Do you hate digging through piles of crumpled receipts?

It is a total pain. You waste hours manually entering data every week.

One small mistake can actually mess up your whole tax return.

This stress keeps you away from growing your actual bisnis.

There is a much better way. Dext handles the hard work for you.

This guide shows you exactly how to use Dext to save time.

Mari kita buat your life easier right now.

Ready to reclaim 10+ hours a month? See how Dext’s automated data entry, expense tracking, and pelaporan dapat merampingkan keuangan Anda.

Dext Tutorial

Getting started is easy and takes just a few minutes.

First, download the app on your phone.

Snap a clear photo of any receipt you have. The AI reads the data for you.

Finally, send it to your akuntansi perangkat lunak.

How to use Dext Bookkeeping Automation

Automating your books is the best way to save time.

Dext Prepare does the heavy lifting for you.

It connects your real-world spending to your digital books.

You do not have to type in data by hand anymore.

Follow these steps to set up your workflow and let the system run itself.

Step 1: Connect Your Software

You need to link your accounts first. This tells Dext where to send your data.

- Log in to your Dext account using the web app on your computer.

- Go to the “Connections” tab to link your akuntansi perangkat lunak.

- Navigate to the “Bank” section.

- Click “Add Bank Account” to set up a bank feed.

- This lets the system match your receipts to your bank account transactions effortlessly.

Step 2: Feed Data into the System

Otomatis needs data to work. You can submit receipts and invoices in many ways.

- Mobile Capture: Open the mobile app (also called the Dext app).

- Use “Single Mode” for one document.

- Switch to multiple modes if you have several documents. This lets you snap many photos in a row.

- Usethe combine mode if a bill has multiple pages.

- If you have a very long bill, take a picture of the long receipt, and the app stitches it together.

- Computer Upload: You can start uploading documents directly on the web. If you have a lot of files, you can even drop in a zip file.

- Email Forwarding: Every user gets a unique Dext email address. Forward your digital bills there to skip the manual upload.

Step 3: Set Rules to Auto Publish

Now you can tell Dext what to do with that data.

- The system will automatically pull the date, total, and tax from your photos.

- You can also upload supplier statements to check if you missed any invoices.

- Go to your supplier settings and turn on auto-publish for regular bills.

- Once this is on, your paperwork goes straight to your accounting software without you having to click a thing.

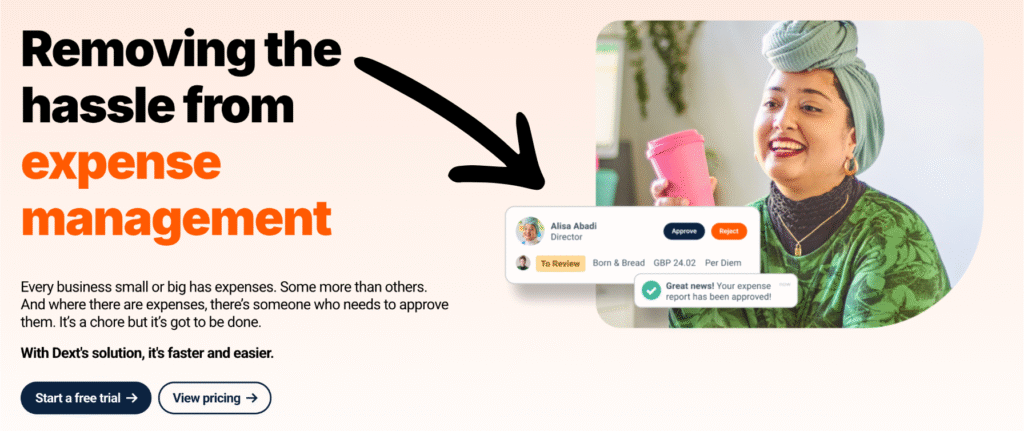

How to use Dext for Business Management

Running a company means watching every penny.

Dext helps you manage your team and money in one place.

Getting started with Dext for bisnis management is simple.

It lets you track who spends what and keeps your records straight.

Here is how to process your admin work without the stress.

Step 1: Add Your Team Members

You do not have to do everything alone.

You can create accounts for your staff to work collaboratively.

- Go to the “Users” tab in the menu.

- Click to add a new user by entering their email.

- This lets them submit items themselves.

- They can upload receipts or use the app to submit expenses.

- You can control their access so they only see what they need to see.

Step 2: Control How Data is Captured

Make sure your team knows how to send in a document.

- Most employees will be using the mobile app.

- Teach them to use single mode for a quick snap of one receipt.

- They can also forward digital invoices to their designated email address.

- You can set rules for line item extraction. This reads every single line on a bill, not just the total.

- This is how Dext works to provide more detail about what you are buying.

Step 3: Track Costs and Reports

You need to see where your money goes.

This step helps you organize financial data for you and your clients.

- Use the dashboard to view all transactions in real time.

- This helps you control costs before they get too high.

- You can connect Dext to your accounting software to keep the two systems in sync.

- When you are ready, you can bundle these expenses into a report.

- This makes it easy to spot errors before you officially file your taxes.

How to use Dext to Capture Receipts & Invoices

Capturing paperwork is easy with Dext.

It moves data from paper into your computer systems.

You can stop losing receipts and save time.

Step 1: Snap Photos on Your Phone

Use your phone to capture data quickly.

- Open the app and look at the camera screen.

- Select the camera mode that fits your needs.

- Take a clear image of the receipt.

- Make sure the date and total paid are visible.

- You can add a note to your team explaining the cost.

- This helps you skip typing it out later.

Step 2: Send Digital Files

You do not need to print out online bills.

- Forward files and PDFs directly to your Dext kotak-masuk.

- You can invite your suppliers or a new vendor to email bills to you.

- You can also upload a single page from your computer.

- This keeps all relevant documents in one place.

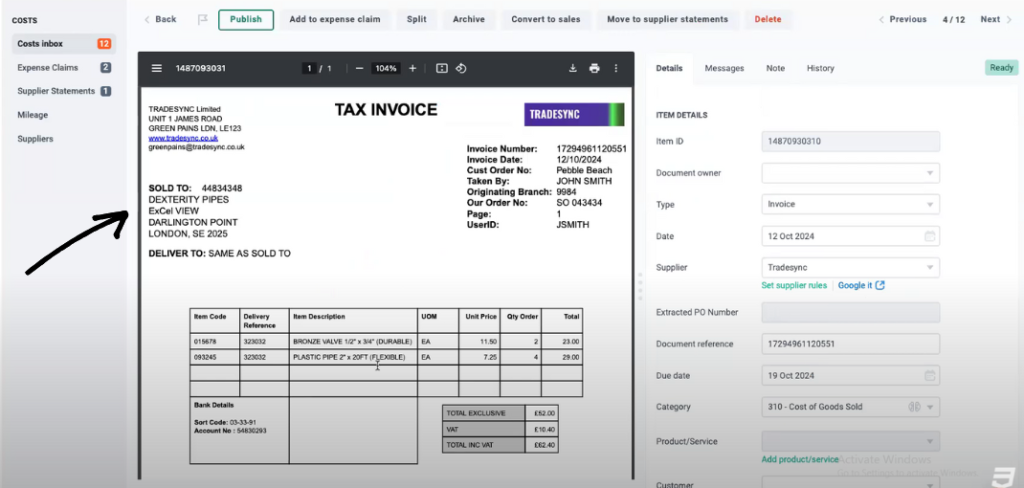

Step 3: Review and Publish

Once the data is in, you need to check it.

- Start by navigating to your inbox to see new items.

- Log in and review the details.

- You can edit the sales tax or category if needed.

- Set rules so the system learns for next time.

- Match the receipt to your bank feed.

- Finally, hit publish to finish.

- This article helps you master every step.

Alternatif untuk Dext

- Xero: Ini adalah platform akuntansi berbasis cloud yang populer. Ini merupakan alternatif untuk fitur pembukuan Atera, menawarkan alat untuk pembuatan faktur, rekonsiliasi bank, dan pelacakan pengeluaran.

- Sage: Sebagai penyedia perangkat lunak manajemen bisnis yang terkenal, Sage menawarkan berbagai solusi akuntansi dan keuangan yang dapat berfungsi sebagai alternatif untuk modul manajemen keuangan Atera.

- Buku Zoho: Sebagai bagian dari rangkaian produk Zoho, ini adalah alat akuntansi yang andal untuk bisnis kecil hingga menengah. Alat ini membantu dalam pembuatan faktur, pelacakan pengeluaran, dan manajemen inventaris, serta merupakan alternatif yang baik bagi mereka yang membutuhkan alat keuangan yang komprehensif.

- Synder: Perangkat lunak ini berfokus pada sinkronisasi platform e-commerce dan pembayaran Anda dengan perangkat lunak akuntansi Anda. Ini merupakan alternatif yang berguna bagi bisnis yang perlu mengotomatiskan aliran data dari saluran penjualan ke dalam pembukuan mereka.

- Akhir Bulan yang Mudah: Alat ini dirancang khusus untuk menyederhanakan proses penutupan akhir bulan. Ini adalah alternatif khusus untuk bisnis yang ingin meningkatkan dan mengotomatiskan tugas pelaporan dan rekonsiliasi keuangan mereka.

- Docyt: Docyt, sebuah platform pembukuan berbasis AI, mengotomatiskan alur kerja keuangan. Platform ini merupakan pesaing langsung fitur pembukuan berbasis AI dari Atera, menawarkan data real-time dan manajemen dokumen otomatis.

- Teka-teki IO: Ini adalah perangkat lunak akuntansi modern yang dirancang untuk perusahaan rintisan. Perangkat lunak ini menggunakan AI untuk mengotomatiskan pembukuan dan memberikan wawasan keuangan secara real-time. Ini merupakan alternatif yang baik untuk perusahaan yang berkembang pesat dan menginginkan solusi sederhana berbasis teknologi.

- Segarkan Saya: Ini adalah platform manajemen keuangan pribadi. Meskipun bukan alternatif bisnis secara langsung, platform ini menawarkan fitur serupa seperti pelacakan pengeluaran dan faktur.

- Melambai: Ini adalah perangkat lunak keuangan gratis yang populer. Ini adalah pilihan yang baik untuk pekerja lepas dan usaha kecil untuk pembuatan faktur, akuntansi, dan pemindaian tanda terima.

- Mempercepat: Sebuah alat yang terkenal untuk keuangan pribadi dan usaha kecil. Alat ini membantu dalam penganggaran, pelacakan pengeluaran, dan perencanaan keuangan.

- Hubdoc: Perangkat lunak ini adalah alat manajemen dokumen. Perangkat lunak ini secara otomatis mengambil dokumen keuangan Anda dan menyinkronkannya ke perangkat lunak akuntansi Anda.

- Expensify: Platform ini berfokus pada manajemen pengeluaran. Sangat cocok untuk memindai tanda terima, perjalanan bisnis, dan membuat laporan pengeluaran.

- QuickBooks: Salah satu program perangkat lunak akuntansi yang paling banyak digunakan. QuickBooks adalah alternatif yang kuat yang menawarkan serangkaian alat lengkap untuk manajemen keuangan.

- Entri Otomatis: Alat ini mengotomatiskan entri data. Ini adalah alternatif yang baik untuk fitur pengambilan tanda terima dan faktur di dalam Atera.

- FreshBooks: Program ini sangat bagus untuk pembuatan faktur dan akuntansi. Program ini populer di kalangan pekerja lepas dan usaha kecil yang membutuhkan cara sederhana untuk melacak waktu dan pengeluaran.

- NetSuite: Sebuah rangkaian perangkat lunak manajemen bisnis berbasis cloud yang andal dan lengkap. NetSuite adalah alternatif bagi bisnis yang lebih besar yang membutuhkan lebih dari sekadar manajemen keuangan.

Perbandingan Dext

Kami juga telah melihat bagaimana Dext dibandingkan dengan alat manajemen pengeluaran dan akuntansi lainnya:

- Dext vs Xero: Xero menawarkan akuntansi komprehensif dengan fitur manajemen pengeluaran terintegrasi.

- Dext vs Teka-teki IO: Puzzle IO unggul dalam wawasan dan perkiraan keuangan berbasis AI..

- Dext vs Synder: Synder berfokus pada sinkronisasi data penjualan e-commerce dan pemrosesan pembayaran.

- Dext vs Easy Akhir Bulan: Easy Month End menyederhanakan prosedur penutupan keuangan akhir bulan.

- Dext vs Docyt: Docyt menggunakan AI untuk mengotomatiskan tugas pembukuan dan manajemen dokumen.

- Dext vs RefreshMe: RefreshMe menyediakan wawasan waktu nyata tentang kinerja keuangan bisnis.

- Dext vs Sage: Sage menawarkan berbagai solusi akuntansi dengan kemampuan pelacakan pengeluaran.

- Dext vs Zoho Books: Zoho Books menyediakan akuntansi terintegrasi dengan fitur manajemen pengeluaran.

- Dext vs Wave: Wave menawarkan perangkat lunak akuntansi gratis dengan fitur pelacakan pengeluaran dasar.

- Dext vs Quicken: Quicken populer untuk pengelolaan keuangan pribadi dan pelacakan pengeluaran bisnis dasar.

- Dext vs Hubdoc: Hubdoc berspesialisasi dalam pengumpulan dokumen dan ekstraksi data secara otomatis.

- Dext vs Expensify: Expensify menawarkan solusi pelaporan dan manajemen pengeluaran yang andal.

- Dext vs QuickBooks: QuickBooks adalah perangkat lunak akuntansi yang banyak digunakan dengan fitur manajemen pengeluaran.

- Dext vs AutoEntry: AutoEntry mengotomatiskan entri data dari faktur, kwitansi, dan laporan bank.

- Dext vs FreshBooks: FreshBooks dirancang untuk bisnis berbasis jasa dengan fitur pembuatan faktur dan pelacakan pengeluaran.

- Dext vs NetSuite: NetSuite menawarkan sistem ERP komprehensif dengan fungsionalitas manajemen pengeluaran.

Kesimpulan

Learning how to use Dext changes the way you work.

You no longer have to stress over lost receipts.

You can stop typing data by hand. The app does the hard work for you.

It organizes your money and keeps your team on track.

This gives you more free time to grow your actual business.

You can relax knowing your books are accurate.

Start simple. Snap a few photos today. Connect your bank and let the automation run.

Your future self will thank you for getting organized right now.

Pertanyaan Yang Sering Muncul

Is Dext easy to use?

Yes, it is very simple. You just download the app and snap a photo. The software reads the teks for you. Most people learn it in a few minutes.

How does Dext software work?

It uses smart technology to read your paper receipts. It pulls out the numbers and dates. Then, it sends that digital data straight to your accounting software.

How to use Dext for expenses?

Snap a picture of your receipt immediately. Dext reads the cost and category. Submit it in the app. It automatically keeps your spending records safe and organized.

How do I send receipts to Dext?

You have three main ways. You can use the mobile app camera. You can email them to your Dext address. Or, you can upload files to your computer.

Is Dext free to use?

No, Dext is not free. You usually have to pay a monthly fee. However, they often offer a free trial so you can test it before you buy.

More Facts about Dext

- Smart Reading: Dext uses special smart technology (called AI) to read and pull information from the documents you upload.

- Automatic Downloads: The software can connect to supplier websites to automatically find and download your bills.

- Banyak Koneksi: Dext integrates with over 30 other accounting programs and connects to more than 11,500 banks and financial institutions.

- Three Main Tools: Dext is a family of three tools: Dext Prepare (for receipts), Dext Precision (for error checking), and Dext Commerce (for online sales).

- Fast Scanning: The software can process a document in about 30 seconds, which is much quicker than typing it in by hand.

- Akurasi Tinggi: The technology it uses to read text is very accurate, getting it right more than 99% of the time.

- Aplikasi Seluler: You can use the Dext app on your phone to snap a photo of a receipt, and it will segera upload it to your account.

- Catching Mistakes: The “Precision” tool analyzes your data to find duplicate payments orincorrect amountss so you can fix them quickly.

- Skor Kesehatan: It gives your business data a “Health Score” to show you how accurate and clean your financial records are.

- Online Sellers: The “Commerce” tool is built for people who sell things on websites like Amazon or Shopify. It automatically grabs all the sales data.

- Safe Storage: Dext keeps your digital records safe for 10 years using the same security banks use.

- Pelacakan Pengeluaran: It helps business owners see exactly how much they are spending in real time.

- Mileage Tracking: You can use the app to track how many work miles you drive so you can be reimbursed for bepergian costs.

- Akses Tim: You can give your employees their own login so they can upload their own receipts without seeing everything else.