Stai cercando di capire quale software di contabilità è la soluzione migliore per la tua attività?

Con così tante scelte, può essere dura!

Due opzioni popolari che potresti prendere in considerazione sono Puzzle IO e QuickBooks.

Tenere traccia del denaro non dovrebbe essere un problema, così come non dovrebbero esserlo le attività che potresti automatizzare.

In questo articolo confronteremo Puzzle IO e QuickBooks per aiutarti a decidere quale sia più adatto a te.

Panoramica

Abbiamo dedicato del tempo all'esplorazione di Puzzle IO e QuickBooks.

Approfondire le loro caratteristiche e il loro funzionamento per diversi Attività commerciale esigenze.

Questo confronto nasce dall'esperienza pratica e da un'attenta valutazione per darti un quadro chiaro di ciò che ognuno offre.

Pronto a semplificare le tue finanze? Scopri come Puzzle IO può farti risparmiare fino a 20 ore al mese. Scopri la differenza.

Prezzi: Piano gratuito disponibile. Piano a pagamento a partire da $ 42,50/mese.

Caratteristiche principali:

- Pianificazione finanziaria

- Previsione

- Analisi in tempo reale

Utilizzato da oltre 7 milioni di aziende, QuickBooks può farti risparmiare in media 42 ore al mese su contabilità.

Prezzi: La prova è gratuita. Il piano parte da $ 1,90 al mese.

Caratteristiche principali:

- Gestione delle fatture

- Monitoraggio delle spese

- Segnalazione

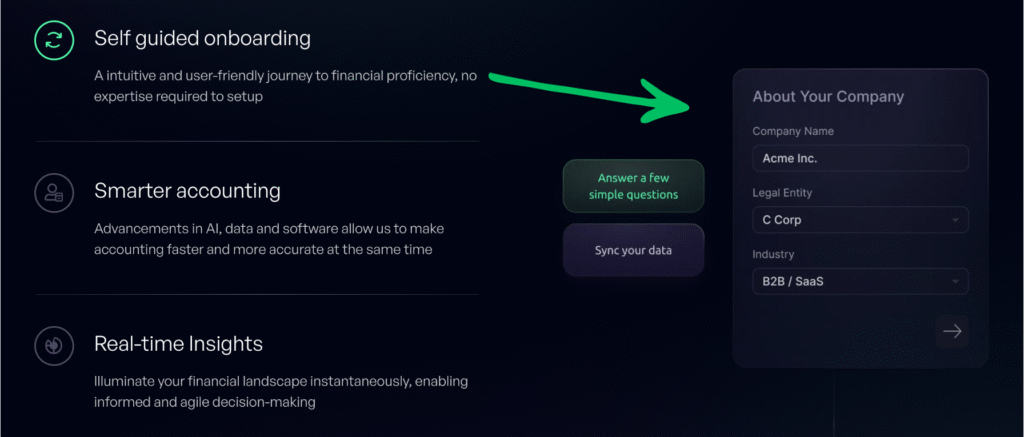

Che cos'è Puzzle IO?

Allora, Puzzle IO, di cosa si tratta?

Consideralo uno strumento che ti aiuta davvero a prevedere il futuro delle finanze della tua azienda.

Non si tratta solo di ciò che sta accadendo ora, ma di ciò che potrebbe accadere.

Esplora anche i nostri preferiti Alternative a Puzzle IO…

La nostra opinione

Pronto a semplificare le tue finanze? Scopri come Puzzle io può farti risparmiare fino a 20 ore al mese. Prova la differenza oggi stesso!

Vantaggi principali

Puzzle IO è davvero eccezionale quando si tratta di aiutarti a capire dove sta andando la tua attività.

- 92% di gli utenti segnalano una maggiore accuratezza nelle previsioni finanziarie.

- Ottieni informazioni in tempo reale sul tuo flusso di cassa.

- Crea facilmente diversi scenari finanziari da pianificare.

- Collabora in modo fluido con il tuo team sugli obiettivi finanziari.

- Tieni traccia degli indicatori chiave di prestazione (KPI) in un unico posto.

Prezzi

- Nozioni di base sulla contabilità: $0/mese.

- Contabilità Plus Insights: $42,50/mese.

- Contabilità più automazione avanzata: $85/mese.

- Scala Accounting Plus: $255/mese.

Professionisti

Contro

Che cos'è QuickBooks?

Ok, parliamo di QuickBooks. Probabilmente è un nome che hai già sentito.

Un sacco di piccole imprese utilizzarlo per gestire le proprie finanze quotidiane.

Consideralo un hub centrale per fatture, spese e monitoraggio delle prestazioni attuali della tua attività.

Esplora anche i nostri preferiti Alternative a QuickBooks…

Vantaggi principali

- Categorizzazione automatizzata delle transazioni

- Creazione e tracciamento delle fatture

- Gestione delle spese

- Servizi di elaborazione paghe

- Reporting e dashboard

Prezzi

- Inizio semplice: $ 1,90/mese.

- Essenziale: $2,80/mese.

- Più: $4/mese.

- Avanzato: $7,60/mese.

Professionisti

Contro

Confronto delle funzionalità

Ecco un'analisi comparativa delle performance di queste due aziende in termini di caratteristiche finanziarie chiave.

Questo ti darà le informazioni chiare di cui hai bisogno per scegliere la soluzione migliore per il tuo piccola impresa.

1. Metriche in tempo reale e cash runway

Questo rappresenta spesso un punto di svolta per i fondatori e i co-fondatori in fase iniziale.

- Puzzle IO: Fornisce informazioni in tempo reale su parametri chiave come il denaro contante pista e il tasso di combustione su una dashboard pulita. Ciò fornisce rapidamente un quadro aggiornato e accurato dello stato attuale dell'azienda.

- QuickBooks: Richiede un maggiore sforzo manuale per ottenere un quadro accurato di queste metriche chiave. Gli utenti spesso devono esportare i dati aziendali dati ai fogli di calcolo e calcolare autonomamente la liquidità disponibile, costringendoli ad attendere più a lungo per informazioni cruciali.

2. Automazione basata sull'intelligenza artificiale e categorizzazione delle transazioni

Flusso di lavoro automazione è fondamentale per risparmiare meno tempo sui compiti noiosi.

- Puzzle IO: Features AI-powered workflow automation for transaction categorization directly into the general ledger. This is designed to reduce errors and make bookkeeping easier for non-accountants.

- QuickBooks: Offre una buona automazione per il collegamento di conti bancari e carte di credito, ma la categorizzazione delle transazioni richiede spesso una revisione manuale, il che significa che chi non è un contabile potrebbe impiegare più tempo a correggere gli errori.

3. Riconoscimento dei ricavi e contabilità di competenza

Gestione complessa contabilità L'applicazione corretta delle regole è essenziale per un corretto monitoraggio dei ricavi.

- Puzzle IO: Offre riconoscimento automatico e integrato dei ricavi e degli accantonamenti contabilità, fondamentale per ottenere un quadro accurato dei ricavi degli investitori. Garantisce la conformità fiscale senza dover ricorrere a un esperto finanziario a tempo pieno in una fase iniziale.

- QuickBooks: Mentre supporta l'accumulo contabilità, le complesse regole per il riconoscimento dei ricavi spesso richiedono un notevole sforzo manuale o un contabile esperto per essere impostate e gestite correttamente.

4. Immobilizzazioni e spese anticipate

Al momento della dichiarazione dei redditi è fondamentale tenere traccia e ammortizzare correttamente i beni e le spese.

- Puzzle IO: Automatizza il monitoraggio e l'ammortamento delle immobilizzazioni e la contabilizzazione dei risconti attivi. Questo semplifica notevolmente la gestione dei libri contabili da parte dei fondatori di startup, che possono così tenerli aggiornati e pronti per il loro commercialista al momento della dichiarazione dei redditi.

- QuickBooks: Supporta sia le immobilizzazioni che le spese anticipate, ma richiede una maggiore configurazione manuale e registrazioni contabili, il che può aumentare il rischio di errori per i non contabili.

5. Dashboard finanziaria e approfondimenti finanziari

Ottenere visibilità immediata sui tuoi contanti e sui tuoi ricavi è un punto di svolta.

- Puzzle IO: La dashboard è progettata per fornire ai fondatori di startup informazioni in tempo reale e dati finanziari fruibili. È strutturata per fornire rapidamente una visione chiara e comprensibile dello stato attuale dell'azienda.

- QuickBooks: Le dashboard si concentrano principalmente sulla contabilità generale e sui bilanci tradizionali. Sebbene potenti, le informazioni finanziarie spesso richiedono un approfondimento più approfondito, e ottenere un quadro preciso può aspettare che il tuo commercialista chiuda i libri contabili.

6. Funzionalità di gestione delle paghe

La gestione dei pagamenti dei dipendenti e dei collaboratori è un requisito obbligatorio.

- Puzzle IO: Solitamente si integra con servizi di terze parti come Gusto o Rippling per la gestione delle buste paga. Si concentra sulla registrazione fluida delle transazioni relative alle buste paga nel libro mastro.

- QuickBooks: Offre opzioni integrate come QuickBooks Payroll (incluso QuickBooks Full Service) contabilità con buste paga) per l'accredito diretto e i pagamenti ai collaboratori. In questo modo, buste paga e contabilità rimangono sotto lo stesso tetto.

7. Versione desktop vs versione online

L'accessibilità e le funzionalità cambiano in base ai prodotti QuickBooks utilizzati.

- Puzzle IO: È disponibile solo in versione online, con accesso online da qualsiasi luogo.

- QuickBooks: Offre due prodotti QuickBooks principali: QuickBooks Online (basato su cloud) e QuickBooks Desktop (installazione locale con licenza per un singolo computer). QuickBooks Desktop ha funzionalità specifiche che mancano nelle versioni online.

8. Gestione delle fatture e degli ordini di acquisto

La gestione del denaro dovuto ai fornitori è fondamentale per il flusso di cassa.

- Puzzle IO: Abilita l'automazione del pagamento delle bollette tramite monitoraggio dei flussi di cassa in uscita e integrazione con piattaforme di gestione delle spese.

- QuickBooks: Fornisce funzionalità avanzate per pagare bollette, creare fatture per i clienti e utilizzare ordini di acquisto per mantenere registri di inventario accurati, in particolare nella versione desktop di QuickBooks.

9. Perché i fondatori hanno scelto Puzzle

Uno sguardo veloce alla mentalità che sta dietro a questa scelta.

- Puzzle IO: Molti fondatori hanno scelto Puzzle perché funziona come QuickBooks, ma con un approccio moderno basato sull'intelligenza artificiale, risparmiando meno tempo su attività noiose e fornendo approfondimenti finanziari più approfonditi.

- QuickBooks: Gli utenti rimangono con QuickBooks perché è il settore contabile standard. L'ampia accettazione e la natura completa di Intuit QuickBooks per tutti piccole imprese è un fattore importante.

Cosa cercare quando si sceglie un software di contabilità?

Ecco una rapida lista di controllo da tenere a mente:

- Facilità d'uso: L'interfaccia è intuitiva? Cerca una configurazione semplice che ti aiuti a rimanere organizzato.

- Funzioni principali: Tiene traccia in modo efficace del denaro, gestisce il tuo piano dei conti e si occupa della riconciliazione?

- Segnalazione Energia: Può generare facilmente report essenziali come bilanci e resoconti finanziari dettagliati per mostrare la tua salute finanziaria?

- Automazione: Riduce al minimo l'inserimento manuale dei dati e offre una buona automazione del flusso di lavoro?

- Integrazione: Si integra bene con altri strumenti che utilizzi, come QuickBooks Time per la gestione del tempo dei dipendenti o sistemi per la gestione delle vendite?

- Pronto per le tasse: Semplifica i calcoli dell'imposta sulle vendite e la preparazione delle dichiarazioni dei redditi a fine anno?

- Gestione clienti: Può gestire la fatturazione per i clienti e inviare promemoria di pagamento?

- Specifiche di QuickBooks: Stai abbandonando i dati desktop e hai bisogno delle funzionalità offerte da QuickBooks oppure sei un lavoratore autonomo e hai bisogno solo di un monitoraggio di base?

- Costi e supporto: Prima di iscriverti, sii consapevole di tutte le potenziali commissioni e consulta le recensioni di QuickBooks per avere informazioni sull'assistenza clienti e sulla facilità di cancellazione.

- Considerazioni finali: Il software migliore è quello che offre alla tua azienda i maggiori vantaggi con il minimo sforzo.

Verdetto finale

La scelta tra un puzzle e QuickBooks dipende dalle tue esigenze.

Se la pianificazione futura e solidi bilanci sono essenziali per la tua startup, puoi provare la loro prova gratuita.

Puzzle IO potrebbe essere fantastico.

QuickBooks è il vincitore per le funzionalità di contabilità quotidiana e le numerose connessioni.

While no fully free software di contabilità does it all.

I loro piani sono adatti a molti. Li abbiamo esaminati.

E conoscere i tuoi obiettivi principali guiderà la tua scelta.

Altro di Puzzle IO

Abbiamo esaminato il confronto tra Puzzle IO e altri strumenti di contabilità. Ecco una rapida panoramica delle loro caratteristiche distintive:

- Puzzle IO contro Xero: Xero offre ampie funzionalità di contabilità con forti integrazioni

- Puzzle IO contro Dext: Puzzle IO eccelle nelle previsioni e nelle analisi finanziarie basate sull'intelligenza artificiale.

- Puzzle IO contro Synder: Synder eccelle nella sincronizzazione dei dati di vendita e pagamento.

- Puzzle IO vs Easy Month End: Easy Month End semplifica il processo di chiusura finanziaria.

- Puzzle IO contro Docyt: Docyt utilizza l'intelligenza artificiale per automatizzare le attività di contabilità.

- Puzzle IO vs RefreshMe: RefreshMe si concentra sul monitoraggio in tempo reale delle performance finanziarie.

- Puzzle IO contro Sage: Sage fornisce soluzioni contabili affidabili per aziende di varie dimensioni.

- Puzzle IO vs Zoho Books: Zoho Books offre una contabilità conveniente con CRM integrazione.

- Puzzle IO contro Wave: Wave fornisce software di contabilità gratuito per le piccole imprese.

- Puzzle IO contro Quicken: Quicken è nota per la gestione delle finanze personali e delle piccole imprese.

- Puzzle IO contro Hubdoc: Hubdoc è specializzato nella raccolta di documenti e nell'estrazione di dati.

- Puzzle IO contro Expensify: Expensify offre una gestione e una rendicontazione completa delle spese.

- Puzzle IO vs QuickBooks: QuickBooks è una scelta popolare per la contabilità delle piccole imprese.

- Puzzle IO vs AutoEntry: AutoEntry automatizza l'inserimento dei dati da fatture e ricevute.

- Puzzle IO contro FreshBooks: FreshBooks è pensato appositamente per la fatturazione aziendale basata sui servizi.

- Puzzle IO vs NetSuite: NetSuite offre una suite completa per la pianificazione delle risorse aziendali.

Altro su QuickBooks

- QuickBooks contro Puzzle IO: Questo software si concentra sulla pianificazione finanziaria basata sull'intelligenza artificiale per le startup. La sua controparte è per la finanza personale.

- QuickBooks contro Dext: Questo è uno strumento aziendale per l'acquisizione di ricevute e fatture. L'altro strumento tiene traccia delle spese personali.

- QuickBooks contro Xero: Questo è un popolare software di contabilità online per le piccole imprese. Il suo concorrente è per uso personale.

- QuickBooks contro Synder: Questo strumento sincronizza i dati dell'e-commerce con il software di contabilità. La sua alternativa si concentra sulla finanza personale.

- QuickBooks vs Easy Month End: Questo è uno strumento aziendale per semplificare le attività di fine mese. Il suo concorrente è per la gestione delle finanze personali.

- QuickBooks contro Docyt: Questo utilizza l'intelligenza artificiale per la contabilità aziendale e l'automazione. L'altro utilizza l'intelligenza artificiale come assistente finanziario personale.

- QuickBooks contro Sage: Si tratta di una suite completa per la contabilità aziendale. Il suo concorrente è uno strumento più semplice da usare per la gestione delle finanze personali.

- QuickBooks contro Zoho Books: Questo è uno strumento di contabilità online per piccole imprese. Il suo concorrente è per uso personale.

- QuickBooks contro Wave: Questo software di contabilità gratuito è pensato per le piccole imprese. La sua controparte è pensata per i privati.

- QuickBooks contro Quicken: Entrambi sono strumenti di finanza personale, ma questo offre un monitoraggio degli investimenti più approfondito. L'altro è più semplice.

- QuickBooks contro Hubdoc: Questo è specializzato nell'acquisizione di documenti per la contabilità. Il suo concorrente è uno strumento di finanza personale.

- QuickBooks contro Expensify: Questo è uno strumento per la gestione delle spese aziendali. L'altro è per il monitoraggio delle spese personali e la creazione di budget.

- QuickBooks vs AutoEntry: Progettato per automatizzare l'inserimento dati per la contabilità aziendale. La sua alternativa è uno strumento di finanza personale.

- QuickBooks contro FreshBooks: Questo è un software di contabilità per liberi professionisti e piccole imprese. La sua alternativa è per la finanza personale.

- QuickBooks contro NetSuite: Si tratta di una potente suite di gestione aziendale per grandi aziende. Il suo concorrente è una semplice app di finanza personale.

Domande frequenti

Quale software è migliore per le piccole e medie imprese, come QuickBooks?

Dipende dalle specifiche esigenze contabili. QuickBooks è ottimo per la contabilità generale, mentre altri possono offrire funzionalità specifiche.

L'automazione del flusso di lavoro può migliorare le finanze della mia azienda con uno dei due software?

Sì, sia Puzzle IO che QuickBooks offrono funzionalità per automatizzare attività come la fatturazione e l'inserimento dati, risparmiando tempo.

In che modo Puzzle IO si confronta con lo standard del settore contabile?

Puzzle IO si concentra sulle previsioni e sulle informazioni basate sull'intelligenza artificiale, un approccio più moderno rispetto al software tradizionale.

Quali sono i fattori chiave da considerare quando valuto le esigenze contabili della mia azienda?

Considera il tuo budget, le funzionalità richieste (come la fatturazione o la busta paga), le integrazioni e i piani di crescita futuri.

È difficile passare da una piattaforma di contabilità (come QuickBooks) a un'altra?

Il passaggio può richiedere tempo e un'attenta pianificazione per garantire che la migrazione dei dati sia accurata e che il team si adatti al nuovo sistema.