Ready to finally ditch those messy spreadsheets and complex financial tools?

For hotels, managing payments, reservations, and expenses can feel like a full-time job on its own.

The good fact is that the right accounting software can make a huge difference.

You can stop stressing about the numbers & focus on giving your guests a five-star experience.

In this guide, we’ll walk you through the 9 best accounting software for hotels in 2025.

Choose a solution that streamlines your operations and boosts your bottom line.

What is the Best Accounting Software for Hotels?

Finding the top AI accounting software for hotels can feel overwhelming. The right choice depends on your hotel’s size and specific needs.

We’ve done the hard work for you, analyzing the top solutions.

Below is our list of the best accounting software for hotels to help you find the perfect match for your business.

1. Xero (⭐4.8)

Xero is a popular choice in the accounting world.

It’s designed for small and growing businesses, including hotels.

You can get a clear view of your financial performance. Xero helps with everything from invoicing to managing bills.

Its powerful features make bookkeeping tasks much easier.

You can create detailed financial reports and stay on top of your cash flow.

Unlock its potential with our Xero tutorial.

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

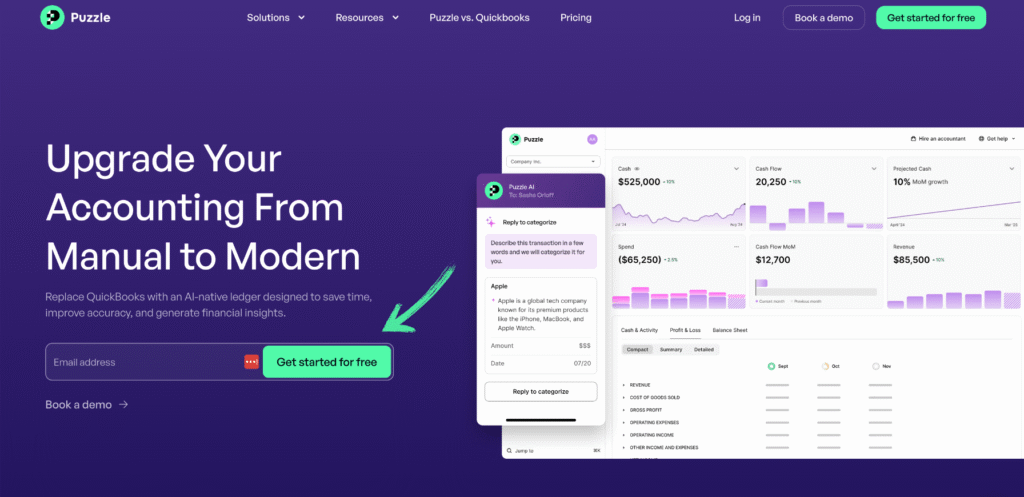

2. Puzzle IO (⭐4.5)

Puzzle IO is a new player in the accounting world, built for modern businesses.

It uses artificial intelligence (AI) to automate many bookkeeping tasks.

The AI accounting features provide real-time insights into your financial performance. Puzzle IO helps you manage cash flow and streamline your finance departments.

Its AI-powered engine can even identify patterns to help with risk management.

Unlock its potential with our Puzzle IO tutorial.

Our Take

Ready to simplify your finances? See how Puzzle io can save you up to 20 hours a month. Experience the difference today!

Key Benefits

Puzzle IO really shines when it comes to helping you understand where your business is headed.

- 92% of users report better financial forecasting accuracy.

- Get real-time insights into your cash flow.

- Easily create different financial scenarios to plan.

- Collaborate seamlessly with your team on financial goals.

- Track key performance indicators (KPIs) in one place.

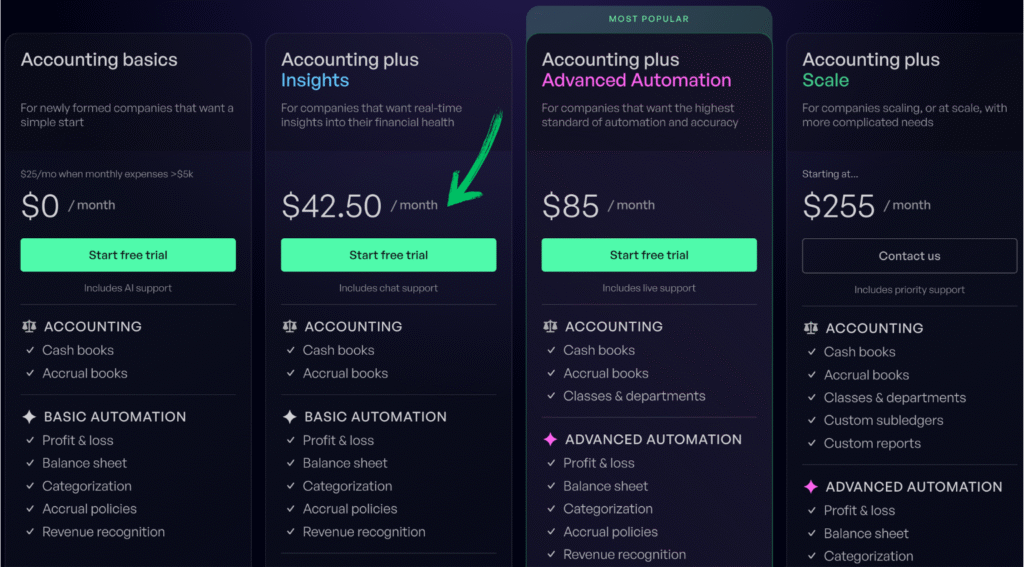

Pricing

- Accounting basics: $0/month.

- Accounting Plus Insights: $42.50/month.

- Accounting Plus Advanced Automation: $85/month.

- Accounting Plus scale: $255/month.

Pros

Cons

3. Dext (⭐4.0)

Dext is all about making data entry simple. It’s a great tool for automating your bookkeeping tasks.

Dext uses AI to capture and categorize receipts and invoices.

This frees up your accounting team to focus on more important things.

It’s perfect for finance departments that want to save time. Dext helps you get accurate financial reports with minimal effort.

Unlock its potential with our Dext tutorial.

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

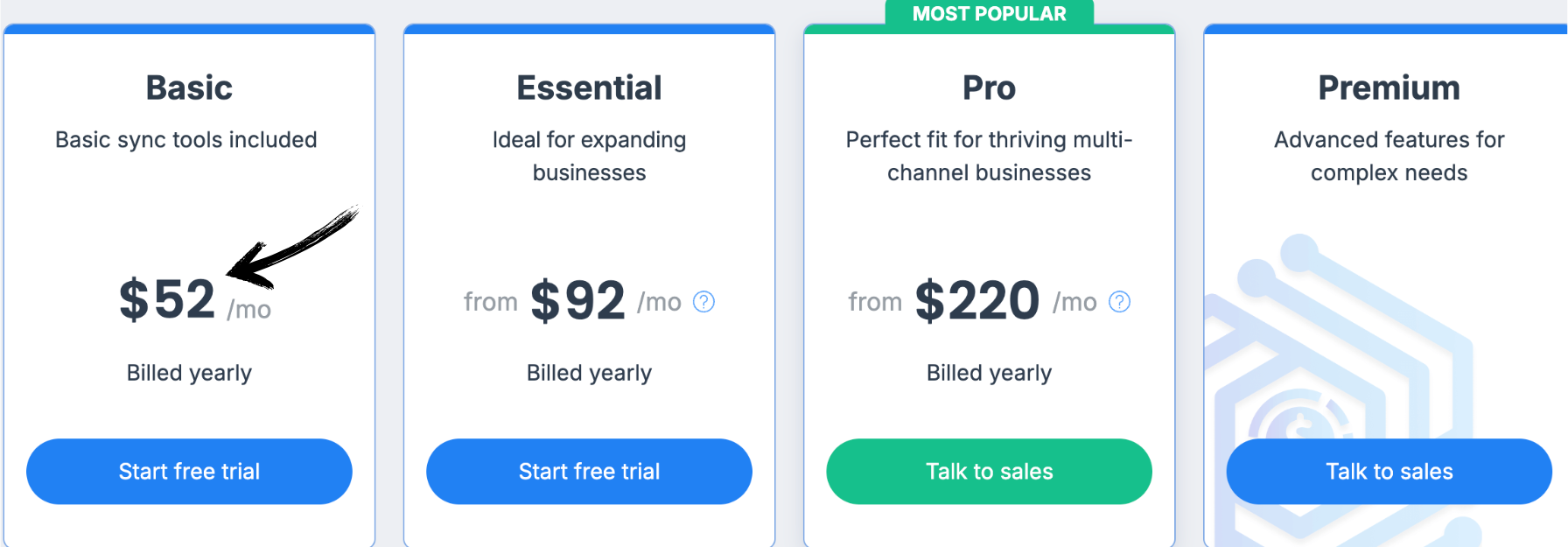

4. Synder (⭐3.8)

Synder is a great tool for businesses that sell online. It connects to your e-commerce platforms and payment gateways.

Synder’s AI accounting features sync your transactions automatically.

This gives you real-time data insights into your financial performance.

You can manage your cash flow easily & get accurate financial reports. Synder simplifies bookkeeping tasks for your finance departments.

Unlock its potential with our Synder tutorial.

Our Take

Synder automates your accounting, syncing sales data seamlessly to QuickBooks, Xero, and more. Businesses using Synder report saving an average of 10+ hours per week.

Key Benefits

- Automatic sales data synchronization

- Multi-channel sales tracking

- Payment reconciliation

- Inventory management integration

- Detailed sales reporting

Pricing

All the plans will be Billed Annually.

- Basic: $52/month.

- Essential: $92/month.

- Pro: $220/month.

- Premium: Custom Pricing.

Pros

Cons

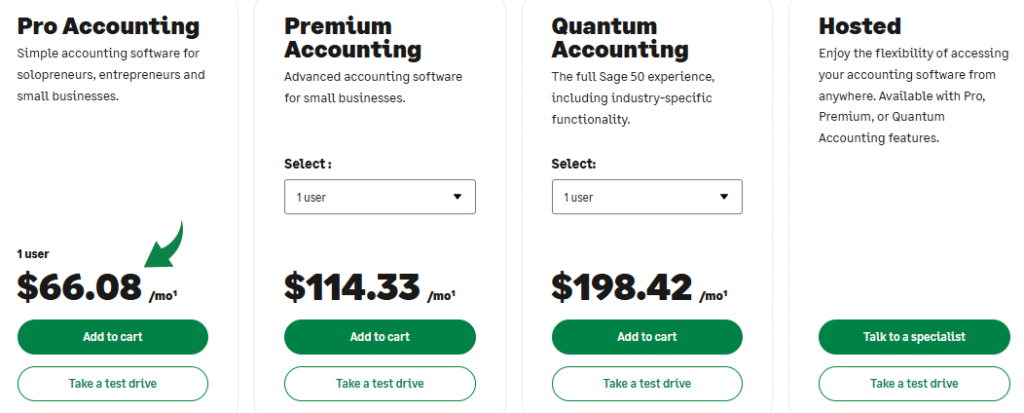

5. Sage (⭐️3.6)

Sage is a long-time leader in the accounting world. It offers a wide range of tools for businesses of all sizes.

Sage provides powerful tools for financial reports and risk management.

Its platform helps streamline bookkeeping tasks for your accounting team.

You can get a clear picture of your financial performance.

Sage is a solid choice for any finance departments looking for a reliable solution.

Unlock its potential with our Sage tutorial.

Our Take

Ready to supercharge your finances? Sage users have reported an average of 73% higher productivity and a 75% faster process cycle time.

Key Benefits

- Automated invoicing and payments

- Real-time financial reports

- Strong security to protect data

- Integration with other business tools

- Payroll and HR solutions

Pricing

- Pro Accounting: $66.08/month.

- Premium Accounting: $114.33/month.

- Quantum Accounting: $198.42/month.

- HR and Payroll bundles: Custom Pricing based on your needs.

Pros

Cons

6. Easy Month End (⭐3.4)

Easy Month End is designed to make closing your books simple.

It focuses on helping you get accurate financial reports quickly. This tool helps with client communication and streamlines your bookkeeping tasks.

It provides a simple way to manage your cash flow.

Easy Month End is a helpful tool for any accounting team looking to simplify their routine.

Unlock its potential with our Easy Month End tutorial.

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

7. QuickBooks (⭐3.2)

QuickBooks is probably the most well-known name in the accounting world.

It’s used by millions of small businesses. QuickBooks offers a full stake of tools to manage your financial performance.

Its features include everything from invoicing to payroll.

It gives you real-time insights into your cash flow and helps with all bookkeeping tasks.

It’s a comprehensive tool for any finance departments.

Unlock its potential with our QuickBooks tutorial.

Key Benefits

- Automated transaction categorization

- Invoice creation and tracking

- Expense management

- Payroll services

- Reporting and dashboards

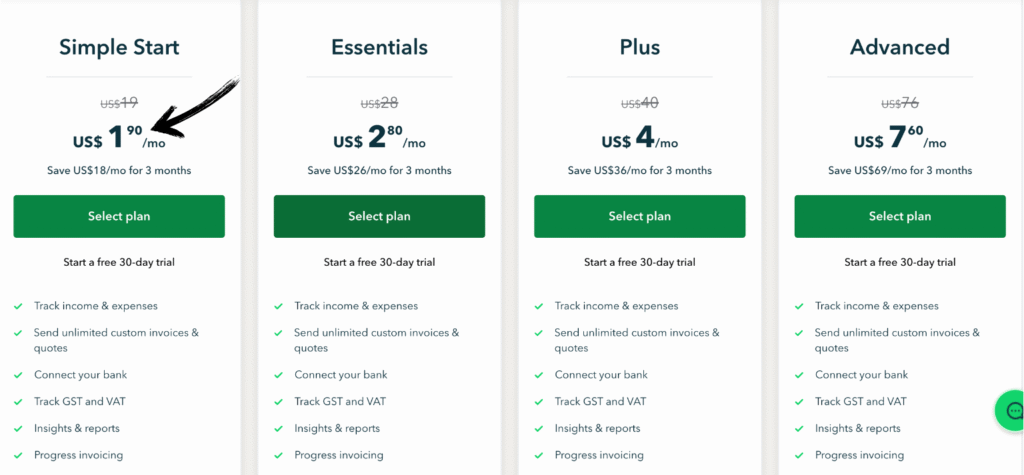

Pricing

- Simple Start: $1.90/month.

- Essential: $2.80/month.

- Plus: $4/month.

- Advanced: $7.60/month.

Pros

Cons

8. Docyt (⭐3.0)

Docyt is an ai-powered platform that automates your bookkeeping.

It uses artificial intelligence (AI) to handle your financial data.

Docyt’s AI accounting engine can identify patterns and provide real-time insights.

This helps you with risk management and getting accurate financial reports.

It’s a powerful tool for your accounting team to manage bookkeeping tasks and cash flow.

Unlock its potential with our Docyt tutorial.

Key Benefits

- AI-Powered Automation: Docyt uses artificial intelligence. It automatically extracts data from financial documents. This includes details from over 100,000 vendors.

- Real-time Bookkeeping: Keeps your books updated in real-time. This provides an accurate financial picture at any moment.

- Document Management: Centralizes all financial documents. You can easily search and access them.

- Bill Pay Automation: Automates the bill payment process. Schedule and pay bills easily.

- Expense Reimbursement: Streamlines employee expense claims. Submit and approve expenses quickly.

- Seamless Integrations: Integrates with popular accounting software. This includes QuickBooks and Xero.

- Fraud Detection: Its AI can help flag unusual transactions. This adds a layer of security. There’s no specific warranty for the software, but continuous updates are provided.

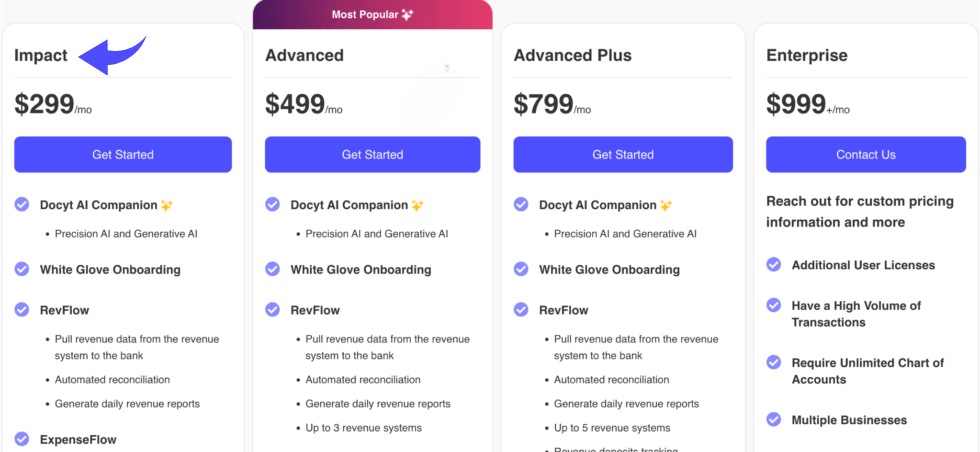

Pricing

- Impact: $299/month.

- Advanced: $499/month.

- Advanced Plus: $799/month.

- Enterprise: $999/month.

Pros

Cons

9. RefreshMe (⭐️2.8)

RefreshMe is a tool that helps with client communication and financial management.

It’s designed to simplify your bookkeeping tasks.

RefreshMe helps you get a quick overview of your financial performance.

It provides a simple, clean interface to manage your cash flow.

It’s a good choice for finance departments that want a no-frills solution to get the job done.

Unlock its potential with our Refreshme tutorial.

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

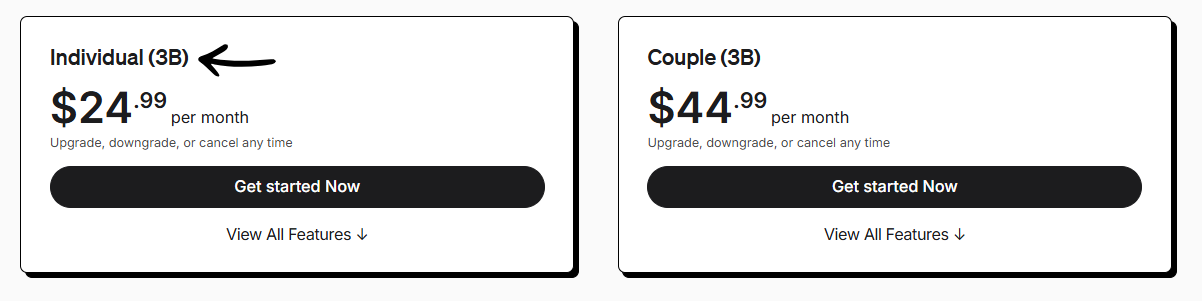

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

What Hotels need in an Accounting Software?

Choosing the right software is a major decision.

You want a tool that not only fits your current needs but also assists your business grow.

When you’re ready to invest, make sure you look for these key features.

- AI and Automation: The best AI accounting software uses artificial intelligence (AI) & robotic process automation to handle repetitive tasks. Look for platforms with AI technology that automates your bookkeeping and financial processes, freeing up your accounting team.

- Data Analysis and Insights: A good system does more than just record transactions. It uses AI in accounting to analyze financial data. Platforms with machine learning algorithms can identify patterns and provide valuable & important insights for financial planning and risk management.

- Comprehensive Features: Make sure the software can handle all your needs. This includes managing expense reports, generating accurate financial statements, and ensuring tax compliance. It should also be a good fit for your internal accounting processes.

- Integration and Scalability: Your new software should integrate seamlessly with your existing systems, like your Property Management System (PMS). The best solutions can also grow with you, whether you’re adding more rooms or properties.

- Professional Support: Consider who the software is designed for. Some are built for small businesses, while others are geared toward accounting firms and other accounting professionals. Look for a solution with strong client communication features and reliable support.

How Can Hotels Benefit from Using Accounting Software?

Using the right accounting software can change your business.

These ai-powered tools help businesses manage financial operations more efficiently.

They automate repetitive tasks, which reduces human error and saves your team a lot of time.

This is a big win for any business looking to improve its internal accounting processes.

You might hear people ask, Will AI replace accountants?

The reality is that AI accounting tools and accounting AI are here to help finance and accounting professionals.

These tools use machine learning & NLP: natural language processing to analyze relevant data and historical data.

This helps with financial reporting and predictive analytics.

They can handle things like expense management software and accounts payable, letting your team focus on more strategic work.

Buyers Guide

We know that choosing the right software for your hotel is a big deal. To give you the best recommendations, we looked at each product carefully.

Our research focused on a few key factors to help you make a smart choice.

- Pricing: We checked the cost of each product. We looked at subscription fees and any extra costs. This helps you understand the total investment.

- Features: We identified the important key features of each product. We looked for things like how they handle repetitive accounting tasks and automate manual data entry. We also looked for advanced AI systems and AI tools that use machine learning to analyze data.

- Negatives: We also found what was missing from each product. No software is perfect. This part of our research helps you understand the downsides so you aren’t surprised later.

- Support & Community: We looked at what kind of help is available. We checked if they offer a community, customer support, or a refund policy. This is important for a smooth experience.

- Performance & Insights: We analyzed how each product helps with a company’s financial performance. We looked at how well they handle cash flow forecasting and give business leaders insights into future trends.

Wrapping Up

Choosing the right accounting system is a big step for your hotel.

We’ve shown you a few of the best options available.

The goal of these accounting tools is to make your life easier.

By using the right accounting automation, you can save time on routine tasks.

This lets you focus on your guests and grow your business.

We gave you a look at how these systems use a powerful AI tool for things like fraud detection and giving valuable insights.

Our goal is to help you, the hotel owner or manager, make a smart choice.

We believe that with the right software, you can take control of your finances and feel more confident as a business leader.

Frequently Asked Questions

What is the best AI accounting software?

There is no single best AI software. The ideal choice depends on your business’s size and unique needs. Look for a solution that streamlines your specific business processes and provides valuable insights.

How do accounting firms use AI accounting software?

Accounting firms leverage AI accounting software to automate repetitive tasks like data entry & financial reporting. This frees up financial experts to focus on higher-level strategy and client communication for business growth.

How does AI accounting software handle financial data?

AI accounting software uses machine learning and AI tools for data management. It automates the process of collecting, categorizing, and analyzing historical data to give you a clear view of your business’s financial health.

How is the accounting industry using AI?

The accounting industry is using AI to automate routine tasks, improve data management, and perform financial analysis. It enhances business processes and provides valuable insights for strategic decision-making and business growth.

Will an AI tool replace my accountant?

No, an AI tool will not replace your accountant. Instead, it serves as a powerful assistant that automates routine tasks and handles complex data, allowing financial professionals to focus on business growth and strategy.