الشعور بأنك عالق في وضعك الحالي برنامج محاسبة?

Zoho Books قد يبدو الأمر رائعًا، ولكن ربما يكون عملك قد نما، وهو لا يواكب هذا النمو.

أمر محبط، أليس كذلك؟ أنت بحاجة إلى أدوات تعمل معك، لا ضدك.

هذه ليست مجرد قائمة؛ إنها طريقك نحو مستقبل مالي أفضل.

سنستكشف أفضل 9 بدائل لبرنامج Zoho Books لعام 2025.

اكتشف البرامج التي تناسب احتياجاتك حقًا عمليوفر لك الوقت، ويمنحك مزيدًا من التحكم.

هل أنت مستعد للعثور على شريكك المثالي؟ محاسبة شريك؟

ما هي أفضل البدائل لبرنامج Zoho Books؟

إيجاد الشخص المناسب محاسبة قد يكون التعامل مع البرمجيات صعباً.

You want something that fits your عمل, makes money management easy, and saves headaches.

لقد قمنا بالعمل اللازم للمساعدة.

إليكم أفضل البدائل لبرنامج Zoho Books.

1. زيرو (⭐4.8)

يُعدّ برنامج Xero لاعباً رئيسياً آخر في عالم المحاسبة، ويحظى بشعبية خاصة لدى الشركات الصغيرة والشركات الناشئة.

تشتهر بسهولة استخدامها الفائقة وتصميمها النظيف.

إذا وجدت برامج أخرى معقدة وغير سلسة، فقد يكون برنامج Xero بمثابة نسمة هواء منعشة.

تم تصميمه للتعاون، مما يسهل العمل مع محاسبك.

أطلق العنان لإمكانياته مع برنامجنا شرح برنامج Xero.

استكشف أيضًا مجموعتنا Zoho Books مقابل Xero مقارنة!

رأينا

انضم إلى أكثر من مليوني شركة باستخدام Xero برنامج محاسبة. اكتشف ميزاته القوية في إصدار الفواتير الآن!

الفوائد الرئيسية

- التسوية المصرفية الآلية

- الفواتير والمدفوعات عبر الإنترنت

- إدارة الفواتير

- تكامل نظام الرواتب

- إعداد التقارير والتحليلات

التسعير

- بداية: 29 دولارًا شهريًا.

- معيار: 46 دولارًا شهريًا.

- غالي: 69 دولارًا شهريًا.

الإيجابيات

السلبيات

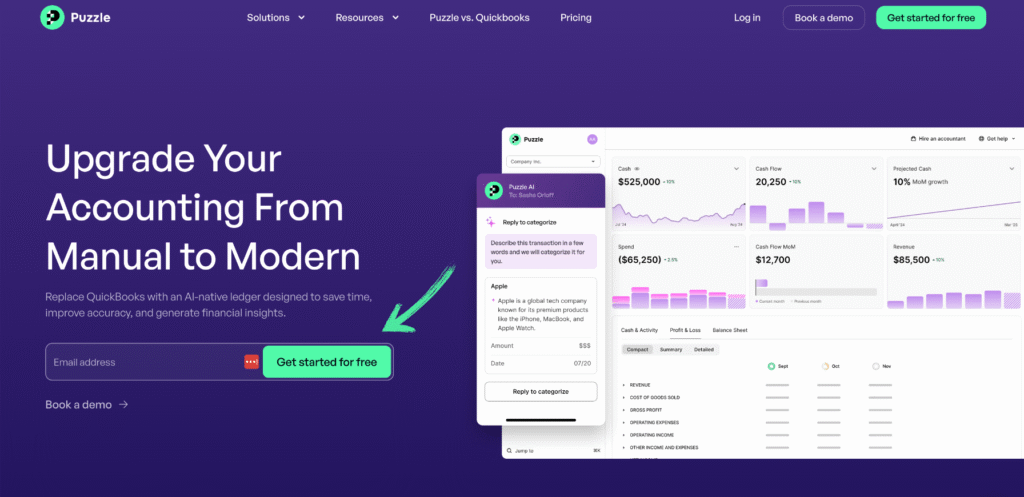

2. لعبة الألغاز IO (⭐4.5)

تم تصميم هذه الأداة خصيصاً للشركات الناشئة ومؤسسيها.

ليس الأمر كالمعتاد محاسبة برمجة.

بدلاً من ذلك، فإنه يمنحك صورة واضحة للغاية وفورية لأموالك، دون كل المصطلحات المعقدة.

اعتبرها بمثابة لوحة تحكم مالية، تُظهر لك بالضبط ما يحدث لأموالك.

أطلق العنان لإمكانياته مع برنامجنا شرح لعبة Puzzle IO.

استكشف أيضًا مجموعتنا Zoho Books مقابل Puzzle IO مقارنة!

رأينا

هل أنت مستعد لتبسيط أمورك المالية؟ اكتشف كيف يمكن لـ Puzzle.io أن يوفر لك ما يصل إلى 20 ساعة شهريًا. جرّب الفرق اليوم!

الفوائد الرئيسية

يتألق برنامج Puzzle IO حقًا عندما يتعلق الأمر بمساعدتك على فهم إلى أين تتجه أعمالك.

- 92% من أفاد المستخدمون بتحسن دقة التنبؤات المالية.

- احصل على معلومات فورية حول تدفقاتك النقدية.

- يمكنك بسهولة إنشاء سيناريوهات مالية مختلفة للتخطيط.

- تعاون بسلاسة مع فريقك لتحقيق الأهداف المالية.

- تتبع مؤشرات الأداء الرئيسية (KPIs) في مكان واحد.

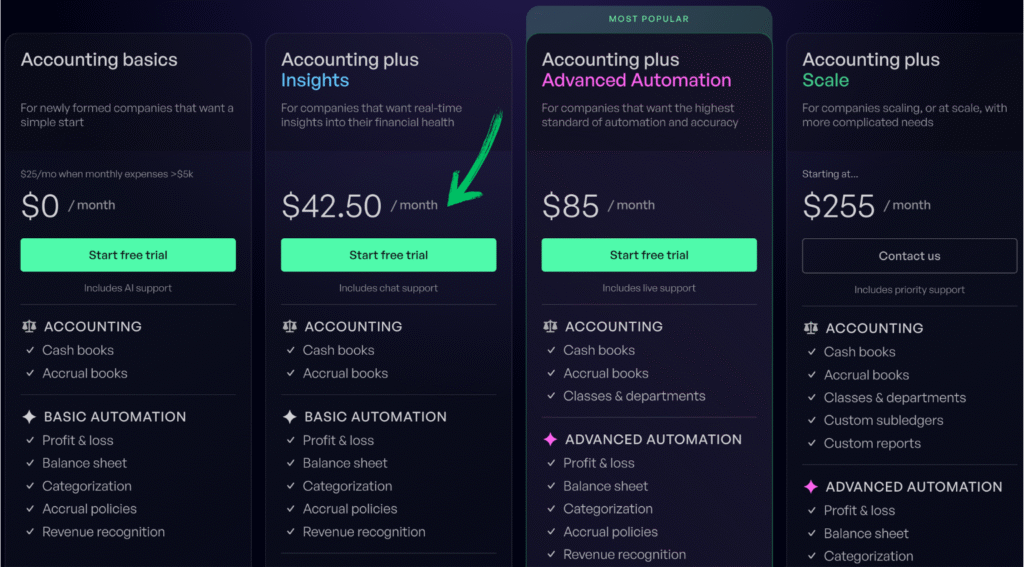

التسعير

- أساسيات المحاسبة: 0 دولار شهرياً.

- رؤى محاسبية إضافية: 42.50 دولارًا شهريًا.

- المحاسبة بالإضافة إلى الأتمتة المتقدمة: 85 دولارًا شهريًا.

- مقياس المحاسبة بلس: 255 دولارًا شهريًا.

الإيجابيات

السلبيات

3. دكت (⭐4.0)

هذه الأداة ليست كاملة محاسبة النظام بحد ذاته.

اعتبره بمثابة مساعد فائق لما هو موجود لديك محاسبة برامج مثل QuickBooks أو Xero.

تتمثل وظيفتها الرئيسية في استخراج المعلومات من إيصالاتك وفواتيرك تلقائيًا.

هذا يعني كتابة أقل بالنسبة لك، وهو مكسب كبير!

أطلق العنان لإمكانياته مع برنامجنا برنامج تعليمي لـ Dext.

استكشف أيضًا مجموعتنا Zoho Books مقابل Dext مقارنة!

رأينا

هل أنت مستعد لاستعادة أكثر من 10 ساعات شهريًا؟ تعرف على كيف يمكن لبرنامج Dext®، الذي يقوم بإدخال البيانات وتتبع النفقات وإعداد التقارير تلقائيًا، أن يبسط أمورك المالية.

الفوائد الرئيسية

يتألق تطبيق Dext حقًا عندما يتعلق الأمر بجعل إدارة النفقات أمرًا في غاية السهولة.

- أفاد 90% من المستخدمين بانخفاض ملحوظ في فوضى الأوراق.

- يتميز بمعدل دقة يزيد عن 98% في استخراج البيانات من المستندات.

- أصبح إعداد تقارير المصروفات سريعًا وسهلاً للغاية.

- يتكامل بسلاسة مع منصات المحاسبة الشائعة، مثل QuickBooks و Xero.

- يساعد على ضمان عدم فقدان أي مستندات مالية مهمة.

التسعير

- الاشتراك السنوي: $24

الإيجابيات

السلبيات

4. سنيدر (⭐3.8)

سنيدر ليس كاملاً محاسبة برنامج؛ إنه مساعد ذكي للشركات عبر الإنترنت.

يقوم النظام تلقائيًا بسحب معلومات مبيعاتك ومدفوعاتك من منصات مثل Shopify أو Stripe مباشرةً إلى حسابك محاسبة برمجة.

هذا يوفر عليك الكثير من العمل اليدوي، خاصة فيما يتعلق بمطابقة المعاملات.

أطلق العنان لإمكانياته مع برنامجنا Synder tutorial.

استكشف أيضًا مجموعتنا Zoho Books مقابل Synder مقارنة!

رأينا

يقوم برنامج Synder بأتمتة عمليات المحاسبة الخاصة بك، ومزامنة بيانات المبيعات بسلاسة مع برنامج QuickBooks. زيرووغير ذلك الكثير. تشير الشركات التي تستخدم تطبيق Synder إلى أنها توفر ما يزيد عن 10 ساعات أسبوعياً في المتوسط.

الفوائد الرئيسية

- مزامنة بيانات المبيعات التلقائية

- تتبع المبيعات متعددة القنوات

- تسوية المدفوعات

- تكامل إدارة المخزون

- تقارير مبيعات مفصلة

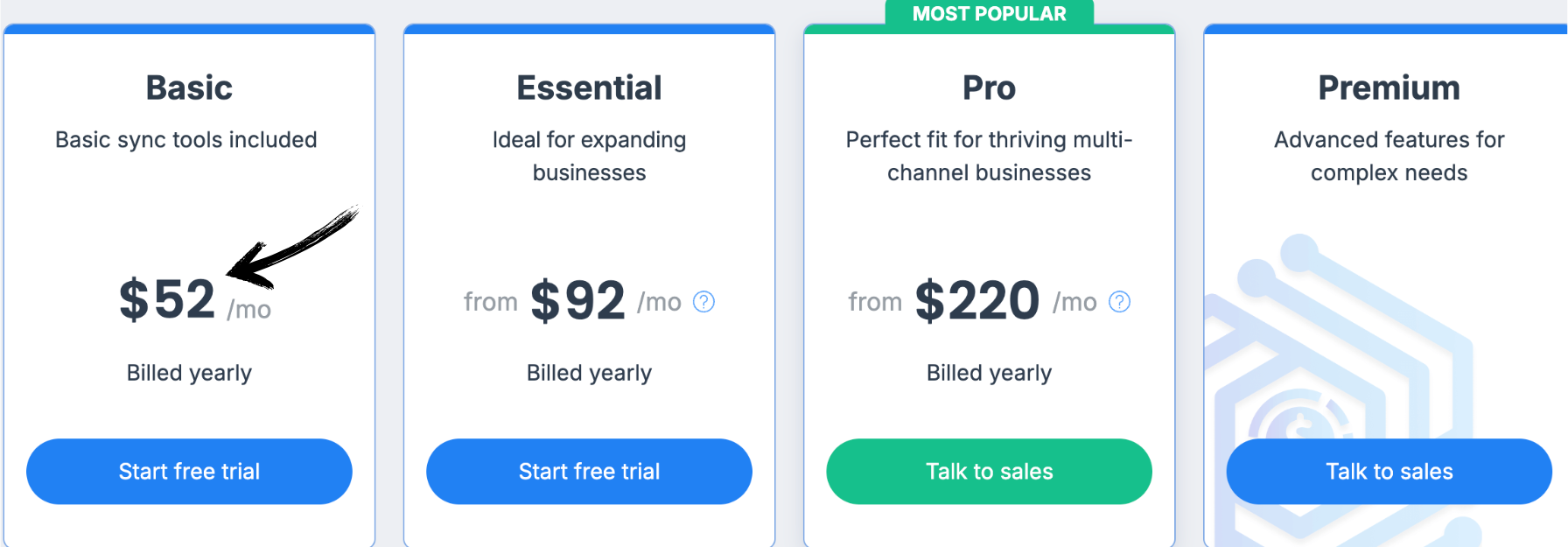

التسعير

ستكون جميع الخطط يتم إصدار الفاتورة سنوياً.

- أساسي: 52 دولارًا شهريًا.

- ضروري: 92 دولارًا شهريًا.

- إيجابي: 220 دولارًا شهريًا.

- غالي: تسعير مخصص.

الإيجابيات

السلبيات

5. نهاية شهر سهلة (⭐3.6)

يساعد إنهاء الشهر السهل يصنع إغلاق نهاية الشهر بشكل أكثر سلاسة.

ليس ممتلئًا محاسبة البرمجيات. بل إنها تساعد المحاسبون ويتولى المحاسبون إدارة المهام والمواعيد النهائية والعملاء.

اعتبره مديرًا لسير العمل مخصصًا فقط لإغلاق حساباتك.

أطلق العنان لإمكانياته مع برنامجنا شرح سهل لنهاية الشهر.

استكشف أيضًا مجموعتنا مقارنة بين Zoho Books و Easy Month End مقارنة!

رأينا

ارتقِ بدقة حساباتك المالية مع برنامج Easy Month End. استفد من ميزة المطابقة الآلية والتقارير الجاهزة للتدقيق. حدد موعدًا لعرض توضيحي مخصص لتبسيط عملية نهاية الشهر.

الفوائد الرئيسية

- سير عمل المطابقة الآلي

- إدارة المهام وتتبعها

- تحليل التباين

- إدارة المستندات

- أدوات التعاون

التسعير

- بداية24 دولارًا شهريًا.

- صغير: 45 دولارًا شهريًا.

- شركة: 89 دولارًا شهريًا.

- مَشرُوع: تسعير مخصص.

الإيجابيات

السلبيات

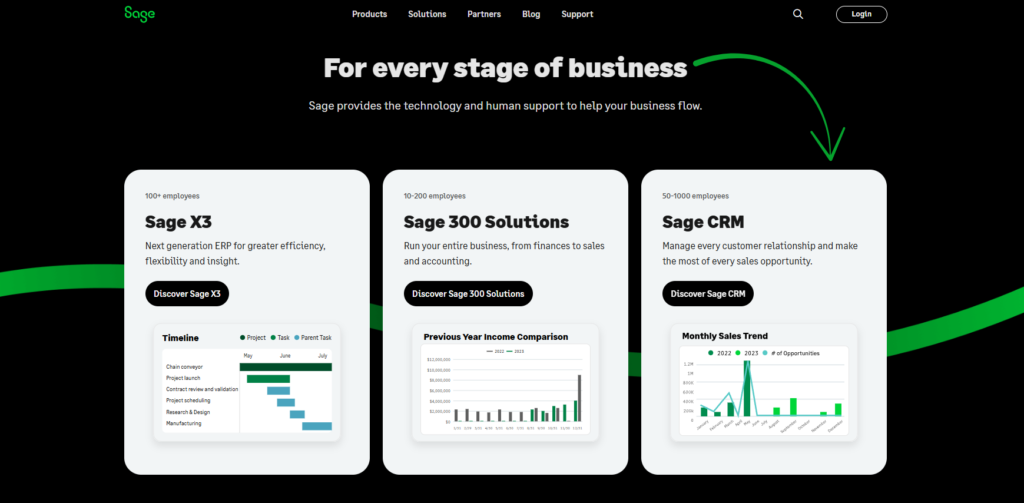

6. المريمية (⭐️3.4)

إذن، Sage اسم كبير في عالم المحاسبة. لقد كانت موجودة منذ فترة طويلة.

يستخدم برنامجهم الذكاء الاصطناعي للمساعدة في أمور مثل إصدار الفواتير ومطابقة الحسابات المصرفية.

من الشركات الناشئة الصغيرة إلى المؤسسات الكبيرة، يساعد في إدارة الشؤون المالية والرواتب والعمليات التشغيلية.

إنه اسم راسخ في مجال المحاسبة.

أطلق العنان لإمكانياته مع برنامجنا برنامج تعليمي لـ Sage.

استكشف أيضًا مجموعتنا Zoho Books مقابل Sage مقارنة!

رأينا

هل أنت مستعد لتعزيز وضعك المالي بشكل كبير؟ أفاد مستخدمو Sage بزيادة في الإنتاجية بنسبة 73% في المتوسط، وتقليل وقت دورة العمل بنسبة 75%.

الفوائد الرئيسية

- إصدار الفواتير والمدفوعات آلياً

- التقارير المالية الفورية

- أمان قوي لحماية البيانات

- التكامل مع أدوات الأعمال الأخرى

- حلول الرواتب والموارد البشرية

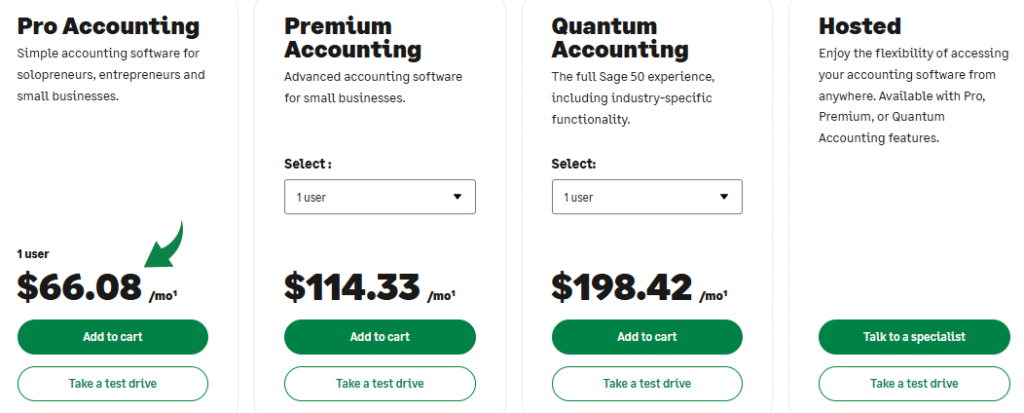

التسعير

- محاسبة احترافية: 66.08 دولارًا شهريًا.

- المحاسبة المتميزة: 114.33 دولارًا شهريًا.

- المحاسبة الكمية: 198.42 دولارًا شهريًا.

- باقات الموارد البشرية والرواتب: أسعار مخصصة بناءً على احتياجاتك.

الإيجابيات

السلبيات

7. ريفريش مي (⭐️3.2)

تركز شركة RefreshMe على توفير رؤى وتحليلات مالية فورية باستخدام الذكاء الاصطناعي.

يهدف هذا النظام إلى منح أصحاب الأعمال رؤية واضحة ومحدثة لوضعهم المالي، مما يساعدهم على اتخاذ قرارات مستنيرة بسرعة.

هذه الأداة ستجنبك الكثير من المتاعب وتضمن لك... بيانات صحيح.

إنها إضافة مفيدة لروتينك المحاسبي.

أطلق العنان لإمكانياته مع برنامجنا شرح تطبيق Refreshme.

استكشف أيضًا مجموعتنا Zoho Books مقابل Refreshme مقارنة!

رأينا

تكمن قوة RefreshMe في توفير رؤى عملية فورية. مع ذلك، قد يمثل غياب التسعير المعلن واحتمالية قلة شمولية ميزات المحاسبة الأساسية عائقًا أمام بعض المستخدمين.

الفوائد الرئيسية

- لوحات معلومات مالية فورية

- الكشف عن الحالات الشاذة المدعوم بالذكاء الاصطناعي

- تقارير قابلة للتخصيص

- توقعات التدفق النقدي

- قياس الأداء المعياري

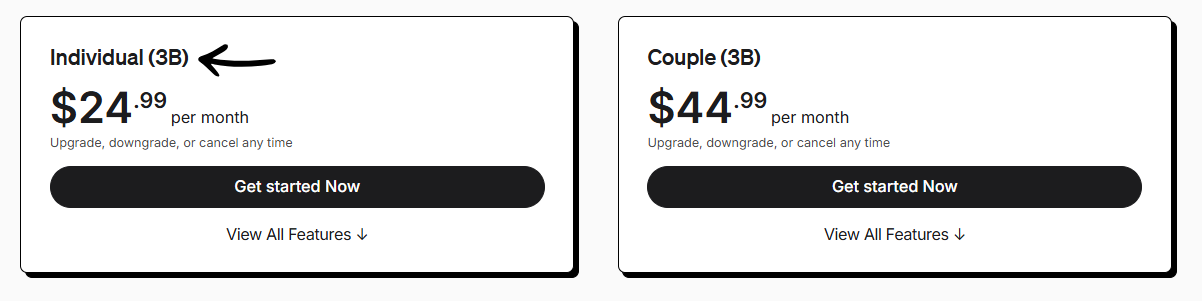

التسعير

- فرد (3ب): 24.99 دولارًا شهريًا.

- الزوجان (3ب): 44.99 دولارًا شهريًا.

الإيجابيات

السلبيات

8. FreshBooks (⭐3.0)

تم تصميم FreshBooks خصيصًا للشركات الصغيرة التي تقدم خدمات متنوعة و المستقلين.

إذا كانت مخاوفك الرئيسية تتعلق بالفواتير، تتبع الوقتوإذا تم الدفع بسرعة، فإنه منافس قوي.

تشتهر الشركة بفواتيرها الجميلة واهتمامها بإدارة العملاء.

أطلق العنان لإمكانياته مع برنامجنا شرح استخدام FreshBooks.

استكشف أيضًا مجموعتنا مقارنة بين Zoho Books و FreshBooks مقارنة!

رأينا

هل سئمت من المحاسبة المعقدة؟ أكثر من 30 مليون شركة تثق في FreshBooks لإنشاء فواتير احترافية. بسّط أعمالك برنامج محاسبة اليوم!

الفوائد الرئيسية

- إعداد فواتير احترافية

- تذكيرات الدفع الآلية

- تتبع الوقت

- أدوات إدارة المشاريع

- تتبع المصروفات

التسعير

- لايت: 2.10 دولار شهرياً.

- زائد: 3.80 دولار شهرياً.

- غالي: 6.50 دولار شهرياً.

- يختار: تسعير مخصص.

الإيجابيات

السلبيات

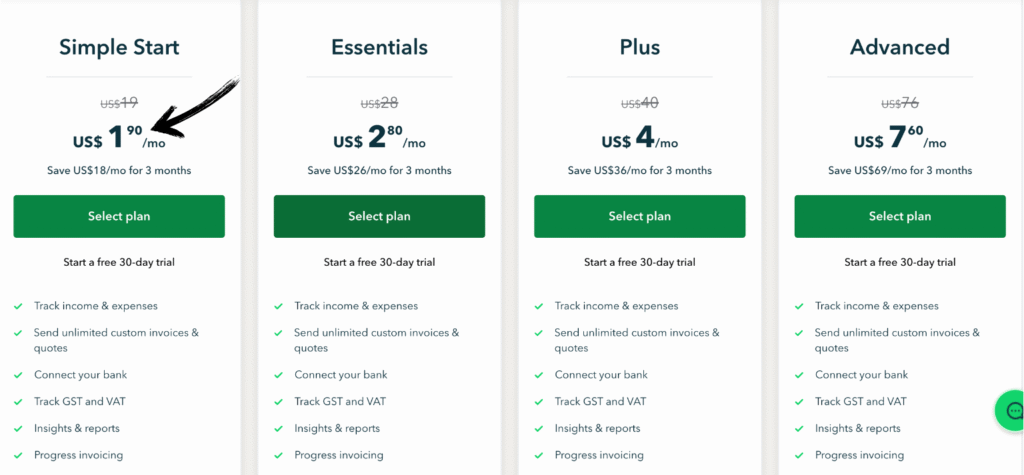

9. برنامج QuickBooks (⭐2.8)

برنامج QuickBooks هو برنامج شائع جدًا برنامج محاسبة.

تستخدمه العديد من الشركات، وخاصة في الولايات المتحدة.

إنه رائع لإدارة جميع مهامك المالية، مثل إصدار الفواتير وتتبع التكاليف وحتى الرواتب.

إنها أداة قوية يمكنها أن تنمو مع نمو أعمالك.

أطلق العنان لإمكانياته مع برنامجنا برنامج تعليمي لبرنامج QuickBooks.

استكشف أيضًا مجموعتنا Zoho Books مقابل QuickBooks مقارنة!

الفوائد الرئيسية

- تصنيف المعاملات آلياً

- إنشاء الفواتير وتتبعها

- إدارة النفقات

- خدمات الرواتب

- التقارير ولوحات المعلومات

التسعير

- بداية بسيطة: 1.90 دولار شهرياً.

- ضروري: 2.80 دولار شهرياً.

- زائد: 4 دولارات شهرياً.

- متقدم: 7.60 دولارًا شهريًا.

الإيجابيات

السلبيات

دليل المشتري

عندما بحث فريقنا عن أفضل برامج المحاسبة عبر الإنترنت، نظرنا في عدة عوامل رئيسية.

كان هدفنا هو إيجاد برنامج محاسبة قائم على الحوسبة السحابية يكون حلاً محاسبياً رائعاً يلبي احتياجات أعمالنا.

كنا نريد أداة تساعدنا في التعامل مع جميع مهامنا المحاسبية والمالية.

كنا بحاجة إليه ليعمل مع حساباتنا المصرفية ويجعل عملية الفوترة سهلة.

كما بحثنا في كيفية تعامل كل أداة مع إدارة النفقات والمعاملات المصرفية.

اخترنا حلاً محاسبياً عبر الإنترنت يمكنه التعامل مع بياناتنا والنمو مع شركتنا.

إليكم كيف أجرينا بحثنا:

- خطط الأسعارلقد راجعنا خطط الأسعار لكل منتج. بحثنا عن سعر مناسب، وما إذا كانت هناك خطة مجانية أو خيارات اشتراك شهري. كما تحققنا من عدم وجود أي رسوم خفية أو إضافات.

- الميزات الرئيسيةقارنّا الميزات الرئيسية لكل أداة. بحثنا عن ميزات مثل فواتير Zoho، ومصروفات Zoho، ودعم تطبيقات الجوال. كما احتجنا إلى ميزات متقدمة مثل إدارة المخزون، وبوابة للموردين، وإصدار فواتير متعددة العملات. تحققنا من قدرتها على إنشاء فواتير احترافية، والمساعدة في طلبات الشراء، وإدارة التدفق النقدي والإيرادات. وبحثنا أيضًا عن ميزات مثل الأتمتة، وإعداد التقارير، والوصول إليها من جهاز محمول.

- السلبياتبحثنا أيضًا عن النواقص في كل منتج. وتحققنا من المشكلات الشائعة التي أبلغ عنها العملاء، مثل وجود حد أقصى لعدد المستخدمين. كما تأكدنا من مدى ملاءمة البرنامج للشركات الناشئة، أو ما إذا كان مناسبًا أكثر للشركات المتوسطة. أردنا التأكد من أن الأداة توفر الوقت، وأنها تتضمن جميع تطبيقات الأعمال التي نحتاجها.

- الدعم أو استرداد الأموالبحثنا في نوع دعم العملاء الذي تقدمه كل شركة. أردنا معرفة ما إذا كان لديها سجل امتثال جيد. كما بحثنا في كيفية تعاملها مع عمليات استرداد الأموال. أردنا التأكد من تكاملها مع تطبيقات الطرف الثالث الشائعة و إدارة علاقات العملاءوعملنا باستخدام أدوات مثل QuickBooks Online. كما كانت عملية إدارة البيانات المحاسبية الجيدة مهمة للغاية بالنسبة لنا.

- أدوات مالية أساسيةاستخدمنا البرنامج لتلبية جميع احتياجاتنا في إدارة الشؤون المالية. كانت ميزة إصدار الفواتير الأساسية مثالية لإيصال الفواتير إلى عملائنا. كما تمكّنا من إرسال تذكيرات الدفع تلقائيًا. ساعدنا هذا في تتبع النفقات وإدارة مواردنا المالية بكفاءة أكبر.

يختتم

يُعد برنامج الإدارة المناسب أمراً أساسياً لأي عمل تجاري.

لقد رأينا كيف يمكن لبدائل Zoho Books أن تساعدك في إدارة الحسابات وتلبية احتياجات عملك.

يتولى هذا النظام أموراً مثل الفواتير و الإبلاغ حسنًا. ولكن يجب أن تعلم أيضًا أن هناك خيارات أخرى متاحة.

تحظى أدوات مثل QuickBooks Online بشعبية كبيرة، خاصة بالنسبة لأولئك الذين لديهم إدارة معقدة للمخزون.

لا تنسَ التحقق من خدمة دعم العملاء والميزات الخاصة بهم.

أعلم أن هذه الأشياء مهمة لأنني استخدمتها لتحقيق نتائج حقيقية لفريقي.

الأسئلة الشائعة

Is Zoho book worth it?

Absolutely. With plans starting at $0 or roughly $15/month, it offers immense value compared to pricier rivals. Features like auto-charging recurring invoices, a client portal, and strong الأتمتة save hours of manual admin work. It is a top-tier choice for efficiency.

Is there a free version of Zoho Books?

Yes, and it is generous. The “Forever Free” plan is available for businesses with annual revenue under $50,000. It includes one user, one accountant, bank reconciliation, and up to 1,000 invoices per year—far better than a standard trial.

Which is better, QuickBooks or Zoho?

QuickBooks has massive brand recognition and more accountants trained on it. However, Zoho Books wins on value, customer support, and built-in automation. Unless your CPA explicitly demands QuickBooks, Zoho provides a more modern experience for a fraction of the price.

Which is better, tally or Zoho Books?

Tally is a legacy desktop fortress; Zoho Books is a modern cloud headquarters. Choose Tally for offline speed and keyboard shortcuts. Choose Zoho to access data from your phone, automate bank feeds, and send invoices فورا from anywhere.

Is Xero better than Zoho Books?

Xero shines with unlimited users on all plans, a perk Zoho lacks. However, Zoho Books strikes back with superior custom workflows and a significantly lower price tag for small teams. Choose Xero for large teams; pick Zoho for automation and value.

Is Zoho books free good?

It is surprisingly robust. Unlike “freemium” traps that block essential tools, Zoho’s free tier includes the client portal, mileage tracking, and automated payment reminders. The 1,000 invoice limit is the only real ceiling, but for micro-businesses, it is usually sufficient.

Who is the competitor of Zoho?

Its primary cloud rivals are QuickBooks Online, Xero, and FreshBooks. In the desktop world, it competes against Sage and TallyPrime. For larger enterprises needing complex ERP features, it even challenges Oracle نت سويت.

More Facts about Zoho Books Alternatives

- FreshBooks is built for freelancers and service workers who need a reliable way to send invoices and track expenses.

- ProfitBooks provides a comprehensive system for tracking finances, expenses, and money transfers.

- QuickBooks Online is software that runs in the cloud and helps businesses manage their finances.

- Xero is an online platform that helps small and medium businesses manage their day-to-day financial tasks.

- موجة offers free software for small businesses and freelancers to send invoices and track accounts.

- Sage Accounting is an online tool for small- to medium-sized businesses to manage invoices and finances.

- Odoo Accounting is part of the Odoo system and connects easily with its other built-in apps.

- MYOB is very popular in Australia and offers features that help prevent bookkeeping mistakes.

- Zoho Books connects to fewer external apps than Xero or QuickBooks Online.

- Zoho Books isn’t right for everyone, so many businesses look for other options.

- Some users feel Zoho Books is pricey because its cheaper plans lack important features.

- Zoho Books is primarily used by small businesses with 50 employees or fewer.

- Many users say Zoho Books has limited customer support, which makes them unhappy.

- Common alternatives to Zoho Books include FreshBooks, QuickBooks, Xero, and Wave.

- FreshBooks is often recommended over Zoho Books because it is easy to use and excels at invoicing.

- Xero is seen as a good replacement for Zoho Books because it integrates with many apps and offers strong support.

- Many businesses want accounting software that does more work automatically than Zoho Books does.

- QuickBooks Online is considered the main standard for small to medium-sized businesses.

- Zoho Books offers a free plan for individuals and very small businesses.

- Zoho Books has tools for sending bills, tracking spending, and managing the items you sell.

- Zoho Books connects with other Zoho apps, making it more useful.

- Zoho Books has a simple screen design that makes accounting tasks easier.

- Zoho Books lets you change reports and bills to fit what your business needs.

- Zoho Books helps you follow tax laws and keeps your data safe.

- Zoho Books offers help to users who want to move their data from other software.

- Zoho Books has clear prices and does not suddenly raise them.

- Zoho Books gives you strong reports to help you understand your business’s financial health.

- Users often report that Zoho Books customer support is not always consistent.

- Zoho Books can be harder to use for paying employees (payroll) as a business grows compared to QuickBooks or Xero.

- Zoho Books offers a friendly way to handle money processes for businesses.

- Zoho Books combines inventory management with customer relationship tools.

- Zoho Books focuses on the customer with fair pricing and helpful support teams.

- Zoho Books lets you customize over 70 different reports and personalize your invoices.

- Zoho Books has a user-friendly interface, making accounting less confusing.

- Some users find that Zoho Books requires too much setup, making it hard to use.

- Giddh focuses on following tax rules and real-time records, mostly for businesses in الهند.