Are you trying to figure out which accounting software is best for your business?

With so many choices, it can be tough!

Two popular options you might consider are Puzzle IO and QuickBooks.

Keeping track of money shouldn’t be a struggle, and neither should tasks you could automate.

In this article, we’ll compare Puzzle IO vs QuickBooks to help you decide which one is a better fit for you.

Overview

We’ve spent time exploring both Puzzle IO and QuickBooks.

Digging into their features and how they work for different business needs.

This comparison comes from hands-on experience and careful evaluation to give you a clear picture of what each offers.

Ready to simplify your finances? See how Puzzle IO can save you up to 20 hours a month. Experience the difference.

Pricing: Free Plan available. Paid plan starts at $42.50/month.

Key Features:

- Financial Planning

- Forecasting

- Real-time Analytics

Used by over 7 million businesses, QuickBooks can save you an average of 42 hours per month on bookkeeping.

Pricing: It has a free trial. Plan starts at $1.90/month.

Key Features:

- Invoice Management

- Expense Tracking

- Reporting

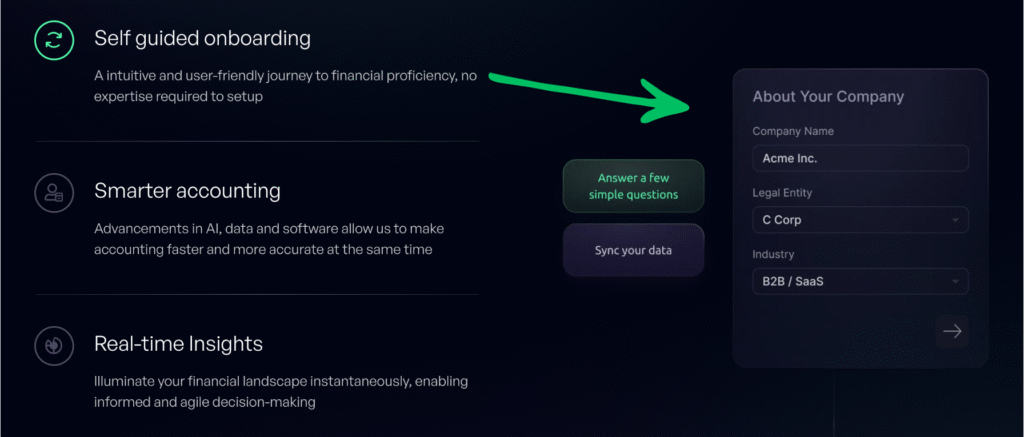

What is Puzzle IO?

So, Puzzle IO, what’s it all about?

Think of it as a tool that really helps you see into the future of your business finances.

It’s not just about what’s happening now, but what could happen.

Also, explore our favorite Puzzle IO alternatives…

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

What is QuickBooks?

Okay, let’s chat about QuickBooks. It’s probably a name you’ve heard.

Lots of small businesses use it to manage their day-to-day money stuff.

Think of it as a central hub for invoices, expenses, and tracking your business’s current performance.

Also, explore our favorite QuickBooks alternatives…

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

Feature Comparison

Here is a side-by-side look at how these two companies perform across key financial features.

This will give you the clear insights you need to choose the best solution for your small business.

1. Real-Time Metrics & Cash Runway

This is often a game-changer for early-stage founders and co-founders.

- Puzzle IO: Provides real-time insights into key metrics like cash runway and burn rate on a clean dashboard. This gives an up-to-date, accurate picture of the current state of the company quickly.

- QuickBooks: Requires more manual effort to get an accurate picture of these key metrics. Users often need to export business data to spreadsheets and calculate cash runway themselves, forcing them to wait longer for crucial information.

2. AI-Powered Automation & Transaction Categorization

Workflow automation is key to saving less time on tedious tasks.

- Puzzle IO: Features AI-powered workflow automation for transaction categorization directly into the general ledger. This is designed to reduce errors and make bookkeeping easier for non-accountants.

- QuickBooks: Has good automation for linking bank accounts and credit cards, but the transaction categorization often requires manual review, meaning non-accountants may spend more time fixing errors.

3. Revenue Recognition & Accrual Accounting

Handling complex accounting rules correctly is essential for proper revenue tracking.

- Puzzle IO: Offers built-in, automated revenue recognition and accrual accounting, which is vital for getting an accurate picture of revenue for investors. It ensures tax compliance without needing a full-time finance expert at an early stage.

- QuickBooks: While it supports accrual accounting, the complex rules for revenue recognition often require significant manual effort or an experienced accountant to set up and maintain correctly.

4. Fixed Assets and Prepaid Expenses

Properly tracking and depreciating assets and expenses is a must for tax time.

- Puzzle IO: Automates the tracking and depreciation of fixed assets and the accrual of prepaid expenses. This makes it much easier for startup founders to keep their books up to date and ready for their accountant at tax time.

- QuickBooks: Supports both fixed assets and prepaid expenses but requires more manual setup and journal entries, which can increase the chance of errors for non-accountants.

5. Financial Dashboard & Financial Insights

Getting instant visibility into your cash and revenue is a game-changer.

- Puzzle IO: The dashboard is built to give startup founders real time insights and actionable financial insights. It’s structured to provide a clear view of the current state of the company quickly.

- QuickBooks: The dashboards focus heavily on the general ledger and traditional financial statements. While powerful, the financial insights often require more digging, and getting an accurate picture can wait until your accountant closes the books.

6. Payroll Features

Handling employee and contractor payments is a regular requirement.

- Puzzle IO: Typically integrates with third-party services like Gusto or Rippling to handle payroll. It focuses on seamlessly recording the payroll transactions in the general ledger.

- QuickBooks: Offers integrated options like quickbooks payroll (including quickbooks full service bookkeeping with payroll) for direct deposit and contractor payments. This keeps payroll and accounting under one roof.

7. Desktop vs Online Version

Accessibility and features change based on the QuickBooks products used.

- Puzzle IO: Is an online version only, offering online access from anywhere.

- QuickBooks: Has two main quickbooks products: quickbooks online (cloud-based) and quickbooks desktop (local installation with a single computer license). QuickBooks Desktop has specific features that online versions lack.

8. Handling Bills and Purchase Orders

Managing money owed to vendors is vital for cash flow.

- Puzzle IO: Enables bill payment automation by tracking cash outflows and integrating with spend management platforms.

- QuickBooks: Provides robust features to pay bills, create invoices for customers, and use purchase orders to maintain accurate inventory records, especially in the QuickBooks desktop version.

9. Why Founders Chose Puzzle

A quick look at the mindset behind the choice.

- Puzzle IO: Many founders chose puzzle because it acts like quickbooks but with a modern, ai powered approach, saving less time on tedious tasks and providing deeper financial insights.

- QuickBooks: Users stick with QuickBooks because it is the accounting industry standard. The wide acceptance and comprehensive nature of Intuit QuickBooks for all small businesses is a major factor.

What to Look For When Choosing Accounting Software?

Here’s a quick checklist to keep in mind:

- Ease of Use: Is the interface intuitive? Look for an easy setup that helps you stay organized.

- Core Functions: Does it effectively track money, manage your chart of accounts, and handle reconciliation?

- Reporting Power: Can it easily generate essential reports like balance sheets and detailed financial reports to show your financial health?

- Automation: Does it minimize manual data entry and offer good workflow automation?

- Integration: Does it connect well with other tools you use, like QuickBooks Time for employee time or systems for managing sales?

- Tax Ready: Does it simplify sales tax calculations and tax preparation at year-end?

- Client Management: Can it handle billing for clients and send payment reminders?

- QuickBooks Specifics: Are you moving from desktop data and need the features that QuickBooks helps with, or are you self-employed and just need basic tracking?

- Costs & Support: Be aware of all potential fees before you sign up, and check QuickBooks reviews for insights on customer support and how easy it is to cancel.

- Final Thoughts: The best software is the one that gives your business the most benefits for the least amount of hassle.

Final Verdict

Choosing between a puzzle vs QuickBooks boils down to your needs.

If future planning and strong financial statements are key for your startup, you can try their free trial.

Puzzle IO could be great.

For everyday accounting features and lots of connections, QuickBooks wins.

While no fully free accounting software does it all.

Their plans suit many. We’ve checked them out.

And knowing your main goals will guide your choice.

More of Puzzle IO

We’ve looked at how Puzzle IO compares to other accounting tools. Here’s a quick peek at their standout features:

- Puzzle IO vs Xero: Xero offers broad accounting features with strong integrations

- Puzzle IO vs Dext: Puzzle IO excels in AI-powered financial insights and forecasting.

- Puzzle IO vs Synder: Synder excels in syncing sales and payment data.

- Puzzle IO vs Easy Month End: Easy Month End simplifies the financial closing process.

- Puzzle IO vs Docyt: Docyt uses AI to automate bookkeeping tasks.

- Puzzle IO vs RefreshMe: RefreshMe focuses on real-time monitoring of financial performance.

- Puzzle IO vs Sage: Sage provides robust accounting solutions for various business sizes.

- Puzzle IO vs Zoho Books: Zoho Books offers affordable accounting with CRM integration.

- Puzzle IO vs Wave: Wave provides free accounting software for small businesses.

- Puzzle IO vs Quicken: Quicken is known for personal and small business finance management.

- Puzzle IO vs Hubdoc: Hubdoc specializes in collecting documents and extracting data.

- Puzzle IO vs Expensify: Expensify offers comprehensive expense reporting and management.

- Puzzle IO vs QuickBooks: QuickBooks is a popular choice for small business accounting.

- Puzzle IO vs AutoEntry: AutoEntry automates data entry from invoices and receipts.

- Puzzle IO vs FreshBooks: FreshBooks is tailored for service-based business invoicing.

- Puzzle IO vs NetSuite: NetSuite offers a comprehensive suite for enterprise resource planning.

More of QuickBooks

- QuickBooks vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- QuickBooks vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- QuickBooks vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- QuickBooks vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- QuickBooks vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- QuickBooks vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- QuickBooks vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- QuickBooks vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- QuickBooks vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- QuickBooks vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- QuickBooks vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- QuickBooks vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- QuickBooks vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- QuickBooks vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- QuickBooks vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Which software is better for small to medium-sized businesses like QuickBooks?

It depends on specific accounting needs. QuickBooks is strong for general accounting, while others may offer niche features.

Can workflow automation improve my business finances with either software?

Yes, both Puzzle IO and QuickBooks offer features to automate tasks like invoicing and data entry, saving time.

How does Puzzle IO compare to the standard in the accounting industry?

Puzzle IO focuses on forecasting and AI-driven insights, a more modern approach compared to traditional software.

What are the key factors to consider when evaluating my business’s accounting needs?

Think about your budget, required features (like invoicing or payroll), integrations, and future growth plans.

Is it difficult to switch from one accounting platform (like QuickBooks) to another?

Switching can take time and careful planning to ensure data migration is accurate and your team adapts to the new system.