Are you tired of the month-end closing feeling like a huge headache?

It can take forever to sort through all those numbers.

But what if there was a better way?

What if your accounting software could make month-end simpler and faster?

Two names often come up: Xero vs Easy Month End.

Overview

We’ve put both Xero and Easy Month End through their paces.

Exploring how they handle real-world business scenarios.

Our hands-on testing focused on ease of use, features for month-end closing, and overall efficiency to bring you this clear comparison.

Join 2 million+ businesses using Xero cloud-based accounting software. Explore its powerful invoicing features now!

Pricing: It has a free trial. paid plan starts at $29/month.

Key Features:

- Bank Reconciliation

- Invoicing

- Reporting

This Easy month-end, join 1,257 users who saved an average of 3.5 hours and reduced errors by 15%. Start your free trial!

Pricing: It has a free trial. The premium plan starts at $45/month.

Key Features:

- Automated Reconciliation

- Streamlined Workflows

- User-Friendly Interface

What is Xero?

So, Xero, huh? It’s popular.

Lots of businesses use it. It’s accounting software in the cloud.

You can access it anywhere. It helps manage your money stuff.

Also, explore our favorite Xero alternatives…

Our Take

Join 2 million+ businesses using Xero accounting software. Explore its powerful invoicing features now!

Key Benefits

- Automated bank reconciliation

- Online invoicing and payments

- Bill management

- Payroll integration

- Reporting and analytics

Pricing

- Starter: $29/month.

- Standard: $46/month.

- Premium: $69/month.

Pros

Cons

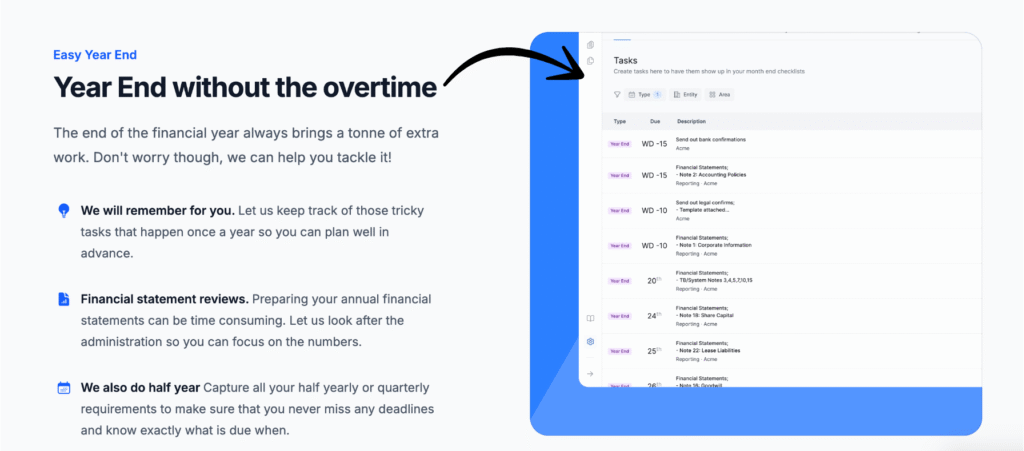

What is Easy Month End?

Easy Month End, right? The name tells you a lot.

It really focuses on making the month-end easier.

It’s designed to streamline that whole process.

Think of it as your month-end buddy. It helps keep everything on track.

Also, explore our favorite Easy Month End alternatives…

Our Take

Elevate financial accuracy with Easy Month End. Leverage automated reconciliation and audit-ready reporting. Schedule a personalized demo to streamline your month-end process.

Key Benefits

- Automated reconciliation workflows

- Task management and tracking

- Variance analysis

- Document management

- Collaboration tools

Pricing

- Starter: $24/month.

- Small: $45/month.

- Company: $89/month.

- Enterprise: Custom Pricing.

Pros

Cons

Feature Comparison

Comparing two different types of tools can be tricky.

Xero is a full cloud based accounting software, while Easy Month End is a focused solution for streamlining the close process.

Let’s look at nine key features to see which one fits your finance team better.

1. Core Accounting & ERP Functionality

- Xero: As a true cloud based accounting software, it provides a wide range of services. This includes general ledger, accounts receivable, and accounts payable functionality. For established businesses or those on the established plan, it has a foundation for an enterprise resource planning system.

- Easy Month End: It is not a core accounting system. It is designed to work with your existing xero accounting software or other ledgers. It does not handle day-to-day transactions like paying bills or sending online invoicing.

2. Month-End Close Focus

- Xero: While it helps with reconciliation and reporting, Xero’s month-end tools are part of a larger system. It allows you to log and store some financial records, but lacks dedicated workflow management tools.

- Easy Month End: This is its main purpose. It provides a structured workflow for the finance team tasks. It helps with a smoother month end close by tracking all your reconciliations and providing audit evidence.

3. Bank and Balance Sheet Reconciliation

- Xero: It uses automatic bank feeds to reconcile day-to-day bank transactions and bank accounts. This is key for cash flow visibility and reducing manual work.

- Easy Month End: It specializes in faster balance sheet reconciliations. It’s designed to collect audit evidence and bring all your reconciliations together in a single platform, taking the stress out of year end and quarter end.

4. Workflow and Team Management

- Xero: Xero accounting software allows collaboration and multiple user access. However, it lacks a dedicated workflow management tool for the closing checklist itself.

- Easy Month End: It offers specific team management and collaboration tools. You can assign tasks, track progress, and have automated sign offs, making the team works more efficiently. You can also leave comments and track every action, leading to a more efficient finance team.

5. Inventory Management

- Xero: Xero offers an inventory management feature on its more established plan. This helps businesses manage their stock levels and inventory data to support business performance.

- Easy Month End: It does not have the ability to manage inventory or track inventory data. Its focus is purely on the financial close process.

6. Cash Flow and Expense Tracking

- Xero: The xero dashboard gives a real-time overview of cash flow management. Xero excels at expense tracking, bill payable functionality, and accounts receivable (invoices owed), making it essential for small business owners.

- Easy Month End: It focuses on the post-transaction process (reconciliation and close). It does not provide the front-end tools for daily cash flow tracking or expense tracking.

7. Scalability and Target Audience

- Xero: With various pricing plans from the early plan up to multi-currency support, Xero is great for small businesses and growing businesses. We recommend xero for any entity needing a complete enterprise resource planning foundation.

- Easy Month End: It is best for established businesses with a growing finance team that needs to formalize and streamline its close process, often integrating with the existing xero accounting software.

8. Mobile Functionality and Access

- Xero: Xero offers a powerful mobile app for ios and android devices. This ability allows you to send online invoicing, capture bills, and reconcile on the go, making it a truly cloud based accounting solution.

- Easy Month End: While cloud based accounting as well, its mobile app functionality focuses on checking in on the close progress and approving tasks, rather than handling day-to-day transactions.

9. Audit and Compliance Documentation

- Xero: Provides an audit evidence trail of transactions. The xero’s reporting features help in checking the financial position.

- Easy Month End: It is specifically built to help the preparer and reviewers collect audit evidence in one place. It makes providing information to auditors for signing off on the year end less of a hassle.

What to Look For When Choosing Accounting Software?

Here are the key points to consider:

- User-Friendly Interface: You want a clean and user-friendly interface that xero makes navigating financial tasks a breeze.

- Scalability: Can it support business growth? Check if xero pricing and pricing plans suit small businesses and expanding businesses.

- Real Time Data: The software should provide real-time data into your financial details and business’s financial health.

- Support & Resources: Look for robust online resources and a responsive way to submit a support ticket to get an answer. Xero central offers a great community for this.

- Accessibility: Does it offer a mobile app for ios and android devices so you can work from multiple locations?

- Feature Depth: Do you need simple financial management or advanced features like project tracking and multiple currencies?

- Client Management: The ability to manage client data and send unlimited invoices is essential for independent contractors and professional services.

- Month End Efficiency: For your finance team, check features for team collaboration on the month end process to avoid manual confirmations and delays.

- Customization: Can you get customizable reporting and easily schedule payments?

- Data Migration: Is the data migration process simple when you upload your existing records? You should be able to test xero or any software easily.

- Contracts: Understand the terms before you cancel or expand your subscription to know the true xero cost.

- Audit Trail: The system should ensure a clear log of changes to protect against errors.

- Onboarding: How quickly can your team handle month-end processes during the first month-end?

Final Verdict

After this deep dive, the right choice depends on your core need.

If your goal is comprehensive financial reporting and managing all daily transactions, then use Xero accounting.

Xero, as a leading cloud-based accounting software, is a stronger choice for small business owners.

Xero lets you handle everything from sales tax to purchase orders and paying up to five bills on the early plan.

However, if your finance team deserves an easier life by solving the pain of the month-end close.

Easy Month End is a fantastic tool. It frees up lives by simplifying ad hoc reconciliations and eliminating spreadsheets from outlook.

You can additionally integrate it to review your main Xero accounting software ERP.

Both are great; pick Xero for overall customer support and scope, or the other to stay organized and get out of manual confirmations faster.

More of Xero

Choosing the right accounting software means looking at a number of options.

Here’s a quick look at Xero vs other popular products.

- Xero vs QuickBooks: QuickBooks is a major competitor. While both offer similar core features, Xero is often praised for its clean interface and unlimited users. QuickBooks can be more complex, but it offers very powerful reporting.

- Xero vs FreshBooks: FreshBooks is a popular option, especially for freelancers and service-based businesses. It excels at invoicing and time tracking. Xero provides a more well-rounded accounting solution.

- Xero vs Sage: Both Sage and Xero offer solutions for small businesses. However, Sage also provides more comprehensive enterprise resource planning (ERP) tools for larger companies.

- Xero vs Zoho Books: Zoho Books is part of a large suite of business apps. It often has more advanced features for inventory and is very cost-effective. Xero, meanwhile, is a leading option for simplicity and ease of use.

- Xero vs Wave: Wave is known for its free plan. It’s a great option for very small businesses or freelancers on a tight budget. Xero offers a wider range of features and is better for business growth.

- Xero vs Quicken: Quicken is mainly for personal finance. While it has some business features, it’s not a true business accounting solution. Xero is built specifically to handle the complexities of business accounting.

- Xero vs Hubdoc: These are not direct competitors. Both Dext and Hubdoc are tools that automate document capture and data entry. They integrate directly with Xero to make bookkeeping faster and more accurate.

- Xero vs Synder: Synder is a platform that connects sales channels and payment gateways to accounting software. It helps automate data entry from platforms like Shopify and Stripe directly into Xero.

- Xero vs Expensify: Expensify focuses specifically on expense management. While Xero has expense features, Expensify offers more advanced tools for managing employee expenses and reimbursements.

- Xero vs Netsuite: Netsuite is a comprehensive ERP system for large corporations. It offers a full suite of business management tools. Xero is not an ERP but is an excellent accounting solution for small businesses.

- Xero vs Puzzle IO: Puzzle IO is a finance platform designed for startups, focusing on real-time financial statements and automated data entry.

- Xero vs Easy Month End: This software is a specialized tool for automating the month-end closing process, helping with reconciliation and audit trails. It is designed to work with Xero, not replace it.

- Xero vs Docyt: Docyt uses AI to automate back-office and bookkeeping tasks. It provides a way to view all your financial documents and data in one place.

- Xero vs RefreshMe: RefreshMe is a simpler accounting software with basic features, often used for personal finance or very small businesses.

- Xero vs AutoEntry: Similar to Dext and Hubdoc, AutoEntry is a tool that automates data extraction from receipts and invoices, designed to integrate with and enhance accounting software like Xero.

More of Easy Month End

Here is a brief comparison of Easy Month End with some of the leading alternatives.

- Easy Month End vs Puzzle io: While Puzzle.io is for startup accounting, Easy Month End focuses specifically on streamlining the close process.

- Easy Month End vs Dext: Dext is primarily for document and receipt capture, whereas Easy Month End is a comprehensive month-end close management tool.

- Easy Month End vs Xero: Xero is a full accounting platform for small businesses, while Easy Month End provides a dedicated solution for the close process.

- Easy Month End vs Synder: Synder specializes in integrating e-commerce data, unlike Easy Month End which is a workflow tool for the entire financial close.

- Easy Month End vs Docyt: Docyt uses AI for bookkeeping and data entry, while Easy Month End automates the steps and tasks of the financial close.

- Easy Month End vs RefreshMe: RefreshMe is a financial coaching platform, which is different from Easy Month End’s focus on close management.

- Easy Month End vs Sage: Sage is a large-scale business management suite, while Easy Month End offers a more specialized solution for a critical accounting function.

- Easy Month End vs Zoho Books: Zoho Books is an all-in-one accounting software, whereas Easy Month End is a purpose-built tool for the month-end process.

- Easy Month End vs Wave: Wave provides free accounting services for small businesses, while Easy Month End offers a more advanced solution for close management.

- Easy Month End vs Quicken: Quicken is a personal finance tool, making Easy Month End a better choice for businesses needing to manage a month-end close.

- Easy Month End vs Hubdoc: Hubdoc automates document collection, but Easy Month End is designed to manage the full close workflow and team tasks.

- Easy Month End vs Expensify: Expensify is an expense management software, which is a different function than Easy Month End’s core focus on the financial close.

- Easy Month End vs QuickBooks: QuickBooks is a comprehensive accounting solution, while Easy Month End is a more specific tool for managing the month-end close itself.

- Easy Month End vs AutoEntry: AutoEntry is a data capture tool, whereas Easy Month End is a complete platform for task and workflow management during the close.

- Easy Month End vs FreshBooks: FreshBooks is for freelancers and small businesses, while Easy Month End offers a dedicated solution for the month-end close.

- Easy Month End vs NetSuite: NetSuite is a full-featured ERP system, which is broader in scope than Easy Month End’s specialized focus on the financial close.

Frequently Asked Questions

Can Xero help me store all my financial documents?

Yes, Xero allows you to attach source documents to transactions, keeping everything organized digitally.

Does Easy Month End require a lot of manual data entry?

Easy Month End aims to reduce manual work with features focused on streamlining the month-end close process.

Could I import data from my existing accounting system into either platform?

Yes, both Xero and Easy Month End typically offer options to import data from other systems.

How often does the financial data update in both Xero and Easy Month End?

Xero often has live bank feeds for near real-time updates. Easy Month End focuses on updating during the monthly close.

Is Easy Month End suitable for any business entity?

Easy Month End can benefit various entities struggling with month-end, but its value depends on their specific needs.