Are you tired of piles of receipts and spending too much time tracking your business costs?

It can feel like a never-ending chore, right?

Two big names you might have heard of are Dext vs Expensify.

Let’s examine what each offers and see which one might become your new favorite tool.

Overview

We looked closely at both Dext and Expensify.

We tried out their features and saw how easy they were to use.

This helped us see the good things and bad things about each one.

Now we can compare them for you!

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and streamlining your finances.

Pricing: It has a free trial. The premium plan starts at $24/month.

Key Features:

- Receipt Scanning

- Expense Reports

- Bank Reconciliation

Join over 15 million users who trust Expensify to simplify their finances. Save up to 83% on time spent on expense reports.

Pricing: It has a free trial. The premium plan starts at $5/month.

Key Features:

- SmartScan Receipt Capture

- Corporate Card Reconciliation

- Advanced Approval Workflows.

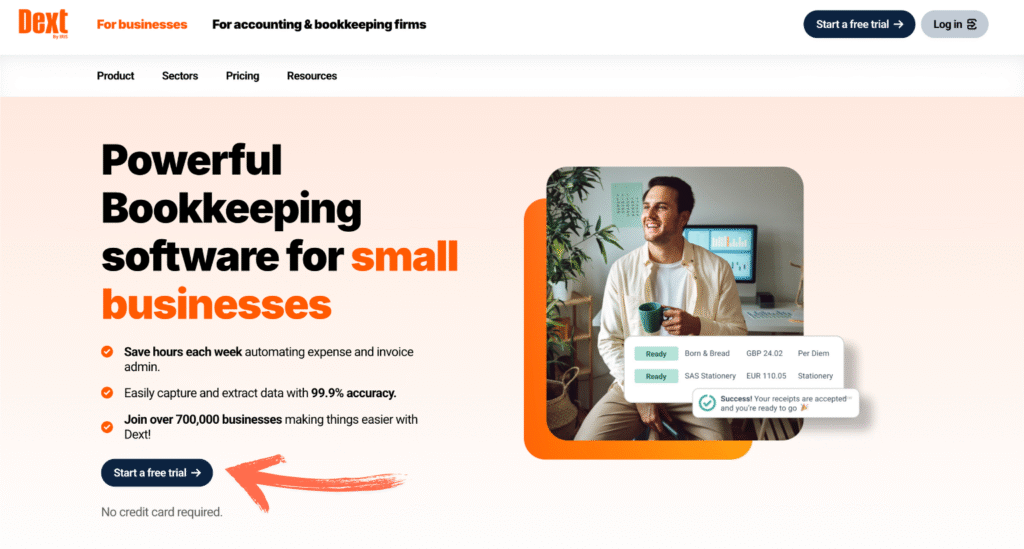

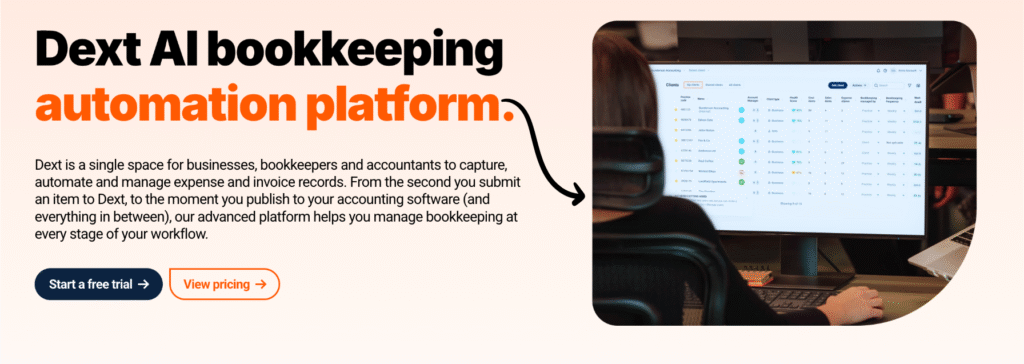

What is Dext?

Okay, so what is Dext?

Think of it like a super smart helper for your papers.

It mostly takes care of things like bills and receipts.

You just snap a picture, and Dext gets all the important info.

Pretty neat, huh?

Also, explore our favorite Dext alternatives…

Our Take

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and reporting can streamline your finances.

Key Benefits

Dext really shines when it comes to making expense management a breeze.

- 90% of users report a significant decrease in paper clutter.

- It boasts an accuracy rate of over 98% in extracting data from documents.

- Creating expense reports becomes incredibly quick and easy.

- Integrates smoothly with popular accounting platforms, such as QuickBooks and Xero.

- Helps ensure you never lose track of important financial documents.

Pricing

- Annually Subscription: $24

Pros

Cons

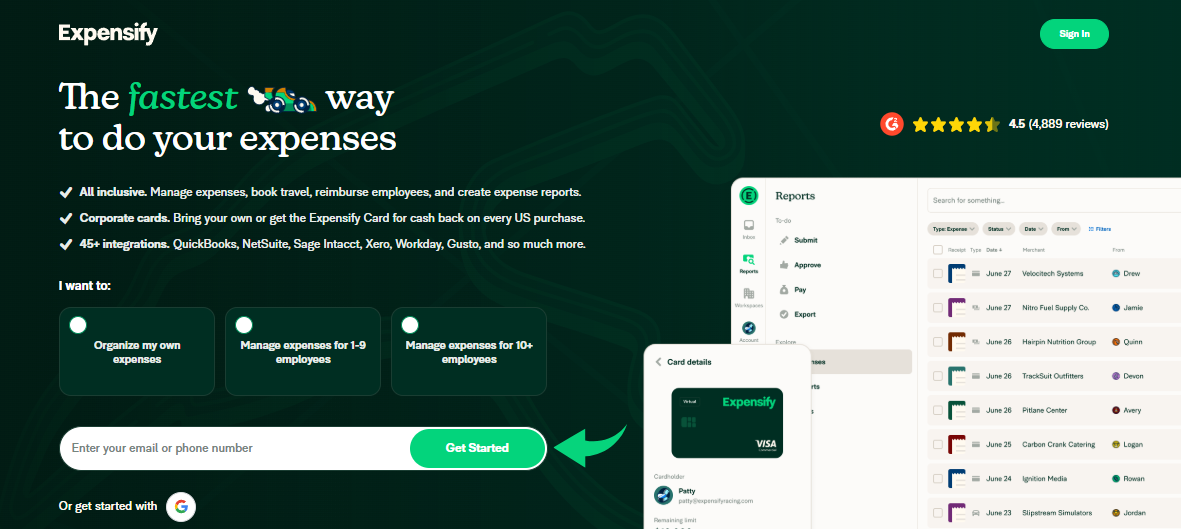

What is Expensify?

Okay, so let’s talk about Expensify.

It’s a tool that helps you keep track of all your business spending.

Think of it like a helper that remembers where your money goes.

It can grab info from your receipts and bank stuff. Pretty handy!

Also, explore our favorite Expensify alternatives…

Key Benefits

- SmartScan technology scans receipt details and extracts them with over 95% accuracy.

- Employees get reimbursed quickly, often in as little as one business day via ACH.

- The Expensify Card can save you up to 50% on your subscription with its cash back program.

- No warranty is offered; their terms state that liabilities are limited.

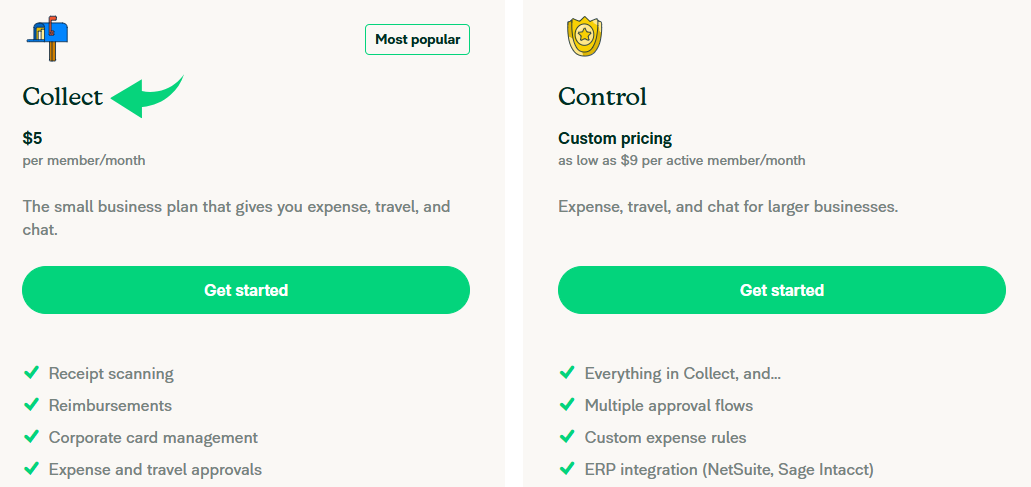

Pricing

- Collect: $5/month.

- Control: Custom Pricing.

Pros

Cons

Feature Comparison

Both Dext and Expensify aim to simplify your expense management process.

Let’s dive into the details and see what each system offers and how they handle different tasks.

1. Data Extraction

- Dext:

- Excels at data extraction using OCR technology.

- Can extract data from receipts, invoices, purchase orders, and other financial documents.

- Capture receipts using the Dext mobile app or through email submission.

- Expensify:

- Uses its SmartScan feature for quick receipt capture.

- Built to be fast and easy for employees to snap a photo with their phone.

- Helps save time by minimizing manual data entry.

2. Mobile App and User Experience

- Dext:

- Dext mobile app is strong and gives clients and accountants access to financial data.

- Lets you log mileage and track expenses on the go.

- Expensify:

- Expensify makes it simple for a small number of employees to manage expenses from their pocket.

- The app is very easy to use for completing reports and getting reimbursement.

3. Approvals and Workflows

- Dext:

- Offers an approval system allowing accountants or employers to approve documents and expense claims.

- Provides a flexible way to process approvals.

- Expensify:

- Known for simple approval workflows.

- A manager can review and approve expense requests in just a few minutes.

- You can set up rules to respond to certain expense claims automatically.

4. Integration

- Dext:

- Offers deep integration with popular tools like QuickBooks Online.

- Has direct integrations that allow for a secure data flow.

- Dext works well within accounting and bookkeeping workflows.

- Expensify:

- Has many integrations to connect to your bank and accounting software.

- A strong connection helps streamline the expense management process.

5. Invoice and Bill Management

- Dext:

- A clear winner for managing invoices.

- You can use fetching invoices to automatically grab them from online vendors.

- Has supplier rules to code and process incoming bills for bookkeeping.

- Expensify:

- Can handle some invoices but it’s not the main focus.

- Dext gives you more power if you deal with lots of bills.

6. Corporate Cards

- Dext:

- Works with corporate cards but does not offer its own card.

- Expensify:

- Offers its own Expensify Card, which helps employers manage expenses.

- Transactions from the card appear on your page immediately in real time.

7. Auditing and Security

- Dext:

- Provides a secure data flow and keeps financial documents stored safely.

- Uses a reliable security service.

- Expensify:

- Also has a strong security solution to protect against online attacks.

- Helps protect your finance data. (e.g., messages like Cloudflare Ray ID found are part of this protection).

8. Data Automation

- Dext:

- Excels at automating data entry and helps save time.

- Dext saves your small business from a ton of manual data entry.

- Focuses on automating data entry at the start of the bookkeeping workflows.

- Expensify:

- Helps to simplify the process by automating report creation and reimbursement.

9. Customer Support

- Dext:

- Provides support for clients and accountants.

- Helps with setup to ensure system dependability.

- Expensify:

- Expensify reviews often mention its solid customer support.

- They try to respond to requests quickly to help you resolve issues.

What to look for when choosing an Accounting Software?

- Check the pricing plans to make sure they fit your budget and offer a free trial today so you can try Dext or Expensify.

- The system must have mobile scanning to easily collect receipts and submit receipts from your phone to save time.

- Look for strong optical character recognition (OCR) to minimize manual entry and prevent malformed data from entering your records.

- It should offer multiple ways to upload documents, not just one. This includes email, mobile scanning, and connecting to bank accounts.

- The software needs reliable bank feeds to automatically import and reconcile transactions, linking them to your receipt bank documents.

- Make sure it supports tracking categories so you can properly code expenses and get accurate tax details for tax time.

- Small business owners need real-time data to track cost and sales data and manage cash flow effectively.

- Find out about use and system dependability—you need a tool that works smoothly after the initial setup and is protected by a strong security service.

- It should have the ability to store receipts securely, and you should be able to easily export or file your statements and records.

- Look for an easy way to manage expenses and automate tasks to keep removing hassle from your bookkeeper.

- The system should help you run your business better by offering an accurate, full picture of your income and profit.

- Check if the Dext account or Expensify connects with business apps and other third-party apps you use to run payroll or send invoices.

- The system should allow several actions to be performed, triggered by a certain word or rule, helping to automate the entire expense management process.

Final Verdict

After looking closely at both tools, we choose Expensify for most small business accounting. Why?

It excels at quick expense tracking and getting payments handled in less time.

Its mobile app is great for track mileage and submitting expenses, which saves your employees hassle.

While Dext Prepare offers unlimited bookkeeping records on certain plans and dext offers multiple ways to gather data collection.

Expensify simply makes the expense tracking part easier for the average small business owner on the go.

If you are a firm and have Xero users, Dext is a great option. But for simple business operations.

Expensify’s easy online accounting helps you pay bills fast.

We have checked all the key features and know what works in the real business accounting world.

Give their starter plan a look today!

More of Dext

We’ve also taken a look at how Dext compares with other expense management and accounting tools:

- Dext vs Xero: Xero offers comprehensive accounting with integrated expense management features.

- Dext vs Puzzle IO: Puzzle IO excels in AI-powered financial insights and forecasting.

- Dext vs Synder: Synder focuses on syncing e-commerce sales data and payment processing.

- Dext vs Easy Month End: Easy Month End streamlines the month-end financial closing procedures.

- Dext vs Docyt: Docyt uses AI to automate bookkeeping and document management tasks.

- Dext vs RefreshMe: RefreshMe provides real-time insights into business financial performance.

- Dext vs Sage: Sage offers a range of accounting solutions with expense tracking capabilities.

- Dext vs Zoho Books: Zoho Books provides integrated accounting with expense management features.

- Dext vs Wave: Wave offers free accounting software with basic expense tracking features.

- Dext vs Quicken: Quicken is popular for personal finance and basic business expense tracking.

- Dext vs Hubdoc: Hubdoc specializes in automated document collection and data extraction.

- Dext vs Expensify: Expensify offers robust expense reporting and management solutions.

- Dext vs QuickBooks: QuickBooks is a widely used accounting software with expense management tools.

- Dext vs AutoEntry: AutoEntry automates data entry from invoices, receipts, and bank statements.

- Dext vs FreshBooks: FreshBooks is designed for service-based businesses with invoicing and expense tracking.

- Dext vs NetSuite: NetSuite offers a comprehensive ERP system with expense management functionalities.

More of Expensify

- Expensify vs Puzzle: This software focuses on AI-powered financial planning for startups. Its counterpart is for personal finance.

- Expensify vs Dext: This is a business tool for capturing receipts and invoices. The other tool tracks personal expenses.

- Expensify vs Xero: This is popular online accounting software for small businesses. Its competitor is for personal use.

- Expensify vs Synder: This tool syncs e-commerce data with accounting software. Its alternative focuses on personal finance.

- Expensify vs Easy Month End: This is a business tool to streamline month-end tasks. Its competitor is for managing personal finances.

- Expensify vs Docyt: This uses AI for business bookkeeping and automation. The other uses AI as a personal finance assistant.

- Expensify vs Sage: This is a comprehensive business accounting suite. Its competitor is an easier-to-use tool for personal finance.

- Expensify vs Zoho Books: This is an online accounting tool for small businesses. Its competitor is for personal use.

- Expensify vs Wave: This provides free accounting software for small businesses. Its counterpart is designed for individuals.

- Expensify vs Hubdoc: This specializes in document capture for bookkeeping. Its competitor is a personal finance tool.

- Expensify vs QuickBooks: This is well-known accounting software for businesses. Its alternative is built for personal finance.

- Expensify vs AutoEntry: This is designed to automate data entry for business accounting. Its alternative is a personal finance tool.

- Expensify vs FreshBooks: This is accounting software for freelancers and small businesses. Its alternative is for personal finance.

- Expensify vs NetSuite: This is a powerful business management suite for large companies. Its competitor is a simple personal finance app.

Frequently Asked Questions

Is Dext better than Expensify?

It depends on what you need! Expensify is great for easy expense reports and reimbursement, especially with its mobile app. Dext is strong for handling lots of receipts and invoices and helps more with detailed bookkeeping.

Which is easier to use, Dext or Expensify?

Most people find Expensify a bit simpler to get started with, especially for submitting expenses. Its mobile app and receipt scanning are very user-friendly. Dext can do more, so it might take a little longer to learn all its features.

Does Expensify offer a free version?

Yes, Expensify has a free version, but it has limited features and is for just one user. Dext doesn’t usually offer a completely free version, but they might have a free trial to test things out.

Can Dext and Expensify integrate with my accounting software?

Yes, both Dext and Expensify can integrate with popular accounting software like QuickBooks and Xero. This helps sync your financial data and streamline your bookkeeping.

Which one is better for handling corporate cards?

Expensify is generally considered better for managing corporate cards. It has specific features that make it easier to track company spending and reconcile card transactions. Dext can handle it, but Expensify has more tools for this.