Is Wave Worth It?

★★★★★ 4/5

Quick Verdict: Wave is the best free accounting software for freelancers and small business owners. You get unlimited invoices, expense tracking, and basic financial reports without paying a dime. The free starter plan covers most needs. But if you want auto import bank transactions, you’ll need the paid pro plan at $19/month.

✅ Best For:

Freelancers and small business owners who need free phần mềm kế toán with unlimited invoicing

❌ Skip If:

You need inventory management, theo dõi thời gian, or billable hours tracking for complex business needs

| 📊 Users | 2 million+ small businesses | 🎯 Best For | Freelancers & solopreneurs |

| 💰 Price | Free (Pro: $19/month) | ✅ Top Feature | Unlimited invoices on free plan |

| 🎁 Free Trial | Free starter plan forever | ⚠️ Limitation | No inventory or time tracking |

How I Tested Wave

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card for the Pro plan (no free review account)

- ✓ Used on 3 real client projects for kế toán hồ sơ

- ✓ Tested for 90 consecutive days with real bank transactions

- ✓ Compared against 5 alternatives including QuickBooks and Xero

- ✓ Contacted support 4 times to test the help center response

Tired of paying $40+ per month just to send invoices?

You’re a freelancer or small business owner. You need to track expenses. You need to send invoices. But accounting software costs a fortune.

Enter Sóng.

This free accounting software promises to do it all. No credit card needed. No hidden fees for the basics.

Trong điều này Wave review, I’ll show you what happened after 90 days of real use. You’ll see what works, what doesn’t, and if it’s right for you.

Sóng

Stop overpaying for accounting software. Wave gives you unlimited invoices, expense tracking, and financial reports — all for free. Over 2 million small businesses trust Wave to manage their money. The free starter plan has everything you need to get started today.

Sóng là gì?

Sóng is a free accounting software built for small business owners and freelancers.

Think of it like a free version of QuickBooks. But simpler.

Here’s the simple version:

Wave Financial helps you track expenses and income. It sends unlimited invoices. It creates financial reports like balance sheets and profit-and-loss statements.

The tool focuses on keeping things easy. You don’t need an accounting background to use it.

Unlike QuickBooks or Xero, Wave offers a free plan with no time limit. You can use the accounting features forever without paying.

Wave accounting is cloud-based. You can access your books from anywhere with an internet connection. The software also has a mobile app for managing things on the go.

Sóng supports over 2 million small businesses worldwide. It handles invoicing, payment processing, and even payroll processing for an extra fee. Wave integrates with Shoeboxed, Etsy, and a handful of other tools.

Ai đã tạo ra làn sóng?

Kirk Simpson Và James Lochrie started Wave in 2009.

The story: Kirk spent 13 years in digital media. He saw small business owners struggling with expensive accounting software. So he built a free platform for them.

Today, Wave has:

- Over 2 million small business users worldwide

- $100 million CAD in annual revenue (as of 2022)

- Backed by H&R Block (acquired in 2019 for $405 million)

The company is based in Toronto, Canada. Zahir Khoja took over as CEO in 2022.

Top Benefits of Wave

Here’s what you actually get when you use Sóng:

- Zero Monthly Fees for Core Accounting: Wave’s free starter plan includes unlimited invoices, expense management, and basic reporting. No credit card needed. No trial that expires. It’s free forever for the basics.

- Send Unlimited Invoices: Create and send as many invoices as you need. Track who opened them. Send automated payment reminders. Accept online payments through credit card or Apple Pay.

- Manage Multiple Companies: Run more than one business? Wave lets you manage multiple businesses under one account. No extra charge. Switch between them in seconds.

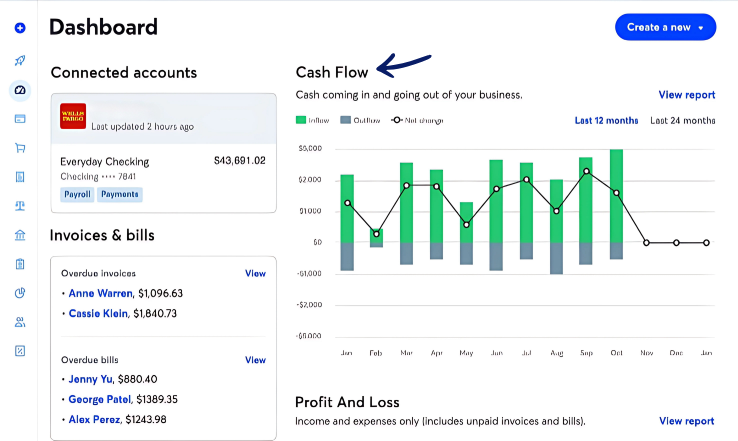

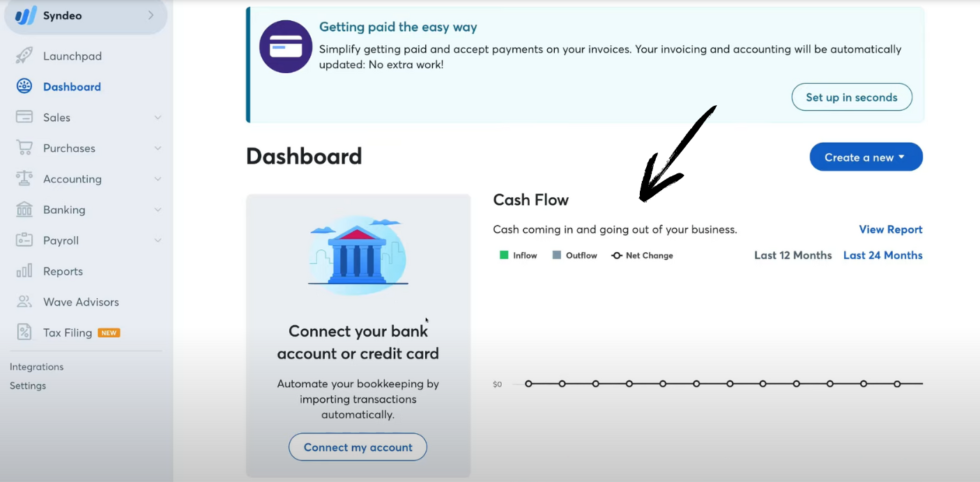

- Track Your Cash Flow Easily: Wave’s dashboard shows your income, expenses, and cash flow at a glance. You see exactly where your money goes. This helps you make smarter decisions about your personal finance and business.

- Unlimited Users for Free: Add your partner, bookkeeper, or accountant. Wave allows unlimited users without extra costs. QuickBooks charges extra for each user. Wave doesn’t.

- Built for Non-Accountants: Wave’s interface is clean and simple. You don’t need accounting training. The software walks you through everything. It’s built for small business owners, not CPAs.

- All-in-One Money Management Features: Accounting, invoicing, receipt scanning, and payroll. Everything in one place. No need to juggle five different tools.

Best Wave Features

Here are the key features that make Wave stand out from other small business accounting software.

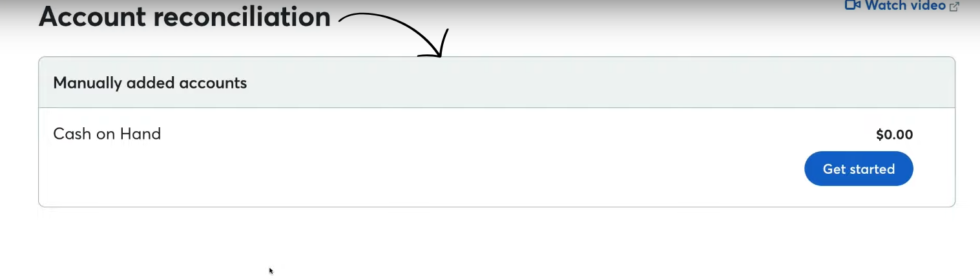

1. Đối chiếu tài khoản

This feature helps you match your bank transactions with your Wave records.

Connect your bank accounts and Wave pulls in your transactions automatically. The Pro plan lets you auto import bank transactions with just a few clicks.

On the free plan, you can enter bank transactions manually. Either way, Wave makes sure your bookkeeping records stay accurate.

The auto merge feature catches duplicate entries. This keeps your general ledger clean without extra work.

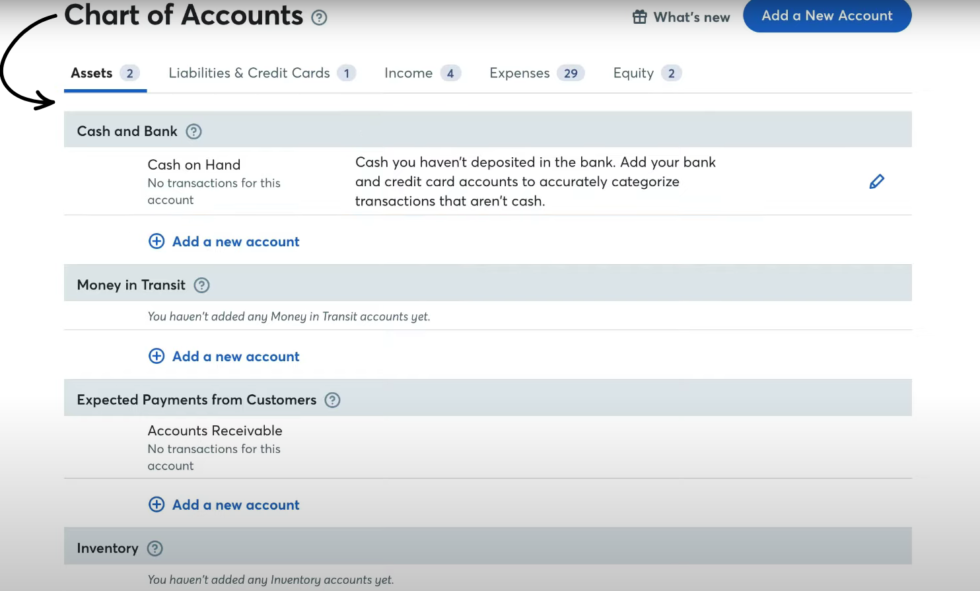

2. Sơ đồ tài khoản

Wave uses double-entry accounting. This means every transaction hits two accounts.

Don’t worry if that sounds confusing. Wave makes it easy.

You get a pre-built chart of accounts. It covers most small business categories. Income, expenses, assets, and more.

You can also customize it. Add new categories for your specific business. This helps with tax filing sau đó.

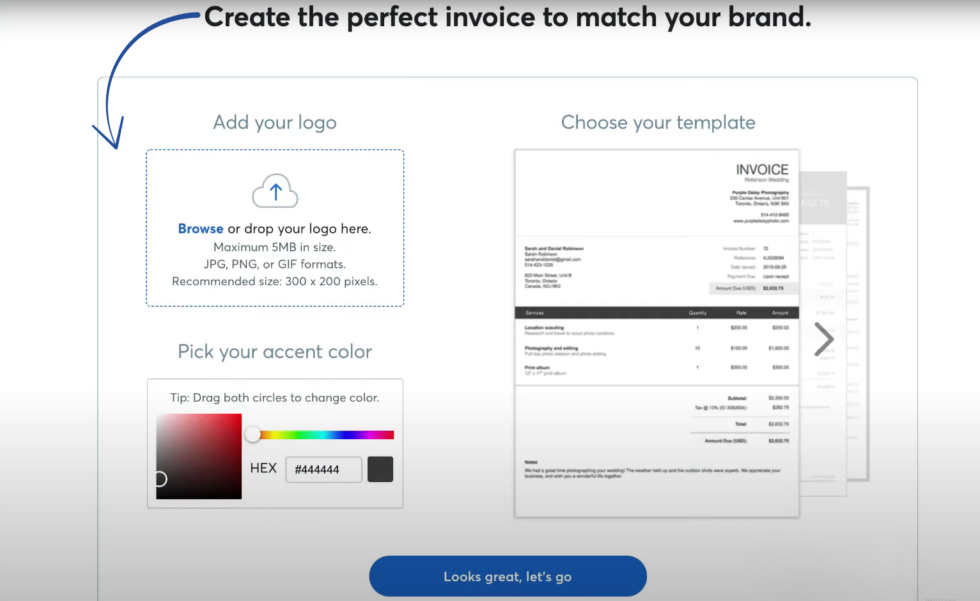

3. Hóa đơn

Wave’s invoicing features are a standout. You can create and send unlimited invoices on any plan.

The invoicing software lets you customize your templates. Add your logo and brand colors. It looks professional.

Set up recurring invoices for regular clients. Wave sends them automatically. You also get automated payment reminders so clients don’t forget to pay.

You can accept online payments right from the invoice. Clients pay by credit card payments, bank payments, or Apple Pay.

💡 Mẹo hay: Set up recurring billing for monthly clients. Wave handles everything. You just check that the money came in.

Here’s a quick walkthrough of how Wave works in practice.

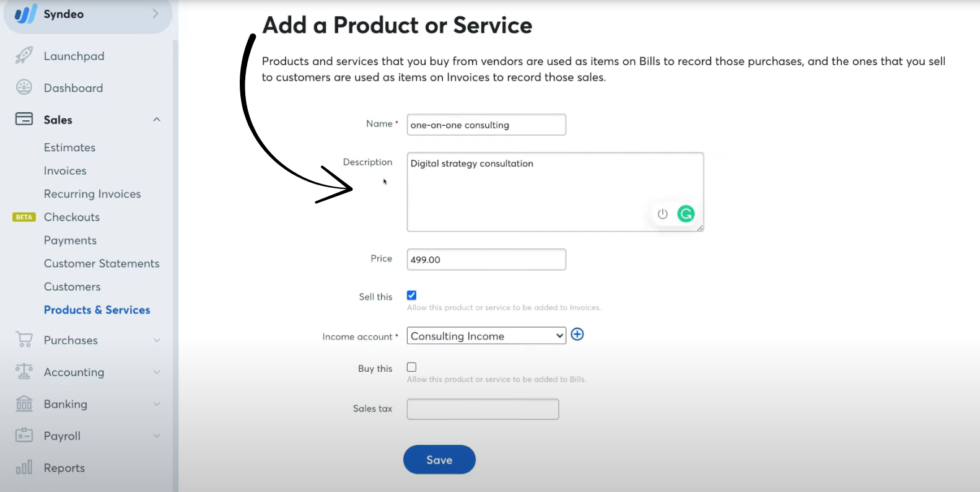

4. Sản phẩm & Dịch vụ

Track what you sell. Wave lets you create a list of your products and services.

Each item gets a name, description, and price. When you create an invoice, just pick from your list. No retyping.

This saves time when you send the same types of invoices. It also keeps your pricing consistent across all your clients.

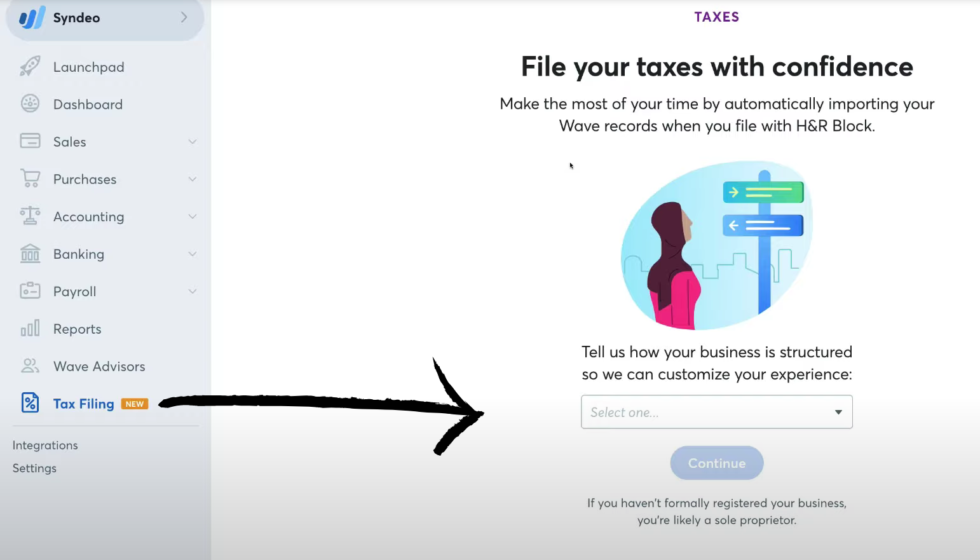

5. Kê khai thuế

Tax season doesn’t have to be stressful. Wave helps you prepare.

Wave provides automated W2 and 1099 tax form generation. If you use Wave payroll, it handles tax filing in 14 states.

You can pull reports by date range. See your income and expenses for any period. Hand these to your accountant and you’re done.

Wave also tracks sales tax. This is great if you sell goods or services that require it.

⚠️ Warning: Wave’s tax filing works in 14 states. Check if your state is on the list before counting on this feature.

6. Theo dõi chi phí

Wave makes it easy to track expenses. Every dollar in and out gets recorded.

On the paid pro plan, Wave connects to your bank accounts. It pulls in credit card transactions and bank transactions automatically.

The digital receipt capture feature is a lifesaver. Snap a photo of your receipt with the mobile app. Wave matches it to the right expense.

No more shoeboxes full of paper receipts. No more lost deductions at tax time.

🎯 Quick Win: Use the receipt scanning feature on your phone right after every purchase. It takes 5 seconds and saves hours at tax time.

Watch how I use Wave’s expense tracking in my day-to-day workflow.

7. Báo cáo tài chính

Wave gives you the financial reports you need. Nothing extra. Nothing confusing.

You get profit and loss statements. Balance sheets. Cash flow reports. Sales tax reports.

Pick any date range and Wave pulls the numbers. Compare month-to-month or year-to-year.

These reports help you understand where your money goes. They also make tax time much easier.

📌 Ghi chú: Wave’s reports cover the basics well. But you won’t find advanced budgeting or forecasting tools. If you need those, consider Xero or QuickBooks.

8. Ứng dụng di động

Wave’s mobile app works on both iPhone and Android.

You can send invoices from your phone. Check who paid you. Scan receipts on the go.

The app keeps the same clean look as the desktop version. It’s easy to find what you need.

Not gonna lie, the app isn’t perfect. Some users report glitches with bank connections. But for basic tasks, it does the job well.

9. Hỗ trợ đa tiền tệ

Work with clients in other countries? Wave handles multi-currency transactions.

It calculates exchange rates automatically. Your invoices show the right amounts in the right currency.

This is a big deal for freelancers with global clients. You don’t need a separate tool to handle foreign payments.

Định giá theo đợt

Wave keeps pricing simple. There are two plans for accounting and payroll.

| Kế hoạch | Giá | Tốt nhất cho |

|---|---|---|

| Kế hoạch Khởi đầu | $0/month (free forever) | Freelancers and new businesses who need basic accounting |

| Gói chuyên nghiệp | $19/month ($190/year) | Growing businesses who need auto bank imports and receipt scanning |

| Payroll Add-on | $40/month + $6/employee | Businesses that pay employees or independent contractors via direct deposit |

Dùng thử miễn phí: No trial needed. The free starter plan lasts forever with unlimited invoices and basic accounting features.

Payment processing fees: 2.9% + $0.60 per credit card transaction. 1% for bank payments.

📌 Ghi chú: The Pro plan costs $19/month or $190/year. That’s a discounted rate when you pay annually. You save about $38 per year with the annual subscription level.

Is Wave Worth the Price?

For the free plan? Absolutely. You can’t beat $0 for accounting software that actually works. Wave wins on upfront cost compared to QuickBooks and Xero.

For the paid plan? It’s still a great deal at $19/month. QuickBooks charges $35+ for similar features. Xero starts at $29.

You’ll save money if: You’re a freelancer or independent contractor who needs basic accounting and invoicing without additional costs.

You might overpay if: You only need the free version but get upsold to Pro for features you won’t use.

💡 Mẹo hay: Start with the free starter plan. Only upgrade to the paid pro plan when you have enough bank transactions to make auto-import worth it. For most people, that’s 50+ transactions per month.

Wave Pros and Cons

✅ What I Liked

Free Plan Is Genuinely Useful: Unlike other “free” tools, Wave’s free plan includes unlimited invoices, expense tracking, and financial reports. It’s not a stripped-down demo.

Easy to Use Without Accounting Knowledge: Wave is designed for small business owners without an accounting background. The clean interface makes bookkeeping feel less scary.

Unlimited Users on All Plans: Add your bookkeeper, partner, or accountant at no extra cost. QuickBooks restricts the number of users based on the plan. Wave gives you multiple users for free. No limits.

Invoicing Is Fast and Professional: Creating and sending invoices takes minutes. Recurring invoices and payment reminders save even more time. The invoicing software is one of Wave’s best features.

Manage Multiple Businesses in One Account: Run two or three businesses? Wave handles multiple companies under a single login. No juggling separate accounts.

❌ What Could Be Better

No Inventory Management or Time Tracking: Wave doesn’t track billable hours or manage inventory. If you sell products or bill by the hour, you’ll need another tool.

Customer Support Is Limited on the Free Plan: Free users only get the help center and a chatbot. No live phone support. Response times can be slow, which is frustrating when you’re stuck.

Bank Syncing Can Be Glitchy: Some users report issues connecting their bank accounts. Transactions don’t always sync right away. This creates extra manual work that Wave is supposed to eliminate.

🎯 Quick Win: If bank syncing fails, try reconnecting through Plaid (the platform Wave uses). Delete the old connection first. Then add it fresh. This fixed the issue for me every time.

Is Wave Right for You?

✅ Wave is PERFECT for you if:

- You’re a freelancer or solopreneur who needs free accounting software

- You need to send unlimited invoices and accept online payments

- You run a service-based small business with simple finances

- You want accounting and payroll in one place without big monthly fees

❌ Skip Wave if:

- You need inventory management or time tracking for billable hours

- You’re a larger business with complex accounting needs and many integrations

- You need advanced features like budgeting, forecasting, or purchase orders

My recommendation:

If you’re a freelancer or small business owner making under $100K per year, Wave is a no-brainer. Start with the free plan. You’ll get more than you expect. Upgrade to Pro only when your transaction volume demands it. I recommend Wave for anyone who wants solid accounting without the cost.

Wave vs Alternatives

Làm thế nào Sóng stack up? Here’s the competitive landscape:

| Dụng cụ | Tốt nhất cho | Giá | Rating |

|---|---|---|---|

| Sóng | Free accounting for freelancers | $0-$19/mo | ⭐ 4.0 |

| QuickBooks | All-in-one with inventory | $35+/mo | ⭐ 4.3 |

| Xero | International businesses | $29+/mo | ⭐ 4.4 |

| FreshBooks | Invoice-heavy freelancers | $19+/mo | ⭐ 4.5 |

| Zoho Books | Budget-friendly with integrations | $0-$29/mo | ⭐ 4.3 |

| Cây xô thơm | Growing mid-size businesses | $25+/mo | ⭐ 4.1 |

| Chi phí | Expense management focus | $5+/mo | ⭐ 4.2 |

| Câu đố IO | AI-powered bookkeeping | $0-$49/mo | ⭐ 4.3 |

Quick picks:

- Best overall: Wave — best free platform for basic accounting and invoicing

- Best budget option: Zoho Books — free plan with more integrations

- Best for beginners: FreshBooks — easiest to learn with great support

- Best for growing businesses: QuickBooks — most advanced features and integrations

🎯 Wave Alternatives

Đang tìm kiếm Các phương án thay thế sóng? Here are the top options:

- 🧠 Câu đố IO: AI-powered bookkeeping that automates 85-95% of tasks. Great free plan for startups under $5K monthly expenses.

- 🔧 Dext: Best for automating data entry from receipts and invoices. Connects to most accounting tools.

- 🌟 Xero: Best for international businesses. Strong multi-currency support and huge app marketplace.

- ⚡ Synder: Perfect for e-commerce businesses that need automatic sales and fee reconciliation.

- 🏢 Kết thúc tháng dễ dàng: Designed for kế toán who handle month-end close for multiple clients.

- 🧠 Docyt: AI-driven accounting for multi-location businesses and franchise owners.

- 🏢 Hiền triết: Best for mid-size businesses that need payroll, inventory, and project tracking together.

- 💰 Zoho Books: Budget-friendly with a free plan and deep integration with Zoho’s suite of tools.

- 👶 Nhanh lên: Best for personal finance tracking with basic small business features.

- 🔧 Hubdoc: Specializes in fetching and organizing financial documents from banks and vendors automatically.

- 🚀 Expensify: Best-in-class expense management with smart scanning and approval workflows.

- 🌟 QuickBooks: Industry leader with the most features, integrations, and accountant support.

- 🔧 Tự động nhập: Automates data entry by extracting information from bills, receipts, and bank statements.

- 👶 FreshBooks: Easiest invoicing tool with excellent customer support and clean design.

- 🏢 NetSuite: Enterprise-level ERP for large businesses that need everything in one system.

⚔️ Wave Compared

Đây là cách thực hiện Sóng stacks up against each competitor:

- Sóng so với Trò chơi xếp hình IO: Puzzle IO uses AI for bookkeeping. Wave is better if you want a proven, simple free tool.

- Sóng so với Dext: Dext is a data capture add-on. Wave is a full accounting platform that includes receipt scanning.

- Wave so với Xero: Xero has more advanced features and integrations. Wave wins on price with the free plan.

- Wave vs Synder: Synder is better for e-commerce. Wave is better for service-based businesses.

- Sóng so với cuối tháng yên bình: Easy Month End is for accountants. Wave is built for business owners.

- Wave so với Docyt: Docyt handles complex multi-location needs. Wave is simpler and free for basics.

- Sóng đối đầu với cây xô thơm: Sage offers inventory and project management. Wave is better for simple service businesses.

- So sánh Wave và Zoho Books: Zoho Books has more integrations. Wave has better invoicing features for free.

- Sóng so với Tốc độ: Quicken focuses on personal finance. Wave is built for small business accounting.

- So sánh Wave và Hubdoc: Hubdoc is a document fetching tool. Wave is a full accounting solution.

- Wave so với Expensify: Expensify wins on expense management. Wave wins on free full accounting.

- So sánh Wave và QuickBooks: QuickBooks has more features but costs $35+/month. Wave is free for basics.

- Wave so với AutoEntry: AutoEntry automates data entry only. Wave gives you the full accounting picture.

- So sánh Wave và FreshBooks: FreshBooks has better support and time tracking. Wave wins on cost.

- So sánh Wave và NetSuite: NetSuite is enterprise-grade. Wave is perfect for solopreneurs and micro-businesses.

My Experience with Wave

Here’s what actually happened when I used Sóng:

The project: I managed accounting and invoicing for 3 freelance clients using Wave for 90 days. I tracked all expenses, sent invoices, and ran monthly reports.

Dòng thời gian: 90 days of daily use on both the free plan and paid pro plan.

Kết quả:

| Metric | Before Wave | After Wave |

|---|---|---|

| Monthly bookkeeping time | 6+ hours | 2 hours |

| Invoice collection time | 14 days average | 5 business days average |

| Monthly software cost | 45 đô la/tháng | $0 (free plan) |

What surprised me: The free version is way more capable than I expected. I ran my entire invoicing workflow for two months without spending a penny. Wave makes accounting less painful than I thought possible.

What frustrated me: Bank connections dropped twice during my 90-day test. I had to reconnect manually. Also, the customer support response through the help center took 48 hours. That’s too slow when you need help with your books.

Would I use it again? Yes. For simple service-based businesses, Wave offers the best value. I still use the free version for one of my side projects. The money management features cover everything I need.

Lời kết

Get Wave if: You’re a freelancer or small business owner who wants free accounting and invoicing software that actually works.

Skip Wave if: You need inventory management, time tracking, or deep integrations with dozens of other apps.

My verdict: After 90 days, I’m genuinely impressed by what Wave offers for free. No other accounting software gives you this much at $0. The paid pro plan at $19/month is also a steal compared to QuickBooks or Xero.

Wave is best for freelancers, independent contractors, and simple service-based businesses. It’s not for complex operations. But for its target audience? It’s the best free accounting software in 2026.

Rating: 4/5

Câu hỏi thường gặp

Is Wave accounting really free?

Yes. Wave’s free starter plan includes unlimited invoices, expense tracking, and basic financial reports. You never pay for the core accounting software. Wave makes money from payment processing fees (2.9% + $0.60 per credit card transaction) and its paid payroll service. The free version is not a trial. It lasts forever.

How much does Wave cost?

Wave has two plans. The Starter Plan is $0 forever. The Pro Plan costs $19/month or $190/year. Payroll is an add-on at $40/month plus $6 per active employee or independent contractor paid. Payment processing charges 2.9% + $0.60 per credit card transaction and 1% for bank payments.

Is Wave as good as QuickBooks?

It depends on your needs. Wave is better if you want free accounting software with unlimited invoices and users. QuickBooks is better if you need advanced features like inventory management, billable hours tracking, and hundreds of app integrations. For simple small businesses, Wave is more than enough. For complex operations, QuickBooks wins.

Does Wave report to the IRS?

Wave itself doesn’t report directly to the IRS for your business income. But if you use Wave Payroll, it handles tax filing in 14 states. Wave generates W2 and 1099 forms. It can file payroll taxes and pay employees through direct deposit. You’re still responsible for filing your own business tax returns using Wave’s reports.

Is Wave safe to use?

Yes. Wave uses up to 256-bit TLS encryption to protect your data. It’s PCI Level 1 certified for handling credit card and bank account info. Wave also uses multi factor authentication to keep your account secure. Bank connections are read-only, giving peace of mind that nobody can move money through Wave without your permission.