Is your accounting software a pain?

Many businesses struggle with confusing systems, hidden costs, or too many useless features.

It’s tough to manage finances, taking time away from growing your business.

But what if it didn’t have to be? This article shares the 9 best QuickBooks alternatives.

They’ll cut your financial stress, simplify bookkeeping, and save you money.

Find the perfect fit for your business!

What are the Best QuickBooks Alternatives?

Choosing new accounting software can be tricky.

There are so many options out there! We’ve done the hard work for you.

We looked at many choices to find the top ones.

Here is our list of the 9 best QuickBooks alternatives to help you decide.

1. Xero (⭐4.8)

Xero is a popular cloud-based accounting software.

It’s really user-friendly for small businesses. Xero isn’t just for data entry.

It helps you with invoices, bills, and bank reconciliation.

Plus, it works great with Hubdoc for document management.

Unlock its potential with our Xero tutorial.

Also, explore our QuickBooks vs Xero comparison!

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

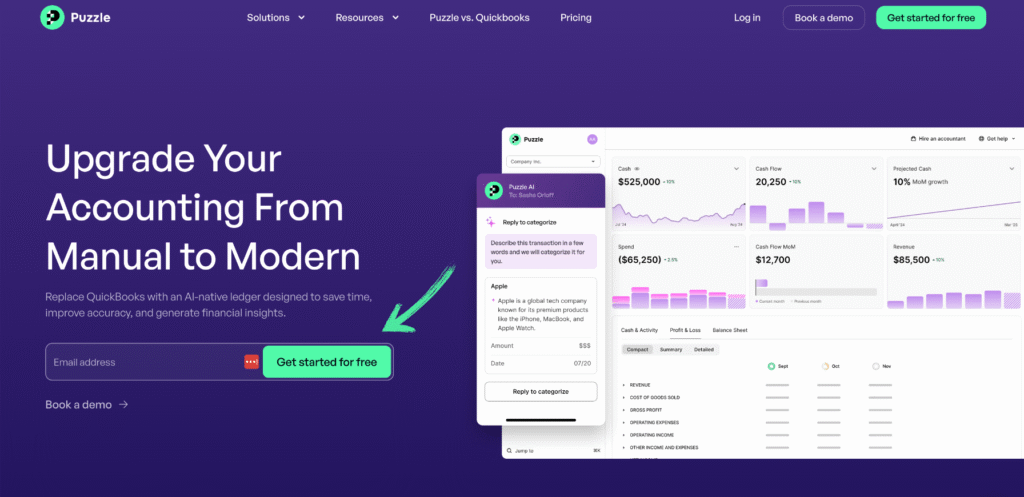

2. Puzzle IO (⭐4.5)

Puzzle IO is a new tool for startups and small businesses.

It focuses on automation and clear financial views, cutting down on manual work.

If you want a modern, simple way to manage money, Puzzle IO is worth a look.

Unlock its potential with our Puzzle IO tutorial.

Also, explore our QuickBooks vs Puzzle IO comparison!

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

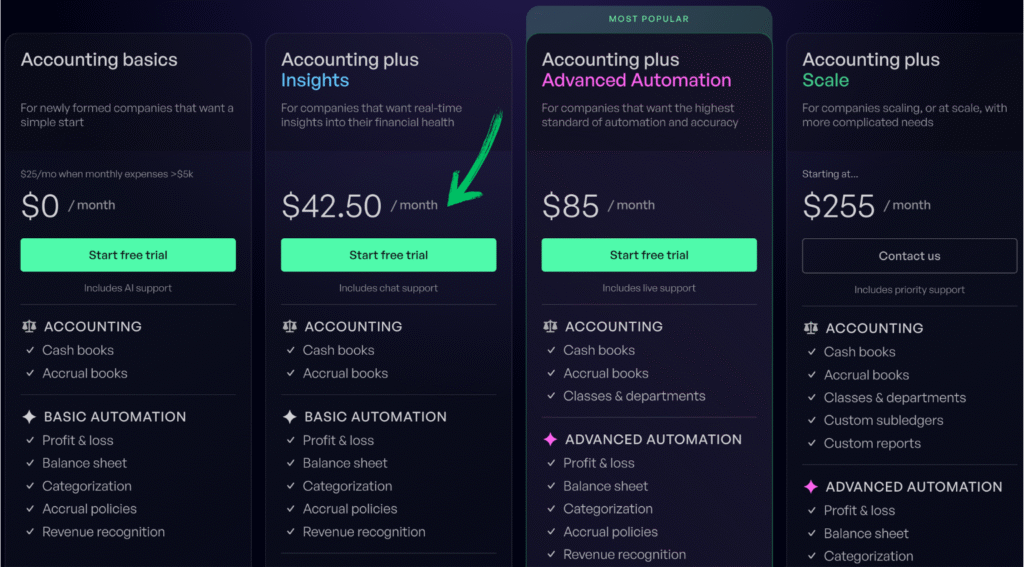

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

3. Dext (⭐4.0)

Dext (formerly Receipt Bank) helps automate document collection.

It’s like a digital assistant for receipts and invoices.

It links with many accounting software programs to make bookkeeping easier, though it’s not a full accounting system.

Unlock its potential with our Dext tutorial.

Also, explore our QuickBooks vs Dext comparison!

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

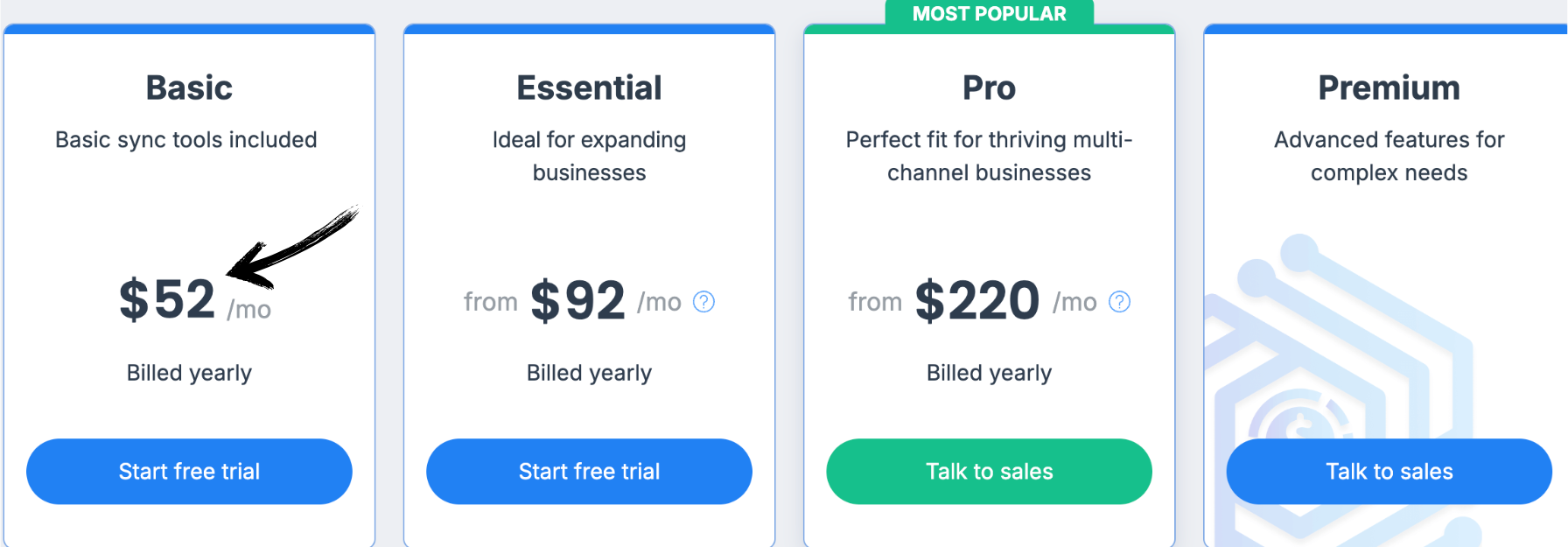

4. Synder (⭐3.8)

Synder helps e-commerce businesses by linking online sales to accounting software.

If you sell on Shopify, Amazon, or Stripe, Synder brings all that data together.

It aims to cut errors and show all your online sales in one place.

Unlock its potential with our Synder tutorial.

Also, explore our QuickBooks vs Synder comparison!

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

5. Easy Month End (⭐3.6)

Easy Month End is a tool designed to make your monthly financial close much simpler.

It’s built for finance teams. It helps you track tasks and manage reconciliations.

Think of it as your checklist, task manager, and reconciliation assistant all in one place.

It helps you manage your financial tasks and get things done on time, every time.

Unlock its potential with our Easy Month End tutorial.

Also, explore our QuickBooks vs Easy Month End comparison!

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

6. Sage (⭐️3.4)

So, Sage is a big name in the accounting world. They have been around for a while.

Their software uses AI to help with things like invoicing and bank reconciliation.

From small startups to large enterprises. It helps manage finances, payroll, and operations.

It’s a well-established name in accounting.

Unlock its potential with our Sage tutorial.

Also, explore our Quickbooks vs Sage comparison!

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

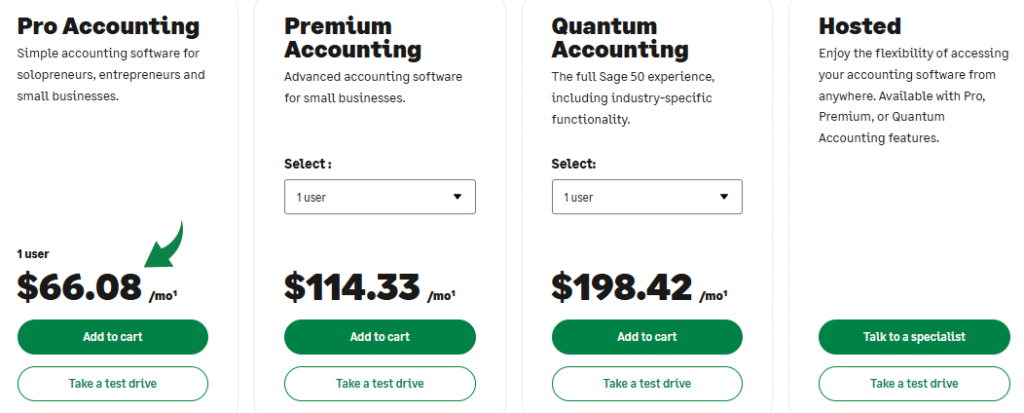

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

7. RefreshMe (⭐️3.2)

RefreshMe focuses on providing real-time financial insights and analysis using AI.

It aims to give business owners a clear and up-to-date view of their financial health, helping them make informed decisions quickly.

This tool can save you from a lot of headaches and make sure your data is accurate.

It’s a handy addition to your accounting routine.

Unlock its potential with our Refreshme tutorial.

Also, explore our Quickbooks vs Refreshme comparison!

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

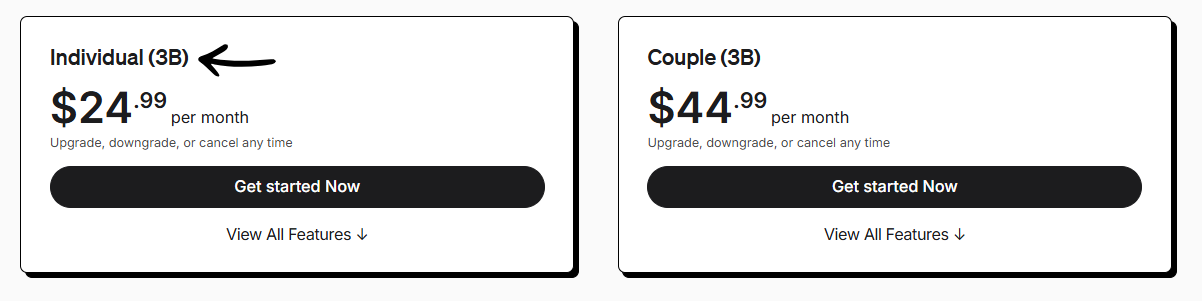

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

8. Docyt (⭐3.0)

Docyt is an AI-powered platform for finance and accounting.

It helps businesses automate their bookkeeping.

Think of it as a smart assistant for your money tasks.

If you want to use AI for your finances and reduce manual work, Docyt is a strong contender.

Unlock its potential with our Docyt tutorial.

Also, explore our Synder vs Docyt comparison!

Key Benefits

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

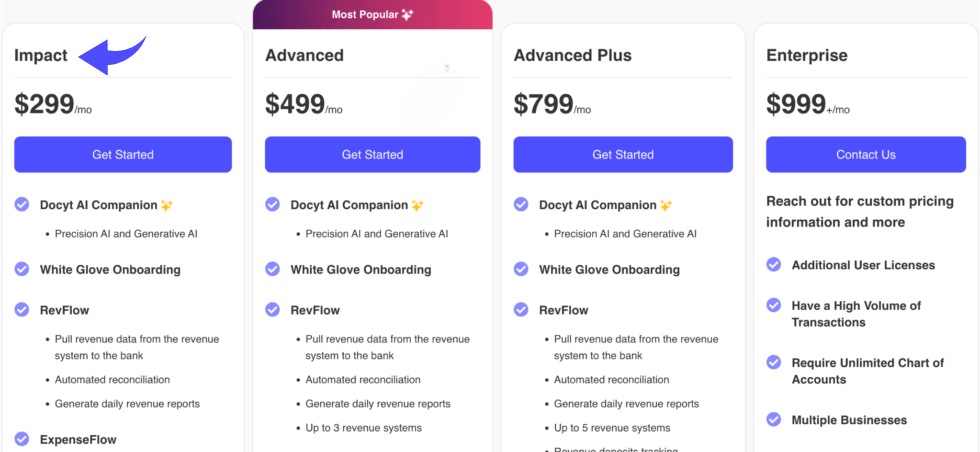

Pricing

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Pros

Cons

9. FreshBooks (⭐2.8)

FreshBooks is ideal for freelancers and service businesses.

It makes invoicing super simple.

If you send many bills and track projects, FreshBooks will save you time.

Unlock its potential with our FreshBooks tutorial.

Also, explore our QuickBooks vs FreshBooks comparison!

Our Take

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

Key Benefits

- Professional invoice creation

- Automated payment reminders

- Time tracking

- Project management tools

- Expense tracking

Pricing

- Lite: $2.10/month.

- Plus: $3.80/month.

- Premium: $6.50/month.

- Select: Custom Pricing.

Pros

Cons

Buyers Guide

When doing our research to find the best tool for accounting, we determined using these factors to find a great alternative to QuickBooks for small business owners and small business customers:

- Pricing: How much did each product cost? We looked at free accounting software options, free plans, and different pricing plans to help small businesses save money. We also considered whether the software was a cloud-based solution or a traditional desktop software, as this can affect cost.

- Features: What were the best accounting features of each product? We looked for a full featured accounting software that goes beyond basic accounting tools. This included advanced features like unlimited invoices, time tracking, recurring invoices, payment reminders, paid plan and the ability to manage invoices and accept payments. We also sought out software that had dedicated invoicing software and invoicing features. We looked for more advanced features such as double entry bookkeeping, inventory tracking, project management, and project tracking. For a comprehensive accounting solution, we also considered features like payroll online, the ability to run payroll, and the creation of professional invoices and create purchase orders. We also looked for helpful features such as a user friendly interface, a client portal or customer portal, and the ability to manage bank accounts, credit card transaction, and bank transfers, with helpful app integrations. This also included the ability to accept payments through a payment gateway, and accounting automation. We also considered if it had similar features to popular choices like Zoho CRM and Sage Accounting.

- Negatives: What was missing from each product? We identified any missing features that would prevent the software from being a great alternative. For example, some tools may be lacking in-depth reporting, or the ability to manage multiple companies. We also noted if a product lacked more advanced features or enterprise resource planning (ERP) capabilities. We also looked at the user experience, noting if the software was less intuitive and user friendly compared to others. We also noted if a product did not support online payments, ACH payments, or other important payment gateway options. We also considered if the software required a constant internet connection. We also looked at features for sales channels and contact data.

- Support & refund: Do they offer a community, support, & refund policy? We assessed the quality of customer support, whether they offered tax prep help, and if they could help with tax prep. We also evaluated if they offered helpful features like late payment reminders, and the ability to track expenses and time tracking. We looked at how well each accounting solution fit into a business’s existing tech stack and if it met the business needs.

Wrapping Up

Picking the best accounting software is a big deal for small business owners.

We’ve shown you a bunch of other QuickBooks alternatives, not just QuickBooks Online or QuickBooks Desktop.

It’s important to find an intuitive accounting software that has all the features you need.

This includes good invoicing features, bill payment, payment processing, and solid reporting features.

We know what we’re talking about because we’ve done the hard work of researching and comparing these accounting apps.

We’ve looked at what works and what doesn’t, so you don’t have to.

You can trust our guide to help you find the right fit for your business.

Frequently Asked Questions

Who is the biggest competitor of QuickBooks?

Xero is widely considered the biggest direct competitor. It challenges QuickBooks with a robust cloud-based platform, cleaner interface, and the ability to add unlimited users on standard plans, which is a major advantage for growing teams.

Is there a free bookkeeping software?

Yes, Wave Accounting is the gold standard for free software. Unlike free trials, it offers permanently free invoicing, receipt scanning, and accounting tools. It is ideal for freelancers and micro-businesses keeping overheads low.

Why is Xero better than QuickBooks?

Xero shines with its unlimited user policy. While QuickBooks often charges per seat, Xero allows your whole team access for one price. Additionally, many users find Xero’s dashboard more intuitive and less cluttered than QuickBooks Online.

What are people replacing QuickBooks with?

Businesses are migrating to Xero for better collaboration and FreshBooks for superior invoicing ease. Zoho Books is also capturing market share by offering a highly affordable, integrated suite for businesses already in the Zoho ecosystem.

Does Google have a program like QuickBooks?

No, Google does not offer dedicated double-entry accounting software. While many use Google Sheets for basic bookkeeping templates, it lacks the automation, bank feeds, and tax compliance features found in specialized tools like QuickBooks.

Is QuickBooks still the best?

It remains the industry giant and CPA favorite due to familiarity. However, it isn’t automatically “the best” for everyone anymore. For users prioritizing modern UI, customer support, or pricing flexibility, competitors like Xero or FreshBooks often rank higher.

Why do CPAs not like QuickBooks Online?

Speed and control are common complaints. Many accountants prefer the rapid data entry and robust reporting of the Desktop version. The Online version can feel sluggish to power users, and forced interface updates sometimes disrupt established workflow efficiency.

More Facts about QuickBooks Alternatives

QuickBooks is often seen as expensive and hard to learn, so many people look for cheaper, easier alternatives.

- Cloud-based software (software you use online) is becoming very popular because you can access it from anywhere.

- Many alternatives to QuickBooks let you get started for free or cost much less.

- People often switch to other software because they want a screen that is easier to understand and use.

- Some users switch because they do not want to be stuck using only one brand’s products.

- Xero is considered the main rival to QuickBooks in 2026. It is known for being easy to use and connecting well with other apps.

- Xero’s prices usually start around $15 a month and can go up to $80 a month if you need more features.

- FreshBooks is great for freelancers and service providers. It helps with sending bills and tracking time.

- FreshBooks usually costs between $21 and $65 per month, but they often have deals for new users.

- Wave Accounting is a free tool for very small businesses. It lets you send invoices and scan receipts without paying a monthly fee.

- Zoho Books is a great choice if you already use other Zoho apps. It has a free plan for businesses that send fewer than 1,000 invoices a year.

- Oracle NetSuite is built for large, complex companies. It can handle money in different currencies and follows tax rules worldwide.

- NetSuite is expensive, and pricing is provided only by quote. While user access might start around $99, the total cost for the system is usually much higher.

- Sage Intacct is ideal for medium-sized companies that need to comply with strict accounting rules.

- Sage 50cloud is a strong desktop program for businesses that need detailed reports. It costs about $625 a year for one person.

- Square charges a fee between 2.6% and 3.5% (plus a few cents) every time you accept a payment.

- ZipBooks has a free plan that helps you send bills and keep track of your contacts.

- Puzzle is a newer tool made just for startups. It offers a free plan for businesses that spend less than $5,000 a month.

- When choosing software, check whether it includes the tools you need, such as payroll, inventory, or project tracking.

- It is smart to read reviews from other users to see if the software has good customer support and is easy to use.

- Prices for accounting software can vary widely. Some are free, some cost $9 a month, and others cost over $200 a month.

- Before choosing, decide whether you want software that runs on your computer (desktop) or software you access online (cloud).