你是不是想弄清楚哪个 会计软件 哪种方式最适合您的业务?

选择太多,反而让人难以抉择!

您可以考虑的两个热门选择是 Puzzle IO 和 QuickBooks。

管理财务不应该是一件难事,那些可以自动化的任务也不应该是一件难事。

在本文中,我们将对 Puzzle IO 与 QuickBooks 进行比较,以帮助您决定哪一个更适合您。

概述

我们花时间研究了 Puzzle IO 和 QuickBooks 这两款软件。

深入研究它们的功能以及它们如何适用于不同情况 商业 需要。

本次比较基于实际经验和仔细评估,旨在让您清楚地了解每款产品所提供的功能和特性。

想简化您的财务管理吗?看看 Puzzle IO 如何每月为您节省多达 20 小时。体验一下它的不同之处。

定价: 提供免费套餐。付费套餐起价为每月 42.50 美元。

主要特点:

- 财务规划

- 预测

- 实时分析

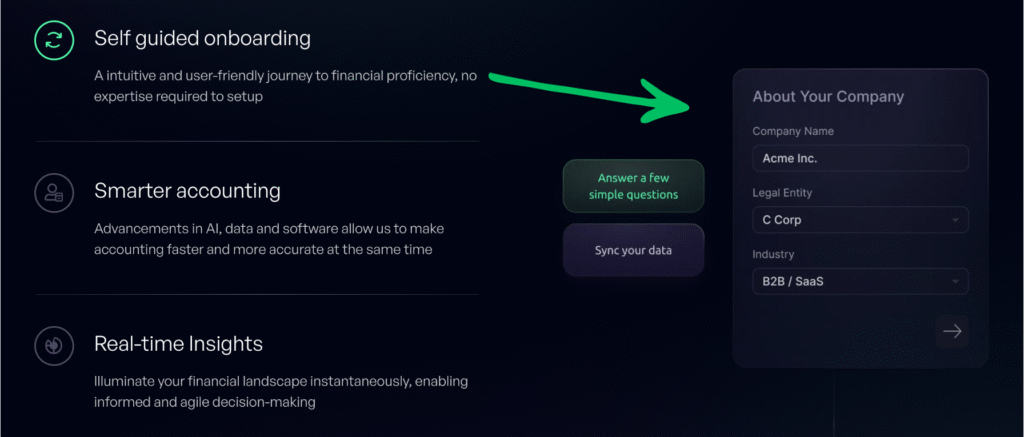

什么是 Puzzle IO?

那么,Puzzle IO,它到底是一款什么游戏呢?

把它看作是一个能真正帮助你预见企业未来财务状况的工具。

这不仅仅关乎现在正在发生的事情,还关乎未来可能发生的事情。

此外,还可以探索我们最喜欢的 Puzzle IO 的替代方案…

我们的观点

想简化您的财务管理吗?看看 Puzzle io 如何每月为您节省多达 20 小时。立即体验它的与众不同!

主要优势

Puzzle IO 在帮助你了解企业发展方向方面表现出色。

- 92% 用户反馈财务预测准确率有所提高。

- 实时掌握您的现金流状况。

- 轻松创建不同的财务方案进行规划。

- 与团队无缝协作,共同实现财务目标。

- 在一个地方跟踪关键绩效指标(KPI)。

定价

- 会计基础知识: 每月0美元。

- Accounting Plus Insights: 每月 42.50 美元。

- Accounting Plus 高级自动化: 每月85美元。

- Accounting Plus 规模: 每月255美元。

优点

缺点

QuickBooks是什么?

好的,我们来聊聊QuickBooks吧。你可能听说过这个名字。

很多 小型企业 用它来管理他们的日常财务事宜。

您可以将其视为发票、费用和跟踪您企业当前业绩的中心枢纽。

此外,还可以探索我们最喜欢的 QuickBooks的替代方案…

主要优势

- 自动交易分类

- 发票创建和跟踪

- 费用管理

- 薪资服务

- 报告和仪表盘

定价

- 简单入门: 每月1.90美元。

- 基本的: 每月 2.80 美元。

- 加: 每月4美元。

- 先进的: 每月7.60美元。

优点

缺点

功能对比

下面我们将并排比较这两家公司在关键财务指标方面的表现。

这将为您提供清晰的见解,帮助您选择最适合您的解决方案。 小型企业.

1. 实时指标和现金储备

这对于早期创业者和联合创始人来说,往往是一个具有变革意义的事件。

- Puzzle IO: 提供现金等关键指标的实时洞察。 跑道 在简洁的仪表盘上清晰显示资金消耗率。这可以快速、准确地展现公司当前的运营状况。

- QuickBooks: 要准确了解这些关键指标,需要投入更多的人工。用户通常需要导出业务数据。 数据 他们需要自行使用电子表格计算现金流周转时间,这迫使他们等待更长时间才能获得关键信息。.

2. 人工智能驱动的自动化和交易分类

工作流程 自动化 这是节省处理繁琐任务时间的关键。

- Puzzle IO: Features AI-powered workflow automation for transaction categorization directly into the general ledger. This is designed to reduce errors and make bookkeeping easier for non-accountants.

- QuickBooks: 它在关联银行账户和信用卡方面具有良好的自动化功能,但交易分类通常需要人工审核,这意味着非会计人员可能需要花费更多时间来纠正错误。

3. 收入确认与权责发生制会计

处理复杂 会计 正确遵守规则对于正确追踪收入至关重要。

- Puzzle IO: 提供内置的自动化收入确认和计提功能 会计这对于投资者准确了解收入情况至关重要。它确保了税务合规,而无需在早期阶段聘请全职财务专家。

- QuickBooks虽然它支持应计制 会计收入确认的复杂规则通常需要大量的人工投入或经验丰富的会计师才能正确设置和维护。

4. 固定资产和预付费用

正确追踪和折旧资产及费用是报税时必不可少的环节。

- Puzzle IO: 它可以自动跟踪和计算固定资产折旧以及预付费用。这使得创业者能够更轻松地保持账目更新,并在报税时为会计师做好准备。

- QuickBooks: 支持固定资产和预付费用,但需要更多的手动设置和日记账分录,这可能会增加非会计人员出错的几率。

5. 财务仪表盘和财务洞察

能够即时了解您的现金流和收入情况,这将彻底改变您的游戏规则。

- Puzzle IO: 该仪表盘旨在为创业公司创始人提供实时洞察和可操作的财务信息。其结构清晰,能够快速呈现公司当前的运营状况。

- QuickBooks: 这些仪表盘主要侧重于总账和传统财务报表。虽然功能强大,但要从中获得财务洞察,往往需要更深入的挖掘,而要全面了解财务状况,则可能需要等到会计师完成账目结算之后。

6. 工资管理功能

处理员工和承包商的付款是日常工作的一部分。

- Puzzle IO: 通常与 Gusto 或 Rippling 等第三方服务集成以处理工资发放。其重点在于将工资交易无缝记录到总账中。

- QuickBooks: 提供集成选项,例如 QuickBooks Payroll(包括 QuickBooks 全方位服务)。 簿记 通过工资管理系统)进行直接存款和支付给承包商的款项。这样可以将工资和会计工作集中在一个机构内完成。

7. 桌面版与在线版

根据所使用的 QuickBooks 产品,其功能和特性会有所不同。

- Puzzle IO: 仅提供在线版本,可从任何地方在线访问。

- QuickBooks: QuickBooks 主要有两款产品:QuickBooks Online(云端版)和 QuickBooks Desktop(本地安装,单机授权)。QuickBooks Desktop 拥有一些在线版本所不具备的特定功能。

8. 处理账单和采购订单

管理好欠供应商的款项对现金流至关重要。

- Puzzle IO: 通过以下方式实现账单支付自动化 追踪现金流出并与支出管理平台集成。

- QuickBooks: QuickBooks桌面版提供了强大的功能,可用于支付账单、创建客户发票以及使用采购订单来维护准确的库存记录。

9. 创始人为何选择拼图

快速了解一下这种选择背后的心态。

- Puzzle IO: 许多创始人选择 Puzzle 是因为它的功能类似于 QuickBooks,但采用了现代化的 AI 技术,可以节省处理繁琐任务的时间,并提供更深入的财务见解。

- QuickBooks: 用户坚持使用 QuickBooks 因为它是 会计行业 标准。其广泛接受性和全面性 Intuit QuickBooks 对所有 小型企业 是一个重要因素。

选择会计软件时应该注意哪些方面?

以下是一份需要记住的简要清单:

- 易用性: 界面是否直观易用?寻找一款设置简单、能帮助你保持井然有序的产品。

- 核心功能: 它能否有效追踪资金、管理会计科目表并处理对账?

- 报告 力量: 它能否轻松生成资产负债表和详细财务报告等重要报告,以展示您的财务状况?

- 自动化: 它是否能最大限度地减少手动数据输入并提供良好的工作流程自动化?

- 一体化: 它能否与您使用的其他工具(例如用于员工考勤的 QuickBooks Time 或用于销售管理系统)良好集成?

- 报税准备: 它是否简化了销售税的计算和年终报税流程?

- 客户管理: 它可以处理客户账单并发送付款提醒吗?

- QuickBooks 的具体细节: 您是从桌面数据迁移过来,需要 QuickBooks 提供的各项功能吗?或者您是自由职业者,只需要基本的跟踪功能?

- 成本与支持: 注册前请务必了解所有潜在费用,并查看 QuickBooks 评论,以了解客户支持情况以及取消订阅的便捷程度。

- 结语: 最好的软件就是能以最小的麻烦为你的企业带来最大的收益。

最终判决

选择拼图还是 QuickBooks,最终取决于您的需求。

如果未来规划和强劲的财务报表对你的创业公司至关重要,你可以试试他们的免费试用版。

Puzzle IO 可能会很棒。

对于日常会计功能和众多连接方式而言,QuickBooks 更胜一筹。

虽然没有完全免费的 会计软件 样样精通。

他们的方案适合很多人。我们已经考察过了。

了解你的主要目标将有助于你做出选择。

更多 Puzzle IO 内容

我们已经对比了 Puzzle IO 与其他会计工具的优劣。以下是其主要功能的简要介绍:

- Puzzle IO 对比 Xero: Xero提供功能全面的会计功能和强大的集成能力。

- Puzzle IO 对阵 Dext: Puzzle IO 在人工智能驱动的金融洞察和预测方面表现出色.

- Puzzle IO 对阵 Synder: Synder 在同步销售和支付数据方面表现出色。

- Puzzle IO 对比 Easy Month End: 简易月末结算简化了财务结算流程。

- Puzzle IO 对阵 Docyt: Docyt利用人工智能技术实现记账任务的自动化。

- Puzzle IO 对比 RefreshMe: RefreshMe专注于实时监控财务绩效。

- Puzzle IO 对阵 Sage: Sage 为各种规模的企业提供强大的会计解决方案。

- Puzzle IO 与 Zoho Books 的比较: Zoho Books 提供价格实惠的会计服务 客户关系管理 一体化。

- Puzzle IO 对阵 Wave: Wave 为小型企业提供免费的会计软件。

- Puzzle IO 对比 Quicken: Quicken 以个人和小企业财务管理而闻名。

- Puzzle IO 与 Hubdoc: Hubdoc 专门从事文档收集和数据提取。.

- Puzzle IO 对比 Expensify: Expensify 提供全面的费用报告和管理服务。

- Puzzle IO 对比 QuickBooks: QuickBooks是小型企业会计的热门选择。

- Puzzle IO 对比 AutoEntry: AutoEntry 可自动从发票和收据中录入数据。

- Puzzle IO 对比 FreshBooks: FreshBooks 专为服务型企业的发票处理而设计。

- Puzzle IO 对比 NetSuite: NetSuite 提供了一套全面的企业资源规划解决方案。

更多 QuickBooks 内容

- QuickBooks 与 Puzzle IO 对比这款软件专注于为初创企业提供人工智能驱动的财务规划。它的对应产品则面向个人理财。

- QuickBooks 与 Dext这是一个用于记录收据和发票的商业工具。另一个工具用于追踪个人支出。

- QuickBooks 与 Xero 的比较这是面向小型企业的热门在线会计软件。它的竞争对手是面向个人用户的。

- QuickBooks vs Synder该工具可将电子商务数据与会计软件同步。其替代版本则专注于个人理财。

- QuickBooks 与 Easy Month End 的比较这是一个用于简化月末工作的商业工具。它的竞争对手是用于管理个人财务的工具。

- QuickBooks 与 Docyt一个应用人工智能进行企业记账和自动化,另一个应用则将人工智能用作个人理财助手。

- QuickBooks 与 Sage这是一个功能全面的企业会计软件。它的竞争对手是一款更易于使用的个人理财工具。

- QuickBooks 与 Zoho Books 的比较这是一个面向小型企业的在线会计工具。它的竞争对手是面向个人用户的。

- QuickBooks 与 Wave 的比较这款软件为小型企业提供免费的会计软件。它的对应版本则面向个人用户。

- QuickBooks 与 Quicken两者都是个人理财工具,但这款工具提供更深入的投资追踪功能,另一款则更简单易用。

- QuickBooks 与 Hubdoc该公司专门从事簿记文档采集。它的竞争对手是一款个人理财工具。

- QuickBooks 与 Expensify 的比较这是一个企业费用管理工具。另一个是用于个人费用跟踪和预算的工具。

- QuickBooks 与 AutoEntry 的比较该软件旨在实现企业会计数据录入的自动化。它的替代产品是一款个人理财工具。

- QuickBooks 与 FreshBooks这是面向自由职业者和小企业的会计软件。它的替代版本则用于个人理财。

- QuickBooks 与 NetSuite这是一个功能强大的企业管理套件,适用于大型企业。它的竞争对手是一款简单的个人理财应用。

常见问题解答

对于像 QuickBooks 这样的中小型企业来说,哪款软件更好?

这取决于具体的会计需求。QuickBooks 在一般会计方面表现出色,而其他软件可能提供一些更专业的功能。

这两款软件能否通过工作流程自动化改善我的企业财务状况?

是的,Puzzle IO 和 QuickBooks 都提供了自动执行诸如开票和数据录入等任务的功能,从而节省时间。

Puzzle IO 与会计行业的标准相比如何?

Puzzle IO 专注于预测和 AI 驱动的洞察,这是一种比传统软件更现代的方法。

评估公司会计需求时需要考虑的关键因素有哪些?

考虑一下您的预算、所需功能(如发票或工资单)、集成和未来发展计划。

从一个会计平台(例如 QuickBooks)切换到另一个会计平台难吗?

系统切换需要时间和周密的计划,以确保数据迁移准确无误,并且您的团队能够适应新系统。