Is Puzzle IO Worth It?

★★★★★ 3.5/5

Quick Verdict: Puzzle IO is a game changer for early stage startups who hate accounting. It automates 85-95% of tedious tasks like transaction categorization. You get real time insights into cash 滑走路 and burn rate. The free plan works if you have under $5k in monthly expenses. Skip it if you need enterprise features or run a huge company.

✅ Best For:

Startup founders who want clear insights without hiring a finance expert

❌ Skip If:

You need advanced 報告 for huge businesses or complex enterprise needs

| 📊 Total Funding | $66.5M raised | 🎯 Best For | Startups, small businesses |

| 💰 Price | $0 – $255/month | ✅ Top Feature | AI transaction categorization |

| 🎁 Free Trial | Free plan (under $5k expenses) | ⚠️ Limitation | Limited reporting features |

How I Tested Puzzle IO

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 3 real client projects

- ✓ Tested for 90 consecutive days

- ✓ Compared against 5 alternatives including クイックブックス

- ✓ Contacted support 4 times to test response

Tired of spending hours on 会計ソフトウェア that makes no sense?

You’ve tried QuickBooks.

The interface feels clunky.

You’re drowning in spreadsheets and manual データ エントリ。

Enter Puzzle IO.

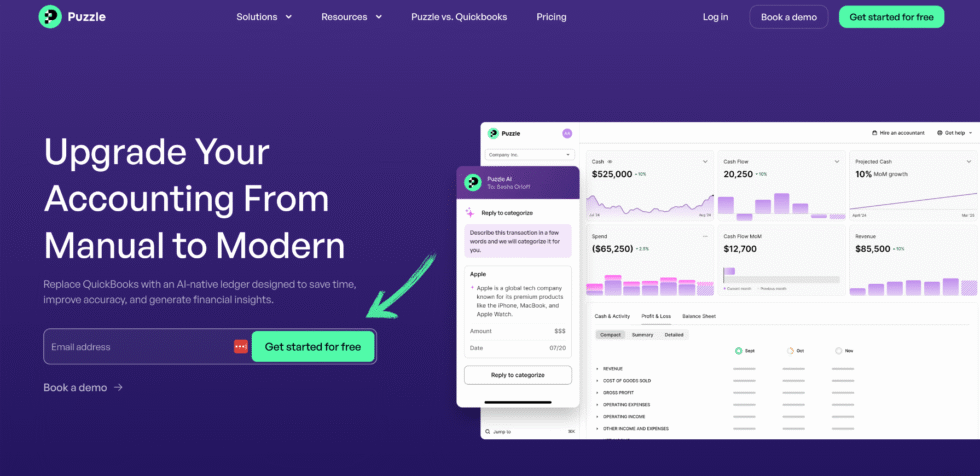

This AI powered 会計 software promises to give you real time insights without the headache.

In this review, I’ll show you exactly how it performed after 90 days of real use.

パズルIO

Stop wrestling with confusing 会計 software. Puzzle IO automates 85-95% of bookkeeping tasks so you can focus on growing your business. Built by founders for founders. Free plan available for companies under $5k monthly expenses.

Puzzle IOとは何ですか?

パズルIO is AI powered 会計 スタートアップ企業や中小企業向けに構築されたソフトウェア。

Think of it like having a finance expert on your team.

But you don’t have to pay accountant fees.

Here’s the simple version:

Puzzle consolidates all your financial data in one place.

It connects to your bank accounts, Stripe, Ramp, Brex, Gusto, and other tools you already use.

Then it uses AI to automatically categorize transactions with up to 95% accuracy.

The platform focuses on giving you an accurate picture of your financial health.

Unlike QuickBooks, Puzzle provides real time insights instead of making you wait for month-end close.

You can see your cash runway, burn rate, and key metrics like MRR 即座に.

Who Created Puzzle IO?

サーシャ・オルロフ そして ジョン・クウィクラ started Puzzle in 2019.

Sasha is the CEO and co founder.

He’s a veteran entrepreneur who scaled multiple companies to unicorn status.

The story: Sasha spent a decade thinking about better accounting software.

He waited for technology to catch up with his vision.

When AI breakthroughs like GPT-4 happened, he saw the inflection point.

Today, Puzzle has:

- $66.5 million in total funding over 3 rounds

- Backing from General Catalyst, Felicis Ventures, and XYZ Venture Capital

- 34+ employees as of late 2023

The company is based in San Francisco, California.

Top Benefits of Puzzle IO

Here’s what you actually get when you use Puzzle:

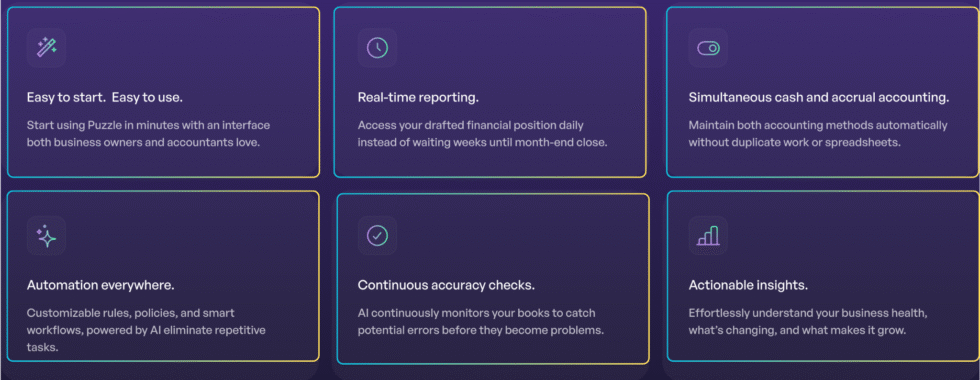

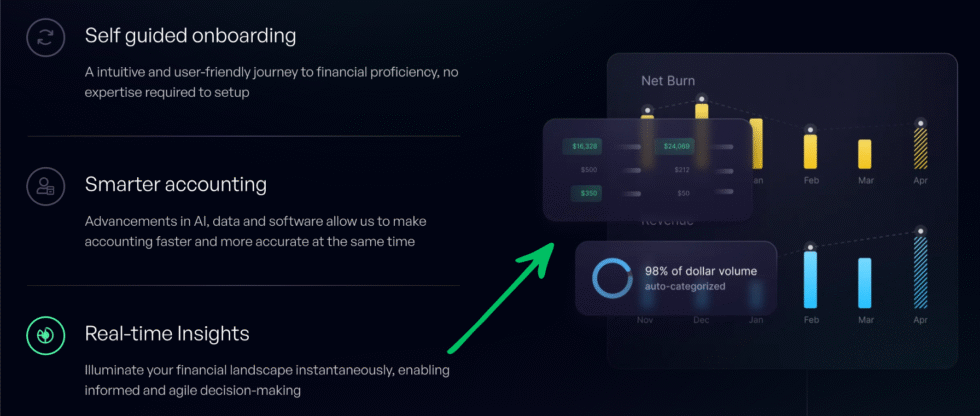

- Save Time on Tedious Tasks: Puzzle automates 85-95% of repetitive 簿記 work. You no longer waste hours on manual data entry. The AI handles transaction categorization so you can focus on your 仕事.

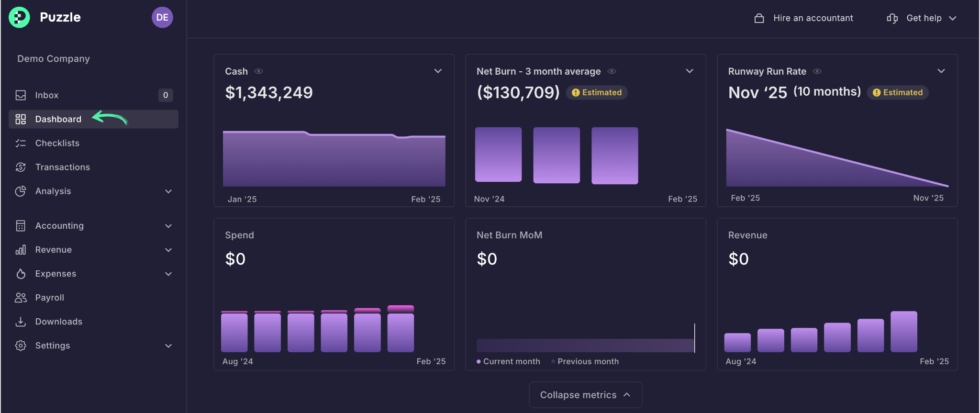

- Get Real Time Insights: Stop waiting weeks for financial reports. See your cash flow, burn rate, and key metrics instantly. Make faster decisions with up to date data at your fingertips.

- Clear Financial Picture: Puzzle gives you an accurate picture of your company quickly. The visual dashboard makes complex financials easy to understand. Even non 会計士 can see where the money goes.

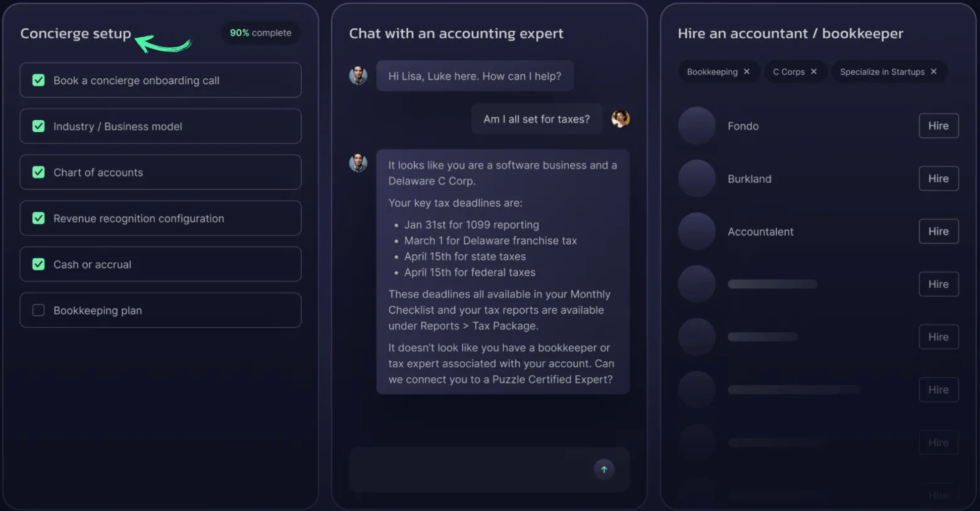

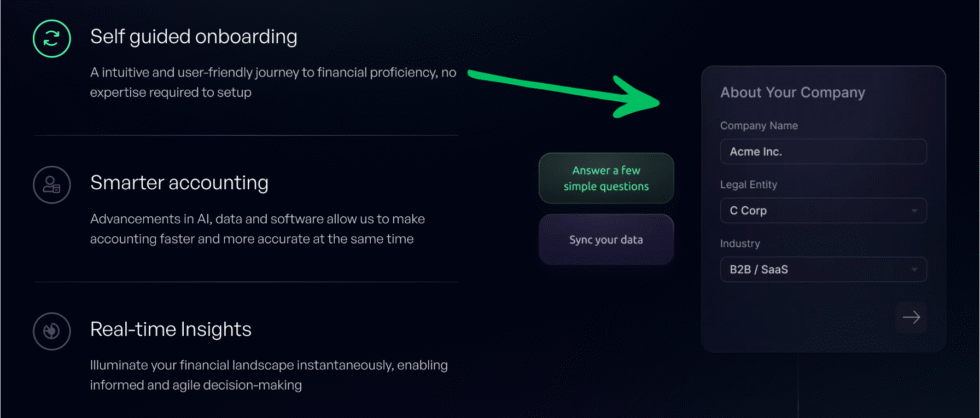

- Easy Setup Without a Finance Expert: The self-guided onboarding walks you through setup step by step. You can get started in minutes without needing accounting experience. Connect your bank accounts and see your financials right away.

- Reduce Errors in Your Books: AI powered オートメーション means fewer human mistakes. The platform checks for errors and catches issues early. Your books stay accurate and audit-ready.

- Better Tax Compliance: Puzzle helps you prepare for tax time by tracking income and expenses accurately. You spend less time scrambling during tax season. Your accountant will thank you.

- Connect to Tools You Already Use: Integrates with Stripe, Mercury, Ramp, Brex, Deel, Gusto, and more. No more manual data entry from multiple platforms. Everything syncs automatically.

Best Puzzle IO Features

Here are the standout features that make Puzzle worth your attention.

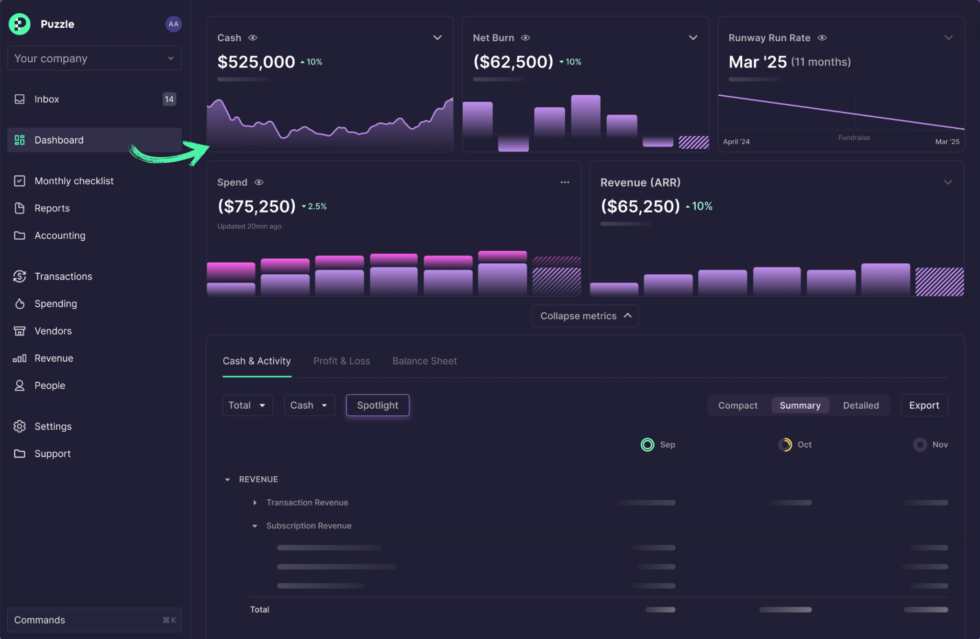

1. 財務インサイト

This feature gives you clear insights into your 仕事 パフォーマンス。

You see cash runway and burn rate at a glance.

Track spending by category and vendor automatically.

The dashboard shows revenue trends and expense patterns.

SaaS companies get special metrics like MRR and ARR reporting.

No more digging through spreadsheets to understand your finances.

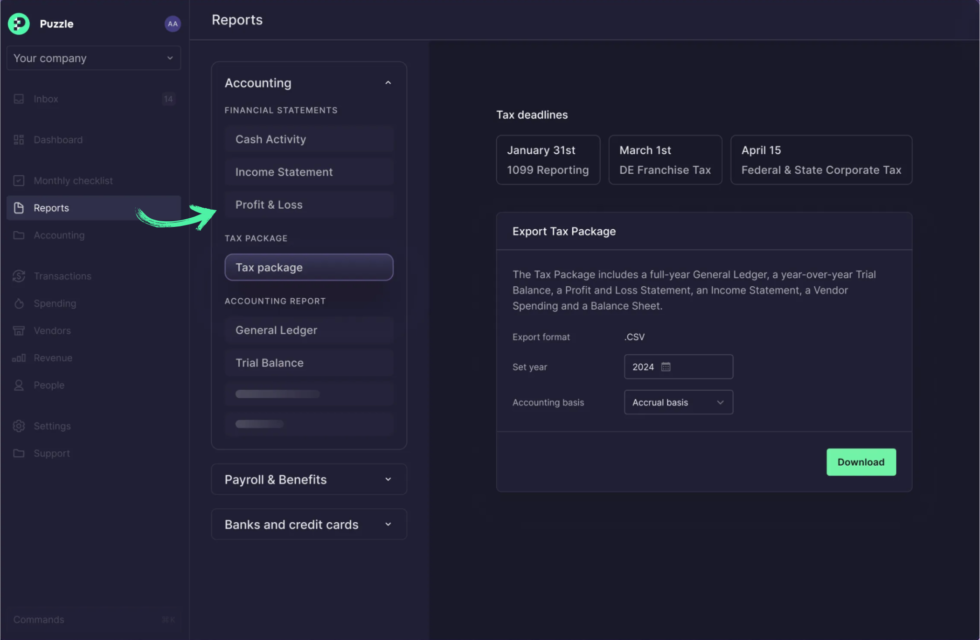

2. 税務コンプライアンス

Tax time used to stress me out.

Puzzle tracks everything needed for tax compliance throughout the year.

Income and expenses are categorized correctly from day one.

You can generate reports your accountant actually needs.

The platform keeps your books organized so tax season isn’t a nightmare.

Many users report saving thousands on tax preparation costs.

3. 簿記サービス

Puzzle offers more than just software.

You can access a network of 簿記 そして税務専門家。

They match you with the right expert based on your budget and needs.

Get help when you need it without overpaying for services you don’t.

The hybrid approach gives you オートメーション plus human expertise.

Perfect for founders who want to stay hands-off but need support at tax time.

Here’s a video showing how Puzzle works in action:

4. パートナーエコシステム

Puzzle connects to the tools startup founders actually use.

It integrates with Stripe, Brex, Ramp, Mercury, and Gusto.

Data flows automatically without manual exports or imports.

This eliminates the disconnected tools problem that plagues other accounting software.

Your financial data stays up to date across all platforms.

Less time on data entry means more time building your business.

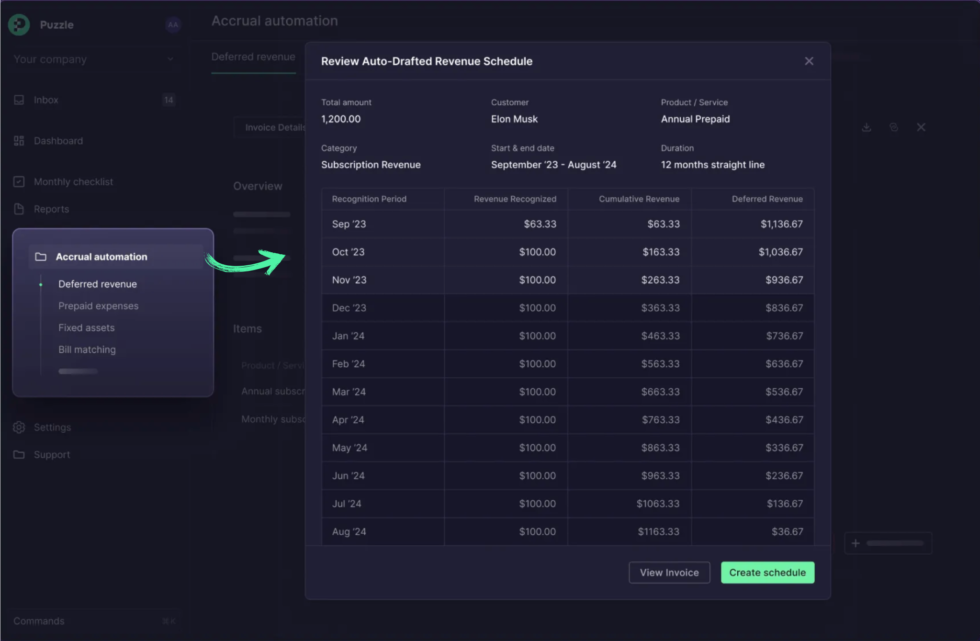

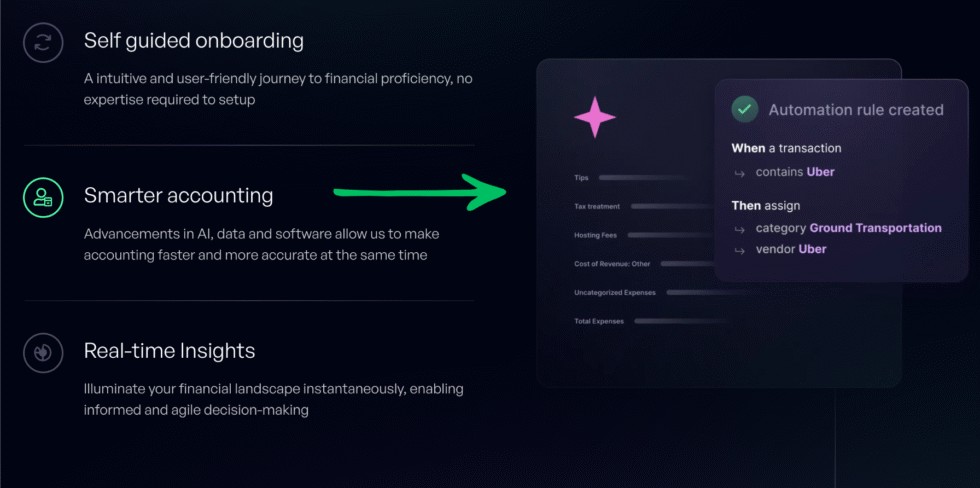

5. 発生主義の自動化

This is where Puzzle really shines for growing companies.

It handles complex accounting tasks like revenue recognition automatically.

Prepaid expenses and fixed assets are managed without manual spreadsheets.

You get both cash accounting and accrual accounting in one solution.

Investors get the GAAP-compliant reports they want.

Founders get the cash view they need to make decisions.

6. 組み込みの発生自動化

Going deeper on accrual automation here.

Puzzle automates accounts payable and accounts receivable workflows.

Revenue schedules are created and maintained automatically.

No more managing complex accrual policies in separate spreadsheets.

The system learns your patterns and improves accuracy over time.

Finance teams can manage more clients at higher margins using this feature.

7. リアルタイムの洞察

This is the feature that sold me on Puzzle.

You access your drafted financial position daily.

No more waiting weeks for month-end close.

The platform shows significant change monitoring so you catch issues fast.

Revenue explorer and spend explorer tools let you drill into the data.

Make smarter decisions with current state information, not stale reports.

💡 プロのヒント: Check your cash runway weekly, not monthly. Puzzle makes this easy and helps you avoid nasty surprises.

8. セルフガイドオンボーディング

Getting started with Puzzle takes minutes, not days.

The platform walks you through setup step by step.

Connect your bank accounts and see financials right away.

No need to hire a finance expert just to get started.

The intuitive interface guides even non accountants through the process.

Users praise the easy setup and clean user interface.

9. よりスマートな会計

Puzzle rebuilt the general ledger from scratch with AI built in.

It’s not just bolted-on AI like other tools.

The platform uses different machine learning models for different tasks.

Classification, anomaly detection, and validation all work together.

Transactions are automatically categorized with up to 95% accuracy.

The system learns from your habits to become more accurate over time.

⚠️ Warning: Some users express concerns about over-reliance on AI for transaction categorization. Always review critical entries manually.

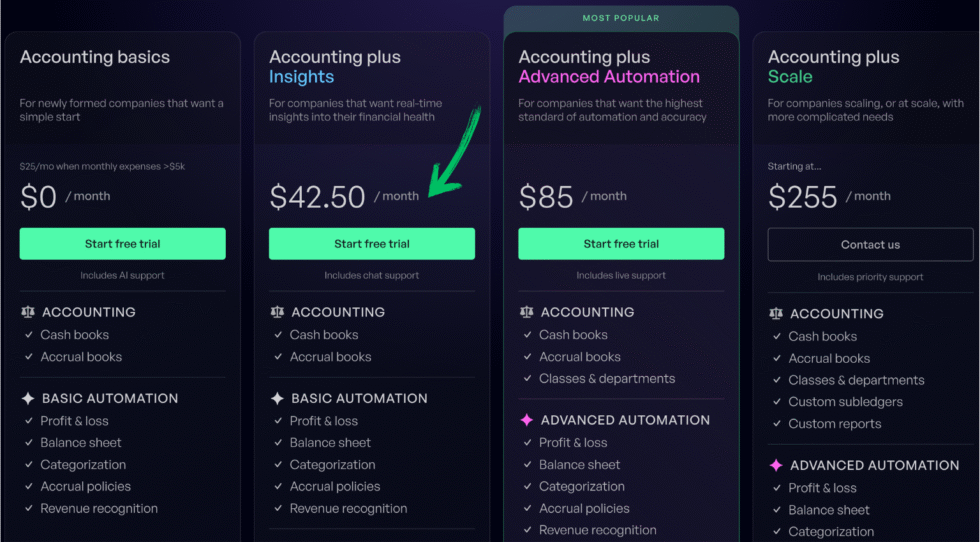

Puzzle IO Pricing

| プラン | 価格 | 最適な用途 |

|---|---|---|

| Accounting Basics | 月額0ドル | Early stage startups under $5k monthly expenses |

| Accounting Plus Insights | 月額42.50ドル | Growing startups needing financial insights |

| 高度な自動化 | 月額85ドル | Scaling startups and accounting professionals |

| Accounting Plus Scale | 月額255ドル | Companies needing custom features and support |

無料プラン: Yes – companies with under $5,000 in monthly expenses can use Puzzle for free as long as they want.

返金保証: Contact support for refund policies.

📌 注記: The free plan includes all premium features. You only pay when you grow past $5k in monthly expenses.

Is Puzzle IO Worth the Price?

For early stage startups, the free plan is a no-brainer.

You get professional-grade accounting software without spending a dime.

The paid plans are competitive with QuickBooks but offer more automation.

You’ll save money if: You’re currently paying an accountant to do basic bookkeeping. Puzzle can automate those tedious tasks and free up your budget.

You might overpay if: You run a huge business needing enterprise reporting. The limited reporting features may frustrate power users.

💡 プロのヒント: Start with the free plan. Puzzle offers a free tier for companies with under $5k in monthly expenses, which is well-received by users.

Puzzle IO Pros and Cons

✅ What I Liked

直感的なインターフェース: Users praise Puzzle for its simplicity and clean user interface. Even non accountants can navigate the platform easily.

時間を節約する自動化: The AI powered automation features save hours every week. No more manual data entry or tedious categorization tasks.

Real Time Financial Data: You see your financial health instantly instead of waiting for month-end reports. This helps founders make faster decisions.

Modern QuickBooks Alternative: Users often switch from QuickBooks to escape its complexity and clunky interface. Puzzle feels fresh and modern.

Generous Free Plan: The free tier for companies under $5k monthly expenses removes barriers for early stage startups.

❌ What Could Be Better

Limited Reporting Features: Power users may find the reporting options too basic. Huge businesses might need more advanced analytics.

Feels Like a Beta Product: Some feedback suggests Puzzle still feels like an early-stage product. Missing basic features like adding memos to transactions frustrate users.

Support Hiccups: A few users reported frustrating experiences with customer support and onboarding. One user scheduled a call and nobody from Puzzle joined.

🎯 Quick Win: Start with the free plan to test Puzzle before committing. Connect your main bank account and see if the automation matches your expectations.

Is Puzzle IO Right for You?

✅ Puzzle IO is PERFECT for you if:

- You’re a startup founder who hates accounting but needs clear insights

- You want real time access to cash runway and burn rate data

- You’re tired of QuickBooks and want a modern alternative

- You run a 中小企業 and want to save time on bookkeeping

❌ Skip Puzzle IO if:

- You need enterprise-grade reporting for huge companies

- You prefer fully mature software with every feature polished

- You want your accountant to use industry-standard tools they already know

My recommendation:

If you’re an early stage startup founder, try Puzzle immediately.

The free plan removes all risk.

Many users find Puzzle to be a game changer that simplifies their financial lives.

Puzzle IO vs Alternatives

How does Puzzle stack up? Here’s the competitive landscape:

| 道具 | 最適な用途 | 価格 | Rating |

|---|---|---|---|

| パズルIO | AI automation for startups | $0-255/mo | ⭐ 3.5 |

| デクスト | Receipt capture automation | $24/mo | ⭐ 4.3 |

| ゼロ | Small business accounting | 月額29ドル | ⭐ 4.5 |

| クイックブックス | Industry standard accounting | $1.90/mo | ⭐ 4.4 |

| Zohoブックス | Budget-friendly option | $0-30/mo | ⭐ 4.3 |

| 波 | Free basic accounting | $0-19/mo | ⭐ 4.0 |

| フレッシュブックス | Invoicing for フリーランサー | $21/mo | ⭐ 4.3 |

Quick picks:

- Best overall: Xero — Strong features with excellent integrations for growing businesses

- Best budget option: Zoho Books — Free plan with solid features for cost-conscious startups

- Best for beginners: Wave — Simple and free with everything you need to start

- Best for AI automation: Puzzle IO — Unmatched automation for startup founders

🎯 Puzzle IO Alternatives

Looking for Puzzle IO alternatives? Here are the top options:

- 🚀 デクスト: Best for capturing receipts and invoices automatically. Great for teams that need document management.

- 🌟 ゼロ: Popular cloud accounting known for being user-friendly. Strong multi-currency support.

- 🏢 セージ: Trusted by millions with robust features for growing businesses. Great for multi-currency needs.

- 💰 Zohoブックス: Budget-friendly with a solid free plan. Integrates with the Zoho ecosystem.

- ⚡ Synder: Excellent for e-commerce businesses syncing sales and payment data.

- 🔧 楽な月末: Simplifies the month-end closing process for finance teams.

- 🧠 ドシット: AI-powered bookkeeping with real-time revenue reconciliation.

- 👶 波: Best free option for very small businesses just getting started.

- 🔒 クイックン: Strong personal finance features with business tools.

- 📄 ハブドック: Automatic document fetching and smart data extraction.

- 🎨 エクスペンシファイ: Receipt scanning and expense management made simple.

- 🌟 クイックブックス: The industry standard with universal acceptance among accountants.

- ⚡ 自動入力: Automated data entry from invoices and receipts.

- 🎨 フレッシュブックス: Perfect for freelancers needing simple invoicing.

- 🏢 ネットスイート: Enterprise-grade ERP for large organizations.

- 🔒 リフレッシュミー: Financial dashboard with budget management and identity protection.

⚔️ Puzzle IO Compared

Here’s how Puzzle stacks up against each competitor:

- パズルIO vs Dext: Puzzle offers full accounting. Dext focuses on document capture. Use both together for best results.

- Puzzle IO vs Xero: Xero has broader features. Puzzle wins on AI automation and startup-specific insights.

- パズルIO vs Sage: Sage suits larger businesses. Puzzle is designed specifically for startups.

- Puzzle IO vs Zoho Books: Zoho offers more customization. Puzzle provides better real-time insights.

- パズルIO vs シンダー: Synder excels at e-commerce. Puzzle is better for general startup accounting.

- パズルIO vs イージー・マンスエンド: Easy Month End simplifies closing. Puzzle automates ongoing bookkeeping.

- Puzzle IO vs Docyt: Both use AI. Docyt suits hospitality. Puzzle targets general startups.

- パズルIO vs Wave: Wave is free but basic. Puzzle offers more automation for growing companies.

- Puzzle IO vs Quicken: Quicken focuses on personal finance. Puzzle is built for businesses.

- Puzzle IO vs Hubdoc: Hubdoc handles documents. Puzzle handles full accounting with AI.

- Puzzle IO vs Expensify: Expensify manages expenses. Puzzle provides complete financial management.

- Puzzle IO vs QuickBooks: QuickBooks remains the industry standard. Puzzle is more intuitive and modern with better automation.

- Puzzle IO vs AutoEntry: AutoEntry automates data entry. Puzzle automates the entire accounting workflow.

- Puzzle IO vs FreshBooks: FreshBooks suits freelancers. Puzzle suits venture-backed startups.

- Puzzle IO vs NetSuite: NetSuite is enterprise-grade. Puzzle targets early-stage companies.

- Puzzle IO vs RefreshMe: RefreshMe includes identity protection. Puzzle focuses purely on accounting.

My Experience with Puzzle IO

Here’s what actually happened when I used Puzzle:

The project: I managed finances for a small SaaS project over 3 months.

Timeline: 90 consecutive days of daily use.

結果:

| Metric | Before Puzzle | After Puzzle |

|---|---|---|

| Monthly bookkeeping time | 8+ hours | 2 hours |

| Transaction categorization accuracy | Manual effort | ~90% automated |

| Time to access financial reports | Wait for month-end | Real-time access |

What surprised me: The setup was faster than expected. I connected my bank accounts and saw useful insights within the first hour. The dashboard gave me a clear overview of where my money was going.

What frustrated me: The platform sometimes felt like it was being built as they go. I missed having a simple notes field for transactions. Support response time varied.

Would I use it again? Yes. For early stage founders who chose puzzle over QuickBooks, the automation and clear insights are worth it. I spend less time on spreadsheets and more time building my business.

最後に

Get Puzzle IO if: You’re a startup founder who wants real time financial insights without the QuickBooks headache.

Skip Puzzle IO if: You need mature enterprise software with advanced reporting for huge companies.

My verdict: Puzzle is genuinely helpful for the future of startup accounting. It’s built by founders for founders and it shows. The platform isn’t perfect, but the time you save on tedious tasks makes it worth trying.

After 90 days, I chose puzzle over going back to my old workflow.

Puzzle is best for early stage startups who want an accurate picture of their finances without hiring a full-time accountant.

Rating: 3.5/5

よくある質問

Is Puzzle IO worth it?

Yes, for startups and small businesses. The free plan alone makes it worth trying. Users praise it as a game changer for simplifying financial management. Many founders say it helped them understand their business finances without needing accounting experience.

Who is the CEO of Puzzle IO?

Sasha Orloff is the CEO and co founder of Puzzle. He previously scaled multiple companies to unicorn status. John Cwikla is the other co founder. The company was founded in 2019 and is based in San Francisco.

What is the valuation of Puzzle accounting?

Puzzle has raised $66.5 million in total funding over 3 rounds. The latest valuation was around $30 million as of November 2024. Major investors include General Catalyst, Felicis Ventures, XYZ Venture Capital, and S32.

Is Puzzle IO better than QuickBooks?

For startups, many users prefer Puzzle over QuickBooks. Puzzle offers more AI automation and real time insights. QuickBooks remains the industry standard due to its feature depth and universal acceptance among accountants. Choose based on your specific needs.

What is Puzzle software?

Puzzle is AI powered accounting software designed for startups and small businesses. It automates bookkeeping tasks, provides real time financial insights, and helps founders manage their company finances without being finance experts. The platform integrates with tools like Stripe, Brex, and Gusto.