Ti senti sopraffatto dal tuo ciclo mensile contabilità compiti?

Immaginare the stress of scrambling to find receipts, reconcile accounts, and meet deadlines.

Tutto questo mentre cerchi di eseguire il tuo Attività commerciale.

Questo articolo approfondisce due temi popolari contabilità soluzioni.

Analizzeremo le funzionalità di Easy Month End e FreshBooks per aiutarti a decidere quale semplificherà davvero il tuo contabilità.

Panoramica

Per darvi un quadro più chiaro.

Abbiamo ampiamente testato Fine mese facile e FreshBooks, esaminandone le caratteristiche, la facilità d'uso e il valore complessivo.

Questo Easy fine mese, unisciti a 1.257 utenti che hanno risparmiato in media 3,5 ore e ridotto gli errori del 15%. Inizia la tua prova gratuita!

Prezzi: La prova è gratuita. Il piano premium parte da 45 dollari al mese.

Caratteristiche principali:

- Riconciliazione automatizzata

- Flussi di lavoro semplificati

- Interfaccia intuitiva

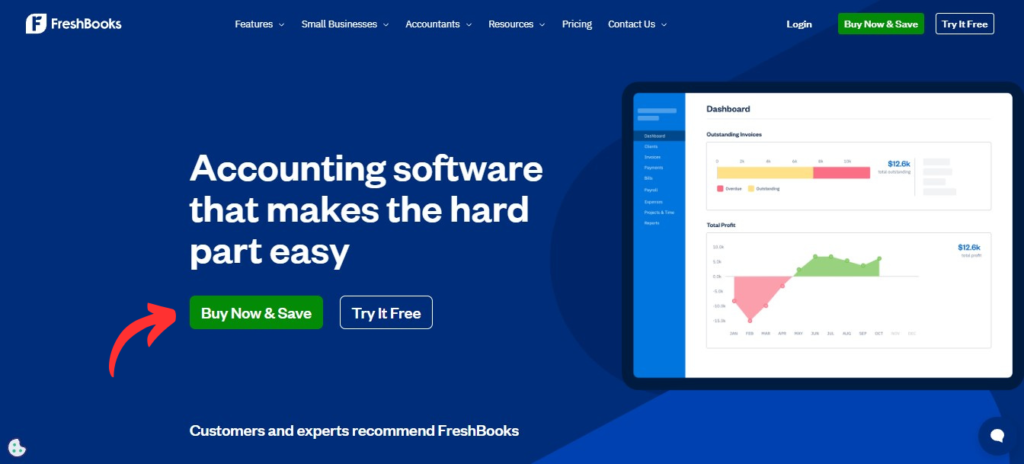

Pronti a semplificare la fatturazione e ricevere pagamenti più velocemente? Oltre 30 milioni di persone hanno utilizzato FreshBooks. Scopritelo per saperne di più!

Prezzi: La prova è gratuita. Il piano a pagamento parte da $ 2,10 al mese.

Caratteristiche principali:

- Monitoraggio del tempo

- Fatturazione

- Contabilità

Che cos'è Easy Month End?

Parliamo di Easy Month End. Di cosa si tratta?

È uno strumento progettato per rendere il tuo mensile contabilità chiudere semplice.

Consideralo la tua guida in quel processo spesso temuto.

Esplora anche i nostri preferiti Alternative facili per la fine del mese…

La nostra opinione

Aumenta la precisione finanziaria con Easy Month End. Sfrutta la riconciliazione automatizzata e la reportistica pronta per la verifica contabile. Prenota una demo personalizzata per semplificare il tuo processo di fine mese.

Vantaggi principali

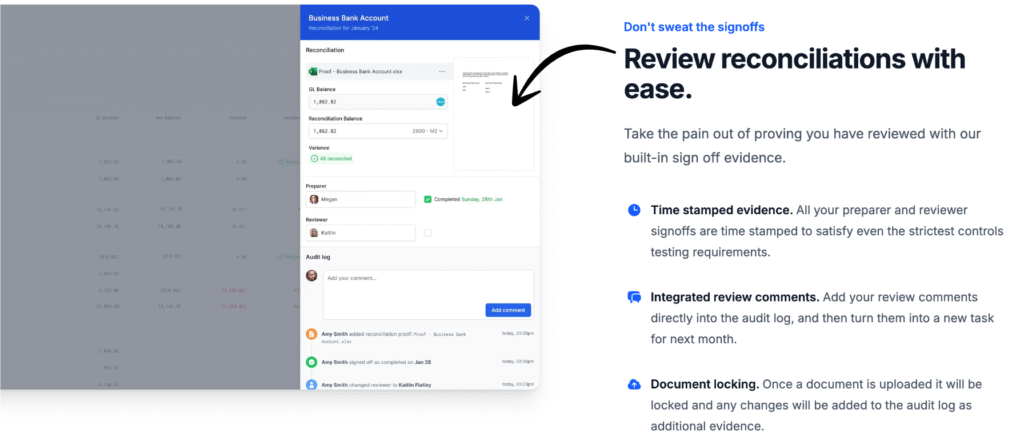

- Flussi di lavoro di riconciliazione automatizzati

- Gestione e monitoraggio delle attività

- Analisi della varianza

- Gestione dei documenti

- Strumenti di collaborazione

Prezzi

- Antipasto: $24/mese.

- Piccolo: $45/mese.

- Azienda: $89/mese.

- Impresa: Prezzi personalizzati.

Professionisti

Contro

Che cos'è FreshBooks?

Ora parliamo di FreshBooks. Di cosa si tratta?

È popolare software di contabilitàMolti liberi professionisti e piccole imprese usalo.

Aiuta nella fatturazione, nel monitoraggio delle spese e nella gestione dei progetti.

Esplora anche i nostri preferiti Alternative a FreshBooks…

La nostra opinione

Stanco della contabilità complessa? Oltre 30 milioni di aziende si affidano a FreshBooks per creare fatture professionali. Semplifica la tua software di contabilità Oggi!

Vantaggi principali

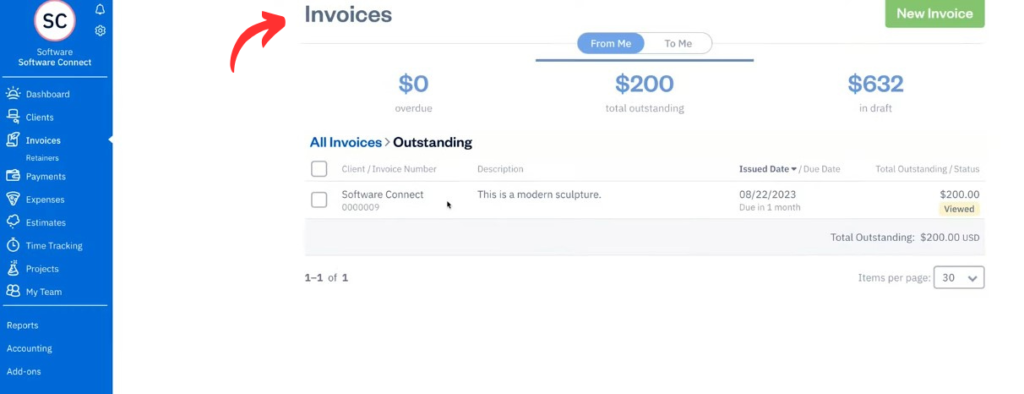

- Creazione professionale di fatture

- Promemoria di pagamento automatici

- Monitoraggio del tempo

- Strumenti di gestione dei progetti

- Monitoraggio delle spese

Prezzi

- Leggero: $2,10/mese.

- Più: $ 3,80/mese.

- Premio: $ 6,50/mese.

- Selezionare: Prezzi personalizzati.

Professionisti

Contro

Confronto delle funzionalità

Ecco un'analisi dettagliata del confronto tra Easy Month End e FreshBooks.

Esploreremo le caratteristiche principali per aiutarti a capire quale piattaforma è più adatta alle tue esigenze.

Le tue esigenze aziendali uniche mentre navighi nella scelta contabilità software.

1. Scopo principale

- Fine mese facile: L'unico scopo di questo strumento è quello di aiutare un team finanziario a gestire in modo più efficiente il processo di chiusura di fine mese. È una soluzione specializzata per attività specifiche del team finanziario.

- FreshBooks: Questa è una piattaforma di soluzioni software di contabilità più ampia per piccola impresa proprietari. Gestisce tutto, dalla fatturazione al monitoraggio delle spese e alla rendicontazione di base.

2. Fatturazione e pagamenti

- Fine mese facile: Questo strumento non ha alcuna funzionalità di fatturazione.

- FreshBooks: FreshBooks eccelle in questo. Puoi creare fatture professionali, impostare la fatturazione ricorrente e persino accettare pagamenti anticipati come carte di credito e pagamenti ACH direttamente. Questo semplifica l'accettazione dei pagamenti e ne velocizza l'esecuzione.

3. Chiusura e riconciliazione di fine mese

- Fine mese facile: Questo è il suo punto di forza principale. Fornisce un flusso di lavoro strutturato per gestire tutte le riconciliazioni. Ti aiuta a raccogliere revisione contabile prove e semplifica il processo, consentendo una chiusura mensile più fluida e riducendo errori e ritardi.

- FreshBooks: Gestisce la riconciliazione bancaria di base, ma non è concepito come strumento dedicato alle riconciliazioni formali dei bilanci o alla fornitura di documentazione per i revisori.

4. Collaborazione di squadra e flusso di lavoro

- Fine mese facile: È progettato per la gestione di team. È possibile assegnare attività al team finanziario, monitorare le approvazioni e lasciare commenti su un ticket per garantire che un'attività venga completata correttamente.

- FreshBooks: La piattaforma consente a più utenti di collaborare ai progetti. Tuttavia, le sue funzionalità di workflow non sono così approfondite o specifiche per i processi di chiusura come Easy Month End.

5. Reporting e contabilità

- Fine mese facile: Reporting is limited to the closing process itself. It’s not a full software di contabilità.

- FreshBooks: Fornisce report contabili standard, come profitti e perdite. Nei piani superiori, offre la contabilità in partita doppia e aiuta a monitorare la redditività del progetto.

6. Prezzi e piani

- Fine mese facile: Offre tre piani tariffari principali che si adattano alle dimensioni del tuo team.

- FreshBooks: Offre quattro piani, tra cui un piano Lite e un piano Plus, che si adattano al numero di clienti fatturabili e alle funzionalità di cui hai bisogno. In genere il prezzo è mensile.

7. Facilità d'uso e piattaforma

- Fine mese facile: La piattaforma è semplice ma pensata appositamente per i professionisti della contabilità che conoscono il flusso di lavoro di chiusura. È un'unica piattaforma per il suo scopo specifico.

- FreshBooks: Noto per la sua dashboard FreshBooks intuitiva, è considerato uno dei migliori software di contabilità per professionisti autonomi e piccola impresa proprietari grazie al suo design intuitivo.

8. Dati e integrazioni

- Fine mese facile: Si integra con altri software di contabilità come QuickBooks e Xero per importare dati per le riconciliazioni.

- FreshBooks: Si integra con oltre 100 app. Questo lo rende un ottimo hub per la gestione finanziaria, in particolare per un'azienda di servizi che utilizza altri software per gestire progetti e clienti.

9. Capacità mobili

- Fine mese facile: Questa è un'applicazione basata sul web. Non ha un'app mobile dedicata.

- FreshBooks: Ha un'app mobile FreshBooks molto apprezzata sia per iOS che per Android dispositiviPuoi gestire la tua attività ovunque ti trovi, con una semplice connessione Internet.

Cosa cercare quando si sceglie un software di contabilità?

- Tipo di attività: Sei un libero professionista, basato sui servizi o sui prodotti? Saranno le tue esigenze specifiche a suggerirti la soluzione più adatta.

- Scalabilità: Il software può crescere con la tua attività? Considera il futuro esigenze aziendali.

- Esigenze di integrazione: Si collega con gli altri tuoi strumenti (ad esempio, gateway di pagamento, CRM)?

- Accesso mobile: Hai bisogno di gestire le tue finanze mentre sei in movimento?

- Assistenza clienti: Che tipo di aiuto è disponibile in caso di problemi?

- Segnalazione Profondità: Hai bisogno di semplici panoramiche o di analisi finanziarie dettagliate?

- Sicurezza: In che modo la piattaforma protegge i tuoi dati sensibili? dati finanziari?

- Interfaccia utente: È facile da imparare e utilizzare per te e per gli altri membri del team? Questo è fondamentale per i nuovi utenti.

Verdetto finale

Dopo averli testati entrambi, consigliamo FreshBooks.

Mentre Easy Month End è ottimo per il suo processo dedicato alla fine del mese.

FreshBooks è una soluzione più completa per le piccole imprese.

La sua piattaforma gestisce tutto, dall'invio di fatture alla gestione dei progetti e monitoraggio del tempo.

In cambio dei tuoi soldi, FreshBooks ti offre un valore aggiunto giornaliero.

Il suo piano premium e altri piani tariffari offrono una gamma di funzionalità come fatture ricorrenti e pagamenti FreshBooks, semplificando le tue finanze e fornendo al tuo team finanziario gli strumenti che merita.

Per la maggior parte dei titolari di piccole imprese, semplificare la propria vita e gestire il denaro senza problemi è la scelta più intelligente.

Altro di Easy Month End

Ecco un breve confronto tra Easy Month End e alcune delle principali alternative.

- Fine mese facile vs Puzzle io: Mentre Puzzle.io è pensato per la contabilità delle startup, Easy Month End si concentra specificamente sulla semplificazione del processo di chiusura.

- Fine mese facile vs Dext: Dext è pensato principalmente per l'acquisizione di documenti e ricevute, mentre Easy Month End è uno strumento completo per la gestione delle chiusure di fine mese.

- Easy Month End vs Xero: Xero è una piattaforma di contabilità completa per le piccole imprese, mentre Easy Month End offre una soluzione dedicata per il processo di chiusura.

- Easy Month End vs Synder: Synder è specializzato nell'integrazione dei dati di e-commerce, a differenza di Easy Month End che è uno strumento di flusso di lavoro per l'intera chiusura finanziaria.

- Fine mese facile vs Docyt: Docyt utilizza l'intelligenza artificiale per la contabilità e l'inserimento dei dati, mentre Easy Month End automatizza i passaggi e le attività della chiusura finanziaria.

- Easy Month End vs RefreshMe: RefreshMe è una piattaforma di coaching finanziario, diversa da Easy Month End, che si concentra sulla gestione attenta.

- Fine mese facile vs. Salvia: Sage è una suite di gestione aziendale su larga scala, mentre Easy Month End offre una soluzione più specializzata per una funzione contabile critica.

- Easy Month End vs Zoho Books: Zoho Books è un software di contabilità completo, mentre Easy Month End è uno strumento appositamente studiato per il processo di fine mese.

- Fine mese facile vs. onda: Wave offre servizi di contabilità gratuiti per le piccole imprese, mentre Easy Month End offre una soluzione più avanzata per una gestione più attenta.

- Easy Month End vs Quicken: Quicken è uno strumento di finanza personale, il che rende Easy Month End la scelta migliore per le aziende che hanno bisogno di gestire la chiusura di fine mese.

- Easy Month End vs Hubdoc: Hubdoc automatizza la raccolta dei documenti, ma Easy Month End è progettato per gestire l'intero flusso di lavoro di chiusura e le attività del team.

- Fine mese facile vs Expensify: Expensify è un software di gestione delle spese, la cui funzione è diversa da quella principale di Easy Month End, incentrata sulla chiusura finanziaria.

- Easy Month End vs QuickBooks: QuickBooks è una soluzione contabile completa, mentre Easy Month End è uno strumento più specifico per la gestione della chiusura di fine mese.

- Fine mese facile vs. Inserimento automatico: AutoEntry è uno strumento di acquisizione dati, mentre Easy Month End è una piattaforma completa per la gestione delle attività e del flusso di lavoro durante la chiusura.

- Easy Month End vs FreshBooks: FreshBooks è pensato per i liberi professionisti e le piccole imprese, mentre Easy Month End offre una soluzione dedicata per la chiusura di fine mese.

- Easy Month End vs NetSuite: NetSuite è un sistema ERP completo, la cui portata è più ampia rispetto a quella di Easy Month End, focalizzata sulla chiusura finanziaria.

Altro su FreshBooks

- FreshBooks contro Puzzle IO: Questo software si concentra sulla pianificazione finanziaria basata sull'intelligenza artificiale per le startup. La sua controparte è per la finanza personale.

- FreshBooks contro Dext: Questo è uno strumento aziendale per l'acquisizione di ricevute e fatture. L'altro strumento tiene traccia delle spese personali.

- FreshBooks contro Xero: Questo è un popolare software di contabilità online per le piccole imprese. Il suo concorrente è per uso personale.

- FreshBooks contro Synder: Questo strumento sincronizza i dati dell'e-commerce con il software di contabilità. La sua alternativa si concentra sulla finanza personale.

- FreshBooks vs Easy Month End: Questo è uno strumento aziendale per semplificare le attività di fine mese. Il suo concorrente è per la gestione delle finanze personali.

- FreshBooks contro Docyt: Questo utilizza l'intelligenza artificiale per la contabilità aziendale e l'automazione. L'altro utilizza l'intelligenza artificiale come assistente finanziario personale.

- FreshBooks contro Sage: Si tratta di una suite completa per la contabilità aziendale. Il suo concorrente è uno strumento più semplice da usare per la gestione delle finanze personali.

- FreshBooks contro Zoho Books: Questo è uno strumento di contabilità online per piccole imprese. Il suo concorrente è per uso personale.

- FreshBooks contro Wave: Questo software di contabilità gratuito è pensato per le piccole imprese. La sua controparte è pensata per i privati.

- FreshBooks contro Quicken: Entrambi sono strumenti di finanza personale, ma questo offre un monitoraggio degli investimenti più approfondito. L'altro è più semplice.

- FreshBooks contro Hubdoc: Questo è specializzato nell'acquisizione di documenti per la contabilità. Il suo concorrente è uno strumento di finanza personale.

- FreshBooks contro Expensify: Questo è uno strumento per la gestione delle spese aziendali. L'altro è per il monitoraggio delle spese personali e la creazione di budget.

- FreshBooks contro QuickBooks: Questo è un noto software di contabilità per le aziende. La sua alternativa è pensata per la gestione delle finanze personali.

- FreshBooks contro AutoEntry: Progettato per automatizzare l'inserimento dati per la contabilità aziendale. La sua alternativa è uno strumento di finanza personale.

- FreshBooks contro NetSuite: Si tratta di una potente suite di gestione aziendale per grandi aziende. Il suo concorrente è una semplice app di finanza personale.

Domande frequenti

Qual è la differenza principale tra Easy Month End e FreshBooks?

Easy Month End si concentra principalmente sulla semplificazione del processo di chiusura contabile di fine mese e dei flussi di lavoro di riconciliazione. Al contrario, FreshBooks vs offre una soluzione di contabilità basata su cloud più ampia, che eccelle nella fatturazione, nel monitoraggio delle spese e nelle funzionalità di base. contabilità per liberi professionisti e piccole imprese.

FreshBooks può sostituire Xero o QuickBooks?

FreshBooks può rappresentare una valida alternativa per le aziende che danno priorità alla fatturazione e al monitoraggio dei progetti. Tuttavia, per esigenze più complesse di inventario, gestione delle paghe o contabilità avanzata, alcune aziende potrebbero comunque preferire soluzioni dedicate come Xero o QuickBooks.

Easy Month End è adatto anche alle piccole imprese o ai liberi professionisti?

Easy Month End è più utile per le piccole imprese o i team che hanno un processo di chiusura mensile strutturato. I liberi professionisti o le piccole imprese con esigenze più semplici potrebbero trovare FreshBooks più completo per la loro gestione finanziaria complessiva.

Queste piattaforme aiutano nella preparazione della dichiarazione dei redditi?

Entrambe le piattaforme forniscono report utili per la preparazione della dichiarazione dei redditi, come i rendiconti finanziari. Tuttavia, nessuna delle due offre servizi di dichiarazione dei redditi diretta. In genere, utilizzerai i loro dati finanziari per il tuo commercialista o per il tuo software.

Ci sono costi nascosti tra FreshBooks e Easy Month End?

Entrambi definiscono chiaramente i loro livelli di prezzo. FreshBooks addebita un costo per utente per i membri aggiuntivi del team e prevede commissioni di transazione per i pagamenti online. I prezzi di Easy Month End variano in base alle dimensioni e alle entità del team, quindi consulta sempre i dettagli specifici del piano per tutte le domande frequenti.