Are you tired of spending too much time closing your books each month?

It can feel like a never-ending puzzle, right?

That’s why we’re diving into two popular tools: Synder vs Easy Month End.

Both promise to simplify your financial close, but which one truly delivers?

Let’s take a closer look and figure out which might be the better fit for you.

Overview

We looked closely at both Synder and Easy Month End.

We tried them out to see how well they work.

This helps us compare them fairly for you. Now, let’s see what each one is all about.

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Check it out today!

Pricing: It has a free trial. The premium plan starts at $52/month.

Key Features:

- Multi-Channel Sales Sync

- Automated Reconciliation

- Detailed Reporting

This Easy month-end, join 1,257 users who saved an average of 3.5 hours and reduced errors by 15%. Start your free trial!

Pricing: It has a free trial. The premium plan starts at $45/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

What is Synder?

Let’s talk about Synder.

It’s a tool that helps your different business apps talk to each other.

Think of it like a helper that moves your money info where it needs to go.

This can save you a lot of time.

Also, explore our favorite Synder Alternatives…

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

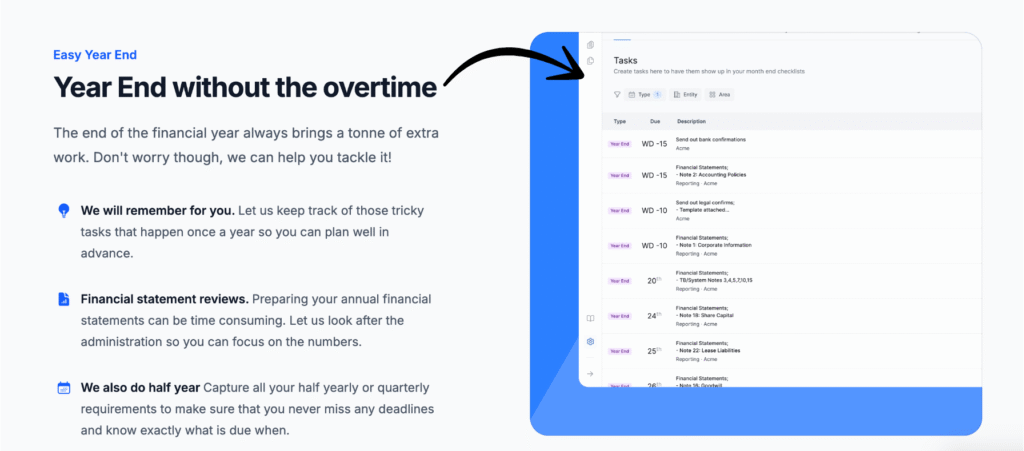

What is Easy Month End

So, Easy Month End is like a helper for when the month finishes.

It tries to make closing your books easier.

Think of it as a way to keep all your money stuff in one place at the end of the month.

It helps you see what money came in and what went out.

Also, explore our favorite Easy Month End Alternatives…

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

Feature Comparison

Let’s look at what each program does. We will compare them on nine key features.

This will help you see the truth about each one.

1. Connecting Your Sales Channels

- Synder is great for connecting all your sales channels.

- It can sync with platforms like Shopify, Stripe, PayPal, and Square.

- This lets you bring historical transactions and new sales data into one single platform.

- Easy Month End focuses more on workflow management.

- It connects to fewer sales platforms.

2. Reconciliation and Automation

- Synder offers automated accounting.

- It helps reconcile your data from multiple places.

- It makes reconciliation a breeze, reducing manual confirmations.

- This is often a one-click process.

- Easy Month End helps you handle month-end tasks.

- It helps you manage and review all your reconciliations.

3. Team Collaboration

- Easy Month End is built for finance teams.

- It has features like “leave comments,” “sign-offs,” and team management.

- This makes it so your team works together smoothly.

- It makes the month-end process more efficient.

- Synder also supports teamwork.

- Easy Month End’s core focus is on team collaboration and workflow management.

4. Data and Reporting

- Synder brings in details like fees, shipping, refunds, and discounts.

- It helps keep your books balanced.

- Easy Month End is great for creating balance sheets.

- It helps you collect audit evidence for auditors.

- This helps reduce stress at quarter-end and year-end.

- It is designed for faster balance sheet reconciliations.

5. Multi-Channel and High Volume

- Synder is a solid choice for multi-channel sales.

- It is built to handle high-volume transactions from many places.

- It also handles multi-currency sales.

- Easy Month End is more focused on the finance team workflow.

- It helps the finance team lead an easier life by streamlining tasks.

6. Accounting System Compatibility

- Synder works with major accounting programs.

- These include QuickBooks, QuickBooks Online, Xero, and Sage Intacct.

- This makes it easy to set up.

- Easy Month End is also compatible with many of these systems.

7. Fees and Pricing

- The total fees you pay will depend on your needs.

- For Synder, you might be charged based on how many transactions you have.

- Easy Month End also has different tiers for its subscriptions.

8. Handling Errors and Security

- Synder helps you resolve errors and mistakes automatically.

- It has a sync mode feature that can catch issues.

- Both programs ensure security.

- This helps you stay confident that your financial data is safe.

- They aim for GAAP compliance.

9. Setup and Ease of Use

- The initial setup for Synder is simple.

- You can connect platforms like Etsy and Clover.

- Easy Month End promises an easier life with a fast setup.

- It helps you get started on your first month-end without hassle.

- It makes the month-end process smooth.

What to look for when choosing an Accounting Software?

Here is what you should check to ensure you get the right tool:

- Does it improve efficiency and make your finance team’s tasks easier? A more efficient finance team deserves tools that automate and reduce manual work.

- Check its ability to handle ecommerce sales. This includes platforms like eBay and getting payouts right.

- See if it can sync data from all your sales channels and payment systems.

- Look for strong revenue recognition features if you have subscriptions. This is important for GAAP compliance.

- Does the system manage inventory and customers well, giving you clear insights?

- Check the system’s focus on the month-end close process. Does it promise a smoother month-end close?

- Look for features that simplify finance team tasks, like team collaboration and easy assignment of tasks.

- Does it offer an Outlook add-in or a similar way for quick access to tasks?

- Can you easily upload and import data, like contracts and other files, to the platform?

- See if you can answer questions and leave comments right in the system. This helps with audit evidence.

- Does the tool handle bank transfer details correctly?

- Check the flexibility for ad hoc tasks and review of accounts.

- Can you handle multiple business entities and easily cancel subscriptions if needed?

- Look for how well it works with QuickBooks, Xero, NetSuite, or Sage Intacct.

- Can the preparer complete the work and send it for review without delays?

- It should offer a simple way to switch or drop old methods, like working in Excel.

- Look for features that make the bookkeeping background easy to understand.

- Does the software offer an expanded view of your data for better decision-making?

- Check if it provides a unique ID or tracking number for transactions.

- Is the company (like one based in San Francisco) well-known and reliable?

- You should feel glad that users are submitting information quickly, which the system should have highlighted as completed.

Final Verdict

So, we looked at both Synder and Easy Month End.

If you deal with lots of online sales and want to track every transaction and get your books in order easily.

Synder is a really good choice.

It helps connect different programs and can even help with tax info.

Easy Month End is helpful for keeping your month-end tasks organized.

We’ve tried these out, so we know what we’re talking about.

If you want to make your financial life simpler, give Synder a try!

More of Synder

- Synder vs Puzzle io: Puzzle.io is an AI-powered accounting tool built for startups, with a focus on metrics like burn rate and runway. Synder is more focused on syncing multi-channel sales data for a broader range of businesses.

- Synder vs Dext: Dext is an automation tool that excels at capturing and managing data from bills and receipts. Synder, on the other hand, specializes in automating the flow of sales transactions.

- Synder vs Xero: Xero is a full-featured cloud accounting platform. Synder works with Xero to automate data entry from sales channels, whereas Xero handles all-in-one accounting tasks like invoicing and reporting.

- Synder vs Easy Month End: Easy Month End is a tool designed to help businesses organize and streamline their month-end closing process. Synder is more about automating daily transaction data flow.

- Synder vs Docyt: Docyt uses AI for a wide range of bookkeeping, including bill pay and expense management. Synder is more focused on automatically syncing sales and payment data from multiple channels.

- Synder vs RefreshMe: RefreshMe is a personal finance and task management application. This is not a direct competitor, as Synder is a business accounting automation tool.

- Synder vs Sage: Sage is a long-standing, comprehensive accounting system with advanced features like inventory management. Synder is a specialized tool that automates data entry into accounting systems like Sage.

- Synder vs Zoho Books: Zoho Books is a complete accounting solution. Synder complements Zoho Books by automating the process of importing sales data from various ecommerce platforms.

- Synder vs Wave: Wave is a free, user-friendly accounting software, often used by freelancers and very small businesses. Synder is a paid automation tool designed for businesses with high-volume, multi-channel sales.

- Synder vs Quicken: Quicken is primarily personal finance management software, though it has some small business features. Synder is built specifically for business accounting automation.

- Synder vs Hubdoc: Hubdoc is a document management and data capture tool, similar to Dext. It focuses on digitizing bills and receipts. Synder focuses on syncing online sales and payment data.

- Synder vs Expensify: Expensify is a tool for managing expense reports and receipts. Synder is for automating sales transaction data.

- Synder vs QuickBooks: QuickBooks is a comprehensive accounting software. Synder integrates with QuickBooks to automate the process of bringing in detailed sales data, making it a valuable add-on rather than a direct alternative.

- Synder vs AutoEntry: AutoEntry is a data entry automation tool that captures information from invoices, bills, and receipts. Synder focuses on automating sales and payment data from ecommerce platforms.

- Synder vs FreshBooks: FreshBooks is an accounting software designed for freelancers and small service-based businesses, with a focus on invoicing. Synder is for businesses with a high volume of sales from multiple online channels.

- Synder vs NetSuite: NetSuite is a comprehensive Enterprise Resource Planning (ERP) system. Synder is a specialized tool that syncs ecommerce data into broader platforms like NetSuite.

More of Easy Month End

Here is a brief comparison of Easy Month End with some of the leading alternatives.

- Easy Month End vs Puzzle io: While Puzzle.io is for startup accounting, Easy Month End focuses specifically on streamlining the close process.

- Easy Month End vs Dext: Dext is primarily for document and receipt capture, whereas Easy Month End is a comprehensive month-end close management tool.

- Easy Month End vs Xero: Xero is a full accounting platform for small businesses, while Easy Month End provides a dedicated solution for the close process.

- Easy Month End vs Synder: Synder specializes in integrating e-commerce data, unlike Easy Month End which is a workflow tool for the entire financial close.

- Easy Month End vs Docyt: Docyt uses AI for bookkeeping and data entry, while Easy Month End automates the steps and tasks of the financial close.

- Easy Month End vs RefreshMe: RefreshMe is a financial coaching platform, which is different from Easy Month End’s focus on close management.

- Easy Month End vs Sage: Sage is a large-scale business management suite, while Easy Month End offers a more specialized solution for a critical accounting function.

- Easy Month End vs Zoho Books: Zoho Books is an all-in-one accounting software, whereas Easy Month End is a purpose-built tool for the month-end process.

- Easy Month End vs Wave: Wave provides free accounting services for small businesses, while Easy Month End offers a more advanced solution for close management.

- Easy Month End vs Quicken: Quicken is a personal finance tool, making Easy Month End a better choice for businesses needing to manage a month-end close.

- Easy Month End vs Hubdoc: Hubdoc automates document collection, but Easy Month End is designed to manage the full close workflow and team tasks.

- Easy Month End vs Expensify: Expensify is an expense management software, which is a different function than Easy Month End’s core focus on the financial close.

- Easy Month End vs QuickBooks: QuickBooks is a comprehensive accounting solution, while Easy Month End is a more specific tool for managing the month-end close itself.

- Easy Month End vs AutoEntry: AutoEntry is a data capture tool, whereas Easy Month End is a complete platform for task and workflow management during the close.

- Easy Month End vs FreshBooks: FreshBooks is for freelancers and small businesses, while Easy Month End offers a dedicated solution for the month-end close.

- Easy Month End vs NetSuite: NetSuite is a full-featured ERP system, which is broader in scope than Easy Month End’s specialized focus on the financial close.

Frequently Asked Questions

What does Synder do?

Synder connects to your sales and payment apps. It puts all your money info into one place in your accounting system. This helps you keep track of your income and expenses easily.

Is Easy Month End hard to use?

No, Easy Month End is made to be simple. It uses checklists to show you what you need to do at the end of each month. This helps you close your books without missing steps.

Can Synder help with taxes?

Yes, Synder can help. It makes sure your sales data is correct. This can make it easier when it’s time to do your taxes because your records are more accurate.

Who should use Synder?

If you sell things online and use different apps for payments, Synder can save you a lot of time. It’s also good for accountants who work with many clients.

Which program is better for a small business owner?

Both programs can help. Synder is great for managing daily sales and money. Easy Month End is good for organizing the month-end closing. It depends on what part of your business you need the most help with right now.