Tired of accounting headaches?

Many small business owners struggle with messy books.

What if you could simplify everything?

This article reveals the 9 best Wave Alternatives for 2025.

Discover tools that automate tasks, clarify finances, and reduce stress.

Find your perfect fit and free up your time. Ready to transform your accounting?

What Are the Best Wave Alternatives?

Choosing the top accounting software can be tricky.

You want something that works for your business, not against it.

We’ve looked at many options to bring you a hand-picked list.

Here are our top 9 recommendations, ranked from best to a close second, to help you make an informed decision.

1. Xero (⭐4.8)

Looking for something modern and easy? Xero is a top choice.

It’s built for small businesses. Think clean design and simple features.

It aims to make accounting less of a chore and more of a breeze.

Xero focuses on collaboration and cloud-based access.

Unlock its potential with our Xero tutorial.

Also, explore our Wave vs Xero comparison!

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

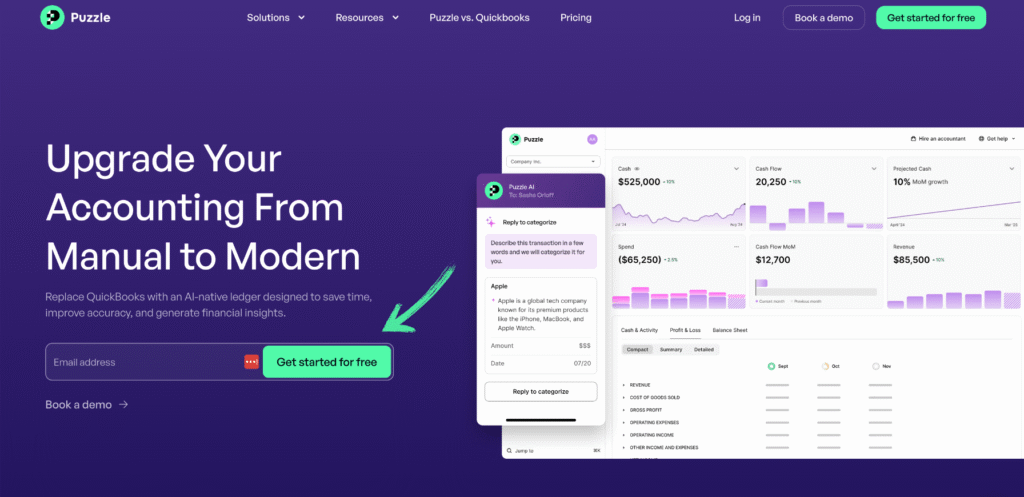

2. Puzzle IO (⭐4.5)

Puzzle IO is a new financial management software for startups and small businesses.

Instead, it gives you a super clear, real-time picture of your money, without all the confusing jargon.

Think of it as your financial dashboard, showing you exactly what’s happening with your cash.

Unlock its potential with our Puzzle IO tutorial.

Also, explore our Wave vs Puzzle IO comparison!

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

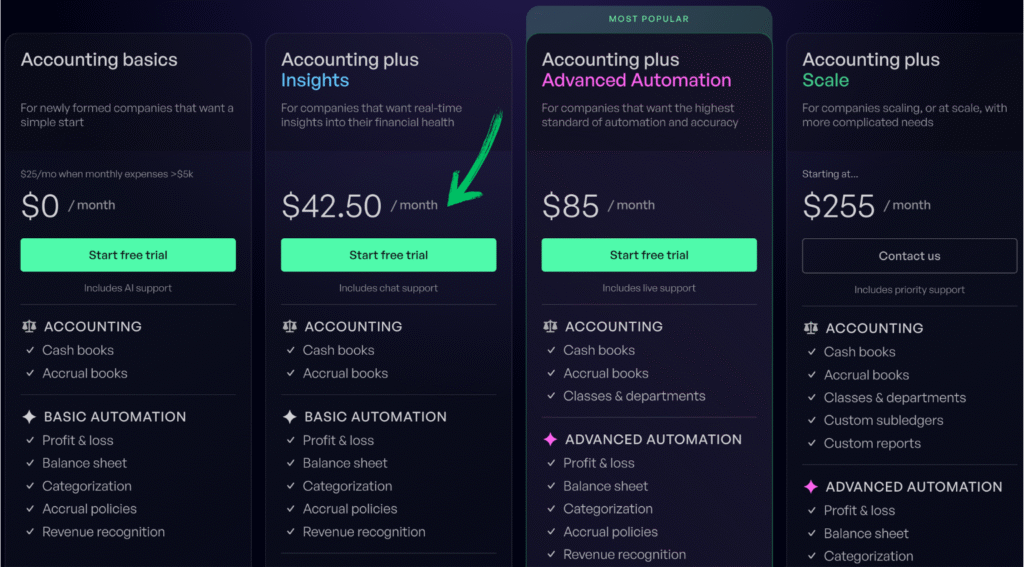

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

3. Dext (⭐4.0)

Dext (formerly Receipt Bank and GreenVault) is not exactly accounting software.

It’s more of an intelligent automation tool.

It helps you get data from receipts and invoices into your accounting software.

Think of it as a super-efficient data entry assistant. It saves you tons of time on manual data input.

Unlock its potential with our Dext tutorial.

Also, explore our Wave vs Dext comparison!

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

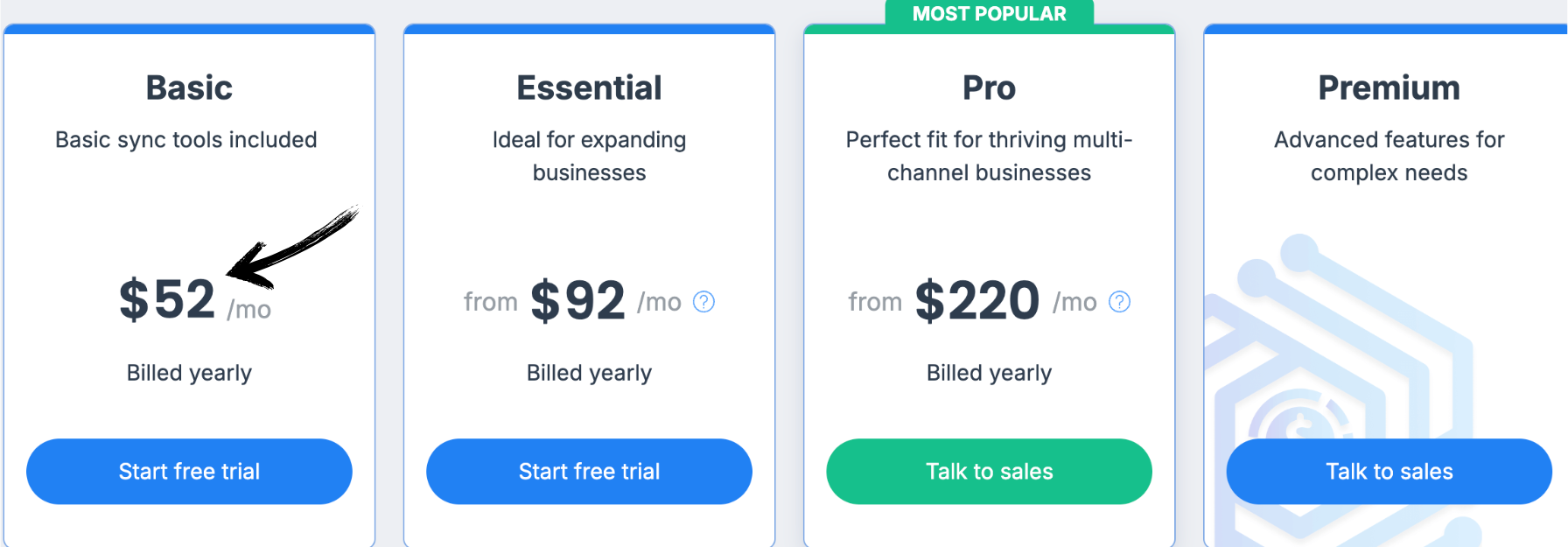

4. Synder (⭐3.8)

Wish your online sales auto-synced to your books?

Synder does just that! It’s not a full accounting alternative.

But it links e-commerce platforms (like Shopify) and payment processors (like Stripe) to your existing accounting software.

It saves online sellers a huge time on data entry.

Unlock its potential with our Synder tutorial.

Also, explore our Wave vs Synder comparison!

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

5. Easy Month End (⭐3.6)

Ever dread month-end closing? Easy Month End is built to make that process smooth.

It’s a workflow and reconciliation tool specifically for finance teams.

Think of it as your checklist, task manager, and reconciliation assistant all in one place.

It helps you manage your financial tasks and get things done on time, every time.

Unlock its potential with our Easy Month End tutorial.

Also, explore our Wave vs Easy Month End comparison!

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

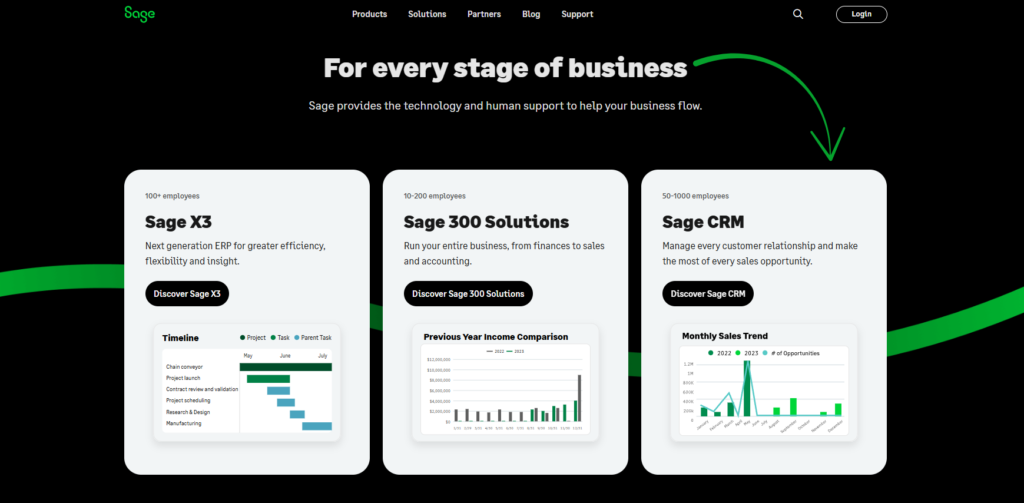

6. Sage (⭐️3.4)

So, Sage is a big name in the accounting world. They have been around for a while.

Their software uses AI to help with things like invoicing and bank reconciliation.

From small startups to large enterprises. It helps manage finances, payroll, and operations.

It’s a well-established name in accounting.

Unlock its potential with our Sage tutorial.

Also, explore our Wave vs Sage comparison!

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

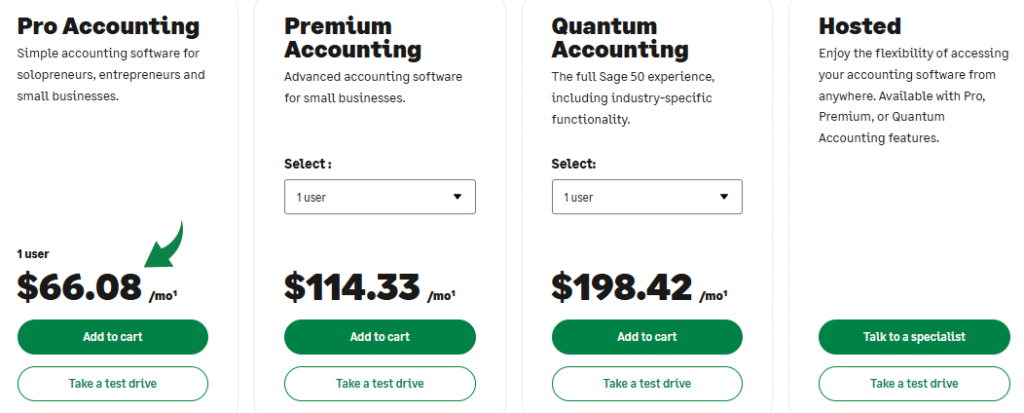

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

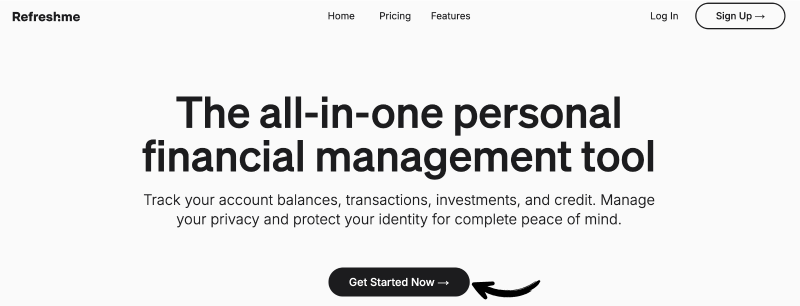

7. RefreshMe (⭐️3.2)

RefreshMe focuses on providing real-time financial insights and analysis using AI.

It aims to give business owners a clear and up-to-date view of their financial health, helping them make informed decisions quickly.

This tool can save you from a lot of headaches and make sure your data is accurate.

It’s a handy addition to your accounting routine.

Unlock its potential with our Refreshme tutorial.

Also, explore our Wave vs Refreshme comparison!

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

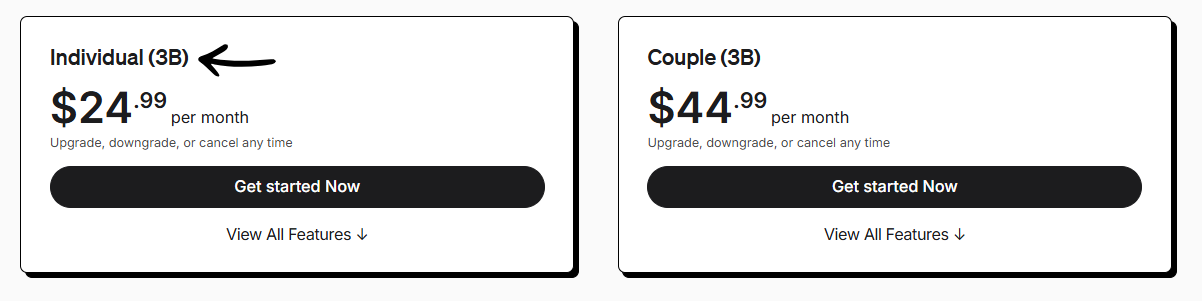

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

8. FreshBooks (⭐3.0)

If you’re a freelancer or a service-based business, FreshBooks might be your perfect match.

It’s built with project-based work in mind.

Think invoicing, time tracking, and expense management.

It simplifies how you bill clients and track your hours and is designed to save you time on admin tasks.

Unlock its potential with our FreshBooks tutorial.

Also, explore our Wave vs FreshBooks comparison!

Our Take

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

Key Benefits

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

Pricing

- Lite: $2.10/month.

- Plus: $3.80/month.

- Premium: $6.50/month.

- Select: Custom Pricing.

Pros

Cons

9. QuickBooks (⭐2.8)

QuickBooks is a huge name in accounting software.

Many businesses, especially in the US, use it.

It’s great for managing all your money tasks, like invoicing, tracking costs, and even payroll.

It’s a strong tool that can grow with your business.

Unlock its potential with our QuickBooks tutorial.

Also, explore our Wave vs QuickBooks comparison!

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

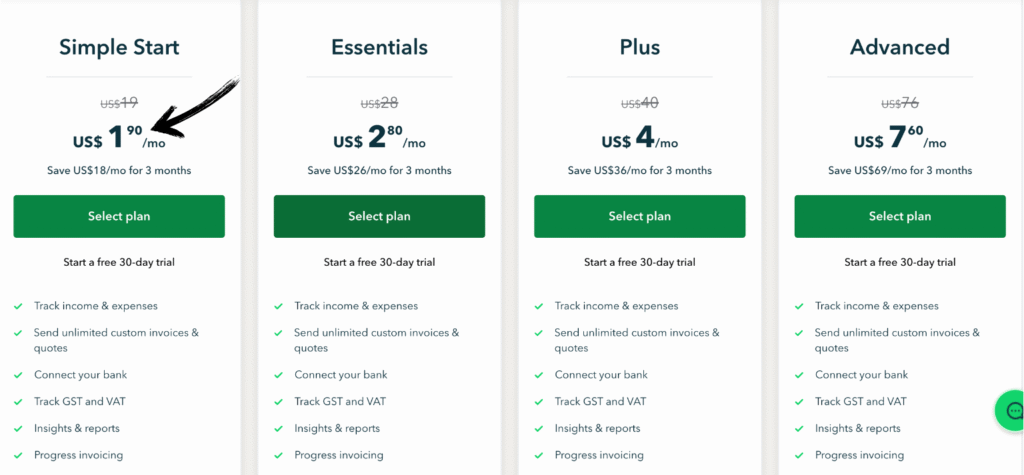

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

Buyers Guide

We conducted our research with a focus on the accounting software industry and what small business owners need to succeed.

- Defining the Market: We started by understanding the core function of Wave accounting software, which is a free invoicing and bookkeeping solution primarily for freelancers and new users. We then identified a list of Wave alternatives, including those that are completely free and those with two plans or more, to see what was available on the market for businesses of different sizes.

- Establishing Evaluation Factors: We developed a list of key features to evaluate each company and its software. These were:

- Pricing: We analyzed how much each product cost, from the starting price to different pricing plans. We considered if there was an option for unlimited invoicing for an unlimited number of customers, or if there were hidden fees that lead to unnecessary costs as a business grows. We also looked for free invoicing and payment processing options.

- Features: We meticulously reviewed the robust features of each product. This included core accounting tools like double entry accounting, general ledger, and the ability to send invoices, track expenses, and manage transactions. We also looked for advanced features like time tracking capabilities for multiple projects, project management tools, inventory management, contact management, and budgeting tools.

- Negatives: We looked for what was missing from each product, such as a lack of time tracking, limited features for larger businesses, or a more complex user interface for new users. We also identified any security concerns or limitations on the number of users or customers.

- Support or Refund: We investigated the level of customer support, including if they offered better customer support than Wave, and if they had a community or refund policy. We also looked for companies that offered multiple integrations to support business growth and help users get paid faster.

- Data Collection: We gathered information from official company websites, user reviews, and industry articles to get a full picture of each product. This included details on their contracts, bookkeeping methods, and how they handle payments.

- Analysis and Comparison: We used the data to create a side-by-side comparison, analyzing how each product performed based on our factors. We assessed which software was an excellent choice for a limited budget, and which offered the most value for businesses that need more complex features.

- Final Recommendation: Based on our comprehensive analysis, we formulated our final recommendations, highlighting the strengths and weaknesses of each product and providing clear guidance to small business owners on which Wave alternative is best for their specific needs.

- We considered the software’s ability to support multiple users, which is crucial as a business grows.

- We also evaluated if the following features were included: invoicing estimates, payment reminders to help get you paid faster, and many integrations with other popular business tools.

Wrapping Up

We’ve explored top Wave accounting alternative options.

Hopefully, this guide helped you discover powerful choices beyond Wave accounting, including QuickBooks Online.

We broke down features and pricing for each accounting alternative.

Many even offer a free trial or free account!

Choosing the right online accounting software for the small businesses is crucial.

While Wave is good, solutions with a monthly fee often provide stronger invoicing features.

Wave payroll integrations, avoiding a costly pro plan.

We’ve done the research, so you can pick the perfect management software and simplify your finances.

Frequently Asked Questions

Is Oracle NetSuite an ERP or CRM?

It is primarily a comprehensive cloud ERP (Enterprise Resource Planning) system. However, it includes a built-in CRM module. You get financials, inventory, and customer relationships in one unified platform, eliminating the need for separate, disconnected software.

Is there a free version of NetSuite?

No, NetSuite does not offer a free version or a free trial. It is a premium enterprise solution. Pricing is custom-quoted based on your modules and user count, requiring a consultation and demo to get started.

What is NetSuite’s biggest competitor?

Microsoft Dynamics 365 and SAP Business ByDesign are its fiercest rivals in the mid-market. For businesses focusing strictly on financials, Sage Intacct is a strong competitor, while Acumatica competes closely on the cloud-native ERP front.

Is Odoo better than NetSuite?

Odoo is modular, open-source, and significantly cheaper, making it great for smaller budgets or tech-savvy teams. NetSuite, however, offers superior out-of-the-box compliance, security, and scalability. Choose NetSuite if you need a robust, standardized enterprise engine.

Is Sage or NetSuite better?

Sage Intacct is a best-in-class financial management tool, often requiring integrations for other functions. NetSuite offers an “all-in-one” suite covering inventory, ecommerce, and CRM. If you want everything under one roof, NetSuite usually wins.

What is the NetSuite controversy?

Users frequently cite opaque pricing and significant cost increases upon contract renewal as major issues. Additionally, implementation is complex and expensive. It is not a quick-fix solution; it requires a serious long-term commitment.

Is SAP or NetSuite better?

SAP S/4HANA is the standard for massive, complex global multinationals. NetSuite is generally more agile, making it the preferred choice for fast-growing mid-sized companies or IPO-bound startups that need speed over extreme customization.

More Facts about NetSuite Alternatives

- QuickBooks is a very popular tool for small businesses to keep track of their finances. Most companies use this before they grow big enough to need a full business software system.

- SAP Business One: This is a starter software system made specifically for small and medium-sized companies.

- Why Use ERP: More businesses are using ERP systems to consolidate all their information in one place and streamline their daily work.

- Infor CloudSuite: This software is built for specific tasks, such as manufacturing or healthcare. It comes ready with the rules and steps those industries need to follow.

- Epicor: This software mostly helps companies that make, move, or sell goods. It handles the complicated parts of running those types of businesses.

- Shutterstock

- Workday: a system for medium- and large-sized companies. It mainly helps them manage their money and their employees (HR).

- Sage Intacct: This is the only accounting software the main professional accounting body (the AICPA) officially recommends.

- Epicor’s Strengths: People know Epicor for being easy to set up in different ways. It is very good at managing how products are made and moved to customers.

- Certinia (FinancialForce): This software works on the Salesforce system. It connects customer service teams with the team that manages the money.

- Ease of Setup: Many people think Sage Intacct is easier to get started with than NetSuite. Microsoft Dynamics can also be easier, but it depends on which version you choose.

- NetSuite’s Users: NetSuite is built for small and medium businesses, but some large companies use it as well.

- Workday’s Focus: Workday is software focused on finance and human resources (HR), primarily for medium- to large-sized companies.

- Cost of NetSuite: NetSuite often costs more in the long run than Odoo or Acumatica. Those other options usually have prices that are easier to predict.

- NetSuite Features: NetSuite offers very detailed features across all its modules. It tries to be just as good as software that focuses on only one specific task.

- NetSuite’s Design: NetSuite provides a set of tools that work together to run an entire business. This differs from some other systems that focus only on one part of a company.

- Setting Up NetSuite: Getting NetSuite ready for use is usually smoother than setting up older systems that must be installed on office computers.

- Buying Modules: NetSuite lets customers buy only the specific parts of the software they need right now.

- Odoo: a flexible system that lets you pick and choose from different apps. You only have to pay for the apps you actually use.