Are you tired of sifting through stacks of receipts or wrestling with complex spreadsheets?

Many of us face the headache of tracking expenses, whether for work or personal budgets.

It can be confusing and time-consuming.

This is where expense software comes in, promising to make life easier.

Today, we’re putting two popular choices head-to-head: RefreshMe vs Expensify.

We’ll break down their features, benefits, and who they’re best for.

Overview

We’ve tried both RefreshMe and Expensify.

We used them like you would every day.

This helped us see how they work.

Unlock deeper financial insights! Refresh Me analyzes your spending and helps you save smarter.

Try it now!

Pricing: It has a free trial. The premium plan at $24.99/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

Join over 15 million users who trust Expensify to simplify their finances. Save up to 83% on time spent on expense reports.

Pricing: It has a free trial. The premium plan starts at $5/month.

Key Features:

- SmartScan Receipt Capture

- Corporate Card Reconciliation

- Advanced Approval Workflows.

What is RefreshMe?

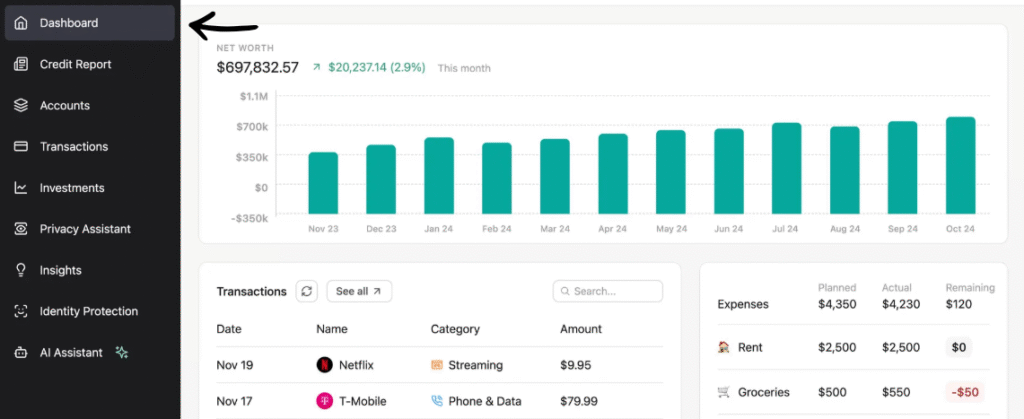

RefreshMe is a tool to help you track your spending.

It can help you keep your receipts in one place. It also helps you see where your money is going.

It tries to make expense tracking simple for everyone.

Also, explore our favorite Refreshme alternatives…

Our Take

RefreshMe’s strength lies in providing real-time, actionable insights. However, the lack of public pricing and potentially less comprehensive core accounting features might be considerations for some users.

Key Benefits

- Real-time financial dashboards

- AI-powered anomaly detection

- Customizable reporting

- Cash flow forecasting

- Performance benchmarking

Pricing

- Individual (3B): $24.99/month.

- Couple (3B): $44.99/month.

Pros

Cons

What is Expensify?

Okay, so let’s talk about Expensify.

It’s a tool that helps you keep track of all your business spending. Think of it like a helper that remembers where your money goes.

It can grab info from your receipts and bank stuff. Pretty handy!

Also, explore our favorite Expensify alternatives…

Key Benefits

- SmartScan technology scans receipt details and extracts them with over 95% accuracy.

- Employees get reimbursed quickly, often in as little as one business day via ACH.

- The Expensify Card can save you up to 50% on your subscription with its cash back program.

- No warranty is offered; their terms state that liabilities are limited.

Pricing

- Collect: $5/month.

- Control: Custom Pricing.

Pros

Cons

Feature Comparison

This detailed comparison highlights the fundamental differences in purpose between Refreshme, a personal finance tool, and Expensify, a professional expense management platform.

1. Core Service and Target Audience

- Refreshme: This is a personal finance tool designed to help individuals track their personal transactions and spending. The core of the service is to give a personalized treatment plan for your money, helping you refresh your financial habits.

- Expensify: It is a dedicated expense management process platform for companies and their employees. Its purpose is to streamline the process of tracking business expenses, from capture to reimbursement, making it a vital system for managers and small business owners.

2. Expense Capture and Entry

- Refreshme: It allows you to automatically collect information from your bank accounts and credit cards. It is a simple tool for managing personal transactions, with the ability to create custom categories to stay organized.

- Expensify: Expensify makes expense capture a standout feature with its SmartScan technology. You can snap a photo of a receipt, and the system will automatically extract the details, eliminating manual data entry. You can also log mileage for projects directly from the app.

3. Approval and Reimbursement

- Refreshme: It lacks features for formal expense approval or reimbursement, as it is not a business-oriented tool. Its purpose is to help you track your personal transactions.

- Expensify: It is built for this. It provides a robust approval workflow where a manager can review and approve expense reports in a real time on a granular level. The system is designed to reimburse employees and contractors quickly with automated payments.

4. Expense Reporting

- Refreshme: It provides detailed reports on your spending habits to help you refresh your budget and financial approach. The content is designed to give you insights into where your money goes.

- Expensify: It helps you file expense reports by automatically matching receipts to transactions. Expensify makes it easy for every employees to submit & for a manager to review, helping the company to maintain compliance.

5. Automation and AI

- Refreshme: It uses AI to provide a personalized treatment for your finances and offers tips to improve your spending. The automation is designed for personal money management.

- Expensify: Its automation features are highly advanced. The system uses AI to automatically categorize expenses, flag policy violations, and match transactions to receipts, which greatly helps a manager save time and effort.

6. User Interface and Usability

- Refreshme: The user interface is simple and highly intuitive, making it easy for anyone to gain access & review their finances. This simplicity is a key part of its appeal.

- Expensify: Expensify makes the expense management process user-friendly with a clean interface. It is designed to simplify a complex system and make completing expense reports quick and easy.

7. Integrations and Ecosystem

- Refreshme: It is a standalone system that connects to your bank account and credit cards. It does not integrate with business accounting software like QuickBooks.

- Expensify: It integrates seamlessly with major accounting platforms, including quickbooks, quickbooks reviews often highlight its robust connection to help with reconciliation. This allows companies to export data directly to their accounting system.

8. Security and Privacy

- Refreshme: It places a high priority on security and privacy. The platform uses advanced security protocol to protect your information and provides features like dark web monitoring and identity theft protection.

- Expensify: It also has robust security protocols in place. Its system is designed to protect business data and a manager can set permissions for who has access to expense reports.

9. Cost and Payment Options

- Refresh me: It offers several affordable plans for individuals, couples, and families. The pricing is transparent and designed to be a budget-friendly way to manage your finances.

- Expensify: It has a flexible pricing model with plans for a small number of users and larger organizations. The expensify card allows for additional benefits and discounts, and the platform facilitates payments and reimbursement.

What to look for in an Accounting Software?

- Scalability: Can the system change with your clients? The license fees of quickbooks desktop might make you cancel before your business data scales. If a purchase orders process has failed, the system should be updated to resolve the issue immediately.

- Support: What kind of help is available if you have questions? Reviews can offer information on whether their support team can resolve complex reconciliation errors. You need a live rep to respond to your requests when a transaction is blocked by a security code.

- Ease of Use: Is it something you and your team can learn quickly? Expensify makes it easy to enter a photo and log mileage from your pocket, but the desktop version of QuickBooks can be harder to master for a new manager.

- Specific Needs: Does it handle the unique things your business does? Does the treatment of clients change based on their age? Does the software manage expenses for a small number of users and allow you to track vendors and customers with tags?

- Security: How safe is your financial data with this software? The face of security is constantly updated. The expensify card provides real time security, but you should always review stored data. The difference in art is clear: simple interfaces are less likely to fail than each complex ones, & they help employers approve requests to manage expenses.

When you receive the latest Expensify reviews, the services must be perfect and analyze user behavior over longer periods, noting how cookies sometimes failed in older cases.

The setup should take a few seconds on the page to be expected, allowing employers to trigger a quick onboarding, as users want access to a perfect product immediately.

Final Verdict

So, which one wins: RefreshMe or Expensify?

After looking at everything, our pick depends on what you need.

If you are a business looking to handle employee expenses, invoices, and complex financial reports.

Expensify is likely your best bet.

It’s built for bigger teams and detailed business needs. It’s simpler and great for personal money tracking.

We tried both, and we understand their strong points.

Choose the one that fits your life or business best.

More of Refreshme

- Refresh me vs Puzzle IO: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Refresh me vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Refresh me vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Refresh me vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Refresh me vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Refresh me vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Refresh me vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Refresh me vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Refresh me vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Refresh me vs Quicken: Both are personal finance tools, but this one offers more in-depth investment tracking. The other is simpler.

- Refresh me vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Refresh me vs Expensify: This is a business expense management tool. The other is for personal expense tracking and budgeting.

- Refresh me vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Refresh me vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Refresh me vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Refresh me vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

More of Expensify

- Expensify vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Expensify vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Expensify vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Expensify vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Expensify vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Expensify vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Expensify vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Expensify vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Expensify vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Expensify vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Expensify vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Expensify vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Expensify vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Expensify vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is RefreshMe good for small businesses?

RefreshMe is better for personal use and budgeting. It helps individuals track spending and plan finances easily. For small businesses, Expensify might be a better choice due to its features for team expenses and invoicing.

Can Expensify track personal expenses too?

Yes, Expensify can track personal expenses. However, its main design and strongest features are for business expense reports and team management. It might be more complex than needed for just personal use.

Which tool is cheaper between RefreshMe vs Expensify?

Pricing can change. Generally, RefreshMe offers simpler plans, often with a free tier for basic use. Expensify typically has more complex pricing based on features and number of users, geared towards businesses.

Do both apps connect to my bank?

Yes, both RefreshMe and Expensify can connect to your bank accounts. This helps them automatically pull in your spending data. This makes tracking expenses much easier and faster for you.

Can I use these apps on my phone?

Absolutely! Both RefreshMe and Expensify have mobile apps. You can use them on your smartphone or tablet. This means you can manage your money and expenses no matter where you are.