Doing books by hand is a total headache.

It takes way too long, and it is easy to make big mistakes.

You probably feel buried under piles of receipts and confusing spreadsheets every single month.

It is time to stop stressing over your finances.

AI can handle the hard work for you so you can finally relax.

Our guide shows you how to use Docyt to automate everything in a few simple steps.

Read on to see how this tool saves you time and keeps your money organized.

Docyt Tutorial

Ready to start? First, connect your bank feeds and akuntansi perangkat lunak.

Next, let the AI scan your receipts and bills.

It sorts everything into the right categories for you.

Review the data and hit sync.

It is that simple to keep your books perfect every single day.

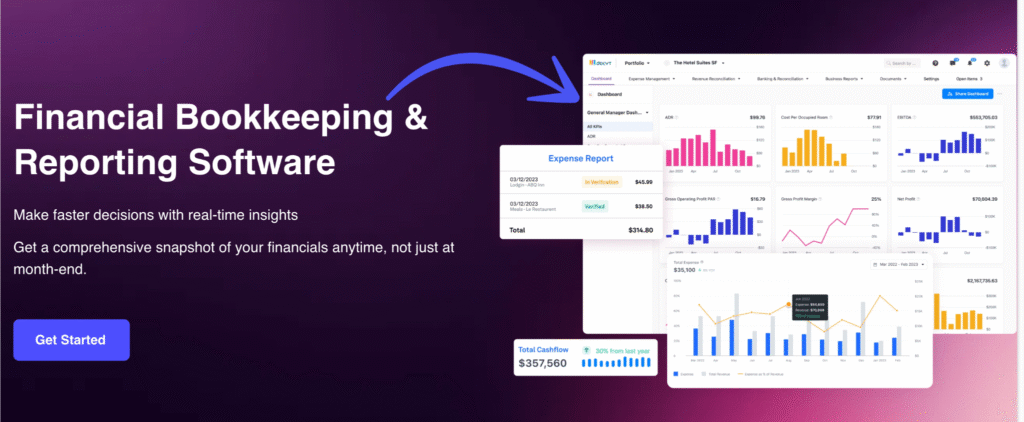

How to use Financial Bookkeeping & Reporting

Are you tired of spending hours on spreadsheets?

Docyt makes managing your bisnis money much easier.

It uses AI-powered tools to do the heavy lifting for you.

You can connect multiple businesses to one dashboard to see everything at once.

This section will show you how to set up your books so you can get real-time insights without the stress.

Step 1: Connect Your Banking Accounts and Software

The first thing you need to do is give the Docyt AI a way to see your money flow.

This stops you from having to do manual data entry.

- Log in and head to the settings to link your banking accounts.

- Connect your ledger, such as QuickBooks Online, so the two systems can communicate.

- Once linked, the software pulls in transactions in real time.

Step 2: Set Up Your Receipt Box and Capture Tools

Keeping track of paper is a pain. Docyt uses a digital receipt box to keep your files organized and safe.

- Download the mobile app to use the receipt capture feature.

- Simply snap a photo of your invoices or receipts as soon as you get them.

- The AI reads the numbers and automatically matches them to your bank spending.

Step 3: Manage Bills and Expense Reports

Now that your data is in the system, you can handle accounts payable and expense management in one place.

You don’t need a separate bill pay tool.

- Review your uploaded bills and schedule payments directly through the platform.

- Staff members can submit their own expense reports for quick approval.

- The system checks for duplicates, so you never pay the same bill twice.

Step 4: Run Real-Time Financial Reports

The best part about using an automated system is knowing your numbers right now.

You don’t have to wait for akuntansi firms to finish their work at the end of the month.

- Click on the reports tab to see real-time financial reports.

- Check your profit and loss or revenue reconciliation to see how much you actually made today.

- Use these facts to make smart choices for your company’s growth.

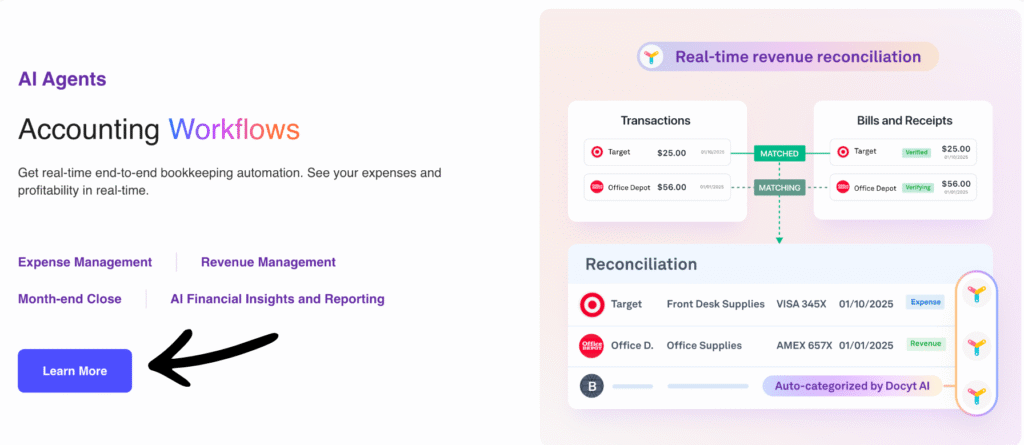

How to use Real-time Revenue Reconciliation

Do you ever wonder if the money in your bank matches what you actually sold?

In the past, you had to wait weeks for accountants to check your books.

Now, you can watch your money move in real-time financial dashboards.

This helps you see your true profitability every single day without the average wait times.

Step 1: Link Your Sales Channels and Apps

To start, you need to link your sales tools to the Docyt app.

This allows the system to see every dollar your customers pay for your services.

- Go to the integrations page and select the tools you use, like Square or Shopify.

- Connect your bank account so the software can see the deposits.

- This connection eliminates the need for manual input, reducing the risk of human error.

Step 2: Upload Your Supporting Documents

For the system to reconcile your sales, it needs to see the proof.

Every document matters when you want perfect financial statements.

- Use the app to upload daily sales summaries or merchant reports.

- Ensure you include any information about fees charged by vendors, such as credit card processors.

- Your team can help with this by snapping photos of end-of-day reports.

Step 3: Match Transactions to Bank Deposits

Once the data is in, the AI gets to work.

It looks at all your transactions and finds where that money landed in your bank.

- The software automatically pairs your sales records with your bank deposits.

- It subtracts expenses like processing fees, so your numbers are exact.

- If something doesn’t match, the system will ask you or your firm to take a look.

Step 4: Monitor Your Client’s or Business Income

If you are running a firm, you can manage each client’s money from one screen.

This makes life much easier for everyone involved.

- Check the dashboard to see if any deposits are missing.

- Look at the “Revenue Gap” to find sales that haven’t hit your bank yet.

- If you need more help, you can always book a demo to see advanced features.

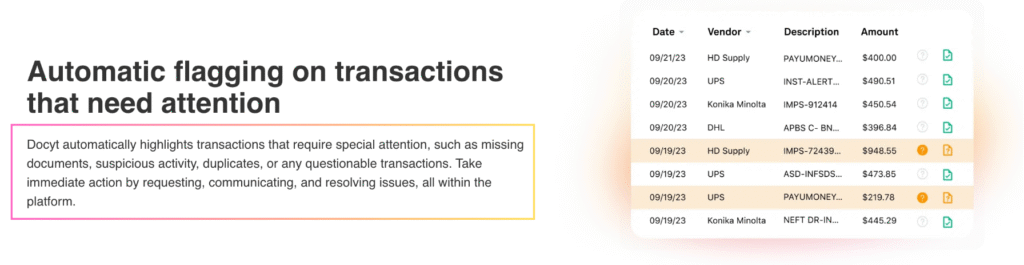

How to use Automatic Flagging on Transactions

Keeping your books clean can be hard when you have hundreds of transactions to track.

Docyt is designed to act like a second pair of eyes that never gets tired.

It uses AI-powered tools to watch for mistakes before they become big problems.

Step 1: Set Your Custom Business Rules

To make the AI work for you, it needs to understand what a normal purchase looks like for your company.

You give it the information it needs to protect your cash.

- Go to the settings tab to follow the setup wizard for flagging rules.

- Tell the system which vendors you use most often and what you usually spend there.

- The AI will then categorize your spending and alert you if a price suddenly changes.

Step 2: Receive Alerts for Errors or Missing Info

You don’t have to go looking for problems; the problems will find you.

You will receive a notification the moment something looks wrong.

- Check your “Action Items” list to see the provided alerts about duplicate bills.

- The system will flag any purchase that is missing a receipt or a digital document.

- This ensures that by the end of the month, every penny is accounted for.

Step 3: Resolve Flags and Fix Mistakes

When the AI finds an error, it is very easy to fix.

You can handle everything right inside the app without calling your accountants.

- Click on the flagged item to see why the AI is worried.

- I recommend uploading the missing receipt or correcting the category immediately.

- Once you fix the issue, the flag disappears, and your financial statements stay accurate.

Alternatives to Docyt

- Dext: Perangkat lunak ini berfokus pada otomatisasi ekstraksi data dari kwitansi dan faktur. Ini menghemat waktu entri data manual dengan mendigitalisasi dokumen Anda.

- Xero: Ini adalah platform akuntansi berbasis cloud yang populer. Ini merupakan alternatif untuk fitur pembukuan Atera, menawarkan alat untuk pembuatan faktur, rekonsiliasi bank, dan pelacakan pengeluaran.

- Akhir Bulan yang Mudah: Perangkat lunak khusus ini dirancang khusus untuk menyederhanakan proses penutupan keuangan. Perangkat lunak ini terintegrasi dengan platform akuntansi lain seperti QuickBooks dan Xero untuk memastikan proses akhir bulan yang lancar dan mudah.

- Puzzle io: Ini adalah perangkat lunak akuntansi modern yang dirancang khusus untuk perusahaan rintisan. Perangkat lunak ini membantu dalam pelaporan keuangan dan otomatisasi, menawarkan wawasan secara real-time dan fokus pada penyederhanaan pembukuan untuk penutupan yang lebih cepat.

- Sage: Sebagai penyedia perangkat lunak manajemen bisnis yang terkenal, Sage menawarkan berbagai solusi akuntansi dan keuangan yang dapat berfungsi sebagai alternatif untuk modul manajemen keuangan Atera.

- Buku Zoho: Sebagai bagian dari rangkaian produk Zoho, ini adalah alat akuntansi yang andal untuk bisnis kecil hingga menengah. Alat ini membantu dalam pembuatan faktur, pelacakan pengeluaran, dan manajemen inventaris, serta merupakan alternatif yang baik bagi mereka yang membutuhkan alat keuangan yang komprehensif.

- Synder: Perangkat lunak ini berfokus pada sinkronisasi platform e-commerce dan pembayaran Anda dengan perangkat lunak akuntansi Anda. Ini merupakan alternatif yang berguna bagi bisnis yang perlu mengotomatiskan aliran data dari saluran penjualan ke dalam pembukuan mereka.

- Akhir Bulan yang Mudah: Alat ini dirancang khusus untuk menyederhanakan proses penutupan akhir bulan. Ini adalah alternatif khusus untuk bisnis yang ingin meningkatkan dan mengotomatiskan tugas pelaporan dan rekonsiliasi keuangan mereka.

- Docyt: Docyt, sebuah platform pembukuan berbasis AI, mengotomatiskan alur kerja keuangan. Platform ini merupakan pesaing langsung fitur pembukuan berbasis AI dari Atera, menawarkan data real-time dan manajemen dokumen otomatis.

- Segarkan Saya: Ini adalah platform manajemen keuangan pribadi. Meskipun bukan alternatif bisnis secara langsung, platform ini menawarkan fitur serupa seperti pelacakan pengeluaran dan faktur.

- Melambai: Ini adalah perangkat lunak keuangan gratis yang populer. Ini adalah pilihan yang baik untuk pekerja lepas dan usaha kecil untuk pembuatan faktur, akuntansi, dan pemindaian tanda terima.

- Mempercepat: Sebuah alat yang terkenal untuk keuangan pribadi dan usaha kecil. Alat ini membantu dalam penganggaran, pelacakan pengeluaran, dan perencanaan keuangan.

- Hubdoc: Perangkat lunak ini adalah alat manajemen dokumen. Perangkat lunak ini secara otomatis mengambil dokumen keuangan Anda dan menyinkronkannya ke perangkat lunak akuntansi Anda.

- Expensify: Platform ini berfokus pada manajemen pengeluaran. Sangat cocok untuk memindai tanda terima, perjalanan bisnis, dan membuat laporan pengeluaran.

- QuickBooks: Salah satu program perangkat lunak akuntansi yang paling banyak digunakan. QuickBooks adalah alternatif yang kuat yang menawarkan serangkaian alat lengkap untuk manajemen keuangan.

- Entri Otomatis: Alat ini mengotomatiskan entri data. Ini adalah alternatif yang baik untuk fitur pengambilan tanda terima dan faktur di dalam Atera.

- FreshBooks: Program ini sangat bagus untuk pembuatan faktur dan akuntansi. Program ini populer di kalangan pekerja lepas dan usaha kecil yang membutuhkan cara sederhana untuk melacak waktu dan pengeluaran.

- NetSuite: Sebuah rangkaian perangkat lunak manajemen bisnis berbasis cloud yang andal dan lengkap. NetSuite adalah alternatif bagi bisnis yang lebih besar yang membutuhkan lebih dari sekadar manajemen keuangan.

Docyt Dibandingkan

Saat mencari perangkat lunak akuntansi yang tepat, akan sangat membantu untuk melihat bagaimana berbagai platform saling bersaing.

Berikut perbandingan singkat Docyt dengan banyak alternatifnya.

- Docyt vs Puzzle IO: Meskipun keduanya membantu dalam hal keuangan, Docyt berfokus pada pembukuan berbasis AI untuk bisnis, sementara Puzzle IO menyederhanakan pembuatan faktur dan pengeluaran untuk pekerja lepas.

- Docyt vs Dext: Docyt menawarkan platform pembukuan AI yang lengkap, sedangkan Dext mengkhususkan diri dalam pengambilan data otomatis dari dokumen.

- Docyt vs Xero: Docyt dikenal karena otomatisasi AI-nya yang canggih. Xero menyediakan sistem akuntansi yang komprehensif dan mudah digunakan untuk kebutuhan bisnis umum.

- Docyt vs Synder: Docyt adalah alat pembukuan berbasis AI untuk otomatisasi back-office. Synder berfokus pada sinkronisasi data penjualan e-commerce dengan perangkat lunak akuntansi Anda.

- Docyt vs Easy Month End: Docyt adalah solusi akuntansi berbasis AI lengkap. Easy Month End adalah alat khusus yang dirancang khusus untuk merampingkan dan menyederhanakan proses penutupan akhir bulan.

- Docyt vs RefreshMe: Docyt adalah alat akuntansi bisnis, sedangkan RefreshMe adalah aplikasi keuangan pribadi dan penganggaran.

- Docyt vs Sage: Docyt menggunakan pendekatan modern yang mengutamakan AI. Sage adalah perusahaan yang sudah lama berdiri dan menawarkan berbagai solusi akuntansi tradisional dan berbasis cloud.

- Docyt vs Zoho Books: Docyt berfokus pada otomatisasi akuntansi berbasis AI. Zoho Books adalah solusi lengkap yang menawarkan serangkaian fitur lengkap dengan harga yang kompetitif.

- Docyt vs Wave: Docyt menyediakan otomatisasi AI yang canggih untuk bisnis yang sedang berkembang. Wave adalah platform akuntansi gratis yang paling cocok untuk pekerja lepas dan usaha mikro.

- Docyt vs Quicken: Docyt dirancang untuk akuntansi bisnis. Quicken terutama merupakan alat untuk manajemen keuangan pribadi dan penganggaran.

- Docyt vs Hubdoc: Docyt adalah sistem pembukuan AI yang lengkap. Hubdoc adalah alat pengumpulan data yang secara otomatis mengumpulkan dan memproses dokumen keuangan.

- Docyt vs Expensify: Docyt menangani berbagai tugas pembukuan lengkap. Expensify adalah spesialis dalam mengelola dan melaporkan pengeluaran karyawan.

- Docyt vs QuickBooks: Docyt adalah platform otomatisasi AI yang meningkatkan kemampuan QuickBooks. QuickBooks adalah perangkat lunak akuntansi komprehensif untuk semua ukuran bisnis.

- Docyt vs AutoEntry: Docyt adalah solusi pembukuan AI layanan lengkap. AutoEntry secara khusus berfokus pada ekstraksi dan otomatisasi data dokumen.

- Docyt vs FreshBooks: Docyt menggunakan AI canggih untuk otomatisasi. FreshBooks adalah solusi yang mudah digunakan dan populer di kalangan pekerja lepas karena fitur pembuatan faktur dan pelacakan waktunya.

- Docyt vs NetSuite: Docyt adalah alat otomatisasi akuntansi. NetSuite adalah sistem perencanaan sumber daya perusahaan (ERP) lengkap untuk perusahaan besar.

Kesimpulan

I hope you found this article helpful for your business.

Managing money no longer has to be a scary chore.

With Docyt, you can let the AI do the boring parts of pembukuan.

You will save time & avoid making costly mistakes.

Now you know how to track sales, pay bills, and catch errors automatically.

It is the best way to keep your finances organized and clear.

Are you ready to take control of your books?

It is time to get started and see how much easier your life can be!

Pertanyaan Yang Sering Muncul

How does Docyt work?

Docyt uses AI to extract data from bank statements and receipts. It organizes your transactions and syncs them with your ledger. This keeps your books accurate and up to date in real time.

Which AI tool is best for accounting?

Docyt is a top choice for automating workflows and multi-entity management. Other leading tools in 2026 include Ramp for expense tracking and QuickBooks Online for its powerful Asisten AI.

How to use accounting software?

Start by connecting your bank feeds and existing software. Upload your receipts and invoices so the system can track them. Finally, review the automated reports to manage your business money.

Do the big 4 accounting firms use AI?

Yes, Deloitte, PwC, EY, and KPMG use advanced AI agents. These tools help them review audit documents, analyze huge amounts of data, and provide faster advice to their global clients.

How to do bookkeeping step by step?

First, record every transaction and keep your receipts. Categorize your spending into the right accounts. Finally, reconcile your bank statements each month to ensure all your numbers match perfectly.

More Facts about Docyt

- Docyt AI helps you track the key numbers and goals that matter most to your type of business.

- The software creates instant reports and charts so you can see how your business is doing right now.

- You can choose how you want to see your data, even if you need to combine reports from different locations.

- If you have fallen behind on your math, Docyt helps you catch up on your pembukuan cepat.

- Instead of waiting until the end of the month, Docyt finishes your books every single day.

- The AI looks for mistakes and tells you if you are about to pay the same bill twice.

- When you mark a bill as “paid,” the system updates immediately to reflect that the money has been sent.

- Docyt talks to over 12,000 banks and 30 different checkout systems to keep your info up to date.

- It is very smart at sorting your spending, getting it right more than 99% of the time.

- Your documents are stored in a digital vault with high-level keamanan.

- The AI reads your receipts and bills just like a human would to find the right information.

- Workers can take pictures of receipts with their phones to save them segera.

- If you see a number on a report, you can click it to view the original receipt image.

- You can change your dashboard to show only the information you care about most.

- Once it gets your data, Docyt does the hard, boring akuntansi bekerja untuk Anda.

- Itautomatically matches the photos of your receipts to your credit card bill.

- It shows you how much money you are making and spending in real-time.

- The AI understands your spending by looking at what you have bought in the past.

- Before anything is finalized, Docyt sorts your transactions into the right categories.

- You can search your bills by the store name or bill status.

- There is a chat tool so you can talk to your team while you check over your bills.

- You can change or fix many bills at once to save energy.

- Docyt helps you keep track of which bills still need to be paid.

- Using this software means you have to type in 80% less data by hand.

- It makes finishing your monthly reports 5 times faster than the old way.

- Docyt is an all-in-one tool that works perfectly with QuickBooks Online.

- On average, businesses save 500 hours of work and $2,000 every year using Docyt.

- As your business gets bigger, Docyt grows with you to track new goals.

- It can combine financial reports from many store locations into a single list.

- Docyt is a comprehensive accounting helper for bisnis kecil and financial professionals.