소규모 사업 회계 업무에 부담감을 느끼시나요?

최적의 소프트웨어를 선택하는 것은 마치 미로를 헤매는 것과 같은 느낌일 수 있습니다.

많은 기업가들이 불편한 인터페이스, 숨겨진 수수료, 그리고 실제로 필요하지 않은 기능들 때문에 어려움을 겪습니다.

하지만 만약 해결책이 있다면 어떨까요? 쉽게 한 모든 것?

만약 당신이 회계 소프트웨어 직관적이고, 가격도 적당하고, 실제로 사용하는 도구들이 가득 담겨 있었나요?

이번 웨이브 리뷰에서 최고의 제품들을 소개합니다. 소규모 사업체 2025년 회계 소프트웨어, Wave가 여러분이 찾던 해답인지 심층적으로 살펴보겠습니다.

이 제품의 특징을 살펴보고 과연 그 명성에 걸맞은지 확인해 보겠습니다.

4백만 개 이상의 중소기업이 Wave를 통해 재무 관리를 하고 있습니다. Wave를 통해 월평균 5시간을 절약한다고 응답한 사용자(88%)의 사례를 확인해 보세요. 부기 웨이브와 함께.

웨이브란 무엇인가요?

Wave는 도움을 주는 도구입니다. 소규모 사업 소유주들은 자신의 돈을 관리합니다.

마치 디지털 노트북과 계산기가 하나로 합쳐진 것과 같습니다.

수입과 지출을 추적할 수 있습니다.

당신의 능력을 확인하는 방법이라고 생각하세요. 사업 특별한 학위 없이도 경제적으로 성공하고 있다.

이 앱은 고객에게 청구서를 보내거나 수입과 지출을 정리하는 데 도움이 됩니다.

이렇게 하면 사업체의 자금 흐름을 더 쉽게 이해할 수 있습니다. 만들다 현명한 선택.

웨이브를 만든 사람은 누구인가요?

커크 심슨 그리고 제임스 로크리 2009년 캐나다에서 Wave를 공동 설립했습니다.

그들의 목표는 간단했습니다. 중소기업의 자금 관리를 간편하게 만드는 것이었습니다.

그들은 기존의 복잡한 옵션들과는 달리 사용하기 쉽고 저렴한 도구를 구상했습니다.

그들은 기업가들이 전문가가 아니더라도 재무 상태를 이해할 수 있도록 돕고자 했습니다.

웨이브는 이후 전 세계 수백만 명을 돕는 기업으로 성장했습니다.

웨이브의 주요 이점

중소기업이 Wave를 선택하는 주요 이유는 다음과 같습니다.

- 핵심 기능은 무료입니다. 가장 큰 장점 중 하나는 수입 및 지출 추적, 송장 발행, 기본 기능 등 필수적인 기능들이 많이 포함되어 있다는 점입니다. 회계 보고서는 무료로 제공됩니다. 이는 신규 사업체가 비용을 절감하는 데 도움이 됩니다.

- 사용하기 쉬움: Wave는 인터넷 사용이 익숙하지 않은 사람들도 쉽게 사용할 수 있도록 간단하고 직관적으로 설계되었습니다. 회계 배경. 직관적인 인터페이스 덕분에 재무 관리가 훨씬 간편해졌습니다.

- 클라우드 기반 접근성: 온라인으로 제공되므로 웨이브에 접속할 수 있습니다. 데이터 from anywhere with an internet connection. This provides flexibility for 사업 owners on the go.

- 통합 청구서 발행: Wave를 사용하면 고객에게 전문적인 청구서를 쉽게 작성하고 보낼 수 있습니다. 또한 결제 상태를 추적하여 현금 흐름을 효과적으로 관리할 수 있습니다.

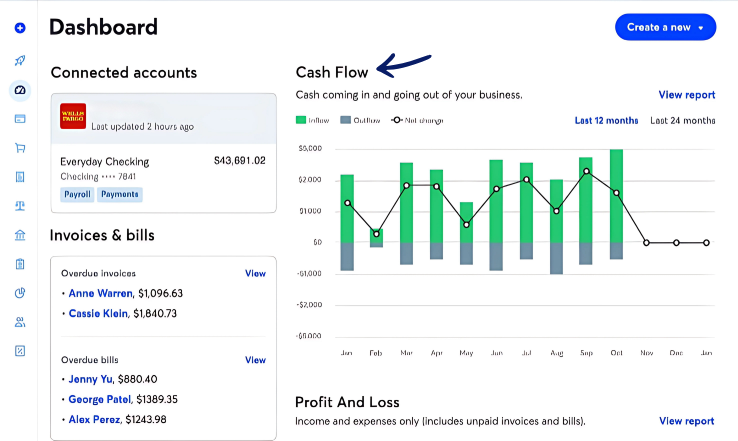

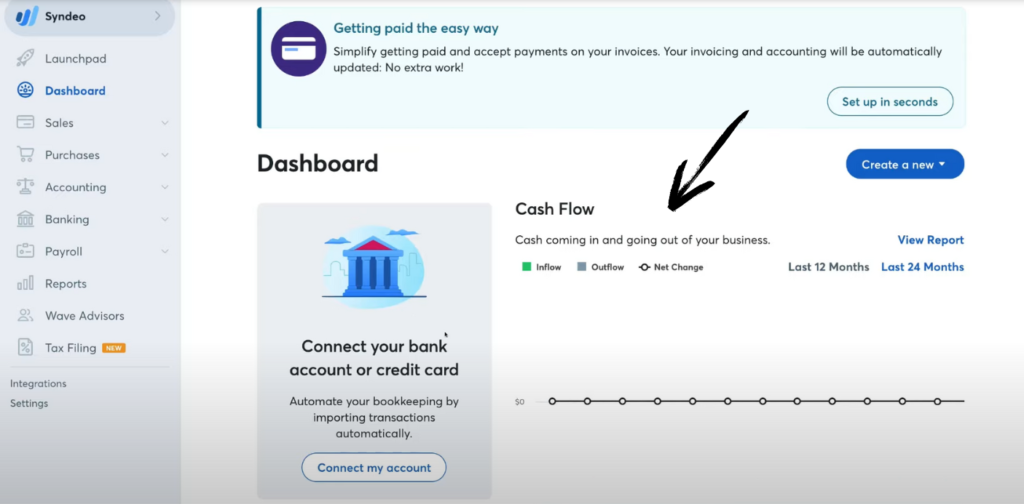

- 은행 연계: 은행 계좌와 신용 카드를 Wave에 연결하면 거래 내역이 자동으로 불러와집니다. 이를 통해 수동 데이터 입력 시간을 절약하고 정확한 기록을 유지할 수 있습니다.

- 확장 가능한 옵션: 핵심 기능은 무료이지만, Wave는 비즈니스 규모가 커지고 요구 사항이 복잡해짐에 따라 급여 및 결제 처리와 같은 유료 추가 기능도 제공합니다.

- 서비스 기반 사업에 적합합니다: 많은 프리랜서 서비스 제공업체들은 특히 Wave의 청구서 발행 및 비용 추적 기능이 자신들의 요구에 매우 적합하다고 생각합니다.

주요 특징

웨이브는 인기 있는 제품입니다. 회계 중소기업 및 프리랜서를 위해 설계된 소프트웨어입니다.

이 서비스는 사용하기 쉬운 도구로 유명하며, 이를 통해 스트레스 없이 자금을 관리하고 세금 신고를 준비할 수 있습니다.

Wave는 송장 발행, 결제 등의 기능을 통합합니다. 부기 모든 재정 정보를 한곳에 모아 관리하기가 더 쉬워집니다.

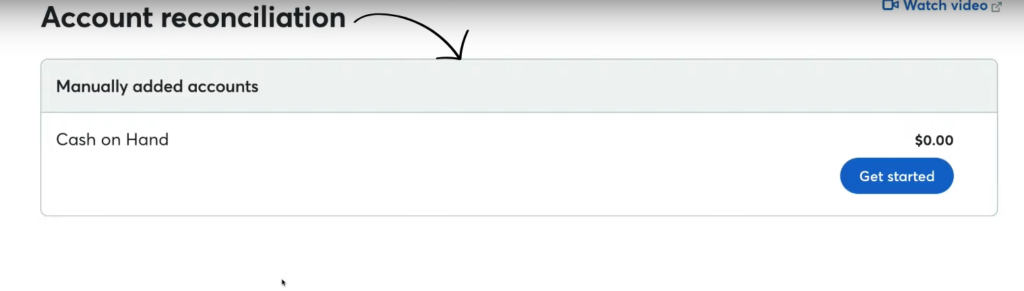

1. 계정 조정

이 기능은 은행 계좌 잔액과 Wave에 기록된 금액이 일치하는지 확인하는 데 도움이 됩니다.

숙제를 꼼꼼히 확인해서 빠뜨린 부분이 없는지 점검하는 것과 같습니다. Wave는 은행 계좌와 연동되어 이 과정을 빠르고 간편하게 만들어 줍니다.

이는 실수를 잡아내고 장부를 정확하게 유지하는 데 도움이 됩니다.

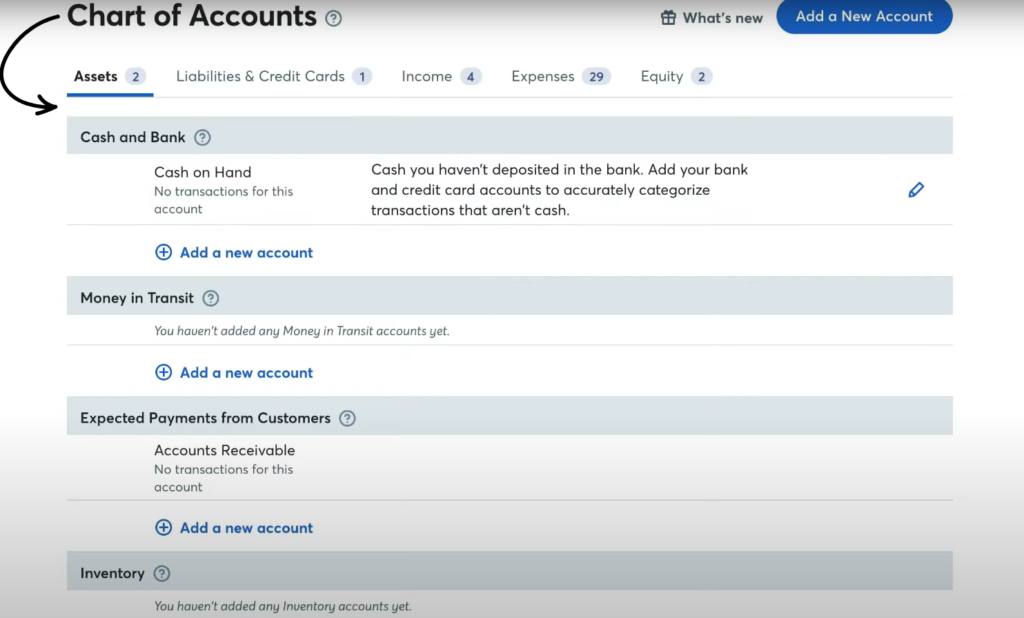

2. 계정과목표

계정과목표는 사업 자금의 모든 범주를 나열한 목록이라고 생각하면 됩니다.

Wave는 이 목록을 읽기 쉽고 이해하기 쉽게 만들어줍니다.

돈이 어디로 가고 어디에서 오는지 파악하는 데 도움이 됩니다.

이는 정확한 재무 기록을 유지하는 데 있어 핵심적인 부분입니다.

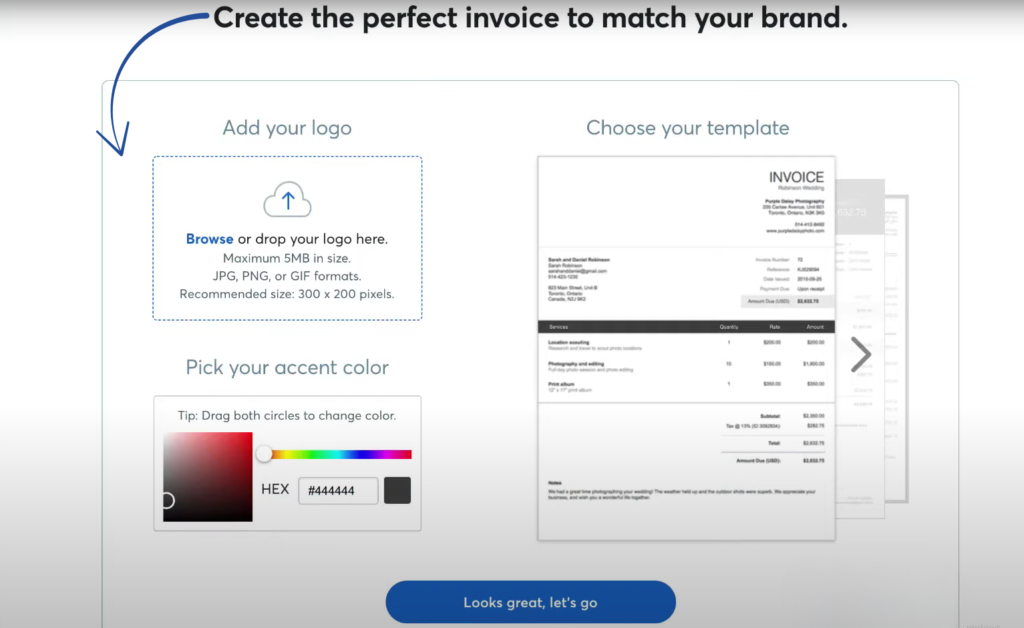

3. 송장

Wave를 사용하면 전문가 수준의 청구서를 작성하여 고객에게 보낼 수 있습니다.

로고와 색상을 추가하여 비즈니스에 맞게 조정할 수 있습니다.

빠르게 이메일을 보낼 수 있을 뿐 아니라, 대금 지급이 연체된 고객에게 알림을 보내도록 설정할 수도 있습니다.

이렇게 하면 더 빨리 급여를 받을 수 있습니다.

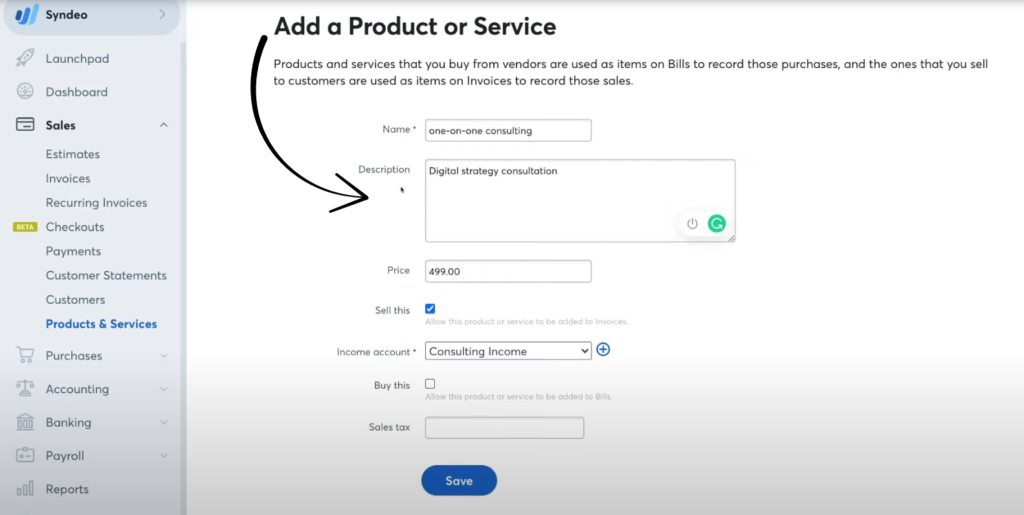

4. 제품 및 서비스

이 기능을 사용하면 판매하는 모든 품목 목록을 만들 수 있습니다.

이는 배송하는 제품일 수도 있고, 잔디 깎기처럼 제공하는 서비스일 수도 있습니다.

이 목록을 이용하면 클릭 한 번으로 송장에 항목을 추가할 수 있습니다.

이렇게 하면 매번 모든 내용을 직접 입력하는 것보다 훨씬 빠르고 쉽게 송장을 작성할 수 있습니다.

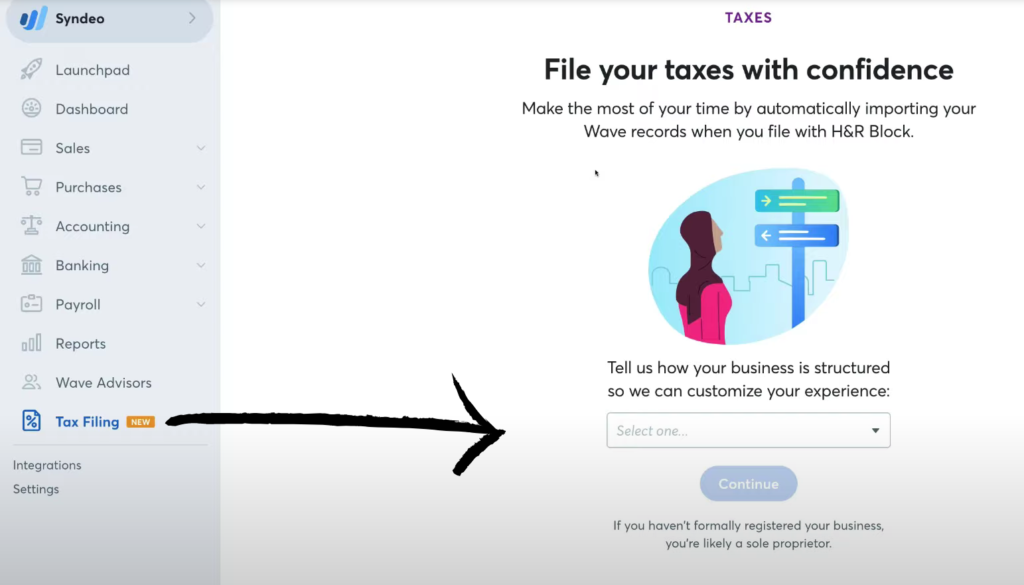

5. 세금 신고

Wave는 세금 신고 기간을 훨씬 수월하게 만들어 줍니다.

이 소프트웨어는 연중 수입과 지출을 정리해 줍니다.

또한 손익계산서와 같은 중요한 보고서를 생성할 수 있으며, 이는 회계사가 세금 신고를 하는 데 필요합니다.

Wave는 급여 관리 기능을 통해 일부 지역에서는 자동 세금 납부 및 신고까지 지원할 수 있습니다.

6. 지출 추적

Wave를 사용하면 사업 운영에 드는 모든 비용을 간편하게 추적할 수 있습니다.

모든 은행 계좌와 신용 카드를 연결하면 프로그램이 자동으로 거래 내역을 가져옵니다.

이렇게 하면 모든 정보를 수동으로 입력할 필요가 없습니다.

모바일 앱을 이용하면 영수증 사진을 찍어 디지털 기록으로 보관할 수도 있습니다.

7. 재무 보고

Wave를 사용하면 비즈니스 현황을 보여주는 중요한 보고서를 쉽게 만들 수 있습니다.

이 보고서를 통해 여러분이 얼마나 벌었는지, 얼마나 썼는지, 그리고 전반적인 재정 상태를 확인할 수 있습니다.

그들은 당신에게 사업에 대한 명확한 그림을 보여주어 현명한 결정을 내릴 수 있도록 도와줍니다.

8. 모바일 앱

Wave는 이동 중에도 비즈니스 재무를 관리할 수 있는 모바일 앱을 제공합니다.

어디에서든 송장을 작성하고, 지출을 추적하고, 재무 보고서를 확인할 수 있습니다.

이 제품은 항상 바빠서 책상에 앉아 있을 시간이 없는 사람들에게 아주 좋습니다.

9. 다중 통화 지원

해외 고객과 거래하는 사업이라면 이 기능이 매우 유용합니다.

Wave는 전 세계 다양한 유형의 자금을 처리할 수 있습니다.

즉, 아무런 번거로움 없이 다른 통화로 송장을 작성하고 결제를 추적할 수 있습니다.

프리랜서와 글로벌 사업을 하는 기업에 아주 좋습니다.

가격

Wave Accounting의 가격 정책을 간단하게 살펴보겠습니다.

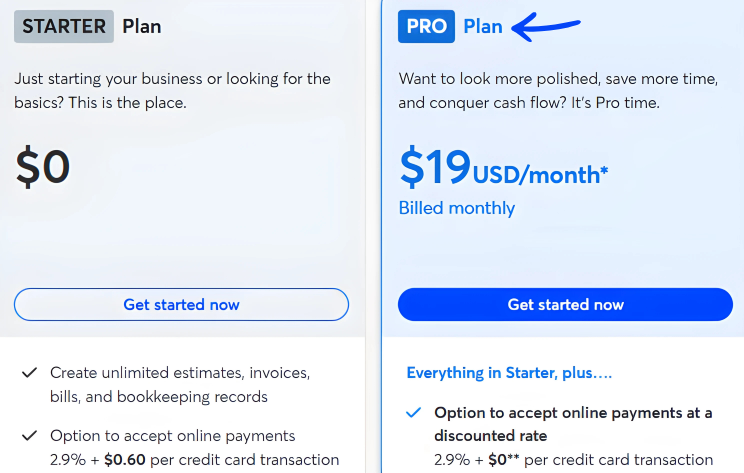

| 플랜 이름 | 가격 | 주요 특징 |

| 스타터 플랜 | $0 | 견적서, 송장, 청구서 및 회계 장부를 무제한으로 작성하세요. |

| 프로 플랜 | 월 19달러 | 은행 거래 내역 자동 가져오기, 자동 병합 및 분류. |

장점과 단점

Wave의 장점과 단점을 모두 이해하면 Wave가 귀사의 비즈니스 요구에 적합한지 판단하는 데 도움이 됩니다.

주요 장점과 잠재적 단점을 살펴보겠습니다.

장점

단점

웨이브의 대안

Wave가 여러분의 요구 사항을 완벽하게 충족하지 못한다면, 다음과 같은 Wave 대안들을 고려해 보세요:

- 퍼즐 IO: 이 소프트웨어는 인공지능 기반 재무 계획에 중점을 두고 있습니다.

- 덱스트: 이 도구는 문서를 캡처하고 데이터를 추출하는 데 매우 유용합니다.

- 제로: 이는 중소기업에서 널리 사용되는 인기 있는 온라인 회계 소프트웨어입니다.

- 시나이더: 이 회사는 전자상거래 및 결제 데이터를 회계 소프트웨어와 동기화하는 데 특화되어 있습니다.

- 쉬운 월말: 이 소프트웨어는 월말 재무 업무를 간소화하도록 설계되었습니다.

- 도시트: 이 시스템은 회계 처리를 위해 인공지능을 사용하고 재무 워크플로우를 자동화합니다.

- 세이지: 이 제품은 종합적인 비즈니스 및 회계 소프트웨어 제품군입니다.

- 조호 북스: 이 온라인 회계 도구는 저렴하고 소규모 사업체에 적합한 것으로 알려져 있습니다.

- 빠르게 하다: 개인 예산을 관리하는 데 도움이 되는 인기 있는 재정 관리 도구입니다.

- 허브독: 이 회사는 회계 처리를 위한 재무 문서를 수집하고 정리하는 데 특화되어 있습니다.

- Expensify: 이 앱은 비용 관리에 중점을 두고 있으며, 영수증을 쉽게 추적하고 제출할 수 있도록 해줍니다.

- 퀵북스: 기업의 송장 발행부터 급여 지급까지 모든 업무를 지원하는 매우 유명한 회계 소프트웨어입니다.

- 자동 입력: 이 도구는 송장 및 영수증과 같은 문서를 스캔하고 분석하여 데이터 입력을 자동화합니다.

- 프레시북스: 이 소프트웨어는 프리랜서와 소규모 사업체를 위해 특별히 개발되었으며, 청구서 발행 및 시간 추적에 중점을 두고 있습니다.

- 넷스위트: 대기업을 위한 강력하고 완벽한 클라우드 기반 비즈니스 관리 솔루션입니다.

파동 비교

- 웨이브 vs 퍼즐 IO이 소프트웨어는 스타트업을 위한 AI 기반 재무 계획에 중점을 두고 있습니다. 개인 재무 관리에 대한 버전도 있습니다.

- 웨이브 vs 덱스트이것은 영수증과 송장을 기록하는 업무용 도구입니다. 다른 도구는 개인 경비를 추적하는 데 사용됩니다.

- 웨이브 vs 제로이 소프트웨어는 중소기업에서 널리 사용되는 온라인 회계 소프트웨어입니다. 경쟁 제품은 개인용으로 개발되었습니다.

- 웨이브 vs 시너더이 도구는 전자상거래 데이터를 회계 소프트웨어와 동기화합니다. 대안으로는 개인 재무 관리에 초점을 맞춘 도구가 있습니다.

- 웨이브 vs 이지 월말이 앱은 월말 업무를 간소화하는 비즈니스 도구입니다. 경쟁 앱으로는 개인 재정 관리 앱이 있습니다.

- 웨이브 vs 도시트하나는 AI를 활용하여 기업 회계 및 자동화를 지원하고, 다른 하나는 AI를 개인 재정 관리 도우미로 활용합니다.

- 웨이브 vs 세이지이 제품은 종합적인 기업 회계 소프트웨어 제품군입니다. 경쟁 제품은 개인 재무 관리에 더 사용하기 쉬운 도구입니다.

- Wave와 Zoho Books 비교: 이는 소규모 사업체를 위한 온라인 회계 도구입니다. 경쟁 제품은 개인용입니다.

- 웨이브 vs 퀵큰둘 다 개인 재무 관리 도구이지만, 이 도구는 보다 심층적인 투자 추적 기능을 제공합니다. 다른 하나는 사용이 더 간편합니다.

- Wave vs Hubdoc이 회사는 회계 장부 작성을 위한 문서 캡처를 전문으로 합니다. 경쟁 업체는 개인 재무 관리 도구입니다.

- Wave vs Expensify이것은 업무 경비 관리 도구입니다. 다른 하나는 개인 경비 추적 및 예산 관리 도구입니다.

- Wave와 QuickBooks 비교: 이는 기업용으로 잘 알려진 회계 소프트웨어입니다. 그 대안은 개인 재무 관리에 맞춰 개발되었습니다.

- 웨이브 방식 vs 자동 입력 방식이 프로그램은 기업 회계 데이터 입력을 자동화하도록 설계되었습니다. 이와 유사한 프로그램으로는 개인 재무 관리 도구가 있습니다.

- 웨이브 vs 프레시북스이 소프트웨어는 프리랜서와 소규모 사업자를 위한 회계 소프트웨어입니다. 개인 재무 관리용으로도 사용할 수 있습니다.

- 웨이브 vs 넷스위트이 제품은 대기업을 위한 강력한 비즈니스 관리 소프트웨어 제품군입니다. 경쟁 제품은 간단한 개인 재무 관리 앱입니다.

Wave를 사용해본 개인적인 경험

우리 팀은 Wave가 훌륭한 플랫폼이라는 것을 알게 되었습니다. 소규모 사업 회계 소프트웨어.

우리는 소규모 사업 소유자들은 무료 버전이 있다는 점을 좋아했습니다.

무료 회계 무료 플랫폼 덕분에 좋은 출발을 할 수 있었습니다.

여러 회사를 관리하고 계정에 여러 사용자를 등록할 수 있었습니다. 무료 스타터 플랜이 정말 큰 도움이 되었습니다.

그것은 우리에게 모든 기본적인 것을 주었습니다. 회계 우리가 필요로 했던 기능들.

무료 버전을 사용하면 무제한으로 송장을 보내고 관리할 수 있습니다. 부기 기록.

온라인 결제도 받을 수 있었고, 더 빠르게 대금을 받을 수 있었습니다. 소프트웨어 덕분에 자금 흐름을 쉽게 추적할 수 있었죠.

이 프로그램 덕분에 고객에게 결제 알림을 보낼 수 있었습니다. 또한 디지털 영수증 캡처 기능을 사용하여 지출을 추적했습니다.

나중에그래서 우리는 유료 프로 플랜을 구매하기로 결정했습니다.

저희는 급여 처리 시스템을 이용하여 팀원들에게 급여를 지급했습니다.

- 소규모 사업체 Accounting SoftwareWave는 사업 자금을 관리하는 데 아주 좋은 도구입니다.

- 무료 회계 소프트웨어이 프로그램은 많은 기능을 무료로 제공합니다.

- 무료 버전기본 플랜은 무료이며 매우 유용합니다.

- 무제한 청구서우리는 필요한 만큼 청구서를 보낼 수 있습니다.

- 정기 청구서저희는 청구서가 자동으로 발송되도록 설정했습니다.

- 온라인 결제 수락고객은 신용카드, 애플페이 또는 은행 송금을 통해 간편하게 결제할 수 있습니다.

- 급여 처리우리는 직원과 계약직 직원들에게 급여를 지급할 수 있습니다.

- 직접 입금우리는 팀원들에게 급여를 지급했습니다. 곧.

- 디지털 영수증 캡처지출 내역을 추적하기 위해 영수증 사진을 찍었습니다.

- 여러 사용자우리 팀 전체가 함께 소프트웨어를 사용할 수 있습니다.

- 자금 관리 기능그 소프트웨어 덕분에 모든 수입과 지출을 추적할 수 있었습니다.

- 청구 가능 시간우리는 프로젝트에 소요한 시간을 추적할 수 있었습니다.

정규 직원이나 독립 계약자 모두에게 계좌이체로 급여를 지급할 수 있었습니다. 덕분에 우리 팀은 안심하고 일할 수 있었습니다.

온라인 결제 시 할인 혜택도 받았습니다. 두 가지 요금제 덕분에 필요한 것을 쉽게 선택할 수 있었습니다.

저희는 일부 고객에게 정기 결제 기능을 사용했습니다.

마지막으로

이번 웨이브 회계 검토 결과를 바탕으로 웨이브를 추천합니다.

이 청구서 발행 소프트웨어는 소규모 사업자에게 매우 적합합니다.

Wave는 다양한 무료 도구를 제공합니다. 영수증 스캔을 통해 지출 내역을 추적할 수 있으며, 은행 계좌와도 연동됩니다.

이 기능은 거래를 자동으로 처리합니다. 유료 플랜은 더 많은 기능을 제공합니다.

웨이브 페이롤을 사용하면 자동 결제 알림을 보낼 수 있습니다.

신용카드 결제도 받을 수 있습니다.

다중 인증 및 무제한 사용자 등의 기능을 갖춘 안전한 플랫폼입니다. 고객 지원 센터에서 도움을 받으실 수 있습니다.

Wave는 사업 재정 관리에 탁월한 선택입니다.

자주 묻는 질문

Is Wave Finances legit?

Absolutely. Wave is a highly reputable financial platform owned by the tax giant H&R Block. It uses bank-grade 보안 to protect your data. You aren’t dealing with a startup; it’s a battle-tested tool used by millions of small business owners globally.

Is Wave actually free?

Yes, the 스타터 플랜 is genuinely $0 per month for unlimited invoicing and bookkeeping. However, they monetize through “pay-as-you-go” payment processing and payroll services. If you want automated bank imports or receipt scanning, you’ll need the 프로 플랜.

Is Wave better than QuickBooks?

It depends on your scale. Wave wins for freelancers and micro-businesses due to its simplicity and zero-cost entry. QuickBooks is superior for larger companies needing inventory management or complex project tracking. If you’re a solopreneur, Wave is often the smarter, leaner choice.

Does Wave App report to IRS?

Yes, Wave is compliant with tax regulations. If you process payments through Wave and meet the IRS thresholds (like the 1099-K requirements), Wave will automatically file the necessary forms and provide copies for your records. It simplifies your tax season significantly.

What are the disadvantages of Wave Accounting?

The biggest drawback is the lack of inventory tracking and built-in 시간 추적. It’s not ideal for product-based businesses. Additionally, the free tier no longer includes automatic bank feeds, requiring manual imports unless you upgrade to their paid Pro tier.

How much does Wave cost?

Wave offers a 무료 스타터 플랜 for basic invoicing. The 프로 플랜 typically costs around $16–$19 per month. For payment processing, you’ll pay standard transaction fees (approx. 2.9% + $0.60), and Payroll starts at a $40 base fee plus $6 per employee.

Who bought Wave Accounting?

Wave was acquired by H&R Block in 2019 for approximately $405 million. This acquisition gave Wave the financial backing of a massive corporation while allowing it to maintain its focus on user-friendly tools for the “little guy” in business.

More Facts about Wave

The Different Plans

- Two Ways to Choose: Wave has two main levels. The Starter plan is free. The Pro plan costs money but gives you more tools.

- What it Costs: The Pro plan costs $16 per month ($170 if you pay for the whole year at once). This is cheaper than other big tools like QuickBooks or Xero.

- Free Stuff: Even if you don’t pay, you can send as many invoices as you want and track how much money you make and spend.

- Paying for Extras: If you want Wave to help pay your employees (Payroll), it costs $40 per month plus $6 per worker.

Money and Payments

- Taking Credit Cards: When a customer pays you with a credit card, Wave charges a 2.9% fee plus 60 cents. If they pay through a bank, Wave takes 1%.

- Safety First: Wave uses very strong security—the same kind banks use—to keep your financial secrets safe.

- Getting Paid: Most users love how easy it is to send bills (invoices), but sometimes it can take a few days for the funds to appear in your bank account.

작동 방식

- 사용하기 쉬움: The main screen is very clean. It shows you simple charts of your cash and expenses so you don’t get confused.

- On Your Phone: You can use an app on your phone to send bills or take pictures of receipts when you are away from your desk.

- Bank Syncing: You can connect your bank account to Wave so it automatically lists your purchases. Sometimes this connection can experience “glitches” or small errors.

- Help and Support: If you use the free version, you mostly have to help yourself using their website or a 챗봇. If you pay for the Pro plan, you get to talk to real people for help.

장점과 단점

- The Good: You can run more than one business on just one account. It also sends automatic reminders to people who forget to pay you.

- The Bad: It is not great for big companies. It doesn’t have tools to track “inventory” (how many items you have in a warehouse) or a timer to track work hours.

- The Basics: It uses “double-entry” bookkeeping. That is a fancy way of saying it keeps your numbers balanced, which makes your accountant very happy at tax time.