Closing the books is always a nightmare.

You stay late staring at messy spreadsheets and tiny errors.

It feels like the work never ends.

This stress ruins your week and hurts your focus.

There is a better way to handle your 会计.

Learn how to use Easy Month End to fix your workflow. This tool automates your checklist and syncs with Xero 即刻.

It makes reconciliation fast and simple. Stop wasting time on manual tasks.

Read this guide to finish your month-end close faster than ever before.

这个轻松的月底,加入1257位用户的行列,他们平均节省了3.5小时,并将错误率降低了15%。立即开始您的免费试用!

Easy Month End Tutorial

Getting started is easy. First, connect your Xero account to sync your 数据.

Next, create a digital checklist for your tasks.

Assign duties to your team and track progress in real time.

Follow these steps to finish your work faster.

How to Use Finance Task Management

Managing a month-end close process is hard for most finance teams.

You have to track many moving parts at once.

Easy Month End helps you organize these chores in one place.

This ensures you create accurate financial statements every single time.

Step 1: Build Your Master Checklist

- Open the “Templates” tab to start your list of recurring tasks.

- Add items like reviewing the income statement and checking fixed assets.

- List every step needed to verify your financial data for the month.

- Save this template so you can reuse it for every future close process.

Step 2: Assign Ownership to Your Team

- Click the dropdown menu next to each task to tag a team member.

- Give specific people responsibility for verifying bank statements and financial records.

- Set clear deadlines so everyone knows when their part must be done.

- This clear ownership is the best way to maintain the company’s financial health.

Step 3: Track Real-Time Progress

- Use the main dashboard to see which tasks are finished and which are late.

- Check the status of the balance sheet and cash flow statement at a glance.

- Watch as your monthly financial statements come together without the usual stress.

- Use the comments section to fix errors quickly for accurate financial 报道.

Step 4: Finalize Your Financial Reporting

- Review the completed checklist to ensure nothing was missed.

- Confirm that all data matches your financial statements before finishing.

- Look at the overall financial health of the 商业 through the summary view.

- Lock the tasks once you are satisfied that the period is officially closed.

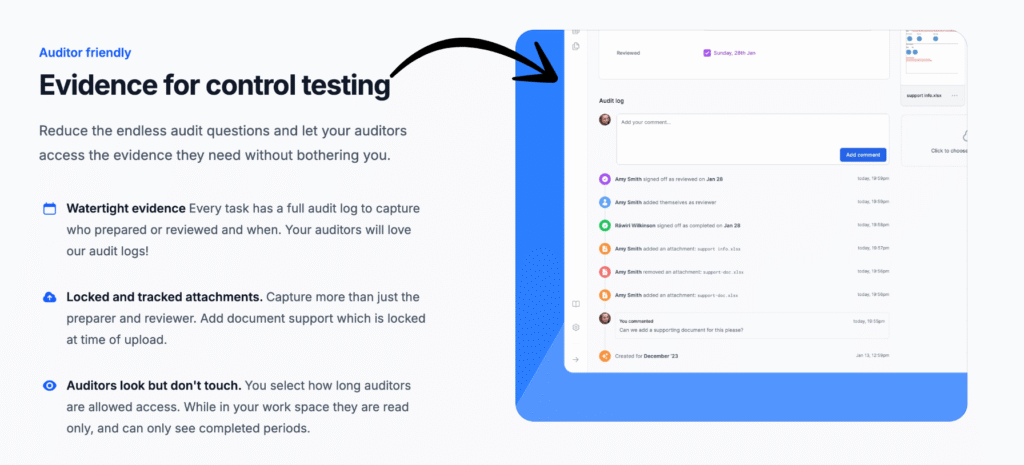

How to Use Auditor Control & Tracking

Preparing your books for an 审计 is a major task for finance and accounting teams.

You need to show exactly how you handled every dollar.

Easy Month End makes this simple by letting auditors see your work without getting in the way.

Follow these steps to set up a smooth monthly closing process.

Step 1: Set Up Read-Only Auditor Access

- Go to the “User Settings” menu and invite your external auditor.

- Choose the “View Only” permission level for their account.

- This allows them to see your financial data collection without changing anything.

- They can look at the previous month or any other accounting period they need to check.

Step 2: Centralize Your Supporting Documents

- Upload your bank reconciliation reports and copies of your bank and credit account statements.

- Attach proof for accounts payable and accounts receivable directly to the tasks.

- Make sure every one of your financial transactions has a receipt or a note attached.

- This makes it easy for the auditor to find the “why” behind your journal entries.

Step 3: Review the Digital Audit Trail

- Use the tracking tool to see a timestamped history of every action taken.

- Show who approved the customer payments and when they did it.

- This log proves you followed best practices throughout the month.

- Having a clear trail is the fastest way to prepare financial statements that auditors will trust.

Step 4: Perform the Final Review

- Run a final review of all auditor-facing folders to ensure they are organized.

- Double-check that all files are labeled correctly for an accurate financial report.

- Once everything is in order, you can close the books with confidence.

- Your transparency will save time and money during the year-end audit.

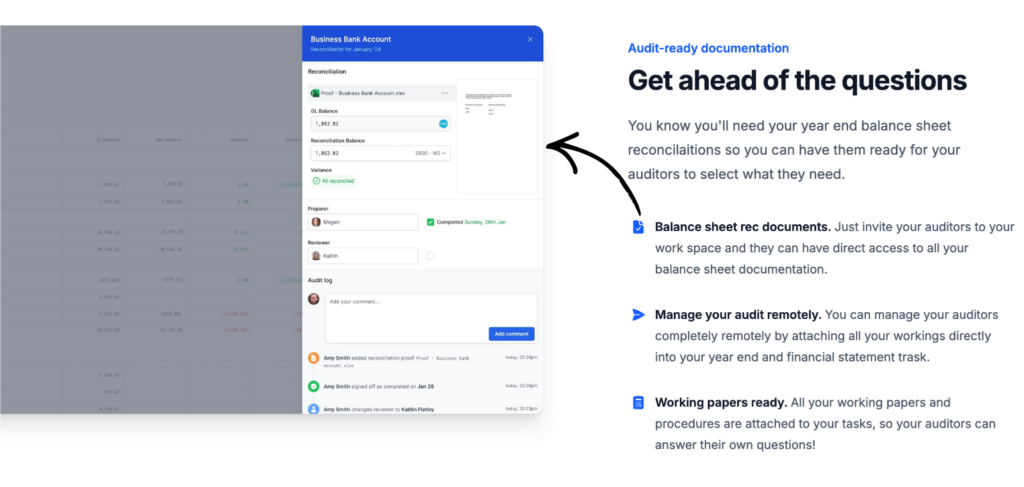

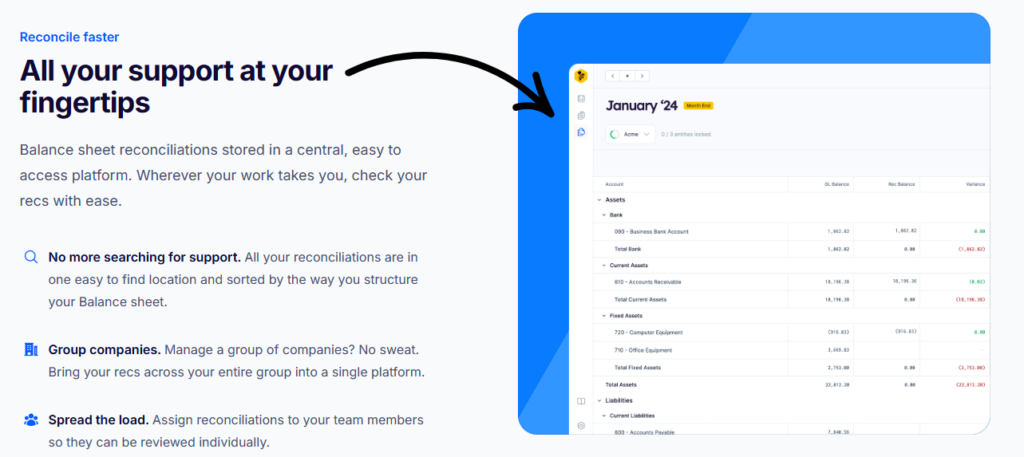

How to Use Balance Sheet Reconciliations

The accounting department often struggles to keep account balances straight.

If you don’t reconcile accounts correctly, your reports will be wrong.

Using Easy Month End helps your accounting team stay up to date without the stress.

Step 1: Connect Your General Ledger

- Start by linking your 会计软件 to Easy Month End.

- This allows the system to collect data and pull in your latest general ledger numbers.

- Once linked, it will show your cash balances, bank accounts, and credit accounts.

- Getting all the data in one place reduces errors caused by manual typing.

Step 2: Match Balances with Supporting Documentation

- Compare your software balance to your supporting documentation, like credit card transactions.

- Check your fixed asset activity and any new asset purchases made during the month.

- Review prepaid and accrued expenses to ensure they are in the correct period.

- If you see accounting errors, you can post journal entries to fix them immediately.

Step 3: Verify Revenue and Vendor Invoices

- Review your revenue recognition to ensure sales are recorded properly.

- Reconcile accounts payable by checking all unpaid vendor invoices.

- Go through expense reports and an inventory count if your business holds stock.

- This step helps you catch mistakes and catch issues 早期的 before they become big problems.

Step 4: Finalize the Month End Close Checklist

- Mark all the tasks on your month-end close checklist as finished.

- Ensure your cash flow matches the financial activity you recorded.

- This gives you a view of your true financial position, enabling leaders to make informed decisions.

- By automating these repetitive tasks, you avoid human error and missed deadlines.

Alternatives to Easy Month End

- 右手: 这款软件专注于自动从收据和发票中提取数据。它通过数字化纸质文件,节省了手动数据录入的时间。

- Xero: 这是一个流行的云端会计平台。它是 Atera 记账功能的替代方案,提供发票、银行对账和费用跟踪工具。

- Puzzle io: 这是一款专为初创企业打造的现代化会计软件。它有助于财务报告和自动化,提供实时洞察,并专注于简化账务流程,从而加快结账速度。

- 圣人: 作为一家知名的商业管理软件提供商,Sage 提供一系列会计和财务解决方案,可以作为 Atera 财务管理模块的替代方案。

- Zoho Books: 作为 Zoho 套件的一部分,这款功能强大的会计工具适用于中小型企业。它有助于开具发票、跟踪费用和管理库存,对于需要全面财务工具的用户来说,是一个不错的选择。

- 辛德: 这款软件专注于将您的电子商务和支付平台与会计软件同步。对于需要将销售渠道的数据自动导入账簿的企业来说,它是一个实用的选择。

- 轻松月末: 该工具专为简化月末结算流程而设计。对于希望改进和自动化财务报告及对账工作的企业而言,它是一种专业的替代方案。

- 多西特: Docyt是一个人工智能驱动的记账平台,可实现财务工作流程自动化。它是Atera人工智能记账功能的直接竞争对手,提供实时数据和自动化文档管理。

- 刷新我: 这是一个个人财务管理平台。虽然它并非直接的商业替代方案,但它提供类似的功能,例如费用和发票跟踪。

- 海浪: 这是一款很受欢迎的免费财务软件。对于自由职业者和小企业来说,它是一个很好的选择,可以用来开具发票、记账和扫描收据。

- 加速: 一款广为人知的个人和小企业理财工具。它有助于预算编制、支出跟踪和财务规划。

- Hubdoc: 这款软件是一款文档管理工具。它会自动获取您的财务文档并将其同步到您的会计软件中。

- Expensify: 这个平台专注于费用管理,非常适合扫描收据、商务旅行和生成费用报表。

- QuickBooks: 最广泛使用的会计软件之一。 QuickBooks 是一个强大的替代方案,它提供了一整套财务管理工具。

- 自动输入: 该工具可自动录入数据,是 Atera 内置收据和发票采集功能的理想替代方案。

- FreshBooks: 这个程序非常适合用于开票和会计核算。它深受自由职业者和小企业的欢迎,因为他们需要一种简单的方式来跟踪时间和费用。

- NetSuite: NetSuite 是一款功能强大且全面的云端企业管理套件。对于需要财务管理以外功能的大型企业而言,NetSuite 是一个理想的选择。

轻松的月末比较

以下是 Easy Month End 与一些主要替代方案的简要比较。

- 轻松月末 vs Puzzle io: Puzzle.io 主要面向初创公司会计,而 Easy Month End 则专注于简化结账流程。

- 轻松月末 vs Dext: Dext 主要用于文档和收据采集,而 Easy Month End 是一款综合性的月末结算管理工具。

- Easy Month End 与 Xero 的对比: Xero 是一个面向小型企业的完整会计平台,而 Easy Month End 则为结算流程提供了一个专门的解决方案。

- 轻松月末 vs 辛德尔: Synder 专注于整合电子商务数据,这与 Easy Month End 不同,后者是一个用于整个财务结算的工作流程工具。

- 轻松月末 vs Docyt: Docyt 使用人工智能进行记账和数据录入,而 Easy Month End 则自动执行财务结算的步骤和任务。

- 轻松月末 vs RefreshMe: RefreshMe 是一个财务辅导平台,这与 Easy Month End 专注于月末结算管理有所不同。

- Easy Month End 与 Sage: Sage 是一款大型企业管理套件,而 Easy Month End 则为关键的会计功能提供更专业的解决方案。

- 轻松月末对比 Zoho Books: Zoho Books 是一款一体化会计软件,而 Easy Month End 是一款专为月末结算流程而设计的工具。

- 轻松的月末 vs 浪潮: Wave 为小型企业提供免费的会计服务,而 Easy Month End 则为月末管理提供更高级的解决方案。

- 轻松月末结算对比 Quicken: Quicken 是一款个人理财工具,因此 Easy Month End 对于需要管理月末结算的企业来说是更好的选择。

- 轻松月末结算对比 Hubdoc: Hubdoc 可以自动收集文档,但 Easy Month End 旨在管理完整的结算工作流程和团队任务。

- 轻松月末结算对比Expensify: Expensify 是一款费用管理软件,这与 Easy Month End 的核心功能——财务结算——有所不同。

- Easy Month End 与 QuickBooks 对比: QuickBooks 是一款综合性的会计解决方案,而 Easy Month End 则是一款更专门用于管理月末结算的工具。

- 简易月末结算与自动录入: AutoEntry 是一款数据采集工具,而 Easy Month End 是一个完整的平台,用于在月末结算期间进行任务和工作流程管理。

- Easy Month End 与 FreshBooks 的对比: FreshBooks 适用于自由职业者和小企业,而 Easy Month End 则提供专门的月末结算解决方案。

- 轻松月末结算对比 NetSuite: NetSuite 是一个功能齐全的 ERP 系统,其范围比 Easy Month End 专注于财务结算的范围更广。

结论

Mastering your financial close does not have to be a struggle.

Many finance teams spend too much time on manual work.

Easy Month-End changes that organize your accounting tasks in one place.

You can trust your accurate data when it is time to prepare reports.

No more worrying about missed steps or late tax filings.

This tool helps you stay on track every single month.

It makes your job easier and faster. Start using these steps today to take control of your books.

You deserve a stress-free close every time.

常见问题解答

What are the steps for the month-end closing?

You must record all income, reconcile bank accounts, and review your balance sheet. Finally, post necessary journal entries and lock the period to ensure your financial reports are accurate.

What is the easiest way to do bank reconciliation?

The easiest way is to use 自动化 software. Connect your bank feed to your accounting tool to automatically match transactions, leaving only unusual discrepancies for you to check manually.

What happens if month end isn’t done right?

Poorly managed closes lead to incorrect financial statements, bad business decisions, and tax errors. It can also cause stress during audits and lead to costly penalties from regulatory authorities.

What are typical month-end tasks?

Common tasks include reconciling bank and credit accounts, reviewing accounts payable and receivable, counting inventory, and recording depreciation. Teams also verify prepaid expenses and accruals during this time.

What does EOM mean in accounting?

EOM stands for “End of Month.” It refers to the date when a reporting period concludes and the process of finalizing all financial transactions for that specific month begins.

How to close accounts payable at the month’s end?

Ensure all vendor invoices are entered and matched to purchase orders. Verify that payments made match your records and reconcile the total outstanding balance to your general ledger.

More Facts about Easy Month End

- Everyone can see which tasks are really worked on in real time. This helps the team work better together to finish the month’s work.

- The software has ready-to-use forms. You can use them to quickly create large reports, such as the Income Statements & Balance Sheet.

- Once the boss approves the numbers, you can “lock” the month. This keeps the data safe while you start the next month.

- You can track every task and set due dates. This will helps everyone on the team know exactly what to do and when to do it.

- You don’t have to wait until the end of the month to check your work. Doing a “soft close” in the middle of the month helps you find mistakes early.

- If you record your work every day, you won’t have a giant pile of work waiting for you on the last day of the month.

- Easy Month End lets you record special items like “depreciation.” This ensures your final reports accurately reflect the true value of the company’s assets.

- Keep all your proof and paperwork in one spot. This makes it easy for auditors to check your work without asking a million questions.

- Closing the month is a very important job. It ensures the company’s financial records are accurate and completed on time.

- The closing process includes several steps: checking bank records, reviewing sales, correcting errors, and preparing final reports.

- Closing the books correctly helps the company pay the right amount of taxes and see exactly how much cash is in the bank.

- When your records are organized and correct, the yearly “audit” (a big check-up) is much faster and less stressful.

- Many different people in the company need to help out. They check to ensure every dollar spent or earned is recorded.

- Fast teams usually finish their monthly reports in 5 days. Teams that aren’t as fast might take 10 days or even longer.

- If a team is messy or doesn’t communicate, closing the month can take weeks.

- When data is scattered across different locations, it slows down and leads to mistakes.

- Doing everything by hand can lead to errors. It also makes the closing process take much longer than it should.

- A “checklist” is a simple list of every job the money team must finish before they can say the month is officially over.

- A good checklist turns a boring chore into a smart plan that helps the whole company grow.

- Using templates means everyone does the work the same way every time. This keeps everything neat.

- Talking clearly with your teammates is one of the most important parts of finishing the month-end work.

- Teams should look for ways to do better next time. Identifying “roadblocks” helps the team work more quickly in the future.

- A “close calendar” shows who owns each task and when it is due. This makes sure no one misses a deadline.

- Checking your most important accounts once a week is a great way to catch errors before they become big problems.

- Writing down how to do things and naming a “leader” for each task makes everyone more responsible.

- “Continuous accounting” means doing a little bit of work every day instead of saving it all for a stressful final week.

- After the month is over, teams should discuss what went wrong. This helps them fix the same problems before they happen again.

- Setting a strict timeline is the best way to ensure the work stays on track and finishes on time.

- When the money data is correct, leaders can make smart choices that keep the company safe and successful.

- Checking everything carefully helps you find and fix errors right away. This keeps the company in compliance with the rules.

- Good records help the company plan for the future. It’s like having a map that enables you to set goals and spend money wisely.

- Closing the month correctly helps the company manage its cash. This ensures there is enough money to pay bills and buy new things.

- When your reports are honest and clear, people like investors will trust the company more.

- A strong closing process eliminates “manual” mistakes—the kind of errors people make when they are tired or rushing.

- The first step in closing is gathering all the info, like how much money came in and how much was spent on bills.

- Once you have the info, you have to verify it by comparing it to bank statements and receipts.

- The team must check everything the company owns—like computers or trucks—to see how much value they lost over time.

- You must record bills that are due soon and payments made early. This shows the company’s true “money health.”

- After all the numbers are checked, the final reports (the Balance Sheet & Income Statement) are put together.

- The very last step is a final look-over. This is a double-check to make sure everything is perfect before the work is done.

- Reconciling is like a matching game. You compare the company’s records with the bank’s records to ensure they match exactly.

- Easy Month End can “talk” to your other computer programs. It pulls in data automatically, so you don’t have to type it all in by hand.

- Automation tools help the team spend less time on boring “copy-paste” work and more time thinking about how to help the business.

- Using technology ensures that data is consistent across departments, preventing confusing arguments.

- Computer systems are great at spotting weird things (anomalies) in the data that a human might miss.