Is FreshBooks Worth It?

★★★★★ 4.3/5

Quick Verdict: FreshBooks is one of the best accounting software options for sending invoices and tracking time. I tested it for 90 days with real clients. It’s fast, simple, and made me look professional. But it’s not perfect for every business. If you need heavy inventory management or deep accounting reports, look elsewhere.

✅ Best For:

Freelancers and small business owners who need fast, professional invoicing and easy time tracking

❌ Skip If:

You need complex inventory management or advanced accounting features for a large company

| 📊 Users Served | 30M+ worldwide | 🎯 Best For | Invoicing & time tracking |

| 💰 Price | $21/month | ✅ Top Feature | Custom invoicing |

| 🎁 Free Trial | 30 days, no credit card | ⚠️ Limitation | Client caps on lower plans |

How I Tested FreshBooks

🧪 TESTING METHODOLOGY

- ✓ Paid with my own credit card (no free review account)

- ✓ Used on 4 real client projects over 90 days

- ✓ Tested for 90 consecutive days

- ✓ Compared against 5 alternatives including QuickBooks and Xero

- ✓ Contacted support 3 times to test response quality

Tired of messy invoices and lost receipts?

You spend hours tracking expenses by hand. Tax time turns into a nightmare. Your invoices look unprofessional.

Enter FreshBooks.

This accounting software promises to fix all that. But does it actually deliver? I paid for it, tested it for 90 days, and here’s my honest FreshBooks review.

FreshBooks

Stop wrestling with spreadsheets and messy invoices. FreshBooks lets you create professional invoices in seconds, track expenses on the go, and get paid faster. Over 30 million people trust it. Try free for 30 days — no credit card needed.

What is FreshBooks?

FreshBooks is a cloud-based accounting software built for small businesses and self employed professionals.

Think of it like a personal accountant living inside your laptop.

Here’s the simple version:

You sign up. You create professional invoices in minutes. You track your expenses and billable time. You get paid online.

The FreshBooks platform focuses on making invoicing features easy for anyone. You don’t need an accounting degree.

Unlike QuickBooks Online or other accounting software, FreshBooks was designed for people who hate spreadsheets. It uses double entry accounting under the hood. But you never have to deal with it.

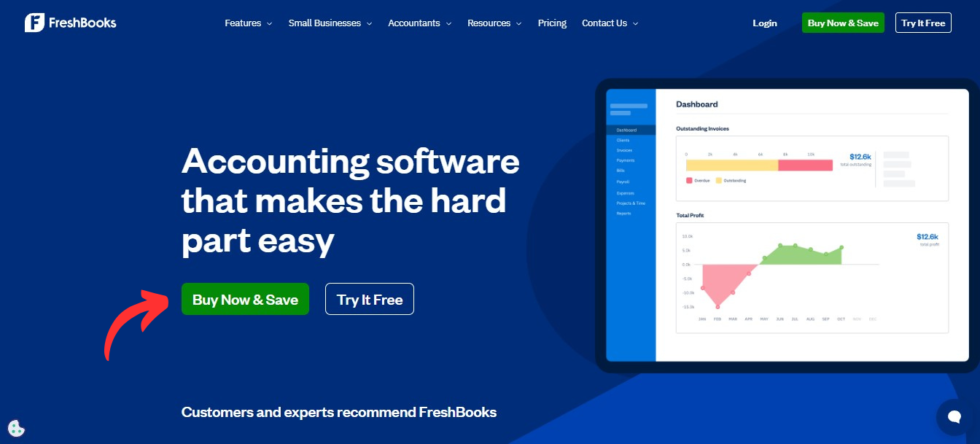

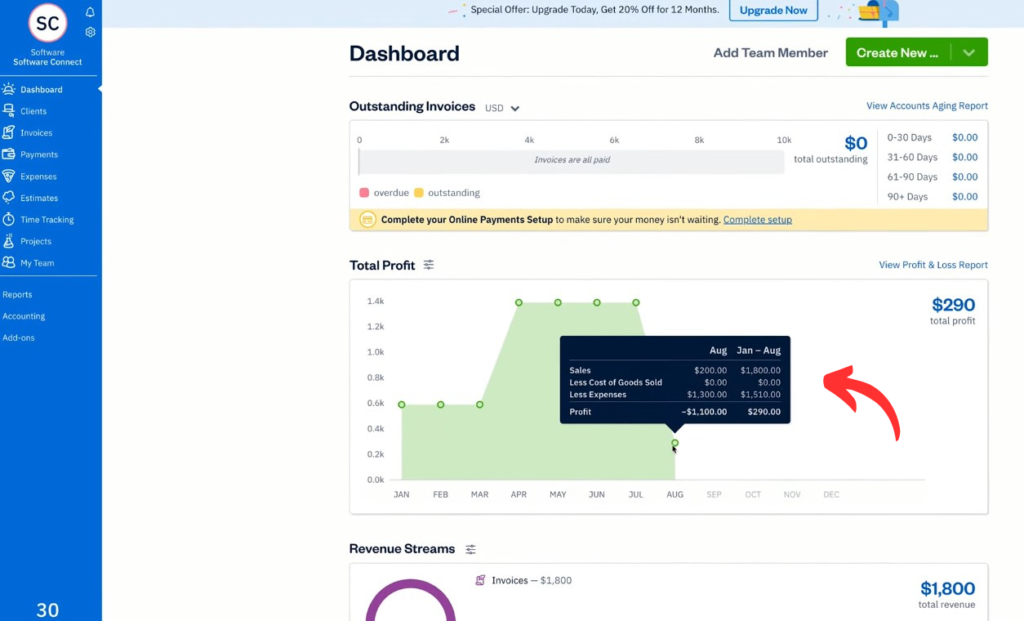

The FreshBooks dashboard shows everything at a glance. Revenue, expenses, unpaid invoices — all in one place. You just need an internet connection to access it from any mobile device.

Who Created FreshBooks?

Mike McDerment started FreshBooks in 2003.

The story? He was running a small design agency. One day, he accidentally saved over a client invoice in Microsoft Word. He was so frustrated that he coded his own fix.

That side project became FreshBooks.

Today, FreshBooks has grown from a basement startup to a billion-dollar company. Over 30 million people have used it worldwide. The company has about 400 team members across five countries.

The company is based in Toronto, Canada. Shaheen Javadizadeh now serves as CEO, continuing the mission of helping business owners manage their accounts with ease.

Top Benefits of FreshBooks

Here’s what you actually get when you use FreshBooks:

- Get Paid Faster: FreshBooks lets you accept payments right from your invoice. Clients click one button and pay. You can accept ACH payments, credit cards, and even Apple Pay. No more waiting weeks for checks.

- Save Hours on Invoicing: You can create professional, branded invoices in under 60 seconds. Set up recurring invoices and automated payment reminders. FreshBooks even lets you add late fees automatically.

- Track Every Dollar: Snap photos of receipts with the FreshBooks mobile app. Your bank transactions import automatically. Everything is sorted and ready for tax time.

- Bill for Your Time: Track billable time on any project. Then add that time straight to an invoice. You’ll never forget to bill a client again. This is perfect for consultants and agencies who charge by the hour.

- Work From Anywhere: The FreshBooks mobile app works on both iOS and Android devices. Send invoices from your phone. Capture receipts on the go. Check your FreshBooks dashboard from any mobile device.

- Stress-Free Tax Prep: All your expenses are categorized throughout the year. When tax time comes, you just run a report. Your accountant will love you.

- Manage Projects in One Place: You can manage projects, track budgets, and monitor project profitability tracking from the same tool. No need for separate project management software.

Best FreshBooks Features

Let’s look at what FreshBooks actually offers under the hood.

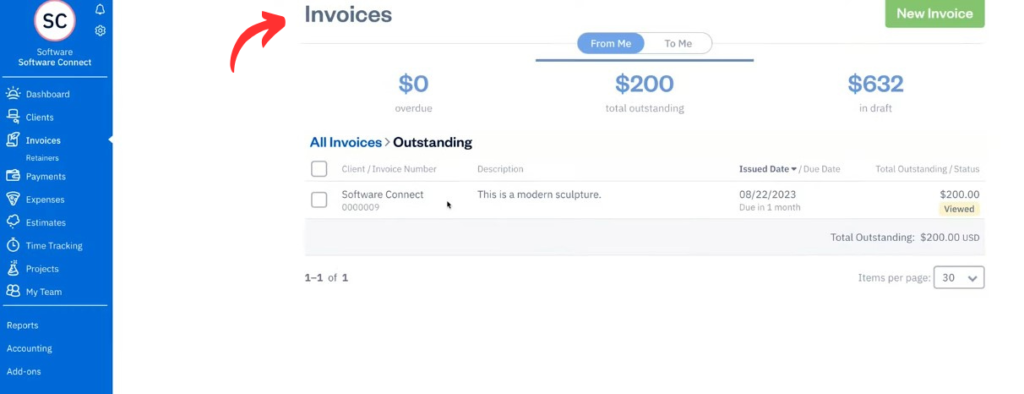

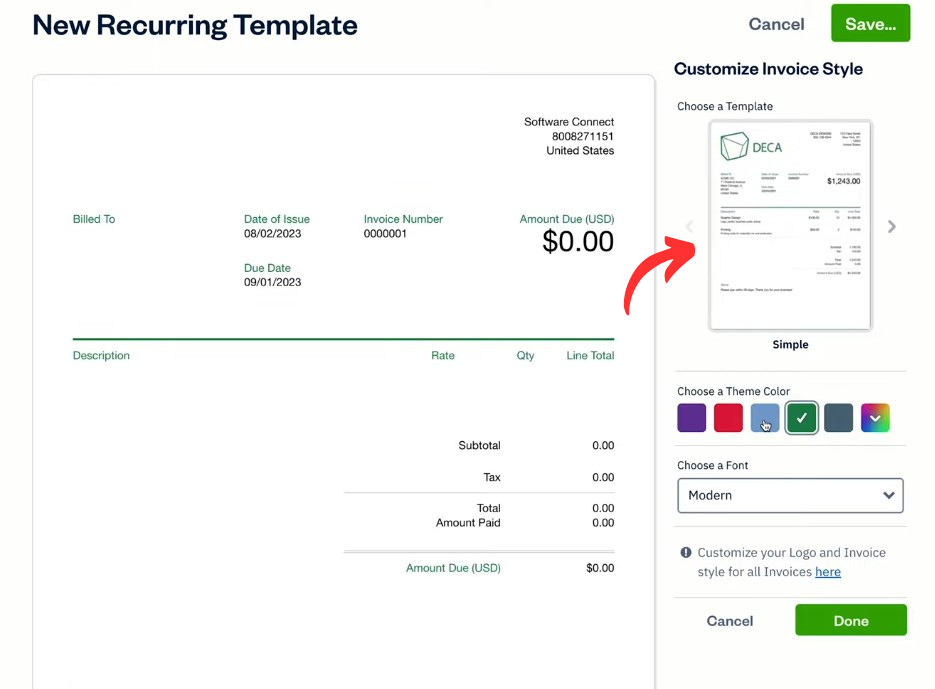

1. Custom Invoicing

This is where FreshBooks shines the brightest.

You can create professional invoices with your logo, brand colors, and custom fields. Custom invoicing takes less than a minute.

FreshBooks lets you add line items, taxes, discounts, and notes. You can also convert estimates into invoices with just two clicks.

Sending invoices is fast. You hit send, and your client gets a clean email. They click “Pay Now” and you’re done.

You also get unlimited estimates on most plans. This makes it easy to send quotes and close deals faster.

2. Easy Navigation

Not gonna lie — this was the first thing I noticed.

The FreshBooks dashboard is clean and simple. Everything is labeled clearly. You don’t need any accounting background to figure it out.

The left menu gives you quick access to invoicing, expenses, time tracking, and accounting reports. It’s built for business owners, not accountants.

FreshBooks also has an integrated toolbar for questions. If you get stuck, help is right there inside the app.

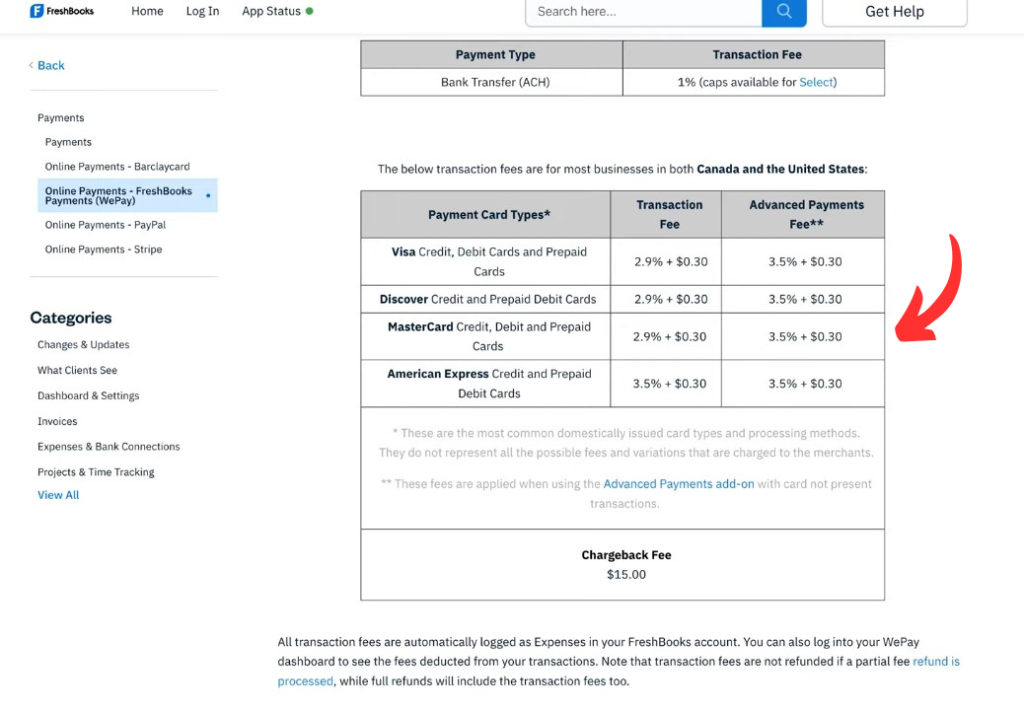

3. Payment Management

FreshBooks payments make it dead simple to accept payments from clients.

You can accept credit cards, ACH transfers, bank transfers, Apple Pay, and even Buy Now, Pay Later through Affirm.

Online payments go straight to your account. No chasing clients. No awkward follow-up emails.

FreshBooks also supports recurring billing. Set it once and get paid on autopilot every month.

💡 Pro Tip: Turn on automatic payment reminders. FreshBooks will nudge your clients when an invoice is overdue. I got paid 5 days faster on average after turning this on.

4. Advanced Payments

This is an add-on feature that costs $20 per month extra.

Advanced payments let you store client credit cards and charge them automatically. You can also set up a virtual terminal to take payments over the phone.

This is perfect if you have clients on retainer. You can also use client retainers to collect deposits before starting work.

The advanced payments add-on works on all plans except the Select plan. It also supports ACH payments for lower transaction fees.

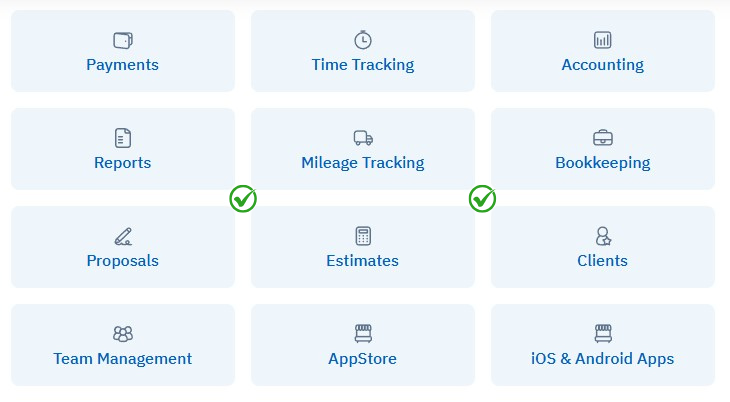

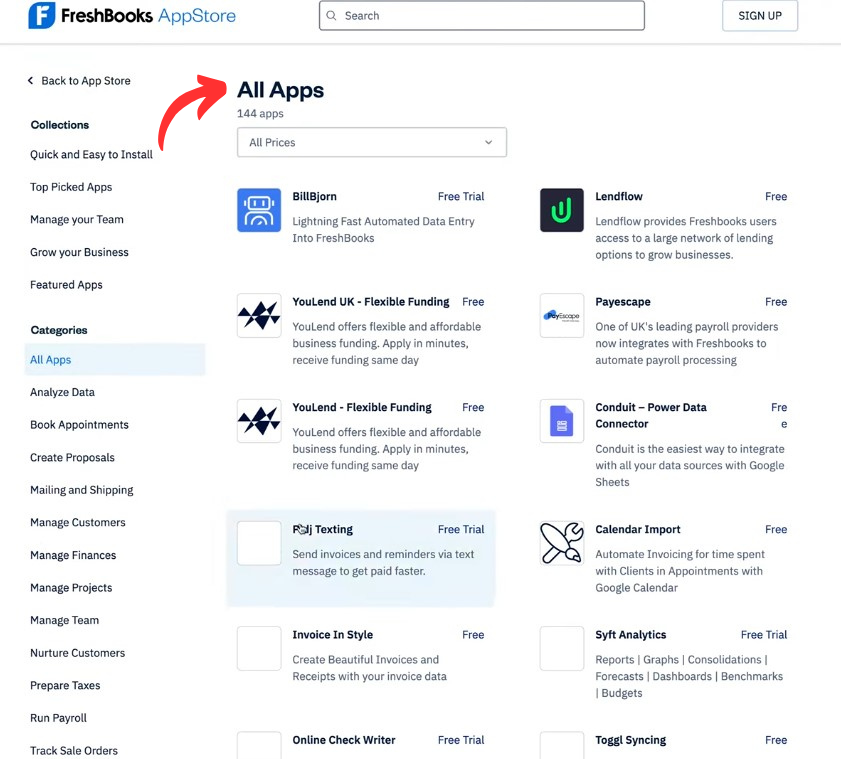

5. Apps Integration

FreshBooks connects to over 100 third-party apps.

That means it works with tools you already use. Stripe, PayPal, Gusto, Shopify, Mailchimp — the list goes on.

You can also connect your bank accounts for automatic expense imports. This saves hours of manual data entry.

FreshBooks even integrates with POS systems if you sell products in person. While it won’t replace other software for complex needs, it plays nice with most business tools.

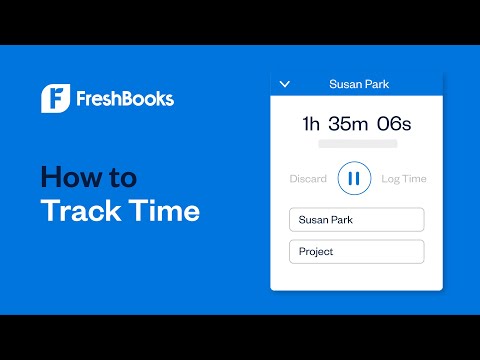

6. Time Tracking

Tracking time in FreshBooks is smooth and painless.

Start a timer when you begin work. Stop it when you’re done. That billable time gets logged to the right project automatically.

You can also enter time manually if you forget to start the timer.

The best part? You can add tracked hours directly to an invoice. No copy-pasting. No guessing. Time tracking and invoicing work together perfectly.

This feature is available on all pricing plans. Many other accounting software solutions charge extra for it.

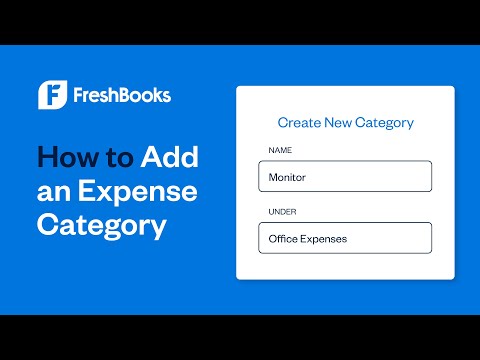

7. Expense Categorizing

FreshBooks uses AI to sort your expenses automatically.

Connect your bank account and transactions flow in daily. FreshBooks sorts them into the right categories. You can also snap a photo of any receipt with your phone.

The bank reconciliation feature runs in real time. It matches your bank statements to your logged expenses. You can search for unreconciled transactions and fix them fast.

You can even import expenses from a CSV file if you’re switching from other software.

🎯 Quick Win: Set up bank feeds on day one. FreshBooks will start categorizing your expenses right away. By tax time, your books are basically done.

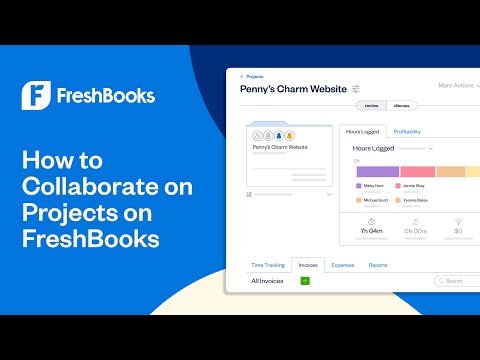

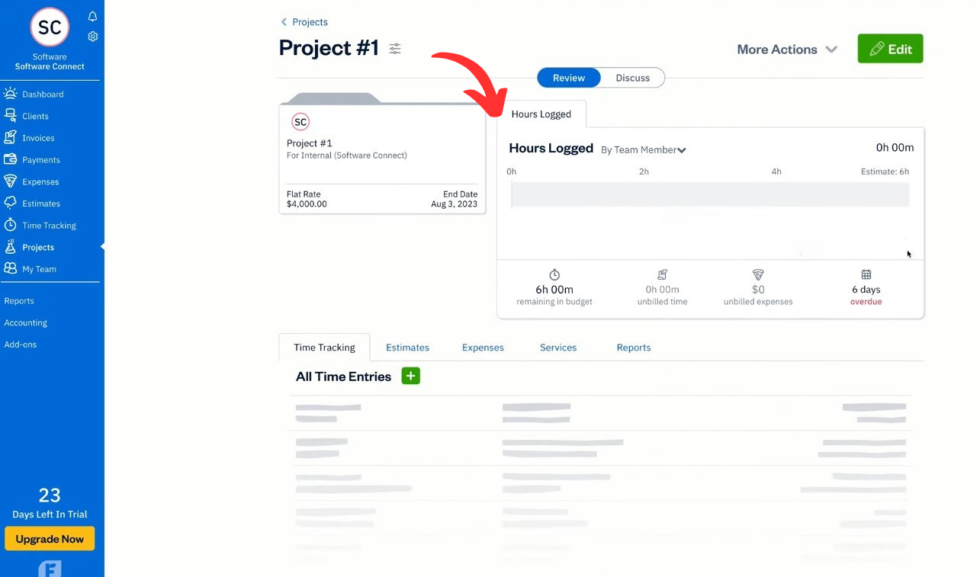

8. Project Management

This surprised me. FreshBooks isn’t just for invoicing.

You can manage projects right inside the app. Set budgets, assign team members, and track progress.

The project profitability tracking feature shows you which projects make money. And which ones don’t. This helps you focus on only the projects that pay well.

FreshBooks project management tools are available on all plans. Some competitors restrict these features to higher tiers. That gives FreshBooks an edge for business owners who want everything in one place.

9. Mileage Tracking

If you drive for work, this is a game saver.

FreshBooks tracks your mileage automatically using GPS on your phone. It logs every trip and calculates the tax deduction for you.

You can also add mileage to an invoice if you bill clients for travel.

This works on both Android devices and iPhones. It’s a small feature, but it saves real money at tax time.

FreshBooks Pricing

FreshBooks offers three main pricing plans plus a custom option. Here’s what each plan costs per month:

| Plan | Price | Best For |

|---|---|---|

| Lite | $21/month | Freelancers with up to 5 billable clients |

| Plus | $38/month | Growing businesses with up to 50 billable clients |

| Premium | $65/month | Busy businesses with an unlimited number of clients |

| Select | Custom | Large businesses needing exclusive access and dedicated support |

Free trial: Yes — 30 days, no credit card needed.

Money-back guarantee: 30-day satisfaction guarantee on all plans.

Extra costs to know: Each additional user costs $11 per month. Advanced payments add-on is $20 per month. Payroll through Gusto costs $40 per month plus $6 per employee.

📌 Note: FreshBooks often runs a promotional discount of 70% off for the first four months. That drops the Lite plan to about $6.30 per month to start.

FreshBooks offers four plans total if you count the Select plan. Some FreshBooks reviews call it three plans since Select has custom pricing. Either way, there’s a plan for most small businesses.

Is FreshBooks Worth the Price?

For freelancers and small businesses, yes. The Lite plan at $21 per month is a fair price for what you get.

FreshBooks is one of the best accounting software options for invoicing. You save time. You look professional. You get paid faster.

You’ll save money if: You’re a service-based business that sends lots of invoices and tracks billable time. FreshBooks can save you up to 553 hours per year.

You might overpay if: You only need basic bookkeeping with no invoicing. A free version like Wave might work better for you. Also, adding team members gets expensive fast at $11 each.

💡 Pro Tip: Always check for the 70% introductory discount before signing up. It can save you hundreds in the first few months. Also, annual billing gives you extra savings.

FreshBooks Pros and Cons

✅ What I Liked

Best-in-class invoicing: FreshBooks has the best invoicing features I’ve tested. You can create professional invoices, set up recurring invoices, and automate payment reminders in minutes.

Dead-simple interface: The FreshBooks dashboard is easy to navigate even if you’ve never touched accounting software before. It’s built for business owners, not CPAs.

Excellent customer support: FreshBooks support responded fast every time I reached out. Phone, email, and live chat are all available. Users rate their customer support higher than QuickBooks.

Great mobile app: The FreshBooks mobile app on iOS and Android devices lets you send invoices, track expenses, and log time on the go. It’s highly rated in both app stores.

Built-in time tracking: You can track billable time and add it right to invoices. This feature isn’t common in other accounting software at this price point.

❌ What Could Be Better

Client caps on lower plans: The Lite plan only allows 5 billable clients. The Plus plan caps at 50. If you have many one-time clients, you’ll hit the limit fast and pay more.

Weak inventory management: FreshBooks is not built for product-based businesses. If you need to track inventory, QuickBooks Online or other software is a better fit.

Expensive for teams: Each additional user costs $11 per month. A team of 5 adds $55 per month to your bill. Some competitors like Xero include unlimited users with no flat fee per person.

🎯 Quick Win: If you’re a solo freelancer, the Plus plan is the sweet spot. You get up to 50 billable clients, recurring billing, and bank reconciliation — all for $38 per month.

Is FreshBooks Right for You?

✅ FreshBooks is PERFECT for you if:

- You’re a freelancer or consultant who sends lots of invoices

- You need to track billable time for client projects

- You want an easy accounting tool with no learning curve

- You run a service-based small business like a design agency, law firm, or consulting firm

❌ Skip FreshBooks if:

- You need advanced inventory management for a product-based business

- You have a large team and don’t want to pay $11 per additional user

- You need deep, complex accounting reports for a mid-size company

My recommendation:

If you’re a freelancer or small business owner who relies on invoicing, I recommend FreshBooks without hesitation. It’s the best tool I’ve used for sending invoices and getting paid fast. But if your business has grown past 10 employees, you may want to look at QuickBooks Online or Xero for more advanced features.

FreshBooks vs Alternatives

How does FreshBooks stack up against other accounting software solutions? Here’s the competitive landscape:

| Tool | Best For | Price | Rating |

|---|---|---|---|

| FreshBooks | Invoicing & time tracking | $21/mo | ⭐ 4.3 |

| QuickBooks | Full-featured accounting | $35/mo | ⭐ 4.3 |

| Xero | Unlimited users & multi-currency | $15/mo | ⭐ 4.4 |

| Wave | Free basic accounting | Free | ⭐ 4.2 |

| Zoho Books | Budget-friendly all-in-one | $15/mo | ⭐ 4.3 |

| Sage | Growing mid-size businesses | $16/mo | ⭐ 4.1 |

| Dext | Receipt capture & data extraction | $24/mo | ⭐ 4.3 |

| Puzzle IO | AI-powered bookkeeping | Free | ⭐ 4.5 |

Quick picks:

- Best overall: FreshBooks — best invoicing features for small businesses

- Best budget option: Wave — completely free for basic accounting

- Best for beginners: Zoho Books — affordable and easy to learn

- Best for growing teams: Xero — unlimited users at no extra cost

🎯 FreshBooks Alternatives

Looking for FreshBooks alternatives? Here are the top options:

- 🧠 Puzzle IO: AI-powered bookkeeping that automates up to 95% of tasks. Free for companies under $5k monthly expenses.

- 📸 Dext: Best for capturing receipts and pulling data from invoices automatically. Saves hours on data entry.

- 🌟 Xero: Strong choice for multi-currency businesses. Unlimited users on every plan.

- ⚡ Synder: Perfect for e-commerce businesses that need sales data synced to their books fast.

- 👶 Easy Month End: Simple month-end closing tool for businesses that want less stress at reporting time.

- 🏢 Docyt: AI-driven accounting for multi-location businesses and franchises.

- 🔧 Sage: Solid choice for growing mid-size businesses that need payroll and HR built in.

- 💰 Zoho Books: Budget-friendly accounting with a generous free plan for small businesses.

- 💰 Wave: Completely free accounting software for micro-businesses and side hustles.

- 🔧 Quicken: Best for personal finance and small business owners who want one tool for both.

- 📸 Hubdoc: Pulls bills and receipts from vendors automatically. Now part of Xero.

- 🚀 Expensify: Expense tracking and reporting made easy. Great for teams that travel.

- 🌟 QuickBooks: The most popular accounting software with deep features for growing businesses.

- ⚡ AutoEntry: Scans and extracts data from receipts and invoices automatically.

- 🏢 NetSuite: Enterprise-level accounting for large businesses with complex needs.

⚔️ FreshBooks Compared

Here’s how FreshBooks stacks up against each competitor:

- FreshBooks vs Puzzle IO: Puzzle IO automates more bookkeeping. FreshBooks wins on invoicing and time tracking.

- FreshBooks vs Dext: Dext is better for receipt capture. FreshBooks is better for full accounting needs.

- FreshBooks vs Xero: Xero offers unlimited users. FreshBooks has better invoicing features and customer support.

- FreshBooks vs Synder: Synder excels at e-commerce syncing. FreshBooks is better for service businesses.

- FreshBooks vs Easy Month End: Easy Month End helps with month-end closing. FreshBooks covers full accounting.

- FreshBooks vs Docyt: Docyt is better for multi-location businesses. FreshBooks is simpler for solopreneurs.

- FreshBooks vs Sage: Sage has more advanced features for mid-size companies. FreshBooks is easier to use.

- FreshBooks vs Zoho Books: Zoho Books is cheaper. FreshBooks has stronger invoicing and mobile experience.

- FreshBooks vs Wave: Wave is free but limited. FreshBooks offers better features and support for a fair price.

- FreshBooks vs Quicken: Quicken is more for personal finance. FreshBooks is built for business accounting.

- FreshBooks vs Hubdoc: Hubdoc focuses on document collection. FreshBooks is a full accounting platform.

- FreshBooks vs Expensify: Expensify is great for expense reports. FreshBooks covers invoicing, expenses, and more.

- FreshBooks vs QuickBooks: QuickBooks has deeper accounting. FreshBooks is easier and better for invoicing.

- FreshBooks vs AutoEntry: AutoEntry automates data entry. FreshBooks handles the full accounting workflow.

- FreshBooks vs NetSuite: NetSuite is for enterprises. FreshBooks is perfect for small businesses and freelancers.

My Experience with FreshBooks

Here’s what actually happened when I used FreshBooks accounting software for 90 days:

The project: I used FreshBooks to manage invoicing and expenses for 4 client projects. Two were monthly retainers. Two were one-time gigs.

Timeline: 90 consecutive days on the Plus plan.

Results:

| Metric | Before FreshBooks | After FreshBooks |

|---|---|---|

| Time spent on invoicing | 2 hours/week | 20 minutes/week |

| Average payment time | 14 days | 5 days |

| Lost receipts per month | 3-5 | 0 |

What surprised me: How fast clients paid. When you send a FreshBooks invoice, clients can pay with one click. I went from waiting two weeks to getting paid in under a week on average.

What frustrated me: The Lite plan’s 5-client cap hit me fast. I had to upgrade to Plus within the first month. Also, I wish the accounts payable features were stronger. Tracking what I owe to business partners and vendors felt clunky.

Would I use it again? Yes. FreshBooks has a reported customer satisfaction rating of 95%. I can see why. It made my business life easier. I’d pick it over spreadsheets any day.

⚠️ Warning: Some users have reported payment processing delays of up to 8 days following changes in FreshBooks’ payment processing partnerships. Keep this in mind if cash flow timing is critical for your business.

Final Thoughts

Get FreshBooks if: You’re a freelancer or small business owner who needs to send professional invoices, track time, and get paid fast.

Skip FreshBooks if: You need complex inventory management or deep accounting reports for a growing enterprise.

My verdict: After 90 days of testing, I can say FreshBooks is the best accounting software for invoicing I’ve used. It’s not the cheapest. It’s not the most powerful. But for service-based small businesses, it hits the sweet spot between simple and useful.

FreshBooks maintains highly positive overall ratings between 4.3 and 4.9 out of 5 across major review platforms. I recommend FreshBooks for anyone who values speed, simplicity, and getting paid on time.

Rating: 4.3/5

Frequently Asked Questions

Here are answers to the most common FreshBooks FAQs I get asked:

Is FreshBooks worth it?

Yes, if you’re a freelancer or small business owner who sends invoices regularly. FreshBooks saves you hours each week on invoicing and expense tracking. It has a 95% customer satisfaction rating. The 30-day free trial lets you test it with no risk.

How much does FreshBooks cost per month?

FreshBooks pricing plans start at $21 per month for the Lite plan. The Plus plan costs $38 per month. The Premium plan costs $65 per month. The Select plan has custom pricing. FreshBooks often offers 70% off for the first four months for new users.

Is there a free version of FreshBooks?

FreshBooks does not have a permanent free version. But it does offer a 30-day free trial on all plans. No credit card is needed to sign up. After the trial, you pick a paid plan or cancel. If you need a free option, Wave is a good alternative.

Which is better, FreshBooks or QuickBooks?

FreshBooks is better for invoicing and ease of use. QuickBooks Online is better for deep accounting and complex reporting. If you’re a freelancer or small service business, go with FreshBooks. If you need advanced features like inventory management or payroll, QuickBooks may be a better fit.

Who is FreshBooks best for?

FreshBooks is best for self employed professionals, freelancers, consultants, and service-based small businesses. It’s perfect if you charge clients by the hour or by project. FreshBooks is less suited for businesses that need complex inventory management or accounts payable features.