Many founders hate accounting because it feels messy and slow.

Manual data entry takes hours and leads to costly errors.

You might feel like you are drowning in receipts and spreadsheets.

This stress pulls you away from growing your 仕事.

There is a better way to manage your money.

Knowing how to use Puzzle IO changes everything for your team.

It uses AI to automate your 簿記 in real time.

Follow this easy guide to setting up your account.

Puzzle IO Tutorial

Setting up Puzzle is simple. First, connect your bank accounts & credit cards.

The AI then automatically organizes your spending.

Review your dashboard to see real-time データ.

This process keeps your books clean without the usual manual work or stress.

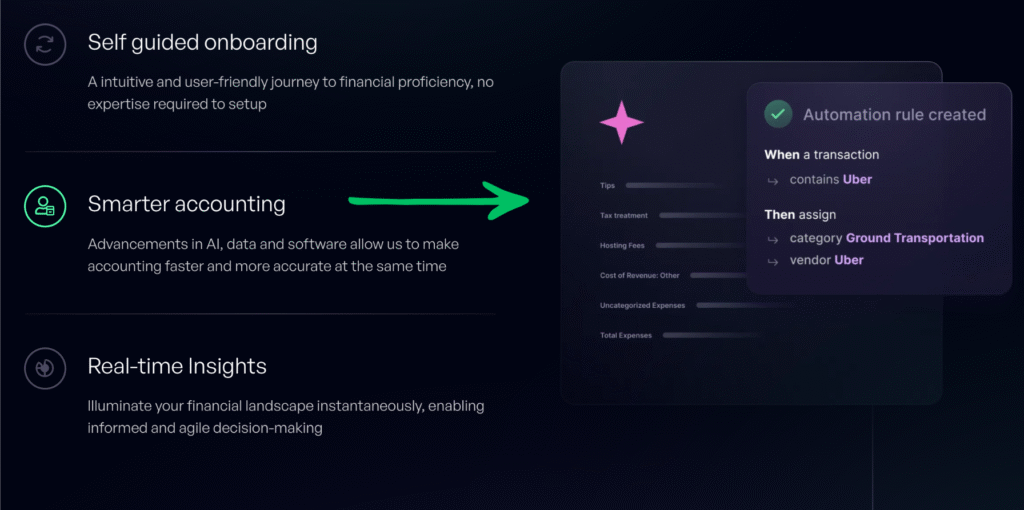

How to Use Smarter Accounting

Managing your general ledger used to be hard work.

You had to type in every single transaction manually.

This old way wasted time and led to mistakes.

よりスマートに 会計 uses intelligent automation to do the heavy lifting for you.

It learns from your activity and 即座に suggests the right categories.

This gives startup founders financial clarity without needing a professional bookkeeper to watch every penny.

Step 1: Connect Your Financial Accounts

First, you need to feed financial data into the system.

This allows the software to see what is happening with your money.

- Log in to your Puzzle dashboard.

- Click on the Connections tab in the settings menu.

- Select your bank (like Mercury or Brex) and credit card providers.

- Follow the secure prompts to link your accounts.

- The system pulls your transaction history automatically to start cash monitoring.

Step 2: Review AI Suggestions

The software is built specifically for early-stage companies.

It uses AI to guess where your money is going.

- Go to the General Ledger or Transactions feed.

- Look for the “Suggested” tag next to new expenses.

- The AI will guess if a purchase is for “Software,” “旅行,” or “Meals.

- If the AI is right, you don’t need to do anything. This helps you save time on manual entry.

Step 3: Correct and Train the AI

Sometimes, the AI might 作る a mistake. You can fix it quickly.

This teaches the tool how to manage your startup’s finances more effectively.

- If a category looks wrong, click the transaction line.

- Select the correct category from the dropdown menu.

- Checked the box that says “Apply to similar future transactions.”

- This trains the system to be more accurate next time and helps ensure compliance.

Step 4: Set Up Autopilot Rules

You can stop doing repetitive tasks completely. Set up rules for recurring bills.

- Identify recurring bills, like your monthly server costs or rent.

- Create a Rule that tells Puzzle to always categorize “AWS” as “Hosting.”

- Save the rule to automate this task forever.

- This keeps your financial statements clean and gives you better real-time insights.

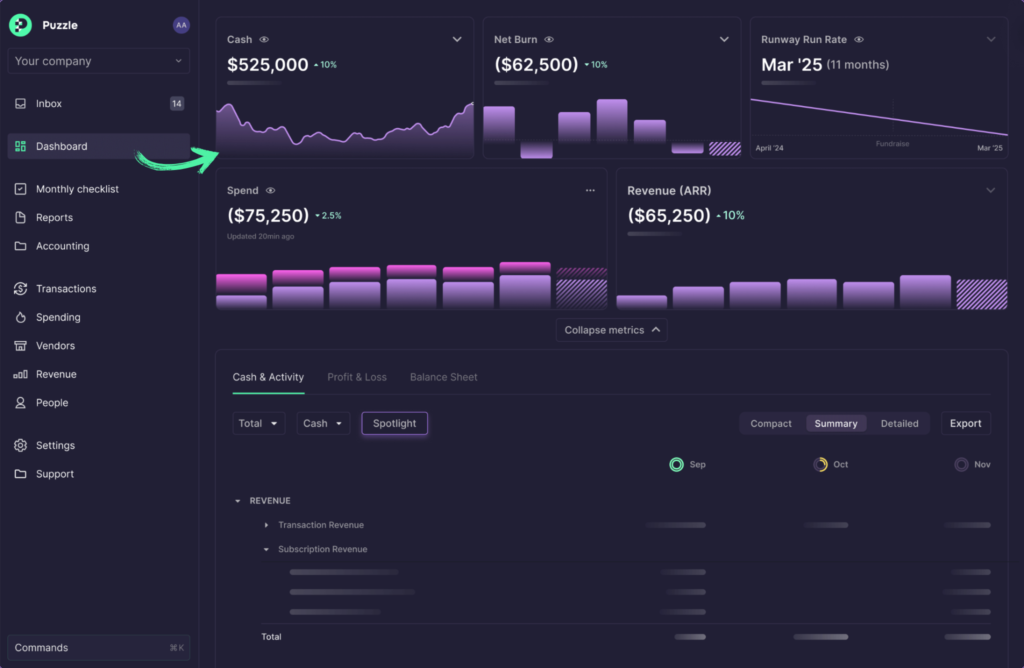

How to Use Financial Insights

Founders need to know their cash flow right now, not next month.

The Financial Insights feature gives you a live look at your money.

This helps you make faster decisions about hiring or spending.

You can use this platform to see your business’s current state without waiting.

Step 1: Access the Main Dashboard

First, you need to see exactly how much money you have.

This helps you understand the value of your cash on hand.

- Log in to the Puzzle app.

- Click the Insights tab on the left sidebar to access your data.

- View your “Cash Balance” and “Burn Rate” widgets at the top.

- These numbers update instantly, so you always know your cash position.

Step 2: Drill Down into Burn Rate

Next, check where your money is going.

This helps your company keep expenses low.

- Click on the Burn Rate chart to expand it.

- Toggle between “Gross Burn” and “Net Burn.”

- Hover over specific months to see spikes in costs.

- Use this data to focus on areas where you can save money.

Step 3: Analyze Revenue Trends

You also need to track who is paying you. This tracks your sales success.

- Scroll down to the Revenue section.

- Filter by specific customer or product lines.

- See which clients are paying on time for your services.

- This helps you spot individual transactions that drive growth.

Step 4: Generate a PDF Report

Finally, share your results with others.

You don’t need to hire an accountant or bookkeeper to build these reports manually.

- Locate the Export button at the top right of the Insights page.

- Select “Monthly Financial Package” to create a plan for your stakeholders.

- Download the PDF to share with your investors or board members.

- The software uses オートメーション and smart systems to do this for you.

- These tools make 報告 easy without any extra work.

How to Use the Partner Ecosystem

あなたの 会計ソフトウェア shouldn’t live on an island.

Puzzle connects with other tools you already use.

This feature adds new capabilities to your 仕事.

It allows different apps to talk to each other.

Step 1: Open the Integrations Library

First, you need to find the right tools to connect.

- Navigate to Settings and select the integration menu.

- Explore the list of available partners, such as Gusto, Rippling, or Stripe.

- You will see options that support Payroll, Revenue, and Banks.

Step 2: Connect Your Payroll Provider

Next, link the system that pays your team. This saves you from typing in data by hand.

- Select your payroll tool from the list.

- Click Connect. It only takes a moment to sign in.

- Allow Puzzle to read your payroll details.

- This automatically pulls in salaries and taxes.

Step 3: Sync Revenue Data

Finally, make sure your sales numbers are correct.

- Find the vendor for your payments, like Stripe.

- Sync your sales data to keep your 簿記 accurate.

- Note that this helps you calculate your real burn 滑走路.

- The system uses rules to sort fees and sales by date.

- Check this every week to keep your books clean.

Puzzle IOの代替品

以下に、Puzzle IO の人気のある代替品をいくつか紹介します。

- デクスト: このソフトウェアは、領収書や請求書からのデータ抽出を自動化することに重点を置いています。書類をデジタル化することで、手作業によるデータ入力にかかる時間を節約します。

- ゼロ: 人気のクラウドベースの会計プラットフォームです。Ateraの簿記機能の代替として、請求書発行、銀行照合、経費追跡などのツールを提供しています。

- セージ: 有名なビジネス管理ソフトウェアプロバイダーである Sage は、Atera の財務管理モジュールの代替として使用できるさまざまな会計および財務ソリューションを提供しています。

- Zohoブックス: Zohoスイートの一部であるこのツールは、中小企業向けの強力な会計ツールです。請求書発行、経費追跡、在庫管理などをサポートし、包括的な財務ツールを必要とする企業にとって優れた代替手段となります。

- シンダー: このソフトウェアは、eコマースおよび決済プラットフォームと会計ソフトウェアの同期に重点を置いています。販売チャネルから帳簿へのデータフローを自動化する必要がある企業にとって、便利な代替手段となります。

- 楽な月末: このツールは、月末処理プロセスを効率化するために特別に設計されています。財務報告と決算処理業務の改善と自動化を目指す企業にとって、最適な代替手段となります。

- ドシット: AIを活用した簿記プラットフォームであるDocytは、財務ワークフローを自動化します。リアルタイムデータと自動文書管理を提供するAteraのAI駆動型簿記機能の直接的な競合製品です。

- リフレッシュミー: これは個人向けの財務管理プラットフォームです。直接的なビジネス向け代替手段ではありませんが、経費や請求書の追跡など、同様の機能を提供しています。

- 波: これは人気の無料財務ソフトウェアです。請求書作成、会計、領収書のスキャンなど、フリーランサーや中小企業に最適です。

- クイックン: 個人および中小企業の財務管理に定評のあるツールです。予算作成、支出追跡、財務計画に役立ちます。

- ハブドック: このソフトウェアは文書管理ツールです。財務文書を自動的に取得し、会計ソフトウェアと同期します。

- エクスペンシファイ: このプラットフォームは経費管理に重点を置いています。領収書のスキャン、出張、経費報告書の作成に最適です。

- クイックブックス: 最も広く使用されている会計ソフトウェア プログラムの 1 つです。 QuickBooks は、財務管理のためのツール一式を提供する強力な代替手段です。

- 自動入力: このツールはデータ入力を自動化します。Ateraの領収書および請求書取得機能の優れた代替手段となります。

- フレッシュブックス: このプログラムは請求書作成と会計処理に最適です。時間と経費をシンプルに追跡したいフリーランサーや中小企業に人気です。

- ネットスイート: 強力で包括的なクラウドベースのビジネス管理スイート。NetSuiteは、財務管理以上の機能を必要とする大規模企業にとって最適な選択肢です。

パズルIOの比較

Puzzle IOを他の会計ツールと比較してみました。Puzzle IOの優れた機能を簡単にご紹介します。

- Puzzle IO vs Xero: Xeroは強力な統合機能を備えた幅広い会計機能を提供します

- パズルIO vs デクスト: Puzzle IOはAIを活用した金融分析と予測に優れています.

- パズルIO vs シンダー: Synder は、売上データと支払いデータの同期に優れています。

- パズルIO vs イージー・マンスエンド: Easy Month End は財務決算プロセスを簡素化します。

- Puzzle IO vs Docyt: Docyt は AI を使用して簿記タスクを自動化します。

- Puzzle IO vs RefreshMe: RefreshMe は、財務パフォーマンスのリアルタイム監視に重点を置いています。

- パズルIO vs Sage: Sage は、さまざまな規模の企業向けに堅牢な会計ソリューションを提供します。

- Puzzle IO vs Zoho Books: Zoho Booksは手頃な価格で会計サービスを提供しています CRM 統合。

- パズルIO vs Wave: Wave は中小企業向けに無料の会計ソフトウェアを提供しています。

- Puzzle IO vs Quicken: Quicken は個人および中小企業の財務管理で知られています。

- パズルIO ハブドック対: Hubdocは文書の収集とデータの抽出を専門としています.

- Puzzle IO vs Expensify: Expensify は包括的な経費報告と管理を提供します。

- Puzzle IO vs QuickBooks: QuickBooks は中小企業の会計に人気の選択肢です。

- Puzzle IO vs AutoEntry: AutoEntry は、請求書や領収書からのデータ入力を自動化します。

- Puzzle IO vs FreshBooks: FreshBooks は、サービスベースのビジネス請求書作成向けにカスタマイズされています。

- Puzzle IO vs NetSuite: NetSuite は、エンタープライズ リソース プランニングのための包括的なスイートを提供します。

結論

You now understand how to use Puzzle io to manage your money.

This tool is perfect for AI startups that need to move fast.

It gives you actionable insights so that you can make smart choices instantly.

You can check your revenue insights and cash burn runway at any time.

This keeps your financial health strong as you grow.

The software even handles hard tasks like accrual 会計 自動的に。

There is a huge demand for simple financial tools right now.

Start using Puzzle io to save time and focus on building your business.

よくある質問

What is puzzle accounting software?

Puzzle is an AI-powered accounting tool designed for startups. It automates data entry, categorizes expenses, and provides real-time financial insights to help founders manage their money easily.

Is puzzle an ERP?

No, Puzzle is not a full Enterprise Resource Planning (ERP) system. It focuses specifically on core accounting, general ledger management, and financial reporting for early-stage companies.

Can you use AI to solve puzzles?

Yes, Puzzle io uses advanced AI to solve accounting challenges. It automatically identifies merchants, categorizes transactions, and learns from your corrections to improve accuracy over time.

How to solve the puzzle easily?

To solve your accounting puzzle, connect your bank accounts to the software. The Autopilot feature organizes your data, leaving you with just a few items to review.

How to build a puzzle step by step?

Building your financial books is easy. First, link your accounts. Second, review AI suggestions. Third, set up rules for recurring costs. This creates a complete financial picture.

More Facts about Puzzle

- Simple Dashboard: Puzzle gives you a single, easy-to-read screen to checkthe health of your company’s finances.

- Built for Startups: This software is made just for startups and handles the two main types of accounting (cash and accrual) automatically.

- Easier than QuickBooks: Many people find Puzzle more modern and easier to understand than QuickBooks.

- Why People Switch: Users often leave QuickBooks for Puzzle to avoid high costs, confusing screens, and hard-to-use features.

- QuickBooks is Still Big: Even though Puzzle is easier to use, QuickBooks remains the industry leader because it offers a vast range of features and integrations.

- 無料オプション: Puzzle is popular because it offers a free plan for companies spending less than $5,000 a month.

- Fast Setup: Switching from QuickBooks to Puzzle is simple and takes just a few minutes.

- 専門家からのサポート: You can invite bookkeepers or finance experts into the software to help you manage your money.

- Drafts in Minutes: When you first join, the software can create a rough draft of your financial reports in about 15 minutes.

- Metrics Tracking: The dashboard lets you track key metrics, such as how much cash you have and how quickly you are spending it.

- 良い 安全: Puzzle uses strong security measures, such as encryption, to keep your money and data safe.

- ヘルプセンター: A library of articles and answers to common questions for users who need help.

- Web-Based: You use Puzzle primarily through a web browser on your computer or phone, not a downloaded program.

- Clean Look: Users really like that the software looks clean and simple to use.

- Real-Time Sync: A big plus is that Puzzle connects to your bank account instantly, so you don’t have to type in numbers by hand.

- AI Concerns: Some users worry that the computer (AI) tries to organize transactions on its own and sometimes makes mistakes that are hard to fix.

- Support Issues: Some users have reported that customer support and the setup process can be frustrating.

- Feels New: Some people say the software feels like it is still in a testing phase (“beta”) and is missing some basic features.

- Due Diligence: The software gives you instant access to the financial reports investors need to review before investing.

- Automates Boring Work: Puzzle does the repetitive, boring accounting tasks for you automatically.

- Investor View: It helps founders move from a messy startup style to a more organized, professional way of running a business.

- Monthly Checklist: The software includes a checklist to help you ensure all your accounts match at the end of the month.

Facts about Puzzle (The Workflow & Process Tool)

- Responsibility Cards: This tool creates cards that show new team members exactly what tasks they are responsible for.

- Visual Database: It uses a visual system to track how well work is flowing and spot where things are getting stuck.

- Project Breakdowns: Users can add sections and steps to their workspace to break big projects into smaller pieces.

- Syncs with Tools: The platform integrates with other modern tools to eliminate manual work.

- Organized Workspaces: It organizes projects into separate areas, keeping things clear and efficient.

- Detailed Notes: You can add notes, links, and training documents to the side of your project view for extra detail.

- Visual Management: A tool that helps teams see and manage their daily processes.

- Define Roles: It lets you clearly say who “owns” a task so everyone knows who is responsible.

- Cost Tracking: You can see exactly how much every step in your process costs, which helps you decide what to fix first.

- Team Chat: Teams can leave comments on specific steps to discuss work and stay on the same page.

- Step-by-Step Maps: Users can create visual maps that show how a process works, step by step.

- ROI Tracking: The tool helps you track the return on investment (ROI) for each tool and step you use.