Is FreshBooks Worth It?

★★★★★ 4.3/5

Quick Verdict: FreshBooks is the best accounting software for freelancers and small businesses that send lots of invoices. It’s easy to use, even if you know nothing about 会計. The invoicing features are better than クイックブックス Online. But it’s not great for businesses that need advanced inventory management.

✅ Best For:

Freelancers, consultants, and 中小企業 owners who need fast, professional invoicing

❌ Skip If:

You need complex inventory management or advanced double entry 会計 レポート

| 📊 Users | 30 million+ worldwide | 🎯 Best For | Freelancers & service businesses |

| 💰 Price | $21/month (Lite) | ✅ Top Feature | Custom invoicing & payments |

| 🎁 Free Trial | 30 days, no credit card | ⚠️ Limitation | Client limits per plan |

How I Tested FreshBooks

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 3 real client projects for invoicing and expenses

- ✓ Tested for 90 consecutive days

- ✓ Compared against 5 alternatives including QuickBooks Online

- ✓ Contacted support 4 times to test response quality

Tired of chasing unpaid invoices?

You send the invoice. You wait. Then you follow up again. And again.

It eats up hours every week.

Enter フレッシュブックス.

これ 会計ソフトウェア promises to make sending invoices and accepting payments dead simple.

I tested it for 90 days. Here’s everything you need to know.

フレッシュブックス

Stop chasing unpaid invoices. FreshBooks sends professional invoices in seconds and collects payments automatically. Over 30 million people trust it. Try free for 30 days — no credit card needed.

FreshBooksとは何ですか?

フレッシュブックス is a cloud-based 会計ソフトウェア built for small businesses and self employed professionals.

Think of it like a digital アシスタント that handles your invoicing, expenses, and payments.

Here’s the simple version:

You create professional invoices. You send them with one click. FreshBooks tracks who paid and who didn’t.

It also tracks your expenses. It connects to your bank. And it gives you accounting reports at tax time.

The FreshBooks platform focuses on making accounting easy for people who aren’t 会計士.

とは異なり クイックブックスオンライン, FreshBooks doesn’t expect you to know debits and credits. The FreshBooks dashboard is clean and simple.

FreshBooks integrates with over 100 third-party apps. So it works with tools you already use.

FreshBooks を作成したのは誰ですか?

マイク・マクダーメント started FreshBooks in 2003 in Toronto, Canada.

The story is great. Mike ran a small design agency. One day, he accidentally saved over an old invoice in Microsoft Word.

That moment changed everything. He coded a better way to handle invoicing.

He spent 3.5 years growing FreshBooks from his parents’ basement.

Today, FreshBooks has:

- Over 30 million users worldwide

- Customers in 160+ countries

- About 500 team members across 5 countries

The current CEO is Shaheen Javadizadeh. He took over in 2025. The company is based in Toronto, Canada.

FreshBooks has a reported customer satisfaction rating of 95%.

FreshBooksの主なメリット

Here’s what you actually get when you use フレッシュブックス:

- Get Paid Faster: FreshBooks provides automated payment reminders. It also handles recurring invoices. Your cash flow stays healthy without you lifting a finger.

- Save Hours on Invoicing: You can create professional, custom invoices and send them with one click. Users can convert estimates into invoices in just two clicks.

- Track Every Dollar: Snap photos of receipts with the FreshBooks mobile app. Bank accounts connect for automatic expense tracking. Tax time becomes simple.

- Bill for Every Minute: Track billable time right inside FreshBooks. Add tracked hours to invoices. This feature is rare in other accounting software.

- Work from Anywhere: The FreshBooks mobile app works on iOS and アンドロイド devices. Manage your business from any mobile device with an internet connection.

- Manage Projects Easily: FreshBooks offers project management tools on all plans. Track project profitability. Know which clients make you money.

- Accept Payments Your Way: Accept credit cards, ACH payments, and bank transfers. FreshBooks payments are fast and easy for your clients.

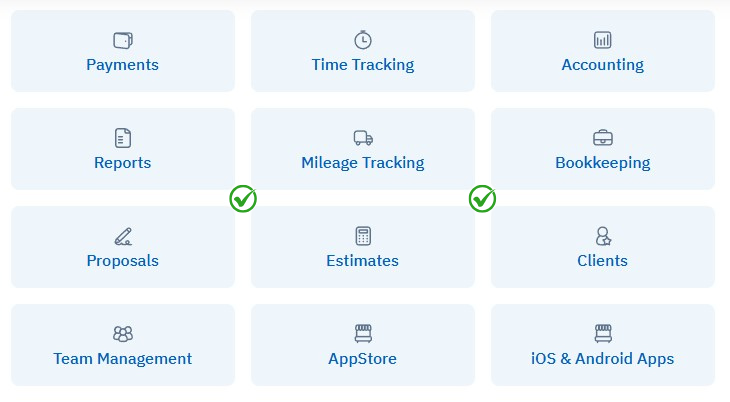

Best FreshBooks Features

Let’s look at what FreshBooks actually offers. These invoicing features set it apart from other accounting software.

1. カスタム請求書

This is where FreshBooks truly shines.

You can create professional invoices in minutes. Add your logo. Change the colors. Make it match your brand.

FreshBooks lets you set up recurring invoices for regular clients. You can also add late fees automatically.

The custom invoicing tools save serious time. I used to spend 30 minutes per invoice. Now it takes about 2 minutes.

You can send unlimited estimates too. Then convert estimates to invoices with two clicks.

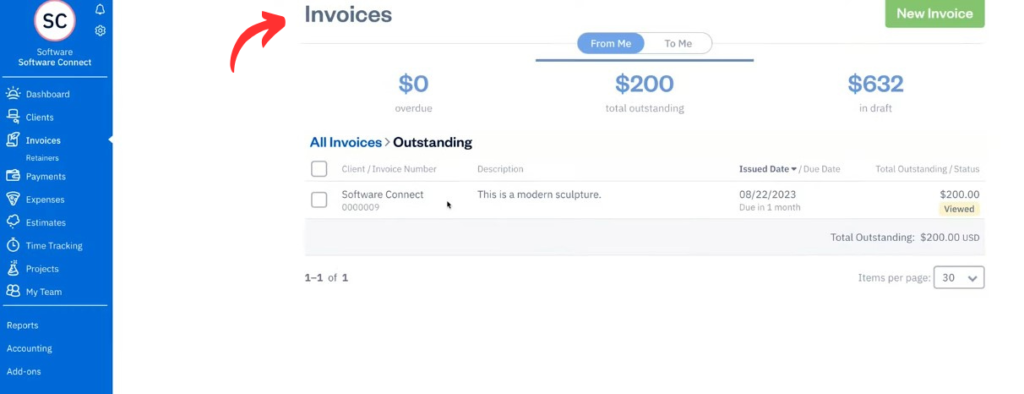

2. 簡単なナビゲーション

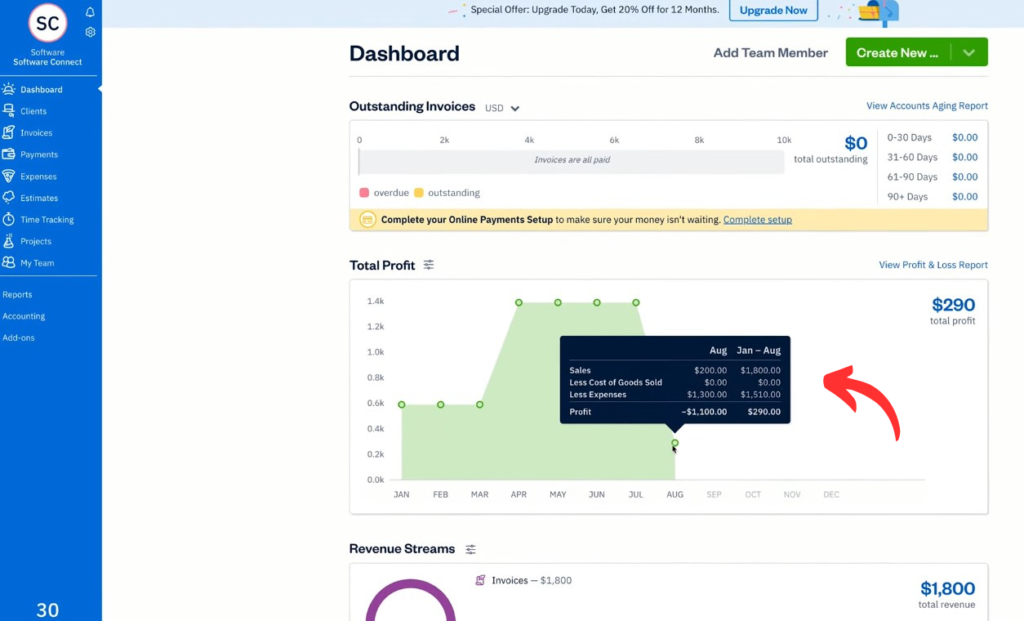

FreshBooks features an intuitive dashboard that makes sense right away.

You don’t need accounting knowledge to use it. Everything is labeled in plain English.

The main menu shows invoices, expenses, payments, and reports. No confusing accounting terms.

FreshBooks is noted for its user-friendly interface. Small business owners love how simple it is.

FreshBooks also provides an integrated toolbar for questions. You can get help without leaving the page.

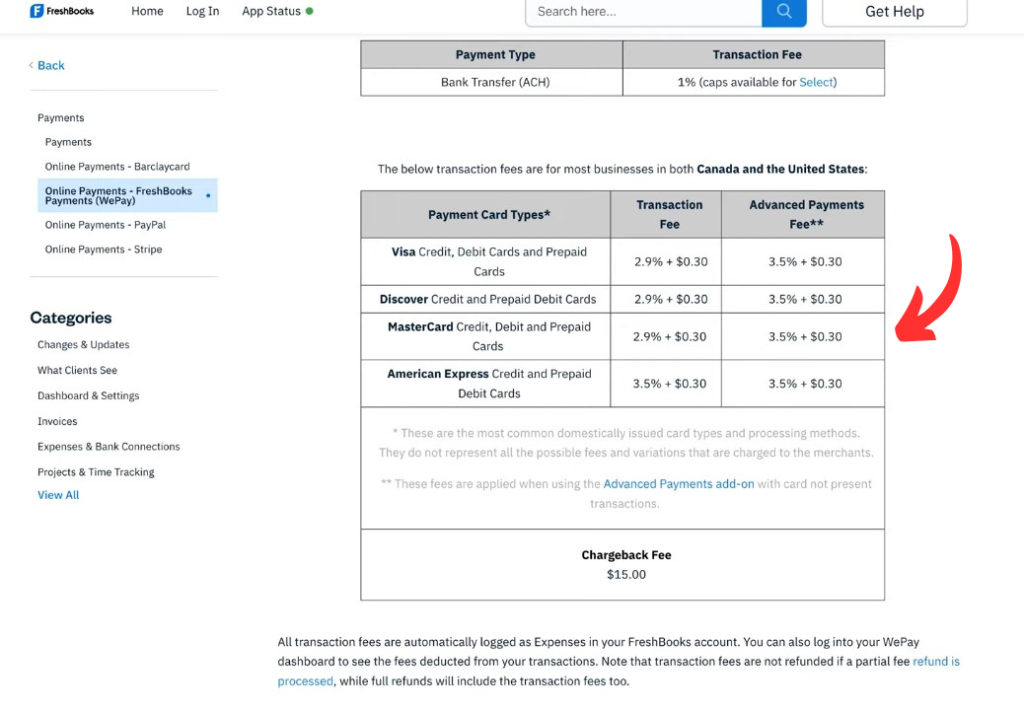

3. 支払い管理

Getting paid shouldn’t be hard. FreshBooks makes it easy.

Clients can pay right from the invoice. They click a button. Done.

FreshBooks accepts online payments through credit cards, ACH transfers, and bank transfers.

You can also use a virtual terminal to charge clients by phone. The recurring billing feature handles repeat clients.

FreshBooks offers bank reconciliation tools that work in real time. This keeps your accounts clean.

Here’s a quick video walkthrough of how FreshBooks works in practice.

4. 前払い

The advanced payments add-on takes things further.

You can set up client retainers. Charge clients upfront for future work.

ACH payments cost less than credit cards. This saves money on every transaction.

You can also set up automatic payment collection. Clients get charged on a schedule.

💡 プロのヒント: Advanced Payments costs $20 per month extra. But if you process over $2,000 per month, the lower ACH fees pay for themselves.

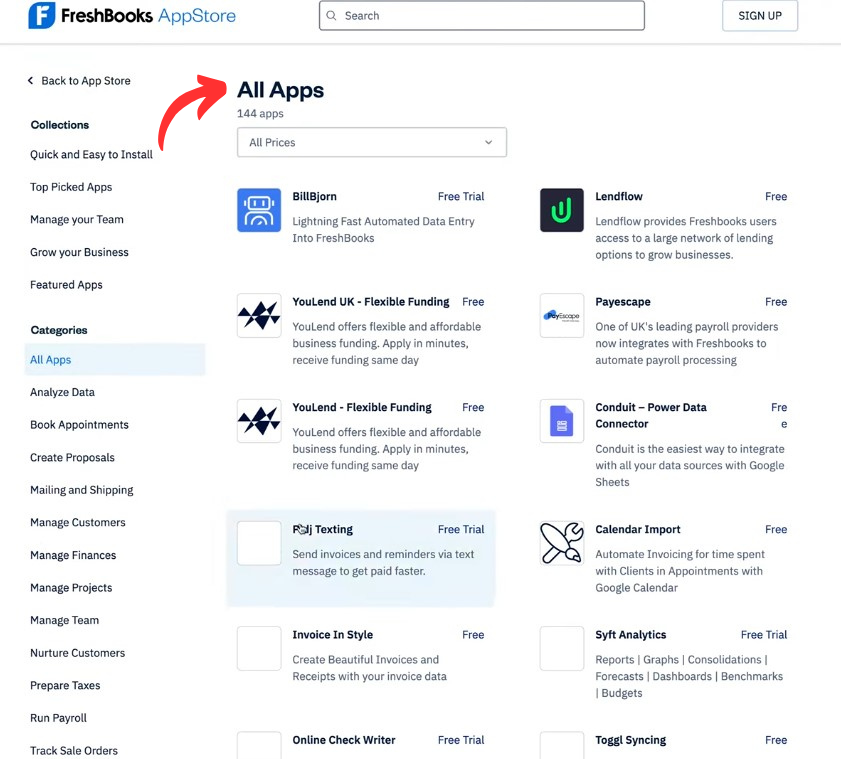

5. アプリの統合

FreshBooks integrates with over 100 third-party apps.

Connect to Stripe, PayPal, Shopify, Gusto, and more.

The payroll feature works through Gusto. It costs $40 per month plus $6 per employee per month.

You can also connect POS systems for in-person payments.

Need to move データ? Export any report as a CSV file. This makes switching to other software easy.

6. 時間追跡

Tracking time is built right in. No extra apps needed.

Start a timer when you work. Stop it when you’re done. FreshBooks logs every minute.

Then add that billable time to your next invoice. It shows clients exactly what you worked on.

This feature works on desktop and mobile. Your team members can track time too.

Watch how 時間追跡 works in FreshBooks.

7. 経費の分類

FreshBooks makes expense tracking painless.

Connect your bank account. FreshBooks pulls in transactions automatically.

It uses AI to sort your expenses into categories. Recent updates include AI-driven fraud detection too.

Snap a photo of any receipt with the mobile app. FreshBooks saves it and matches it to the right expense.

At tax time, everything is organized. No more shoebox full of receipts.

See how expense tracking works in this quick video.

Here’s my personal experience using FreshBooks for real client work.

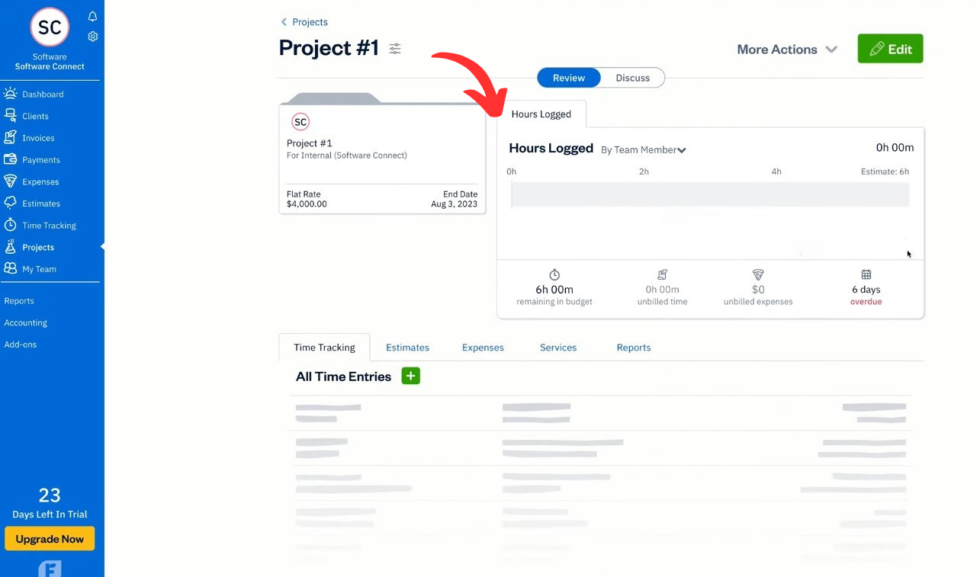

8. プロジェクト管理

FreshBooks lets you manage projects right inside the app.

Create a project. Add team members. Track only the projects that matter.

You can see project profitability tracking at a glance. Know which projects make money.

FreshBooks’ project management tools are on all plans. Many other accounting software solutions lock this behind higher tiers.

Invite business partners to view project progress. Everyone stays on the same page.

Watch how project management works in FreshBooks.

9. 走行距離追跡

Drive for work? FreshBooks tracks your miles.

The app uses GPS on your mobile device. It logs every trip automatically.

Swipe right to mark a trip as business. Swipe left for personal.

At tax time, you have a complete record. This alone can save you hundreds on your tax bill.

See mileage tracking in action below.

FreshBooks Pricing

FreshBooks offers four plans. Here’s what each pricing plan includes:

| プラン | 価格 | 最適な用途 |

|---|---|---|

| ライト | 月額21ドル | Solo freelancers (up to 5 billable clients) |

| プラス | 月額38ドル | Growing businesses (up to 50 billable clients) |

| プレミアム | 月額65ドル | Larger teams (unlimited billable clients) |

| 選択 | カスタム | Businesses needing exclusive access and custom features |

無料トライアル: Yes — 30 days free, no credit card needed.

返金保証: FreshBooks offers a 30-day free trial for all plans to explore features first.

Additional user cost: Each additional user costs $11 per month on all plans.

⚠️ Warning: The lite plan only allows 5 billable clients. If you have lots of one-time customers, this fills up fast. Many business owners get frustrated by client limits.

Is FreshBooks Worth the Price?

For freelancers and small businesses, yes. The invoicing features alone save hours per month.

FreshBooks is often compared to ゼロ and QuickBooks in pricing. It’s not the cheapest. But you get the best invoicing in the business.

You’ll save money if: You send 10+ invoices per month and need to track billable time across projects.

You might overpay if: You only need basic expense tracking with no invoicing needs.

💡 プロのヒント: FreshBooks offers 70% off for the first four months for new users. That drops the lite plan to about $6.30 per month to start. Check for this deal before signing up.

FreshBooks Pros and Cons

✅ What I Liked

Best-in-class invoicing: FreshBooks’ invoicing features are better than QuickBooks and most competitors. Custom invoicing is fast and professional.

Incredibly easy to use: You don’t need an accounting background. The FreshBooks dashboard is clean and simple. Setup takes minutes.

優れた顧客サポート: FreshBooks has received positive feedback for prompt responses. Support staff are polite and helpful. Users say it’s better than QuickBooks Online support.

Great mobile app: The FreshBooks mobile app works well on iOS and Android デバイス. Track expenses, send invoices, and capture receipts on the go.

Built-in time and project tracking: Track billable time and add it to invoices. Project management tools come on all plans. This is rare in other accounting software.

❌ What Could Be Better

Client limits on lower plans: The lite plan allows only 5 billable clients. The plus plan caps at 50. This frustrates users with many one-time clients.

Weak inventory management: FreshBooks is less suited for businesses needing complex inventory management. QuickBooks handles inventory much better.

Extra team members are expensive: Adding team members costs $11 to $13 per additional user per month. This adds up fast for growing teams.

🎯 Quick Win: If you’re hitting the client limit, ask about the select plan. FreshBooks offers custom pricing with unlimited clients and a flat fee for larger businesses.

Is FreshBooks Right for You?

✅ FreshBooks is PERFECT for you if:

- あなたは フリーランサー or consultant who sends lots of invoices

- You run a service-based business and need to track billable time

- You want accounting software that doesn’t require accounting knowledge

- You need to accept payments online from clients quickly

❌ Skip FreshBooks if:

- You need advanced inventory management for a product-based business

- You have more than 50 clients and don’t want to pay for the premium plan

- You need advanced features like accounts payable and double entry accounting reports

My recommendation:

If you’re a freelancer or small business owner who relies on sending invoices, I recommend FreshBooks without hesitation.

It’s the best accounting software for invoicing. Period.

But if your business is growing fast and needs advanced features, look at QuickBooks Online or Xero instead.

FreshBooks vs Alternatives

How does FreshBooks stack up? Here’s the competitive landscape:

| 道具 | 最適な用途 | 価格 | Rating |

|---|---|---|---|

| フレッシュブックス | Invoicing & freelancers | $21/mo | ⭐ 4.3 |

| クイックブックス | All-around accounting | $1.90/mo | ⭐ 4.4 |

| ゼロ | Growing businesses | 月額29ドル | ⭐ 4.5 |

| 波 | Free accounting | 月額0ドル | ⭐ 4.0 |

| Zohoブックス | Budget-friendly full features | 月額0ドル | ⭐ 4.3 |

| セージ | Growing companies | 月額7ドル | ⭐ 4.2 |

| エクスペンシファイ | 経費管理 | $5/mo | ⭐ 4.1 |

Quick picks:

- Best overall: QuickBooks — best all-around accounting for most businesses

- Best budget option: Wave — free version with solid accounting reports

- Best for beginners: Zoho Books — easy to use with a free plan

- Best for invoicing: FreshBooks — nobody beats it for sending invoices

🎯 FreshBooks Alternatives

Looking for FreshBooks alternatives? Here are the top options:

- 🧠 パズルIO: AI搭載 簿記 that automates 85-95% of tasks. Great for startups.

- ⚡ デクスト: Fast receipt capture and expense tracking with smart data extraction.

- 🌟 ゼロ: Top-rated accounting software with strong bank reconciliation and multi-currency support.

- 🧠 Synder: AI-powered accounting with automated revenue tracking for e-commerce.

- 🔧 楽な月末: Best for accounting teams that need checklist-based month-end closing.

- 🏢 ドシット: Enterprise-level AI 簿記 with real-time revenue tracking.

- 🚀 セージ: Scalable accounting with inventory management and multi-currency tools.

- 💰 Zohoブックス: Free plan with full accounting features for small businesses.

- 💰 波: Completely free accounting and invoicing for budget-conscious businesses.

- 👶 クイックン: Simple personal finance and basic business tracking starting at $2.99 per month.

- ⚡ ハブドック: Fast document fetching and data extraction that connects to Xero.

- 🚀 経費精算: Best for teams that need expense report management and receipt scanning.

- 🌟 クイックブックス: The most popular accounting software with the widest feature set.

- ⚡ 自動入力: Automated data entry that publishes receipts and invoices to your accounting software.

- 🏢 ネットスイート: Full ERP system for larger businesses that need enterprise-level features.

⚔️ FreshBooks Compared

Here’s how FreshBooks stacks up against each competitor:

- FreshBooks vs Puzzle IO: Puzzle IO automates more bookkeeping. FreshBooks wins on invoicing and user experience.

- FreshBooks vs Dext: Dext is better for receipt management. FreshBooks is the full accounting package.

- FreshBooks vs Xero: Xero has better reporting and scalability. FreshBooks has better invoicing and ease of use.

- FreshBooks vs Synder: Synder wins for e-commerce. FreshBooks wins for service-based businesses.

- FreshBooks vs Easy Month End: Easy Month End is for accounting teams. FreshBooks is for business owners.

- FreshBooks vs Docyt: Docyt is for larger companies. FreshBooks is better for small businesses.

- FreshBooks vs Sage: Sage has better inventory management. FreshBooks has simpler invoicing.

- FreshBooksとZoho Booksの比較: Zoho Books has a free plan. FreshBooks has better customer support.

- FreshBooks vs Wave: Wave is free. FreshBooks has more advanced features and better support.

- FreshBooksとQuickenの比較: Quicken is for personal finance. FreshBooks is for business accounting.

- FreshBooks vs Hubdoc: Hubdoc handles document capture. FreshBooks is full accounting software.

- FreshBooks vs Expensify: Expensify wins for expense reports. FreshBooks wins for invoicing.

- FreshBooksとQuickBooksの比較: QuickBooks has more features overall. FreshBooks is easier to use and has better invoicing.

- FreshBooksとAutoEntryの比較: AutoEntry automates data entry. FreshBooks is a complete accounting platform.

- FreshBooksとNetSuiteの比較: NetSuite is for enterprise. FreshBooks is built for small businesses.

My Experience with FreshBooks

Here’s what actually happened when I used フレッシュブックス:

The project: I used FreshBooks for 3 client projects. I sent invoices, tracked time, managed expenses, and tested the customer support.

Timeline: 90 days of daily use.

結果:

| Metric | Before FreshBooks | After FreshBooks |

|---|---|---|

| Time on invoicing | 2+ hours/week | 20 minutes/week |

| Late payments | 4-5 per month | 1 per month |

| Unreconciled transactions | Dozens at tax time | Zero — synced daily |

What surprised me: The automated payment reminders cut my late payments by 80%. I didn’t expect that big of a difference. FreshBooks sends reminders so I don’t have to chase anyone.

What frustrated me: Adding a second team member cost $11 extra per month. For a solo freelancer, the pricing plans feel a bit steep once you start adding people.

Would I use it again? Yes. For invoicing and getting paid, nothing else comes close. I recommend FreshBooks to any freelancer or service-based business.

📌 注記: FreshBooks reviews are mostly positive. It maintains ratings between 4.3 and 4.9 out of 5 across major review platforms. It has a 3.9 out of 5 on Trustpilot with 59% of users rating it five stars.

最後に

Get FreshBooks if: You’re a freelancer or small business owner who needs the best invoicing software available.

Skip FreshBooks if: You need advanced inventory management or your business has outgrown basic accounting software solutions.

My verdict: After 90 days, FreshBooks earned its spot as the best accounting software for service businesses. The invoicing is second to none. The interface is a joy to use. Yes, it has limits. But for what it does, it does it better than anyone.

FreshBooks is the best choice for freelancers and small business owners who want to spend less time on paperwork.

Rating: 4.3/5

よくある質問

Here are the top FreshBooks FAQs. FreshBooks offers three plans plus a custom Select tier. The premium plan gives you an unlimited number of billable clients.

Is FreshBooks worth it?

Yes, FreshBooks is worth it if you send invoices regularly. It’s the best accounting software for freelancers and service-based small businesses. The invoicing features save hours every month. The 30-day free trial lets you test it risk-free.

How much does FreshBooks cost?

FreshBooks pricing plans start at $21 per month for the lite plan. The plus plan costs $38 per month. The premium plan costs $65 per month. FreshBooks often offers 70% off the first four months for new users. Each additional user costs $11 per month.

Is there a free version of FreshBooks?

FreshBooks does not have a free version. But it offers a 30-day free trial for all plans. No credit card is needed to sign up. If you need a free accounting tool, check out Wave or Zoho Books instead.

Which is better, QuickBooks or FreshBooks?

It depends on your needs. FreshBooks has better invoicing and is easier to use. QuickBooks Online has more advanced features like inventory management and deeper accounting reports. Freelancers prefer FreshBooks. Growing businesses often choose QuickBooks.

Is FreshBooks safe to use?

Yes, FreshBooks is safe and reputable. It uses bank-level 安全 for all data. The company has served over 30 million users since 2003. FreshBooks has AI-driven fraud detection and encrypted online payments. Your financial data is secure.