recibos y automatizar los informes de gastos de los empleados.

- Sage frente a QuickBooks: QuickBooks es una plataforma líder en el sector contable para pequeñas empresas. Es conocido por su interfaz intuitiva y su amplia gama de funciones.

- Sage vs. AutoEntry: Esta es otra herramienta que automatiza la entrada de datos de recibos y facturas. Funciona bien como complemento de software de contabilidad como Sabio.

- Sage frente a FreshBooks: FreshBooks es especialmente bueno para trabajadores independientes y empresas de servicios, con un enfoque en la facturación simple y el seguimiento del tiempo.

- Sage frente a NetSuite: NetSuite es un sistema ERP a gran escala para empresas grandes. Sabio tiene una gama de productos, algunos de los cuales compiten en este nivel, pero NetSuite es una solución más grande y más compleja.

Más de QuickBooks

- QuickBooks frente a Puzzle IOEste software se centra en la planificación financiera basada en IA para startups. Su contraparte es para finanzas personales.

- QuickBooks frente a DextEsta es una herramienta empresarial para registrar recibos y facturas. La otra herramienta registra los gastos personales.

- QuickBooks frente a XeroEste es un popular software de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- QuickBooks frente a SynderEsta herramienta sincroniza datos de comercio electrónico con software de contabilidad. Su alternativa se centra en las finanzas personales.

- QuickBooks vs. Easy Month EndEsta es una herramienta empresarial para agilizar las tareas de fin de mes. Su competidor es la gestión de finanzas personales.

- QuickBooks frente a DocytEste utiliza IA para la contabilidad y automatización empresarial. El otro utiliza IA como asistente de finanzas personales.

- QuickBooks frente a SageEsta es una suite completa de contabilidad empresarial. Su competidor es una herramienta más fácil de usar para finanzas personales.

- QuickBooks frente a Zoho BooksEsta es una herramienta de contabilidad en línea para pequeñas empresas. Su competidor es para uso personal.

- QuickBooks frente a WaveEste software de contabilidad gratuito está diseñado para pequeñas empresas. Su contraparte está diseñada para particulares.

- QuickBooks frente a QuickenAmbas son herramientas de finanzas personales, pero esta ofrece un seguimiento de inversiones más detallado. La otra es más sencilla.

- QuickBooks frente a HubdocEsta herramienta se especializa en la captura de documentos para contabilidad. Su competidor es una herramienta de finanzas personales.

- QuickBooks frente a ExpensifyEsta es una herramienta para la gestión de gastos empresariales. La otra es para el seguimiento y presupuesto de gastos personales.

- QuickBooks vs. Entrada automáticaEstá diseñado para automatizar la entrada de datos para la contabilidad empresarial. Su alternativa es una herramienta de finanzas personales.

- QuickBooks frente a FreshBooksEste es un software de contabilidad para autónomos y pequeñas empresas. Su alternativa es para finanzas personales.

- QuickBooks frente a NetSuiteEsta es una potente suite de gestión empresarial para grandes empresas. Su competidor es una sencilla aplicación de finanzas personales.

Preguntas frecuentes

¿Es QuickBooks mejor para las pequeñas empresas?

Sí, QuickBooks suele ser mejor para las pequeñas empresas. Es más fácil de aprender y usar. Incluye muchas funciones que las pequeñas empresas necesitan. Esto les facilita la gestión financiera.

¿Puede Sage gestionar grandes empresas?

Sí, Sage puede gestionar grandes empresas con éxito. Cuenta con funciones avanzadas y puede gestionar tareas complejas. Está diseñado para crecer con empresas más grandes y sus necesidades específicas.

¿Qué es más asequible, Sage o QuickBooks?

El costo puede variar. QuickBooks suele ofrecer diferentes planes para distintas necesidades. Sage también tiene diferentes versiones. Debe consultar el plan específico de cada uno para ver cuál le conviene más.

¿Necesito experiencia en contabilidad para utilizarlos?

No necesitas mucha experiencia. QuickBooks está diseñado para que sea fácil de usar para principiantes. Sage puede requerir un poco más de aprendizaje, pero ambos se pueden usar sin necesidad de ser contador.

¿Puedo cambiar de Sage a QuickBooks (o viceversa)?

Sí, generalmente puedes cambiar. Transferir tus datos podría requerir algo de esfuerzo. Ambas empresas ofrecen herramientas o ayuda para facilitar el cambio a tu empresa.