Are you tired of sifting through endless receipts and spreadsheets?

Do you want to simplify your accounting process and save valuable time?

Especially accounting firms looking to optimize their workflow.

This guide will help you understand Docyt vs Expensify’s key features so that you can make an informed decision for your firm.

Overview

We’ve put both Docyt and Expensify through their paces, testing their core features and real-world accounting applications.

This direct comparison will show you how each platform compares, helping you decide which is a better fit for your firm.

Tired of manual bookkeeping? Docyt AI automates data entry and reconciliation, saving users an average of 40 hours.

Pricing: It has a free trial. The premium plan starts at $299/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

Join over 15 million users who trust Expensify to simplify their finances. Save up to 83% on time spent on expense reports.

Pricing: It has a free trial. The premium plan starts at $5/month.

Key Features:

- SmartScan Receipt Capture

- Corporate Card Reconciliation

- Advanced Approval Workflows.

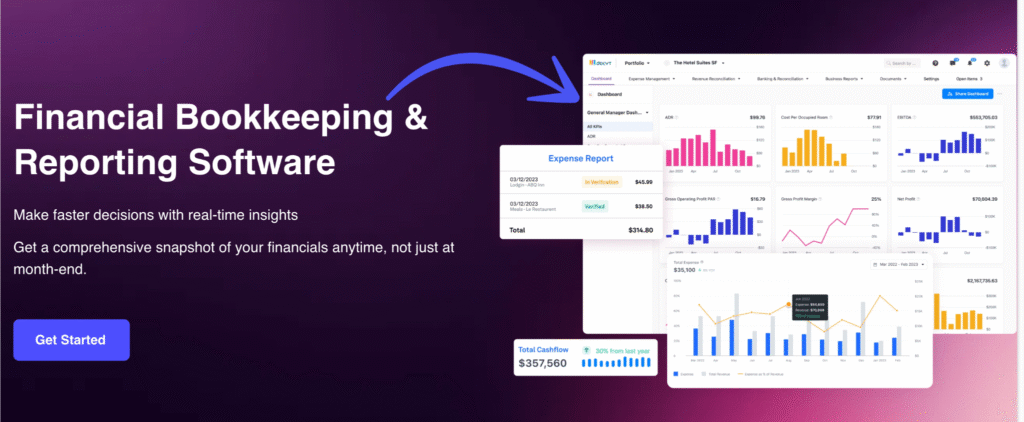

What is Docyt?

Docyt is like having a super-smart assistant for your accounting.

It uses special AI to do a lot of the heavy lifting.

Think of it as a tool that connects to your bank and credit cards and automatically sorts your transactions.

Also, explore our favorite Docyt alternatives…

Key Benefits

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

Pricing

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Pros

Cons

What is Expensify?

Expensify is well-known for making expense reports super easy.

It’s like magic for your receipts! You just snap a picture of your receipt with your phone.

Then, Expensify reads the info and fills out your expense report for you.

Also, explore our favorite Expensify alternatives…

Key Benefits

- SmartScan technology scans receipt details and extracts them with over 95% accuracy.

- Employees get reimbursed quickly, often in as little as one business day via ACH.

- The Expensify Card can save you up to 50% on your subscription with its cash back program.

- No warranty is offered; their terms state that liabilities are limited.

Pricing

- Collect: $5/month.

- Control: Custom Pricing.

Pros

Cons

Feature Comparison

Both Docyt and Expensify aim to make your financial life easier.

But they focus on different parts of the financial operations.

This comparison will help you see which accounting automation tool is the game-changer for your specific needs.

1. Core Automation Philosophy

- Docyt: Docyt AI is a comprehensive ai automation software tool. It automates nearly all accounting processes, including automating back-office and bookkeeping duties. Docyt learns your business intricacies, handling time-consuming tasks across the entire ledger, not just expenses.

- Expensify: Expensify makes the expense management process incredibly simple. Its automation focuses on the front-end, like immediately processing a photo of a receipt. It’s a specialist at quickly completing the expense management process for employees.

2. Financial Visibility and Reporting

- Docyt: You gain instant financial status visibility through real-time reports. Docyt’s AI-powered platform is capable of offering real-time insights into your key performance indicators and cash flow, ensuring constant financial control for strategic decision-making.

- Expensify: Expensify offers real-time insights into employee spending, which aids the manager in expense review. It’s reporting primarily tracks categories, projects, and tags to help employers see where payments are going.

3. Multi-Entity and Scalability

- Docyt: Docyt’s AI-powered platform can generate consolidated roll-up reports for all your business locations effortlessly. It provides both consolidated roll-up reports and individual financial statements for deeper departmental accounting, making it ideal for small businesses with big growth plans.

- Expensify: Expensify is scalable for a small number of users up to a large company. While it handles multiple projects and categories, its focus is on individual expense reports rather than complex, multi-entity accounting processes.

4. Reconciliation and Accuracy

- Docyt: This ai automation software excels at revenue reconciliation and automated bank reconciliation. It continuously checks your bank accounts and other data sources, reducing revenue accounting errors and eliminating manual data entry for these tedious tasks.

- Expensify: Expensify’s automation drastically reduces eliminating manual data entry for receipts. Its automated reimbursement and corporate card features help simplify the bank reconciliation process, but it doesn’t handle full revenue reconciliation.

5. Expense Tracking and Capture

- Docyt: Employees submit receipts using the photo feature on the mobile app. The docyt AI platform then handles time-consuming tasks by automatically matching the receipt to the corresponding transaction and stored data.

- Expensify: Expensify makes receipt capture and mileage logging easy. A quick photo and the details are processed in a few seconds. You can log expenses and attach them to specific categories and tags from your pocket or web browser.

6. Accounting Workflows and Month-End

- Docyt: Docyt AI provides full ai bookkeeping and automates accounting and bookkeeping workflows. It helps your accountants dramatically speed up the month-end close process, providing real-time insights that eliminate the average long wait for final figures.

- Expensify: Expensify streamline s the expense management process within the broader accounting processes. It helps employers with approval and expense review before the month-end, allowing faster expense processing.

7. Integrations and Data Flow

- Docyt: Docyt AI seamlessly integrates with accounting platforms like QuickBooks Online for a continuous, real-time data sync. This is key for ensuring constant financial control and keeping your accounting processes current.

- Expensify: Expensify offers a simple connection for expense export into QuickBooks Online and other platforms. This ensures payments and expense claims are immediately transferred for reimbursement and tracking.

8. User Experience and Support

- Docyt: While comprehensive, expensify reviews show that Docyt offers excellent support. Docyt AI is designed to be the full ai bookkeeper that simplifies your life by handling these tedious tasks as a human would.

- Expensify: Expensify reviews consistently rate its ease of use. It’s a flexible tool for employees. If you encounter an issue, the platform can respond to your query via web or desktop to resolve it, meeting expected service levels.

9. Technical Security and Commands

- Docyt: The platform utilizes a robust security service to protect all financial information, ensuring data is not compromised by malicious sql command injection or other threats.

- Expensify: If there is a server issue, an error message may display the Cloudflare Ray ID. This is a technical identifier that helps the company and site owner resolve access issues, confirming a sophisticated security solution is in place when a request is blocked.

What to Look for When Choosing Accounting Software?

- Integration with existing tools: Does it connect with your current POS, CRM, or ERP systems?

- Scalability for growth: Can it handle more users or business locations as you grow?

- Automation level: How much manual data entry does it truly eliminate?

- Reporting capabilities: Does it offer the specific insight and financial statements you need?

- Ease of use: Is the interface intuitive for your team, reducing training time?

- Customer support: What kind of help is available when you face issues?

- Security features: How does it protect your sensitive financial data entry?

- Cost vs. Value: Does the accounting solution provide good value for its price, considering its accounting features and potential time savings?

- Mobile access: Can you manage finances on the go?

Final Verdict

After looking closely at both Docyt and Expensify.

We pick Expensify as the better all-around choice for most businesses.

Here’s why: it’s incredibly easy to use, especially for managing daily expenses and receipts.

Its SmartScan feature is a real time-saver, simplifying a task many people dread.

While Docyt offers powerful AI for deeper bookkeeping.

We believe its user-friendly design and strong focus on quick reimbursements make it a winner for streamlining your financial process.

More of Docyt

When looking for the right accounting software, it’s helpful to see how different platforms stack up.

Here is a brief comparison of Docyt vs many of its alternatives.

- Docyt vs Puzzle IO: While both help with finances, Docyt focuses on AI-powered bookkeeping for businesses, while Puzzle IO simplifies invoicing and expenses for freelancers.

- Docyt vs Dext: Docyt offers a complete AI bookkeeping platform, whereas Dext specializes in automated data capture from documents.

- Docyt vs Xero: Docyt is known for its deep AI automation. Xero provides a comprehensive and user-friendly accounting system for general business needs.

- Docyt vs Synder: Docyt is an AI bookkeeping tool for back-office automation. Synder focuses on syncing e-commerce sales data with your accounting software.

- Docyt vs Easy Month End: Docyt is a full AI accounting solution. Easy Month End is a niche tool designed specifically to streamline and simplify the month-end closing process.

- Docyt vs RefreshMe: Docyt is a business accounting tool, whereas RefreshMe is a personal finance and budgeting app.

- Docyt vs Sage: Docyt uses a modern, AI-first approach. Sage is a long-standing company that offers a wide range of traditional and cloud-based accounting solutions.

- Docyt vs Zoho Books: Docyt focuses on AI accounting automation. Zoho Books is an all-in-one solution that offers a full suite of features at a competitive price.

- Docyt vs Wave: Docyt provides powerful AI automation for growing businesses. Wave is a free accounting platform best suited for freelancers and micro-businesses.

- Docyt vs Quicken: Docyt is built for business accounting. Quicken is primarily a tool for personal finance management and budgeting.

- Docyt vs Hubdoc: Docyt is a complete AI bookkeeping system. Hubdoc is a data capture tool that automatically collects and processes financial documents.

- Docyt vs Expensify: Docyt handles a full range of bookkeeping tasks. Expensify is a specialist in managing and reporting on employee expenses.

- Docyt vs QuickBooks: Docyt is an AI automation platform that enhances QuickBooks. QuickBooks is a comprehensive accounting software for all business sizes.

- Docyt vs AutoEntry: Docyt is a full-service AI bookkeeping solution. AutoEntry focuses specifically on document data extraction and automation.

- Docyt vs FreshBooks: Docyt uses advanced AI for automation. FreshBooks is a user-friendly solution popular with freelancers for its invoicing and time-tracking features.

- Docyt vs NetSuite: Docyt is an accounting automation tool. NetSuite is a full enterprise resource planning (ERP) system for large corporations.

More of Expensify

- Expensify vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Expensify vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Expensify vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Expensify vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Expensify vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Expensify vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Expensify vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Expensify vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Expensify vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Expensify vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Expensify vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Expensify vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Expensify vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Expensify vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is Docyt better for large accounting firms?

Docyt offers strong AI automation for comprehensive accounting workflows, making it suitable for firms managing multiple business locations and complex financial data. Its ability to generate roll-up financial statements and provide deep real-time financial insights can be a significant advantage for larger operations seeking to streamline back-office and bookkeeping.

Can Expensify handle invoicing and bill payments?

Yes, Expensify includes accounting features for creating and sending invoices. It also allows for managing bill payments, helping to streamline your accounts payable and receivable processes. While primarily known for expense reports, its capabilities extend to cover these basic financial management needs.

Which software is easier for new users to learn?

Expensify generally has a lower learning curve due to its focused design on expense reporting and intuitive mobile app. Docyt, with its broader AI automation for full accounting workflows and back-office and bookkeeping, might require a bit more initial setup and learning.

Do both Docyt and Expensify integrate with QuickBooks?

Yes, both Docyt and Expensify offer robust integrations with popular accounting solutions like QuickBooks. This ensures that your expense and financial data can flow seamlessly between the expense management platform and your primary accounting system, reducing manual data entry and improving reconciliation.

How do these tools improve financial visibility?

Both tools significantly improve visibility into your financial health. Docyt provides real-time financial insight into profitability and overall business performance, while Expensify offers clear reports on spending habits. They help you gain instant understanding of where your money goes, supporting better decision-making.