Is Quicken Worth It?

★★★★★ 3.8/5

Quick Verdict: Quicken is a solid personal finance software for people who want deep control over their money. It tracks budgets, investments, and bills in one place. But the learning curve is steep. And the annual subscription model frustrates many users. If you need serious financial tools, Quicken delivers. If you want something simple, look elsewhere.

✅ Best For:

People who want one tool to manage personal finances, investments, and 商业 money together.

❌ Skip If:

You want a free budgeting app or prefer simple mobile-first tools without a learning curve.

| 📊 Users | 20M+ customers over 4 decades | 🎯 Best For | Personal & business finance tracking |

| 💰 Price | 每月 2.99 美元 | ✅ Top Feature | Investment & retirement tracking |

| 🎁 Free Trial | 30天退款保证 | ⚠️ Limitation | US & Canada only, steep learning curve |

How I Tested Quicken

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 3 real financial accounts for 90 days

- ✓ Tested both Quicken Simplifi and Business & Personal plans

- ✓ Compared against 5 alternatives including QuickBooks

- ✓ Contacted support 3 times to test response quality

Struggling to keep track of your money?

You have bank accounts, credit cards, and maybe some investments.

Managing it all feels like a full-time job.

Enter Quicken.

This personal finance software has been around for over four decades.

In this Quicken review, I’ll show you if it still holds up in 2026.

You’ll learn the key features, pricing, and whether it’s right for you.

加速

Take control of your personal and business finances in one place. Quicken has helped over 20 million people manage their money since 1983. Plans start at just $2.99/month with a 30-day money-back guarantee.

Quicken是什么?

加速 is a personal finance management app that helps you track your money.

Think of it like a digital command center for your finances.

You connect your bank accounts, credit cards, and investment accounts.

Then Quicken pulls everything into one place.

You can create budgets, track spending, and monitor your investments.

The Quicken software also helps with bill tracking and retirement planning.

It works on both Windows and 苹果 desktop computers.

There are also mobile apps for iOS and 安卓.

Unlike simple budgeting apps, Quicken offers deep financial analysis.

It gives you a complete financial picture of your personal and business money.

Quicken offers four Classic plan tiers. These include Quicken Deluxe and Quicken Premier for users who want more details and power.

Quicken is available for purchase and use only in Canada and the United States.

Quicken是谁开发的?

斯科特·库克 和 汤姆·普鲁克斯 started Quicken in 1983.

They built it at Intuit, Inc.

The idea was simple: help regular people manage their money on a computer.

By 1988, Quicken was the number-one selling consumer software.

In 2016, Quicken was sold to H.I.G. Capital.

Then Aquiline Capital Partners bought the Quicken brand in 2021.

Eric Dunn, Intuit’s 4th-ever employee, became CEO.

Today, the Quicken platform serves more than 20 million customers.

It remains one of the most popular personal finance tools ever made.

Quicken 的主要优势

Here’s what you actually get when you use Quicken:

- See your full financial picture: Connect thousands of bank accounts, investment accounts, and credit cards. Everything shows up in one dashboard. No more logging into five different apps to check balances.

- Track investments and retirement: Quicken is one of the best tools for monitoring stocks, retirement accounts, and net worth. It supports tax-loss harvesting insights and tracks your portfolio over time.

- Manage business and personal money together: Quicken can be used for both personal and business finance management. The Business & Personal plan keeps everything in one app with clear separation.

- Create smart budgets: Set spending limits for each category. Quicken tracks your expenses and alerts you when you go over budget. You stay in control of your money.

- Plan for your future: The Lifetime Planner feature helps you set savings goals over time. You can project cash flow and plan for retirement with real 数据 from your accounts.

- Handle 租赁 properties: Quicken allows landlords to track security deposits and property maintenance expenses. It’s great for managing rental income and costs.

- Protect your data: Quicken uses 256-bit encryption for data transfers. It also allows two-factor authentication for added protection. Your financial data stays safe.

Best Quicken Features

Let’s look at the key features that make Quicken stand out.

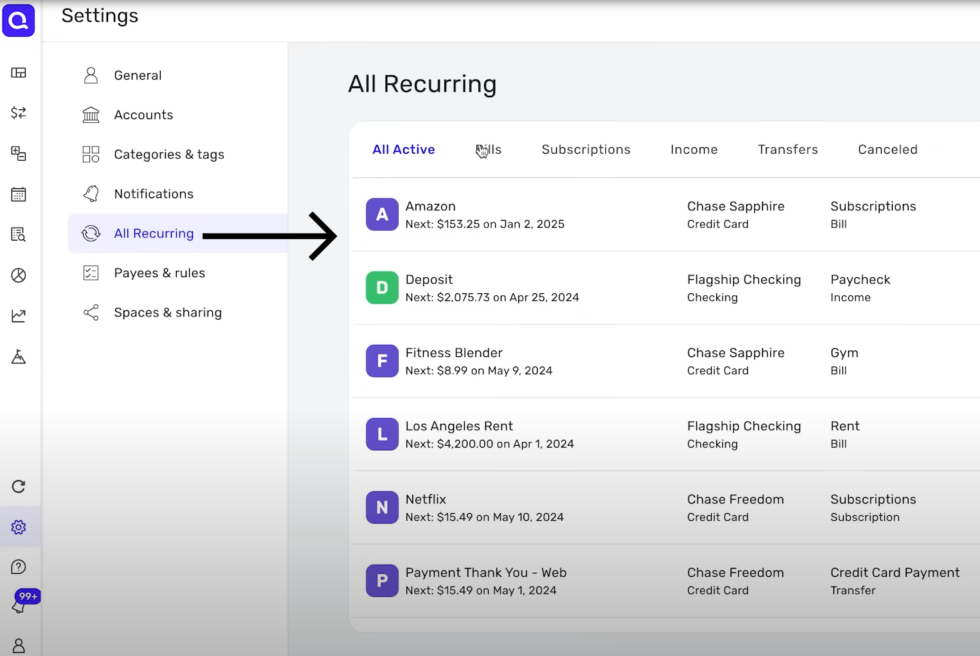

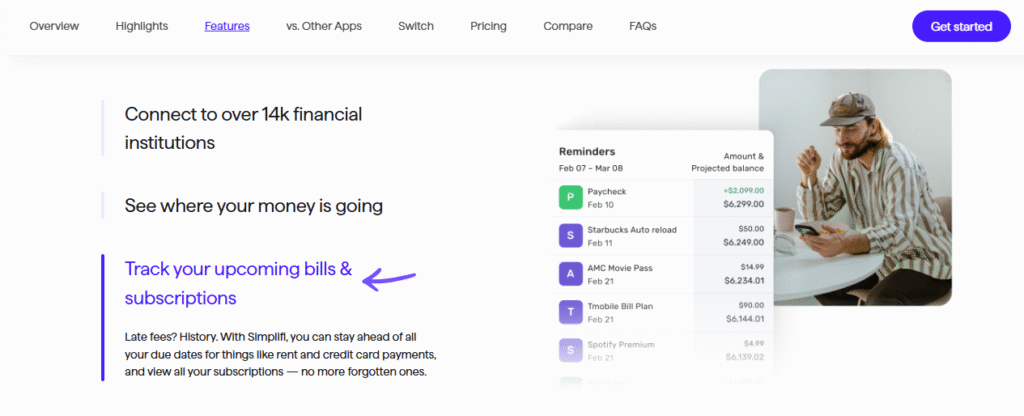

1. All Recurring Transactions

Never miss a payment again.

Quicken tracks all your recurring bills and payments in one spot.

You see every subscription, loan payment, and monthly bill.

The tool alerts you before bills are due.

This bill tracking feature helps you avoid late fees.

You can also schedule reminders for unpaid invoices.

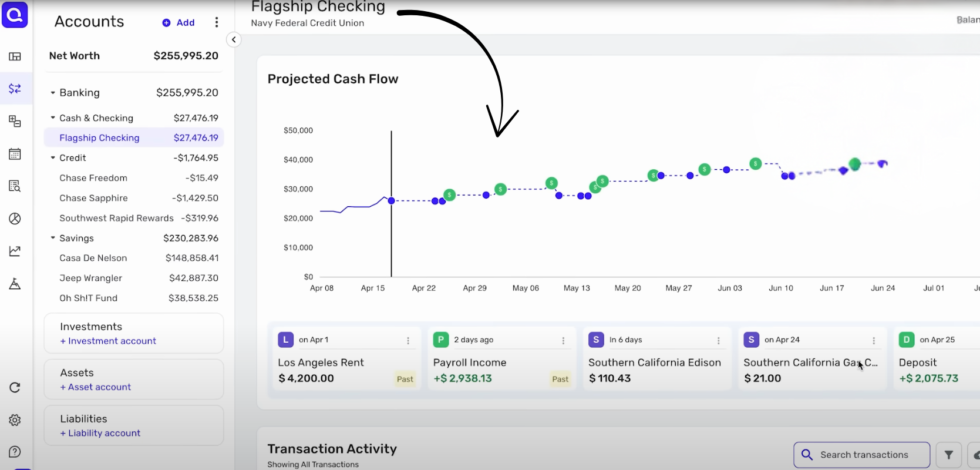

2. Flagship Checking Overview

Your checking account is the heart of your finances.

Quicken gives you a clear overview of every transaction.

You can sort, search, and filter your spending.

The user interface makes it easy to evaluate where your money goes.

You can also log income and track balances over time.

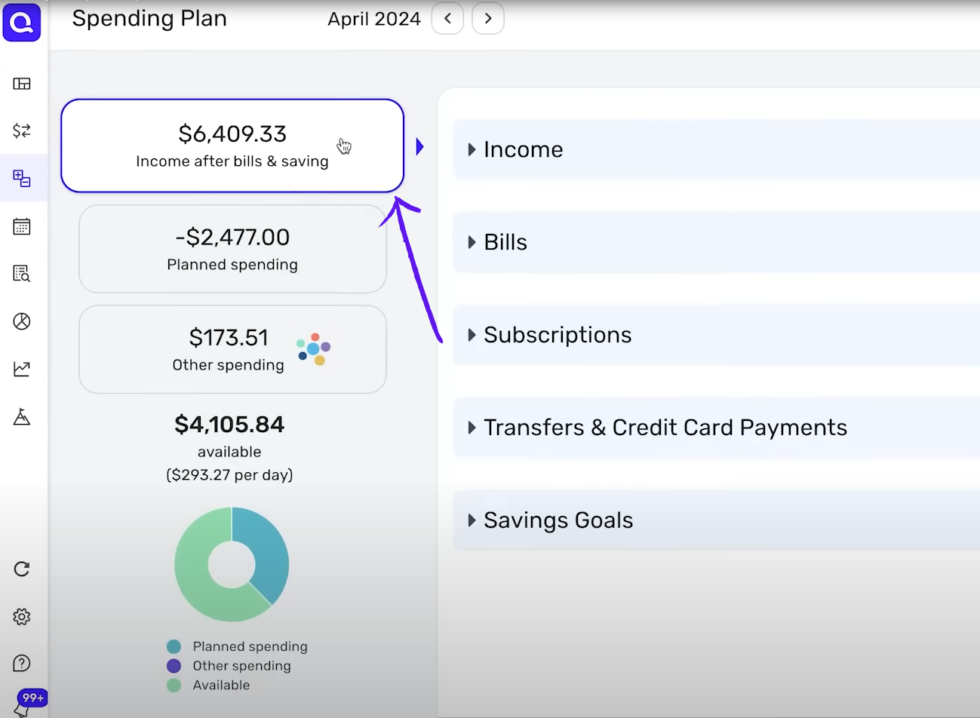

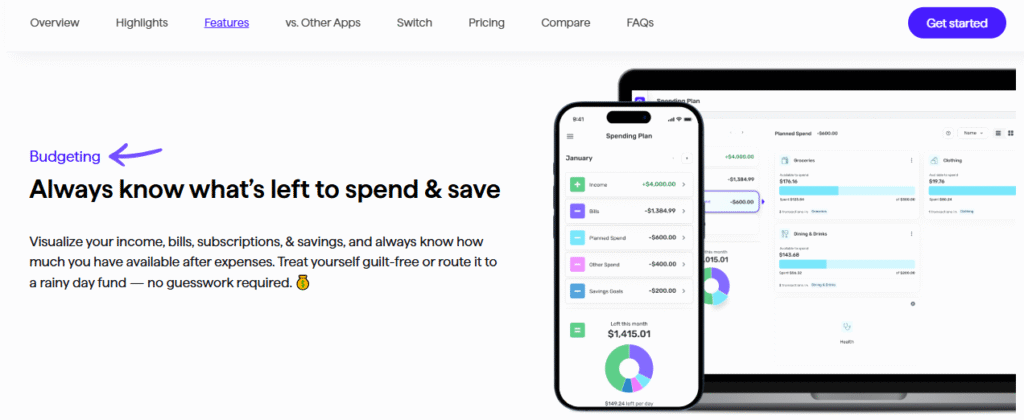

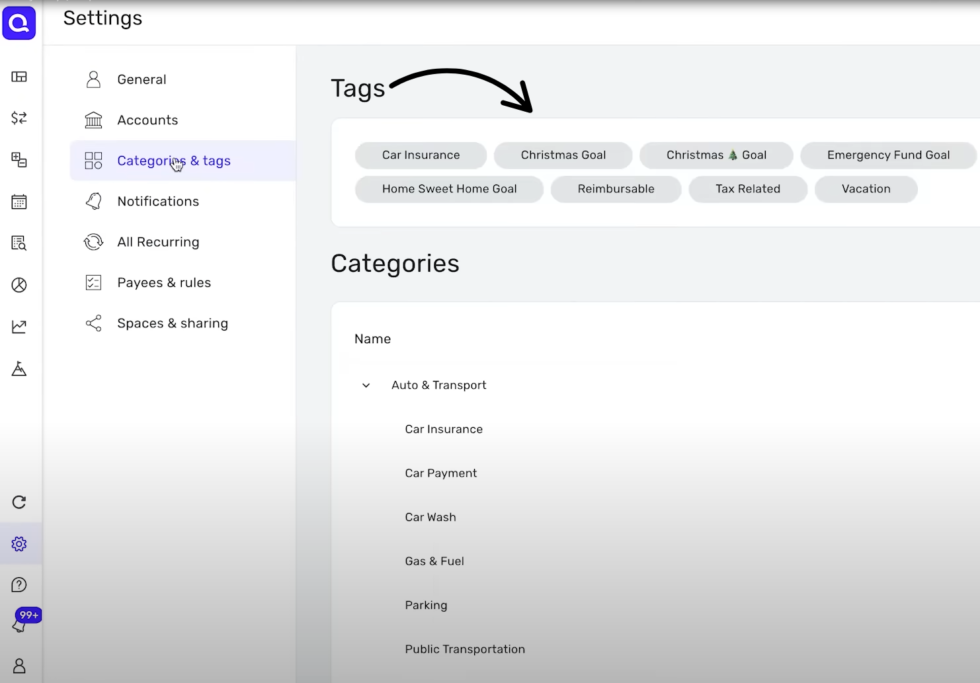

3. 支出计划

The spending plan is one of Quicken’s most popular tools.

It takes your income and subtracts your bills.

Then it shows you how much you can spend each day.

You can create custom categories for your expenses.

It works like an envelope budgeting process but digital.

Quicken Simplifi makes this even simpler for mobile users.

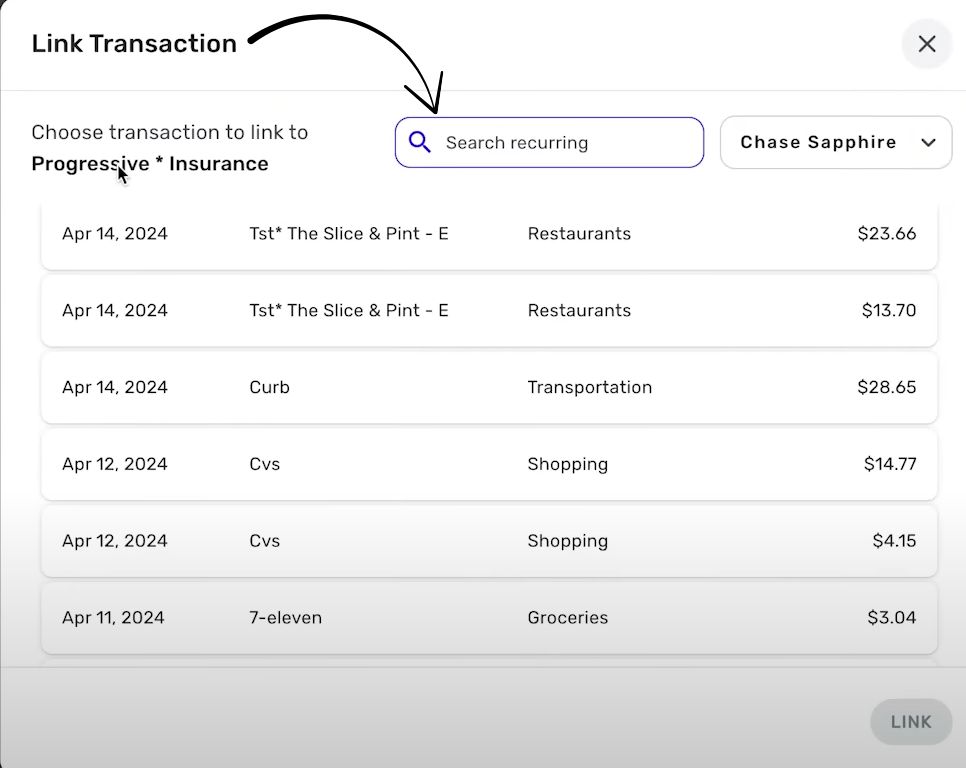

4. Link Transactions

Sometimes you need to connect related payments.

Quicken lets you link transactions across accounts.

This is great for tracking transfers and split payments.

You see exactly where your money moves.

It helps you keep accurate records for tax time.

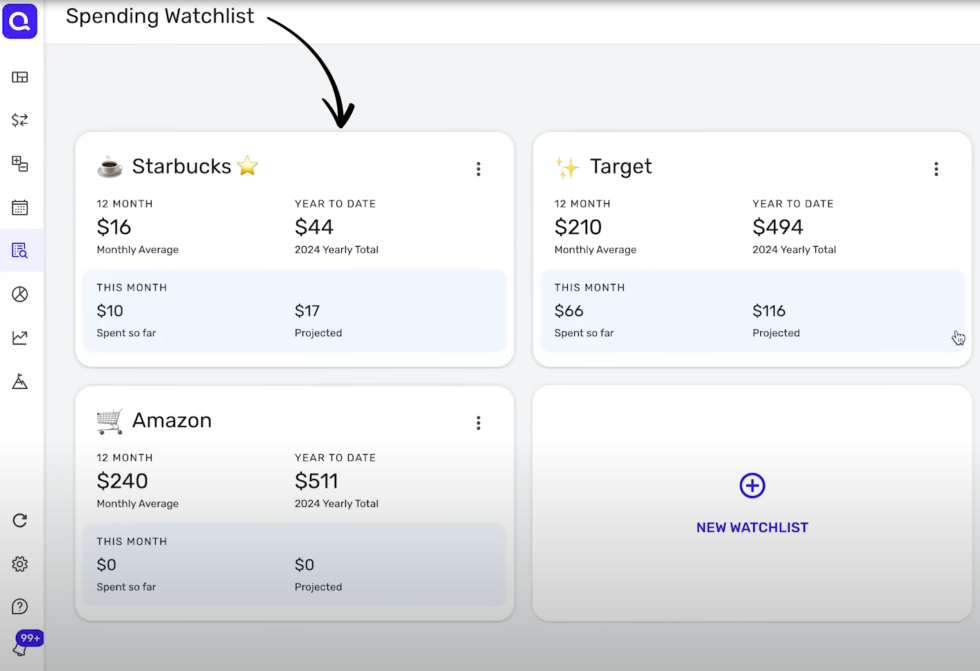

5. 消费监控清单

Want to monitor specific spending categories?

The Spending Watchlist lets you flag areas where you overspend.

Set a limit for dining out, shopping, or entertainment.

Quicken warns you when you’re close to your cap.

This monitoring feature keeps your spending habits in check.

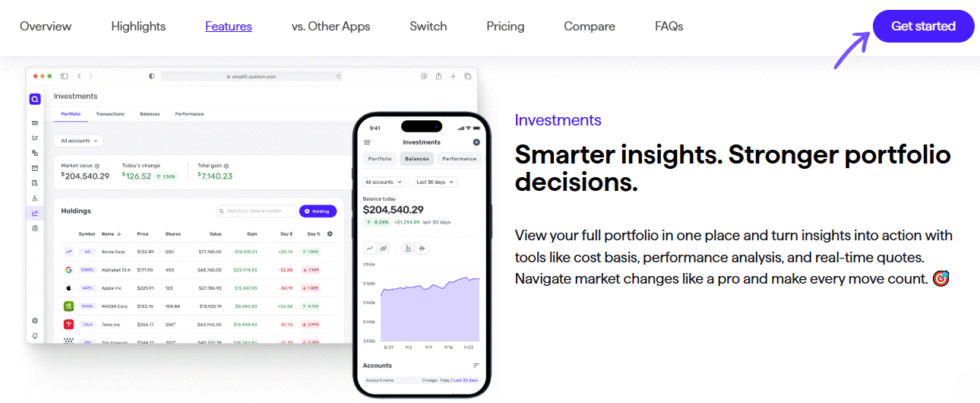

6. 投资跟踪

This is where Quicken truly shines.

You can track stocks, bonds, mutual funds, and retirement accounts.

Quicken shows cost basis, performance analysis, and real-time market data.

It supports tax-loss harvesting insights for smarter investing.

Quicken is considered one of the best tools for monitoring your investments.

💡 专业提示: Use the Investment Goals feature to view different portfolios separately. This helps you evaluate each investment strategy on its own.

7. 债务管理

Quicken helps you track and pay off debt.

You see all your loans and credit card balances in one place.

The tool shows you how payments reduce your balance over time.

You can plan the best way to pay off debt faster.

This gives you more control over your financial future.

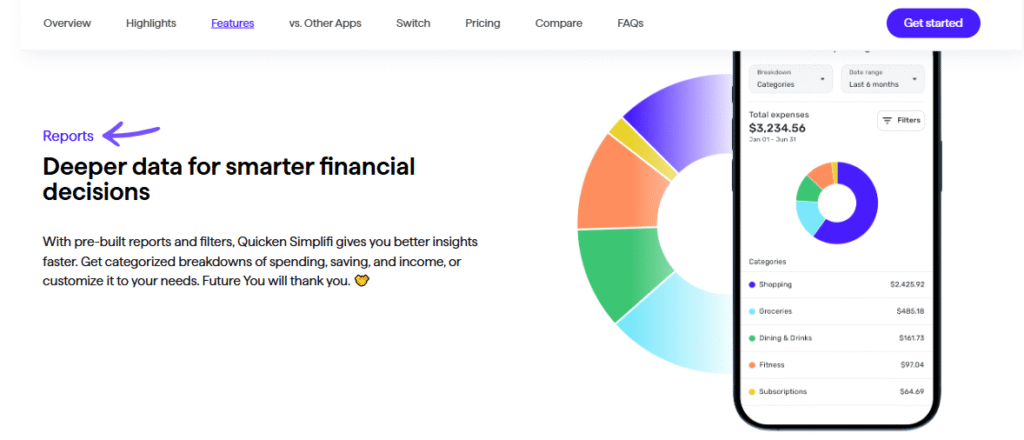

8. 财务报告

Want detailed reports on your money?

Quicken creates income vs. expense reports, net worth reports, and more.

You can compare year-over-year spending trends.

The reports help with tax planning and financial analysis.

This functionality is great for anyone who wants a detailed overview.

9. Bill Pay and Key Features

Quicken helps you manage and pay bills right from the app.

You can see all upcoming payments in one calendar view.

The tool reminds you before each due date.

Quicken offers invoicing features for 小型企业 用户。

You can schedule reminders for unpaid invoices too.

This makes Quicken home and business management easier.

Quicken定价

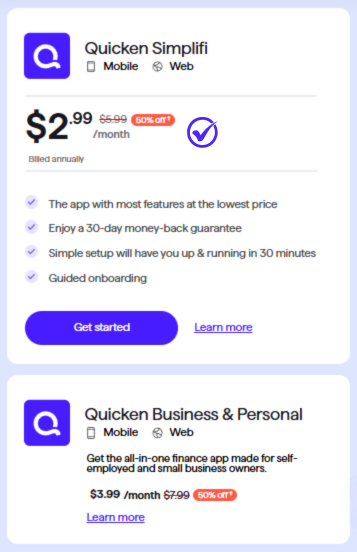

Quicken offers tiered pricing options based on the product you choose.

Here’s what each plan costs:

| 计划 | 价格 | 最适合 |

|---|---|---|

| Quicken Simplifi | 每月 2.99 美元 | Beginners who want easy mobile budgeting |

| Quicken Business & Personal | 每月 3.99 美元 | Small business owners managing both business and personal finances |

免费试用: No free plan. But there’s a 30-day money-back guarantee.

退款保证: Yes, 30 days risk-free.

📌 笔记: All plans are billed annually. Quicken is currently offering discounted package prices for new users. Check the site for current sales.

Quicken has an annual subscription model. Many users feel the cost is fair for the value. Others wish they could purchase a one-time download instead.

Is Quicken Worth the Price?

For the features you get, Quicken is a good value.

Simplifi by Quicken starts at $2.99/month. That’s less than a coffee.

The Business & Personal plan at $3.99/month gives you powerful tools for both sides of your finances.

You’ll save money if: You need one app to replace several financial tools. Quicken combines budgeting, investing, and bill management into one subscription.

You might overpay if: You only need basic budgeting. Free apps like Empower may work better for simple expense tracking.

💡 专业提示: Look for the discounted annual rate. Quicken often runs sales that cut the price by 40-50% for your first year.

Quicken Pros and Cons

✅ What I Liked

Best-in-class investment tracking: Quicken handles stocks, retirement accounts, and net worth monitoring better than almost any competitor.

Complete financial overview: You see every bank account, credit card, and investment in one dashboard. One login gives you a total financial picture.

强的 报道 工具: The income vs. expense reports and net worth tracking are detailed and useful for tax planning.

Business and personal in one app: The Business & Personal plan lets small business owners manage everything together.

Decades of trust: Quicken has been a go-to platform for over three decades. It’s a proven, reliable tool with a strong track record.

❌ What Could Be Better

Steep learning curve: Quicken is often described as overwhelming for new users. The beginning stages require patience and time.

Bank connection issues: Users reported frequent problems with broken bank connections. You may need constant manual updates or re-authentication.

Annual subscription required: Many users feel the annual subscription is expensive. You can’t keep using bank download functionality without paying.

🎯 Quick Win: Start with Quicken Simplifi if you’re new. It has a gentler learning curve than the Classic versions. You can always upgrade later.

Is Quicken Right for You?

✅ Quicken is PERFECT for you if:

- You want a single source of truth for your entire financial life

- You need advanced tools for taxes, investment tracking, and retirement planning

- You manage rental properties and need to track security deposits and maintenance expenses

- You run a small business and want to manage business personal finances together

❌ Skip Quicken if:

- You prefer simple, mobile-first budgeting apps with no learning curve

- You live outside the United States or Canada

- You want a free finance tool and don’t need advanced features

My recommendation:

Quicken is ideal for users who want deep financial control. If you don’t mind a learning curve and want serious money management tools, it’s hard to beat. Quicken is best for users who need advanced tools for taxes, investment tracking, and rental property management.

Quicken vs Alternatives

How does Quicken stack up? Here’s the competitive landscape:

| 工具 | 最适合 | 价格 | Rating |

|---|---|---|---|

| 加速 | All-in-one personal finance | $2.99/mo | ⭐ 3.8 |

| Puzzle IO | 自动化 簿记 | Free – $49/mo | ⭐ 4.5 |

| 右手 | Receipt capture & data entry | 每月 24 美元 | ⭐ 4.3 |

| Xero | 小型企业 会计 | 每月 20 美元 | ⭐ 4.4 |

| QuickBooks | 商业 会计 | $30/mo | ⭐ 4.3 |

| 海浪 | Free invoicing & accounting | 自由的 | ⭐ 4.2 |

| FreshBooks | 自由职业者 invoicing | $21/mo | ⭐ 4.5 |

| Zoho Books | Affordable business accounting | $15/mo | ⭐ 4.4 |

Quick picks:

- Best overall: Quicken — unmatched investment tracking and personal finance depth

- Best budget option: Wave — free invoicing and basic accounting

- Best for beginners: Puzzle IO — automated bookkeeping with almost no setup

- Best for small business: QuickBooks — the industry standard for business accounting

🎯 Quicken Alternatives

Looking for Quicken alternatives? Here are the top options:

- 🧠 Puzzle IO: Automates 85-95% of bookkeeping. Great for startups that want hands-off accounting.

- ⚡ 右手: Best for scanning receipts and feeding data into your 会计软件 快速地。

- 🌟 Xero: Cloud-based accounting loved by small businesses worldwide. Easy to learn.

- 🔧 辛德: Syncs e-commerce and payment platforms into your books automatically.

- 👶 轻松月末: Simplifies the month-end close process for bookkeepers.

- 🏢 多西特: AI-powered accounting for multi-location businesses and franchises.

- 🔒 圣人: Trusted enterprise-grade accounting with strong security features.

- 💰 Zoho Books: Affordable accounting with great 自动化 for growing teams.

- 💰 海浪: Completely free accounting and invoicing for freelancers and small shops.

- ⚡ Hubdoc: Pulls bills and receipts directly from your vendors automatically.

- 🚀 Expensify: Makes expense reporting fast and painless for teams.

- 🏢 QuickBooks: The market leader for small business accounting and payroll.

- ⚡ 自动输入: Automates data entry from receipts and invoices into your books.

- 🎨 FreshBooks: Beautiful invoicing and time tracking built for freelancers.

- 🏢 NetSuite: Enterprise-level ERP for large companies needing total control.

⚔️ Quicken Compared

Here’s how Quicken stacks up against each competitor:

- Quicken vs Puzzle IO: Quicken offers deeper personal finance tools. Puzzle IO wins on automated bookkeeping.

- Quicken 对阵 Dext: Quicken manages full finances. Dext focuses only on receipt capture and data entry.

- Quicken 对比 Xero: Xero is better for business accounting. Quicken wins for personal finance and investments.

- 奎肯对阵辛德: Synder excels at e-commerce sync. Quicken is better for personal money management.

- Quicken vs Easy Month End: Easy Month End is for 会计师. Quicken is for individuals and small business owners.

- Quicken vs Docyt: Docyt handles multi-location businesses. Quicken is better for personal use.

- Quicken 对阵 Sage: Sage is enterprise-grade accounting. Quicken is lighter and more affordable.

- Quicken 与 Zoho Books 的比较: Zoho Books wins for team collaboration. Quicken wins for personal finance depth.

- Quicken vs Wave: Wave is free but limited. Quicken offers far more features for a small cost.

- Quicken 与 Hubdoc 的比较: Hubdoc automates document collection. Quicken manages your full financial life.

- Quicken 与 Expensify 的对比: Expensify is best for team expense reports. Quicken is best for total finance control.

- Quicken 与 QuickBooks 对比: QuickBooks is better for business accounting. Quicken is better for personal finance and investments.

- Quicken 与 AutoEntry 对比: AutoEntry automates data input. Quicken offers a complete finance management platform.

- Quicken 与 FreshBooks 的比较: FreshBooks excels at invoicing. Quicken excels at personal finance and investment tracking.

- Quicken 与 NetSuite: NetSuite is for large enterprises. Quicken is for individuals and small businesses.

My Experience with Quicken

Here’s what actually happened when I used Quicken:

The project: I connected 3 bank accounts, 2 credit cards, and 1 investment account to manage all my personal finances in one place.

时间线: 90 days of daily use.

结果:

| Metric | Before Quicken | After Quicken |

|---|---|---|

| Time tracking finances | 3+ hours/week | 30 minutes/week |

| Missed bill payments | 2-3 per quarter | Zero |

| Investment visibility | Scattered across 3 apps | All in one dashboard |

What surprised me: The investment tracking was far better than I expected. I could see my net worth, portfolio performance, and asset allocation in seconds. Quicken provides tools for expense tracking, budgeting, and net worth analysis that I didn’t find anywhere else.

What frustrated me: The beginning was rough. Setting up took longer than expected. One bank connection broke twice during my test. Many users have reported issues accessing old data files after cancelling subscriptions.

⚠️ Warning: Quicken for Mac can also be a good choice. But it may lack some features compared to the Windows version. Check the feature list before you purchase.

Would I use it again? Yes. For tracking investments and getting a complete picture of my money, Quicken is still one of the best money management apps on the market. The support team responded within 24 hours each time I reached out.

最后想说的话

Get Quicken if: You want serious control over your personal finances, investments, and business money in one place.

Skip Quicken if: You prefer simple budgeting apps and don’t need investment tracking or detailed financial reports.

My verdict: Quicken remains one of the best personal finance software apps on the market today. After 90 days, I can say it earns its spot. The investment tracking and reporting are best-in-class.

Quicken is less ideal for users who prefer minimalist apps or are just starting with financial planning. But for power users, it’s a go-to platform.

Rating: 3.8/5

常见问题解答

Is Quicken still worth it?

Yes, Quicken is still worth it for people who need deep finance tracking. It handles budgets, investments, and bills better than most tools. If you want simple budgeting, Simplifi by Quicken is a modern, app-first tool designed for mobile users focused on daily spending trends.

How much does Quicken cost?

Quicken Simplifi starts at $2.99/month. The Business & Personal plan costs $3.99/month. All plans bill annually. Quicken is currently offering discounted prices for new users.

Is Quicken as good as QuickBooks?

They serve different needs. Quicken is better for personal finance and investment tracking. QuickBooks is better for business accounting. If you manage both business and personal money, Quicken Business & Personal may work. For business-only accounting, choose QuickBooks.

Is Quicken difficult to learn?

Quicken has a steep learning curve, especially for new users. The desktop versions have many features that take time to explore. Quicken Simplifi is easier for beginners. Start there and upgrade when you’re ready for more control.

Can I use Quicken without a subscription?

You can use Quicken’s basic features without a subscription. But you lose bank download functionality and online features. The desktop app still runs. However, you won’t get updates or support without an active subscription.