Is your accounting software giving you a headache?

Chasing payments or dreading tax season? You’re not alone.

Many small businesses struggle with disorganized finances.

Imagine a system that tracks every penny, sends invoices, and handles overdue payments effortlessly.

This article explores the 9 best FreshBooks alternatives, helping you find the perfect accounting tool to simplify your life.

Ready to take control? Let’s dive in!

What Are the Best FreshBooks Alternatives?

Choosing the right accounting software can feel tricky.

You want something that works for your business, not against it.

We’ve dug deep to find the top tools that offer what FreshBooks does, and often much more.

Ready to find a perfect fit that makes managing your money easy?

Check out our top picks below!

1. Xero (⭐4.8)

Let’s talk about Xero. It’s a really popular cloud-based accounting tool.

Many small businesses love it, especially those who work with an accountant.

Think of it as a friendly helper for your business numbers.

It connects well with many other apps, too, which is super handy.

Unlock its potential with our Xero tutorial.

Also, explore our FreshBooks vs Xero comparison!

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

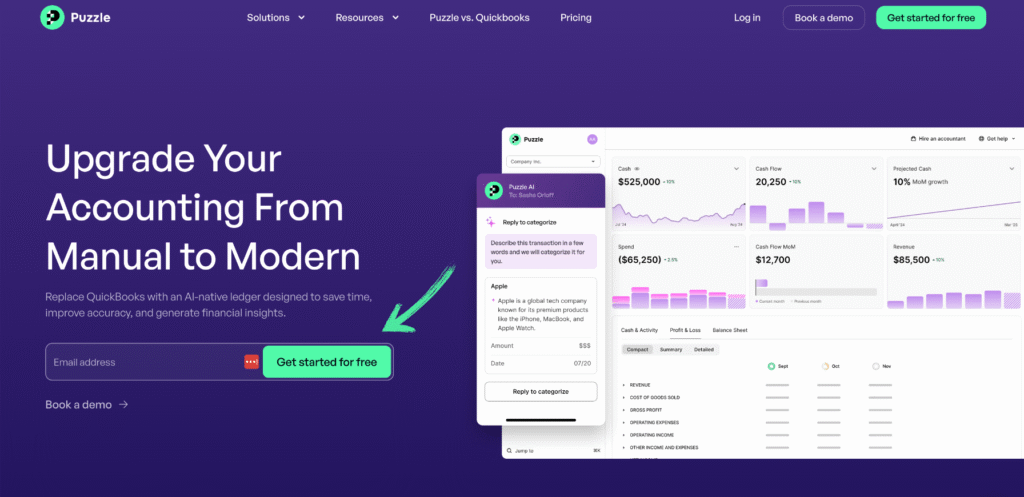

2. Puzzle IO (⭐4.5)

This is a newer accounting tool, especially for startups and tech firms.

It gives you real-time money insights.

Think of it as a smart dashboard showing your business’s exact financial spot.

It helps you make fast, smart choices.

Unlock its potential with our Puzzle IO tutorial.

Also, explore our FreshBooks vs Puzzle comparison!

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

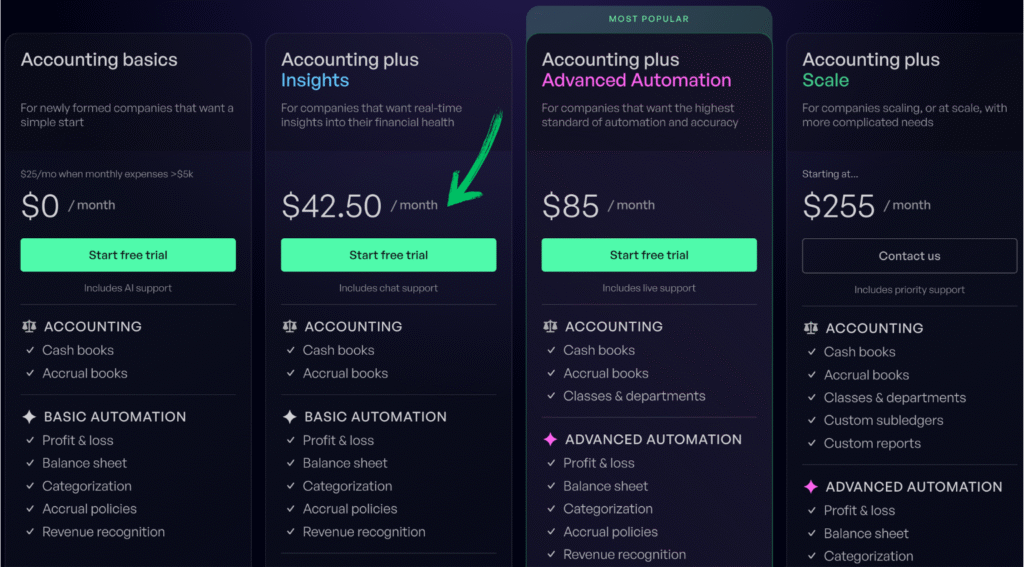

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

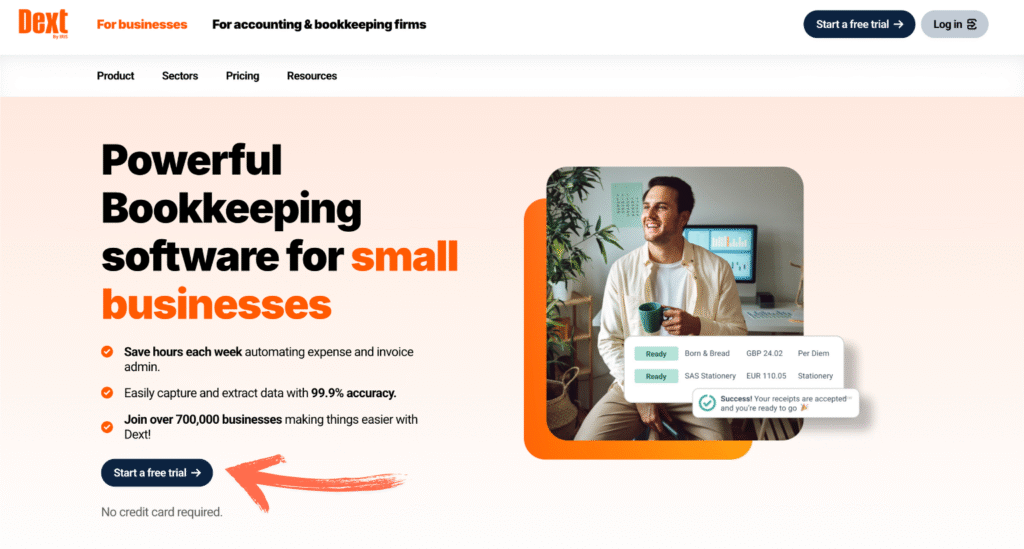

3. Dext (⭐4.0)

Think of it as a smart assistant for receipts and invoices.

It pulls information from your documents fast.

It’s great if you have lots of paperwork and want to go paperless.

It works well with other accounting tools.

Unlock its potential with our Dext tutorial.

Also, explore our FreshBooks vs Dext comparison!

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

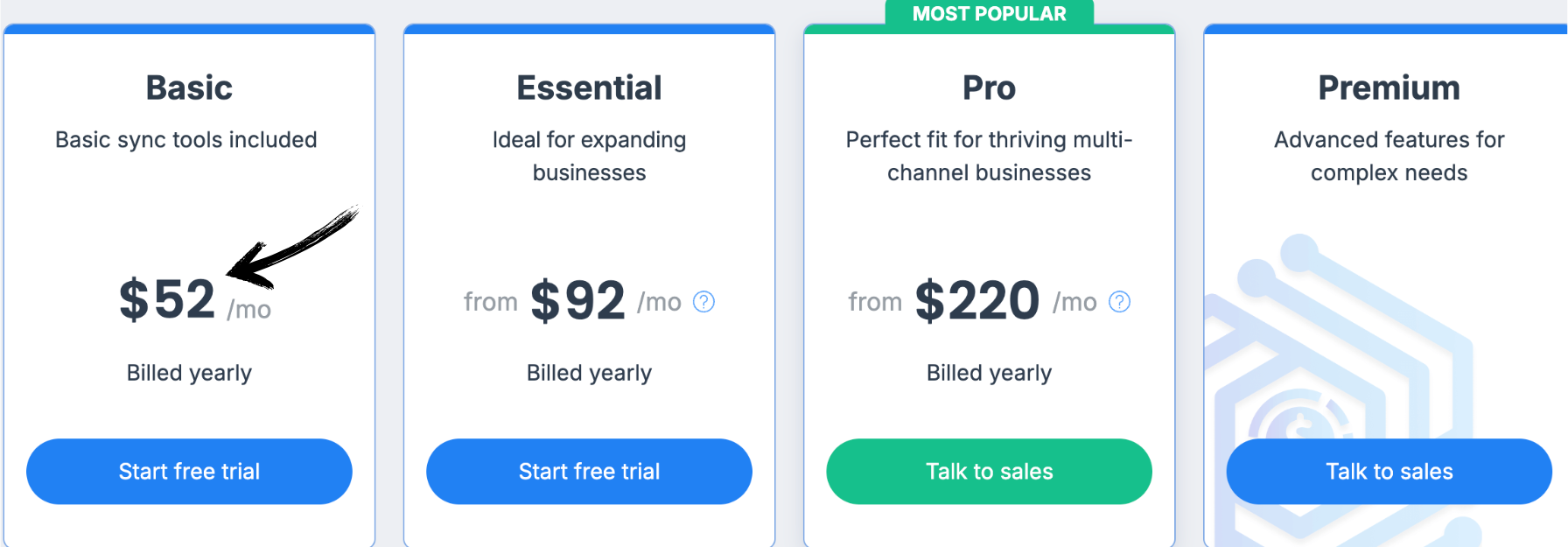

4. Synder (⭐3.8)

Synder is not a full accounting system. It’s a smart connector.

It syncs your sales data from online platforms like Shopify or Amazon directly to your accounting software.

Think of it as a bridge for your online sales numbers.

This saves time and stops errors.

Unlock its potential with our Synder tutorial.

Also, explore our FreshBooks vs Synder comparison!

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

5. Easy Month End (⭐3.6)

Easy Month End is not a full accounting system.

It helps accountants and businesses close their books each month.

Think of it as a checklist for your month-end tasks.

It makes sure you don’t miss anything. It’s for making the monthly closing process easier.

Unlock its potential with our Easy Month End tutorial.

Also, explore our FreshBooks vs Easy Month End comparison!

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

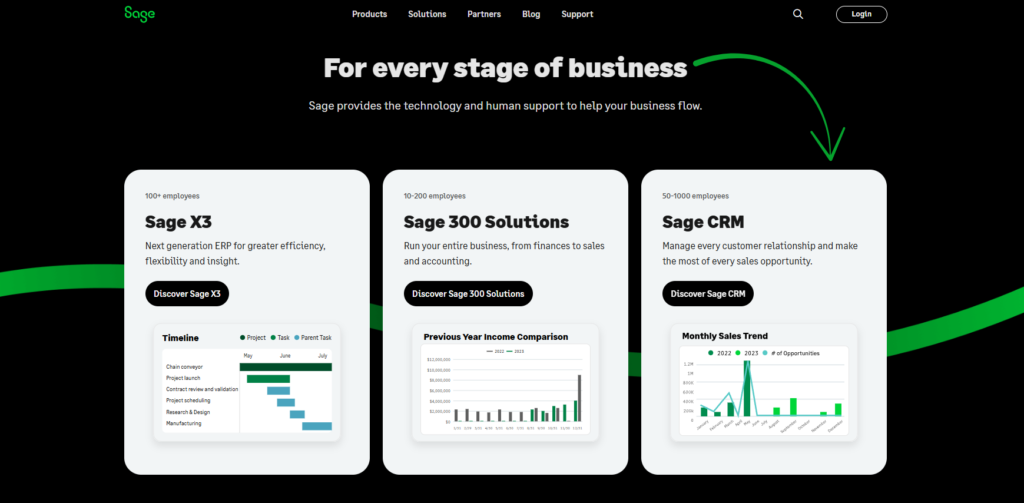

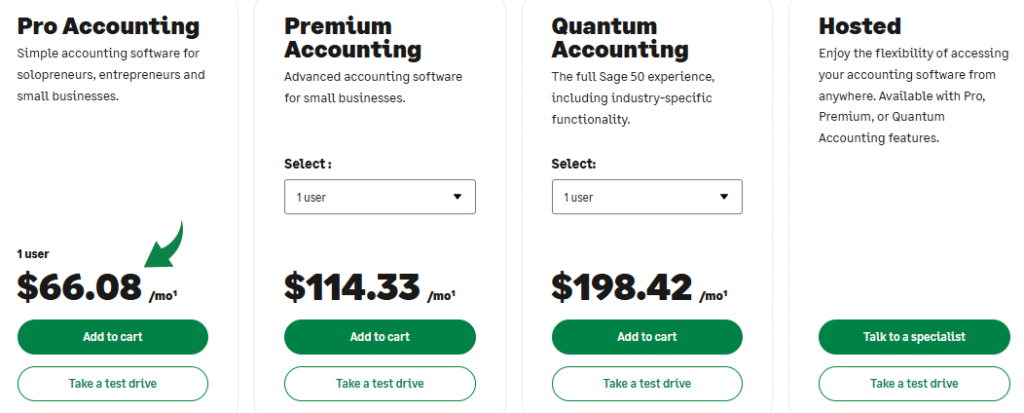

6. Sage (⭐️3.4)

Sage is a great choice if you want something mostly free.

It’s for small businesses, freelancers, and consultants.

It helps manage your money without big costs. Think of it as a helpful financial assistant on a budget.

Unlock its potential with our Sage tutorial.

Also, explore our FreshBooks vs Sage comparison!

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

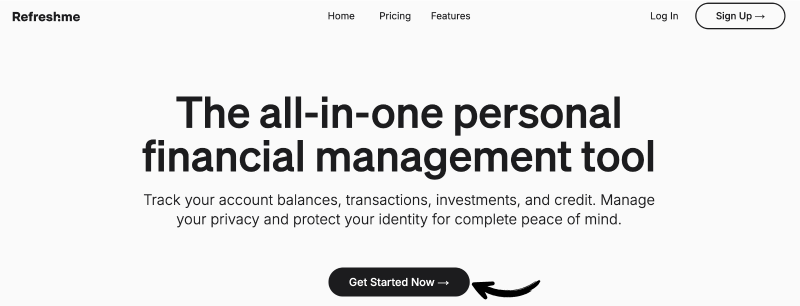

7. RefreshMe (⭐️3.3)

Let’s talk about RefreshMe. This tool manages expenses.

It’s like a personal assistant for receipts and spending.

It makes tracking every penny easy, especially for business trips.

It’s not a full accounting system, but it handles expense reports very well.

Unlock its potential with our RefreshMe tutorial.

Also, explore our FreshBooks vs RefreshMe comparison!

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

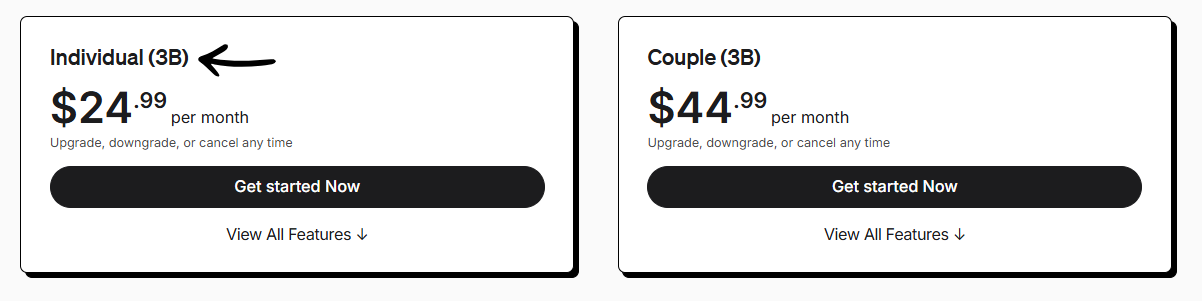

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

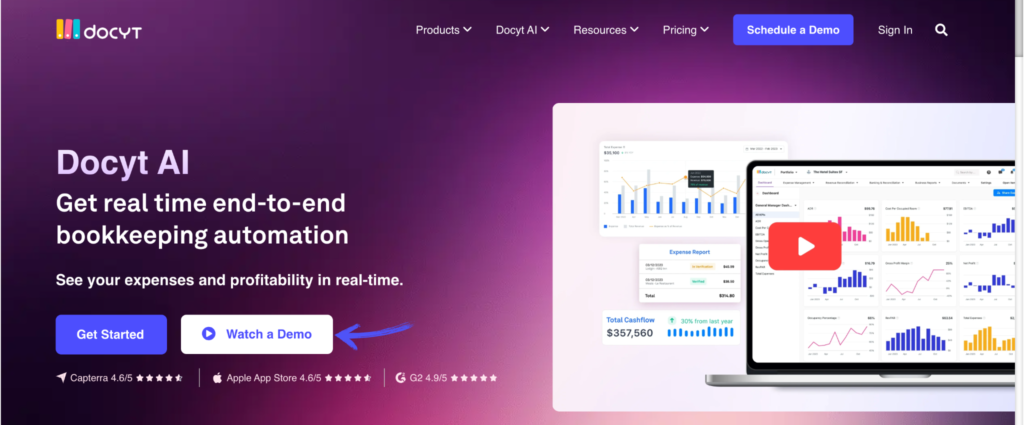

8. Docyt (⭐3.0)

Docyt is an AI-powered platform for business finance.

It automates many money tasks.

Think of it as a smart robot for bookkeeping, expenses, and payroll.

It gives you real-time financial views and keeps things accurate.

Unlock its potential with our Docyt tutorial.

Also, explore our FreshBooks vs Docyt comparison!

Key Benefits

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

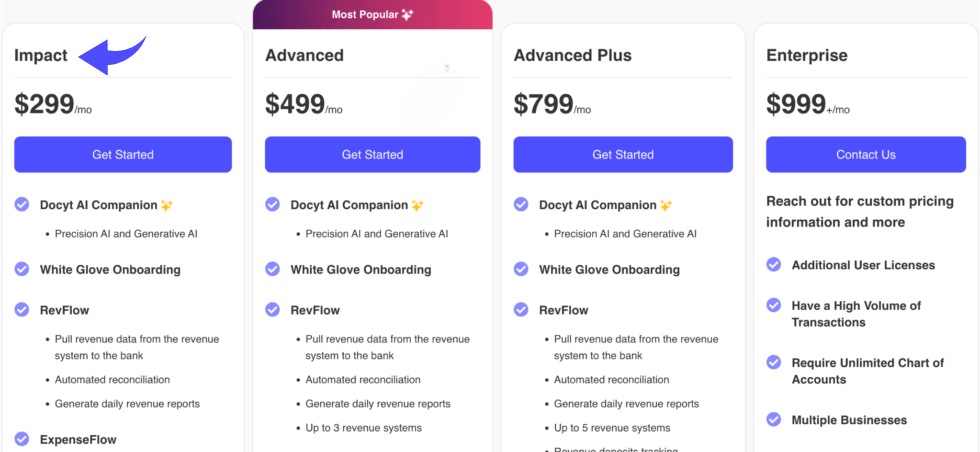

Pricing

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Pros

Cons

9. QuickBooks (⭐2.8)

QuickBooks is a very popular accounting software.

Many businesses use it to handle their money.

It tracks income, expenses, and payroll.

It’s a strong tool that can grow with your business.

Unlock its potential with our QuickBooks tutorial.

Also, explore our FreshBooks vs QuickBooks comparison!

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

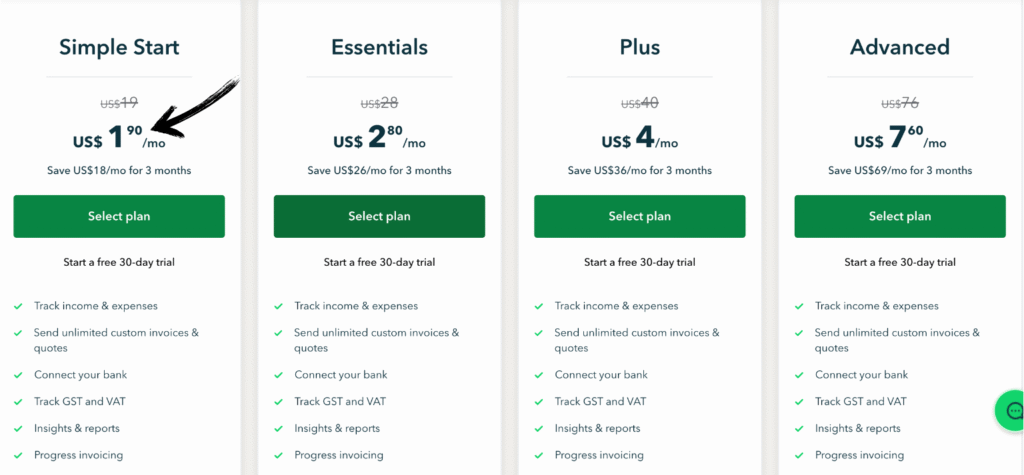

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

Buyers Guide

When researching the best accounting software to recommend as FreshBooks Alternatives, we followed a rigorous, multi-step process.

Our goal was to assess which accounting solutions offered the right balance of price, features, and support to genuinely help small business owners and drive business growth.

Here are the steps we took to ensure a comprehensive and objective evaluation:

1. Identify Target Audience Needs:

- We first defined the core needs of small business owners, focusing on essential functionalities like creating invoices, time and expense tracking, and managing basic business finances.

- We prioritized accounting features that improve cash flow, such as set automatic payment reminders and strong support for accounts receivable.

2. Determine Core Feature Set (Key Factors):

- We established a baseline of necessary key features any effective alternative must possess, moving beyond simple invoice creation to look at the comprehensive tools needed for proper financial management.

- We gave extra weight to automation capabilities, such as the ability to automatically categorize expenses.

3. Factor-Based Research and Evaluation:

We conducted our research by systematically evaluating each potential alternative against these four critical factors:

- Pricing: We analyzed the cost structures to identify genuinely affordable accounting solutions. We looked past introductory offers to assess long-term affordable pricing and value compared to the comprehensive feature set.

- Features: This was the deepest dive, evaluating advanced functionalities and comprehensive feature set, including the quality of customizable invoice templates, robust invoicing, bank reconciliation, bill management, and time tracking. We also noted specialized needs like robust inventory management or resource management.

- Negatives: We documented specific missing components, such as a lack of built-in payroll services or poor multi currency support. We checked if the right accounting software required integration with other business tools for core financial tasks.

- Support or Refund: We assessed the availability of responsive customer support (e.g., live chat or phone) and the quality of the money-back guarantee or free trial offered to new users.

4. Usability and Platform Review

- We assessed the intuitive user interface of each cloud based accounting platform to ensure ease of use for non-accountants.

- We reviewed the integration quality for critical features like bank accounts connection, payment processing, and linking with common payment gateways.

5. Advanced Capabilities Assessment

- For scaling businesses, we specifically checked reporting capabilities, including the ability to generate basic financial reporting and advanced reporting (financial reports).

- We noted providers offering services often associated with enterprise resource planning (ERP), such as integrated inventory tracking and global payroll solutions (or the ability to manage payroll easily).

6. Final Recommendation and Review

- The final recommendations for the best accounting software were based on the software’s ability to consistently perform essential accounting tasks, provide strong automation capabilities (like set automatic payment reminders and automatically categorize expenses), and demonstrate a clear path for business growth.

- We confirmed the ability to quickly create professional invoices, create recurring invoices, and utilize payment reminders to improve cash flow and financial processes.

Wrapping Up

We hope this guide makes choosing your next Freshbooks Alternatives easy.

We studied everything: expense management, project management tools, subscription billing, and the best integration capabilities.

We especially looked for automated payment reminders that work.

You should listen to our advice because we don’t just look at cost.

We dig into the details so you get the best tool for your business growth.

Now you know how to find the best accounting software for your company!

Frequently Asked Questions

Which is better, FreshBooks or QuickBooks?

QuickBooks is the heavy lifter. It handles inventory, advanced reporting, and larger teams better than FreshBooks. However, FreshBooks offers a far superior, intuitive interface for self-employed professionals. Use FreshBooks if you sell services; use QuickBooks if you sell products.

Can I use FreshBooks for free?

Only for a short time. FreshBooks offers a 30-day free trial to test its features. After that, you must subscribe to a paid plan (Lite, Plus, or Premium). Unlike Wave, there is no permanent free tier available.

What are the disadvantages of FreshBooks?

The costs add up. Unlike competitors that allow unlimited users, FreshBooks charges extra for each additional team member. Furthermore, its inventory management features are quite basic compared to QuickBooks. It’s built for freelancers, not massive retail operations.

What is better than FreshBooks?

It depends on your needs. For growing businesses requiring complex inventory management or payroll, QuickBooks Online or Xero are often superior choices. If you need a completely free solution for basic bookkeeping, Wave is the industry standard. FreshBooks wins on simplicity.

Is Wave or FreshBooks better?

Wave is free; FreshBooks is paid. That’s the big difference. Wave is excellent for cost-conscious startups needing basic functionality. FreshBooks justifies its price with superior customer support, time tracking, and more polished invoicing automation. You get what you pay for.

What is the easiest bookkeeping software to use?

FreshBooks consistently wins awards for this. Its interface is designed for non-accountants, using plain language instead of jargon. While Wave and Xero are user-friendly, FreshBooks sets the gold standard for “plug-and-play” financial management for freelancers.

What is the parent company of FreshBooks?

FreshBooks is operated by 2ndSite Inc., a company founded by Mike McDerment in Toronto. It remains a private company, backed by investors like JPMorgan Chase and Oak Investment Partners, rather than being owned by a tech giant like Intuit.

More Facts about FreshBooks Alternatives

Facts About FreshBooks

- What it does: FreshBooks is famous for being easy to use. It helps business owners send bills (invoices), track time, manage projects, and monitor spending.

- Who it is for: It is great for freelancers and service businesses. However, it might not be the right fit for every company, especially those that sell products (inventory) or need very detailed reports.

- Pricing: FreshBooks has four different pricing plans. The cost depends on how many clients you bill and which features you need.

- Payroll: FreshBooks does not have its own payroll system. Instead, it connects with a service called Gusto to help you pay employees.

- Limitations: While FreshBooks is simple and affordable, it lacks some advanced tax and reporting features found in other software. As your business grows, you might need a tool with more options.

Facts About QuickBooks Online

- Why people choose it: QuickBooks Online is a top choice for businesses of all sizes because it has many powerful features and grows with you. It connects with over 750 other business apps.

- Features: It is better than FreshBooks for growing businesses that need to track inventory (products) and run complex reports.

- Pricing: QuickBooks Online offers four levels of pricing plans.

Facts About Xero

- Key benefit: Xero is very user-friendly and allows unlimited users to access the account without paying extra. This makes it great for teams.

- Features: It offers real-time dashboards and strong accounting tools. It is often seen as a middle ground between the ease of FreshBooks and the power of QuickBooks.

- Pricing: Xero generally offers three monthly subscription plans.

Facts About Wave Accounting

- Who it is for: Wave is perfect for very small businesses, freelancers, or “side hustles” that want to track money without a big monthly bill.

- Cost: It is a leading free option. Wave offers a free “Starter” plan that includes unlimited invoicing.

- Paid options: They also have a “Pro” plan (around $16 a month) for users who need more advanced features.

Facts About Zoho Books

- What it offers: Zoho Books is cloud-based software made for growing businesses. It is known for its good automation (automating tasks for you) and its ease of customization.

- Pricing: It offers a free plan with basic features. For more tools, several paid plans are available. It also comes with a 14-day free trial.

Facts About Other Accounting Tools

- ZipBooks: This software has one free plan with limited access and three paid plans starting around $15 per month.

- Hiveage: This tool is known for being simple. It lets you send bills once or set them to repeat automatically. It offers a free plan and paid plans starting at $16-$19 per month.

- Kashoo: This is a strong alternative to FreshBooks because it offers “double-entry” accounting (a professional method) and allows unlimited users.

- Expensify: This platform focuses mostly on tracking receipts and business expenses rather than full accounting.

- Sage 50: This is best for older, established businesses that do complex work, such as manufacturing or shipping products.

- NetSuite: This is a massive system for very large companies that need to manage everything from money to supply chains.

- DayZero & Puzzle io: These are newer tools. DayZero uses AI to help online stores, while Puzzle Io helps startups track specific goals, such as “burn rate” (how fast they spend money).

What to Look for in Accounting Software

- Invoicing: Good software should make it easy to send bills to customers.

- Expense Tracking: It must help you keep an eye on where your money is going.

- Mobile Access: Being able to check your numbers from your phone is very helpful.

- Scalability: The software should be able to handle increased workload as your business grows.