Many founders hate accounting because it feels messy and slow.

Manual data entry takes hours and leads to costly errors.

You might feel like you are drowning in receipts and spreadsheets.

This stress pulls you away from growing your 사업.

There is a better way to manage your money.

Knowing how to use Puzzle IO changes everything for your team.

It uses AI to automate your 부기 in real time.

Follow this easy guide to setting up your account.

Puzzle IO Tutorial

Setting up Puzzle is simple. First, connect your bank accounts & credit cards.

The AI then automatically organizes your spending.

Review your dashboard to see real-time 데이터.

This process keeps your books clean without the usual manual work or stress.

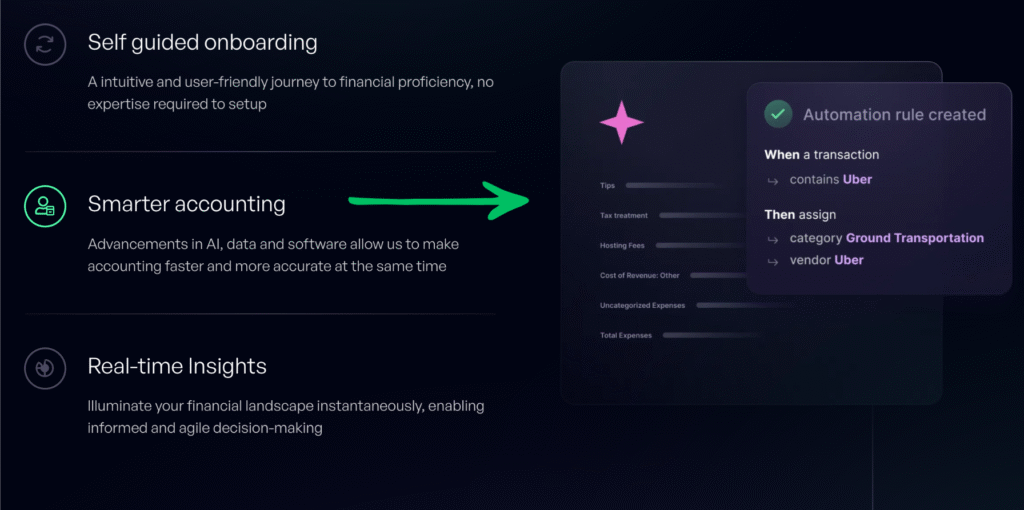

How to Use Smarter Accounting

Managing your general ledger used to be hard work.

You had to type in every single transaction manually.

This old way wasted time and led to mistakes.

더 스마트하게 회계 uses intelligent automation to do the heavy lifting for you.

It learns from your activity and 곧 suggests the right categories.

This gives startup founders financial clarity without needing a professional bookkeeper to watch every penny.

Step 1: Connect Your Financial Accounts

First, you need to feed financial data into the system.

This allows the software to see what is happening with your money.

- Log in to your Puzzle dashboard.

- Click on the Connections tab in the settings menu.

- Select your bank (like Mercury or Brex) and credit card providers.

- Follow the secure prompts to link your accounts.

- The system pulls your transaction history automatically to start cash monitoring.

Step 2: Review AI Suggestions

The software is built specifically for early-stage companies.

It uses AI to guess where your money is going.

- Go to the General Ledger or Transactions feed.

- Look for the “Suggested” tag next to new expenses.

- The AI will guess if a purchase is for “Software,” “여행하다,” or “Meals.

- If the AI is right, you don’t need to do anything. This helps you save time on manual entry.

Step 3: Correct and Train the AI

Sometimes, the AI might 만들다 a mistake. You can fix it quickly.

This teaches the tool how to manage your startup’s finances more effectively.

- If a category looks wrong, click the transaction line.

- Select the correct category from the dropdown menu.

- Checked the box that says “Apply to similar future transactions.”

- This trains the system to be more accurate next time and helps ensure compliance.

Step 4: Set Up Autopilot Rules

You can stop doing repetitive tasks completely. Set up rules for recurring bills.

- Identify recurring bills, like your monthly server costs or rent.

- Create a Rule that tells Puzzle to always categorize “AWS” as “Hosting.”

- Save the rule to automate this task forever.

- This keeps your financial statements clean and gives you better real-time insights.

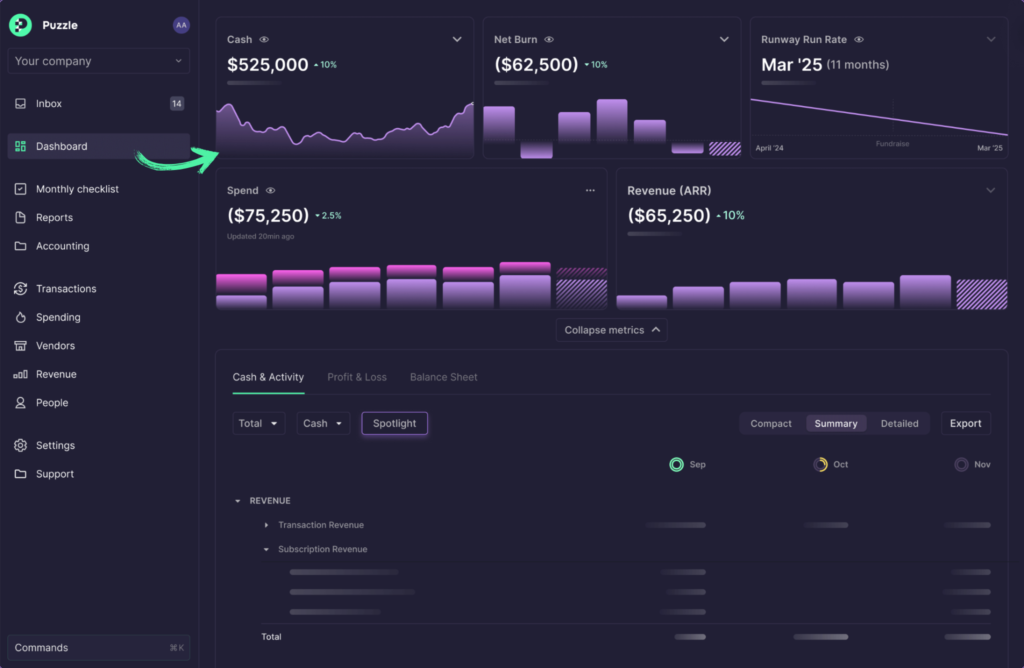

How to Use Financial Insights

Founders need to know their cash flow right now, not next month.

The Financial Insights feature gives you a live look at your money.

This helps you make faster decisions about hiring or spending.

You can use this platform to see your business’s current state without waiting.

Step 1: Access the Main Dashboard

First, you need to see exactly how much money you have.

This helps you understand the value of your cash on hand.

- Log in to the Puzzle app.

- Click the Insights tab on the left sidebar to access your data.

- View your “Cash Balance” and “Burn Rate” widgets at the top.

- These numbers update instantly, so you always know your cash position.

Step 2: Drill Down into Burn Rate

Next, check where your money is going.

This helps your company keep expenses low.

- Click on the Burn Rate chart to expand it.

- Toggle between “Gross Burn” and “Net Burn.”

- Hover over specific months to see spikes in costs.

- Use this data to focus on areas where you can save money.

Step 3: Analyze Revenue Trends

You also need to track who is paying you. This tracks your sales success.

- Scroll down to the Revenue section.

- Filter by specific customer or product lines.

- See which clients are paying on time for your services.

- This helps you spot individual transactions that drive growth.

Step 4: Generate a PDF Report

Finally, share your results with others.

You don’t need to hire an accountant or bookkeeper to build these reports manually.

- Locate the Export button at the top right of the Insights page.

- Select “Monthly Financial Package” to create a plan for your stakeholders.

- Download the PDF to share with your investors or board members.

- The software uses 오토메이션 and smart systems to do this for you.

- These tools make 보고 easy without any extra work.

How to Use the Partner Ecosystem

당신의 회계 소프트웨어 shouldn’t live on an island.

Puzzle connects with other tools you already use.

This feature adds new capabilities to your 사업.

It allows different apps to talk to each other.

Step 1: Open the Integrations Library

First, you need to find the right tools to connect.

- Navigate to Settings and select the integration menu.

- Explore the list of available partners, such as Gusto, Rippling, or Stripe.

- You will see options that support Payroll, Revenue, and Banks.

Step 2: Connect Your Payroll Provider

Next, link the system that pays your team. This saves you from typing in data by hand.

- Select your payroll tool from the list.

- Click Connect. It only takes a moment to sign in.

- Allow Puzzle to read your payroll details.

- This automatically pulls in salaries and taxes.

Step 3: Sync Revenue Data

Finally, make sure your sales numbers are correct.

- Find the vendor for your payments, like Stripe.

- Sync your sales data to keep your 부기 accurate.

- Note that this helps you calculate your real burn 통로.

- The system uses rules to sort fees and sales by date.

- Check this every week to keep your books clean.

Puzzle IO의 대안

다음은 Puzzle IO의 인기 있는 대체 게임 몇 가지입니다.

- 덱스트: 이 소프트웨어는 영수증과 송장에서 데이터를 자동으로 추출하는 데 중점을 둡니다. 서류를 디지털화하여 수동 데이터 입력에 소요되는 시간을 절약해 줍니다.

- 제로: 이는 인기 있는 클라우드 기반 회계 플랫폼입니다. 아테라(Atera)의 회계 기능을 대체할 수 있는 제품으로, 송장 발행, 은행 계좌 대조, 비용 추적 등의 도구를 제공합니다.

- 세이지: 잘 알려진 비즈니스 관리 소프트웨어 제공업체인 Sage는 Atera의 재무 관리 모듈을 대체할 수 있는 다양한 회계 및 재무 솔루션을 제공합니다.

- 조호 북스: Zoho 제품군의 일부인 이 소프트웨어는 중소기업에 적합한 강력한 회계 도구입니다. 송장 발행, 비용 추적, 재고 관리에 도움이 되며, 포괄적인 재무 관리 도구가 필요한 기업에게 좋은 대안이 될 수 있습니다.

- 시나이더: 이 소프트웨어는 전자상거래 및 결제 플랫폼을 회계 소프트웨어와 동기화하는 데 중점을 둡니다. 판매 채널에서 회계 장부로 데이터 흐름을 자동화해야 하는 기업에 유용한 대안입니다.

- 쉬운 월말: 이 도구는 월말 결산 프로세스를 간소화하기 위해 특별히 설계되었습니다. 재무 보고 및 대조 작업을 개선하고 자동화하려는 기업을 위한 전문적인 대안입니다.

- 도시트: AI 기반 회계 플랫폼인 Docyt는 재무 워크플로우를 자동화합니다. 실시간 데이터와 자동화된 문서 관리 기능을 제공하는 Docyt는 Atera의 AI 기반 회계 기능과 직접적인 경쟁 관계에 있습니다.

- 리프레시미: 이는 개인 재무 관리 플랫폼입니다. 직접적인 비즈니스용 대안은 아니지만, 지출 및 송장 추적과 같은 유사한 기능을 제공합니다.

- 파도: 이 프로그램은 인기 있는 무료 재무 관리 소프트웨어입니다. 프리랜서와 소규모 사업자가 송장 발행, 회계 처리, 영수증 스캔 등에 활용하기에 좋은 선택입니다.

- 빠르게 하다: 개인 및 소규모 사업체의 재정 관리에 널리 알려진 도구입니다. 예산 책정, 지출 추적 및 재무 계획 수립에 도움이 됩니다.

- 허브독: 이 소프트웨어는 문서 관리 도구입니다. 재무 문서를 자동으로 가져와 회계 소프트웨어와 동기화합니다.

- Expensify: 이 플랫폼은 경비 관리에 특화되어 있습니다. 영수증 스캔, 출장, 경비 보고서 작성에 매우 유용합니다.

- 퀵북스: 가장 널리 사용되는 회계 소프트웨어 프로그램 중 하나입니다. QuickBooks는 재무 관리를 위한 모든 도구를 제공하는 강력한 대안입니다.

- 자동 입력: 이 도구는 데이터 입력을 자동화합니다. Atera의 영수증 및 송장 캡처 기능을 대체할 수 있는 좋은 대안입니다.

- 프레시북스: 이 프로그램은 청구서 발행 및 회계 처리에 매우 유용합니다. 시간과 비용을 간편하게 추적해야 하는 프리랜서와 소규모 사업체에서 인기가 높습니다.

- 넷스위트: 강력하고 완벽한 클라우드 기반 비즈니스 관리 솔루션인 NetSuite는 단순한 재무 관리 이상의 기능을 필요로 하는 대규모 기업을 위한 최적의 선택입니다.

퍼즐 IO 비교

Puzzle IO가 다른 회계 도구와 어떻게 다른지 살펴보았습니다. 주요 기능을 간단히 살펴보겠습니다.

- Puzzle IO vs Xero: Xero는 강력한 통합 기능을 갖춘 광범위한 회계 기능을 제공합니다.

- 퍼즐 IO vs 덱스트: Puzzle IO는 AI 기반 금융 분석 및 예측 분야에서 탁월한 역량을 자랑합니다..

- 퍼즐 IO vs 시나이더: Synder는 판매 및 결제 데이터 동기화에 탁월합니다.

- 퍼즐 IO vs 이지 먼스 엔드: Easy Month End는 재무 마감 프로세스를 간소화합니다.

- 퍼즐 IO vs Docyt: Docyt는 AI를 사용하여 회계 업무를 자동화합니다.

- Puzzle IO vs RefreshMe: RefreshMe는 재무 성과를 실시간으로 모니터링하는 데 중점을 둡니다.

- Puzzle IO vs Sage: Sage는 다양한 규모의 기업에 적합한 강력한 회계 솔루션을 제공합니다.

- Puzzle IO vs Zoho Books: Zoho Books는 저렴한 회계 솔루션을 제공합니다. CRM 완성.

- 퍼즐 IO vs 웨이브: Wave는 중소기업을 위한 무료 회계 소프트웨어를 제공합니다.

- Puzzle IO vs Quicken: Quicken은 개인 및 소규모 사업체의 재무 관리에 특화된 프로그램으로 알려져 있습니다.

- 퍼즐 IO vs Hubdoc: Hubdoc은 문서 수집 및 데이터 추출 전문 기업입니다..

- Puzzle IO vs Expensify: Expensify는 포괄적인 경비 보고 및 관리 기능을 제공합니다.

- Puzzle IO와 QuickBooks 비교: QuickBooks는 소규모 사업체 회계에 널리 사용되는 프로그램입니다.

- Puzzle IO vs AutoEntry: AutoEntry는 송장과 영수증에서 데이터를 자동으로 입력해 줍니다.

- Puzzle IO vs FreshBooks: FreshBooks는 서비스 기반 비즈니스 청구서 발행에 최적화되어 있습니다.

- Puzzle IO vs NetSuite: NetSuite는 전사적 자원 관리(ERP)를 위한 포괄적인 제품군을 제공합니다.

결론

You now understand how to use Puzzle io to manage your money.

This tool is perfect for AI startups that need to move fast.

It gives you actionable insights so that you can make smart choices instantly.

You can check your revenue insights and cash burn runway at any time.

This keeps your financial health strong as you grow.

The software even handles hard tasks like accrual 회계 자동으로.

There is a huge demand for simple financial tools right now.

Start using Puzzle io to save time and focus on building your business.

자주 묻는 질문

What is puzzle accounting software?

Puzzle is an AI-powered accounting tool designed for startups. It automates data entry, categorizes expenses, and provides real-time financial insights to help founders manage their money easily.

Is puzzle an ERP?

No, Puzzle is not a full Enterprise Resource Planning (ERP) system. It focuses specifically on core accounting, general ledger management, and financial reporting for early-stage companies.

Can you use AI to solve puzzles?

Yes, Puzzle io uses advanced AI to solve accounting challenges. It automatically identifies merchants, categorizes transactions, and learns from your corrections to improve accuracy over time.

How to solve the puzzle easily?

To solve your accounting puzzle, connect your bank accounts to the software. The Autopilot feature organizes your data, leaving you with just a few items to review.

How to build a puzzle step by step?

Building your financial books is easy. First, link your accounts. Second, review AI suggestions. Third, set up rules for recurring costs. This creates a complete financial picture.

More Facts about Puzzle

- Simple Dashboard: Puzzle gives you a single, easy-to-read screen to checkthe health of your company’s finances.

- Built for Startups: This software is made just for startups and handles the two main types of accounting (cash and accrual) automatically.

- Easier than QuickBooks: Many people find Puzzle more modern and easier to understand than QuickBooks.

- Why People Switch: Users often leave QuickBooks for Puzzle to avoid high costs, confusing screens, and hard-to-use features.

- QuickBooks is Still Big: Even though Puzzle is easier to use, QuickBooks remains the industry leader because it offers a vast range of features and integrations.

- 무료 옵션: Puzzle is popular because it offers a free plan for companies spending less than $5,000 a month.

- Fast Setup: Switching from QuickBooks to Puzzle is simple and takes just a few minutes.

- 전문가의 도움: You can invite bookkeepers or finance experts into the software to help you manage your money.

- Drafts in Minutes: When you first join, the software can create a rough draft of your financial reports in about 15 minutes.

- Metrics Tracking: The dashboard lets you track key metrics, such as how much cash you have and how quickly you are spending it.

- 좋은 보안: Puzzle uses strong security measures, such as encryption, to keep your money and data safe.

- 고객 지원 센터: A library of articles and answers to common questions for users who need help.

- Web-Based: You use Puzzle primarily through a web browser on your computer or phone, not a downloaded program.

- Clean Look: Users really like that the software looks clean and simple to use.

- Real-Time Sync: A big plus is that Puzzle connects to your bank account instantly, so you don’t have to type in numbers by hand.

- AI Concerns: Some users worry that the computer (AI) tries to organize transactions on its own and sometimes makes mistakes that are hard to fix.

- Support Issues: Some users have reported that customer support and the setup process can be frustrating.

- Feels New: Some people say the software feels like it is still in a testing phase (“beta”) and is missing some basic features.

- Due Diligence: The software gives you instant access to the financial reports investors need to review before investing.

- Automates Boring Work: Puzzle does the repetitive, boring accounting tasks for you automatically.

- Investor View: It helps founders move from a messy startup style to a more organized, professional way of running a business.

- Monthly Checklist: The software includes a checklist to help you ensure all your accounts match at the end of the month.

Facts about Puzzle (The Workflow & Process Tool)

- Responsibility Cards: This tool creates cards that show new team members exactly what tasks they are responsible for.

- Visual Database: It uses a visual system to track how well work is flowing and spot where things are getting stuck.

- Project Breakdowns: Users can add sections and steps to their workspace to break big projects into smaller pieces.

- Syncs with Tools: The platform integrates with other modern tools to eliminate manual work.

- Organized Workspaces: It organizes projects into separate areas, keeping things clear and efficient.

- Detailed Notes: You can add notes, links, and training documents to the side of your project view for extra detail.

- Visual Management: A tool that helps teams see and manage their daily processes.

- Define Roles: It lets you clearly say who “owns” a task so everyone knows who is responsible.

- Cost Tracking: You can see exactly how much every step in your process costs, which helps you decide what to fix first.

- Team Chat: Teams can leave comments on specific steps to discuss work and stay on the same page.

- Step-by-Step Maps: Users can create visual maps that show how a process works, step by step.

- ROI Tracking: The tool helps you track the return on investment (ROI) for each tool and step you use.