Month-end closing a nightmare?

All that financial data, deadlines looming, and your time vanishing?

It’s a huge drain for small businesses, pulling you from growth.

Imagine an easy month-end. Fast, clear insights, zero stress.

This article reveals the 9 Best Easy Month End Alternatives for 2025.

Discover tools and strategies to cut errors, save time, and get a true financial picture.

Ready to ditch the dread? Let’s go.

What Are the Best Easy Month End Alternatives?

Tired of month-end hassles? We’ve done the hard work for you.

Our expert review narrows down the top choices.

Get ready to find the perfect solution to simplify your financial closing.

Here are our top 9 recommendations to make your month-end a breeze.

1. Xero (⭐4.8)

Xero is an online accounting software. It’s great for small businesses.

You can manage your finances from anywhere. It helps with invoicing, payroll, and more.

It connects directly to your bank, making reconciliation super easy.

Many businesses globally use it for its simplicity.

Unlock its potential with our Xero tutorial.

Also, explore our Easy Month End vs Xero comparison!

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

2. Puzzle IO (⭐4.5)

Puzzle is a new kind of accounting software.

It’s built for startups. It uses AI to automate bookkeeping.

You can see your finances clearly.

Puzzle helps you keep track of all your money, from payments to cash flow.

It aims to make accounting simple and clear, even if you’re not an expert.

Unlock its potential with our Puzzle IO tutorial.

Also, explore our Easy Month End vs Puzzle comparison!

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

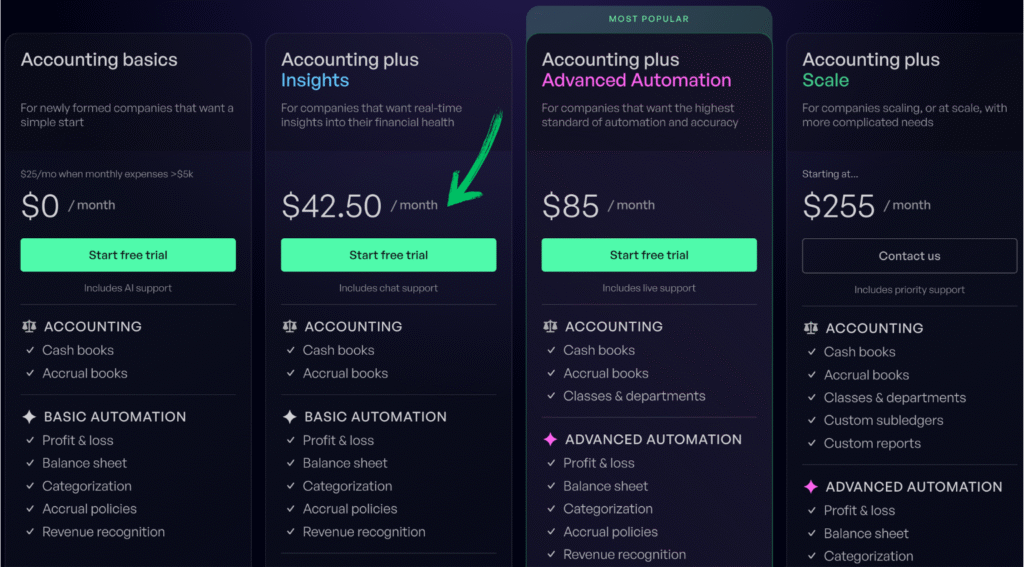

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

3. Dext (⭐4.0)

Dext (formerly Receipt Bank) focuses on data extraction.

It automates receipt and invoice processing. You snap a picture.

Dext then grabs all the important info. This saves you tons of time on manual data entry.

It’s great for small businesses and accountants who deal with lots of paperwork.

Unlock its potential with our Dext tutorial.

Also, explore our Easy Month End vs Dext comparison!

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

4. Synder (⭐3.8)

Synder (formerly CloudBusiness) helps connect your sales platforms.

It links e-commerce, POS, and payment systems, then it syncs this data to your accounting software.

Synder makes sure all your sales, fees, and payments sync up perfectly.

This means no more manual data entry for your online transactions.

Unlock its potential with our Synder tutorial.

Also, explore our Easy Month End vs Synder comparison!

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

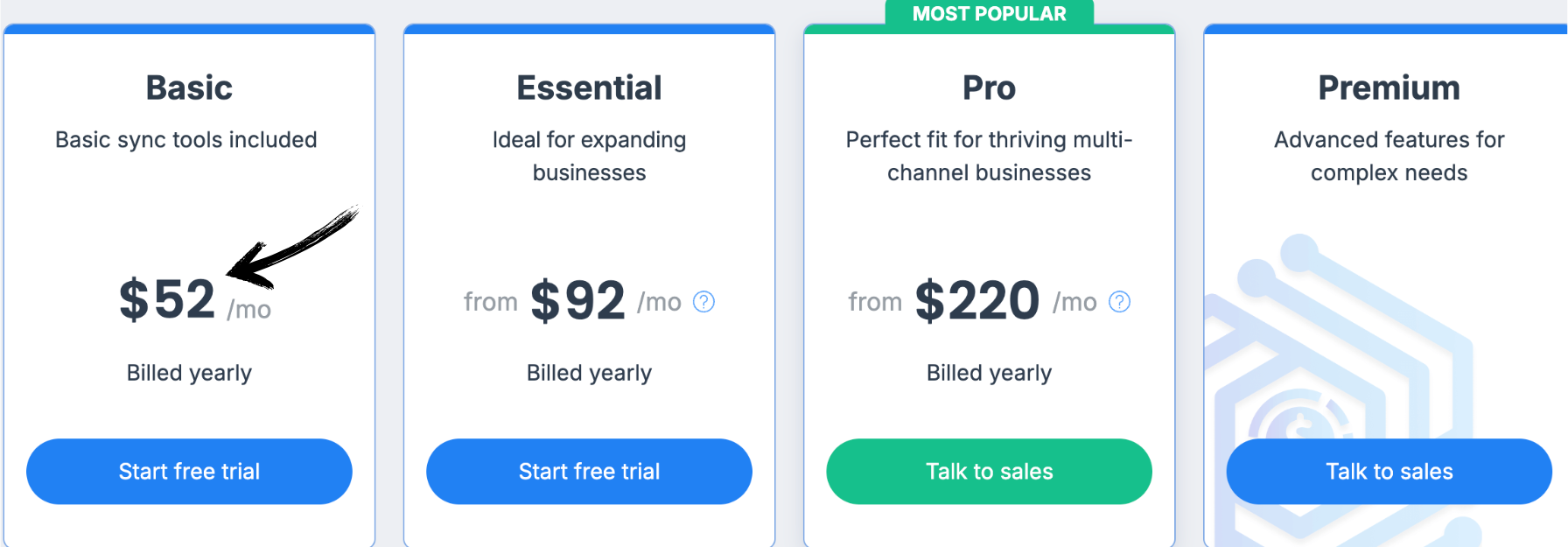

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

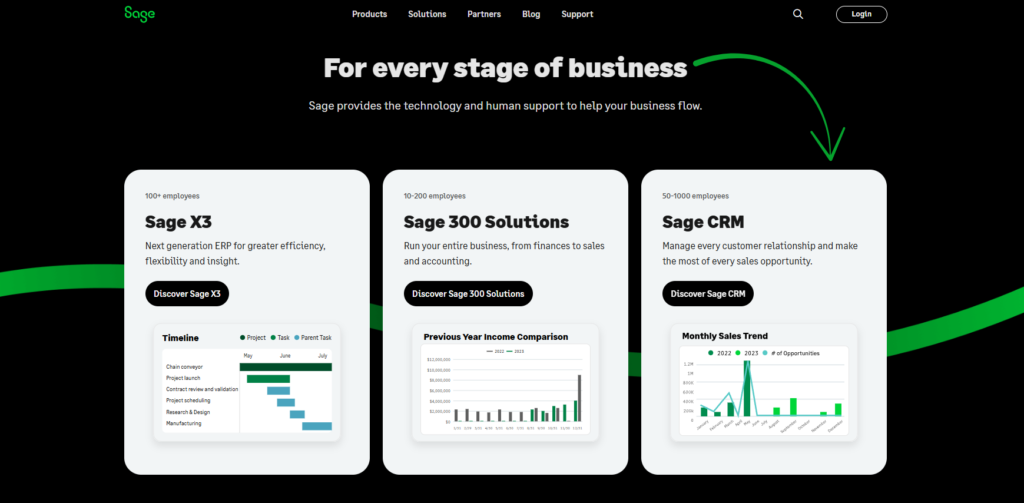

5. Sage (⭐3.6)

Sage offers a range of accounting products.

They cater to different business sizes.

From small startups to large enterprises. It helps manage finances, payroll, and operations.

It’s a well-established name in accounting.

Unlock its potential with our Sage tutorial.

Also, explore our Easy Month End vs Sage comparison!

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

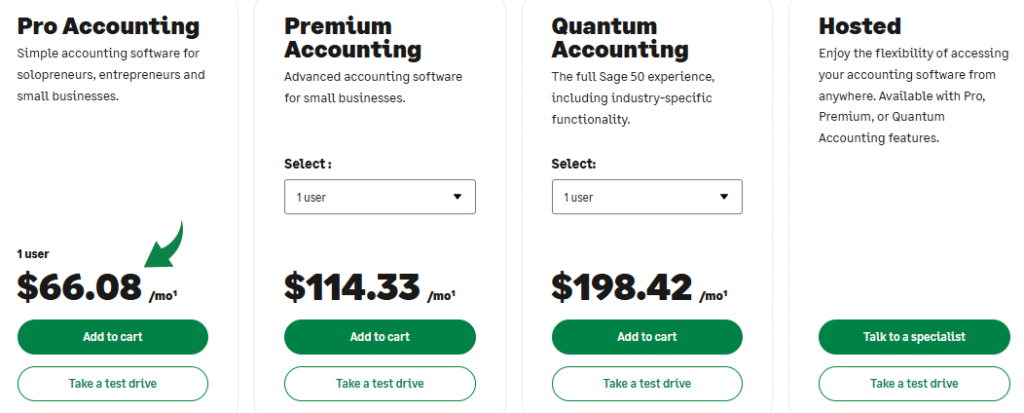

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

6. RefreshMe (⭐3.4)

RefreshMe helps you keep your books clean.

It works to spot and fix mistakes in your financial tasks.

This tool can save you from a lot of headaches and make sure your data is accurate.

It’s a handy addition to your accounting routine.

Unlock its potential with our Refreshme tutorial.

Also, explore our Easy Month End vs Refreshme comparison!

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

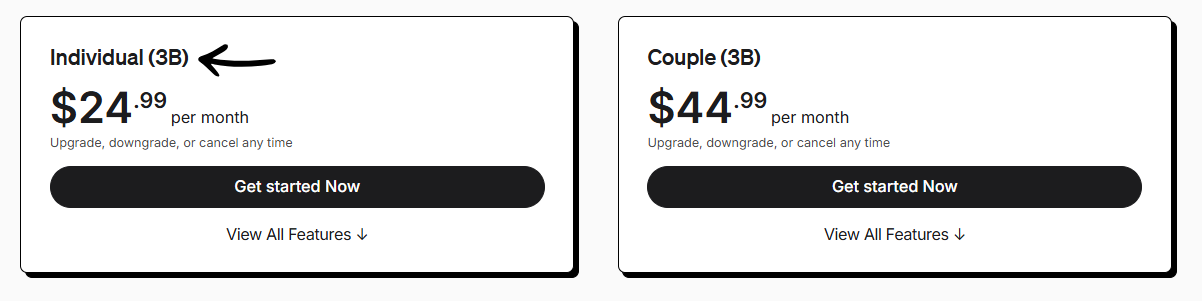

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

7. FreshBooks (⭐3.2)

FreshBooks is designed for service-based businesses.

If you’re a freelancer, a self-employed professional, or run a small service-based business.

FreshBooks might be your new best friend.

It’s known for its excellent invoicing features and simplicity.

It makes getting paid easy and keeps your books tidy.

Unlock its potential with our FreshBooks tutorial.

Also, explore our Easy Month End vs FreshBooks comparison!

Our Take

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

Key Benefits

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

Pricing

- Lite: $2.10/month.

- Plus: $3.80/month.

- Premium: $6.50/month.

- Select: Custom Pricing.

Pros

Cons

8. Docyt (⭐3.0)

Docyt is an AI-powered accounting automation platform.

It automates bookkeeping and expenses. You can capture documents easily.

It uses smart technology to gather and process your financial documents.

Docyt helps you get real-time insights into your business money.

Unlock its potential with our Docyt tutorial.

Also, explore our Easy Month End vs Docyt comparison!

Key Benefits

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

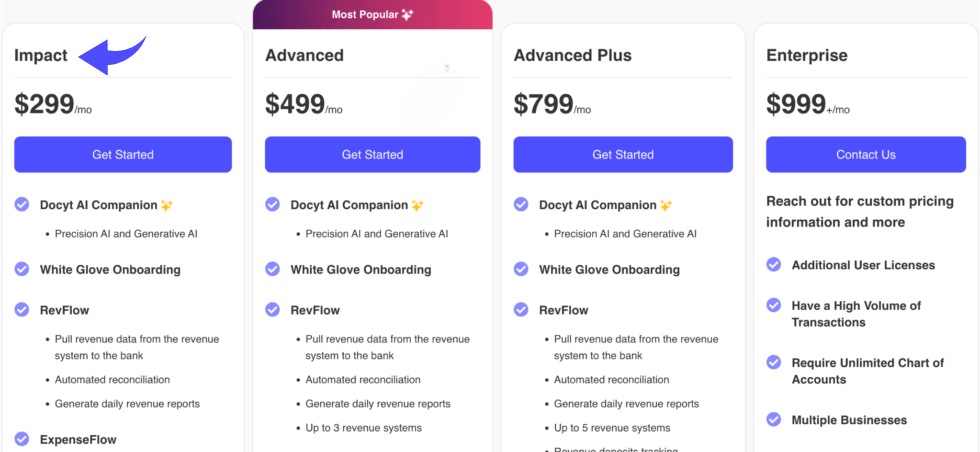

Pricing

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Pros

Cons

9. QuickBooks (⭐2.8)

QuickBooks is a popular choice for the small businesses.

It helps you manage your money easily. You can track income and expenses.

Many small and medium-sized businesses use it because it’s so versatile.

It helps you track income, expenses, and even manage payroll.

Unlock its potential with our QuickBooks tutorial.

Also, explore our Easy Month End vs QuickBooks comparison!

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

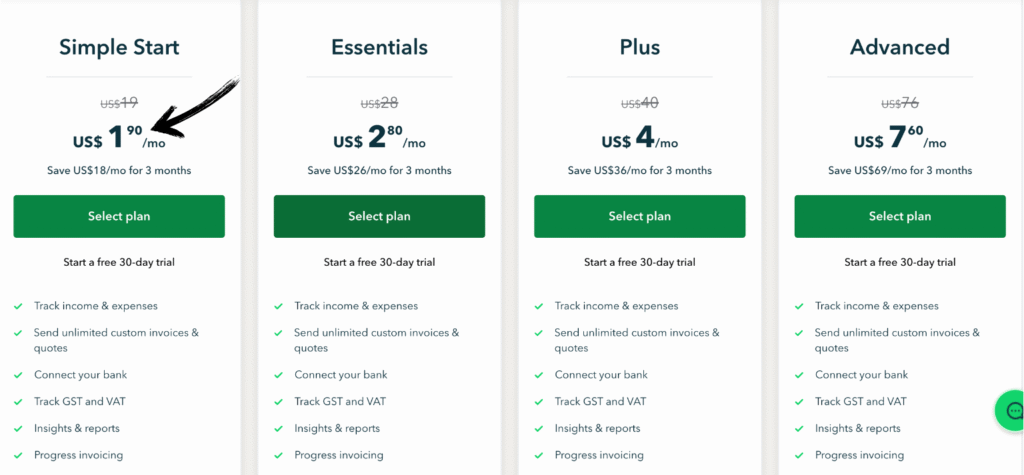

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

Buyers Guide

Our team used Easy Month End to make our month end close process much simpler and faster.

We needed the right software to get a clear picture of our business’s financial health.

With just a few clicks, we could generate accurate financial statements, including cash flow statements and balance sheets.

The tool’s user friendly interface and analytics features gave our finance teams the control they needed.

Users report that the tool is a best fit for getting things done quickly and accurately.

We could even manage recurring invoices and handle expense tracking with ease, making our work more efficient.

- Faster Financial Reporting: We used the software to generate financial reports quickly, which helped with compliance and record-keeping. The reporting and analytics tools gave us deep insights into our spending.

- Easy to Use: The user friendly interface and mobile apps made it easy for everyone on our team to use. This helped boost our productivity and organization.

- Comprehensive Features: The right software offered essential project management and customizable invoicing capabilities. We could also easily integrate it with QuickBooks Online, making our workflows smoother.

- Affordable and Secure: The monthly subscription was very affordable, and the security features ensured our data was safe. The customer support was also excellent.

- Efficient and Effective: The tool’s features made us more efficient. We reate a clear record of our transactions. The Easy Month End offer was a great choice for our companies and their needs.

Wrapping Up

We’ve covered how powerful the right management software can be for your team.

The Easy Month End offer is a great way to simplify the month end close process.

You can handle even complex tasks with ease.

Additionally, this tool offers simple plans that fit any business.

You can use their mobile apps to get work done anywhere.

The software also works well with QuickBooks Online.

If you’re not sure, you can even check out the free trial to see if it’s the right fit for you.

It makes the month end close so much simpler and faster.

Frequently Asked Questions

Is there a completely free accounting software?

Absolutely. Wave Accounting is the gold standard for 100% free core features like invoicing and ledger management. No monthly subscriptions. It’s built specifically for freelancers and small teams who hate hidden fees.

Are free budget apps actually safe?

Generally, yes. Apps like Fudget are safer because they don’t link to your bank. They use local storage or encrypted cloud backups. Just ensure the app utilizes 256-bit SSL encryption before entering any sensitive data.

Is there a Canadian alternative to QuickBooks?

Wave and FreshBooks are both proud Canadian companies. Wave offers a better free tier for general accounting. FreshBooks, based in Toronto, is superior for service-based businesses needing precise time tracking and professional invoicing.

What is the free budgeting app that doesn’t link to bank account?

Fudget is the ultimate “no-link” app. It functions like a digital ledger. You manually enter income and expenses. It’s fast, private, and perfect for those who don’t want an app “watching” their bank transactions.

Are there any alternatives to Midjourney?

Google’s Imagen 3 is currently a top-tier rival. For open-source fans, Flux and Stable Diffusion offer incredible photorealism. Leonardo.Ai provides a more user-friendly interface if you want to avoid Discord entirely.

How to speed up month end close?

Stop waiting for the 31st. Implement a “continuous close” by reconciling bank accounts and recording accruals weekly. Automating your AP/AR through software can shrink a 10-day close down to just three.

Which free software is best for accounting?

Wave wins for ease of use and price. However, if you prefer open-source control, Akaunting is a powerful self-hosted alternative. Zoho Books also offers a robust free tier for businesses earning under $50k USD.

More Facts about Easy Month-End Alternatives

- BlackLine is a top choice for large companies because it follows strict rules and automates math tasks.

- FloQast is great for medium-sized teams because it uses simple checklists and is easy to get started with.

- FreshBooks is an easy tool made for small business owners and people who work for themselves.

- Buxfer helps people and businesses keep track of their money so they can spend it more wisely.

- Agicap helps businesses see how much cash they have and plan for the future.

- Sibill is a tool that makes it easier for businesses to handle their budgets and spending.

- Xente helps companies control what they buy and see exactly where their money is going.

- FloQast uses the internet to help accounting teams collaborate and complete their end-of-month work faster.

- Datarails uses smart computers (AI) to make Excel better at organizing data and making reports.

- LiveFlow connects QuickBooks to spreadsheets, automatically updating reports.

- Docyt uses AI to organize receipts and do the bookkeeping for you.

- Xero lets small business owners handle their bills and pay their workers from anywhere online.

- QuickBooks is a popular app that helps small businesses easily track their finances.

- Zoho Books is an online tool that helps small businesses send bills and track their spending.

- Dext saves time by automatically reading information from receipts and invoices.

- Puzzle IO is designed for new companies (startups) and uses AI to handle their accounting.

- Focusing on the most important and complicated accounts first makes the work more accurate.

- Using a shared checklist and doing a “practice close” in the middle of the month helps teams stay organized.

- Meeting before the month ends helps ensure all bills are ready to be paid.

- Switching from old-fashioned spreadsheets to special software makes it easier to see who is doing what.

- Letting computers handle easy tasks while people check the risky ones saves a lot of time.

- Doing a “soft close” means processing some money tasks early so there is less work at the end of the month.

- Automation software can finish work in a few hours that used to take many days.

- Using software instead of typing things in by hand helps prevent mistakes.

- Continuous accounting means checking your money daily or weekly, rather than waiting until the end of the month.

- Getting data ready early and using automatic bank updates can save one or two days of work.

- Using internet-based tools for bank tasks and expenses helps stop errors.

- Using the same templates for all reports speeds up the work.

- Giving every person a specific job and a deadline on a checklist keeps everything on track.

- Good money management should focus on using checklists and robots to do the boring, manual work.

- ChatFin can match up almost all your transactions (95%) without a human needing to help.

- Doing regular tasks a few days before the month ends helps everything run smoothly.

- Smart AI tools can find weird mistakes and do math entries by themselves.

- New AI tools can analyze changes in money and explain exactly why they occurred.

- Checking your bank and credit card statements every day keeps your records up to date and accurate.

- Using a digital list to match transactions every week helps you see the truth about your money.

- Most new accounting tools work perfectly with famous apps like QuickBooks or Xero.

- These tools help businesses save time, fix mistakes, and understand their money faster.

- Apps like Workiva and FloQast help accounting teams work better together.

- Software that does tasks automatically makes finance teams faster and more helpful.

- Most new tools are built to take the hard work out of the process and make the numbers more accurate.

- Numeric and Leapfin are tools that quickly match numbers and generate fast reports.

- Knowing exactly how much money you have right now helps leaders make better choices.

- It is very important that the software is easy for people to learn and use.

- The software should be able to “talk” to the other programs a business already uses.

- Many programs let you change settings to fit exactly what your business needs.

- A free trial lets a business test the software to see if they like it before buying it.

- Good reports are important because they show how well a business is doing.

- Being able to talk and share tasks inside the software helps the whole team work as one.