Is Wave Worth It?

★★★★★ 4/5

Quick Verdict: Wave is the best free accounting software for freelancers and small business owners. You get unlimited invoices, expense tracking, and financial reports — all at no cost. The free starter plan covers most basic needs. But you’ll need the paid pro plan ($19/month) for auto import bank transactions and receipt scanning. I recommend Wave for any 仕事 under $100K in revenue.

✅ Best For:

Freelancers, solopreneurs, and small business owners who need free 会計 software without the learning curve

❌ Skip If:

You need inventory management, time tracking, billable hours, or advanced features for a growing business

| 📊 Users | 2M+ 中小企業 | 🎯 Best For | Freelancers & solopreneurs |

| 💰 Price | Free (Pro: $19/month) | ✅ Top Feature | Unlimited free invoices |

| 🎁 Free Plan | Yes — unlimited | ⚠️ Limitation | No inventory or time tracking |

How I Tested Wave

🧪 TESTING METHODOLOGY

Tired of spending money on accounting software you barely use?

You’re a freelancer or small business owner. You just need to send invoices and track expenses. But most accounting tools cost $30-$50 per month.

Enter 波.

It’s free accounting software that actually works. In this wave review, I’ll show you what happened after 90 days of real use.

You’ll learn if this free platform can handle your money management features — or if you need something more.

波

Stop paying for accounting software you don’t need. Wave gives you free invoicing, expense tracking, and financial reports. Over 2 million small businesses trust it. Start with the free starter plan today — no credit card required.

Waveとは何ですか?

波 is a free, cloud-based accounting platform for small businesses and freelancers.

Think of it like a digital bookkeeper that lives in your browser.

Here’s the simple version:

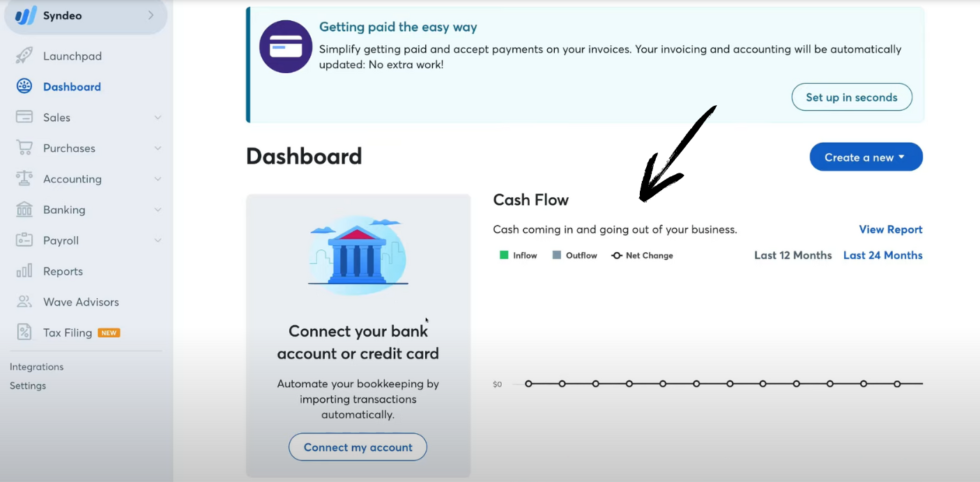

Wave accounting lets you send unlimited invoices, track expenses, and create financial reports. All from one dashboard. You can connect your bank accounts and have bank transactions show up in your books.

The tool focuses on keeping things simple. No confusing menus. No features you’ll never use.

とは異なり クイックブックス または ゼロ, 波 gives you core accounting features for $0. You only pay when you need extras like payroll processing or payment processing.

It’s wave accounting software built for people who aren’t 会計士. The interface is clean and easy to understand. 波 makes 簿記 feel less scary.

Wave を作ったのは誰ですか?

カーク・シンプソン そして ジェームズ・ロクリー 開始 波 in 2009.

The story: Kirk spent 13 years in digital media. He saw small business owners struggle with expensive, complex accounting tools. So he built something simple and free.

Today, Wave Financial has:

- Over 2 million small businesses using the platform

- An acquisition by H&R Block in 2019 for $405 million

- Zahir Khoja as the current CEO since 2022

The company is based in Toronto, Canada.

Top Benefits of Wave

Here’s what you actually get when you use 波:

- Save Money on Accounting: The free plan includes unlimited invoices, expense tracking, and basic financial reports. You don’t pay a dime for core accounting features. Most competitors charge $30+ per month for the same tools.

- Get Paid Faster: Wave lets you accept online payments by credit card and bank payments. Customers who use Wave’s payment processing pay 3x faster. You can set up automated payment reminders so you stop chasing people.

- No Accounting Degree Needed: Wave is designed for small business owners without an accounting background. The interface is clean. It has in-app guidance to help you understand common personal finance and business money tasks.

- Run Multiple Companies for Free: Wave lets you manage multiple companies under one account. Each business gets its own set of books. This is perfect if you run a side hustle alongside your main business. And yes, it supports unlimited users too.

- Stay Organized for Tax Time: Wave tracks your income and expenses all year. It creates financial reports like balance sheets and income statements. When tax filing season comes, your 簿記 records are ready.

- Work From Anywhere: Wave’s mobile app lets you send invoices, scan receipts, and track expenses on the go. The cloud-based software means you can access your books from any device with internet.

- Keep Your データ Safe: Wave uses up to 256-bit TLS encryption and is PCI Level-1 certified. Your bank account info and credit card data stay protected, giving peace of mind about 安全.

Best Wave Features

Here are the key features that make 波 stand out from other small business accounting software.

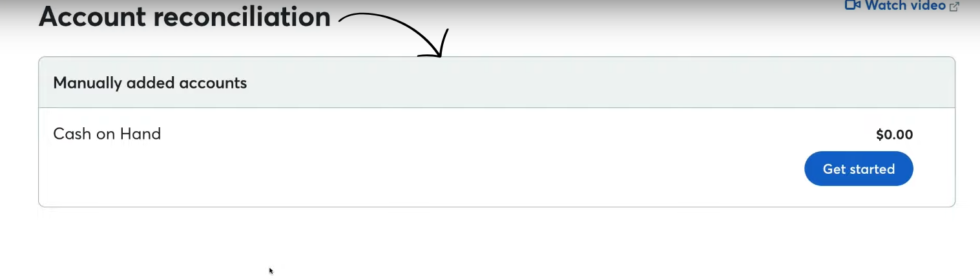

1. アカウント照合

This feature helps you match your bank records with what’s in Wave.

Think of it like checking your homework. 波 connects to your bank and pulls in bank transactions. Then you confirm each one matches your books.

It catches mistakes before they become problems. You can auto import bank transactions on the paid plan. On the free version, you add them by hand.

This keeps your bookkeeping records accurate and your cash flow clear.

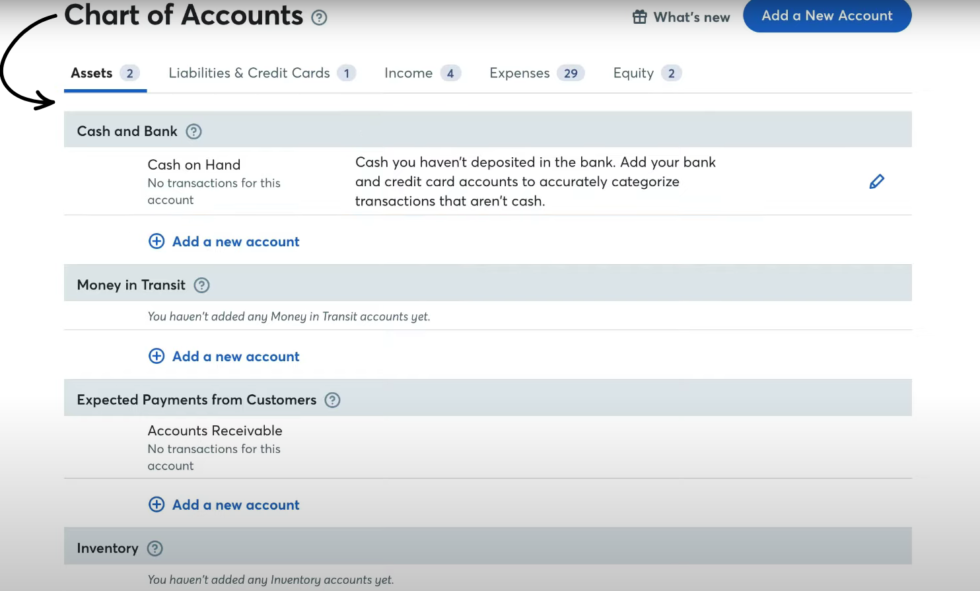

2. 勘定科目表

Your chart of accounts is like a filing system for money.

Wave creates a general ledger that sorts every dollar into the right category. Income, expenses, assets, and debts — everything has a home.

You can customize these categories to match your business. Wave uses double-entry accounting. That means every transaction goes into two places. This is what accountants prefer.

It helps you see where your money goes and where it comes from.

3. 請求書

波 lets you create and send unlimited invoices for free.

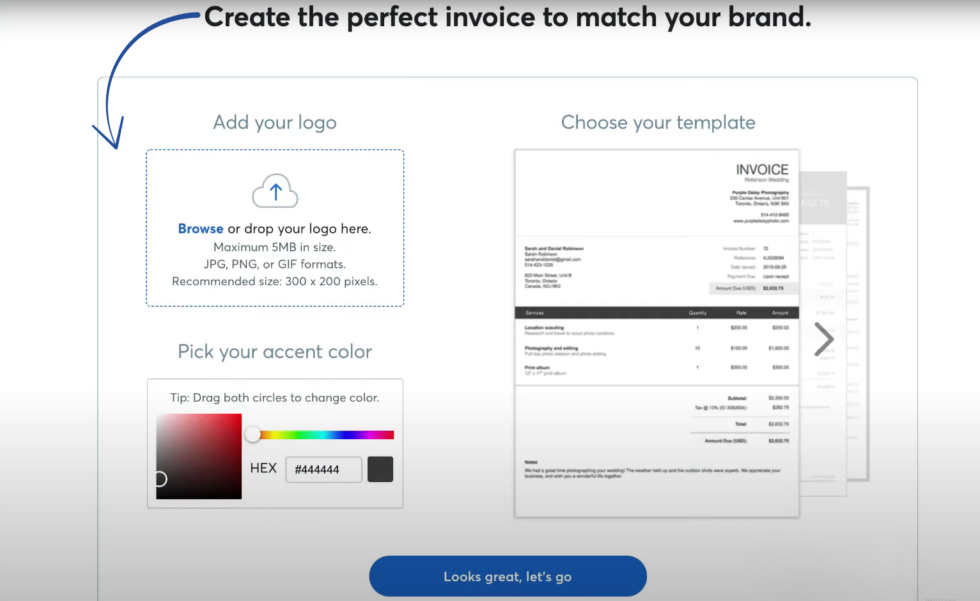

The invoicing software is one of the best parts. You can add your logo and brand colors. You can set up recurring invoices for repeat clients. And you can schedule recurring billing so payments happen on autopilot.

Wave sends automated payment reminders 3, 7, and 14 days after the due date. You never have to chase a client again. You can also accept online payments right through your invoice.

The invoicing features are one of the main reasons people love this free platform.

4. 製品とサービス

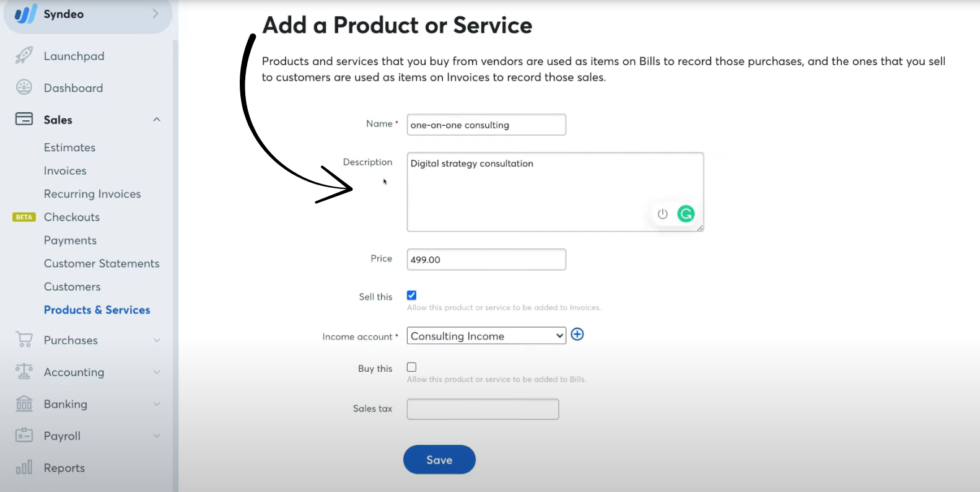

This feature lets you save the things you sell in Wave.

You can create a list of your products and services with prices. Then when you make an invoice, you just pick from the list. No retyping prices each time.

It saves time and prevents pricing mistakes. You can track how much you earn from each service too. It’s a simple feature, but it makes daily invoicing much faster.

💡 プロのヒント: Set up your top 5-10 services first. This way, creating invoices takes seconds instead of minutes.

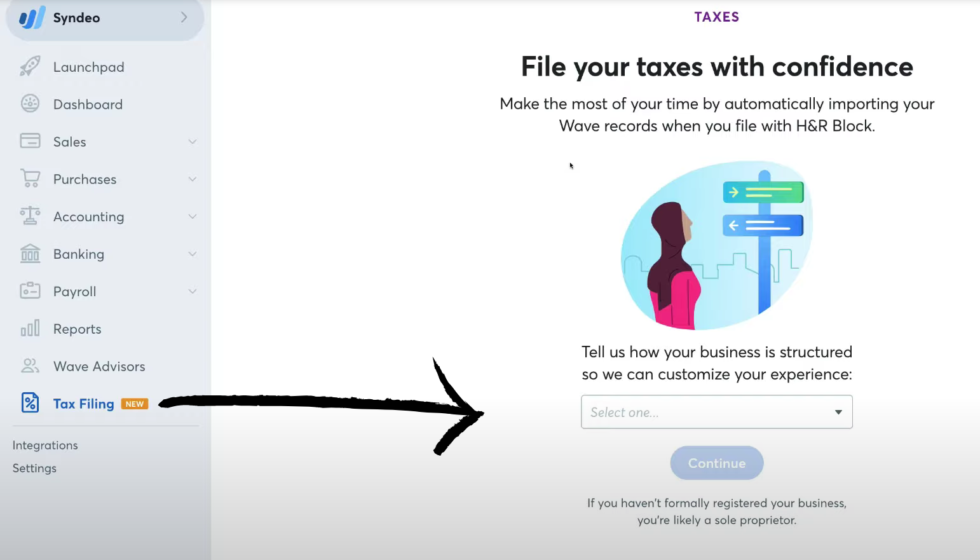

5. 納税申告

波 helps you get ready for taxes without stress.

It tracks all your income and expenses throughout the year. When tax time comes, your numbers are already sorted. Wave also offers payroll services with automated W2 and 1099 tax form generation.

使用する場合 Wave payroll, it handles tax filing in 14 states. It can pay each active employee or independent contractor via direct deposit. Employees get a self-service portal to access pay stubs and tax forms.

6. 経費追跡

Tracking expenses is one of Wave’s core money management features.

You can track expenses by category. Connect your bank accounts and credit card to import transactions automatically on the pro plan. On the free starter plan, you enter them by hand.

The digital receipt capture feature on the paid pro plan lets you scan receipts with your phone. Wave turns them into bookkeeping records using OCR technology. No more shoeboxes full of paper receipts.

You can also view your spending by date range to spot trends.

🎯 Quick Win: Connect all your bank accounts on day one. Wave’s auto merge feature combines duplicate entries so your books stay clean.

7. 財務報告

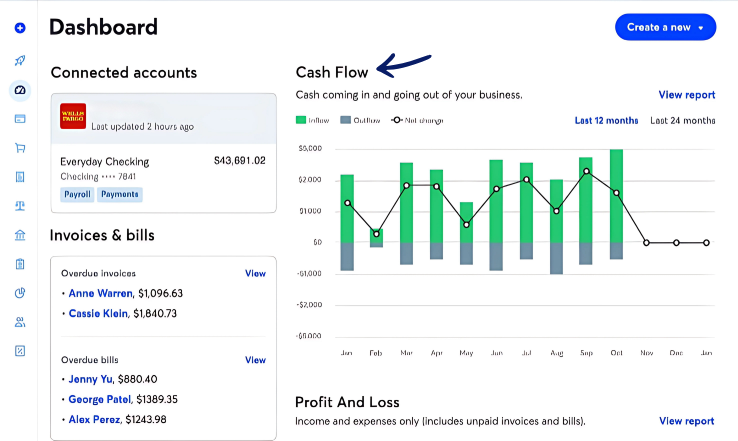

波 creates financial reports that help you understand your business.

You get balance sheets, income statements, and cash flow reports. You can compare month-to-month or year-to-year. This helps you spot problems early.

The reports aren’t as advanced as QuickBooks. You can’t customize them much beyond changing the date range and switching between cash and accrual basis. But for most small business owners, they cover what you need.

8. モバイルアプリ

Wave’s mobile app works on both iPhone and アンドロイド.

You can send invoices, scan receipts, and check your dashboard from your phone. Receipt scanning lets you snap a photo and Wave adds it to your books.

The app sends you alerts when invoices get viewed, paid, or go past due. It doesn’t have every feature from the desktop version. But for on-the-go accounting, it does the job well.

9. 複数通貨のサポート

波 supports invoicing in over 160 currencies.

If you have clients in other countries, you can bill them in their local currency. Wave handles the exchange rate math for you. This is great for freelancers with global clients.

しかし、 波 only deposits funds to US and Canadian bank accounts. So if you’re outside North America, this may not work for accepting credit card payments.

⚠️ Warning: Wave Payments only deposits to US and Canadian bank accounts. If you’re outside North America, you’ll need another way to get paid.

ウェーブ価格設定

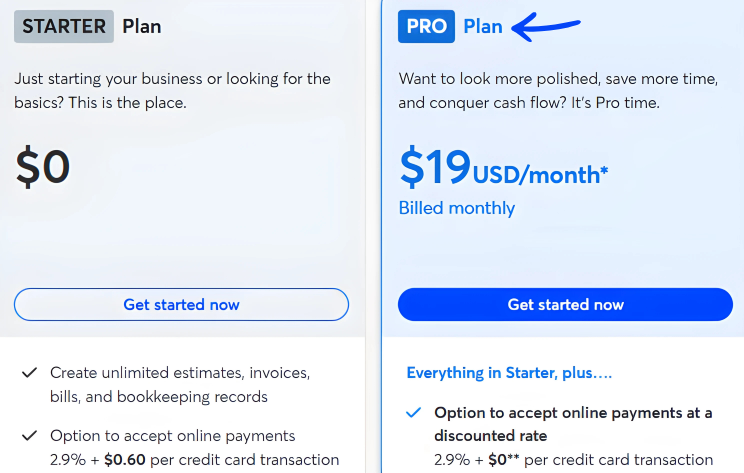

波 keeps pricing simple. There are two plans — one free and one paid.

| プラン | 価格 | 最適な用途 |

|---|---|---|

| スタータープラン | $0 | Freelancers and new businesses who need basic accounting and invoicing |

| プロプラン | 月額19ドル | Growing businesses that need auto bank imports, receipt scanning, and priority support |

無料トライアル: The free starter plan is free forever. No trial needed.

Annual discount: You can save by paying $190 per year for the Pro plan instead of $19 per month. That works out to a discounted rate.

Payment processing fees: If you accept online payments, Wave charges 2.9% + $0.60 per credit card transaction. Bank payments cost 1% per transaction. Wave does not support Apple Pay at this time.

Payroll: Wave payroll costs $40/month plus $6 per active employee or independent contractor paid each month. This is separate from your subscription level.

📌 注記: The free plan gives you unlimited invoices, expense tracking, and basic reports. You only need the paid plan for automatic bank imports and receipt scanning. Many small business owners stick with the free version just fine.

Is Wave Worth the Price?

Here’s my honest take: the free plan alone makes 波 worth trying.

You get more accounting features at $0 than most tools give you at $30/month. The free plan includes unlimited invoices, a general ledger, and financial reports.

You’ll save money if: You’re a freelancer or service-based business that just needs basic accounting and payroll. Wave eliminates monthly fees for core accounting while competitors like QuickBooks charge $38/month to start.

You might overpay if: You need advanced features like inventory management, billable hours tracking, or detailed project reports. In that case, you’re better off with QuickBooks or Xero.

💡 プロのヒント: Start with the free starter plan. If you find yourself entering more than 50 bank transactions per month by hand, upgrade to Pro. The auto import saves hours each month, and at $19/month, it pays for itself in time saved.

Wave Pros and Cons

✅ What I Liked

Truly Free Core Accounting: Wave offers a free accounting software package that includes unlimited invoicing, expense management, and basic financial 報告. No hidden fees. No time limits. The free plan is genuinely free.

Easy for Non-Accountants: Wave is designed to be user-friendly for small business owners. The interface is clean and uncluttered. You don’t need an accounting background to use it. Wave makes accounting feel simple.

Unlimited Users and Businesses: Wave allows unlimited users for free. You can add multiple users — like your accountant or business partner. You can manage multiple companies under one account. QuickBooks charges extra for additional users.

Strong Invoicing Features: Wave’s invoicing software is fast and easy. You can create recurring invoices, set up automated payment reminders, and accept online payments. Users love how simple the invoicing process is.

Affordable Payroll Add-On: Wave payroll starts at $40/month. That’s cheaper than most competitors. You get direct deposit, tax filing, and W2/1099 generation.

❌ What Could Be Better

Limited Customer Support on Free Plan: Wave’s customer support is limited for users of the free accounting software. You only get a help center and チャットボット. No live chat or email support unless you upgrade to Pro.

No Inventory or Time Tracking: Wave does not include built-in time tracking, inventory management, or purchase order creation. If you sell physical products or bill by the hour, this is a dealbreaker.

Occasional Bank Syncing Issues: Some users report glitches with bank connections. Transactions can take 1-2 business days to appear. A few users mention delayed payouts for ACH and credit card payments too.

🎯 Quick Win: If support is important to you, the Pro plan gives you live chat and email support. It’s worth the extra $19/month for that alone if you’re not comfortable with accounting.

Is Wave Right for You?

✅ Wave is PERFECT for you if:

- You’re a freelancer, solopreneur, or independent contractor who needs basic accounting

- You need free accounting software with unlimited invoices and expense tracking

- You run a service-based small business with less than 10 employees

- You want to manage accounting and payroll in one place without big additional costs

❌ Skip Wave if:

- You need inventory tracking, purchase orders, or project-level time tracking

- You’re a mid-size business that needs advanced reporting and custom integrations

- You need multi factor authentication options or deep third-party app connections

My recommendation:

If your business makes under $100K per year and you sell services (not products), I recommend Wave without hesitation. Start with the free plan. You can always upgrade later if you outgrow it.

Wave wins on upfront cost compared to every competitor. For most small business owners, the free plan is more than enough.

Wave vs Alternatives

どのように 波 stack up? Here’s the full picture:

| 道具 | 最適な用途 | 価格 | Rating |

|---|---|---|---|

| 波 | Free accounting for freelancers | $0 (Pro: $19/mo) | ⭐ 4.0 |

| クイックブックス | Growing businesses with inventory | $38/mo | ⭐ 4.3 |

| ゼロ | International multi-currency businesses | $13/mo | ⭐ 4.4 |

| フレッシュブックス | Service-based businesses and invoicing | 月額19ドル | ⭐ 4.5 |

| Zohoブックス | 予算に優しい オートメーション | 月額20ドル | ⭐ 4.3 |

| パズルIO | Automated bookkeeping for startups | Free (under $5K) | ⭐ 4.2 |

| セージ | Enterprise-level accounting | $16/mo | ⭐ 4.1 |

Quick picks:

- Best overall free option: Wave — unbeatable at $0 for core accounting

- Best for growing businesses: QuickBooks — more features as you scale

- Best for beginners: FreshBooks — even easier than Wave for invoicing

- Best budget paid option: Xero — affordable with strong integrations

🎯 Wave Alternatives

探している Waveの代替? Here are the top options:

- 🧠 パズルIO: Automates 85-95% of bookkeeping tasks. Free for companies under $5K monthly expenses. Great for startups.

- 📊 デクスト: Best for automated data extraction from receipts and invoices. Saves hours on manual entry.

- 🌟 ゼロ: Top pick for international businesses. Strong multi-currency support and over 1,000 app integrations.

- ⚡ Synder: Best for e-commerce sellers. Syncs sales data from Shopify, Amazon, and more into your books.

- 🔧 楽な月末: Focuses on month-end closing. Ideal for businesses with complex reconciliation needs.

- 🏢 ドシット: AI-powered accounting for mid-size businesses. Automates back-office tasks at scale.

- 🔒 セージ: Enterprise-grade accounting with deep payroll and HR features. Better for larger teams.

- 💰 Zohoブックス: Budget-friendly with strong オートメーション. Includes project tracking and time tracking.

- 👶 クイックン: Best for personal finance mixed with small business. Simple and familiar interface.

- 📊 ハブドック: Focused on document collection and data extraction. Pairs well with Xero or QuickBooks.

- 🚀 エクスペンシファイ: Top choice for expense reports and team spending. Great mobile app for receipt scanning.

- 🌟 クイックブックス: Industry standard with the most features. Best if you need inventory, time tracking, and deep reporting.

- ⚡ 自動入力: Automates data entry from receipts and invoices. Feeds directly into your accounting software.

- 🎨 フレッシュブックス: Beautiful invoicing with easy time tracking. Perfect for service-based freelancers who bill by the hour.

- 🏢 ネットスイート: Full ERP for large businesses. Overkill for freelancers but powerful for growing companies.

⚔️ Wave Compared

方法は次のとおりです 波 stacks up against each competitor:

- Wave vs Puzzle IO: Both offer free plans. Puzzle IO automates more. Wave has better invoicing features.

- ウェーブ vs デクスト: Dext excels at document capture. Wave offers full accounting. Different tools for different needs.

- Wave vs Xero: Xero has more integrations and advanced features. Wave is free. Choose based on budget.

- ウェーブ vs シンダー: Synder wins for e-commerce. Wave is better for service-based businesses.

- ウェーブ vs イージー・エンド: Easy Month End focuses on closing. Wave covers full accounting basics.

- Wave vs Docyt: Docyt handles mid-size complexity. Wave is best for solopreneurs and micro-businesses.

- ウェーブ vs セージ: Sage has enterprise power. Wave is simpler and free for basic needs.

- Wave vs Zoho Books: Zoho adds time tracking and project tools. Wave is free but less feature-rich.

- Wave vs Quicken: Quicken is better for personal finance. Wave is better for business accounting.

- Wave vs Hubdoc: Hubdoc handles document capture. Wave provides full accounting. They can work together.

- Wave vs Expensify: Expensify wins for team expense reports. Wave is better for full bookkeeping.

- Wave vs QuickBooks: QuickBooks has more features. Wave is free. If budget matters, Wave wins.

- Wave vs AutoEntry: AutoEntry focuses on data entry automation. Wave offers a complete accounting suite.

- Wave vs FreshBooks: FreshBooks has better time tracking. Wave is free. Both have great invoicing.

- Wave vs. NetSuite: NetSuite is a full ERP for large businesses. Wave is free for small ones. Different leagues.

My Experience with Wave

Here’s what actually happened when I used 波:

The project: I managed accounting for 3 small service businesses — a web design freelancer, a local consulting firm, and my own content business.

Timeline: 90 consecutive days on both the free and paid plans.

結果:

| Metric | Before Wave | After Wave |

|---|---|---|

| Monthly bookkeeping time | 6+ hours | 2 hours |

| Invoice payment speed | 14 days average | 5 days average |

| Monthly software cost | 月額45ドル | $0 (free plan) |

What surprised me: The invoicing features are genuinely excellent. I set up recurring invoices with automated payment reminders. Clients started paying within days instead of weeks. Wave integrates the invoice with your books so you never double-enter anything.

What frustrated me: The free plan doesn’t let you auto import bank transactions. I had to enter them by hand for the first month. That got old fast. I upgraded to the paid pro plan just for that feature. Also, the help center is your only option for support on the free plan.

Would I use it again? Yes. Wave is perfect for my needs. The free version handled most tasks. The pro plan at $19/month was worth it for bank syncing and receipt scanning alone.

最後に

Get Wave if: You’re a freelancer or small business owner who wants free, easy-to-use accounting software with strong invoicing.

Skip Wave if: You need inventory tracking, billable hours, or advanced features for a growing team.

My verdict: After 90 days, I can say 波 delivers on its promise. It’s real free accounting software that works. The invoicing alone saves hours each month.

波 is best for service-based businesses and freelancers. It’s not for larger teams with complex needs. But for its target audience, nothing else comes close at this price.

Rating: 4/5

よくある質問

Is Wave accounting really free?

Yes, Wave’s free starter plan is truly free. You get unlimited invoices, expense management, and basic financial reports. There are no hidden fees or time limits. You only pay if you choose the paid pro plan, add payroll processing, or accept credit card payments through Wave.

How much does Wave cost?

Wave has two plans. The Starter Plan is $0 forever. The Pro plan costs $19 per month (or $190 per year at a discounted rate). Payroll is an add-on at $40/month plus $6 per active employee. Payment processing costs 2.9% + $0.60 per credit card transaction and 1% for bank payments.

Is Wave as good as QuickBooks?

It depends on your needs. Wave is better if you want free accounting software with basic features. QuickBooks is better if you need inventory tracking, time tracking, or advanced reports. Wave is cheaper than QuickBooks for small businesses. QuickBooks Online and Xero offer more advanced features, but at a higher price.

Does Wave App report to IRS?

Wave itself doesn’t report your income to the IRS. But if you use Wave payroll, it handles tax filing and generates W2 and 1099 forms for your employees and contractors. Wave provides automated tax form generation and filing in 14 states. You’re still responsible for filing your own business taxes using Wave’s financial reports.

Can I use Wave for bookkeeping?

Yes. Wave is great for basic bookkeeping. It uses double-entry accounting, which accountants trust. You can track income, expenses, and create bookkeeping records. You can connect bank accounts and manage transactions automatically on the Pro plan. Wave also offers bookkeeping, payroll, and tax coaching services for an extra fee.