You’re a small business owner. You’re juggling a lot. Invoicing?

You need simple accounting. But, finding the right software? Tough.

You’re wasting time. Time you could spend growing your business.

Confusing software slows you down. Mistakes cost money, and Frustration builds.

FreshBooks claims to be the answer. Simple. Powerful. But is it really?

We’ll break down FreshBooks and see if it’s worth your time and money. Let’s get started.

Tired of complex accounting? 30 million+ businesses trust FreshBooks to create professional invoices. Simplify your accounting software today!

What is FreshBooks?

FreshBooks is an online tool. It helps small businesses manage money.

Think of it as a digital helper. You can create invoices. Send them to customers.

Get paid faster with online payment options. Track your expenses.

FreshBooks even helps with payroll.

You can use it on your computer or with their mobile app.

It’s designed to be easy. Even if you’re not an expert at accounting.

FreshBooks makes payments and keeping track of money easier for small businesses.

Who Created FreshBooks?

Mike McDerment created FreshBooks. He ran a small web design company.

He got frustrated with invoicing. He lost billable hours.

He built FreshBooks to fix that. He wanted an easy time tracking.

Plus, simple invoices. He wanted to customize templates.

Now, small businesses use its dashboard. It helps them avoid hiring an accountant.

FreshBooks’ vision: save small businesses time.

Top Benefits of FreshBooks

- Send Invoices: FreshBooks lets you quickly create and send invoices. With online options, you can get paid faster and customize them, too.

- Accounting Software for Small Businesses: It’s built for people who don’t love accounting. It simplifies complex tasks, helping you focus on your work.

- Recurring Invoices: Set up invoices to send automatically. Great for repeat customers. Save time each month.

- Track Time: Keep track of your hours for projects. Know exactly how much to bill. This ensures you get paid for all your work.

- FreshBooks Payments: Get paid directly through FreshBooks. It makes online payments easy, and customers can pay with a click.

- Accounts Payable: Manage your bills and vendor payments. See what you owe and when. Stay on top of your expenses.

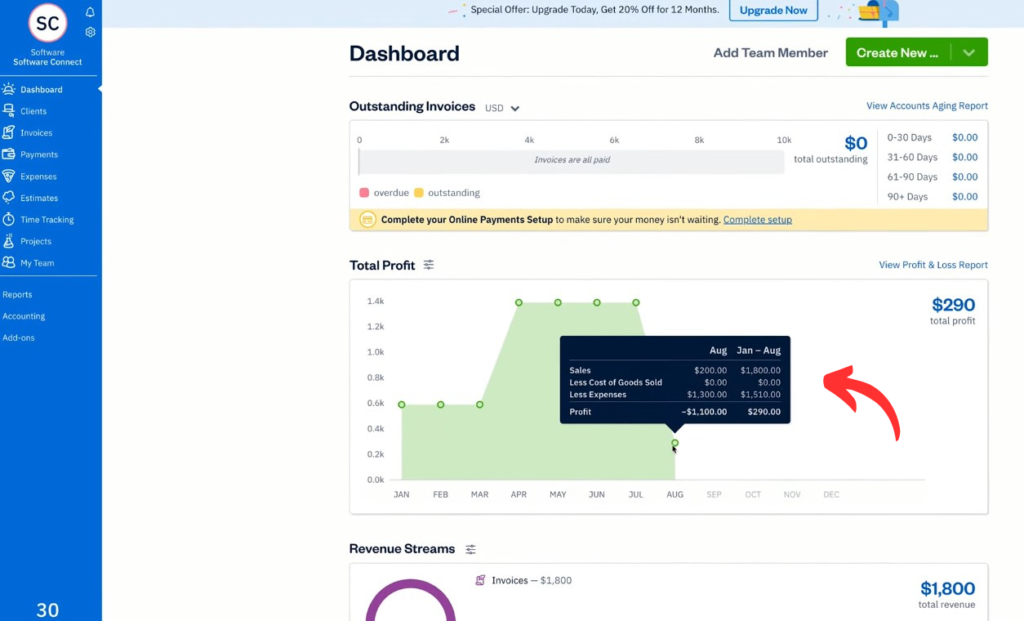

- Accounting Reports: Get clear reports on your business finances. See where your money is going. This will help you make smart decisions.

- Double-Entry Accounting: FreshBooks uses this method for accuracy. It helps keep your books balanced, reducing mistakes.

Best Features

FreshBooks is an accounting software designed for freelancers and small businesses.

It makes it easy to handle your finances, so you can spend less time on paperwork and more time on your clients.

FreshBooks helps you manage everything from sending bills to tracking expenses and even your time.

Let’s look at nine of the best ones.

1. Custom Invoicing

You can set invoices to send on their own. This is great for regular clients.

You don’t have to remember to send them. FreshBooks does it for you.

This saves you time. You can focus on other work.

You just set it up once. Then, it works automatically.

2. Easy Navigation

The FreshBooks website is simple to use. You can find what you need quickly.

The dashboard shows you important information.

You don’t need to be an expert. Everything is easy to understand.

This makes managing your money less stressful.

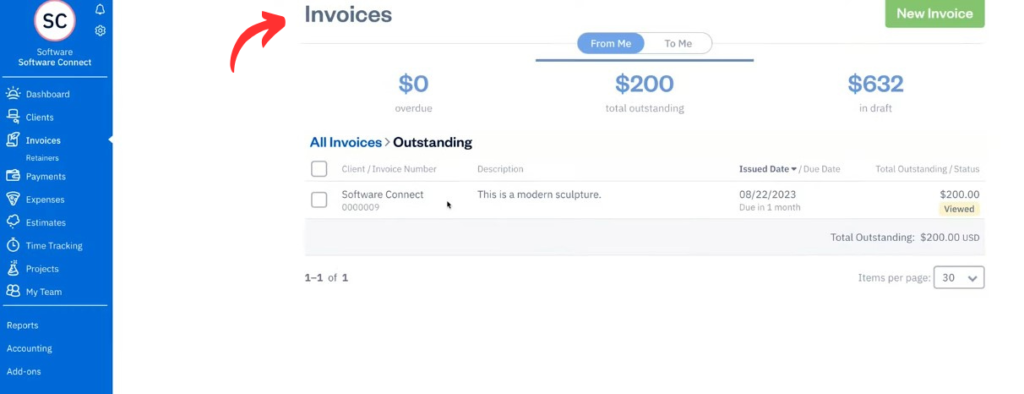

3. Payment Management

FreshBooks lets you accept payments online. Customers can pay with credit cards.

This makes getting paid faster. You can see all your payments in one place.

You can also track who has paid. This helps you keep your cash flow organized.

4. Advanced Payments

You can make your invoices look professional. You can add your logo and colors.

This makes your brand look good. You can also add notes and details.

This helps customers understand the bill. It makes your business look more professional.

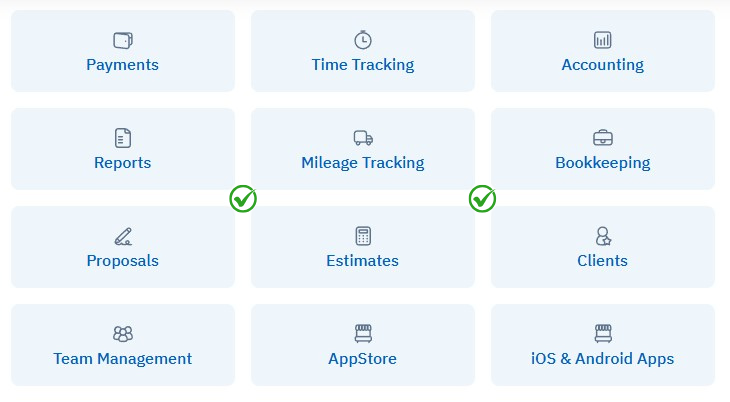

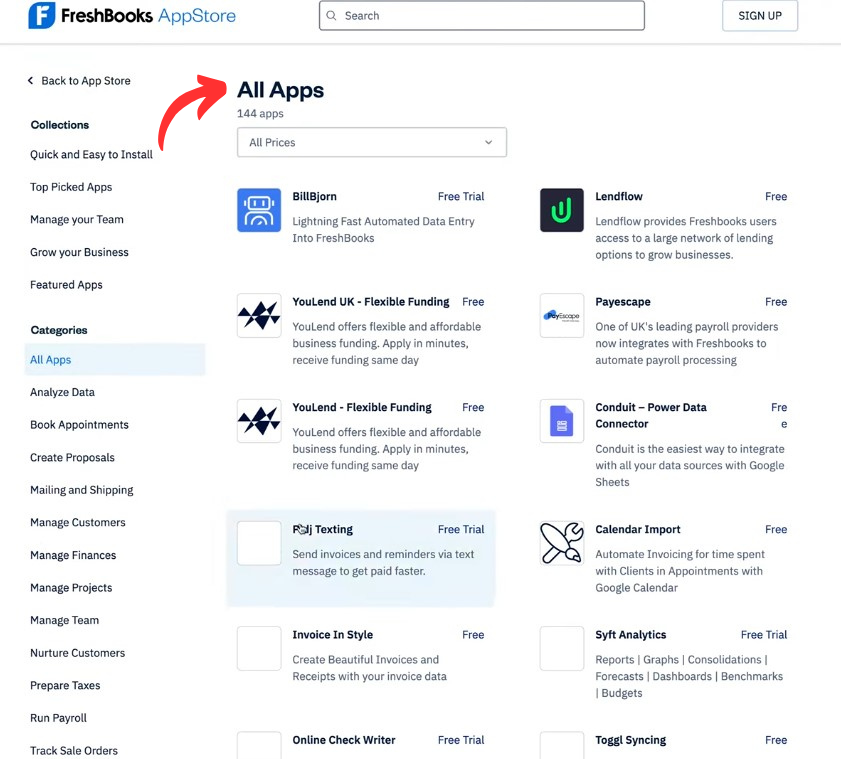

5. Apps Integration

FreshBooks works with other apps. You can integrate it into your bank accounts.

You can also connect it to other tools. This makes your work easier.

You don’t have to enter data twice. This saves you time.

It helps you keep all your information in one place.

6. Time Tracking

FreshBooks has a simple timer you can use to track the hours you work on a project.

You just hit start and stop.

When you’re done, you can add that time directly to a client’s invoice.

This makes sure you get paid for every hour you work.

7. Expense Categorizing

The software helps you keep track of your business spending.

You can add and connect your bank account or credit card, and FreshBooks will automatically pull in your expenses.

You can also take a picture of a receipt with your phone, and the app will get all the important details.

This makes it simple to stay on top of your costs.

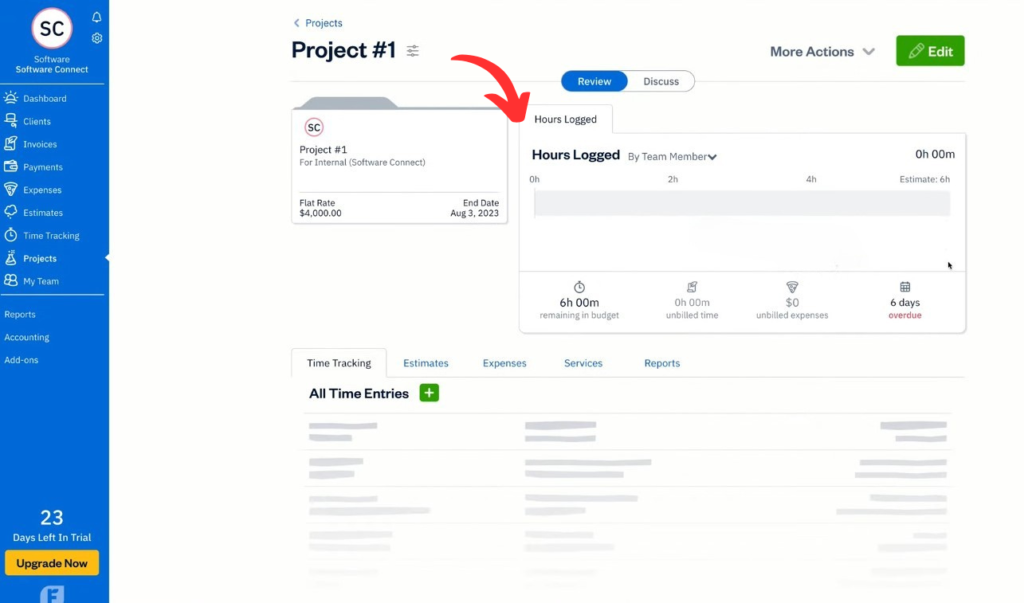

8. Project Management

FreshBooks lets you organize your projects and collaborate with your clients and team.

You can share files, chat with your clients, and see how your projects are doing.

It also lets you see the profitability of a project by tracking expenses and hours worked.

9. Mileage Tracking

If you use your car for business, FreshBooks has a feature that tracks your mileage.

It uses your phone’s GPS to log your trips automatically.

You can then quickly mark each trip as business or personal.

This helps you keep a record for tax deductions without having to write everything down.

Pricing

| Plan Name | Price |

| Lite | $21/month |

| Plus | $38/month |

| Premium | $65/month |

| Select | Custom |

Pros and Cons

Pros

Cons

Alternatives of FreshBooks

Here are the FreshBooks alternatives with a one-line expansion for each:

- Puzzle IO: This software focuses on AI-powered financial planning.

- Dext: This tool is great for capturing documents and extracting data.

- Xero: This is a popular online accounting software for small businesses.

- Synder: It specializes in syncing e-commerce and payment data with accounting software.

- Easy Month End: This software is designed to streamline your month-end financial tasks.

- Docyt: It uses artificial intelligence for bookkeeping and automates financial workflows.

- Sage: This is a comprehensive business and accounting software suite.

- Zoho Books: An online accounting tool, it is known for being affordable and great for small businesses.

- Wave: This option provides free accounting software for small businesses.

- Quicken: A popular personal finance management tool that helps organize budgets.

- Hubdoc: It specializes in capturing and organizing financial documents for bookkeeping.

- Expensify: This app is focused on expense management, making it easy to track and submit receipts.

- QuickBooks: A very well-known accounting software that helps businesses with everything from invoicing to payroll.

- AutoEntry: This tool automates data entry by scanning and analyzing documents like invoices and receipts.

- NetSuite: A powerful and complete cloud-based business management suite for larger companies.

FreshBooks Compared

- FreshBooks vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- FreshBooks vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- FreshBooks vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- FreshBooks vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- FreshBooks vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- FreshBooks vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- FreshBooks vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- FreshBooks vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- FreshBooks vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- FreshBooks vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- FreshBooks vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- FreshBooks vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- FreshBooks vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- FreshBooks vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- FreshBooks vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Personal Experience with FreshBooks

Our team started using FreshBooks to simplify our finances.

As self employed professionals, we needed an easy way to manage our money and projects.

The software helped us with all of our accounting software solutions.

We used the freshbooks mobile app on our ios and android devices to stay and keep control on top of things, even when we were on the go, as long as we had an internet connection.

The app made it simple to track our billable clients and expenses.

FreshBooks made it easy to manage projects and see our project profitability tracking.

We used the different plans, like the lite plan, plus plan, and select plan, to get the right features for us.

The software helped us with recurring billing, and we could add late fees automatically.

- We could send an unlimited number of estimates to our clients and then convert estimates to invoices.

- We could invite team members and business partners as an additional user.

- The freshbooks dashboard gave us a quick look at our finances.

- We could handle client retainers and send an unlimited estimates.

- The software made it simple to track ach payments and ach transfers. We also had access to a virtual terminal for other payments.

- At tax time, the reports were a huge help. We no longer had to worry about unreconciled transactions.

- The freshbooks platform also helped us with bank reconciliation and other accounting tasks.

- We used freshbooks offers to get a good deal on our subscription, as we didn’t want the free version.

- FreshBooks has many advanced features that other other accounting software or other software don’t have.

- FreshBooks has three plans and the four plans when you include the Select plan.

- You can get exclusive access to certain features and there are pos systems integrations.

The freshbooks faqs are a great resource for help. We used a csv file to import our data.

Our plan had a flat fee per month. We could see the only the projects we were working on.

We found it to be a great accounting software solution.

The software is much better for our business than quickbooks online.

FreshBooks doesn’t have inventory management.

Final thoughts

FreshBooks is great for small businesses. It simplifies accounting.

It’s easy to use. It has strong invoicing and time tracking.

The management tools help you stay organized. It’s good cloud accounting software.

FreshBooks helps track billable time. The phone support is helpful.

It may not be best for large companies needing complex accounting features.

If you need simple invoicing and time tracking, we recommend FreshBooks.

If you want to use FreshBooks, try their free trial. See if it fits your needs.

Frequently Asked Questions

Is FreshBooks reputable?

Absolutely. FreshBooks is a highly reputable, cloud-based accounting leader trusted by millions of small business owners. It is famous for its award-winning customer support and specialized focus on service-based freelancers.

Which is better, FreshBooks or QuickBooks?

It depends on your scale. FreshBooks wins for ease of use and service-based billing. QuickBooks is the powerhouse for product-based businesses needing heavy inventory tracking and deep financial scaling.

How much does FreshBooks cost monthly?

Pricing starts at $21 for the Lite plan. The Plus plan costs $38, while the Premium tier is $65. Note that each additional team member adds an extra $11 to your monthly bill.

Is there a free version of FreshBooks?

FreshBooks does not offer a permanent free version. However, they provide a generous 30-day free trial with no credit card required. This allows you to test all features before committing.

What are the downsides of FreshBooks?

The main weaknesses are the client limits on lower tiers and the extra cost per user. It also lacks robust inventory management features, making it less ideal for retail or high-volume product companies.

Does FreshBooks do accounting?

Yes, it is full-service double-entry accounting software. It handles everything from automated bank reconciliation and expense tracking to generating professional financial reports like Balance Sheets and P&L statements.

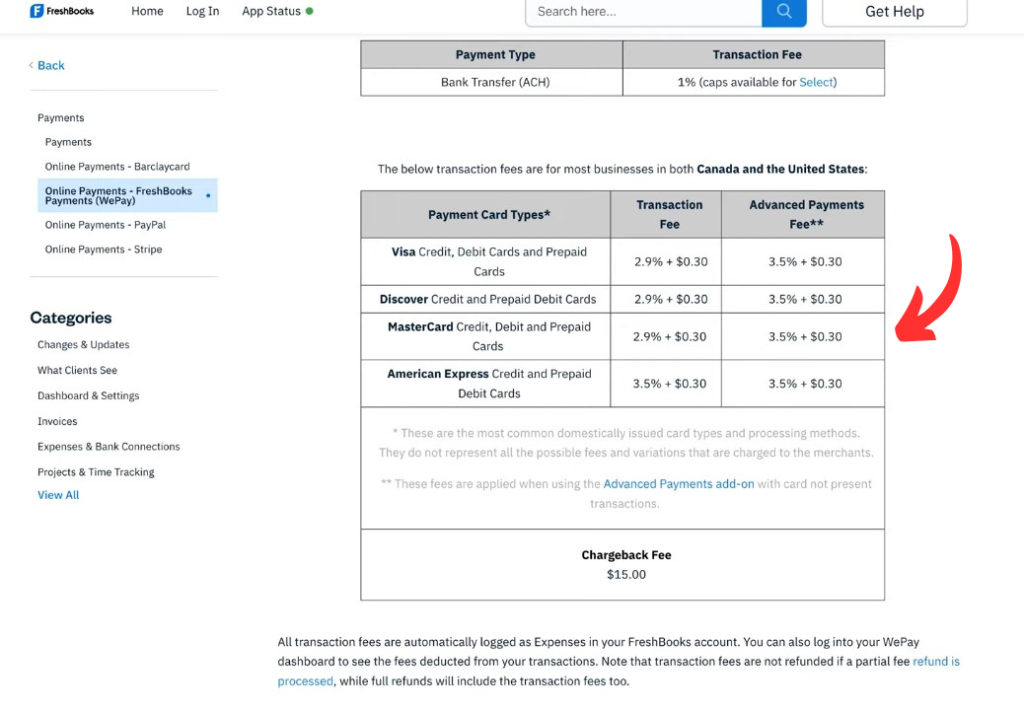

How much does FreshBooks charge per transaction?

Standard transaction fees are 2.9% + $0.30 for most credit cards. ACH bank transfers are much cheaper at just 1%. If you use American Express, the fee increases to 3.5% + $0.30.

More Facts about FreshBooks

- Easy to Use: FreshBooks is a top choice for service-based small businesses because it is very easy to learn. You don’t need to be an accountant to understand the dashboard.

- Smart Tools: The software uses AI to automatically organize your spending. It also helps keep your money safe by working with trusted payment partners.

- Simple Bookkeeping: You can take photos of your receipts with your phone to save them. You can also link your bank account so the software tracks your spending for you.

- Mobile App: There is an app for iPhones and Androids. It lets you send bills and track your work time while you are away from your desk.

- Great for Freelancers: It is highly recommended for people who work for themselves, like consultants or photographers.

- Professional Invoices: You can make beautiful bills that show exactly what work you did. You can send them with just one click and even set them to send automatically every month.

- Helpful Reminders: If a customer forgets to pay, FreshBooks can automatically send them a friendly email reminder.

- Works with Other Apps: FreshBooks connects with over 100 other programs to help you do more.

- Project Management: All plans include tools to help you manage your projects and turn tracked hours into a bill in just two clicks.

- Real-Time Banking: The software constantly communicates with your bank to ensure your records are accurate, without you having to type everything in by hand.

- Customer Support: People love their support team because they are kind and fast. You can call them, email them, or use a live chat inside the program.

- Room to Grow: While it’s great for small shops, some businesses find it too basic once they get very large or need to track a lot of physical products (inventory).

- Pricing Plans: There are three main plans: Lite ($21/month) for up to 5 clients, Plus ($38/month) for up to 50 clients, and Premium ($65/month) for unlimited clients.

- Extra Costs: Adding a team member costs about $11 per person each month. If you want to run payroll through Gusto, it costs $40 per month, plus a fee per employee.

- Try Before You Buy: You can try FreshBooks for free for 30 days without giving them your credit card number. They often give new users a big discount for the first few months.

- High Ratings: Most users give the software a high rating (4.3-4.9 stars) because it makes getting paid much easier.