Keeping track of paper receipts is a big hassle.

Do you hate stuffing crumpled paper into your pockets? We all do.

If you lose those receipts, you actually lose your own money.

That stress adds up quickly. Tax time becomes a nightmare, and nobody wants that.

But there is an easier way to handle it.

Expensify automates the whole messy process for you. It scans receipts 即座に.

Then it automatically builds your reports.

Stop wasting your valuable time on paperwork. Learn how to use Expensify right now.

Save 83% of your time on paperwork. Small teams can save $37,859 by switching to Expensify. Join 15 million users and start your free trial today!

Expensify Tutorial

Mastering Expensify is simple. You do not need technical skills.

We will guide you through the process.

First, download the mobile app. Next, snap a picture of any receipt.

SmartScan reads the numbers automatically.

Finally, submit your report for approval.

It really is that easy to manage your money.

How to Use Expense Management Feature

Managing your money should not be a full-time job.

With an expense management platform like Expensify, you can stop worrying about lost receipts.

This system helps you manage expenses without the stress of manual データ エントリ。

You can keep your financial data organized and up to date with just a few taps.

Step 1: Capture Your Receipts with SmartScan Technology

The first step in Expensify is getting your receipts into the system.

You don’t need to type in prices or dates yourself.

- Open the app on your mobile device.

- Use the smart scan feature to take a photo of your paper receipt.

- If you have a digital receipt, forward it from your email or phone number directly to the app.

- The AI will read the receipt and fill in the details for you.

Step 2: Organize with Expense Categories and Mileage

Once your receipts are in, you need to tell the system what they are for.

This keeps your financial operations running smoothly and helps you identify spending trends 後で.

- Assign each item to a specific expense category, such as “旅行,” “Meals,” or “Office Supplies.

- Use the app to track mileage if you drive for work; it uses GPS to calculate distance automatically.

- Check that each entry complies with your company policies to avoid issues later.

Step 3: Use Approval Workflows and Syncing

The final part of the expense management process is getting your money back.

Expensify connects to your 会計 software to make this fast.

- Submit your items into tailored reports that show exactly what you spent.

- The system uses approval workflows to send your report to the right manager.

- Once they approve expenses, the data syncs with your company’s books.

- You get paid back directly into your bank account.

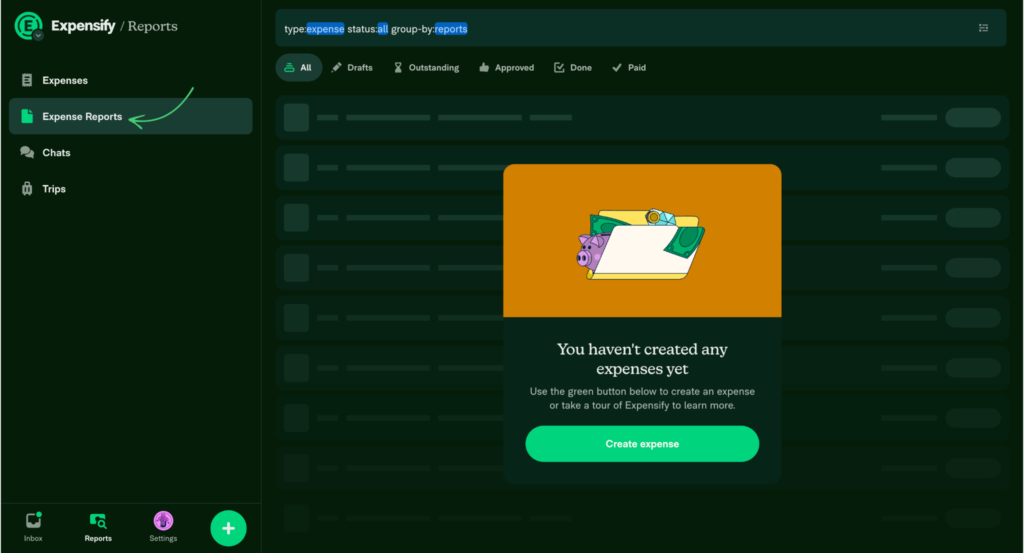

How to Use Expensify Expense Reports

Creating reports is the best way for businesses and employees to stay organized.

This platform makes it easy to group your spending so you can get reimbursed quickly.

You can use your own device to handle everything while you are away from the office.

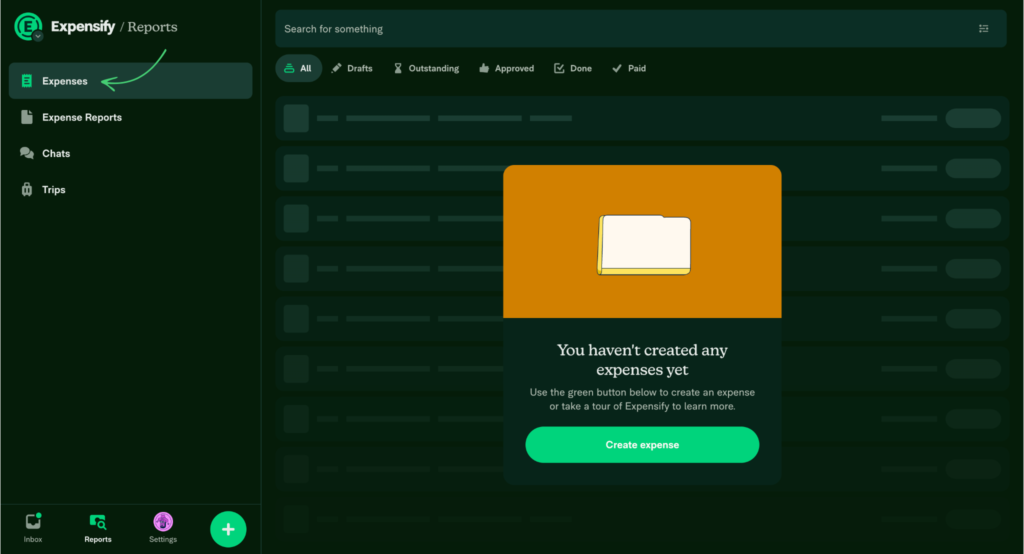

Step 1: Create a New Report Folder

The first step is creating a place for your receipts.

You want to keep things neat, so there are no errors when it is time for a manager to sign off on your money.

- Open the Expensify system and go to the reports tab.

- Click to create a new report and give it a clear name based on projects or the current date.

- You can access your past reports here as well if you need to check old data.

- If you use an Expensify card, your transactions will show up here automatically to streamline the process.

Step 2: Add Expenses and Check Rules

Now you need to put your receipts into the report.

You musensure thatre everythincomplies withws the rules your company has set.

This keeps everyone in compliance and protects the company’s funds.

- Pick the individual expenses or invoices you want to include.

- Move them into your new report folder.

- Look for any red flags from the system that show a mistake.

- Users can see if they spent too much in certain departments before they hit submit.

Step 3: Submit for Approval

Once your report looks good, it is time to send it away.

This functionality is what makes Expensify so helpful for users who want to save time.

- Review the final total to make sure it matches your actual spending.

- Hit the “Submit” button to send it to the right person.

- 見つけることもできます ユーチューブ tutorials if you get stuck on a specific step.

- Once you establish this habit, you won’t have to worry about losing money again.

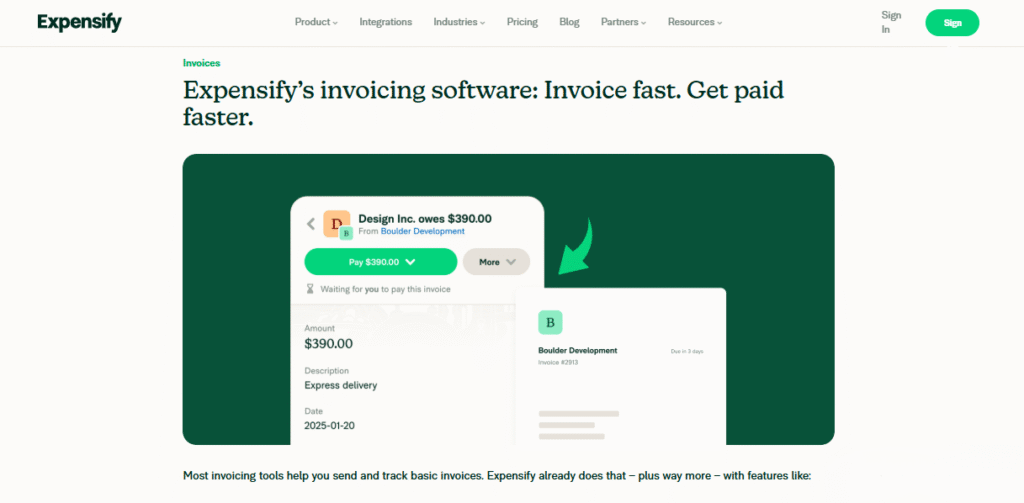

How to Use Expensify Bill Pay and Invoicing

Managing money coming in and going out is vital for any 仕事.

Expensify helps you handle bills and send invoices without the stress of messy spreadsheets.

You can manage everything from one simple screen.

Step 1: Set Up Your Business Billing Profile

Before you send your first bill, you need to tell the system who you are. This ensures your documents look professional to your clients and vendors.

- Go to your settings and enter your legal 仕事 name and tax ID.

- Upload your company logo so it appears on every invoice you send.

- Link your business bank account so you can receive payments or pay vendors directly.

Step 2: Create and Send a Professional Invoice

Getting paid for your hard work should be the easy part. You can create an invoice in seconds and send it to your client’s 受信トレイ.

- Click on “New Invoice” and type in your client’s email address.

- Add line items for the work you did or the products you sold.

- Set a due date for the payment and hit the “Send” button.

- The system will track if the client has opened or paid the invoice yet.

Step 3: Pay Company Bills Electronically

Paying your own bills is just as simple as getting paid. You can keep all your outgoing money organized in one place.

- Forward any bills you receive to your unique Expensify email address.

- Review the bill details that the system automatically pulls from the document.

- Use the approval workflow to make sure the right person okays the spend.

- Click to pay the vendor via ACH or credit card without leaving the app.

Alternatives to Expensify

- デクスト: このソフトウェアは、領収書や請求書からのデータ抽出を自動化することに重点を置いています。書類をデジタル化することで、手作業によるデータ入力にかかる時間を節約します。

- ドシット: このプラットフォームはAIを基盤とし、簿記やバックオフィス業務を自動化します。Docytは手作業によるデータ入力を排除し、リアルタイムの財務分析を提供することを目指しており、高度に自動化されたソリューションを求める企業にとって強力な選択肢となります。

- セージ: あらゆる規模の企業にソリューションを提供する強力なプラットフォームです。特に複雑な財務ニーズを持つ企業にとって、強力な代替手段となります。

- ゼロ: 人気のクラウドベースの会計プラットフォームです。Ateraの簿記機能の代替として、請求書発行、銀行照合、経費追跡などのツールを提供しています。

- 楽な月末: この専門ソフトウェアは、決算プロセスを簡素化するために特別に設計されています。QuickBooksやXeroなどの会計プラットフォームと統合することで、スムーズで簡単な月末処理を実現します。

- パズルio: これはスタートアップ向けに特別に開発された最新の会計ソフトウェアです。財務報告と自動化を支援し、リアルタイムの洞察を提供し、決算処理の合理化に重点を置いています。

- セージ: 有名なビジネス管理ソフトウェアプロバイダーである Sage は、Atera の財務管理モジュールの代替として使用できるさまざまな会計および財務ソリューションを提供しています。

- シンダー: このソフトウェアは、eコマースおよび決済プラットフォームと会計ソフトウェアの同期に重点を置いています。販売チャネルから帳簿へのデータフローを自動化する必要がある企業にとって、便利な代替手段となります。

- 楽な月末: このツールは、月末処理プロセスを効率化するために特別に設計されています。財務報告と決算処理業務の改善と自動化を目指す企業にとって、最適な代替手段となります。

- ドシット: AIを活用した簿記プラットフォームであるDocytは、財務ワークフローを自動化します。リアルタイムデータと自動文書管理を提供するAteraのAI駆動型簿記機能の直接的な競合製品です。

- リフレッシュミー: これは個人向けの財務管理プラットフォームです。直接的なビジネス向け代替手段ではありませんが、経費や請求書の追跡など、同様の機能を提供しています。

- 波: これは人気の無料財務ソフトウェアです。請求書作成、会計、領収書のスキャンなど、フリーランサーや中小企業に最適です。

- クイックン: 個人および中小企業の財務管理に定評のあるツールです。予算作成、支出追跡、財務計画に役立ちます。

- ハブドック: このソフトウェアは文書管理ツールです。財務文書を自動的に取得し、会計ソフトウェアと同期します。

- クイックブックス: 最も広く使用されている会計ソフトウェア プログラムの 1 つです。 QuickBooks は、財務管理のためのツール一式を提供する強力な代替手段です。

- 自動入力: このツールはデータ入力を自動化します。Ateraの領収書および請求書取得機能の優れた代替手段となります。

- フレッシュブックス: このプログラムは請求書作成と会計処理に最適です。時間と経費をシンプルに追跡したいフリーランサーや中小企業に人気です。

- ネットスイート: 強力で包括的なクラウドベースのビジネス管理スイート。NetSuiteは、財務管理以上の機能を必要とする大規模企業にとって最適な選択肢です。

Expensify の比較

- Expensify vs Puzzleこのソフトウェアは、スタートアップ企業向けのAIを活用した財務プランニングに重点を置いています。また、個人向け財務プランニングにも活用されています。

- Expensify vs Dext: これは領収書や請求書を記録するためのビジネスツールです。もう一つのツールは個人的な経費を追跡するためのものです。

- Expensify vs. Xero: これは中小企業向けの人気のオンライン会計ソフトウェアです。競合製品は個人向けです。

- Expensify vs Synderこのツールは、eコマースデータを会計ソフトウェアと同期します。代替ツールは個人財務に重点を置いています。

- Expensify vs Easy Month End: これは月末の業務を効率化するビジネスツールです。競合製品は個人の財務管理用です。

- Expensify vs DocytこれはAIをビジネスの簿記と自動化に活用しています。もう一つは、AIを個人の財務アシスタントとして活用しています。

- Expensify vs Sage: これは包括的なビジネス会計スイートです。競合製品は、より使いやすい個人財務ツールです。

- Expensify vs Zoho Books: これは中小企業向けのオンライン会計ツールです。競合製品は個人向けです。

- Expensify vs Wave: 中小企業向けの無料会計ソフトウェアを提供しています。個人向けに設計されたバージョンもあります。

- Expensify vs Hubdoc: 簿記用の文書キャプチャに特化しています。競合製品は個人向け財務ツールです。

- ExpensifyとQuickBooksの比較: これは企業向けの有名な会計ソフトウェアです。代替ソフトは個人財務向けに作られています。

- Expensify vs AutoEntry: これは、ビジネス会計のデータ入力を自動化するために設計されています。代替として、個人向け財務ツールとしても利用できます。

- Expensify vs FreshBooks: これはフリーランサーや中小企業向けの会計ソフトウェアです。代替ソフトとして、個人財務管理にもご利用いただけます。

- Expensify vs. NetSuite大企業向けの強力なビジネス管理スイートです。競合製品はシンプルな個人向け財務アプリです。

結論

Learning how to use Expensify is a smart move for your work life.

You can say goodbye to lost receipts and messy piles of paper.

The simple interface makes it easy for any individual to get started.

Just select the features you need, and the dashboard will show you your spending trends.

You can sync your bank accountdirectly witho the system.

This helps reduce mistakes and ensure total accuracy.

Your manager will love how fast you follow company policies.

Do not let the complexities of business 旅行 slow you down anymore.

It only takes one tap to start. You can level up your workflow today.

Join the many people who focus on their work instead of paperwork.

Start by starting your first report right now.

よくある質問

Is Expensify no longer free?

Expensify still offers a 無料プラン for individuals, limited to 25 SmartScans per month. For businesses, paid plans start at roughly $5 per user/month (Collect plan) if you use the Expensify Card. Without the card, prices are higher (approx. $10-$18/user), so checking the latest bundled pricing is essential.

What are the pros and cons of Expensify?

Pros: Industry-leading “SmartScan” technology, seamless integration with QuickBooks/Xero, and fast next-day reimbursement. 短所: The pricing model can be confusing (often requiring their corporate card for the best rates), and customer support is primarily chat-based rather than phone-based.

What is the difference between QuickBooks and Expensify?

考えてみてください クイックブックス as your complete financial engine (invoicing, payroll, P&L), while エクスペンシファイ is a specialized fuel injector. Expensify handles the nitty-gritty of receipt scanning and employee reimbursements, then syncs that clean data directly into QuickBooks for final 会計.

Is Expensify good for small business?

Absolutely. It is specifically designed to scale from フリーランサー to SMBs. The “Collect” plan automates receipt tracking and approval workflows, which saves small teams hours of manual data entry and simplifies tax season significantly.

How do I submit expenses using Expensify?

The easiest method is using the mobile app to snap a photo of your receipt; SmartScan automatically extracts the merchant, date, and amount. Alternatively, you can forward email receipts to receipts@expensify.com or manually enter details via the web dashboard.

Is Expensify easy to learn?

Yes, it boasts a “mobile-first” design that is highly intuitive. Most users master the core loop—snap a photo, create a report, hit submit—within minutes. The platform minimizes buttons and relies on オートメーション 重労働をこなす。

How do I get started with Expensify?

Simply download the app or sign up on their website to create a free account. You can immediately start scanning receipts. For business use, connect your 会計ソフトウェア (like Xero or NetSuite) and invite employees to begin automating their expense reports.

More Facts about Expensify

- Pick Your Account: When you sign up, you can choose between a personal account or your business account.

- ダッシュボード: After you join, you get a main screen that shows your recent spending and reports that need work.

- 自分だけのものにしましょう: You can create your own spending categories and rules when you set up your account.

- Mistake Finder: The app automatically points out if you break a rule or enter the same receipt twice.

- Get Paid Back: You can send your reports through the app to get reimbursed for work costs.

- Approval Steps: Bosses can review and approve your spending before any money is paid out.

- 余分な 安全: You can also enable two-factor authentication to keep your account even safer.

- SmartScan: You can take a picture of a receipt, and the app “reads” it to find the date, store name, and price.

- Work Anywhere: The mobile app lets you do almost everything on your phone, even without an internet connection. connection

- Easy Sending: You can build and send whole reports right from your smartphone.

- Email Receipts: You can forward receipts from your email to the app, and it will process them for you.

- Travel Help: The app integrates with travel tools so you can book trips and easily track costs.

- Automatic Work: Expensify handles the hard parts, from scanning the paper to putting money in your bank.

- Right Person, Right Time: The system knows exactly which manager should see your report based on company rules.

- Rule Watcher: The app continuously checks your spending against your company’s rules to ensure everything is in order.

- Group Workspace: You can create a “Workspace” to keep your team’s expenses organized.

- Accounting Links: Expensify talks to tools like QuickBooks and ゼロ to keep the math correct.

- プロのヒント: For the best results, scan receipts as soon as you get them and use the same names for your categories.

- Card Links: Link your own credit card so your purchases appear in the app automatically.

- The Expensify Card: Using their special card can give you 2% back on your spending and even lower your monthly bill by half.

- Distance Tracker: The app uses GPS to see how far you drove for work and calculates how much money you should get back.

- Live Spending: You can watch how much money is being spent in real-time on your dashboard.

- Budgets: You can set a spending limit and receive a warning if you exceed it.

- Scheduled Submit: A feature that collects your receipts and automatically sends them to your boss on a set day.