Doing books by hand is a total headache.

It takes way too long, and it is easy to make big mistakes.

You probably feel buried under piles of receipts and confusing spreadsheets every single month.

It is time to stop stressing over your finances.

AI can handle the hard work for you so you can finally relax.

Our guide shows you how to use Docyt to automate everything in a few simple steps.

Read on to see how this tool saves you time and keeps your money organized.

Docyt Tutorial

Ready to start? First, connect your bank feeds and 会計 ソフトウェア。

Next, let the AI scan your receipts and bills.

It sorts everything into the right categories for you.

Review the データ and hit sync.

It is that simple to keep your books perfect every single day.

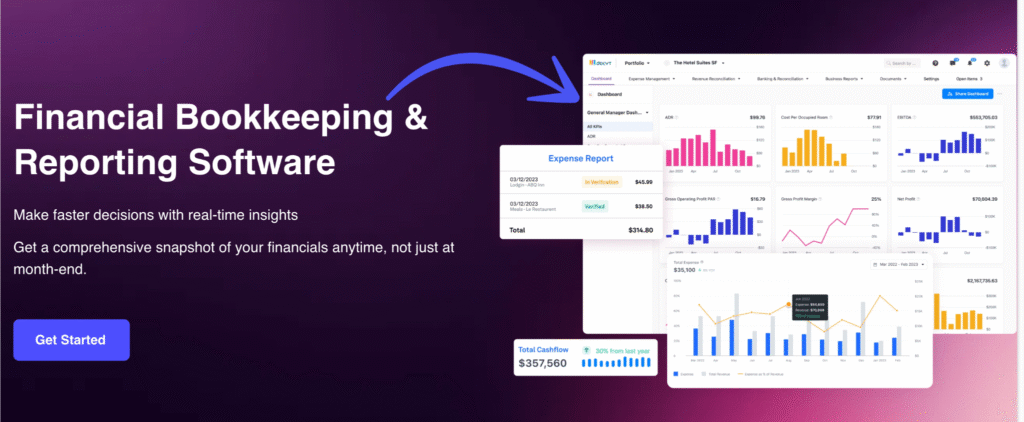

How to use Financial Bookkeeping & Reporting

Are you tired of spending hours on spreadsheets?

Docyt makes managing your 仕事 money much easier.

It uses AI-powered tools to do the heavy lifting for you.

You can connect multiple businesses to one dashboard to see everything at once.

This section will show you how to set up your books so you can get real-time insights without the stress.

Step 1: Connect Your Banking Accounts and Software

The first thing you need to do is give the Docyt AI a way to see your money flow.

This stops you from having to do manual data entry.

- Log in and head to the settings to link your banking accounts.

- Connect your ledger, such as クイックブックス Online, so the two systems can communicate.

- Once linked, the software pulls in transactions in real time.

Step 2: Set Up Your Receipt Box and Capture Tools

Keeping track of paper is a pain. Docyt uses a digital receipt box to keep your files organized and safe.

- Download the mobile app to use the receipt capture feature.

- Simply snap a photo of your invoices or receipts as soon as you get them.

- The AI reads the numbers and automatically matches them to your bank spending.

Step 3: Manage Bills and Expense Reports

Now that your data is in the system, you can handle accounts payable and expense management in one place.

You don’t need a separate bill pay tool.

- Review your uploaded bills and schedule payments directly through the platform.

- Staff members can submit their own expense reports for quick approval.

- The system checks for duplicates, so you never pay the same bill twice.

Step 4: Run Real-Time Financial Reports

The best part about using an automated system is knowing your numbers right now.

You don’t have to wait for 会計 firms to finish their work at the end of the month.

- Click on the reports tab to see real-time financial reports.

- Check your profit and loss or revenue reconciliation to see how much you actually made today.

- Use these facts to make smart choices for your company’s growth.

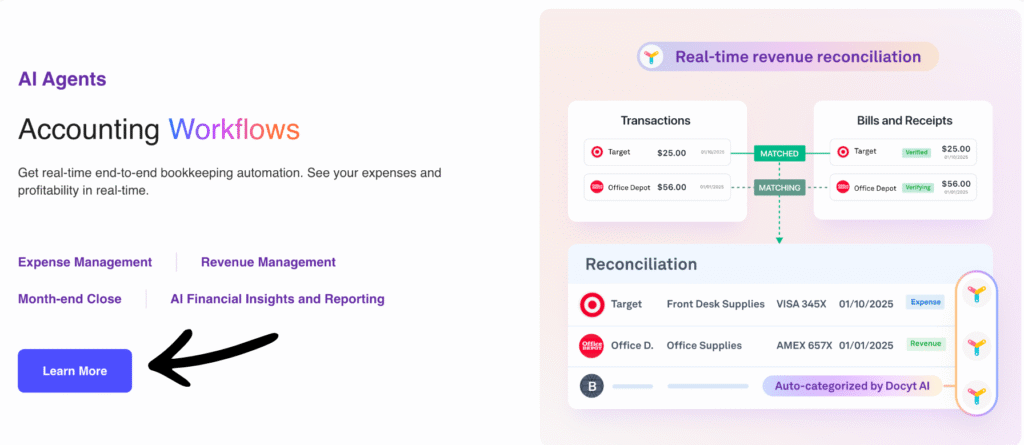

How to use Real-time Revenue Reconciliation

Do you ever wonder if the money in your bank matches what you actually sold?

In the past, you had to wait weeks for accountants to check your books.

Now, you can watch your money move in real-time financial dashboards.

This helps you see your true profitability every single day without the average wait times.

Step 1: Link Your Sales Channels and Apps

To start, you need to link your sales tools to the Docyt app.

This allows the system to see every dollar your customers pay for your services.

- Go to the integrations page and select the tools you use, like Square or Shopify.

- Connect your bank account so the software can see the deposits.

- This connection eliminates the need for manual input, reducing the risk of human error.

Step 2: Upload Your Supporting Documents

For the system to reconcile your sales, it needs to see the proof.

Every document matters when you want perfect financial statements.

- Use the app to upload daily sales summaries or merchant reports.

- Ensure you include any information about fees charged by vendors, such as credit card processors.

- Your team can help with this by snapping photos of end-of-day reports.

Step 3: Match Transactions to Bank Deposits

Once the data is in, the AI gets to work.

It looks at all your transactions and finds where that money landed in your bank.

- The software automatically pairs your sales records with your bank deposits.

- It subtracts expenses like processing fees, so your numbers are exact.

- If something doesn’t match, the system will ask you or your firm to take a look.

Step 4: Monitor Your Client’s or Business Income

If you are running a firm, you can manage each client’s money from one screen.

This makes life much easier for everyone involved.

- Check the dashboard to see if any deposits are missing.

- Look at the “Revenue Gap” to find sales that haven’t hit your bank yet.

- If you need more help, you can always book a demo to see advanced features.

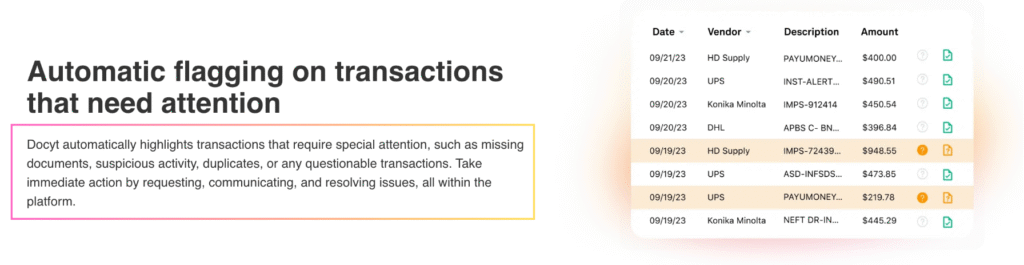

How to use Automatic Flagging on Transactions

Keeping your books clean can be hard when you have hundreds of transactions to track.

Docyt is designed to act like a second pair of eyes that never gets tired.

It uses AI-powered tools to watch for mistakes before they become big problems.

Step 1: Set Your Custom Business Rules

To make the AI work for you, it needs to understand what a normal purchase looks like for your company.

You give it the information it needs to protect your cash.

- Go to the settings tab to follow the setup wizard for flagging rules.

- Tell the system which vendors you use most often and what you usually spend there.

- The AI will then categorize your spending and alert you if a price suddenly changes.

Step 2: Receive Alerts for Errors or Missing Info

You don’t have to go looking for problems; the problems will find you.

You will receive a notification the moment something looks wrong.

- Check your “Action Items” list to see the provided alerts about duplicate bills.

- The system will flag any purchase that is missing a receipt or a digital document.

- This ensures that by the end of the month, every penny is accounted for.

Step 3: Resolve Flags and Fix Mistakes

When the AI finds an error, it is very easy to fix.

You can handle everything right inside the app without calling your accountants.

- Click on the flagged item to see why the AI is worried.

- I recommend uploading the missing receipt or correcting the category immediately.

- Once you fix the issue, the flag disappears, and your financial statements stay accurate.

Alternatives to Docyt

- デクスト: このソフトウェアは、領収書や請求書からのデータ抽出を自動化することに重点を置いています。書類をデジタル化することで、手作業によるデータ入力にかかる時間を節約します。

- ゼロ: 人気のクラウドベースの会計プラットフォームです。Ateraの簿記機能の代替として、請求書発行、銀行照合、経費追跡などのツールを提供しています。

- 楽な月末: この専門ソフトウェアは、決算プロセスを簡素化するために特別に設計されています。QuickBooksやXeroなどの会計プラットフォームと統合することで、スムーズで簡単な月末処理を実現します。

- パズルio: これはスタートアップ向けに特別に開発された最新の会計ソフトウェアです。財務報告と自動化を支援し、リアルタイムの洞察を提供し、決算処理の合理化に重点を置いています。

- セージ: 有名なビジネス管理ソフトウェアプロバイダーである Sage は、Atera の財務管理モジュールの代替として使用できるさまざまな会計および財務ソリューションを提供しています。

- Zohoブックス: Zohoスイートの一部であるこのツールは、中小企業向けの強力な会計ツールです。請求書発行、経費追跡、在庫管理などをサポートし、包括的な財務ツールを必要とする企業にとって優れた代替手段となります。

- シンダー: このソフトウェアは、eコマースおよび決済プラットフォームと会計ソフトウェアの同期に重点を置いています。販売チャネルから帳簿へのデータフローを自動化する必要がある企業にとって、便利な代替手段となります。

- 楽な月末: このツールは、月末処理プロセスを効率化するために特別に設計されています。財務報告と決算処理業務の改善と自動化を目指す企業にとって、最適な代替手段となります。

- ドシット: AIを活用した簿記プラットフォームであるDocytは、財務ワークフローを自動化します。リアルタイムデータと自動文書管理を提供するAteraのAI駆動型簿記機能の直接的な競合製品です。

- リフレッシュミー: これは個人向けの財務管理プラットフォームです。直接的なビジネス向け代替手段ではありませんが、経費や請求書の追跡など、同様の機能を提供しています。

- 波: これは人気の無料財務ソフトウェアです。請求書作成、会計、領収書のスキャンなど、フリーランサーや中小企業に最適です。

- クイックン: 個人および中小企業の財務管理に定評のあるツールです。予算作成、支出追跡、財務計画に役立ちます。

- ハブドック: このソフトウェアは文書管理ツールです。財務文書を自動的に取得し、会計ソフトウェアと同期します。

- エクスペンシファイ: このプラットフォームは経費管理に重点を置いています。領収書のスキャン、出張、経費報告書の作成に最適です。

- クイックブックス: 最も広く使用されている会計ソフトウェア プログラムの 1 つです。 QuickBooks は、財務管理のためのツール一式を提供する強力な代替手段です。

- 自動入力: このツールはデータ入力を自動化します。Ateraの領収書および請求書取得機能の優れた代替手段となります。

- フレッシュブックス: このプログラムは請求書作成と会計処理に最適です。時間と経費をシンプルに追跡したいフリーランサーや中小企業に人気です。

- ネットスイート: 強力で包括的なクラウドベースのビジネス管理スイート。NetSuiteは、財務管理以上の機能を必要とする大規模企業にとって最適な選択肢です。

Docytの比較

適切な会計ソフトウェアを探すときは、さまざまなプラットフォームを比較すると役立ちます。

以下は、Docyt とその代替手段の簡単な比較です。

- Docyt vs Puzzle IO: どちらも財務に役立ちますが、Docyt は企業向けの AI を活用した簿記に重点を置いており、Puzzle IO はフリーランサーの請求書作成と経費処理を簡素化します。

- Docyt vs Dext: Docyt は完全な AI 簿記プラットフォームを提供しており、Dext はドキュメントからの自動データキャプチャに特化しています。

- Docyt vs Xero: Docytは高度なAI自動化で知られています。Xeroは、一般的なビジネスニーズに対応する包括的で使いやすい会計システムを提供しています。

- ドサイト vs シンダー: Docytは、バックオフィス業務の自動化を目的としたAI会計ツールです。Synderは、eコマースの売上データと会計ソフトウェアの同期に重点を置いています。

- Docyt vs Easy Month End: Docytは完全なAI会計ソリューションです。Easy Month Endは、月末処理プロセスを合理化・簡素化するために特別に設計されたニッチツールです。

- Docyt 対 RefreshMe: Docyt はビジネス会計ツールですが、RefreshMe は個人の財務および予算管理アプリです。

- Docyt vs Sage: Docytは、最新のAIファーストのアプローチを採用しています。Sageは、従来型およびクラウドベースの幅広い会計ソリューションを提供する老舗企業です。

- Docyt vs Zoho Books: DocytはAIによる会計自動化に重点を置いています。Zoho Booksは、競争力のある価格で包括的な機能を提供するオールインワンソリューションです。

- Docyt 対 Wave: Docytは、成長中の企業に強力なAI自動化を提供します。Waveは、フリーランサーや小規模ビジネスに最適な無料の会計プラットフォームです。

- Docyt 対 Quicken: Docytはビジネス会計向けに開発されました。Quickenは主に個人の財務管理と予算作成のためのツールです。

- Docyt 対 Hubdoc: Docytは完全なAI簿記システムです。Hubdocは、財務文書を自動的に収集・処理するデータキャプチャツールです。

- Docyt vs Expensify: Docytは簿記業務全般に対応します。Expensifyは従業員経費の管理と報告のスペシャリストです。

- DocytとQuickBooksの比較: Docytは、QuickBooksを強化するAI自動化プラットフォームです。QuickBooksは、あらゆる規模の企業に対応する包括的な会計ソフトウェアです。

- Docyt と AutoEntry: DocytはフルサービスのAI簿記ソリューションです。AutoEntryは、特に文書データの抽出と自動化に重点を置いています。

- Docyt vs FreshBooks: Docytは高度なAIを活用して自動化を実現しています。FreshBooksは、請求書発行機能と時間追跡機能を備えた、フリーランサーに人気のユーザーフレンドリーなソリューションです。

- DocytとNetSuiteの比較: Docytは会計自動化ツールです。NetSuiteは、大企業向けの包括的なエンタープライズ・リソース・プランニング(ERP)システムです。

結論

I hope you found this article helpful for your business.

Managing money no longer has to be a scary chore.

With Docyt, you can let the AI do the boring parts of 簿記.

You will save time & avoid making costly mistakes.

Now you know how to track sales, pay bills, and catch errors automatically.

It is the best way to keep your finances organized and clear.

Are you ready to take control of your books?

It is time to get started and see how much easier your life can be!

よくある質問

How does Docyt work?

Docyt uses AI to extract data from bank statements and receipts. It organizes your transactions and syncs them with your ledger. This keeps your books accurate and up to date in real time.

Which AI tool is best for accounting?

Docyt is a top choice for automating workflows and multi-entity management. Other leading tools in 2026 include Ramp for expense tracking and QuickBooks Online for its powerful AIアシスタント.

How to use accounting software?

Start by connecting your bank feeds and existing software. Upload your receipts and invoices so the system can track them. Finally, review the automated reports to manage your business money.

Do the big 4 accounting firms use AI?

Yes, Deloitte, PwC, EY, and KPMG use advanced AI agents. These tools help them review 監査 documents, analyze huge amounts of data, and provide faster advice to their global clients.

How to do bookkeeping step by step?

First, record every transaction and keep your receipts. Categorize your spending into the right accounts. Finally, reconcile your bank statements each month to ensure all your numbers match perfectly.

More Facts about Docyt

- Docyt AI helps you track the key numbers and goals that matter most to your type of business.

- The software creates instant reports and charts so you can see how your business is doing right now.

- You can choose how you want to see your data, even if you need to combine reports from different locations.

- If you have fallen behind on your math, Docyt helps you catch up on your 簿記 速い。

- Instead of waiting until the end of the month, Docyt finishes your books every single day.

- The AI looks for mistakes and tells you if you are about to pay the same bill twice.

- When you mark a bill as “paid,” the system updates immediately to reflect that the money has been sent.

- Docyt talks to over 12,000 banks and 30 different checkout systems to keep your info up to date.

- It is very smart at sorting your spending, getting it right more than 99% of the time.

- Your documents are stored in a digital vault with high-level 安全.

- The AI reads your receipts and bills just like a human would to find the right information.

- Workers can take pictures of receipts with their phones to save them 即座に.

- If you see a number on a report, you can click it to view the original receipt image.

- You can change your dashboard to show only the information you care about most.

- Once it gets your data, Docyt does the hard, boring 会計 あなたのために働きます。

- Itautomatically matches the photos of your receipts to your credit card bill.

- It shows you how much money you are making and spending in real-time.

- The AI understands your spending by looking at what you have bought in the past.

- Before anything is finalized, Docyt sorts your transactions into the right categories.

- You can search your bills by the store name or bill status.

- There is a chat tool so you can talk to your team while you check over your bills.

- You can change or fix many bills at once to save energy.

- Docyt helps you keep track of which bills still need to be paid.

- Using this software means you have to type in 80% less data by hand.

- It makes finishing your monthly reports 5 times faster than the old way.

- Docyt is an all-in-one tool that works perfectly with QuickBooks Online.

- On average, businesses save 500 hours of work and $2,000 every year using Docyt.

- As your business gets bigger, Docyt grows with you to track new goals.

- It can combine financial reports from many store locations into a single list.

- Docyt is a comprehensive accounting helper for 中小企業 and financial professionals.