毎月の忙しさに圧倒されている 会計 タスクですか?

想像する the stress of scrambling to find receipts, reconcile accounts, and meet deadlines.

すべてをあなたの 仕事.

この記事では、2つの人気の 会計 ソリューション。

Easy Month EndとFreshBooksの機能を比較して、どちらが本当にあなたの業務を簡素化するかを決めるお手伝いをします。 会計.

概要

最も鮮明な画像をお届けします。

私たちは徹底的にテストしました 楽な月末 FreshBooks を比較し、その機能、使いやすさ、全体的な価値を検証します。

Easyの月末、1,257人のユーザーが平均3.5時間を節約し、エラーを15%削減しました。ぜひ無料トライアルをお試しください!

価格: 無料トライアルがあります。プレミアムプランは月額45ドルからです。

主な特徴:

- 自動調整

- 合理化されたワークフロー

- ユーザーフレンドリーなインターフェース

請求書作成を簡素化し、より早く支払いを受け取りたいと思いませんか?3,000万人以上がFreshBooksをご利用いただいています。詳しくはこちらをご覧ください!

価格: 無料トライアルがあります。有料プランは月額2.10ドルからです。

主な特徴:

- 時間追跡

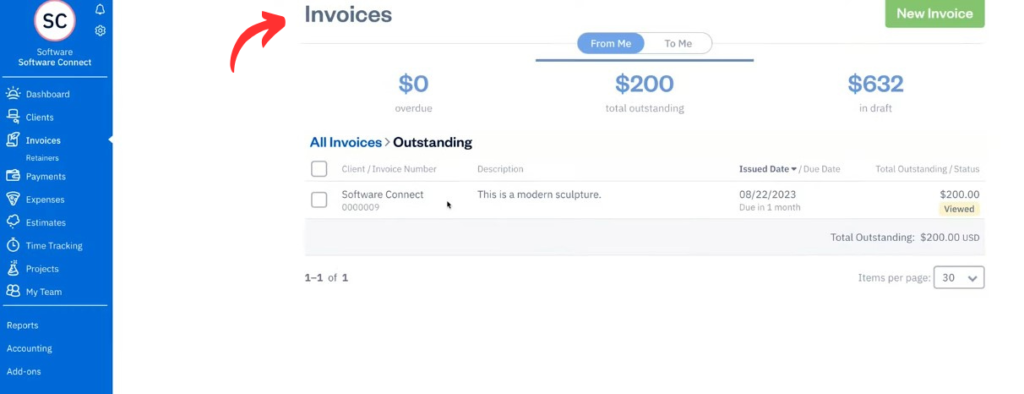

- 請求書発行

- 簿記

Easy Month End とは何ですか?

イージー・マンス・エンドについてお話しましょう。それは何ですか?

これは、毎月の 会計 シンプルに閉じる。

これを、しばしば恐れられるプロセスにおけるガイドとして考えてください。

また、私たちのお気に入りを探索してください 月末の簡単な代替案…

私たちの見解

Easy Month Endで財務精度を向上。自動照合と監査対応レポートを活用できます。月末処理プロセスを効率化するための個別デモをご予約ください。

主なメリット

- 自動調整ワークフロー

- タスク管理と追跡

- 差異分析

- 文書管理

- コラボレーションツール

価格

- スターター: 月額 24 ドル。

- 小さい: 月額45ドル。

- 会社: 月額89ドル。

- 企業: カスタム価格設定。

長所

短所

FreshBooksとは何ですか?

さて、FreshBooksについてお話しましょう。FreshBooksとは一体何でしょうか?

人気の 会計ソフトウェア多くのフリーランサーや 中小企業 それを使用してください。

請求書の発行、経費の追跡、プロジェクトの管理に役立ちます。

また、私たちのお気に入りを探索してください FreshBooksの代替品…

私たちの見解

複雑な会計処理にうんざりしていませんか?3,000万社以上の企業がFreshBooksを信頼し、プロフェッショナルな請求書を作成しています。 会計ソフトウェア 今日!

主なメリット

- プロフェッショナルな請求書作成

- 自動支払いリマインダー

- 時間追跡

- プロジェクト管理ツール

- 経費追跡

価格

- ライト: 月額2.10ドル。

- プラス: 月額3.80ドル。

- プレミアム: 月額6.50ドル。

- 選択: カスタム価格設定。

長所

短所

機能比較

ここでは、Easy Month End と FreshBooks を比較して詳しく見ていきます。

どのプラットフォームが適しているかを理解できるように、主要な機能について説明します。

選択を進める上での独自のビジネスニーズ 会計 ソフトウェア。

1. コア目的

- 楽な月末このツールの唯一の目的は、財務チームが月末処理をより効率的に行えるように支援することです。これは、財務チームの特定のタスクに特化したソリューションです。

- フレッシュブックス: これは、より広範な会計ソフトウェアソリューションプラットフォームです。 中小企業 オーナー向け。請求書の発行から経費の追跡、基本的なレポート作成まで、あらゆる業務を処理できます。

2. 請求と支払い

- 楽な月末: このツールには請求書発行機能はありません。

- フレッシュブックスFreshBooksはこの点で優れています。プロフェッショナルな請求書の作成、定期支払いの設定、クレジットカードやACH決済などの前払い決済の直接受付も可能です。これにより、支払いの受付が簡単になり、より迅速に支払いを受けることができます。

3. 月末処理と調整

- 楽な月末: これが最大の強みです。すべての照合を管理するための構造化されたワークフローを提供します。 監査 証拠を収集し、プロセスを合理化することで、月末処理がスムーズになり、エラーや遅延が減少します。

- フレッシュブックス: 基本的な銀行調整を処理しますが、正式な貸借対照表調整や監査人向けの文書提供専用のツールとして構築されていません。

4. チームコラボレーションとワークフロー

- 楽な月末: チーム管理向けに設計されています。財務チームのタスクを割り当て、承認状況を追跡し、チケットにコメントを残してタスクが正しく完了したかを確認できます。

- フレッシュブックスこのプラットフォームでは、複数のユーザーがプロジェクトで共同作業を行うことができます。ただし、ワークフロー機能はEasy Month Endほど詳細ではなく、決算プロセスに特化したものではありません。

5. 報告と会計

- 楽な月末: Reporting is limited to the closing process itself. It’s not a full 会計ソフトウェア.

- フレッシュブックス: 損益計算書などの標準的な会計レポートを提供します。上位プランでは、複式簿記に対応し、プロジェクトの収益性追跡に役立ちます。

6. 価格とプラン

- 楽な月末: チームの規模に応じて変化する 3 つの主要な料金プランがあります。

- フレッシュブックス: Lite プランと Plus プランを含む 4 つのプランがあり、課金対象のクライアント数と必要な機能に応じて拡張できます。 料金は通常月単位です。

7. 使いやすさとプラットフォーム

- 楽な月末このプラットフォームはシンプルですが、決算ワークフローを理解している会計専門家向けにカスタマイズされています。特定の目的に特化した単一のプラットフォームです。

- フレッシュブックス: FreshBooksのユーザーフレンドリーなダッシュボードで知られています。自営業者や会計士にとって最高の会計ソフトウェアの一つと考えられています。 中小企業 直感的なデザインのため、オーナーに好評です。

8. データと統合

- 楽な月末: 他の会計ソフトウェアと統合可能 クイックブックス Xero を使用して照合用のデータをインポートします。

- フレッシュブックス: 100以上のアプリと連携します。特に、プロジェクトや顧客管理に他のソフトウェアを使用しているサービスベースのビジネスにとって、財務管理の優れたハブとなります。

9. モバイル機能

- 楽な月末: これはWebベースのアプリケーションです。専用のモバイルアプリはありません。

- フレッシュブックス: iOSとAndroidの両方で高評価のFreshBooksモバイルアプリがあります デバイス簡単なインターネット接続で、外出先でもビジネスを管理できます。

会計ソフトウェアを選択する際に注意すべきことは何ですか?

- あなたのビジネスタイプ: あなたは フリーランサー、サービスベース、それとも製品ベースでしょうか? お客様の具体的なニーズに応じて最適なものが決まります。

- スケーラビリティ: ソフトウェアはビジネスの成長に合わせて拡張できますか?将来性を考慮してください ビジネスニーズ.

- 統合のニーズ: 他のツール(例:決済ゲートウェイ、 CRM)?

- モバイルアクセス: 外出先で財務を管理する必要がありますか?

- カスタマーサポート: 問題が発生した場合、どのようなサポートを受けることができますか?

- 報告 深さ: 簡単な概要、または詳細な財務分析が必要ですか?

- 安全: プラットフォームはあなたの機密情報をどのように保護しますか 財務データ?

- ユーザーインターフェース: あなたやチームメンバーにとって、簡単に習得して使用できますか?これは新しいユーザーにとって重要なポイントです。

最終評決

両方をテストした結果、FreshBooks をお勧めします。

Easy Month End は専用の月末処理に最適です。

FreshBooks は中小企業向けのより完全なソリューションです。

そのプラットフォームは、請求書の送信からプロジェクト管理まですべてを処理します。 時間追跡.

FreshBooks は、あなたのお金に対して、より多くの日々の価値を提供します。

プレミアム プランやその他の料金プランでは、定期的な請求書や FreshBooks 支払いなどのさまざまな機能が提供され、財務を簡素化し、財務チームに必要なツールを提供します。

ほとんどの中小企業経営者にとって、生活を簡素化し、手間をかけずに資金を管理することが賢明な選択です。

月末の楽な過ごし方

以下は、Easy Month End といくつかの主要な代替製品との簡単な比較です。

- 簡単な月末 vs パズル io: Puzzle.io はスタートアップの会計向けですが、Easy Month End は決算プロセスの合理化に特に重点を置いています。

- イージー・マンスエンド vs Dext: Dext は主に文書と領収書のキャプチャを目的としていますが、Easy Month End は包括的な月末処理管理ツールです。

- 月末の簡単操作 vs Xero: Xero は中小企業向けの完全な会計プラットフォームであり、Easy Month End は決算プロセス専用のソリューションを提供します。

- イージー・マンスエンド vs シンダー: Synder は、財務決算全体のワークフロー ツールである Easy Month End とは異なり、電子商取引データの統合に特化しています。

- イージー・マンスエンド vs Docyt: Docyt は簿記とデータ入力に AI を使用し、Easy Month End は財務決算の手順とタスクを自動化します。

- Easy Month End vs RefreshMe: RefreshMe は財務コーチング プラットフォームであり、綿密な管理に重点を置く Easy Month End とは異なります。

- イージー・マンスエンド vs Sage: Sage は大規模なビジネス管理スイートであり、Easy Month End は重要な会計機能向けのより専門的なソリューションを提供します。

- Easy Month End vs Zoho Books: Zoho Books はオールインワンの会計ソフトウェアですが、Easy Month End は月末処理専用のツールです。

- イージー・マンスエンド vs ウェーブ: Wave は中小企業向けに無料の会計サービスを提供しており、Easy Month End は綿密な管理のためのより高度なソリューションを提供しています。

- Easy Month End vs Quicken: Quicken は個人向け財務ツールであるため、月末処理を管理する必要のある企業にとって Easy Month End はより適した選択肢となります。

- イージー・マンスエンド vs Hubdoc: Hubdoc はドキュメントの収集を自動化しますが、Easy Month End は完全な決算ワークフローとチームタスクを管理するように設計されています。

- Easy Month End vs Expensify: Expensify は経費管理ソフトウェアであり、財務決算に重点を置いた Easy Month End とは異なる機能を備えています。

- Easy Month End と QuickBooks: QuickBooks は包括的な会計ソリューションですが、Easy Month End は月末処理そのものを管理するためのより具体的なツールです。

- 簡単な月末処理と自動入力: AutoEntry はデータキャプチャツールですが、Easy Month End は決算時のタスクとワークフロー管理のための完全なプラットフォームです。

- Easy Month End vs FreshBooks: FreshBooks はフリーランサーや中小企業向けであり、Easy Month End は月末処理専用のソリューションを提供します。

- 月末処理の簡単化 vs NetSuite: NetSuite はフル機能を備えた ERP システムであり、Easy Month End が財務決算に特化している範囲よりも広範囲にわたります。

FreshBooksの詳細

- FreshBooks vs Puzzle IOこのソフトウェアは、スタートアップ企業向けのAIを活用した財務プランニングに重点を置いています。また、個人向け財務プランニングにも活用されています。

- FreshBooks vs Dext: これは領収書や請求書を記録するためのビジネスツールです。もう一つのツールは個人的な経費を追跡するためのものです。

- FreshBooks vs Xero: これは中小企業向けの人気のオンライン会計ソフトウェアです。競合製品は個人向けです。

- FreshBooks vs Synderこのツールは、eコマースデータを会計ソフトウェアと同期します。代替ツールは個人財務に重点を置いています。

- FreshBooks vs Easy Month End: これは月末の業務を効率化するビジネスツールです。競合製品は個人の財務管理用です。

- FreshBooks vs DocytこれはAIをビジネスの簿記と自動化に活用しています。もう一つは、AIを個人の財務アシスタントとして活用しています。

- FreshBooks vs Sage: これは包括的なビジネス会計スイートです。競合製品は、より使いやすい個人財務ツールです。

- FreshBooksとZoho Booksの比較: これは中小企業向けのオンライン会計ツールです。競合製品は個人向けです。

- FreshBooks vs Wave: 中小企業向けの無料会計ソフトウェアを提供しています。個人向けに設計されたバージョンもあります。

- FreshBooksとQuickenの比較どちらも個人向け財務ツールですが、こちらの方がより詳細な投資追跡機能を備えています。一方、こちらはよりシンプルです。

- FreshBooks vs Hubdoc: 簿記用の文書キャプチャに特化しています。競合製品は個人向け財務ツールです。

- FreshBooks vs Expensifyこれはビジネス経費管理ツールです。もう1つは、個人の経費追跡と予算管理のためのツールです。

- FreshBooksとQuickBooksの比較: これは企業向けの有名な会計ソフトウェアです。代替ソフトは個人財務向けに作られています。

- FreshBooksとAutoEntryの比較: これは、ビジネス会計のデータ入力を自動化するために設計されています。代替として、個人向け財務ツールとしても利用できます。

- FreshBooksとNetSuiteの比較大企業向けの強力なビジネス管理スイートです。競合製品はシンプルな個人向け財務アプリです。

よくある質問

Easy Month End と FreshBooks の主な違いは何ですか?

Easy Month Endは、主に会計の月末締め処理と調整ワークフローの効率化に重点を置いています。対照的に、FreshBooksは、請求書発行、経費追跡、基本的な会計機能に優れた、より包括的なクラウドベースの会計ソリューションを提供しています。 簿記 フリーランサーや中小企業向け。

FreshBooks は Xero や QuickBooks の代わりになりますか?

FreshBooksは、請求書発行やプロジェクト管理を重視する企業にとって強力な代替手段となり得ます。しかし、より複雑な在庫管理、給与計算、あるいは高度な簿記業務のニーズには、XeroやQuickBooksといった専用ソリューションを好む企業もいるかもしれません。

Easy Month End は小規模企業やフリーランサーに適していますか?

Easy Month Endは、月末締め処理が体系化されている中小企業やチームにとってより効果的です。フリーランサーや、よりシンプルなニーズを持つ小規模企業の場合、財務管理全般においてFreshBooksの方がより包括的だと感じるかもしれません。

これらのプラットフォームは税金の準備に役立ちますか?

どちらのプラットフォームも、損益計算書など、税務申告に役立つレポートを提供しています。ただし、どちらも直接的な税務申告サービスは提供していません。通常、これらのプラットフォームの財務データは、税理士やソフトウェアに利用されます。

FreshBooks と Easy Month End の価格設定には隠れた料金がありますか?

どちらも料金プランを明確に定めています。FreshBooksはチームメンバーの追加ごとにユーザー数に応じて料金が請求され、オンライン決済には取引手数料がかかります。Easy Month Endはチームの規模と組織形態に応じて料金が変動するため、よくある質問については必ずプランの詳細をご確認ください。